eCommerce: Asian Start-ups

Forbes Asia 100 To Watch 2024: 9 Retailers to Follow

"Forbes Asia 100 To Watch" list identifies the Asian companies that are worth watching closely, for the fourth time this year. Which retailers made the 2024 list?

Article by Cihan Uzunoglu | August 29, 2024Download

Coming soon

Share

Forbes Asia 100 To Watch 2024: Key Insights

Baby and Wellness Market: In the health and wellness arena, Applecrumby and Little Joy are making strides with baby products and nutritional supplements, while DealCart is making grocery shopping more accessible for Pakistan’s middle class.

Beauty and Dining Trends: ESQA Cosmetics is rising in vegan beauty in Southeast Asia, and Hungry Hub is changing how Thai consumers book and enjoy dining experiences with its value-focused platform.

Secondhand and Niche Retail: iMotorbike, Mine.is, and PopChill are capitalizing on the growing secondhand market, offering reliable motorcycles and luxury goods, while Simplus is catering to the demand for small home appliances across Southeast Asia.

From baby products in Malaysia to secondhand luxury clothing in South Korea, startups across Asia Pacific are catching the eye of investors and consumers alike. While some companies are steadily climbing the ladder, others are surging ahead, seizing opportunities in booming sectors such as eCommerce and retail.

What is driving these companies to the forefront of innovation, and how are they making their mark in an increasingly competitive market? Here are 9 handpicked retailers from the Forbes Asia 100 To Watch list (in no particular order) that are on the rise and worth following closely.

1. Applecrumby

Based in Malaysia, Applecrumby sells baby products, including chlorine-free diapers and wipes. Founded by Sean and Jesmine Tan, the company offers subscription packages for repeat orders.

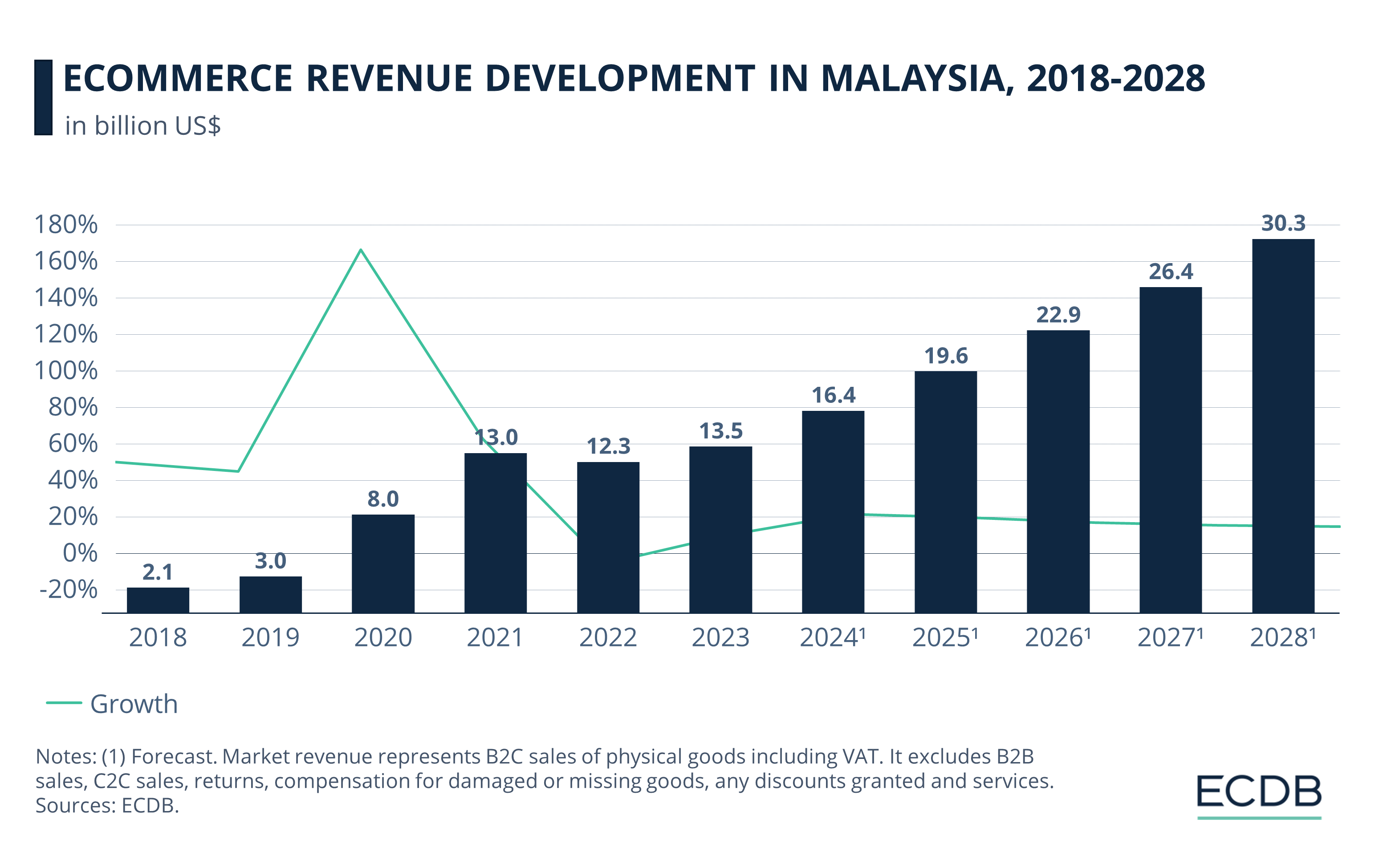

Standing at US$2 billion in 2018, the Malaysian eCommerce market reached US$13 billion by 2021. Continuing its growth, the market is expected to hit US$30 billion in a few years, suprassing the likes of Denmark, Switzerland, and the Netherlands.

Selling through platforms like TikTok Shop and Shopee, the company delivers across Southeast Asia and mainland China. In March 2024, Applecrumby raised US$4.2 million from 500 Global.

2. DealCart

DealCart, based in Pakistan, is an online grocery platform targeting the country's growing middle class. Customers can order fresh produce, snacks, and daily essentials.

The platform also allows small grocery stores to sell their products. In July 2024, DealCart raised US$3 million in seed funding co-led by Shorooq Partners and Sturgeon Capital.

3. ESQA Cosmetics

Indonesia’s first vegan cosmetics brand, ESQA Cosmetics, was founded by childhood friends Cindy Angelina and Kezia Trihatmanto.

The brand offers a range of cosmetics and skincare products available online and through retailers like Sephora and Sociolla. ESQA has expanded into Vietnam and Singapore, and raised US$6 million in a Series A round in 2022, led by Unilever Ventures.

4. Hungry Hub

Hungry Hub is a Thai online restaurant booking platform that allows users to search for restaurants by cuisine, location, or occasion and pay for meals in advance.

It offers discounts and has gained traction among consumers seeking value dining experiences. In 2022, Hungry Hub raised funds from Orzon Ventures in a Series A round.

5. iMotorbike

Based in Malaysia, iMotorbike is an eCommerce platform for buying and selling used motorcycles. The platform ensures reliability with 170-point inspections and offers easy returns.

Operating in Malaysia and Vietnam, the company raised US$2.6 million in June 2023 in a Series A round led by Gobi Partners and Shanghai-based Ondine Capital.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

6. Little Joy

Little Joy, founded in Indonesia, sells nutrient-rich supplements for low- and middle-income families. It also offers products for pregnant and breastfeeding mothers.

Aiming to reduce malnutrition among Indonesian children, Little Joy raised a Series A funding round in 2023 from investors such as Prasetia Dwidharma and Atlas Global Kapital.

7. Mine.is

South Korea-based Mine.is operates Charan, a second-hand luxury clothing marketplace. The platform offers brand-name clothing from labels like Polo Ralph Lauren and Sandro at a fraction of the original price.

In 2024, Mine.is raised a total of US$11 million, including a 10-billion-won Series A round in April from Altos Ventures and other investors.

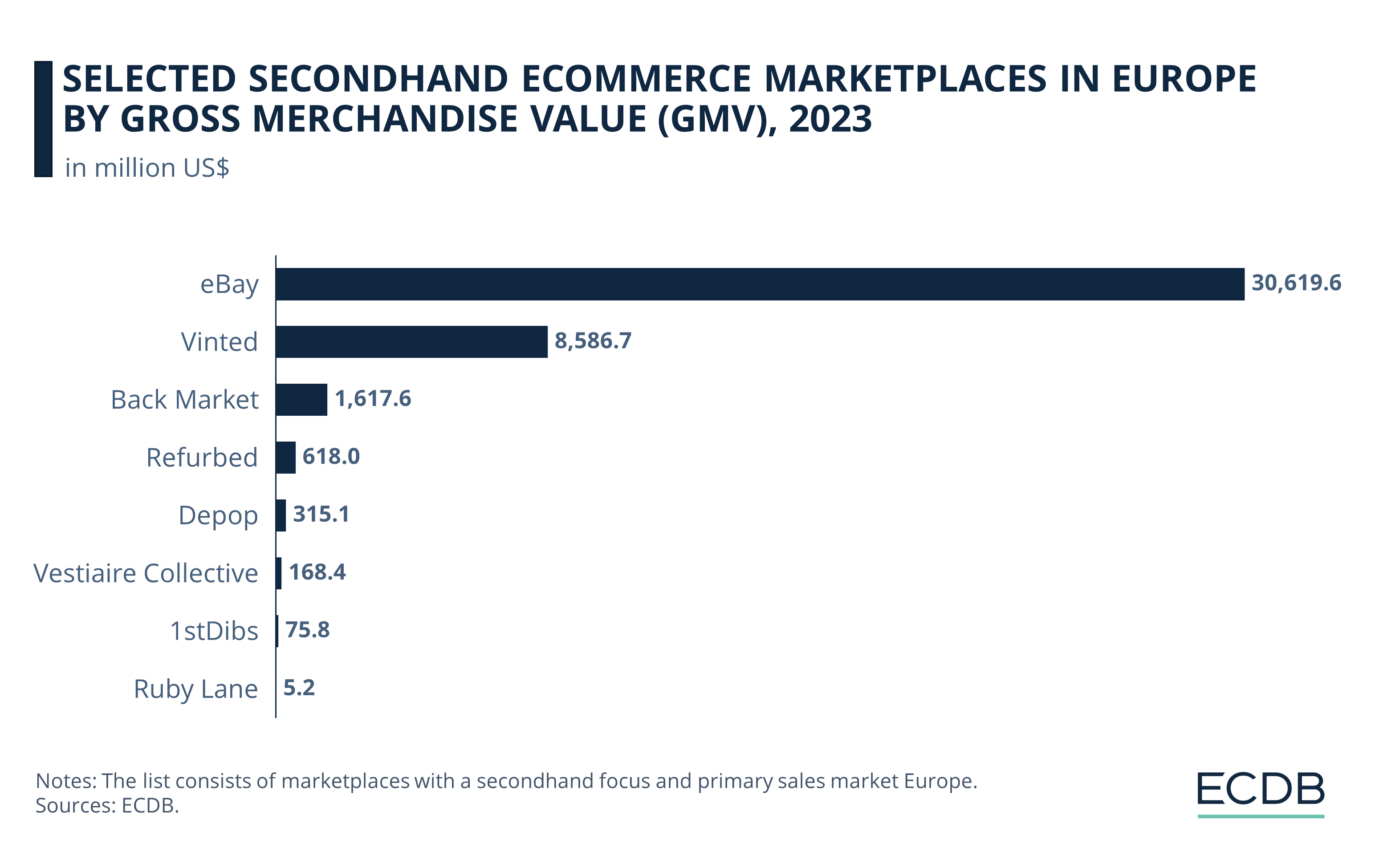

Buying secondhand products online is becoming more popular by the day: eBay dominated the European market with a GMV (gross merchandise value) of US$30 billion in 2023.

8. PopChill

Taiwan’s PopChill is a marketplace for second-hand luxury goods, ensuring product authenticity and quality through rigorous inspections before delivery.

The company raised US$6.2 million in funding from investors like Acorn Pacific Ventures, Top Taiwan Venture Capital, and 500 Global. PopChill plans to expand into Hong Kong and Singapore in 2024.

9. Simplus

Simplus, based in Thailand, sells small home appliances like toasters, hair dryers, and air fryers across Southeast Asia. The company operates on platforms like TikTok Shop, Shopee, and Lazada.

In 2023, Simplus announced it had turned profitable, backed by Jakarta-based AC Ventures.

Forbes Asia 100 To Watch 2024:

Closing Thoughts

Despite a challenging funding environment, the companies on this year's Forbes Asia 100 to Watch list have collectively attracted over US$2 billion in investments, with many securing funds even as venture capital hit a seven-year low.

This diverse group of startups, spanning industries from biotech to retail, showcases a strong streak of innovation, from AI systems for space exploration to digital channels tapping into new consumer markets.

With representation from 16 countries, including India, China, and Singapore, these companies are gaining traction in some of the world's most competitive sectors, proving that success in these industries is far from an overnight feat.

Sources: Forbes, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics