Beauty & Care Products eCommerce

Top Online Beauty Stores in the Global Care Products Market: Sephora Leads

Mirror, mirror on the wall, who is the most successful online beauty retailer of them all? ECDB has the data for your answer, so let's enter the online world of Beauty and Personal Care products.

Article by Antonia Tönnies | August 21, 2024Download

Coming soon

Share

Top Online Beauty Stores in the Global Care Products Market: Key Insights

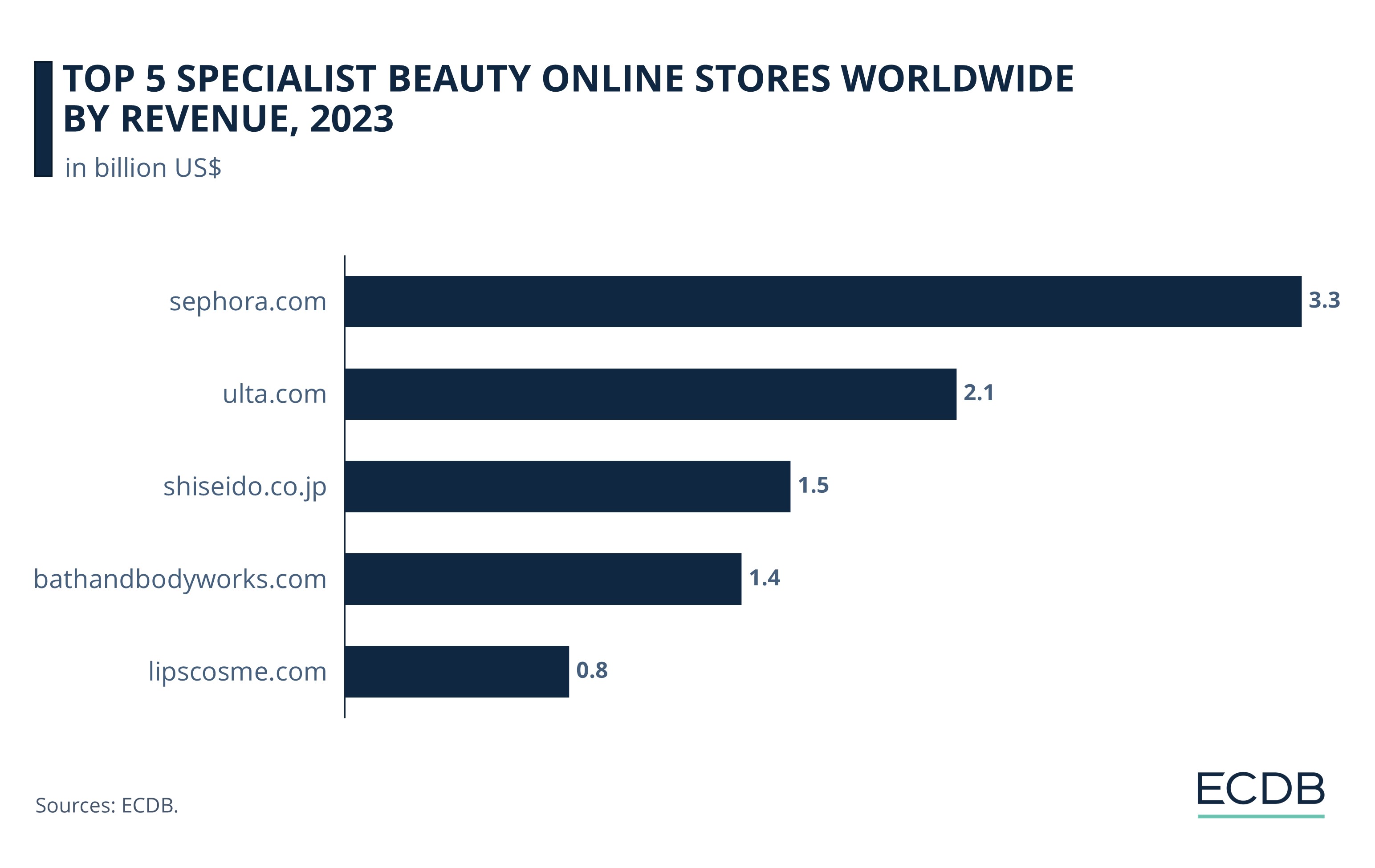

Leading Online Beauty Retailer: Sephora.com leads with US$3.3 billion in sales, followed by Ulta.com at US$2.1 billion, demonstrating the dominance of established beauty specialists.

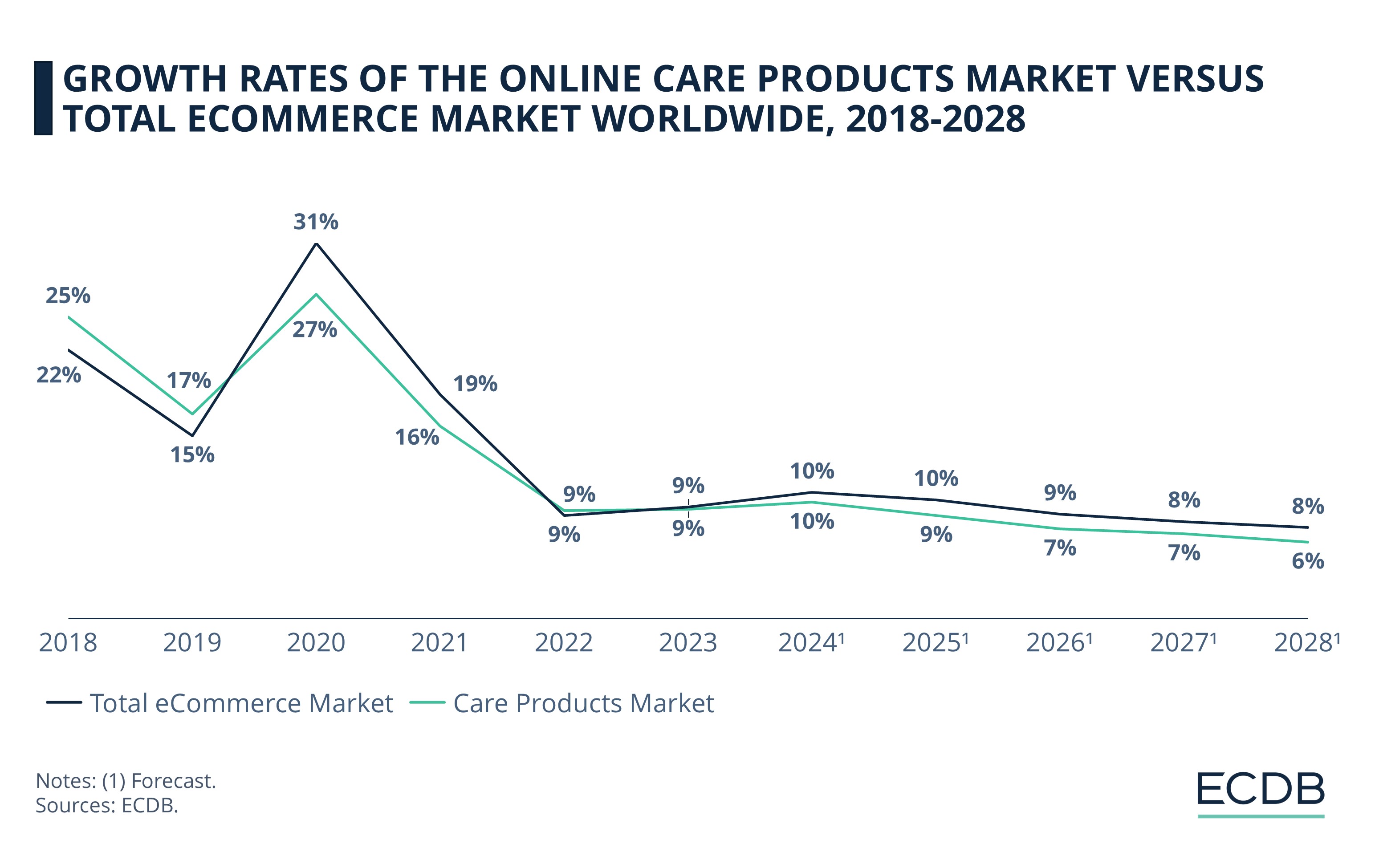

Pandemic Impact: The pandemic significantly boosted growth in the Care Products market, with beauty specialists like Sephora and Ulta seeing sharp increases in 2020. Following the pandemic, the market has stabilized, with growth rates flattening but still showing a positive trend.

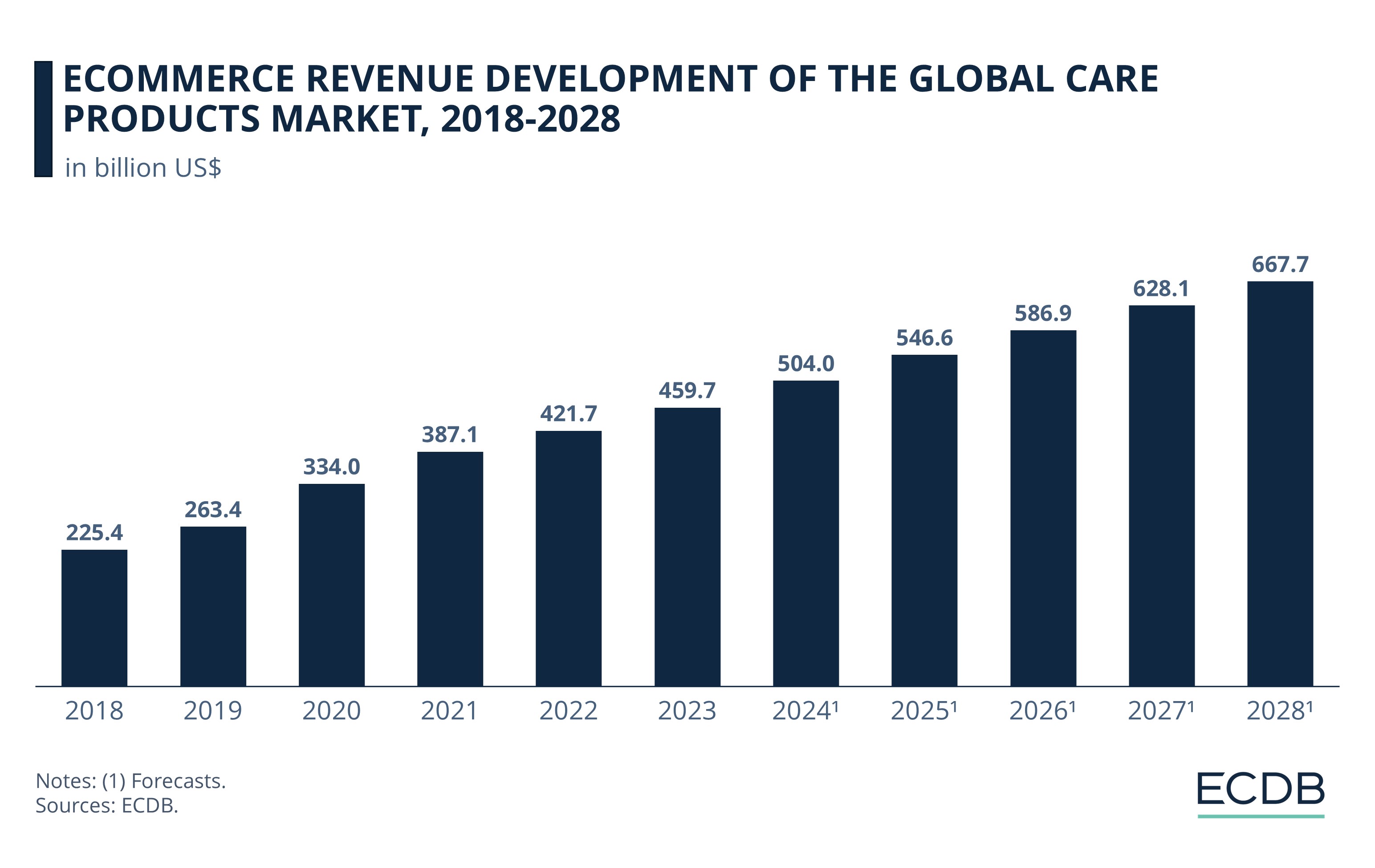

Care Products Market Trend: Global Care Products market revenue grew consistently from US$225.4 billion in 2018 to US$459.7 billion in 2023, with a projected CAGR of 7.3% through 2028.

Are you in need of a new skin care routine or are you looking for the perfect shade of lipstick? The eCommerce Care Products category includes all that and more. Meanwhile, beauty specialists such as Ulta and Shiseido are driving sales in a variety of regions around the world.

Who is the leading online beauty retailer? What does the Personal Care market consist of? And how has it all evolved over the past few years? Let's explore the key players and trends shaping this booming market.

What Is the Care Products Market?

Beauty has a lot to do with care and thus is directly linked to the Care Products market. But what is the Care Products market and what items can be found in this category?

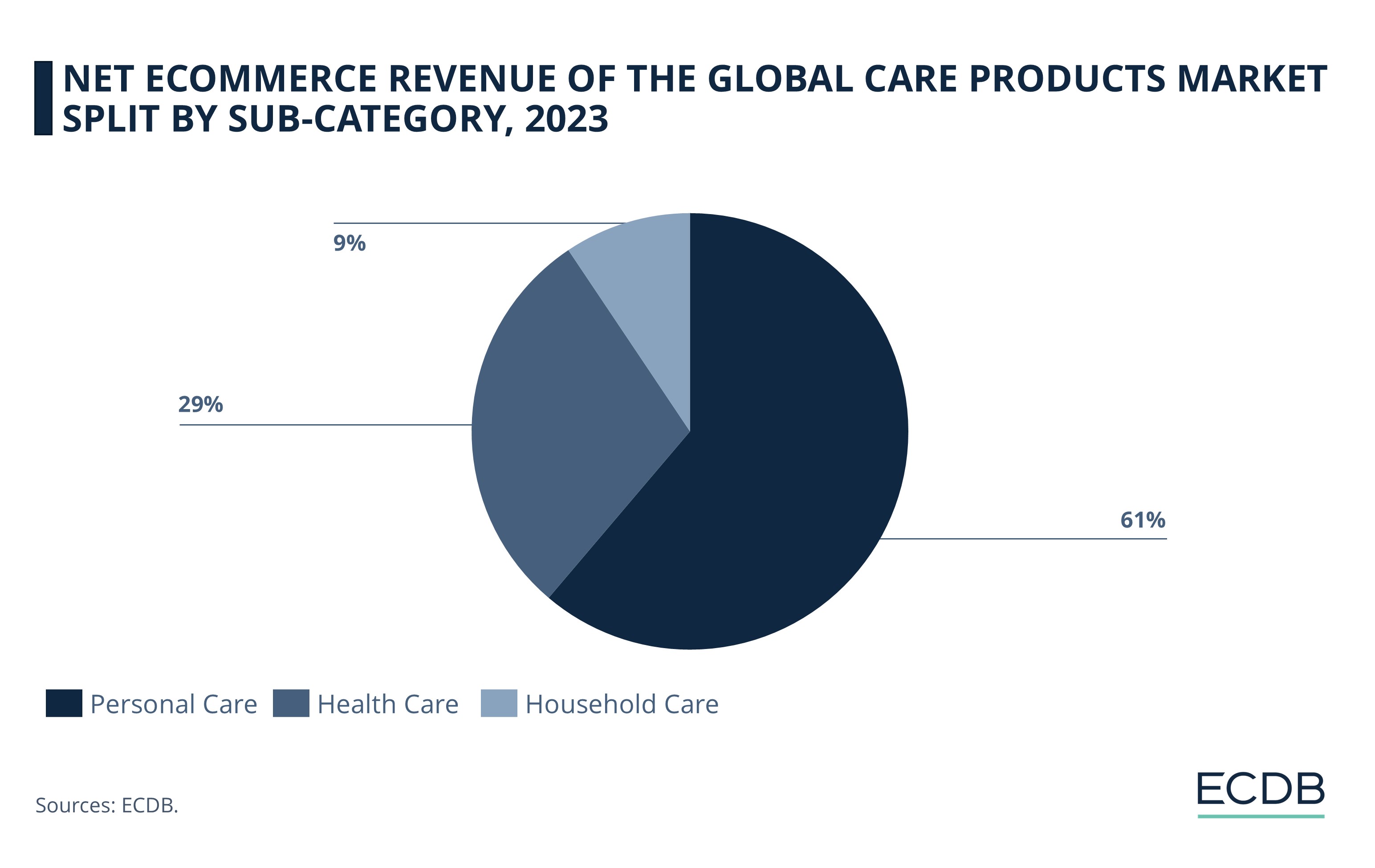

The Care Products section is one of the ECDB's super categories, along with Fashion, Electronics, Grocery, Furniture & Homeware, Hobby & Leisure, and DIY. The Care Products category includes Personal Care products (e.g. shampoos, shower gels, make-up, feminine hygiene, fragrances), Household Care products (e.g. detergents, brooms, cleaning cloths, sponges) and Health Care products (e.g. supplements, nutrition, pharmaceuticals).

Please note that this category does not capture professional products and services for Personal Care (e.g. beauty treatments, make-up courses), cleaning services (e.g. housekeeping services, window cleaning services) or medical treatments (e.g. nutrition counselling, medical consultations, health assessments). All monetary figures refer to the annual gross revenue and do not factor in shipping costs.

What Is the World’s Leading Online

Beauty Store?

By 2023, 9.9% of the world's net eCommerce sales were generated in the Care Products subcategory, driven in part by beauty specialists – but who are the leading online beauty specialists?

At the top of the list is an old, well-known player, especially familiar in Europe and the United States. But Japanese online beauty experts have also made it into the world's top 5 specialty beauty stores.

1. Sephora.com

The world's number one online beauty retailer by revenue is sephora.com, with eCommerce net sales of US$3.3 billion in 2023. The company was founded by Dominique Mandonnaud in France back in 1970, well before eCommerce existed. The online store, owned by luxury conglomerate LVMH Moët Hennessy - Louis Vuitton SE, debuted 30 years later, in 1999 to be exact.

In recent years, Sephora has shown great online growth, especially in the pandemic year 2020 with a jump of 70% compared to 2019, but also before COVID-19, as in 2019, with a year-on-year growth of 33.6%. In addition, the online domain of the United Kingdom, sephora.co.uk, has shown a significant boost in annual net sales growth in 2023 with 556%, ranking as the fourth-fastest growing online stores worldwide.

2. Ulta.com

In second place follows ulta.com, which generated revenues of US$2.1 billion in 2023 - 36% less than sephora.com. Run by Ulta Beauty, Inc., which has been in business for more than 30 years, the online beauty retailer is entirely focused on the Care Products segment of the U.S. market.

After the extreme 108% increase in online net sales in 2020 thanks to the pandemic, Ulta's growth trend remained smaller but consistent between 2% and 9%. This significant uptick catapulted the online store directly into the billion-dollar revenue range. Last year, the retailer also surpassed the US$2 billion mark.

3. Shiseido.co.jp

The Japanese online store, shiseido.co.jp, ranks third with annual revenues of US$1.5 billion in 2023. Owned by the namesake company Shiseido Co., Ltd., the online store is entirely dedicated to the Care Products market in Japan.

It is interesting to note that even though the online beauty retailer focuses fully on the eCommerce market in Japan, which has a much smaller population as the United States (36% of the U.S. population), there is not such a big difference in sales between Shiseido and Ulta. This demonstrates the value that different populations place on Personal Care, with cultural beauty standards playing an important role.

4. Bathandbodyworks.com

Next in line comes the U.S. online retailer bathandbodyworks.com, belonging to the company Bath & Body Works, Inc. In 2023, the online store achieved total eCommerce net sales of US$1.5 billion, focusing mainly on the U.S. market (98.5%). The online store's product assortment is 90% Personal Care products and 10% Furniture & Homeware.

Similar to Ulta, Bath and Body Works had a similarly strong rise in 2020, soaring from US$958 million to US$2 billion, passing the US$1 billion mark with a growth of 109.1%. Nonetheless, the online retailer couldn't maintain that height, losing nearly US$500 million after the corona peak to reach US$1.5 billion in revenues last year.

5. lipscosme.com

The fifth online store lipscosme.com completes the ranking, which is the property of AppBrew Co., Ltd. The beauty specialist achieved eCommerce net sales of US$773 million in 2023, focusing mainly on the Personal Care segment in Japan, where 96.8% of its sales are generated.

As far as ECDB data reveals, the online beauty retailer follows a great growth trend since 2020. Back when the corona pandemic came to an end in 2022, lipscosme.com's revenue saw a remarkable surge of 25.7% compared to 2021. For the future, the development trend is set to remain similar to 2023 around 1% to 3%.

eCommerce Revenue Development in the Global Care Products Market

The eCommerce revenue development of the global Care Products market from 2018 to 2028 shows a consistent upward trend. It is projected to achieve a compound annual growth rate of 7.3% over the next four years (CAGR 2024-2028). Let’s take a closer look at the latest developments of the market:

2018 to 2019: Starting in 2018, the market revenue was at US$225.4 billion. In the following year, it reached US$263.4 billion.

2020 to 2021: The steady growth continued in 2020 with a significant rise to US$334 billion and then to US$387.1 billion in 2021.

2022 to 2023: In 2022 and 2023, market revenue generated US$421 billion and US$459.7 billion in eCommerce revenue.

2024 to 2028: From 2024, the figures are forecasts, and they predict a continued upward trend. Revenue is expected to increase to US$504 billion in 2024 and further to US$667.7 billion in 2028.

Overall, the data suggests robust and steady growth in eCommerce sales for the global Care Products market over the course of a decade, reflecting increasing consumer demand and market expansion.

Growth Rates of Online Care Products vs. Total eCommerce Market Worldwide

While the revenue trend for the global Care Products market is almost linear, the growth rate provides a more detailed look at the impact of the pandemic years on this eCommerce segment:

2018-2019: The Care Products market grew from 22% to 15%, while the overall eCommerce market dropped from 25% to 17%, showing an initial strong phase followed by a slowdown.

2020-2021: The pandemic boosted growth, with Care Products peaking at 27% in 2020, then dropping to 16% in 2021. The overall eCommerce market mirrored this trend, from 31% to 19%.

2022-2023: Both markets stabilized at 9% growth, reflecting post-pandemic adjustments and a leveling off in consumer spending.

2024-2028: Steady, moderate growth for Care Products from 10% in 2024 to 6% in 2028, with the overall eCommerce market following a similar pattern, dropping from 10% to 8%.

Overall, the global Care Products market and the general eCommerce market show a similar pattern of development, with slight differences in percentage terms.

A big driver of the pandemic was social media, as it was the only tool to interact socially under restrictions and lockdowns. This included watching make-up and skincare tutorials, which encouraged users to buy the products directly online. This changed in 2022, when offline businesses were able to receive consumers normally again.

Personal Care Leads the Market Share

As mentioned above, the online Care Products segment includes a total of three subcategories, each of which has additional subcategories such as Medical Supplies, OTC Drugs, Eye Cosmetics, and Shampoos, to name a few.

The largest share of Care Products belongs to Personal Care at 61%. The second largest share is held by Health Care at 29%, followed by Household Care at 9%.

Top Online Beauty Stores in the Global Care Products Market:

Closing Thoughts

The Care Products market demonstrated remarkable resilience and continued to increase, particularly during the pandemic. This period underlined the importance of personal, household, and health care which led to a significant increase in online sales. Looking ahead, market growth is expected to stabilize, with beauty specialists continuing to drive significant sales, while the rise of players such as Sephora and Ulta highlights the importance of eCommerce in the beauty industry.

Social media, be it Instagram or TikTok, has managed to raise awareness of beauty products, especially among younger generations such as Gen Z. Social media trends, such as the glass skin or the 10-step skincare routine, promote online shopping for Care Products, but also increasingly offline shopping since 2022, which explains the growth trend development in eCommerce.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

Deep Dive

Walmart Introduces Prescription Deliveries, Outpacing Drugstores CVS and Walgreens

Walmart Introduces Prescription Deliveries, Outpacing Drugstores CVS and Walgreens

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

eCommerce in the United States: Best Product Categories

eCommerce in the United States: Best Product Categories

Deep Dive

Mexican Online Pharmacy Market: The Top 5 Stores

Mexican Online Pharmacy Market: The Top 5 Stores

Back to main topics