eCommerce: Care Products & Retail

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

Rossmann and DM are two German drugstore chains with eCommerce presence in the European market. Both made a name for themselves with brick-and-mortar retail, but are their online platforms suited to generate the same success? With ECDB proprietary data, learn about eCommerce revenues, growth rates, and AOV.

Article by Nadine Koutsou-Wehling | October 28, 2024Download

Coming soon

Share

Rossmann vs DM in 2024: Key Insights

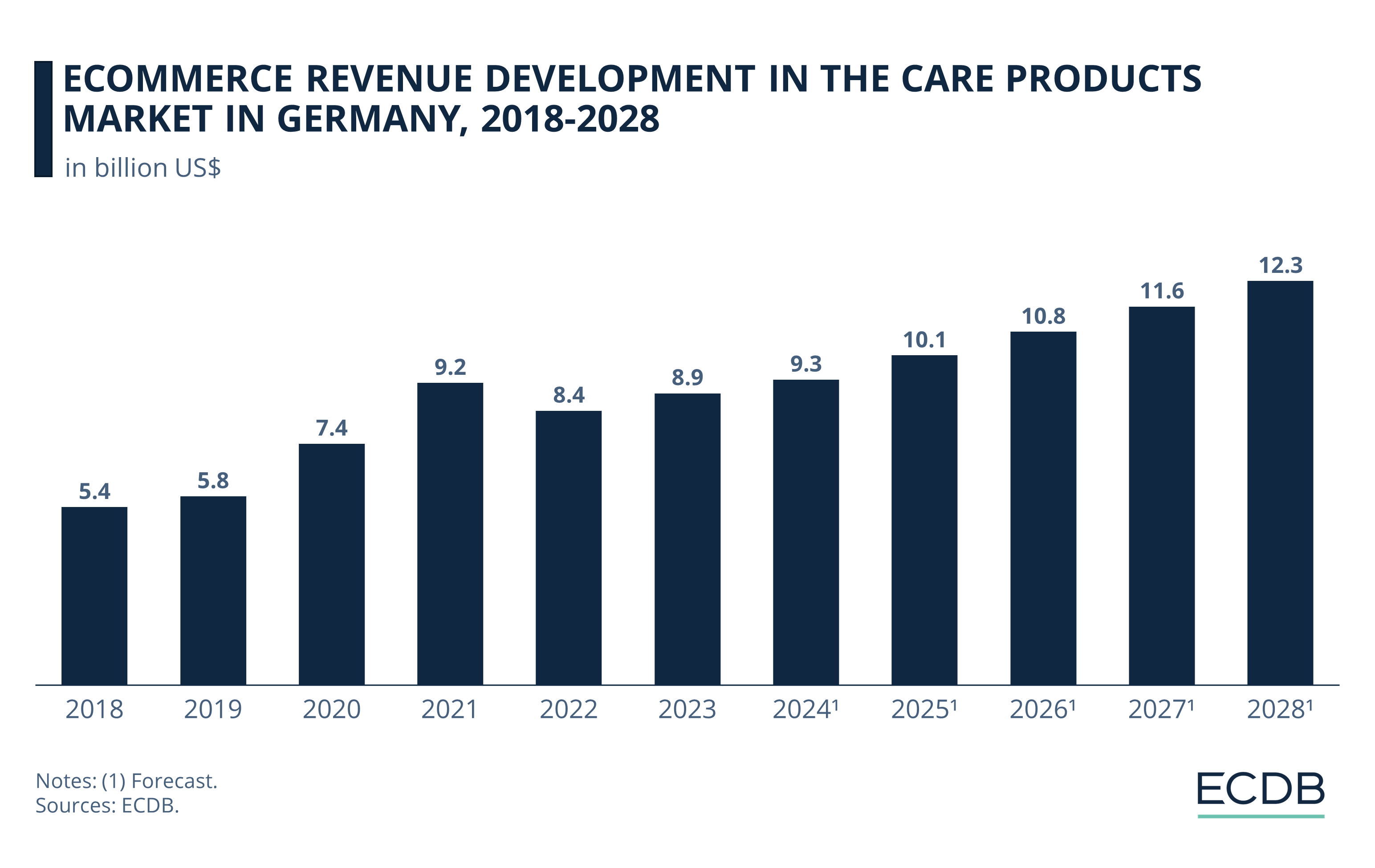

Steady Growth in Germany's Online Care Products Market: Care products are steadily increasing online, with revenues expected to reach nearly $12 billion by 2027.

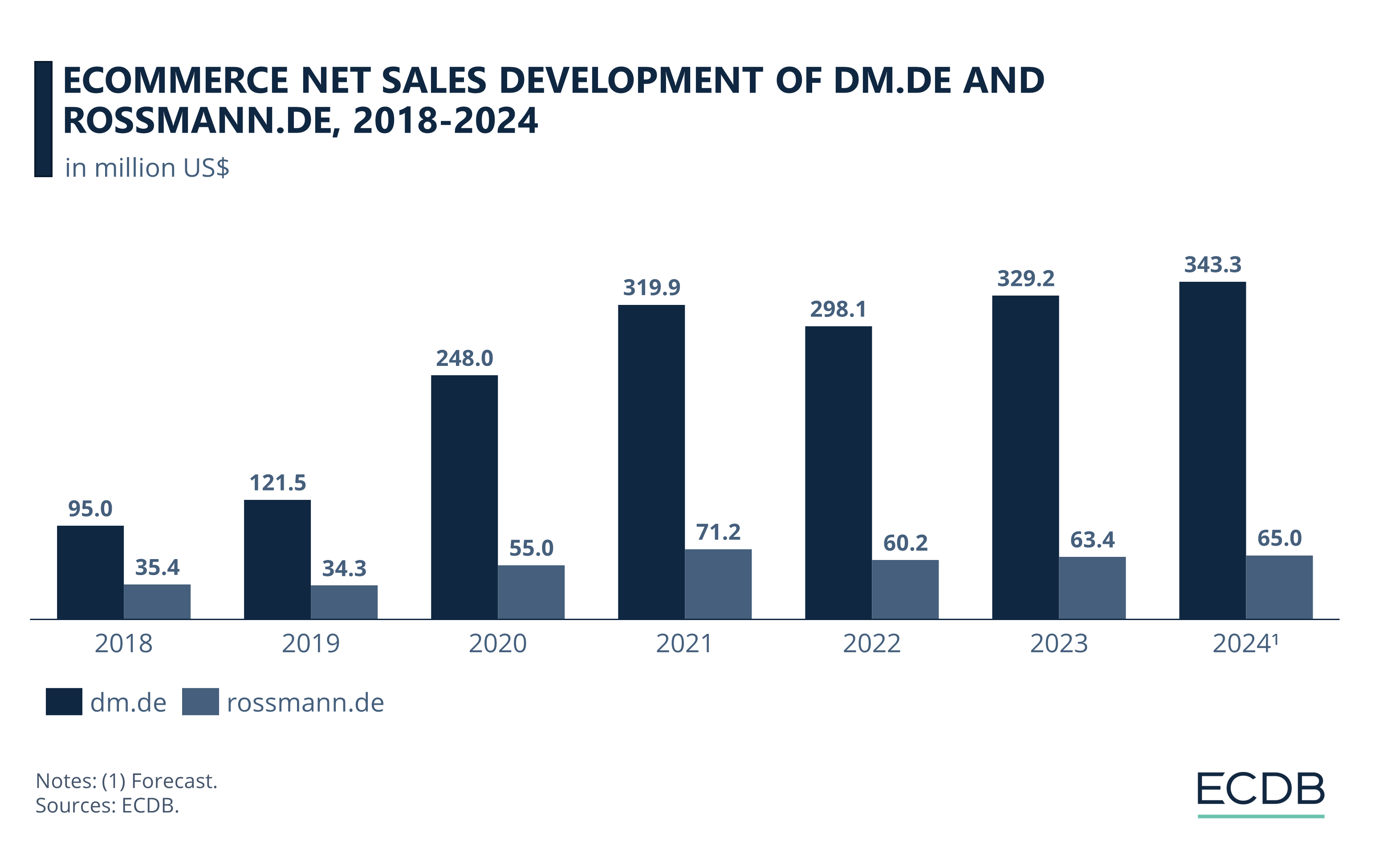

DM.de Leads in Online Revenue: DM's eCommerce revenues exceed Rossmann's by over five times, despite similar business models.

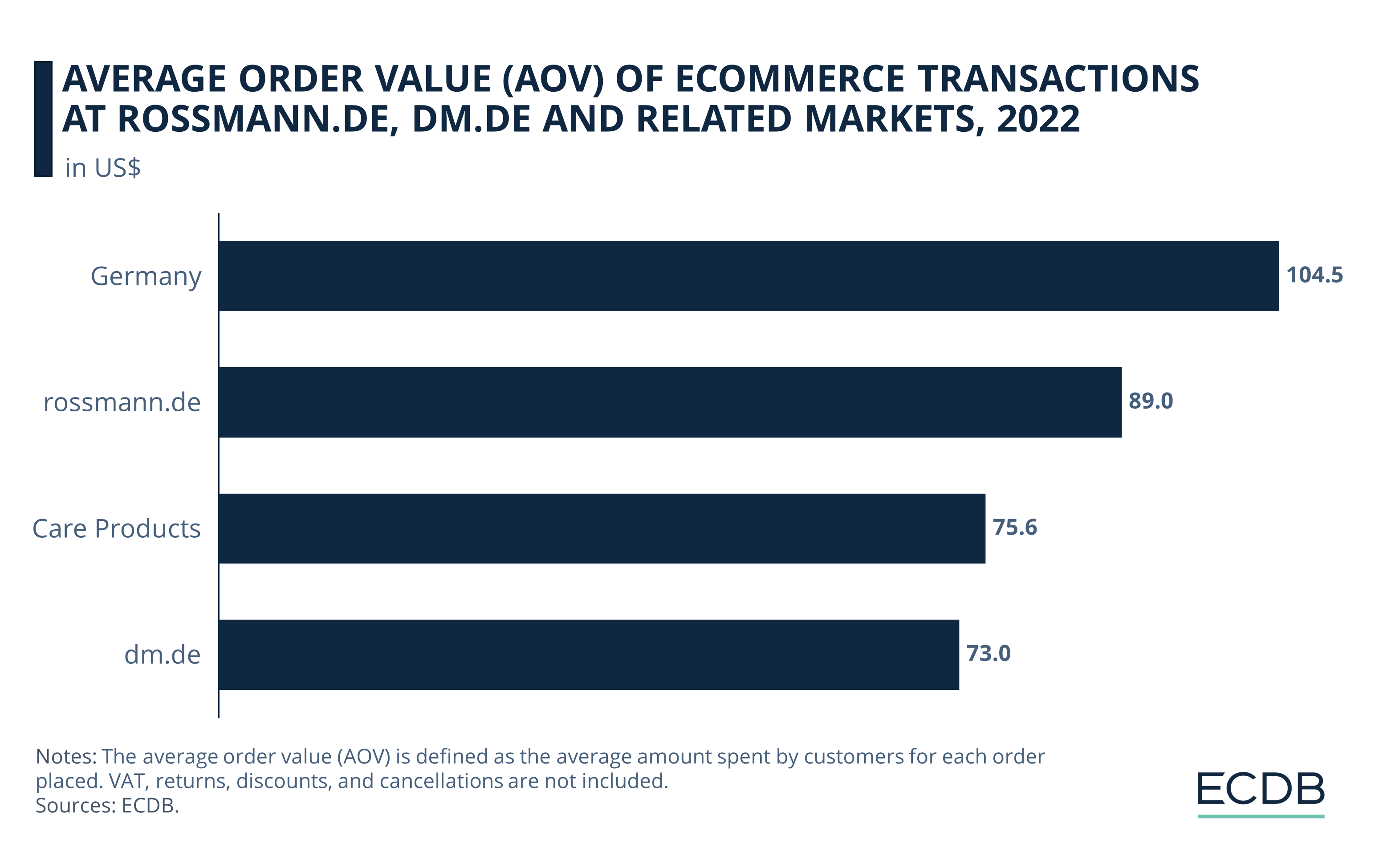

Benchmark Insights: DM.de has a lower average order value than rossmann.de, indicating more consumers purchase lower-priced items at DM, giving it competitive advantages.

Germany is home to a few drugstores that have expanded into European markets. The drugstores in question, Rossmann and DM, as well as European drugstores in general, sell OTC health products and other care products. This includes personal care (fragrances, skin and body care items), groceries (mostly organic or special dietary products), hobby & leisure, electronic appliances and gardening products. Drugstores are over-the-counter (OTC) pharmaceutical stores, although the definition varies. Which one of the two drugstore chains, rossmann.de or dm.de, emerges on top in a head-to-head comparison?

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

Care Products eCommerce in Germany: Revenues to Surpass US$12 Billion by 2028

Both Rossmann and DM generate at least 60% of their eCommerce revenue from the sale of care products (defined by ECDB as health care, personal care, and household care products). Looking at the eCommerce revenue development of the care products market in Germany, it is safe to say that the pandemic has had an accelerating impact on growth. But can DM and Rossmann survive in the online market?

After 2022, sales are forecast to advance steadily, with an annual market increase of US$600 million to US$800 million.

With US$8.9 billion in online revenues by 2023, forecasts expect that number to exceed US$12 billion by 2028.

DM and Rossmann: Similar Concept, Different Online Revenues

There are clear parallels between the two competing drugstore chains: Both have a business model that focuses on the sale of health-related products, cleaning utensils, beauty and hygiene products, groceries and recreational goods. Moreover, both maintain a comparable network of physical outlets not only in Germany but also across Europe, with about 2,200 stores per brand in Germany alone and more than 4,000 establishments in all over Europe. However, when comparing the online net sales of the respective store brands, dm.de has a significant advantage over rossmann.de.

Why is this the case? Since the total revenues of the two brands (including both offline and online net sales) do not differ that much, there must be a reason related to the online experience.

Having generated three to four times the online net sales of rossmann.de in 2018 and 2019, the pandemic pushed dm.de to an even higher level of US$248 million in 2020, rising to US$319.9 million the following year.

While 2022 saw a slight decline to US$298.1 million, dm.de’s online net sales are expected to have recovered quickly by 2023 and 2024.

Rossmann’s online platform does not match these revenues. Despite having experienced a similar peak in online net sales during the pandemic, rossmann.de’s online net sales remained at a significantly lower level than its direct competitor’s.

DM: More Orders at Lower Values Drive Online Revenue

The AOV, or average order value, of eCommerce transactions indicates how much consumers spend on average on their online orders.

Germany as a whole has an AOV of US$109.7 per consumer, while the global care products market has a lower AOV of US$77. This is due to a simple equation: Including all online orders across all product categories will encompass higher value categories such as electronics or furniture, which leads to higher average values. A direct comparison of the two competing platforms shows that consumers tend to spend more money per order (US$89) at rossmann.de than at dm.de (US$73). Given dm.de‘s online revenue advantage over rossmann.de, a significantly higher proportion of consumers shop at dm.de than at rossmann.de.

Germany as a whole has an AOV of US$109.7 per consumer, while the global care products market has a lower AOV of US$77. This is due to a simple equation: Including all online orders across all product categories will encompass higher value categories such as electronics or furniture, which leads to higher average values.

A direct comparison of the two competing platforms shows that consumers tend to spend more money per order (US$89) at rossmann.de than at dm.de (US$73).

Online Store: Competitive Advantages

While the two online stores have very similar strategies, there are some differences that may explain the greater demand for dm.de's service:

Free Click & Collect Service for Customers: DM's Click & Collect service is free for online shoppers with a customer account. Rossmann's Click & Collect service is available for purchases of €20 or more. This allows DM's customers to place more frequent orders, with the added benefit of providing DM with consumer data for each order.

Lower Minimum Order Value: Although the difference in minimum order value is only €10, dm.de undercuts rossmann.de in the price it charges for home delivery orders at no extra cost.

More Digital Payment Methods: DM’s online platform offers a wider range of payment methods than Rossmann’s: Klarna, gift cards, and eWallets (Apple Pay and Google Wallet). While Rossmann offers the option to pay by invoice, the provider Riverty is not as well known in Germany as Klarna, which may deter some consumers from using the service.

Higher Social Media Engagement and Online Traffic: DM has more combined followers on Facebook and Instagram and a higher SEO score than its direct competitor, Rossmann. DM is also more visible in paid search results, although not consistently.

Customer Preferences and Habits: Although the two stores are very similar in nature, consumers find differences in the quality of each brand's offerings and store atmosphere. While both stores' private labels are objectively interchangeable, the force of habit may motivate some users to prefer one over the other.

DM vs. Rossmann: Final Remarks

A comparison of the two most successful German drugstores shows that despite similar attributes such as store count, international presence, overall revenue and business structure, there can be significant disparities in online net sales performance.

It is apparent that both DM and Rossmann are pursuing an online strategy which aims at bringing customers into their physical stores. But a modern approach that prioritizes customer convenience could provide a competitive advantage. Considering how quick commerce has changed the face of eCommerce, it can prove particularly successful to deliver customers their habitual items on a whim, or the items they need urgently but forgot/didn't manage to buy, instead of lagging behind the state of the art with high minimum order values, long delivery times and bulky packaging. Partnering with established service providers in the area can make this strategy viable.

Sources: DM – Rossmann – Statista – Wirtschaftswoche

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

Deep Dive

Amazon Enhances Online Grocery Shopping for Prime Members

Amazon Enhances Online Grocery Shopping for Prime Members

Back to main topics