eCommerce Share of Total Revenue

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

Alibaba, Amazon, and JD.com are shifting focus from eCommerce to higher-margin sectors like cloud computing, logistics, and advertising, reshaping their revenue streams.

Article by Cihan Uzunoglu | October 14, 2024Download

Coming soon

Share

eCommerce Share of Total Revenue: Key Insights

Declining eCommerce Share: The eCommerce share of total revenue for Alibaba, Amazon, and JD.com has dropped over the past five years as they increasingly focus on higher-margin sectors like cloud computing, logistics, and advertising.

Alibaba’s Diversification Strategy: With eCommerce growth slowing, Alibaba is leaning more on expanding its cloud services, international commerce, and logistics operations to fuel future revenue growth beyond its core retail platforms.

Amazon’s Focus on Higher Margins: Amazon's dependence on eCommerce has lessened as it pivots toward more lucrative areas like AWS, third-party seller services, and advertising.

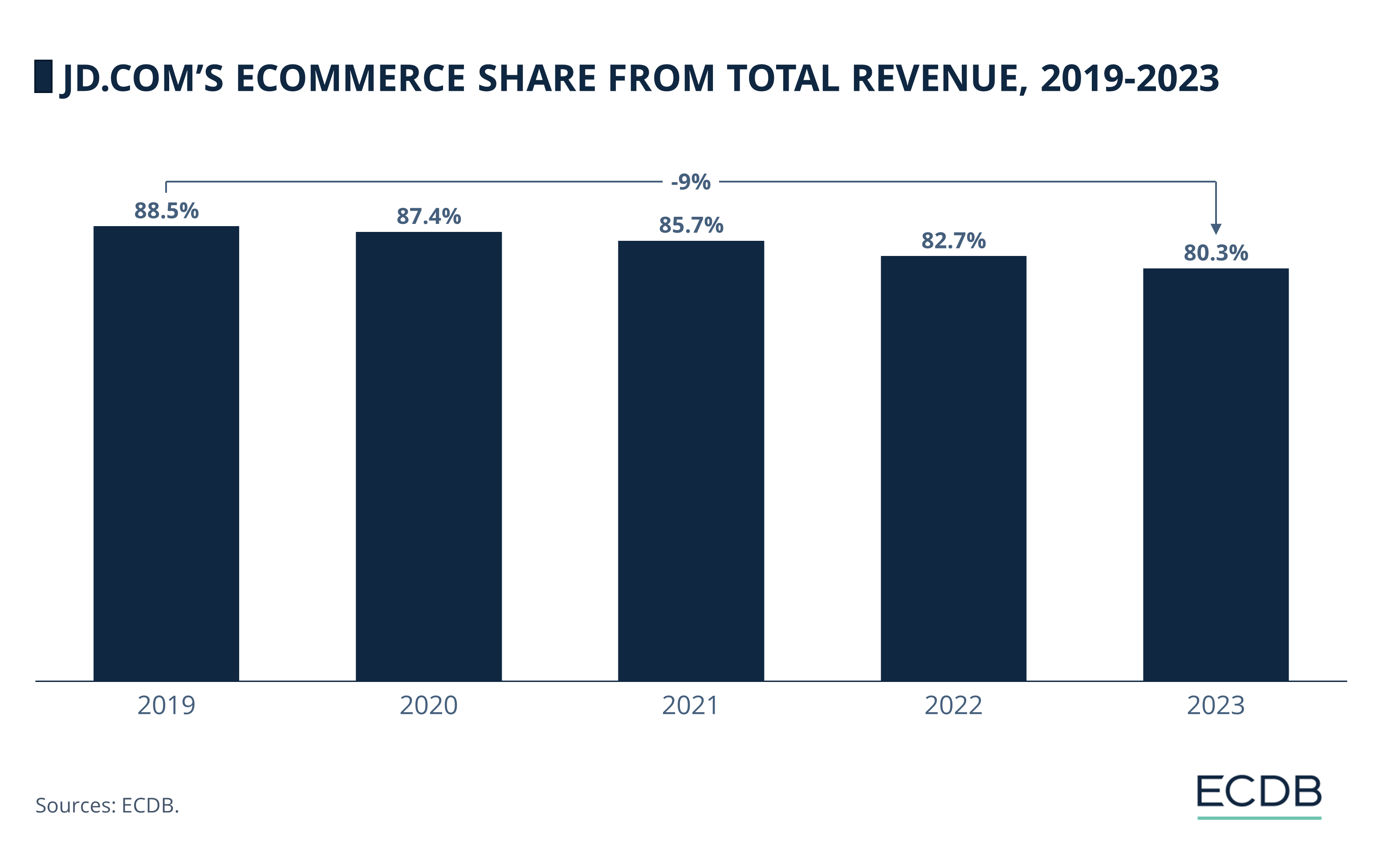

JD.com’s Logistics-Driven Growth: JD.com has seen a steady decline in eCommerce's share of its revenue as it strengthens its focus on logistics and third-party marketplace sales, with JD Logistics emerging as a major driver of profitability compared to traditional retail.

When we think of Alibaba, Amazon, and JD.com, we think of eCommerce giants, but the way these companies make money is changing. Today, eCommerce is only one part of a much bigger picture, as each company invests heavily in higher-margin sectors like cloud computing, logistics, and advertising.

Their traditional strength in online retail still matters, but it no longer drives the kind of growth it once did. How are these companies navigating this shift? And what does it mean for the future of eCommerce?

Shifting Revenue Streams: The Changing Role of eCommerce

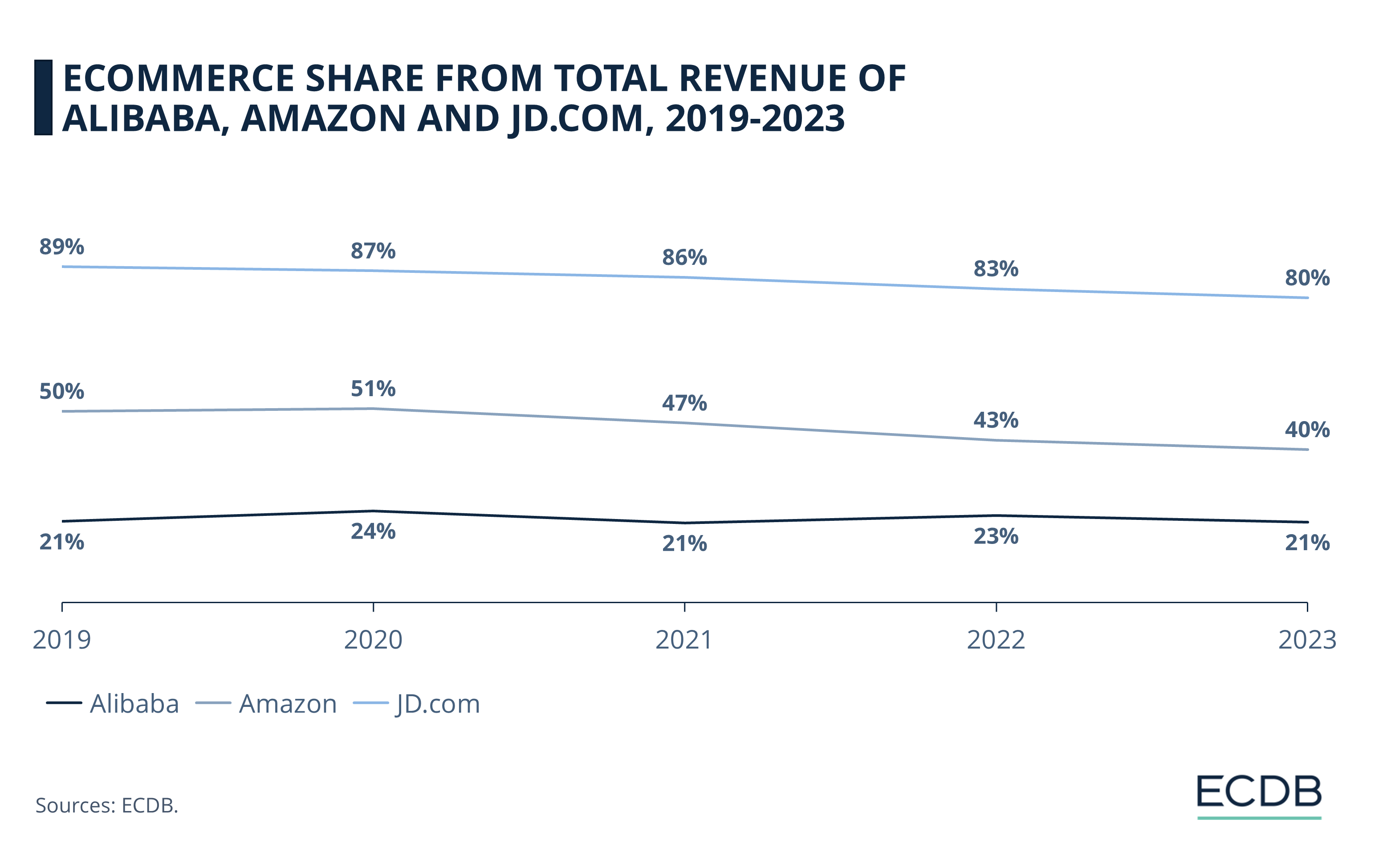

Over the past five years, the eCommerce share of total revenue for global giants Alibaba, Amazon, and JD.com has fluctuated. Looking at this data reveals the changing dynamics of their business models and the growing importance of other revenue streams.

Before we go into specifics for each player, let's first break down the numbers:

Alibaba’s eCommerce share of total revenue remained relatively consistent, fluctuating between 21% and 24% from 2019 to 2023.

In contrast, Amazon saw a more significant decline, with eCommerce accounting for 50% of its revenue in 2019, dropping to 40% by 2023.

JD.com, which historically had the highest reliance on eCommerce, saw its share decrease from 89% in 2019 to 80% in 2023.

So, what does this mean? Even though these companies are known for their eCommerce business, there’s a growing importance of non-eCommerce segments for each of these companies. These segments diversify revenue streams in response to market saturation, rising competition, and the pursuit of higher-margin businesses.

Take Alibaba, for example: the company's steady share of eCommerce is only part of the story. As the company focuses on expanding its cloud computing and logistics businesses, it is redefining the sources of its future growth.

1. Alibaba

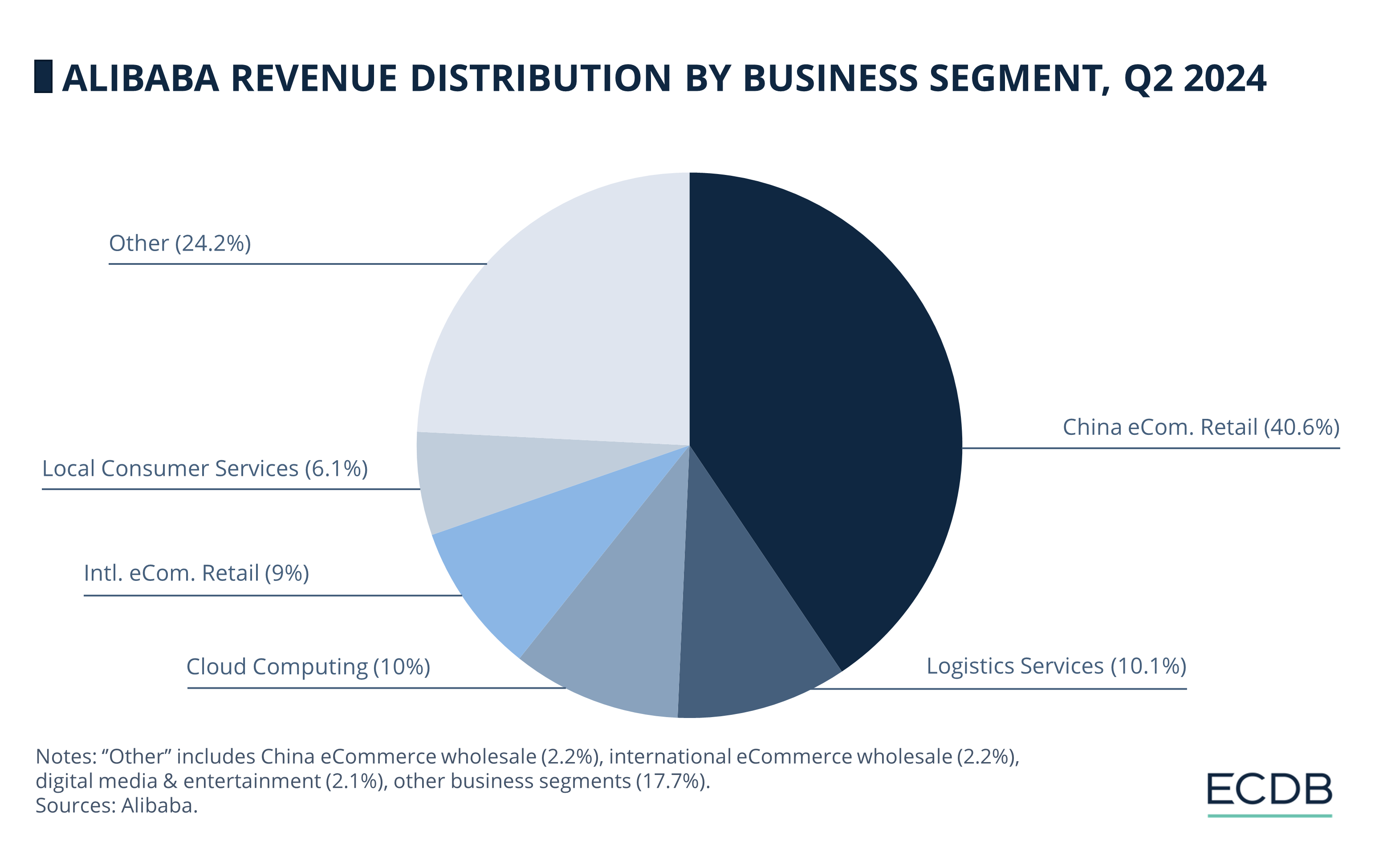

Despite fluctuations, Alibaba's share of revenue from eCommerce, specifically through its Taobao and Tmall platforms, has shown limited growth and even slight declines in some years. This indicates a plateauing of its core eCommerce business in terms of its contribution to total revenue.

The company has been diversifying its revenue sources, which involves expanding into other business segments that are becoming increasingly significant to the overall revenue. For example, Taobao and Tmall Group, which are projected to account for 46% of total revenue in FY2025, remain Alibaba's largest revenue generators. However, other segments like international commerce, cloud computing, and logistics are rapidly growing.

Increasing Cloud and Tech Focus,

Stagnating eCommerce Growth

From 2019 to 2023, Alibaba experienced a slight contraction in its eCommerce share of total revenue – from 21% in 2019 to 24% in 2020, and then back to 21% by 2023. This is partly due to the slowdown in domestic eCommerce growth in China, which reached a saturation point, combined with increased competition from rivals like JD.com and Pinduoduo.

Another factor here is the growing importance of Alibaba's non-eCommerce segments. A key driver of the revenue shift is Alibaba's cloud computing division, which has shown significant growth. Although it is expected to make up 12% of total revenue in FY2025, it has been experiencing strong demand from businesses looking to digitize and scale their operations.

The cloud segment increased from ¥103.5 billion (US$14.6 billion) in FY2023 to ¥106.4 billion (US$15 billion) in FY2024, which is expected to continue. This growth highlights Alibaba’s increasing focus on technology infrastructure and services, which is playing a larger role in its overall revenue structure.

How Global Commerce and Logistics Drive Alibaba’s Future

International commerce has also become a critical growth engine for Alibaba. The company has seen its international business, through platforms like AliExpress, Lazada, and Trendyol, grow significantly.

In FY2025, international commerce is projected to generate ¥108 billion (US$15.2 billion), up from ¥103 billion (US$14.5 billion) in FY2024. This growth reflects Alibaba's efforts to expand outside China and tap into global markets where eCommerce penetration is still growing. The international push has been vital for maintaining overall revenue growth in a more competitive and saturated domestic Chinese market.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Another aspect of Alibaba’s strategy is its investment in logistics, primarily through Cainiao, its smart logistics network. Although logistics doesn’t contribute as much as eCommerce to Alibaba’s total revenue, Cainiao is becoming increasingly important, helping to support the company's vast eCommerce operations and global ambitions.

The logistics business recorded ¥2.1 billion in revenue in Q3 FY2022, representing a year-over-year growth of 15.1%, further solidifying its role as a key part of Alibaba's ecosystem.

What about Alibaba's arguably fiercest competitor, Amazon? What has happened on the western front?

2. Amazon

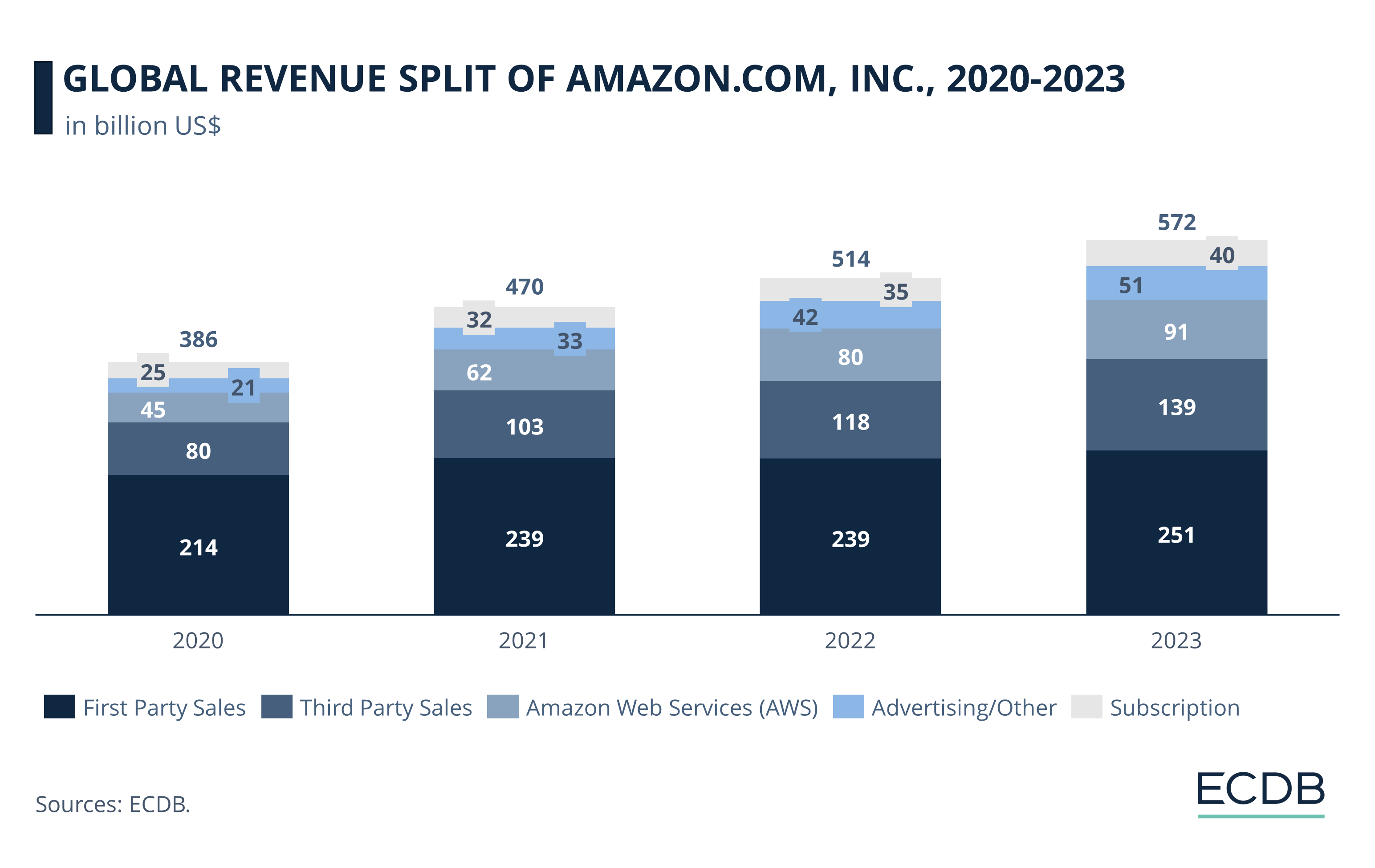

Amazon’s eCommerce business has seen a gradual decline in its share of total revenue over recent years, signaling a shift in the company’s overall focus. While the company's overall revenue has continued to grow, the proportion coming from online retail has diminished as other segments, like cloud computing and advertising, have become increasingly prominent.

This decline in eCommerce share is similar to Alibaba’s situation, where core eCommerce has plateaued as a revenue driver. For Amazon, the contraction is driven by market saturation, especially in mature markets like the U.S., and the rise of lower-margin businesses.

Amazon’s Shift to High-Margin Ventures

Similar to Alibaba, Amazon has responded by diversifying its operations, significantly expanding its cloud computing division (AWS) and increasing its focus on third-party seller services and advertising.

Amazon Web Services (AWS) has been the company’s most notable success outside eCommerce. AWS accounted for 16% of total revenue in 2023, bringing in over US$91 billion and generating more than half of the company’s operating income. Its growth – more than 100% over four years – demonstrates the strategic importance of cloud computing to Amazon’s future. Unlike eCommerce, which operates on thin margins (around 4%), AWS has margins as high as 30%, simply making it a more profitable business.

The Rise of Third-Party Sellers and Advertising at Amazon

Third-party seller services and advertising have also emerged as crucial revenue streams. Third-party seller services grew 74% between 2020 and 2023, reaching US$139 billion, while advertising services saw a 143% increase, bringing in US$47 billion in 2023. These segments offer higher margins and require less direct investment than first-party retail, making them more lucrative.

In contrast, Amazon’s first-party eCommerce business has struggled with rising costs and fierce competition. The growth seen during the COVID-19 pandemic has slowed significantly, as has the overall U.S. eCommerce market. Additionally, Amazon’s operating margins in eCommerce are low, with fulfillment and logistics costs cutting into profitability, a problem faced by other major players like Alibaba.

We'll conclude our analysis with another retail giant, JD.com. The company's performance has been worth watching as its reliance on eCommerce has gradually decreased in recent years.

3. JD.com

JD.com's eCommerce share of total revenue has declined modestly over the past few years, similar to trends observed with Alibaba and Amazon. This drop reflects JD.com's shift toward diversifying its revenue streams beyond eCommerce, driven by slower growth in China’s saturated eCommerce market and rising competition from platforms like Pinduoduo.

Unlike Alibaba, which relies heavily on third-party sales, JD.com’s unique direct sales model gives it more control over product quality, pricing, and logistics. However, the company has been increasing its reliance on third-party marketplace sales.

By 2023, third-party sales contributed 22% of total revenue, highlighting the growing importance of this segment in balancing JD.com's business model. The shift toward more third-party transactions has allowed JD.com to offset slower growth in its core retail business, much like Amazon’s expansion into third-party seller services.

JD Logistics: A Key Driver of Growth and Efficiency

In recent years, JD.com has aggressively expanded its logistics and services businesses, which have become critical drivers of revenue growth. JD Logistics, in particular, has seen substantial expansion: For the first half of 2024, JD Logistics generated ¥86.3 billion (US$12.2 billion) in revenue.

JD Logistics has proven to be a strategic advantage for JD.com, enabling it to offer same-day and next-day deliveries, which sets it apart from competitors. By integrating its supply chain with cutting-edge technologies such as robotics and AI, JD.com has solidified its leadership in delivery efficiency. This logistics operation operates at an operating margin of 4.9%, significantly better than the eCommerce business, which has lower margins due to the high costs associated with direct sales.

Service Revenues Propel JD.com's Profitability Shift

JD.com’s service revenues, which include logistics and other non-retail services, have grown steadily, rising from ¥21.1 billion (US$3 billion) in 2021 to ¥30.1 billion (US$4.2 billion) in 2023. This growth reflects JD.com’s efforts to diversify away from low-margin retail operations and capitalize on higher-margin service offerings, similar to Amazon’s focus on advertising and AWS.

While the company’s eCommerce margins remain low due to the high cost of operating a direct sales model, the logistics and services segments offer better profitability.

eCommerce Share of Total Revenue:

Final Thoughts

The eCommerce share of total revenue for Alibaba, Amazon, and JD.com will likely continue to decline as they focus on higher-margin businesses like cloud computing, logistics, and advertising.

We believe, however, that eCommerce will remain strategically vital, serving as an entry point for users to engage with broader ecosystems, from subscriptions to digital services. AI and automation could reshape the profitability of eCommerce, reducing costs and boosting margins, while partnerships and consolidation – especially in logistics – could further shift revenue streams away from retail.

All in all, it's safe to say that these companies are evolving into multifaceted platforms where eCommerce is a foundation but no longer the primary growth driver.

Sources: Trefis, Investopedia, Feedough, NCrypted, Appscrip, StartupTalky, Shopify, JD.com, Vizologi, The Motley Fool, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics