ALIBABA

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

With its online revenues crossing US$1.1 trillion in 2023, Alibaba has cemented its position as global eCommerce kingpin. But which companies pose a competition to Alibaba?

Article by Nashra Fatima | October 21, 2024Download

Coming soon

Share

Top Alibaba Competitors: Key Insights

By Revenue: As the world’s largest eCommerce company, Alibaba surpasses each of its competitors in revenues which reached US$1.1 trillion in 2023. Its closest competitor is Amazon.com Inc, with US$733 billion.

By Growth: Despite its leading status, Alibaba’s GMV growth declined in 2023. From a growth perspective, social commerce sensation ByteDance is a rival, with a staggering yearly growth of 79.5% in 2023.

By Category: Alibaba mainly operates in the product category fashion, from where it derived 37% of its revenues in 2023. In this category, it outperforms its leading competitors, all of whom are Chinese, including PDD Holdings and JD.com.

Alibaba is the only eCommerce company across the world with revenues of over US$1.1 trillion in 2023. But like any other leader, it has its rivals.

Our ECDB data reveals that Alibaba’s online sales declined in 2023, while some of its competitors grew rapidly. The findings underscore the ambitious nature of the global eCommerce industry, where companies continue jostling for the top ranks.

So, who are Alibaba’s biggest contenders? And how does their performance compare to Alibaba’s?

Key Facts about Alibaba Group Holding, Ltd.

Before diving into a competitor analysis, here are some key facts about Alibaba:

Alibaba is currently the largest eCommerce company in the world by revenue.

Alibaba’s main market is Greater China, where it generated 88.5% of all its revenues in 2023. Other markets include South Korea, Indonesia, and Japan, with 0.9% each.

Alibaba’s largest product category is fashion, which constitutes 37% of its total revenue. Next up are electronics (16.9%), hobby & leisure (12.7%) and care products (12.6%).

Alibaba’s top earning domains are taobao.com, tmall.com, and aliexpress.com. While the first two are China-focused, the last generates the largest share of its sales in the United States.

Who Are Alibaba’s Biggest Competitors?

Purely in terms of eCommerce revenues, Alibaba has a clear lead over other top-ranking eCommerce companies. Another trend is also visible: most of Alibaba’s competitors are Chinese.

Alibaba reigns over global eCommerce, with online revenues of US$1.1 trillion in 2023.

Amazon.com Inc. is Alibaba’s closest rival, with US$733 billion in revenues. It is the only U.S.-based company on our list.

PDD Holdings, Inc., also Chinese, is third, with US$584 billion.

JD.com Inc. follows closely at rank four, with US$509 billion.

ByteDance Ltd. is fifth, with US$408 billion. It is also proving to be a growth champion in global eCommerce.

Our ECDB data also helps us chart each company’s yearly GMV performance, which refers to the gross merchandise volume. Only brands that operate online marketplaces are included in the company's marketplace GMV. The eCommerce sales generated by the brands that do not operate any online marketplaces are not included in the marketplace GMV of the company but in its eCommerce activity revenue. So, the eCommerce revenue of a company can be higher than its marketplace GMV.

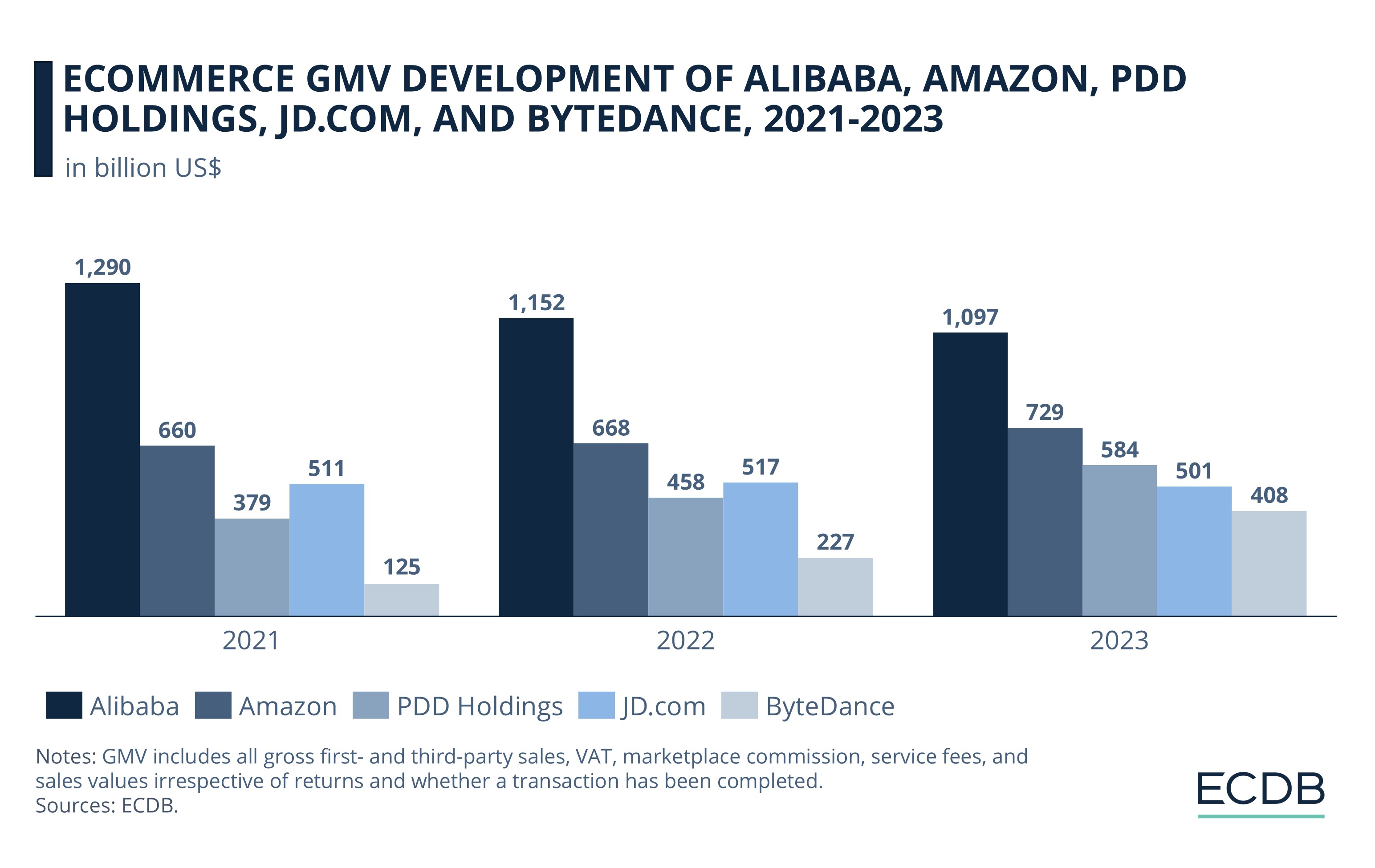

Here is the GMV development of Alibaba and its top competitors from 2021 to 2023:

Alibaba and Its Competitors' GMV Development: Alibaba's GMV declined from US$1.3 trillion in 2021 to US$1.1 trillion in 2023. The GMV growth of its top rivals indicates that the competition for Alibaba has steadily increased in the past three years.

1. Alibaba Group Holding, Ltd.

Alibaba has consistently topped its competitors in terms of GMV, with the figures crossing US$1 trillion in 2021, 2022, and 2023.

However, tracing the yearly development, it becomes evident that Alibaba’s growth has declined in recent years. The GMV dropped from US$1.3 trillion in 2021 to US$1.2 trillion in 2022. The downward trend continued in 2023, when the GMV fell further to US$1.1 trillion.

Alibaba may dominate China’s eCommerce landscape, which is its key market. However, it faces increasing competition from players like PDD Holdings and relative newcomers like ByteDance. Scrutiny from the Chinese government under its anti-monopoly investigation also impacted Alibaba; it was forced to pay upwards of US$2.6 billion in fines.

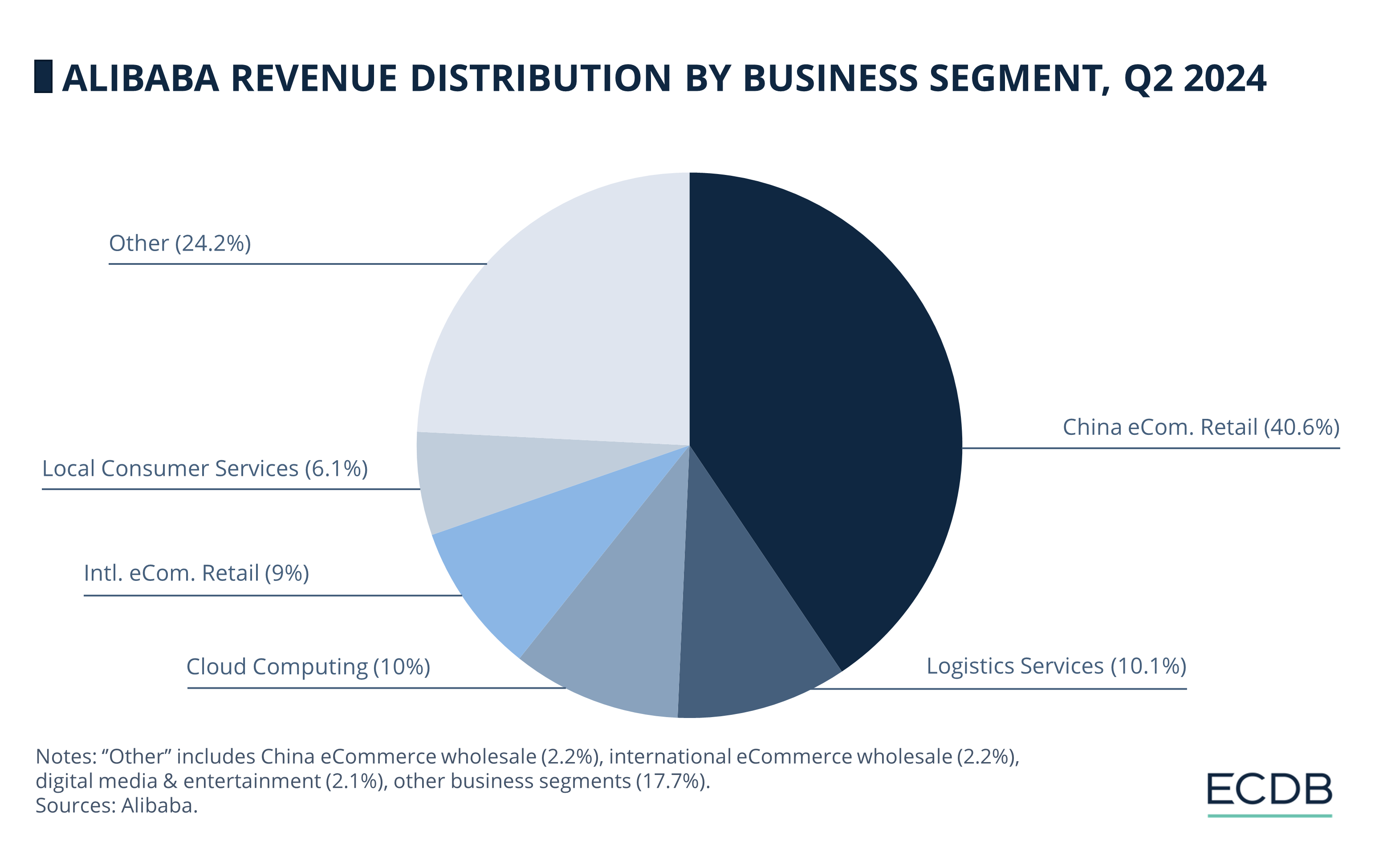

Alibaba's Business Segments: In 2024, over 40% of Alibaba's total revenues came from its eCommerce retail operations in China. But its non-eCommerce segments like logistics and cloud computing are growing.

Alibaba’s core eCommerce business has plateaued as its tech focus has strengthened. As of Q2 2024, eCommerce in China is still its largest business segment. But other segments like logistics (10.1%), cloud computing (10%), and international eCommerce retail (9%) are now also making substantial contributions to Alibaba’s revenues.

2. Amazon.com, Inc.

One of the most well-known eCommerce companies, Amazon.com Inc. may have struggled in China because of Alibaba, but it has built a global name for itself. The company has gone from strength to strength: its GMV climbed from US$660 billion in 2021 to US$729 billion in 2023.

Amazon’s diverse strategy strengthens its market position. It has successful online stores beyond its home market – across the Americas, Europe, and Asia. Amazon generates most of its revenues through its eCommerce activities, but it has diversified in terms of its business segments.

In addition to its online store and marketplace, Amazon earns from its prime services as well as subscription services and AWS (Amazon Web Services). But its eCommerce offerings like Prime Day sales event, same-day delivery, and a budding live commerce platform keep Amazon a notch above other contenders. Amazon continues to be the retail leader in Western markets.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

3. PDD Holdings, Inc.

Alibaba’s biggest Chinese rival is PDD Holdings. PDD started from a GMV of $379 billion in 2021 but expanded rapidly. Its GMV reached US$458 billion in 2022. Growth was even faster in 2023, when GMV hit US$517 billion.

PDD’s early success came from rural and lower-tier markets in China, where the competition was less intense at the time. It also used a unique group buying model, mainly through its platform Duo Duo Grocery, to make big gains in the pandemic years.

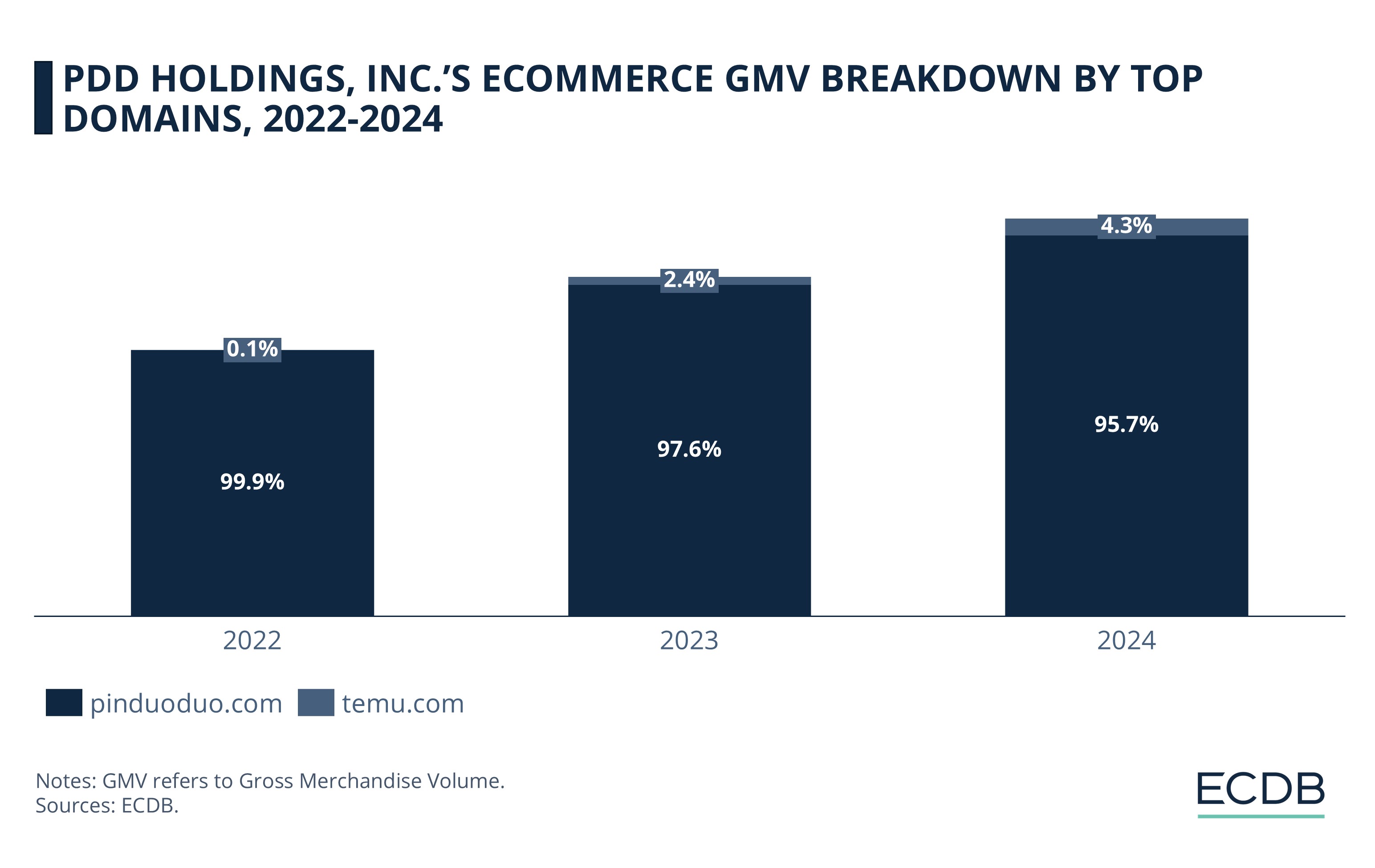

PDD Holdings' Domains: The China-focused Pinduoduo.com is PDD's top performing domain, constituting over 97% of the company revenues in 2023. But the internationally focused Temu.com is growing and is slated to contribute increasing shares to total revenues.

PDD replicated its discount-driven model outside of China through its marketplace Temu, an international marketplace. Launched in 2022, Temu has seen incredible success in diverse markets like the United States, Germany, and South East Asian countries. It has started to contribute higher shares to PDD’s overall GMV – from 0.1% in 2022 to a projected 4.3% in 2024.

4. JD.com, Inc.

JD.com's GMV was $511 billion in 2023, when it ranked third, after Alibaba and Amazon. After a modest increase in 2022, its GMV declined to US$501 billion in 2023. In this year, PDD claimed the third position.

Once Alibaba’s main Chinese competitor, JD.com’s eCommerce performance has stagnated due to several reasons, including eCommerce saturation in China, where it generates nearly all its online revenues, as well as a strategy shift.

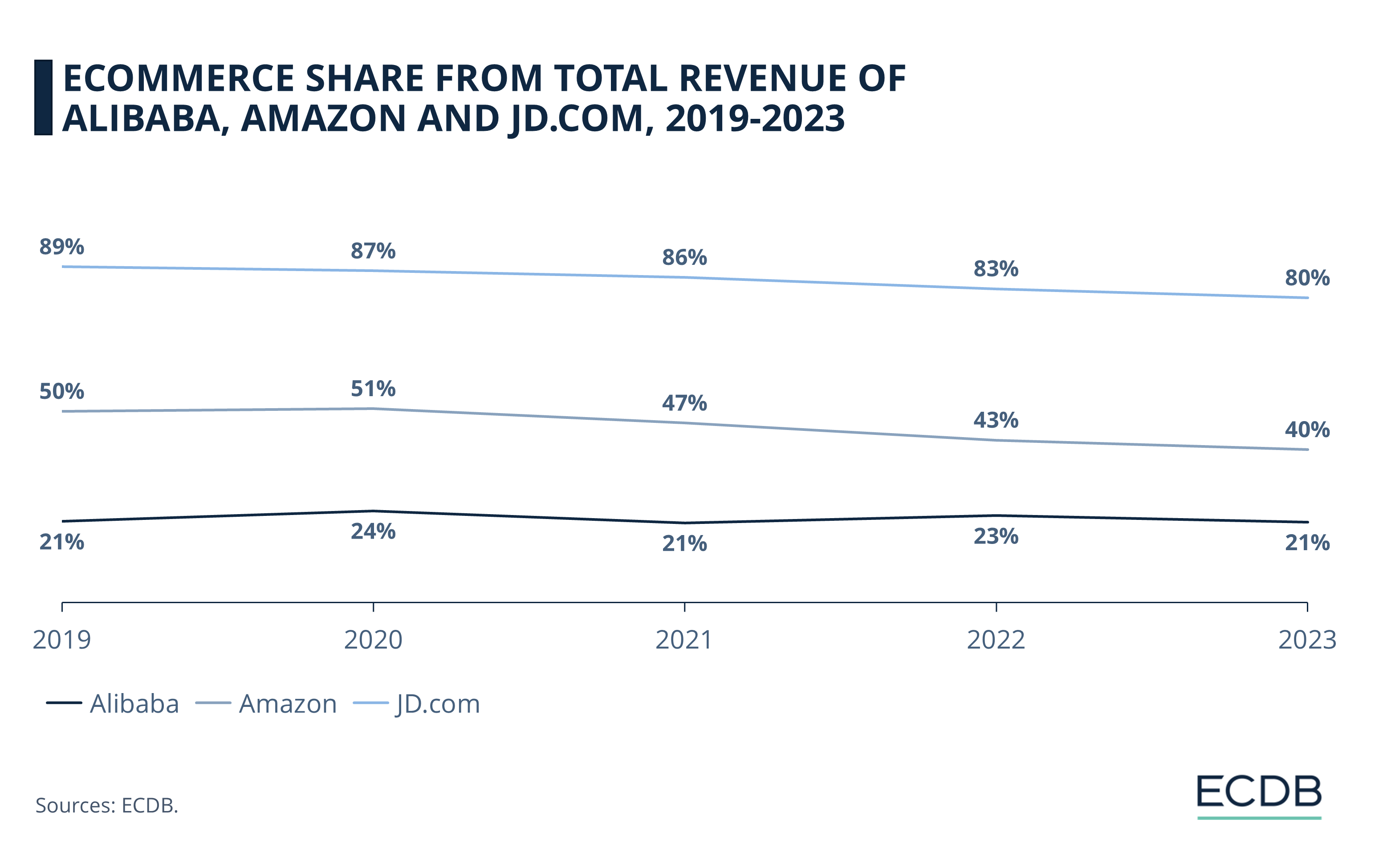

JD.com's eCommerce Share: JD.com has a strong online retail focus, with 80% of its revenues generated through its eCommerce operations in 2023. But the yearly development shows that, in fact, the eCommerce share in JD.com's total retail has declined in recent years.

JD.com Inc.’s eCommerce share in total revenue is still higher than its contenders like Alibaba and Amazon, but it has dropped modestly: from 89% in 2021 to 80% in 2023. The company is more focused on its logistics and third-party marketplace sales. While the diversification in revenue streams may benefit the company’s overall earnings, it is offset by slower gains in its eCommerce business.

5. ByteDance, Ltd.

ByteDance has broken into the top ranks, offering competition to Alibaba with its rapid rise in China and beyond. The company has achieved remarkable success in a short time, thanks to its Douyin and TikTok which spearhead the trend of social commerce globally.

In 2021, as the newest player in the eCommerce market, ByteDance had a GMV of $125 billion. Growth skyrocketed in the next year, putting its GMV to $227 billion. The trajectory continued in 2023, when the GMV reached US$408 billion.

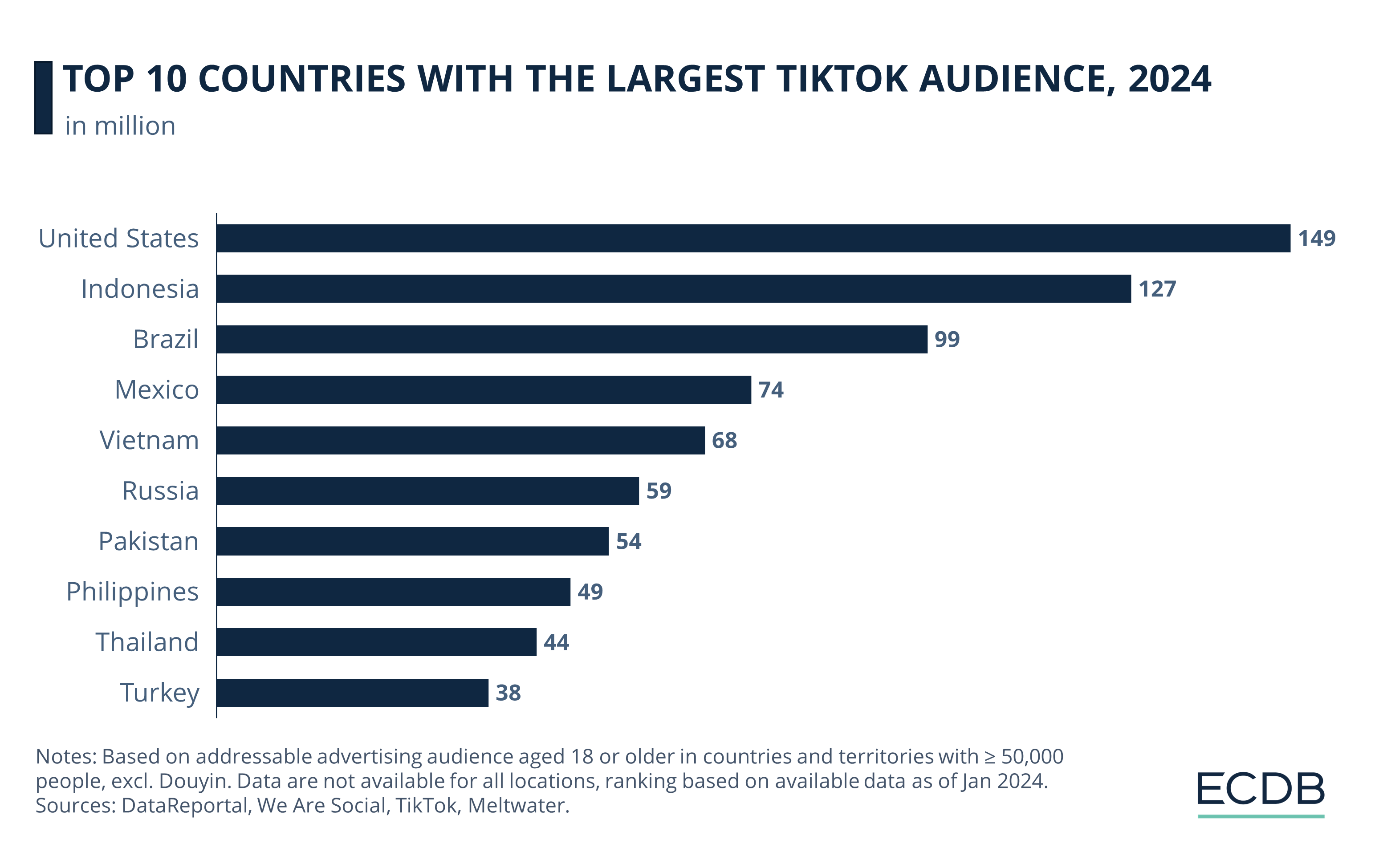

The United States has the largest group of TikTok users as of 2024, at 149 million.

Indonesia is second with 127 million.

Brazil is third with 99 million.

Inarguably, ByteDance’s success comes from integrating eCommerce into its social media platforms. The trend took hold in China, where 75% of the global social commerce revenue was generated in 2023. The Chinese Douyin had a GMV of US$387.6 billion in 2023. TikTok Shop, its global version, first conquered Southeast Asian markets. It has also gained traction in Europe and the U.S., which currently houses the most TikTok users.

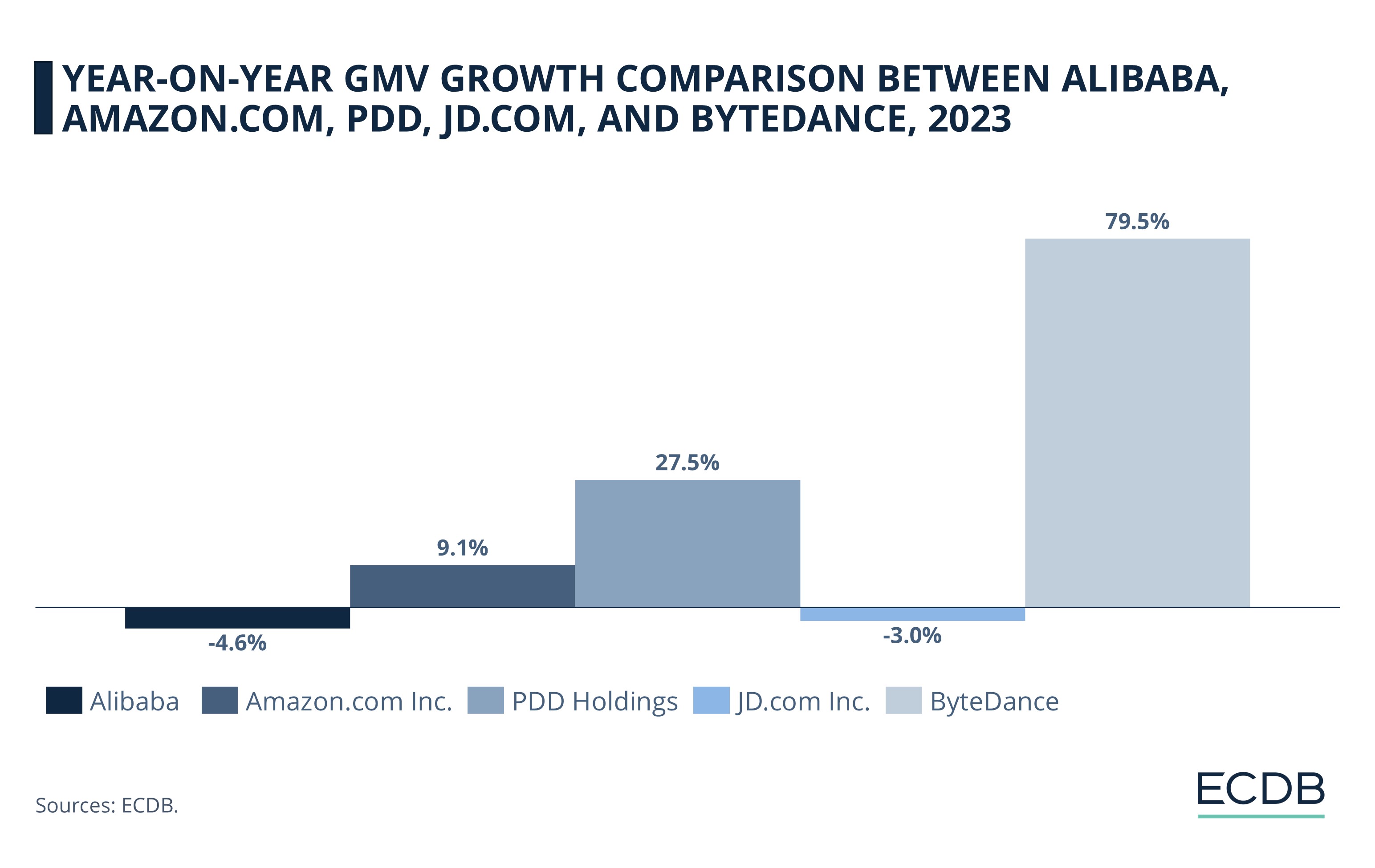

Alibaba’s Competitors by Growth: ByteDance Registers Record Growth

While it may be ahead of other companies in terms of revenue, Alibaba is in fact behind its competitors from a growth perspective.

Here are the yearly GMV growth rates recorded by Alibaba and its top competitors in 2023:

Alibaba saw the steepest decline in its GMV compared to others in 2023, at -4.6%. Its large revenues balanced out the negative growth, allowing Alibaba to maintain its lead.

JD.com is the only other company on our list to see negative growth (-3%).

Amazon had robust growth of 9.1%, putting its revenues closer than ever before to Alibaba.

PDD Holdings was the bigger winner by growth than Amazon. Riding on the successful performance of its marketplace Temu, as well as Pinduoduo.com, the company had an impressive yearly growth of 27.5%.

ByteDance emerges as the biggest growth champion by far. Although it ranks fifth at present, its growth was an astounding 79.5% in 2023. It was not a one-off event, as ByteDance has shown consistent yearly expansion throughout 2020 (1,151.4%), 2021 (72.5%), and 2022 (81.6%).

Going forward, Alibaba is anticipated to reclaim some of the lost ground, with its yearly GMV growth projected to be 4% in 2024. Amazon is likely to have comparable growth.

While JD.com’s growth is still expected to falter (-0.6%), PDD Holdings and ByteDance are poised for much higher growth than Alibaba in 2024: at 17.2% and 51.7% respectively.

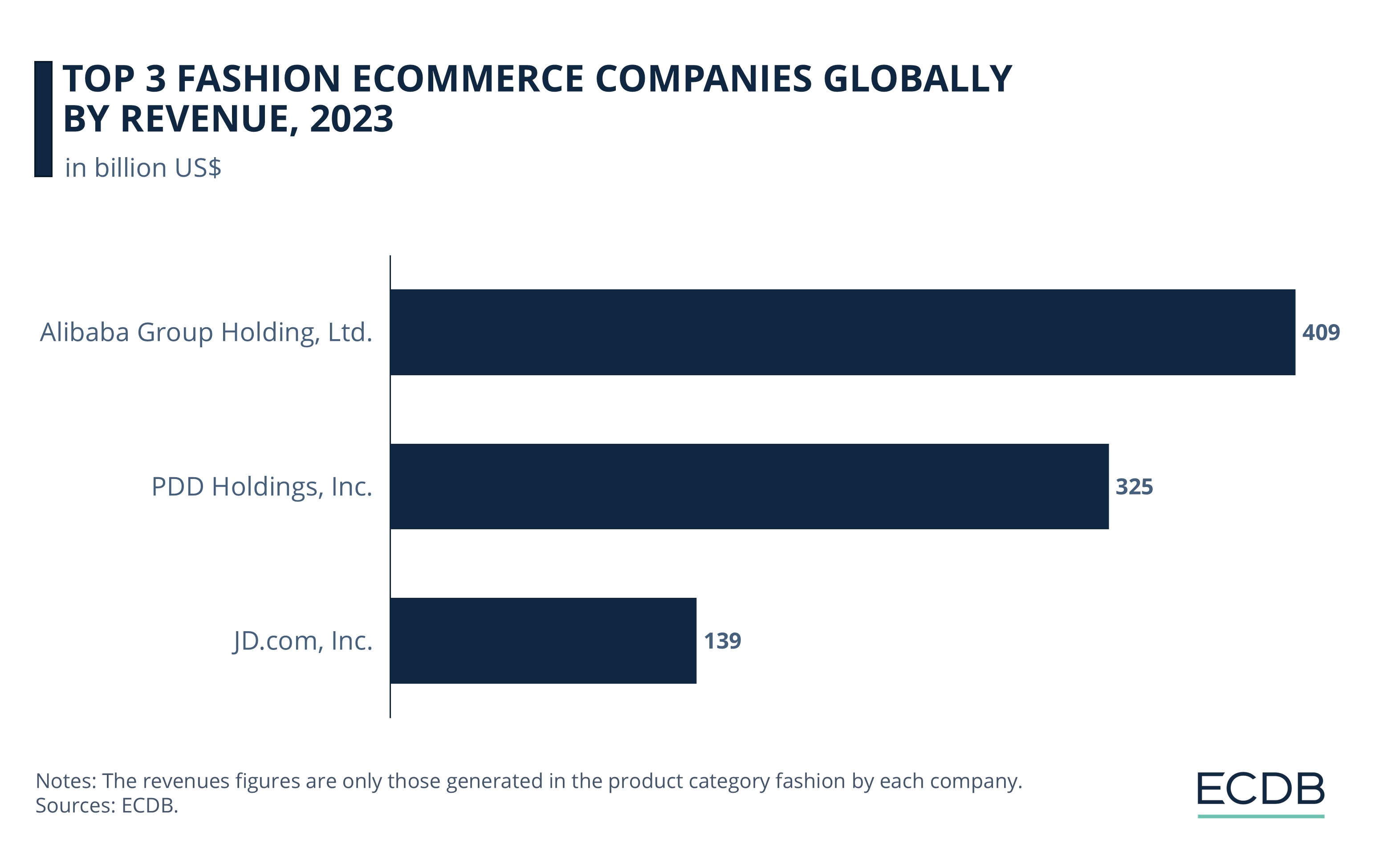

Alibaba’s Competitors in Fashion eCommerce: Is PDD Catching Up?

Alibaba’s main category is fashion, and it has the highest fashion eCommerce revenues globally. However, its Chinese rivals – PDD Holdings and JD.com – have also shown solid performance in this category.

Alibaba’s fashion eCommerce revenues were US$409 billion in 2023.

PDD Holdings is next in line, with US$325 billion.

JD.com Inc. is third with US$139 billion.

Fashion is the biggest eCommerce category worldwide. In China, the fashion subcategory apparel was the top product by revenue in 2023. At 55.7%, a higher share of PDD’s revenues come from fashion than Alibaba’s. Although it has strong projected growth, doubts abound whether PDD could sustain its success through its low-price, low-quality strategy.

On the other hand, Alibaba is a well-established name in fashion, specifically in China. Having moved past government scrutiny, its market shares are also looking up. Such factors indicate that although its competitors may perform well, Alibaba is likely to maintain its lead in fashion eCommerce in the near future, especially since its closest competitor Amazon specializes in hobby & leisure.

Top Alibaba Competitors: Closing Thoughts

Alibaba’s fiercest competitor is Amazon, which maintains a lead in developed markets like the United States and Europe. Alibaba is unlikely to gain a substantial foothold in Amazon’s core territories through its eCommerce operations.

Within China, Alibaba still leads by a high margin, but its rivals are stronger than before. PDD’s budget-focused, high-growth strategy could prompt Alibaba to adjust its approach, either by expanding into similar segments or introducing new models to combat PDD's discounting power. A newer threat is ByteDance – Alibaba’s fastest-growing competitor. It has captured a younger audience and is slated to see accelerated growth in the upcoming years.

Nonetheless, Alibaba is unlikely to lose its top rank in the short term, thanks to its established name, diverse operations, and a forward-looking strategy. With plans to expand its logistics operations in Europe and other segments like international commerce retail and cloud computing, Alibaba remains well-positioned to maintain its lead in global eCommerce.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Tinaba Partners with Alipay+ to Launch European Super App

Tinaba Partners with Alipay+ to Launch European Super App

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Online Shopping in China: Where Chinese Consumers Shop Online

Online Shopping in China: Where Chinese Consumers Shop Online

Back to main topics