eCommerce: Key Marketplaces

PDD Holdings: The Parent Company of Pinduoduo and Temu Continues Growing

PDD Holdings operates Pinduoduo, China's largest marketplace, and Temu, the emerging eCommerce platform that is disrupting global markets. What is their strategy for success? Here are the ins and outs of PDD Holdings' business model.

Article by Nadine Koutsou-Wehling | August 02, 2024Download

Coming soon

Share

PDD Holdings Success Strategy: Key Insights

PDD Holdings' Strategy: Affordability is a prime factor for the conglomerate, which started out by selling low-cost items to consumers in rural China through Pinduoduo.

Multiple Sources of Income: PDD makes money by charging transaction fees for each item sold through its online platforms and by providing advertising and marketing services to merchants. Prices are kept low by aggregating order volume.

Revenue Growth Continues Into 2024: PDD Holdings' recent earnings announcements confirms the company's ongoing revenue growth. In particular, transaction services have increased over the last quarter, which indicates growing marketplace activity on PDD's domains.

PDD Holdings is the parent company of Pinduoduo and Temu, two online marketplaces with a significant presence in eCommerce. PDD Holdings' earnings release for the fiscal year of 2023 and the first quarter of 2024 reflect the success across its subsidiaries.

So what makes these eCommerce marketplaces thrive? Here is what ECDB proprietary data has to say about PDD Holdings, Pinduoduo and Temu.

What Is Pinduoduo’s Strategy?

Pinduoduo, which means "together, more savings", was founded in 2015 by former Google employee Colin Huang. The eCommerce site reached remote populations in China, where the established platforms at the time, namely Alibaba and JD, hit roadblocks.

More specifically, Pinduoduo leveraged the following factors:

Affordability: Pinduoduo's initial hallmark was low prices, with deep discounts and the occasional free item. The platform first sold groceries at cheap prices and then ventured into other categories, maintaining the low-cost strategy all throughout.

Social Referrals: Huang has a background in the gaming industry, and this experience is said to have inspired him to create Pinduoduo's system, which uses network effects to find new customers. Users earn rewards by adding their social circle to the site, a win-win situation.

Broad Access: Pinduoduo allowed customers early on to refer acquaintances and pay for their orders via WeChat, Tencent’s widely used app with a 90% penetration rate. This allowed PDD to reach older consumers in rural areas who did not have the experience or skills to install a new eWallet and connect their bank accounts, making it easier for them to participate without additional effort.

After focusing on serving a large user base in remote locations, PDD expanded its operations to urban markets where Alibaba and JD operated. Their sales focus was on higher-end products, while PDD competed with low costs.

To attract consumers, a low pricing strategy can clearly be a competitive advantage. But how does PDD Holdings ensure that its revenues keep growing?

How Does PDD Holdings Make Money?

In addition to platform fees, there are other sources of revenue for the conglomerate. These include

Transaction fees: For every sale made through either pinduoduo.com or temu.com, PDD Holdings takes a commission. The exact fee depends on factors like product category and seller performance.

Advertising: Sellers pay to promote their products on the platform, akin to retail media advertising elsewhere.

Merchant and Marketing Services: Pinduoduo interacts with merchants through an online bidding system that determines the price and placement of the item on the platform.

Pinduoduo keeps prices low by aggregating consumer orders before routing them to merchants, thereby leveraging volume discounts. The lower prices increase the number of shoppers who want to buy on the platform, which in turn increases the discounts generated by orders at scale.

Pinduoduo's Revenue Growth

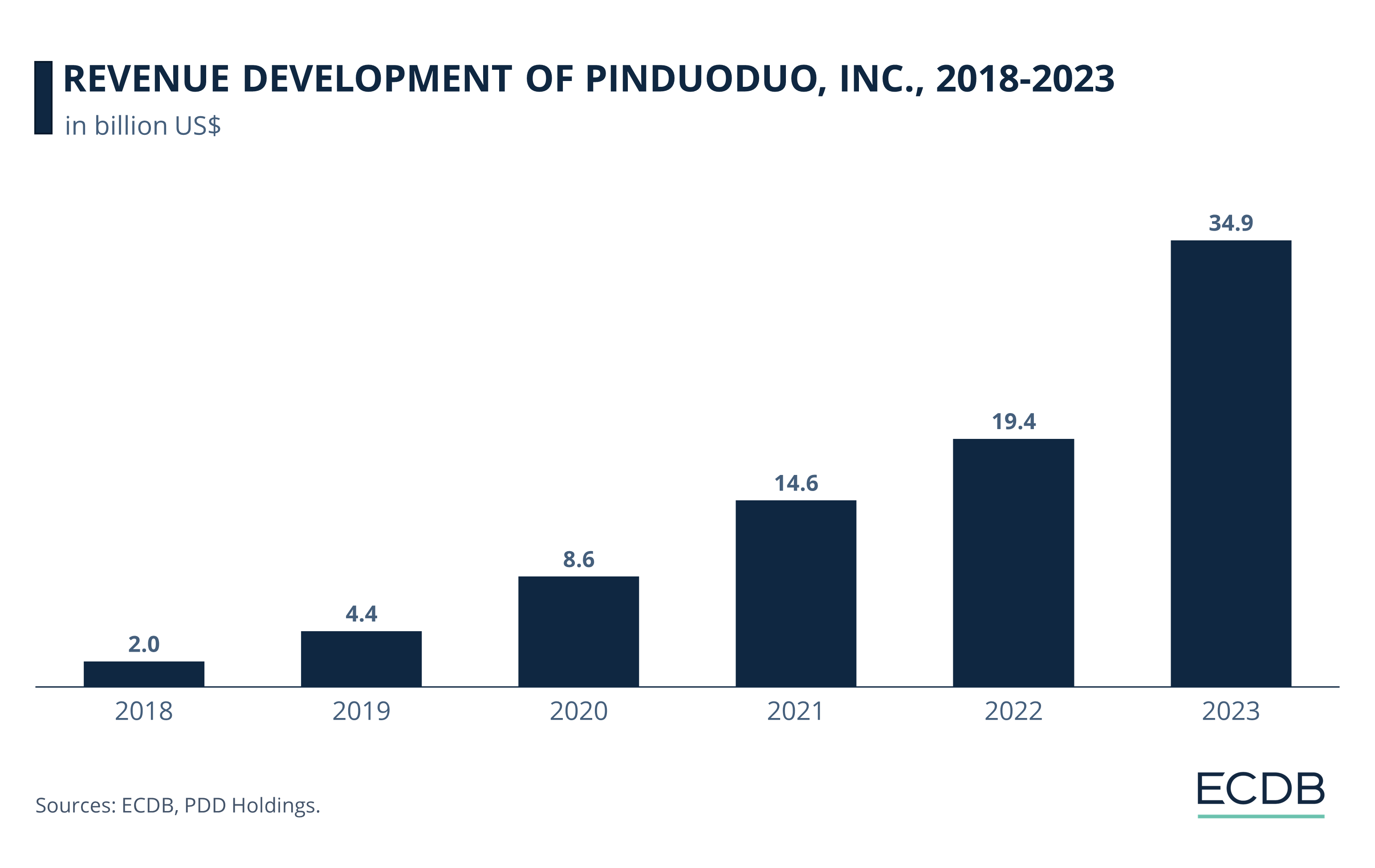

PDD's revenues continued to grow throughout the pandemic and during the economic downturn in the years that followed.

As a newer player, PDD’s revenues are at a lower level than what Alibaba generates, but the rise is significantly steeper each year. Certainly, its strategy of focusing on affordability has been particularly successful in recent years, as consumers were looking for cheap prices to cope with the rising cost of living in an inflationary environment.

Temu Could Lead PDD Holdings

to Global eCommerce Success

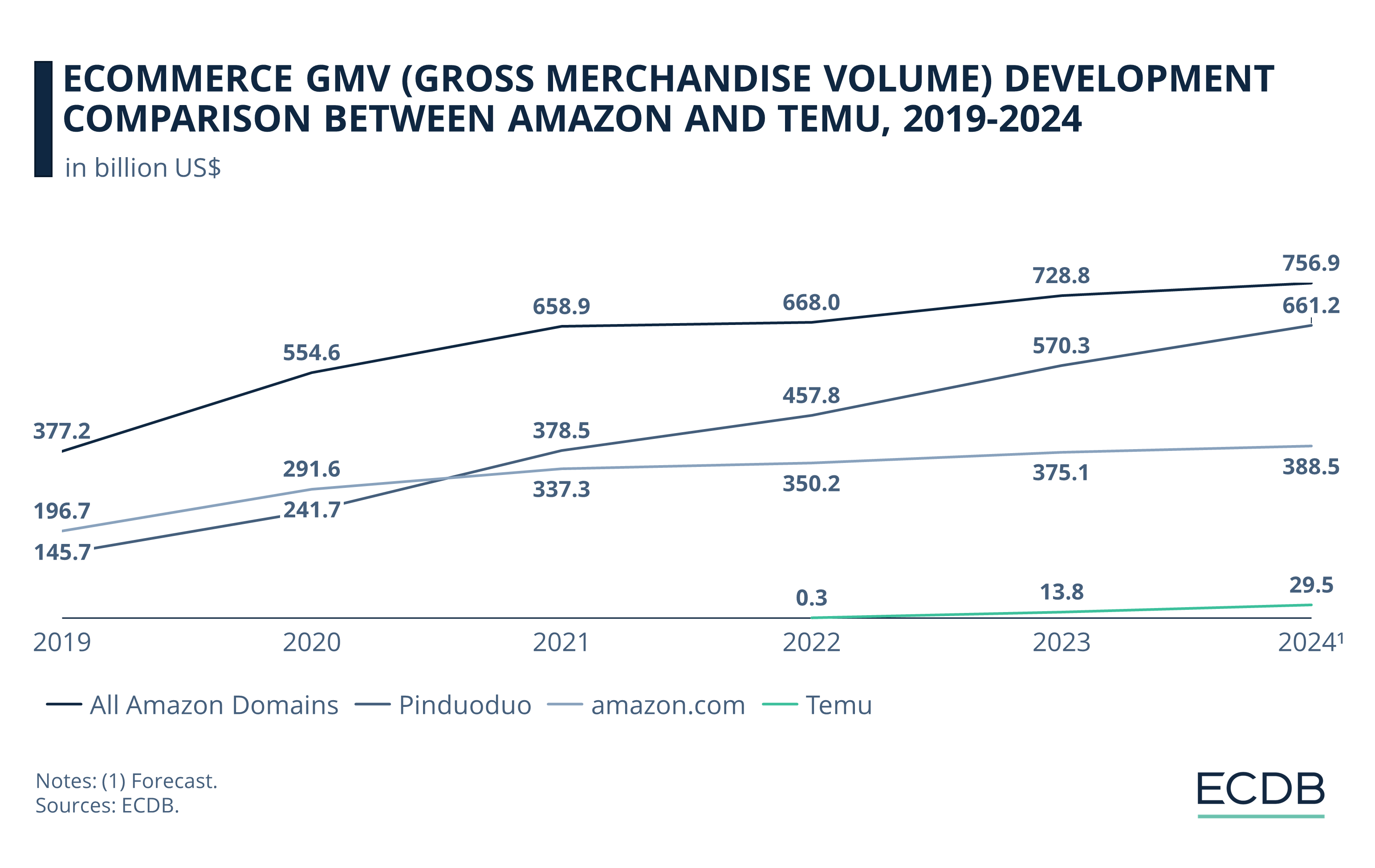

With the international expansion through Temu, PDD Holdings is approaching Amazon's market leadership alarmingly quick. Considering how fast Pinduoduo grew in its first years, it is not unlikely that Temu may experience similar growth.

Temu is PDD Holding's international site, designed to succeed where Alibaba has failed. The group is competing with both international and domestic players, the former including Amazon and Shein. This is also primarily achieved by leveraging the C2M (consumer-to-manufacturer) production model.

PDD Holdings: Steady GMV Growth on Pinduoduo and Temu

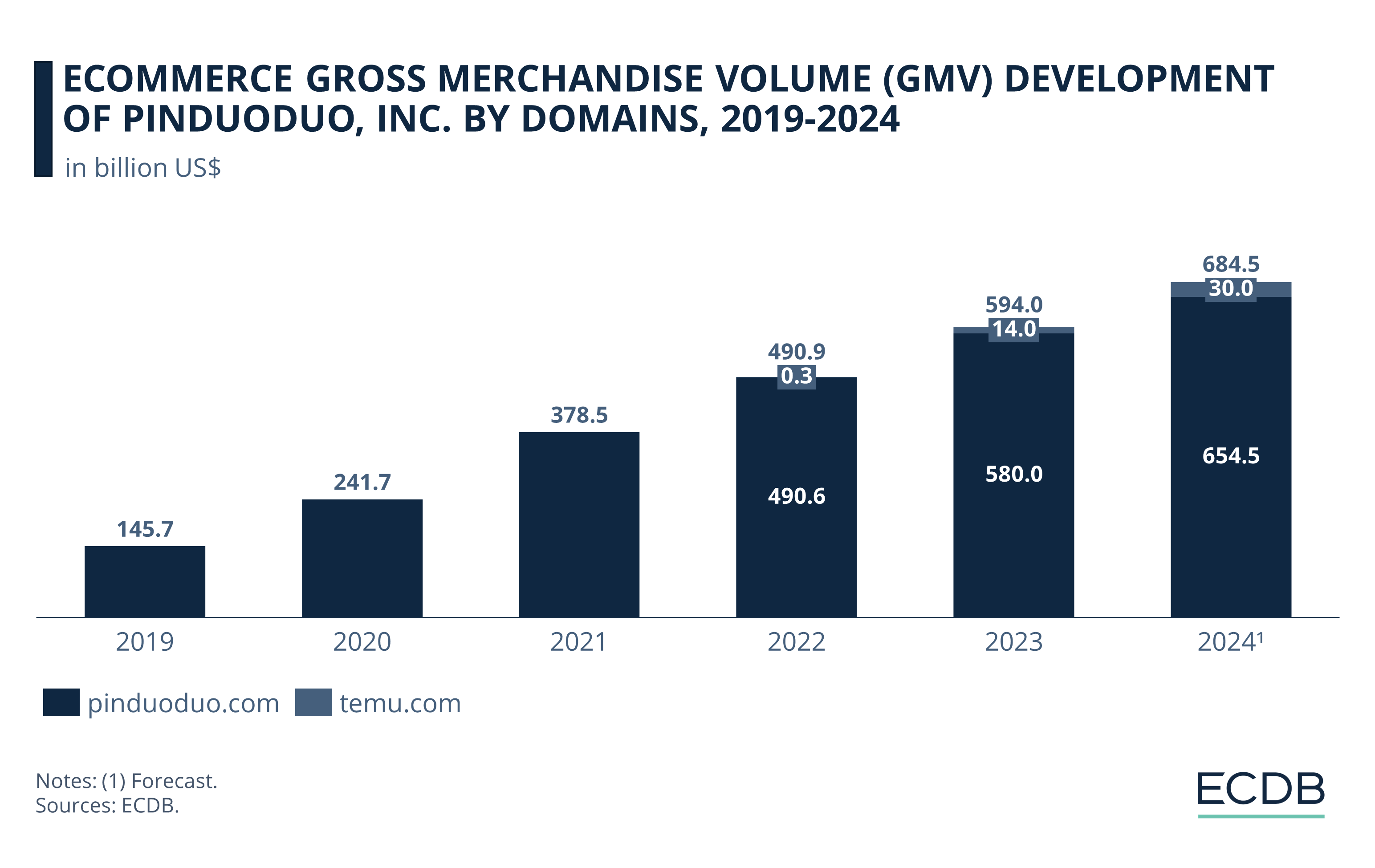

A closer look at gross merchandise volume (GMV), which measures marketplace activity over a given period, shows that it mirrors the steady revenue growth shown in the previous section.

The chart visualizes how Pinduoduo accounts for the bulk of PDD Holdings' overall GMV, while Temu’s GMV development over the past few years is quite small in comparison. Pinduoduo.com registered transactions in the hundreds of billions, which multiplied further during the pandemic years and after.

More precisely, in 2019, US$146 billion eCommerce transactions were conducted on Pinduoduo, which increased to US$500 billion in 2022.

By comparison, Temu saw marketplace activity of around US$300 million in 2022, having launched in September. By 2023, this figure was US$14 billion, while pinduoduo.com generated US$580 billion in transactions.

The positive trend is expected to continue in 2024, with an expected marketplace activity of US$654.5 billion on pinduoduo.com and US$30 billion on temu.com.

Note that GMV does not equal the revenue PDD Holding makes, which takes a percentage of GMV as a fee for platform provision.

PDD Holdings’ Earnings: Wrap-Up

PDD Holdings’ latest announcement corresponds to the collective outcry that its shopping platform Temu has stirred over the past year. With Alibaba’s revenues fluctuating, and Amazon facing criticism that its site has fallen prey to low-cost merchants and fake reviews, PDD Holdings emerges as the winner of last year.

However, one should not be too quick to judge the outcome. While Temu gained popularity and saw steep growth in 2023, it is questionable whether the low-price, low-quality strategy is viable in the long run. PDD Holdings has invested heavily in promoting the shopping platform, but sustaining its growth is another story, especially for consumers in countries that are used to different values.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

Sources: Nikkei Asia – PDD Holdings – TechinAsia – Technode

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Tinaba Partners with Alipay+ to Launch European Super App

Tinaba Partners with Alipay+ to Launch European Super App

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics