eCommerce: Alibaba Group

Alibaba Business Analysis: GMV, Revenue & Europe Expansion

Find out about Alibaba Group's GMV, revenue, and Europe expansion. We provide the latest insights and developments in the 2024 business analysis.

September 27, 2024Download

Coming soon

Share

Alibaba Business Analysis: Key Insights

Revenue Slowdown: Alibaba Group's revenue growth slowed significantly into the second quarter of 2024, primarily due to fewer income from operations and higher costs for investments.

Core Revenue Source: Alibaba Group's core revenue source in 2023 was its domestic eCommerce platforms, Taobao and Tmall. They generated 46% of total revenue, while international commerce, logistics, and cloud computing each contributed 11%.

European Strategy: Tmall sells European products to Chinese consumers, while AliExpress sells Chinese products to Europeans. Alibaba faces challenges in Europe with AliExpress but is entering with Miravia and Trendyol.

Rising Challenges: Alibaba's European expansion faces challenges like different consumer preferences, strong competition, stringent regulations, language barriers, and supply chain issues.

Listed on the New York Stock Exchange since 2014, Alibaba operates worldwide. Alibaba is a major player in online retail, alongside Amazon.

Facing competition from domestic platforms Pinduoduo and JD.com, Alibaba is expanding into Europe with subsidiaries Tmall, AliExpress, Trendyol and Miravia (you can find more about Miravia in the dedicated insight).

Recent reports show Alibaba's growth is slowing in 2023 and into 2024. Here is why that may be and how Alibaba's latest company restructuring and market conditions tie into the slowdown.

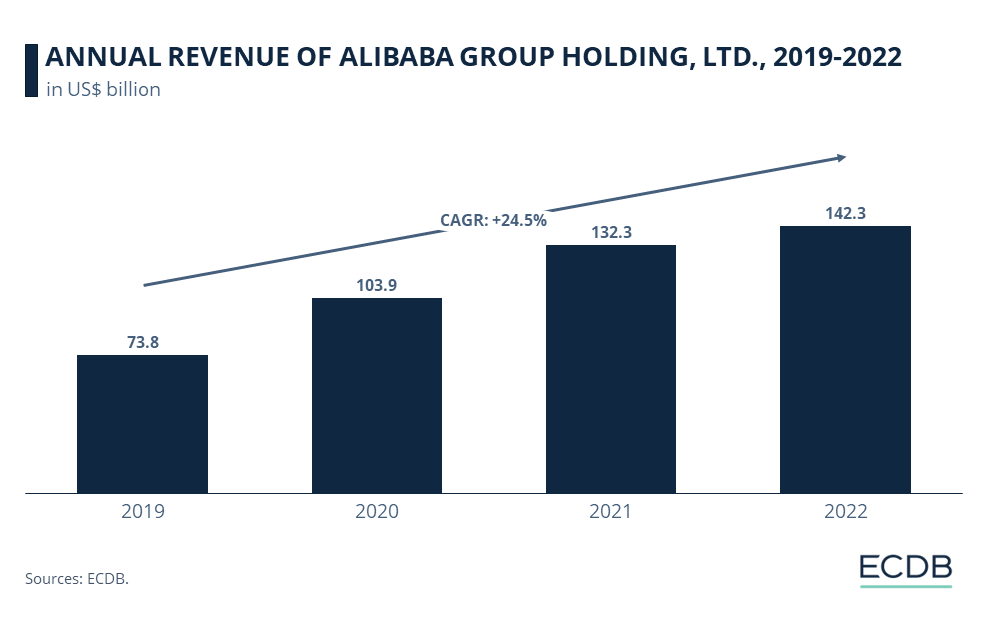

Alibaba Group Revenues: Slow Recovery From 2022 Drop

Alibaba Group's revenue growth has consistently demonstrated strong rates:

Revenues rose from US$74 billion in 2019 to US$132 billion in 2021.

By 2022, retailer's revenues declined, reaching US$129 billion.

Recovery was slow in 2023, despite Alibaba's company restructuring initiative to enhance efficiency across all sectors.

The latest earnings report for the second quarter of 2024 shows that Alibaba still has a few hurdles to clear before it can return to high growth. The conglomerate reportedly managed to stabilize Taobao and Tmall's market share, and quarterly revenue grew by 4% year-over-year to US$33.5 billion. But Alibaba's operating income fell 15% from a year earlier. Together with rising costs due to increasing investments, this resulted in a 27% decrease for net income in Q2 2024.

Nonetheless, Alibaba's other business segments outside of eCommerce saw growth. Because the Alibaba Cloud also broadcast the Paris Olympics via cloud infrastructure for the first time in the history of this major sporting event, it increased the conglomerate's recognition and public perception.

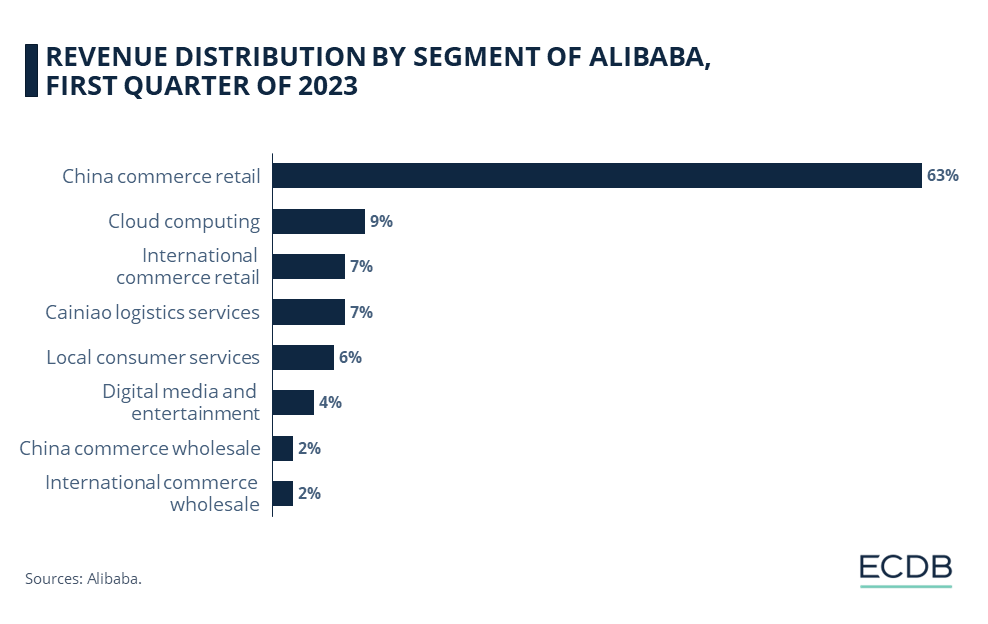

It is Alibaba's diverse business model that enables a steady stream of income and continuous growth. Here is how much each segment contributed in 2023.

Alibaba Group's Success: The Right eCommerce Platform

Below is an illustration of how the Group’s various business segments contribute to total revenue.

By far the largest segment of Alibaba's revenue comes from its domestic eCommerce platforms, Taobao and Tmall. 46% of 2023 revenues were generated by the China commerce retail segment, making it the holding company's core revenue source.

All other sectors account for significantly smaller shares: 11% each for international commerce retail like AliExpress and Trendyol, Cainiao logistics service, and cloud computing.

Further behind are local consumer services (6%), china commerce wholesale (2%), international commerce wholesale (2%), and digital media and entertainment (2%).

It does not take a mathematical genius to realize that national eCommerce domains are the bread and butter of the conglomerate's bottom line. But what exactly is the performance of its two flagship businesses, Taobao and Tmall?

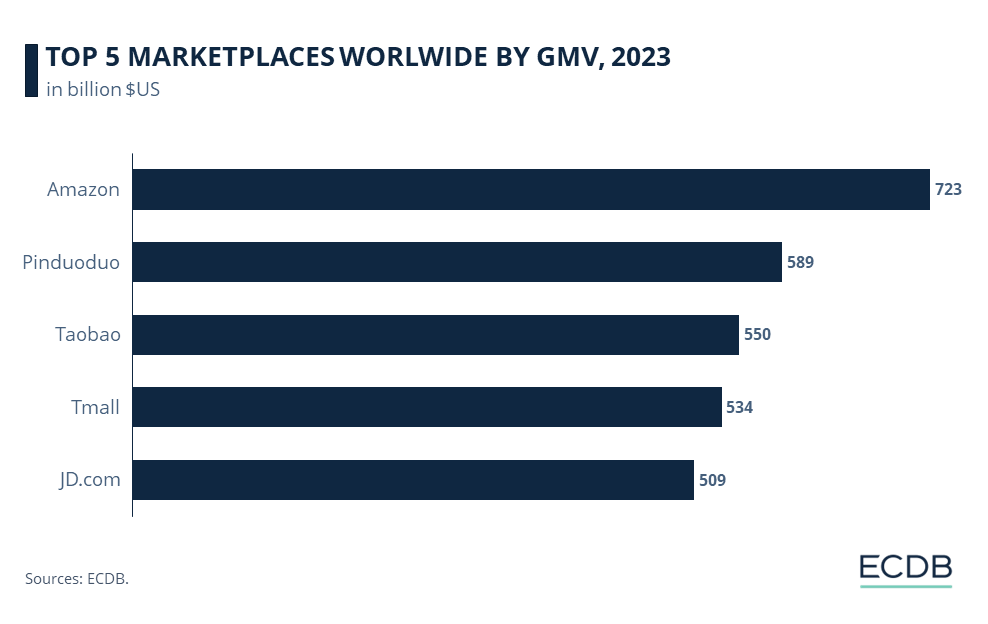

Taobao and Tmall: GMV of Leading Marketplaces

Taobao is a C2C marketplace launched by Alibaba in 2003. As the adoption of eCommerce became more widespread in the Chinese society, other local services like JD.com entered the market. Because of its C2C focus, Taobao has been characterized by a wide range of products at very low prices, rather than focusing on selling premium products.

In 2008, in order to keep up with competitors offering quality products, Tmall was launched as a subdivision of Taobao under the name "Taobao Mall". Tmall is a B2C eCommerce platform that ensures the credibility and quality of merchants through authorization checks. However, because Taobao has the larger reach and logistics network, the two platforms are closely linked to improve visibility and ensure seamless delivery.

The success of these by now well-established platforms in China is undeniable. Despite their national focus, Taobao and Tmall are formidable rivals to the number one global eCommerce player, Amazon. The following chart illustrates just how close the race to the largest marketplace has become.

While Amazon still tops the list of the leading marketplaces by GMV in 2022 with US$692.8 billion, Taobao is not far behind with its US$616.8 billion GMV. After that, Tmall is ranked third with a GMV approaching the US$600 billion mark.

A look at the rest of the rankings shows that China is a leading economy for online marketplaces, including Alibaba Group's direct competitors, JD.com and Pinduoduo.

Upon closer examination of the global stage for online marketplaces, it becomes increasingly clear why Alibaba Group may want to consolidate its position by venturing into markets outside of Asia: Not only to rival and surpass Amazon's GMV with one of its eCommerce platforms, but also to fend off domestic competitors.

Tmall Europe: Strategy for Success?

Tmall's strategy in China is to sell European products to Chinese consumers, while AliExpress does the opposite, selling Chinese products to European consumers. However, the sustainability of AliExpress is questionable, as European consumers were largely dissatisfied with product quality and long delivery times.

Apart from significant partnerships with European retailers, Alibaba has its own domains to challenge the European status quo. One of these is Miravia, the Spanish eCommerce site.

Based on what we know about Tmall's presence in China and how the Alibaba Group uses technological innovation and consumer preferences to sell products, here is what the Group will likely continue to build on:

1. Discounts and Shopping Events

Tmall, known for its use of discounts and shopping events in China, could use the same strategy in Europe. Shopping events such as Singles’ Day have been a great success for Tmall – generating billions in sales and attracting massive customer attention.

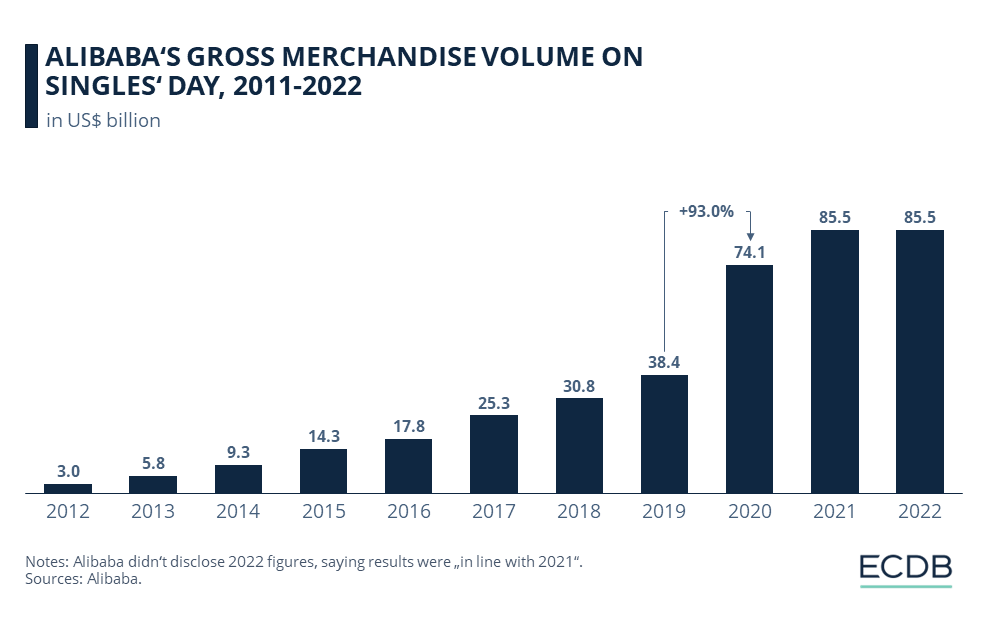

The chart below shows the development of GMV generated on Singles' Day, or the period on and around November 11th, alone.

In 2012, GMV surpassed the US$1 billion mark for the first time, and this trend has been positive through 2021.

As expected, the largest spike occurred during the pandemic, with a 93% year-over-year increase in 2020. Reaching a GMV of US$85.5 billion by 2021, these numbers show the immense profit potential of the shopping event.

But 2023 performance announcements (or rather, a lack thereof), put to question the growth viability of Singles' Day for Alibaba.

The Group could introduce similar events in Europe, specifically tailored to the shopping habits and special occasions celebrated in the region. In terms of discounts, Alibaba could negotiate with participating brands to offer limited-time price reductions or exclusive deals to European shoppers. This strategy would not only attract bargain hunters, but also encourage consumers to explore brands they may not have considered before. Pairing these discounts with an easy-to-use and secure platform could significantly enhance Tmall's appeal in the European market.

2. Gamification and Livestreams

Gamification and live streaming are an established feature in Asian eCommerce, so Alibaba will likely try to engage European customers similar to the way it entertains its Chinese user base.

This approach could involve creating interactive games and quizzes related to the products or brands on the platform. Such games offer rewards like discounts or exclusive access to new products, thereby encouraging customer participation and interaction with brands. This approach not only makes shopping more enjoyable, but it also serves as a unique method of product promotion.

A great potential is livestream shopping. In these virtual events, influencers or brand representatives showcase products live, answer viewers’ questions, and offer exclusive deals. This interactive form of marketing creates a sense of community and immediacy that can drive impulse purchases and brand loyalty. Introducing livestream shopping to Europe via Tmall could provide a novel shopping experience that sets Tmall apart from other eCommerce platforms in the region. As Alibaba has years of proficiency in this format, its entry into the European market means bringing its expertise to the continent. But live shopping is not the only service Alibaba has to offer.

3. European Logistics Service

To solidify its presence and ensure efficient operations in Europe, Alibaba could establish a dedicated logistics service handling warehousing, distribution, and delivery of products sold on its European platforms. By controlling the logistics, one can maintain service quality and reduce delivery times – factors imperative for success in the competitive European eCommerce market and one of the reasons AliExpress has failed on a larger scale.

This move could also benefit the larger Alibaba ecosystem by enabling faster and more efficient delivery for its other platforms operating in the region, such as AliExpress. Its logistics network could serve as a foundation for Alibaba's expansion and could potentially facilitate the launch of additional services or platforms in the future, further strengthening Alibaba's global presence. Of course, this applies to the cloud computing, food delivery, and streaming divisions as well.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Challenges for a European Expansion

Despite the promising outlook, Alibaba's European expansion will meet a host of challenges.

Consumer preferences in Europe differ significantly from those in China—not only in terms of product choice, but also in terms of platform style, presentation, and communication.

Europeans may not respond as positively to the gamified shopping experience that is popular in China.

Similarly, the widespread use of livestreaming might not resonate with European consumers who may prefer more traditional forms of online shopping. Tmall would need to carefully tailor its customer engagement strategies to accommodate these different preferences.

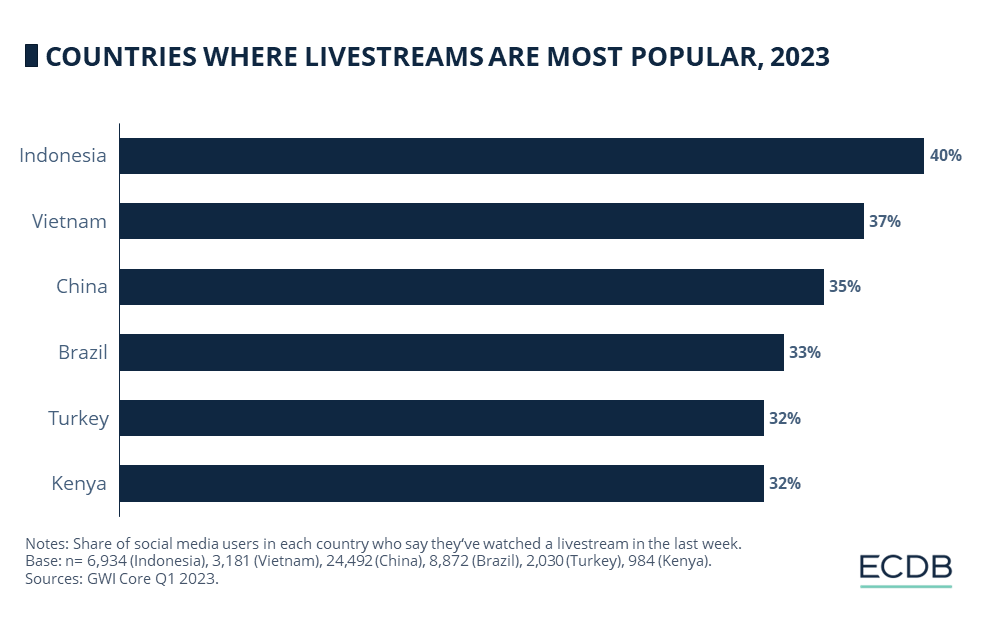

Looking at the data below, we see that, so far, European countries are not among those that stand out for their livestream preferences.

Of course, with the right approach, things could change. But there are other hurdles waiting around the corner, such as:

Established eCommerce Market Players: Tmall will have to compete with established eCommerce giants such as Amazon and eBay, as well as numerous local online retailers. These platforms have a deep understanding of local market dynamics and consumer preferences, having built trust and brand recognition over years of business activity.

Regulatory Challenges: European markets are known for their stringent regulations and standards, particularly in areas such as data privacy and consumer rights. Navigating these can be a significant challenge for foreign companies like Alibaba.

Language and Cultural Barriers: Europe is a very diverse continent with numerous languages spoken across different regions. Creating a platform interface, customer support services, and marketing materials in multiple languages can be a daunting task, while the result may ultimately prove unsatisfactory for consumers.

Supply Chain Complexities: Setting up a dedicated logistics service in Europe means dealing with complex supply chain issues, including warehousing, distribution, and customs procedures. Differences in import regulations between European countries can further complicate these processes.

All of these issues highlight the potential for Alibaba to enter the European market and disrupt the status quo, but also the risk of failure. Either way, ECDB will continue to monitor developments and provide you with data on Tmall's performance in Europe.

Alibaba Business Analysis: Closing Thoughts

Alibaba's ventures outside of China reflect efforts not only to compete with Amazon's dominance in online retail, but also to outpace domestic rivals JD.com and Pinduoduo. In addition to internal restructuring initiatives, the conglomerate is working to gain widespread recognition internationally, not only through the launch of eCommerce platforms, but sponsoring of major events and provision of Cloud infrastructure.

Sources: Alibaba Group - Alizala - Channel X - CNBC: 1 2 3 - Daxue Consulting

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Back to main topics