Livestreaming in China

The Story Behind the Success of Livestream Platforms in China

Live commerce in China surged during the pandemic, but has it maintained momentum? Discover market trends, user demographics, key platforms, and regional adoption patterns.

Article by Lucia Laurer | September 26, 2024Live commerce took off in China in 2016, but the market truly exploded during the pandemic when the zero-covid policy kept consumers at home, boosting online shopping.

How has live commerce shopping developed in China over the years, and what are the top platforms in the market? We will also discuss generational preferences among Chinese shoppers, the top platforms used, and how different markets worldwide are adopting this trend.

What is Live Commerce?

Live commerce combines livestreaming and online shopping, offering a dynamic, real-time buying experience. Hosts present products, interact with viewers, and answer questions, creating an engaging and interactive shopping event. This format enhances customer trust and drives immediate purchasing decisions.

Originating in China, live commerce has seen remarkable growth, particularly during the pandemic. It leverages the power of social interaction and instant feedback, making it a preferred shopping method for many.

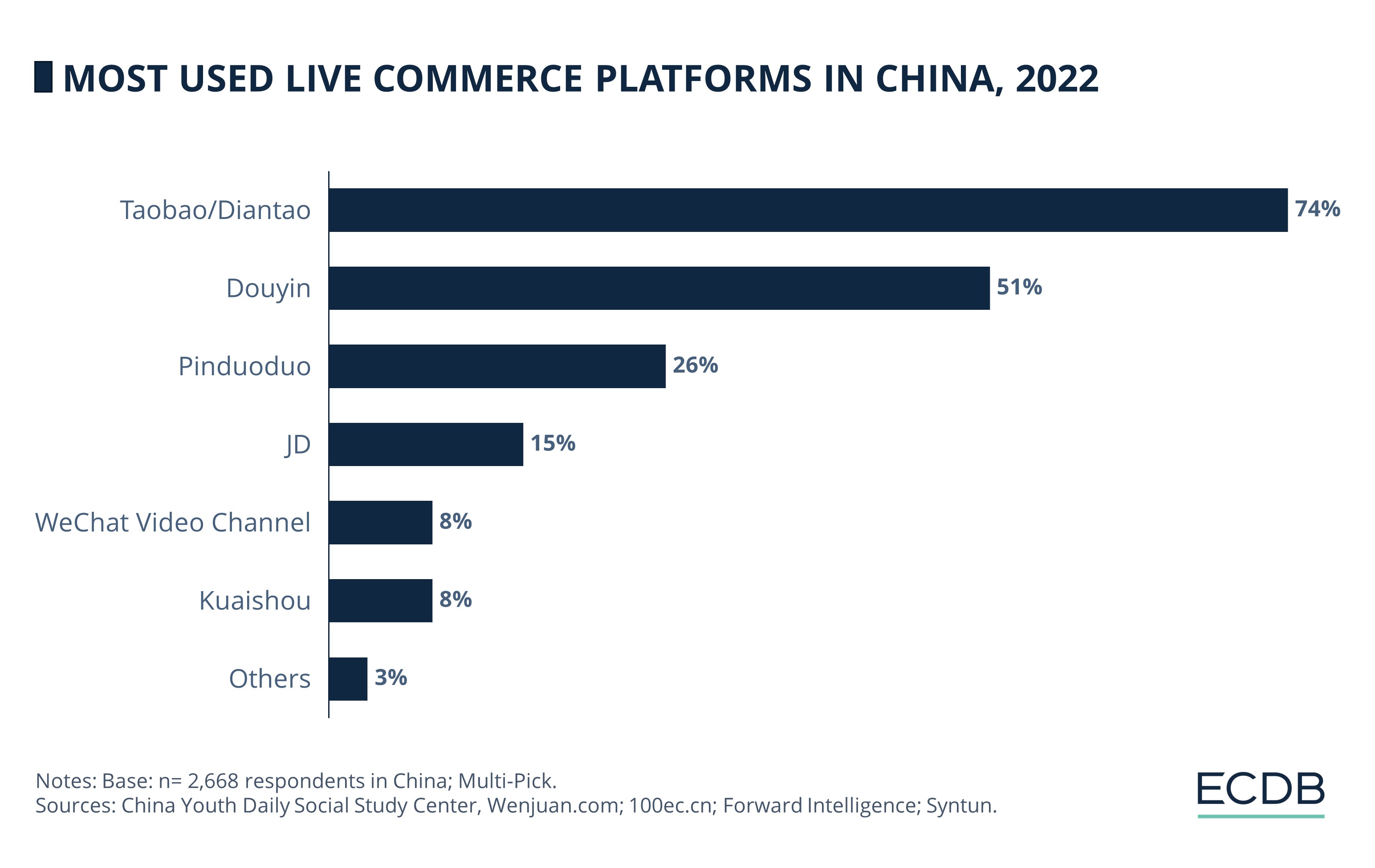

Top Live Commerce Platforms in China: Taobao Leads, Followed by Douyin

In recent years, the livestream commerce market in China has become more competitive, with many players now challenging Taobao’s lead:

Alibaba’s well-rooted eCommerce platform Taobao, and its flagship livestream app Diantao (formerly known as Taobao Live), lead in popularity among Chinese live commerce users, with a usage rate of 74%.

Douyin follows in the second place, with a usage rate of 51%.

Pinduoduo and JD.com also exhibit double-digit usage rates, while WeChat Video Channel and Kuaishou account for relatively smaller rates of 8% each.

When it comes to the share in total GMV, however, Kuaishou and Douyin have already passed Taobao and Diantao, according to data published by Statista.

Taobao had quickly become the leader in the livestream commerce market since its inception in 2016, accounting for more than half of the sector's GMV by 2020.

But Kuaishou and Douyin gained ground in the following years, contributing higher GMV shares than former leader Taobao/Diantao. By 2022, Douyin made up nearly half (47%) of the total GMV of leading live commerce Chinese platforms. Kuaishou stood second, accounting for 27% of the total GMV.

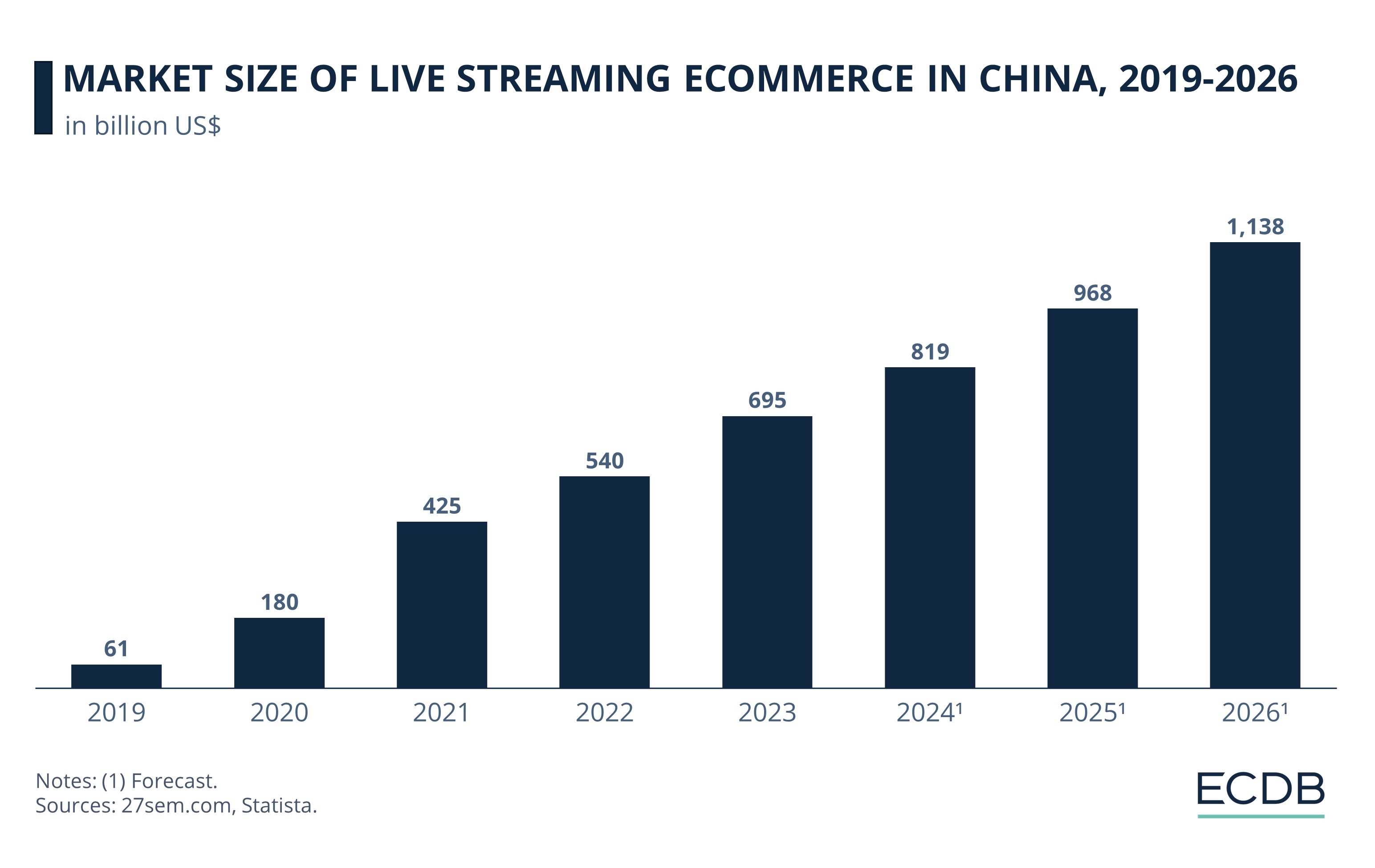

China’s Live Commerce Market Size: Development from 2019 to 2026

Data about live commerce in China shows that in terms of size, the market has seen a continuous growth since 2019:

The largest growth jumps occurred during the pandemic years. In 2020, the market size increased by an unprecedented 196% and reached US$180 billion.

The upward trend continued in 2021, when the market grew by 136% and hit US$425 billion.

From 2022 and onwards, as the lockdown restrictions were loosened and the normalization period began, the growth rate slowed down. For instance, the marked size increased by a much more modest 27% in 2022, followed by a slightly improved 29% in 2023.

Nonetheless, the market did not decline or register negative growth, indicating that a more durable shift towards live commerce happened among Chinese consumers. The market size also kept on recording growth, with its worth amounting to US$695 billion in 2023.

Forecasts predict that the live commerce market will grow steadily and surpass the US$1 trillion mark by 2026.

The phenomenal success of live commerce in China, coupled with favorable external conditions, has led to the emergence of a plethora of providers and livestreaming hosts. But its usage among consumers varies according to the shoppers’ generation.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

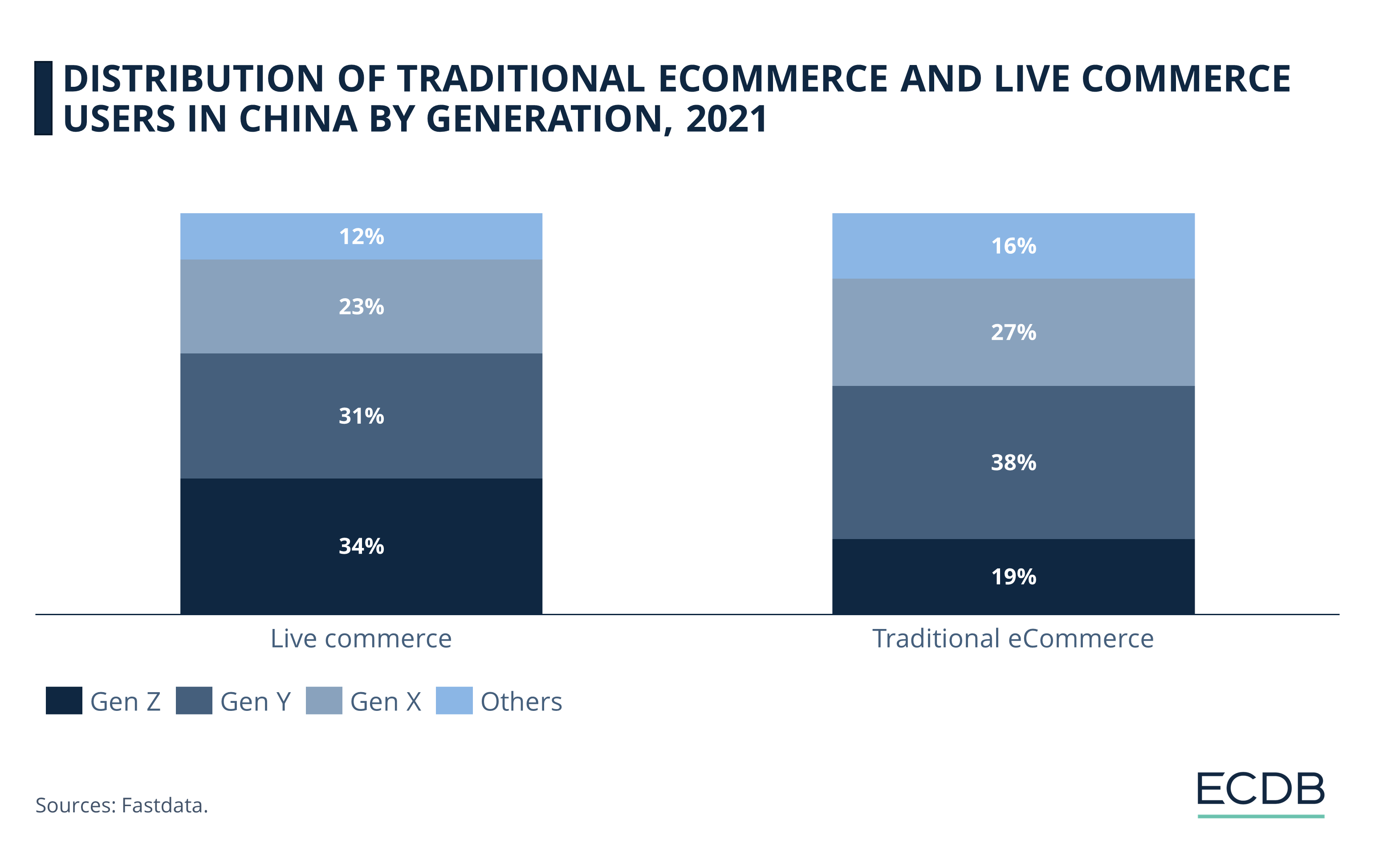

Chinese Live Commerce: 34% of Gen Z in China Uses Live Commerce

According to market research, people from Gen Z are the most active live commerce users in China.

34% of Gen Z shoppers have engaged in live shopping, compared to only 19% who participated in traditional eCommerce, as of 2021.

For all other generations, traditional eCommerce participation is much higher than live commerce use.

For example, 38% of millennials are eCommerce users versus 31% who are livestream shoppers. Similarly, 27% of Gen X are eCommerce shoppers versus 23% of those who are live commerce participants.

The trend indicates the popularity of live commerce among younger shoppers in China. It also confirms the position of Gen Z as an increasingly important demographic to consider for businesses in China, particularly when it comes to eCommerce marketing strategies.

Live Commerce: A Shrinking Trend?

As the livestream commerce market in China follows its path, the rise of new hosts and providers shows that the market is becoming more diverse and competitive. New businesses, livestream providers, and hosts are seeking to gain influencer status through this business model.

As more and more competitors join the fray, not everyone is able to gain the audience to generate the millions of yuan common when the trend first took off. As a result, host incomes are shrinking.

Other factors shaping the live commerce market are that consumers are being more frugal due to the economic recession in China, and the rise of AI influencers who are doing the same jobs for less money.

Moreover, companies like Douyin are taking note of the rapid growth of sellers in live commerce and are moving to regulate it for several reasons:

Protect consumers: Livestreams often leave little room for detailed product information, potentially leading to uninformed purchases. Douyin's crackdown includes a ban on quick launches and penalties for violators.

Concern about quality and environmental impact. As items promoted on livestreams are often inexpensive, they tend to contribute to waste and pollution.

Risk of exploitation: Low-cost items may discourage returns, thus ensuring the seller's profit despite potential customer dissatisfaction.

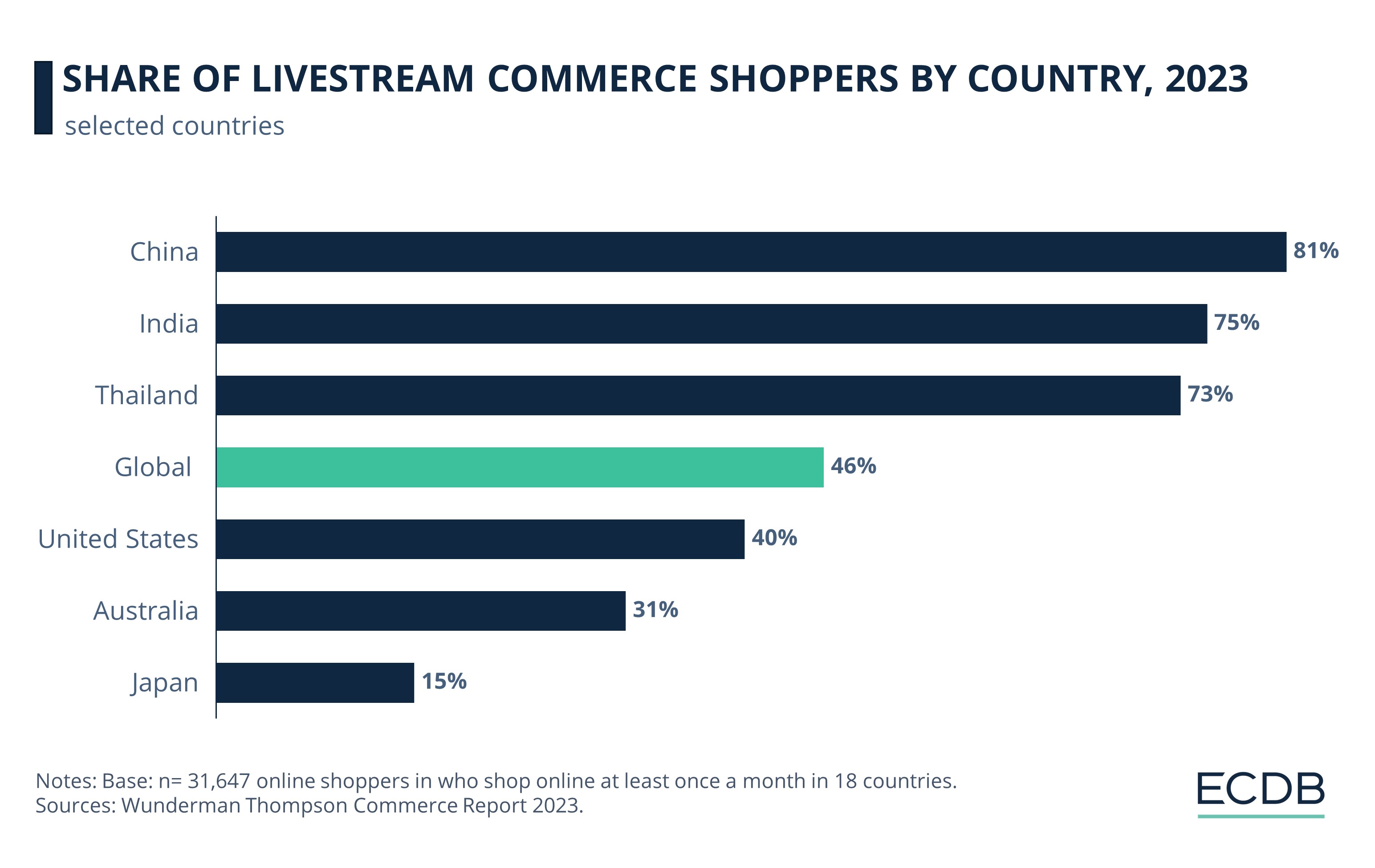

Beyond China: India and Thailand Are Emerging Consumer Markets for Live Commerce

Livestream commerce has redefined the way brands connect with their audience in China – and it has the potential to reshape eCommerce in other countries as well:

Currently, at 81% (well above the global average of 46%), China houses the largest share of live commerce shoppers.

Consumers in India (75%) and Thailand (73%) are taking to the trend readily, compared to online shoppers in other nations.

Another notable consumer market is the UAE, where 72% of online shoppers said they participate in live shopping.

In comparison, the trend of live shopping is slower in markets like the United States (40%), UK (35%), Australia (31%) and Germany (26%).

Live shopping is least preferred in Japan which, at 15%, has the lowest share of shoppers who engage in live commerce.

Several factors could be contributing to the low preference in Japan, including an engrained popularity of convenience stores which means consumers are less likely to watch a live shopping stream before making purchase decisions.

Live Commerce in China: Closing Thoughts

China’s live commerce market has seen continuous expansion in the past years, with projections optimistic for the future. But notably, the growth rate has slowed after the pandemic, and signs of market saturation are also visible.

The eCommerce ecosystem and consumer behavior in China both proved conducive to the growth of live commerce. In fact, high smartphone penetration and an existing inclination towards social commerce can be credited with the success of live commerce in China.

On the other hand, live commerce is yet to attain similar popularity levels in the North American and European markets. The introduction of new technologies and features – such as the recently launched TikTok Shop – can accelerate this trend going forward, particularly among Gen Z who are active social media users and buyers.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Who Are the Number One Shop Software Providers in Each European Country?

Who Are the Number One Shop Software Providers in Each European Country?

Deep Dive

The United States Takes the International Lead in eCommerce Revenue per Capita

The United States Takes the International Lead in eCommerce Revenue per Capita

Deep Dive

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Deep Dive

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Deep Dive

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Back to main topics