eCommerce: Miravia

Miravia Business Analysis: Alibaba's New Platform & Fastest Growing Online Marketplace in 2023

Can Miravia, backed by Alibaba, sustain its quick growth and compete with eCommerce giants like Shein, Temu, and Amazon in terms of revenue?

Article by Cihan Uzunoglu | July 24, 2024Download

Coming soon

Share

Miravia Business Analysis: Key Insights

Rapid Growth:

Miravia saw an 8,027% annual growth rate in 2023, making it the fastest growing online marketplace, with its GMV reaching US$1.15 billion and projected to hit US$1.62 billion by 2025.

Strategic Partnerships:

Through its partnership with Rithum, Miravia enhances its marketplace by integrating a comprehensive eCommerce platform, connecting with global brands, and offering users a unique shopping experience enriched by influencer content and interactive tools.

Promotion Strategies:

Miravia captures the Spanish eCommerce market by employing aggressive promotion strategies like flash sales, countdown timers, and exclusive discounts, similar to Shein and Temu, and uses viral marketing to expand its audience.

Influencer Engagement:

Leveraging Alibaba Group's financial strength, Miravia adopts successful strategies from Shein and Temu while engaging over 26 million followers through a robust influencer network and significant social media presence, offering a customized shopping experience.

As the world's largest eCommerce market, China has spawned many successful marketplaces. The most recent and memorable examples are Shein and Temu. These platforms sell incredibly cheap products and have gained immense popularity due to their gamified app design.

Miravia is one of the latest entries into this world. The latest marvel from the Alibaba Group has already made a name for itself in Spain, with its sights set on the rest of the world.

What is Miravia?

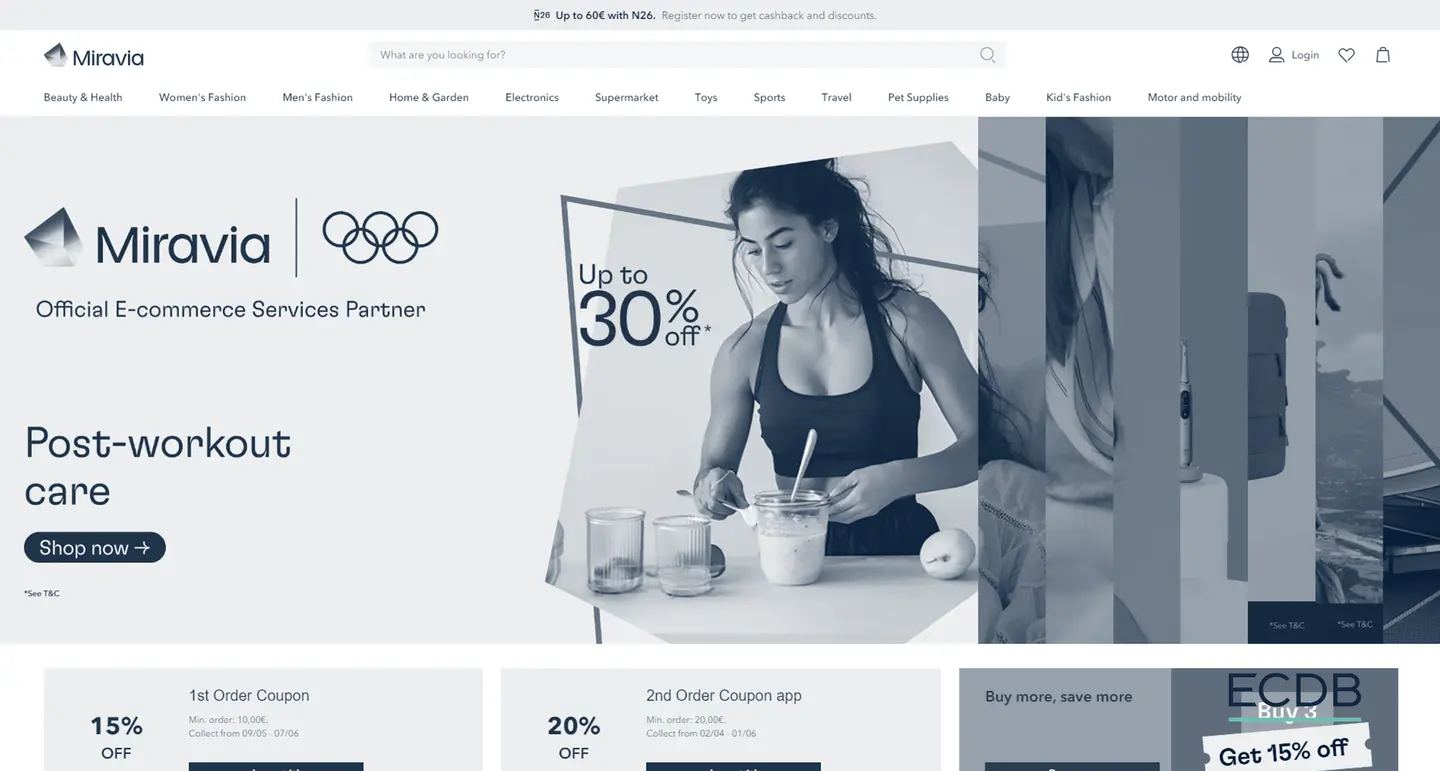

Miravia is a dynamic online shopping platform that launched in Spain in 2022. It blends eCommerce and entertainment, offering a vibrant and agile shopping experience. As a marketplace, Miravia features a wide range of products from popular brands, catering to diverse interests in fashion, beauty, and lifestyle.

A standout feature is its integration of innovative solutions like exclusive influencer content and virtual makeup try-on lenses. These elements help consumers stay updated on the latest trends and enhance the shopping experience with an interactive dimension.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

For sellers and brands, Miravia provides a flexible space to establish their own stores. They can design storefronts, choose products, set prices and promotions, and implement loyalty programs. This direct interaction with customers creates a tailored shopping experience that benefits both buyers and sellers.

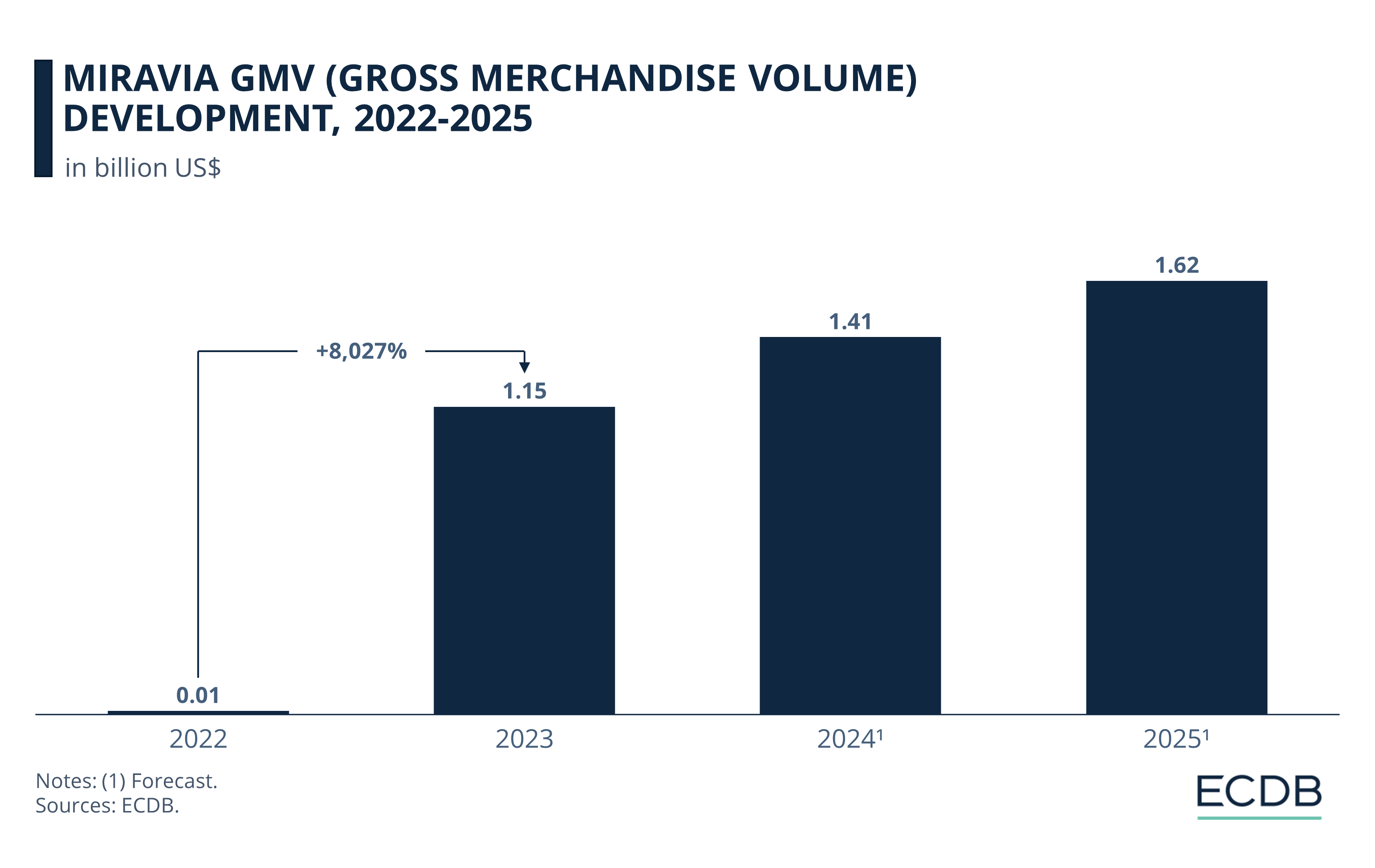

Miravia GMV: 8,000% Growth in 2023

With an annual growth rate of 8,027%, Miravia was the fastest growing online marketplace in 2023. Generating all its eCommerce net sales in Spain:

Miravia reached US$1.15 billion in GMV last year.

It is expected to grow 22% this year and 15% next year, forecast to hit US$1.62 billion in revenues by 2025.

Most Popular Products on Miravia

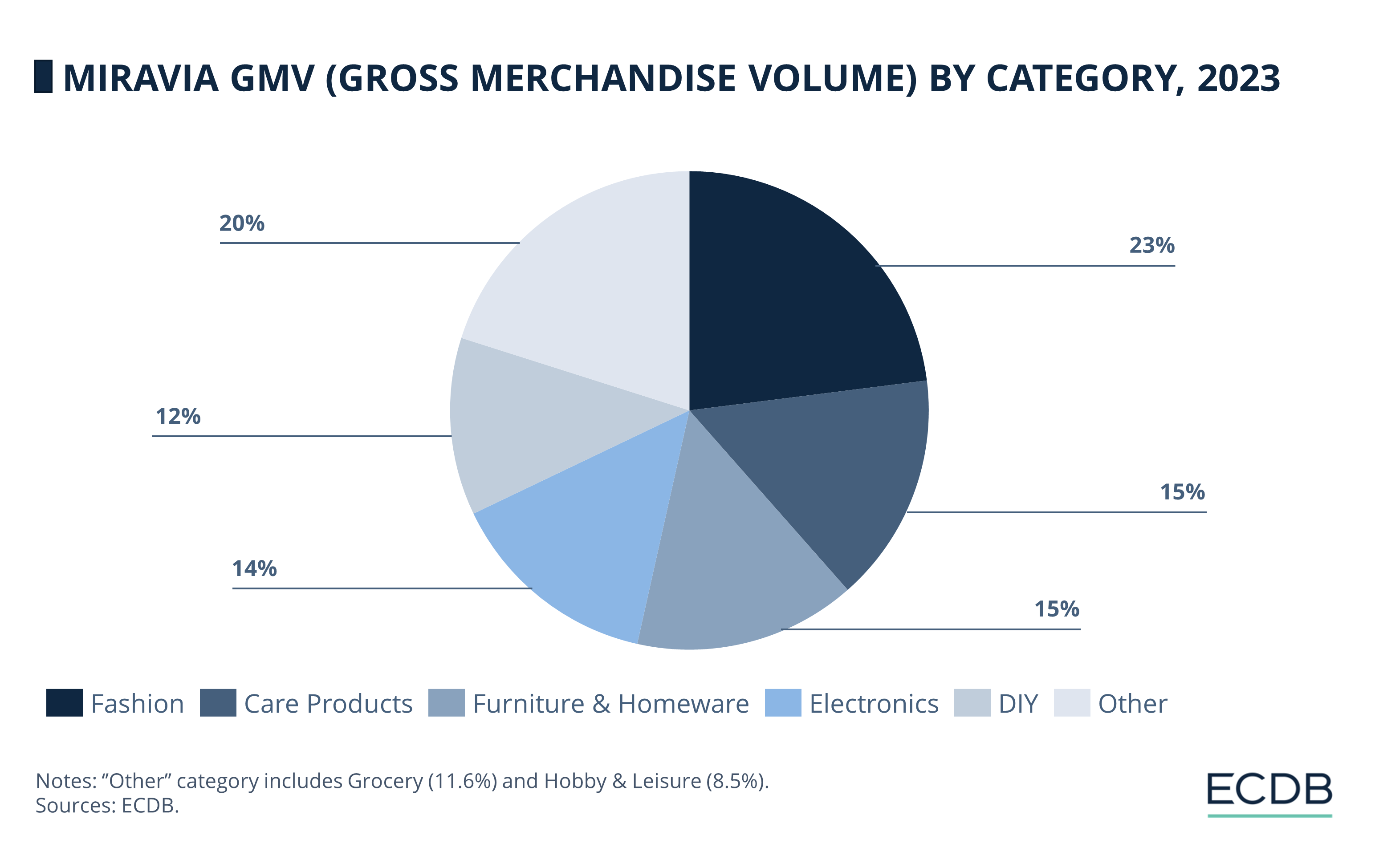

Miravia has a fairly even distribution among its product categories:

Fashion leads the way, accounting for 23% of net sales in 2023.

The Personal Care, Furniture & Homeware, and Electronics categories account for around 15% of the online marketplace's sales.

Other categories such as DIY, Grocery and Hobby & Leisure have shares of 8.5% to 12%.

With US$264.8 million filtered revenue in 2023, Miravia is ranked 5th among marketplaces in the Spanish online fashion market. Given its stellar growth over the past year, can Miravia hold its own and compete with the top names in the market such as Amazon, AliExpress, Zalando and Vinted?

Miravia’s Partnership with Rithum

To fuel its rapid growth and expand its reach, Miravia has partnered with CommerceHub (later rebranded to Rithum), a leading commerce network connecting global retailers and brands. This strategic move enhances Miravia's capabilities as a marketplace and entertainment hub, offering users a unique shopping experience enriched by exclusive influencer content and interactive tools.

Rithum, known for its comprehensive eCommerce platform powered by ChannelAdvisor, will integrate its unified commerce solution with Miravia's operations. This integration is crucial as Miravia seeks to establish itself as the go-to eCommerce ecosystem where brands, buyers, and creators connect seamlessly.

By leveraging Rithum's robust network, Miravia can connect with tens of thousands of brands, including global giants like L’Oreal Paris and Disney, as well as prominent Spanish fashion brands like Alohas, Atria The Brand, and Name The Brand.

The partnership with Rithum empowers Miravia's merchants by providing tools to reach new buyers and expand its market presence. This collaboration aligns with Miravia's mission to offer an agile and engaging online shopping experience, as it enhances its marketplace with a vast array of products and exclusive content.

Miravia Business Analysis: Joining the Ranks of Shein and Temu

Miravia has firmly established itself within a competitive business model pioneered by Shein and Temu. These platforms are characterized by aggressive promotion strategies, creating a sense of urgency among consumers. Like its counterparts, Miravia employs flash sales, countdown timers, and exclusive discounts to captivate its audience.

Despite not being a dedicated fast fashion brand, Miravia's rise in Spain can arguably be linked to the high share of fast fashion brand net sales among the top 100 online fashion stores in Spain.

Miravia’s approach mirrors the success seen by Shein and Temu, both of which have quickly gained traction in eCommerce by leveraging viral marketing and heavy discounting. These platforms flood social media with ads, creating buzz and attracting a large user base rapidly. Shein, known for affordable fashion, and Temu, which saw massive growth since its launch in Spain in April 2023, have set a high bar with their innovative shopping experiences.

Strategic Growth and Financial Backing

Miravia, owned by Alibaba Group, leverages substantial financial backing and infrastructure from its parent company, which also operates AliExpress. This financial muscle allows Miravia to compete effectively, offering significant discounts and a wide range of products to attract and retain customers. By adopting successful elements of Shein and Temu's strategies, Miravia has carved out a substantial presence in the Spanish eCommerce market.

Since its launch, Miravia has made a big impact in Spain, offering a model where users access the latest trends in fashion, beauty, and lifestyle through innovative solutions like influencer content and virtual makeup testing tools. This dual focus on eCommerce and entertainment helps Miravia stand out.

Miravia’s success is driven by its focus on quality and mid-to-high-end products, targeting high-income consumers. The marketplace provides free shipping on orders over €10 (US$10.85) for items shipped by Miravia and offers 30 days for free returns, making it convenient for shoppers.

Influencer Network and

Social Media Presence

Currently, Miravia’s platform boasts more than 8,000 brands and over 10 million references. Over 800 brands have created official stores on Miravia, customizing storefronts, defining prices and promotions, and directly interacting with customers. This level of customization and engagement helps build brand loyalty and enhances the shopping experience.

To connect with its audience, especially Generation Z, Miravia has built a network of 200 influencers and content creators, reaching more than 26 million followers. These influencers are crucial to Miravia’s digital strategy, creating content for social media and the platform.

Notable ambassadors like Spanish TikToker Marina Rivers, Paula Gonu, and Luc Loren have participated in campaigns featuring exclusive television interview formats.

Miravia’s social media presence is noteworthy, with over 107,000 followers on Instagram and more than 37,000 on TikTok as of May 2024. The platform supports influencer professionalization through programs like the Creators Academy, offering advice and tools for creating valuable content.

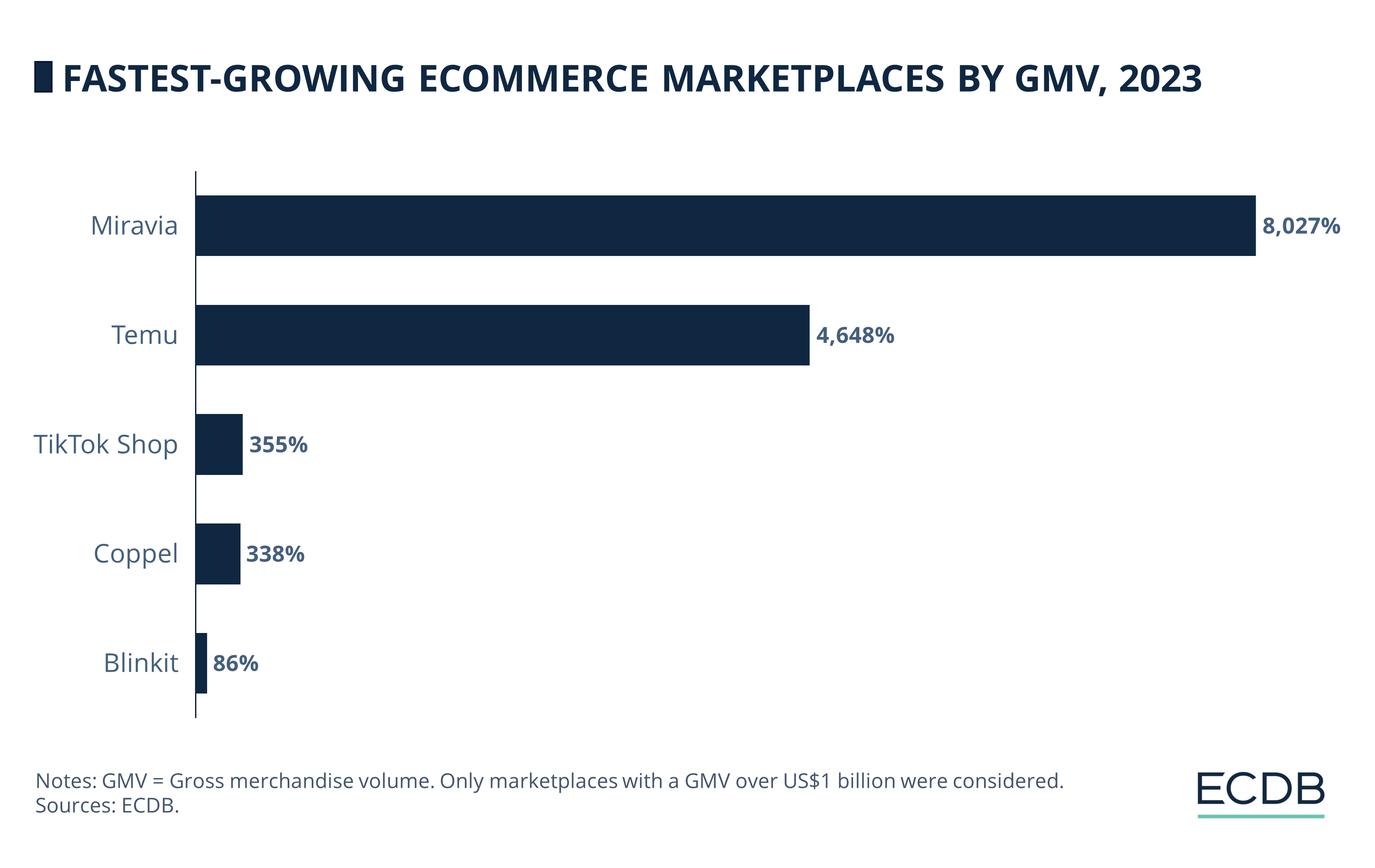

Fastest Growing Online Marketplaces of 2023

Miravia's impact on the market and the speed with which it has done so is undeniable. What about other online marketplaces, are there others that came close to Miravia's growth rate last year?

Among the fastest growing online marketplaces (with a GMV of over US$1 billion) of 2023:

While Miravia is at #1 with 8,027% growth in 2023, Temu follows in the second place with an impressive growth of 4,648% last year.

TikTok Shop is at #3 with 355% growth.

Number 4 is the Mexican marketplace Coppel, having grown 338% last year.

Blinkit from India rounds out the top 5 with 86% growth in 2023.

Miravia Business Analysis: Closing Thoughts

Fast growth doesn't always mean sustainable growth. Time will tell how strong Miravia will be against giants like Amazon, as well as newer but already influential players like Shein and Temu.

In a competitive world like the global eCommerce market, it's not easy to sustain success. Having entered the Spanish market as it’s “one of the European markets with the greatest potential in the eCommerce sector”, thanks to its “high penetration of Internet and mobile technology” – in the words of Miravia’s CEO Yann Fontaine, we can't wait to see in which direction Miravia will evolve and continue its journey.

Sources: Fashion United, Just Style, Drapers, El País, PR Newswire, Marketing4Commerce, The Star, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics