eCommerce: Markets & Product Categories

South Korean Online Fashion 2024: Revenue, Stores & Trends

The South Korean online fashion market is gaining global attention as K-pop, TV series, and movies attract worldwide audiences. How is this influencing the domestic market?

Article by Nadine Koutsou-Wehling | October 23, 2024Download

Coming soon

Share

South Korean Online Fashion: Key Insights

Fashion eCommerce Is Gaining Relevance: South Korean online fashion is on a steady but slow growth path. The market is still very much in its expansion phase, but has gained international awareness and popularity through cultural trends.

Coupang Sells the Most Fashion Online: Coupang, the "Amazon of South Korea", is a one-stop shop for online shoppers in the market, and fashion products are part of the mix.

Fashion Trends: Women's fashion is currently shaped by feminine looks, oversized clothing, and minimalist styles.

South Korean fashion is a global topic of discussion. Cultural phenomena in South Korea like K-Pop and K-Fashion are not only popular in South Korea, but the interest in music, fashion, and celebrities goes beyond borders. Does this have an impact on the Korean eCommerce market? ECDB has the data.

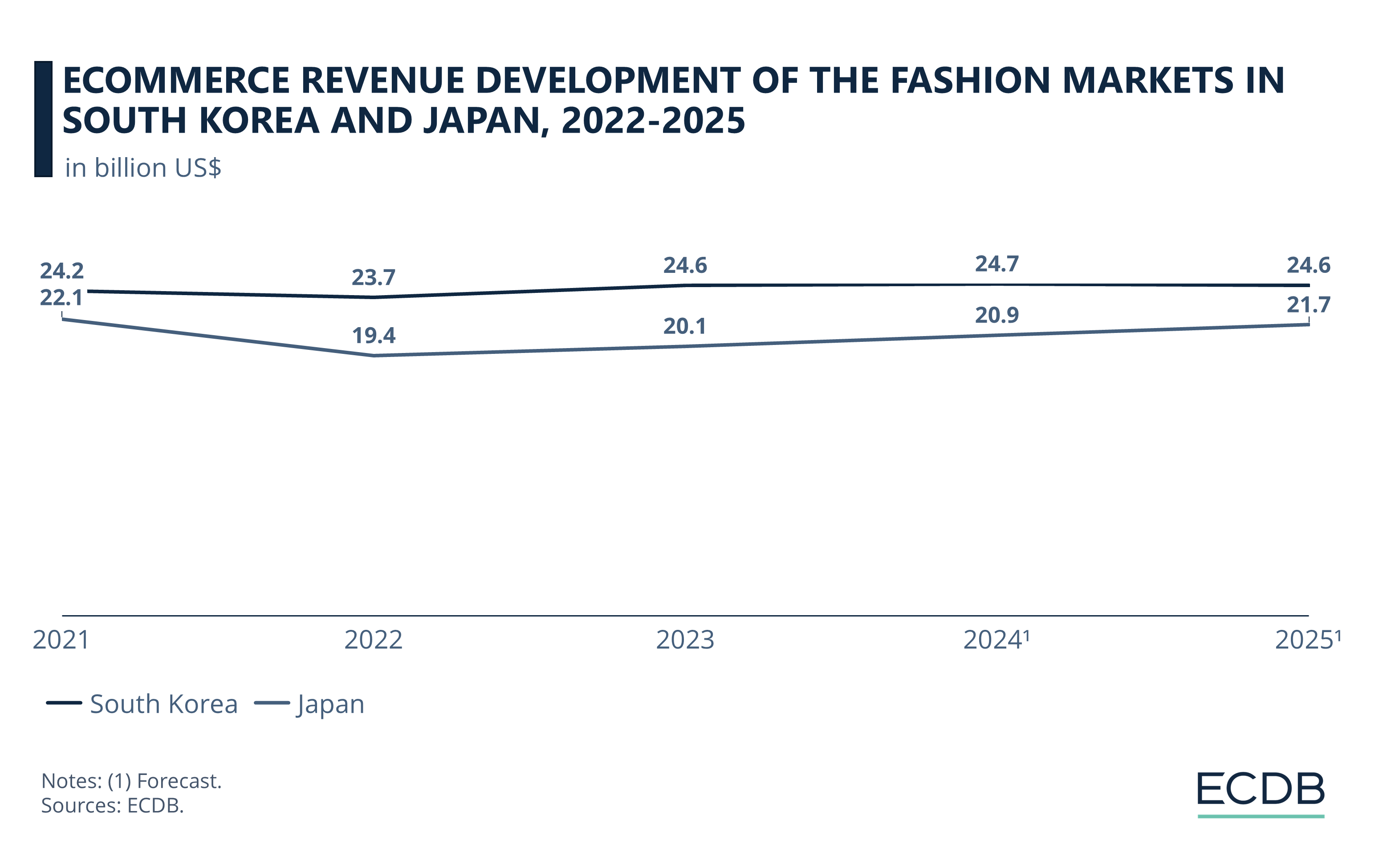

South Korea’s Online Fashion Market Has Revenues of Around US$25 Billion in 2024

In 2024, South Korean fashion revenues make up 18% of eCommerce revenues in the country. It is the second largest category after electronics. When comparing eCommerce revenue growth, South Korea's progress is more stable than that of Japan. South Korea is the fourth-largest eCommerce market, with projected revenues of US$138.5 billion by 2024. In contrast, Japan, as the fifth-largest market, is expected to reach US$117.4 billion in eCommerce revenue by the same year.

South Korean online fashion revenues were stable after 2021. In comparison, Japanese eCommerce revenues declined after the pandemic and are just now recovering.

In the following years, the revenue trend in South Korea shows steady development. The Japanese online fashion market is expected to generate revenues slightly below that.

Despite being the fourth-largest eCommerce market, South Korea is still very much in the expansion phase as an economy. The South Korean government signed FTAs (Free Trade Agreements) with 52 countries in 2017, and actively encourages FDI (Foreign Direct Investment) through tax incentives, and bureaucratic facilitation.

In addition to the technology and automotive industries, which are significant contributors to the South Korean economy, cultural products are becoming increasingly important to South Korea’s value creation. This is how the country is trying to develop its eCommerce market more quickly, and the outlook is optimistic.

Top Fashion Stores: Coupang Sells Most Fashion in South Korean eCommerce

ECDB data shows that South Koreans spent US$24.6 billion on online fashion shopping in 2023. This figure has grown slowly, contradicting the country's expanding eCommerce sector. But where do South Koreans prefer to shop the most? Here are the online stores that sell the most fashion products in South Korea.

Coupang ranks first, with US$6.6 billion in online fashion net sales.

Nike follows further behind, with US$1.5 billion in online net sales. It is the only international retailer in the top 5.

Musinsa generated US$479 million in 2023 and ranks third.

SSG ranks fourth with US$393 million.

Gmarket is in fifth place with US$380 million in online fashion net sales.

South Korean Fashion: Business What is each store’s strategy? The following list includes the top 3.

1. Coupang

Coupang is widely known as the “Amazon of South Korea”, for simple reasons: It has the same strategy and dominance in South Korea. Therefore, being number one in fashion sales reflects Coupang's role as a one-stop shop for South Korean online shoppers.

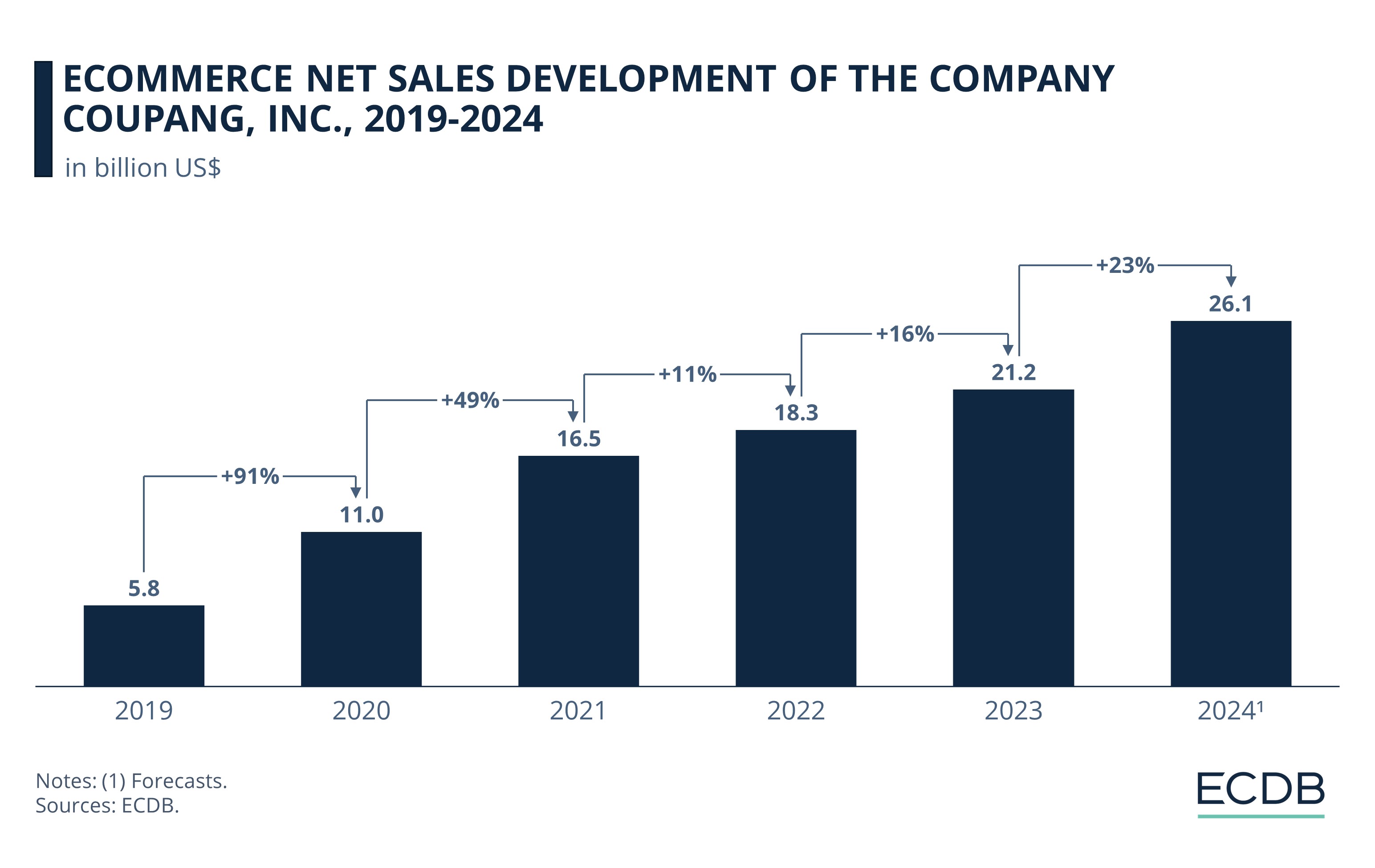

Coupang’s revenue performance has been consistently positive over the past 5 years, with double-digit revenue growth.

Coupang's initial focus was on daily necessities and food, but its product range has expanded to include all kinds of categories. The company takes a customer-centric approach, offering perks such as one-day delivery ("Rocket Delivery"), a grocery service ("Rocket Fresh"), a streaming service ("Coupang Play"), food delivery ("Coupang Eats"), and fintech ("Coupang Pay"). It recently added Quick Commerce to deliver purchases even faster than Rocket Delivery.

Recently, Coupang acquired Farfetch and is entering the luxury goods market with this investment.

2. Nike

Nike has been in the South Korean market since 1981. In 2016, Nike launched a D2C (direct-to-consumer) strategy, meaning that it started selling directly to customers instead of through department stores or resellers. This included typical Nike marketing events such as run clubs, training clubs, mobile apps, and personalized sneakers.

In South Korea, Nike has a physical presence through distinctive, cool-looking flagship stores and an online platform. It combines both channels in a hybrid shopping experience, making it easy for customers to try on and order products in-store, or pre-select certain items online and then buy them physically.

A notable strategy for Nike in South Korea is to work with national celebrities: This includes a partnership with NewJeans, a K-Pop girl group that many young people look up to. The Nike collaboration, called “A Feel For Every You” features NewJeans and has been clicked 5 million times.

The brand also collaborated with Peaceminusone, a fashion line by South Korean rapper G-Dragon. They released a special edition of sneakers for fans.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

3. Musinsa

Musinsa.com started as a street snap platform for people to post their outfits and comment on the posted content. Over time, the growing community and the individual contributions on the site inspired the founder to expand Musinsa’s influence by producing unique content. This included interviews with brand designers and artists, coverage of brand collections, and products that were exclusive to the site.

In this way, Musinsa entered into a mutually beneficial relationship with fashion SMEs (small and medium enterprises). The SMEs were able to reach a wider audience and Musinsa gained a competitive edge by selling distinctive products from emerging fashion designers.

Today, Musinsa has become popular beyond South Korea, especially among young fans who are fascinated by K-Pop and want a piece of South Korean culture for themselves.

What are the general fashion trends in the market?

Fashion Trends and Consumer Behavior

K-Pop and K-Fashion contribute to the perception of South Korea abroad, but so do Netflix shows like Singles’ Inferno (a dating show), Love Village (another dating show), Next in Fashion (a design competition), or Culinary Class Wars (a cooking competition). They introduce South Korean culture to international audiences and provide a sense of familiarity through entertainment. The same goes for movies and series like Parasite, Squid Game, and Oldboy, to name a few.

Cultural content like this significantly shapes perceptions of South Korea and inspires consumers to try out some of the trends and styles on display.

So, what are the trends in South Korean fashion currently? Here are some in women’s fashion, although that doesn’t mean at all that South Korean men aren’t fashion-conscious!

Cute, feminine looks: Tennis skirts, hanbok (a modern version of a traditional dress), puffed sleeves, button-up dresses, floral dresses, colorful crop tops.

Oversized clothing: Includes oversized tops, coats, jeans and clunky shoes, as well as bucket hats, oversized button-down shirts and cargo pants.

Minimalist styles: Pastel colors, monochromatic outfits, androgynous looks, and basic t-shirts.

Y2K looks: A lot of denim, colorful and themed shirts, sleek sunglasses.

The nature of fashion is that it is subject to change. South Korean trends are going to shift accordingly.

South Korean Fashion: Closing Remarks

Like the South Korean economy, South Korean eCommerce is set to grow. Despite flat predictions for the fashion market, the influence of K-Pop and K-Fashion globally ensures steady interest in what’s new in the market.

Brands that can effectively use social media, entertainment, and influencer/celebrity collaborations to make their products known are at a clear advantage. The market shapes consumer preferences across borders and is centered around mobile shopping and convenience, which players should be taking into consideration when breaking into South Korean fashion.

Sources: About Musinsa – Daxue Consulting – Fashionchingu – Foxylabny – Koreanculture – Lifestyleasia – L’Officiel

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Online Toys Market: Top Stores & Market Development

Online Toys Market: Top Stores & Market Development

Deep Dive

eCommerce Success Stories 2024: Why Sephora, Shein and Coupang Stand Out

eCommerce Success Stories 2024: Why Sephora, Shein and Coupang Stand Out

Deep Dive

eCommerce Companies Worth Considering for Stock Traders

eCommerce Companies Worth Considering for Stock Traders

Deep Dive

Coupang GMV: South Korea's Top Marketplace

Coupang GMV: South Korea's Top Marketplace

Back to main topics