eCommerce: Success Stories

eCommerce Success Stories 2024: Why Sephora, Shein and Coupang Stand Out

Three eCommerce platforms stand out for their successful strategies: Sephora, Shein and Coupang. Find out how they are similar and how they differ.

Article by Nadine Koutsou-Wehling | August 20, 2024Download

Coming soon

Share

Success Stories in eCommerce: Key Insights

Fertile Breeding Ground: eCommerce is growing across global markets. New online shoppers continue to emerge in countries like Mexico, Brazil and India.

Three Success Stories: Three different kinds of companies have been generating various types of success. Sephora is a traditional brick-and-mortar retailer with additional eCommerce sales, while Shein and Coupang are pure-play online platforms.

Social Media Strategies: All brands effectively use social media to reach their target audiences across multiple platforms. Shein and Sephora, in particular, have been successful in capturing the attention of younger consumers.

What is eCommerce success? When looking at this topic, it quickly becomes clear that there is no one way to achieve eCommerce success. Rather, it depends on the background and structure of each company.

There are companies that are built on eCommerce, like Amazon. Then there are those that started out with brick-and-mortar sales and later moved online, like Walmart.

Taking into account companies with varying structures, we picked three from the ECDB database that each represent a specific type of eCommerce success story.

Era of the US$100 Billion eCommerce Companies

eCommerce is on the rise worldwide. The global development of eCommerce is ongoing, with large consumer segments becoming part of the shopper base every day. Countries like Mexico, Brazil and India are just three examples of burgeoning markets with large populations and current modernization processes.

At the same time, the largest players continue to drive record sales on their eCommerce platforms, with the top marketplaces already approaching US$1 trillion in annual GMV (gross merchandise volume). More commonly, however, eCommerce platforms are approaching US$100 billion in GMV or even net sales.

Basically, GMV measures all transactions on a platform, including third-party sales. Net sales calculate the first-party sales of brands in an online shop.

Here are three eCommerce players with three different ways of achieving success.

1. Sephora

Sephora is the perfect example of a company with a solid brick-and-mortar heritage that has successfully taken its business online. Sephora has even managed to become a hashtag in its own right, broadcast on national news. But let's not get ahead of ourselves.

Sephora is a French personal care and beauty products brand founded in 1969. Since 1997, it has been part of the LVMH Group, a conglomerate that houses a large portfolio of global luxury brands. Like any good brand, Sephora has an immediate point of differentiation: The black-and-white stripes that adorn its store entrances. Its website has an equally clean and sleek look, with white and black as the dominant colors.

Sephora is strong in UGC (user-generated content), which applies to its social media presence as well as its website. The latter also features extensive reviews that help customers find the right product for them.

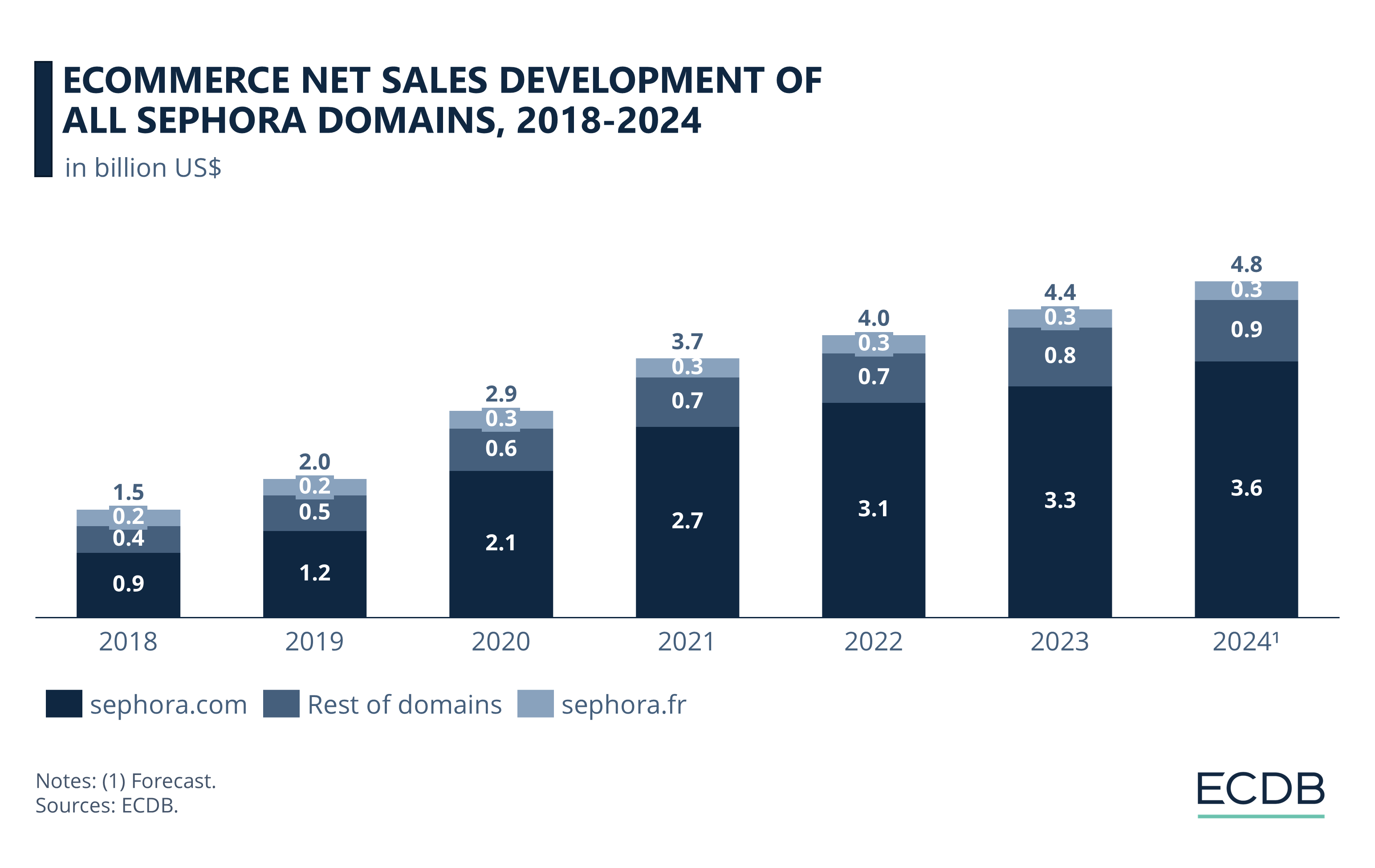

Sephora’s online net sales across all domains follow the typical pattern of high growth during the pandemic. But in the years immediately following, Sephora maintained its growth.

Sephora’s most successful domain is sephora.com. The majority of Sephora’s net sales are generated there. Sephora.fr is less relevant in comparison.

Neither do the rest of Sephora domains, including markets like the UK, Australia, Germany, Spain, and many more, generate nearly as much revenue as sephora.com combined.

Sephora is credited with pioneering the "try before you buy" strategy, offering customers product samples to help them make purchasing decisions. While Sephora did not pioneer social media marketing with influencer content and UGC, the brand is still very successful with it.

What is Sephora’s social media strategy?

As a brand with roots in the 1970s, Sephora has not always been online. But it has embraced digital and eCommerce in a way that has boosted the brand’s visibility and image.

Much of the content is generated by influencers and ambassadors called the Sephora Squad. The Squad is accessible through an official application at Sephora and requires a high social media following.

Sephora's videos or reels primarily feature content that showcases and samples products. Brand ambassadors share their morning routines and favorite products, including fragrances.

Instagram is more product-focused, while TikTok is more entertainment-focused. Sephora uses the platform to participate in dominant trends, which appeals to a broad audience. Sephora is also on Pinterest, where it offers makeup or hair styling ideas and features new products and collections.

Sephora is a shining example of eCommerce success, indicative of an offline brand that uses eCommerce and online social platforms to generate buzz and attract customers. The strategy has worked so well that Sephora is now one of Gen Alpha’s favorite companies. The hashtag #sephorakids has proliferated news broadcasts, which investigate the impact of TikTok trends on young users. Tweens flock to Sephora to try out the latest makeup and personal care trends they have seen on social platforms.

The next success story is another professional at creating hype for youngsters.

2. Shein

Unlike the previous brand, Shein is a pure online store. Shein is of Chinese origin, founded in the country by Chinese entrepreneur Chris Xu in 2008. Since then, however, the brand’s headquarters have moved to Singapore.

Wherever it's based, Shein's hype is global. The low prices of its products and its highly trend-oriented styles make Shein stand out from its competitors. The speed of product turnaround is made possible by Shein's use of the consumer-to-manufacturer (C2M) model, which creates a direct link between consumer demand and production facilities.

The innovative C2M production model is another reason for Shein’s defining position in the market, which has been first pioneered in China in the early 2010s. Now, with the success of Shein and Temu, the advantages of C2M production have reached European entrepreneurs. But Shein has a clear lead over the others – building the digital infrastructure necessary for a C2M model to work seamlessly takes years.

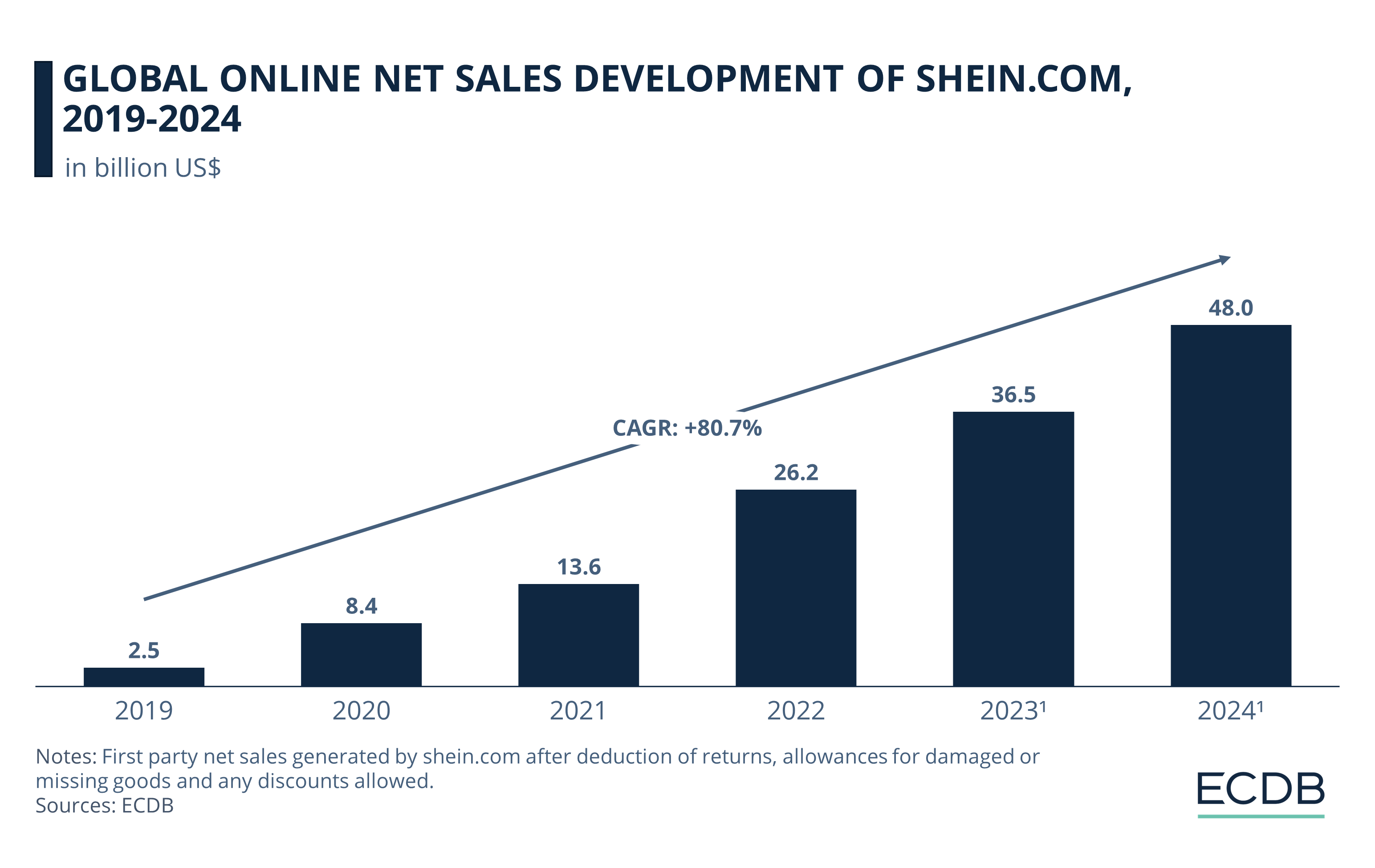

Shein took off during Covid-19 and has continued to expand its global reach since then. It jumped from US$2.5 billion eCommerce net sales in 2019 to US$8.4 billion in 2020, and by 2023 it was already generating US$36.7 billion.

Forecasts for 2024 and 2025 predict even higher sales: US$48.2 billion in eCommerce net sales are expected in 2024 and US$54.4 billion in 2025.

Companies with a similar strategy to Shein have emerged over the years, including the sites Zaful or Cider. But none of them have been able to replicate Shein's success because it's difficult to manage inventory, technology, marketing, and product design to gain consumer recognition and remain profitable despite low prices and deep discounts.

Shein’s social media presence is what makes the brand so iconic to young consumers. Here is what that means.

What is Shein’s social media strategy?

Shein has gained widespread recognition among its target audience by reaching them where they are: On social media platforms.

Influencer marketing is common on Instagram and TikTok, and Shein works with social media personalities of all levels: The brand has worked with Khloé Kardashian, as well as smaller influencers, making Shein's products seem highly accessible.

On Instagram, the focus is on posting photos of outfits and products. The attainability aspect of Shein is further enhanced by its inclusion of models of all body types.

TikTok has become infamous for Shein with its Shein product hauls, where influencers unpack their large Shein packages with bundles of items, inspiring their audience to emulate the experience. Other popular content includes GRWM (get ready with me) to show users' dressing routines, OOTD (outfit of the day), or wearing vs. styling, where an outfit is changed to show different styles.

On Pinterest, Shein shares outfit ideas for different situations and body types. Shein has a few million followers on Pinterest, but it is quite clear that this is not its main platform.

Shein is included here as an eCommerce success story because it serves as a model for many smaller businesses. As a pure-play eCommerce store, it is only accessible offline through its pop-up stores in global cities. As a result, the brand has become notorious, with shoppers standing in long lines outside the store to get a chance to shop offline at Shein. Of course, the pop-up stores are always designed in a way that makes them great for social media posts.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

The third success story in the fray is another pure-play online platform.

3. Coupang

You may or may not have heard of Coupang, the thriving eCommerce store in South Korea, that is seen as a cross between Amazon, DoorDash, Instacart and PayPal. Coupang founder Bom Kim shows how startups can use the experiences of successful eCommerce platforms to emulate the good while avoiding the bad, and in consequence outperforming the original.

Coupang started in 2010 as a copycat of Groupon. Bringing daily deals to South Korea, Coupang was quite successful from the start, but Kim quickly realized that the business model required advertising costs that were too high.

Over the years, Coupang has borrowed from major eCommerce platforms such as eBay and Amazon to offer customers a wide range of products at low cost. By combining these key aspects with fast delivery, Coupang has climbed up the ranks of online platforms over the years to become a monopoly over other sites in the country.

Coupang’s main selling point is its customer-centric approach: Like Amazon, Coupang invests heavily in logistics infrastructure and vertical integration (creating companies that all contribute to the main business) to lower costs, attract more customers, and hire sellers for the platform, resulting in a wider selection of products.

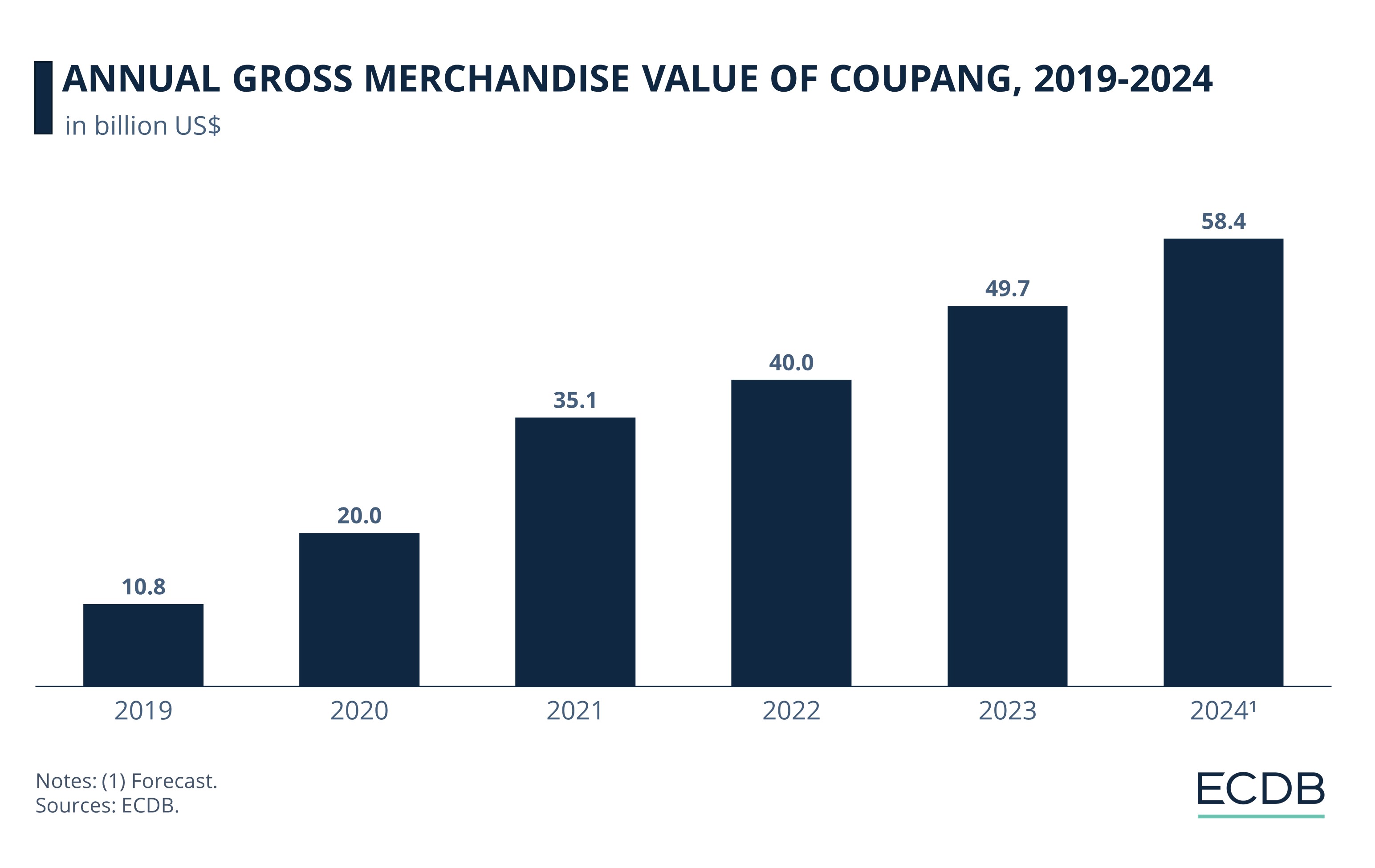

Coupang's GMV spiked during the Covid-19 pandemic, but continued to grow afterward. In 2022, GMV was at US$40 billion. In 2023, it almost reached US$50 billion. Growth is expected to continue in 2024.

The most recent earnings report published by Coupang for Q2 2024 confirms the positive outlook analysts have for the company: Overall revenues were up 25% from April to June 2024, compared to the previous year. Especially the developing segments (meaning everything outside of eCommerce) grew by 177%. The report led to a 10% jump in Coupang’s share price.

Coupang’s business strategy is highly adaptable to the preferences of its customer base. Like Amazon, Coupang has its own streaming service, called Rocket WOW. It offers digital payment and BNPL (buy now, pay later) services with Coupang Pay, and has its own food and grocery delivery service called Rocket Fresh and Eats.

Not for nothing is Coupang also called the Amazon of South Korea. As a next step, the company is organizing to offer its logistics services to other retailers in the region, making itself even more indispensable by entering the B2B space.

Its acquisition of luxury eCommerce retailer Farfetch for US$500 million at the beginning of 2024 has nonetheless led to net losses. The acquisition is expected to yield higher profits, however.

What is Coupang’s social media strategy?

Coupang’s content is 100% in Korean, which speaks to its regional focus.

Coupang’s Instagram site introduces the variety of products available on Coupang, as well as how to use them.

The products are often displayed with a humorous note, which makes the brand and its products seem more approachable and memorable.

On TikTok, Coupang plays with recurring characters who act as brand influencers, promoting products and brands in a way that emphasizes entertainment over advertising.

Coupang’s success shows how emerging brands can learn from established players. The company used Groupon’s success to gain traction in South Korea with a similar approach, but recognizing the downsides of the business model, Coupang adapted to become what online shoppers in South Korea were looking for.

Global eCommerce Success Stories: Wrap-Up

Each of these three brands has tapped into a segment of the market that gives online shoppers exactly what they are looking for. Sephora and Shein created a buzz among young consumers, who are the main customer base of tomorrow. Coupang took advantage of an existing gap in the market to take over eCommerce in South Korea, Amazon-style.

If anything, the common denominator among these companies is that adapting to market trends and consumer preferences is paramount to staying relevant. In this sense, brands can even shift from brick-and-mortar to include online, as Sephora did, and become one of the most trendy brands for the youngest generation who have never known a world without the internet.

Sources: Coschedule – Generalist – LVMH – Seoulz – Vogue

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics