eCommerce: Brazil

Brazil eCommerce Market: Top Stores, Revenue & Market Trends

Which online stores dominate Brazil's thriving eCommerce market, and how are trends like live commerce and WhatsApp transforming the landscape? Read on to find out.

Article by Cihan Uzunoglu | June 20, 2024Download

Coming soon

Share

Brazil eCommerce Market: Key Insights

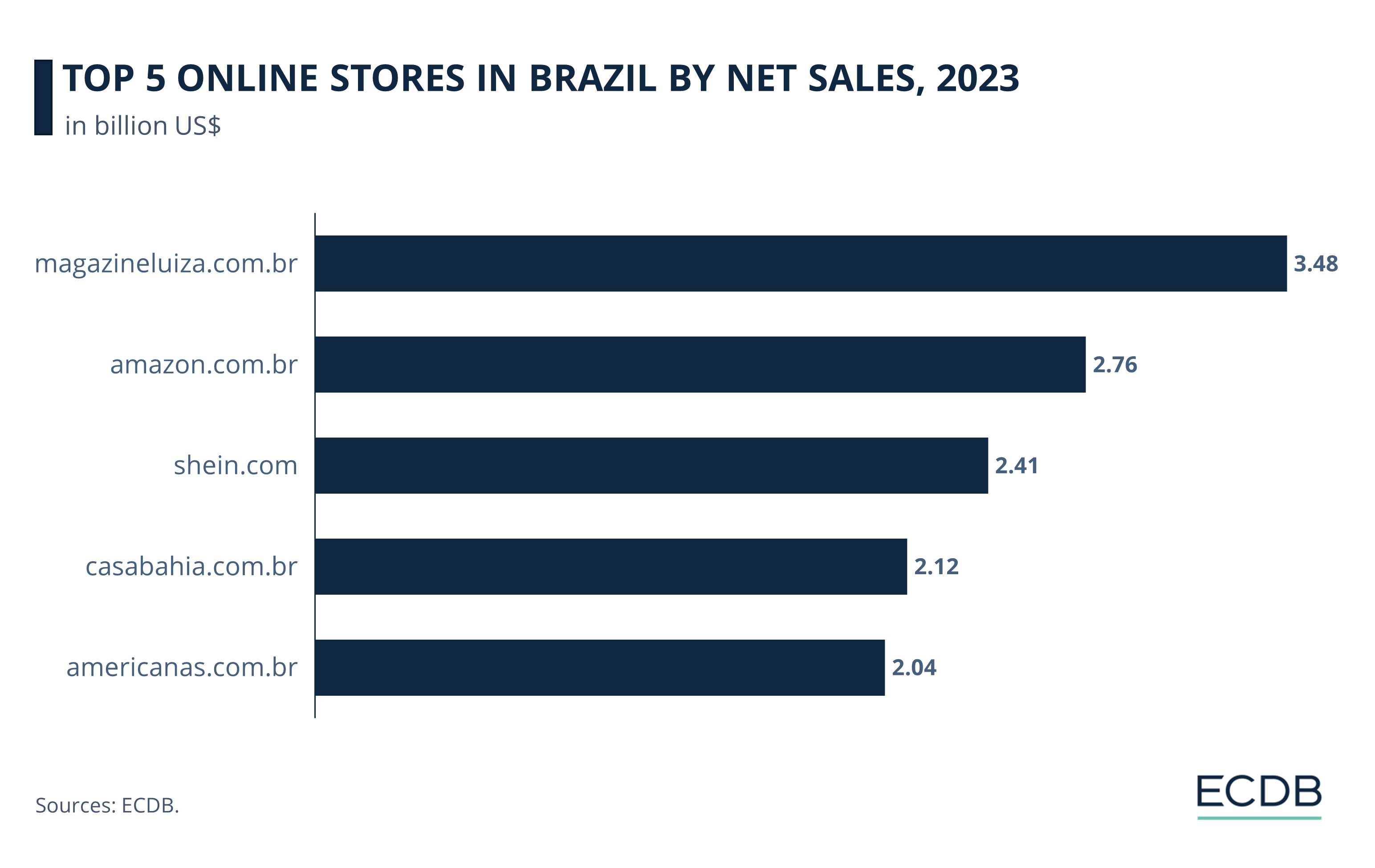

Key Players: The Brazilian eCommerce market is led by key players such as Magazine Luiza, Amazon, Shein, Casas Bahia, and Americanas. Magazine Luiza led in sales and Shein displayed the highest growth rate last year.

Projected Growth: Brazil's eCommerce market, currently the 14th largest globally, is expected to grow to US$56 billion by 2028, driven by increased online transactions and strategic moves by global competitors like Amazon and AliExpress.

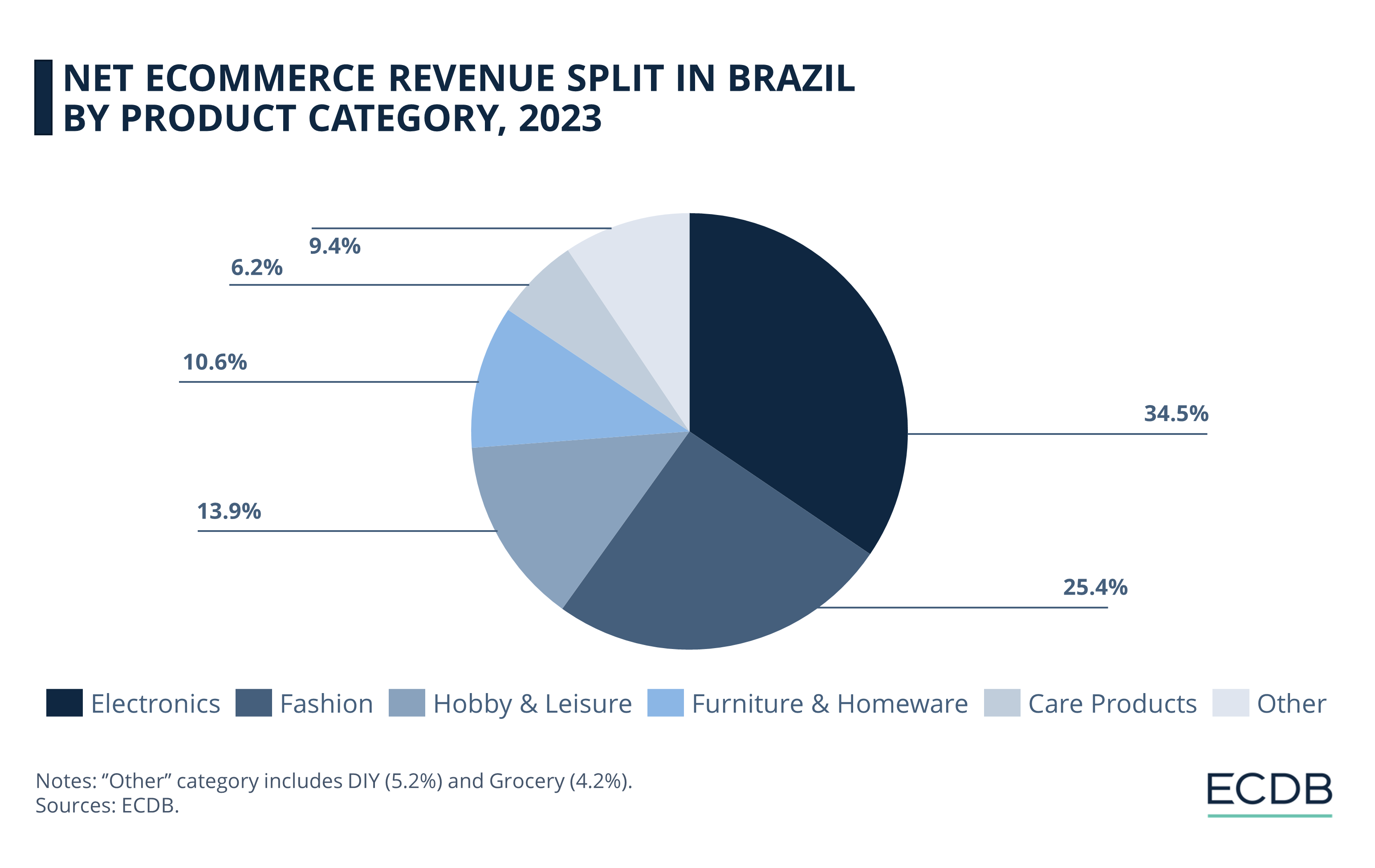

Product Categories: Electronics dominate the market, accounting for 34.5% of total revenue, followed by fashion at 25.4%, with other notable categories including hobby & leisure (13.9%), furniture & homeware (10.6%), care products (6.2%), DIY products (5.2%), and grocery items (4.2%).

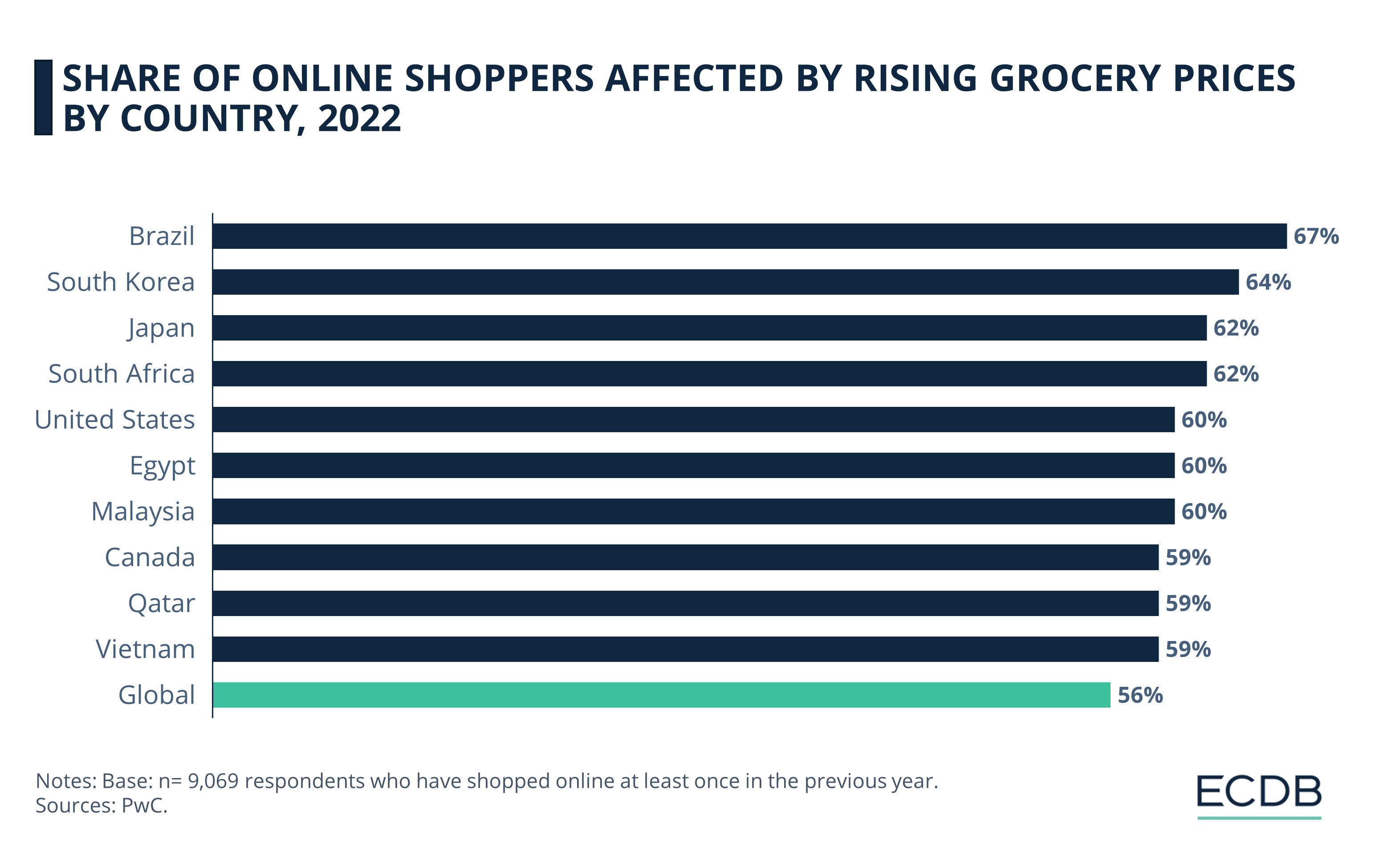

Impact of Inflation: Inflation has significantly affected online shopping behaviors in Brazil, particularly grocery prices: nearly 70% of Brazilian online shoppers were impacted by rising food prices. Despite this, Brazil saw a 30% increase in mobile shopping hours last year.

eCommerce Trends: Brazilian eCommerce trends include the growing popularity of live commerce (33% consumer preference), the role of WhatsApp Business (70 million downloads), and the potential for U.S. brands in cross-border logistics with 68% of Brazilian shoppers buying from international merchants.

Brazil's eCommerce scene is rapidly evolving, becoming a hotspot for both global giants and local innovators. Despite facing numerous challenges, the market continues to show remarkable growth, driven by investments in infrastructure, rising consumer adoption, and innovative business strategies.

Which online stores lead the eCommerce market in Brazil? Our data shows the clear dominance of one player, while competition is tighter for the rest of the top 5.

Top 5 Online Stores in Brazil

The Brazilian eCommerce market is dominated by several key players, each showing varied performance in terms of net sales and growth:

Magazineluiza.com.br: With an impressive net sale of US$3.48 billion in 2023, Magazine Luiza experienced a growth rate of 5.5% compared to the previous year.

Amazon.com.br: Amazon's Brazilian domain generated US$2.76 billion in net sales in 2023, which marks a significant growth of 37.2% from the previous year.

Shein.com: Shein, known for its fast fashion offerings, recorded net sales of US$2.41 billion in Brazil in 2023. The platform saw the highest growth among the top five, with a remarkable increase of almost 40% over the previous year.

Casasbahia.com.br: Casas Bahia reported net sales of US$2.12 billion in 2023. However, unlike its competitors, the company faced a slight decline of 1.3% in sales compared to the previous year.

Americanas.com.br: Rounding out the top five is Americanas, with net sales of US$2.04 billion in 2023. The company experienced a healthy growth rate of 13.9% from the previous year.

In order to understand the dynamics between these players and the market, let’s have a closer look at each of these online stores.

1. Magazine Luiza

Magazine Luiza (Magalu) is significantly expanding its digital ecosystem and enhancing service offerings. A key development is MagaluPay, a digital account integrated with the Magalu super app, enabling deposits, money transfers, bill payments, and cashback via QR code purchases, aimed at boosting customer loyalty and shopping frequency within the ecosystem.

Additionally, Magalu has bolstered its digital and logistics capabilities through acquisitions. It acquired Stoq, a startup specializing in cloud-based point of sale (POS) systems, enhancing service for small and medium-sized retailers by integrating sales channels. The acquisition of GFL and SincLog has improved logistics operations, facilitating same-day delivery and efficient cargo management.

Magalu's commitment to social impact is evident through the ComSchool acquisition, which offers eCommerce and digital economy courses, aiding Brazil's digital transformation. MagaluAds, another initiative, helps sellers promote products online, leveraging Magalu's audience to boost sales and engagement.

2. Amazon Brazil

Amazon's Brazilian domain has seen significant growth due to continuous investment in logistics and delivery capabilities.

A notable example is the new delivery center in Mexico City, part of a broader strategy to improve distribution efficiency and reduce delivery times in key markets like Brazil and Mexico. This focus on logistical improvements addresses Brazil's complex shipping environment, ensuring prompt order deliveries despite infrastructure challenges.

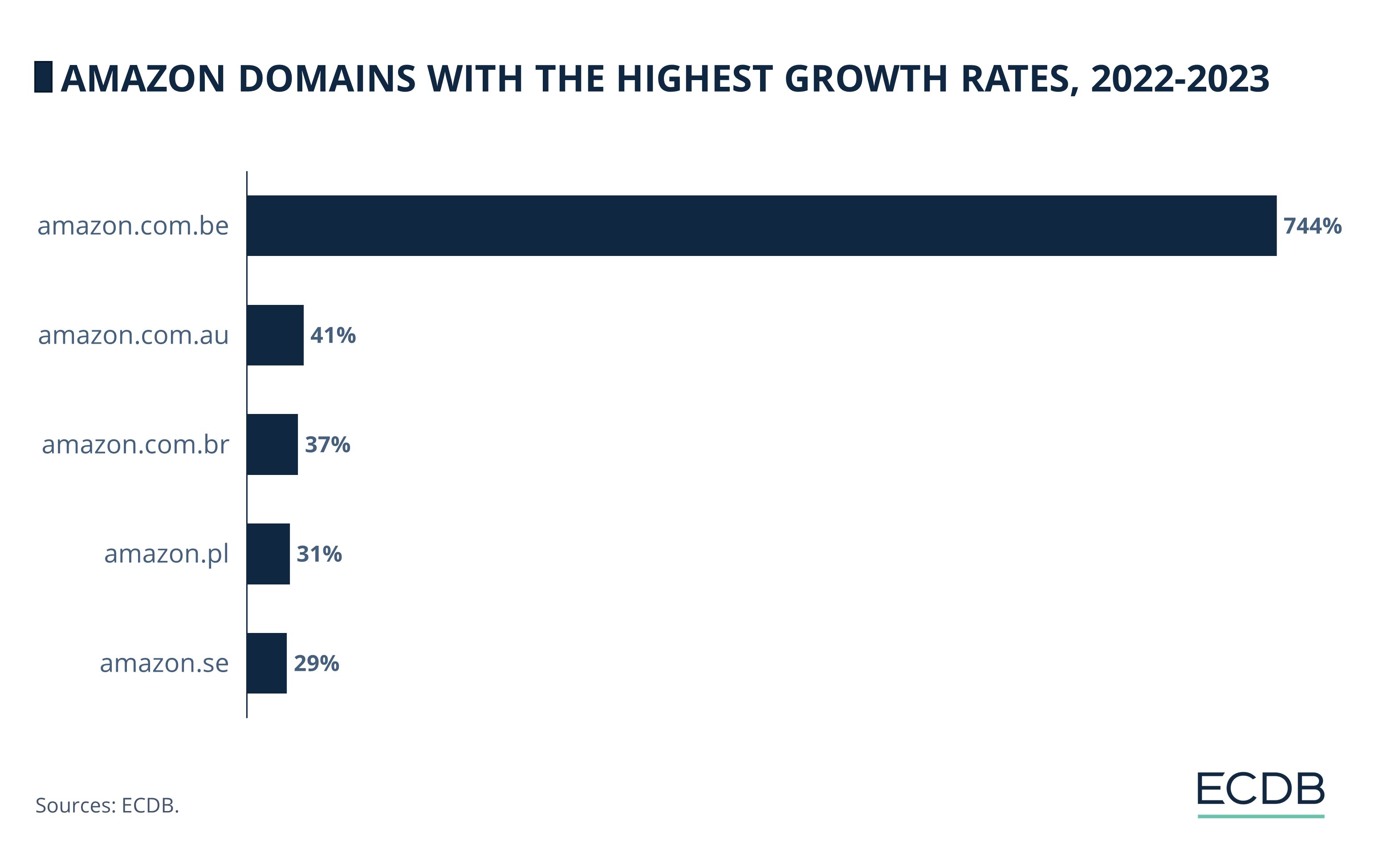

Amazon's investments have led to a 37% increase in Gross Merchandise Volume (GMV) between 2022 and 2023, making it the third fastest-growing Amazon domain globally. These enhancements have attracted more customers and retailers by promising next-day delivery and a wide product selection.

Despite barriers like intense competition and insufficient eCommerce infrastructure, Amazon's strategic investments have strengthened its market position in Latin America, offering greater convenience and choice to customers.

3. Shein

Shein has rapidly gained popularity in Brazil, achieving significant growth in recent years. This surge has positioned Shein on par with leading local clothing retailers like Renner.

The key to Shein's success lies in its ability to offer lower prices and a fast pace of new product introductions, with around 2,000 new items launched daily. This strategy has forced local competitors to adapt by investing in AI-based management systems and on-demand production to keep up with Shein's rapid growth.

4. Casas Bahia

Casas Bahia recently announced a significant debt restructuring plan, extending the repayment of R$4.1 billion (approximately US$800 million) from 22 months to 72 months. This plan, developed with key creditors like Banco Bradesco and Banco do Brasil, aims to enhance cash flow by R$4.3 billion over the next 4 years. The move has positively impacted the company's stock, which surged by over 30% following the announcement.

While the restructuring reduces interest payments, the total debt remains unchanged, posing potential long-term challenges due to increased interest costs. Despite this, analysts see the move as crucial for providing short-term financial stability and allowing Casas Bahia to focus on its business transformation.

5. Americanas

Americanas, too, has been navigating a significant financial crisis, filing for bankruptcy protection in January 2024 due to a US$4 billion shortfall in its balance sheet. This crisis led to the replacement of its management team with executives experienced in corporate recovery. An independent investigation attributed the discrepancies to fraudulent activities by former executives, involving unauthorized loans and misreported financials.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

In response, Americanas' major shareholders proposed a capital increase of R$10 billion (US$1.9 billion) to help stabilize the company. This plan aims to address its substantial debts and secure the necessary funds to maintain operations and meet obligations to employees and suppliers.

Despite these efforts, Americanas' stock has been significantly affected, experiencing a sharp decline but showing signs of recovery following the restructuring announcements and efforts to restore investor confidence.

eCommerce Market in Brazil:

Continued Growth

Currently standing as the 14th largest eCommerce market, Brazil’s eCommerce revenue is predicted to reach almost US$40 billion by 2024. Looking forward, the market is anticipated to grow at a compound annual growth rate (CAGR) of 8.9% from 2024 to 2028. This growth trajectory is expected to result in a projected market volume of US$56 billion by 2028.

The online share of the Brazilian retail market, which refers to the proportion of retail transactions conducted via the Internet, currently stands at 10.3%. This share is expected to increase significantly, reaching 16.6% by 2028.

Strategic Moves by Global Competitors

Global competitors like Amazon and AliExpress are making strategic moves to capture market share in Brazil. Amazon has invested heavily in distribution centers in Brazil and Mexico, aiming to enhance its delivery capabilities and compete with local players. Despite these efforts, Amazon's presence in Latin America remains relatively small compared to its dominance in other regions.

AliExpress, on the other hand, has focused on leveraging its logistical arm, Cainiao, to streamline operations in Brazil. Cainiao has established regional headquarters in São Paulo and plans to open multiple distribution centers across the country. These efforts aim to reduce shipment times and improve delivery efficiency, making AliExpress a formidable competitor in the region.

Top Online Product Categories in Brazil: Electronics Are a Third of the Market

But what do Brazilian online shoppers buy the most? Based on our data, within the Brazilian eCommerce sector:

Electronics dominate the Brazilian eCommerce market, contributing 34.5% of the total revenue.

The fashion segment follows closely, making up 25.4% of the market's revenue.

Hobby & leisure items account for 13.9% of the revenue.

Furniture & homeware represent 10.6% of the market.

Care products contribute 6.2% to the total revenue.

DIY products make up 5.2% of the revenue.

Grocery items account for 4.2% of the market.

Impact of Inflation on

Online Shopping in Brazil

Inflation has had a profound impact on the global economy, with varying effects across different regions. In Brazil, inflation has significantly affected online shopping behaviors, especially regarding grocery prices.

A survey conducted in June 2022 revealed that nearly 70% of Brazilian online shoppers were impacted by rising food prices, the highest percentage globally. This highlights the acute economic pressures faced by Brazilian consumers, influencing their purchasing decisions and overall eCommerce activity.

Although the total hours spent on shopping apps saw a slight decline in 2023, Brazil bucked this trend, experiencing a 30% increase in mobile shopping hours. This reflects the growing market and consumer engagement in the country, despite factors such as inflation.

eCommerce Trends in Brazil

Before we wrap up, let's take a look at some eCommerce trends in Brazil that you should be keeping an eye on.

Live Commerce

Live commerce, which involves merchants selling products via live streaming, has gained significant traction worldwide, including in Brazil. With 33% of its consumers showing a preference for this shopping format, live commerce has become a vital trend.

The COVID-19 pandemic accelerated its adoption in 2020, as live broadcasts became a primary sales channel during social isolation. Brands like Farm and Americanas utilized live commerce effectively, integrating product demonstrations and sales on streaming platforms. The success of live commerce lies in its interactive nature, blending entertainment with shopping, which has resonated well with Brazilian consumers.

WhatsApp Penetration

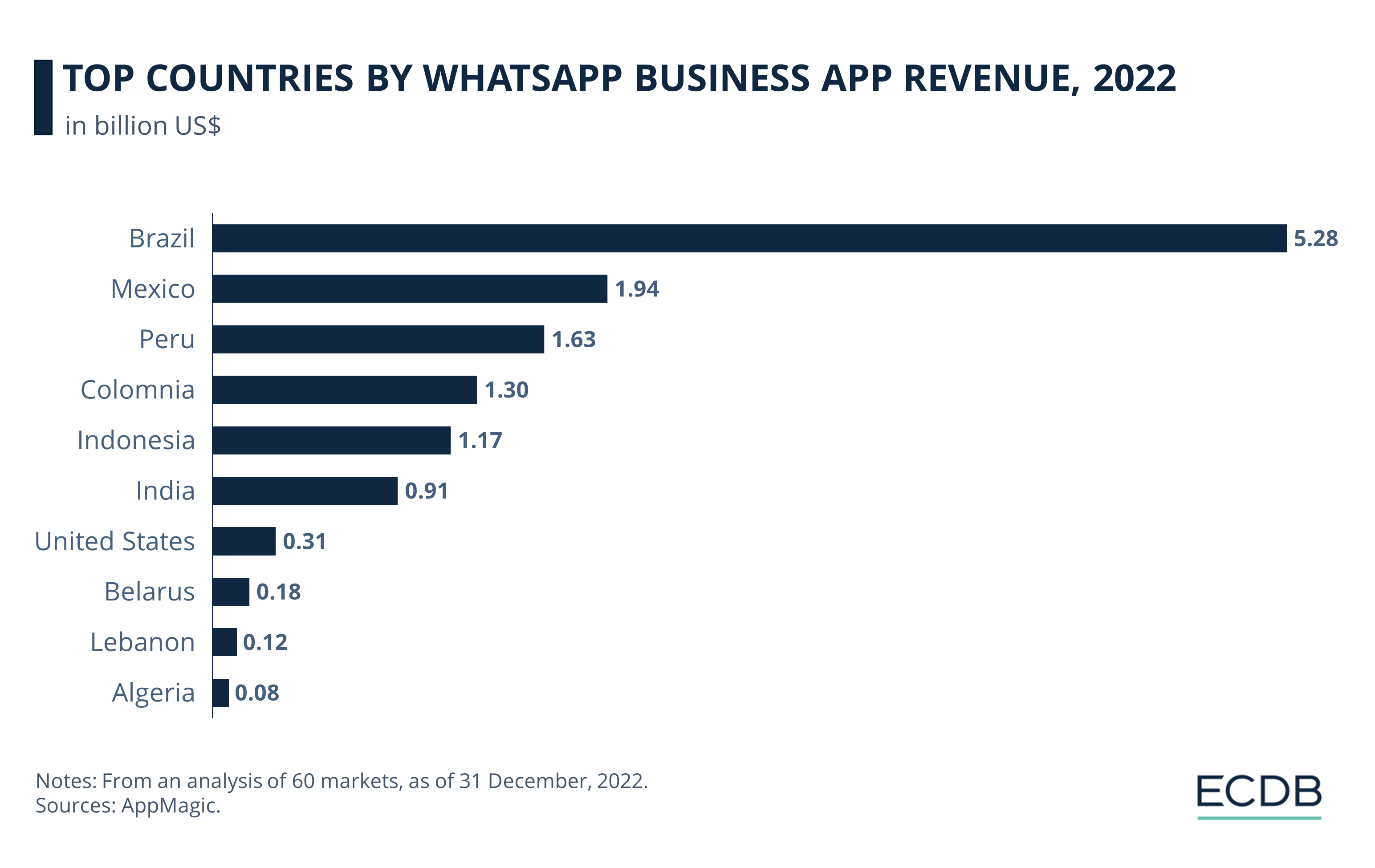

Additionally, WhatsApp has become a critical tool for businesses in Brazil. WhatsApp Business, designed to help small business owners manage customer communications, saw nearly 70 million downloads in Brazil alone in June 2022.

This underscores the app's significant role in the country's business ecosystem, with Brazil generating a staggering US$5.3 billion in revenue from WhatsApp Business in December 2022.

Cross-Border Logistics

With the rise of digital commerce reshaping global markets, many U.S. brands are exploring new frontiers, and Brazil's vibrant online market has emerged as a key target. The pandemic and subsequent growth of Brazilian eCommerce highlighted the potential for cross-border sales.

U.S. brands have an opportunity to tap into this market, with 68% of Brazilian online shoppers purchasing from international merchants. Leveraging cross-border logistics simplifies the process, removing the need for a local warehouse or subsidiary. By partnering with logistics experts familiar with Brazilian regulations and culture, American brands can efficiently navigate this expanding market.

eCommerce in Brazil: Final Thoughts

The future of eCommerce in Brazil looks promising, with continued growth and innovation on the horizon. With domestic and international companies heavily investing in infrastructure to expand their offerings, this will benefit Brazilian consumers through improved convenience, a broader product selection, and enhanced shopping experiences.

Additionally, the rise of trends such as live commerce and the widespread use of WhatsApp for business communications are further transforming the landscape. With a dynamic market and increasing consumer adoption, Brazil is set to remain a key player in the global eCommerce arena. As the market evolves, it offers significant opportunities for both local and international players to thrive and innovate.

Sources: Magazine Luiza, Amazon Brazil, Shein, Casa Bahia, Americanas, Finimize, BNN Bloomberg, MarketScreener, Devdiscourse, Econverse, CGTN Radio, ChinaDivision, Forbes, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics