eCommerce: Top Marketplaces

Fastest-Growing Online Marketplaces in the World: Miravia and Temu on Top

eCommerce marketplaces connect sellers and consumers with each other. The most successful marketplaces saw growth rates in the thousands last year. Here are the top marketplaces by GMV growth rates and the reasons for their success.

Article by Nadine Koutsou-Wehling | July 23, 2024

Fastest Growing eCommerce Marketplaces: Key Insights

Miravia Ranks First, Temu Comes Second: The top two fastest growing eCommerce marketplaces are Miravia, an Alibaba subsidiary, and Temu, the marketplace powered by PDD Holdings. Both can offer large assortments and deep discounts with the capital backing of their powerful parent companies.

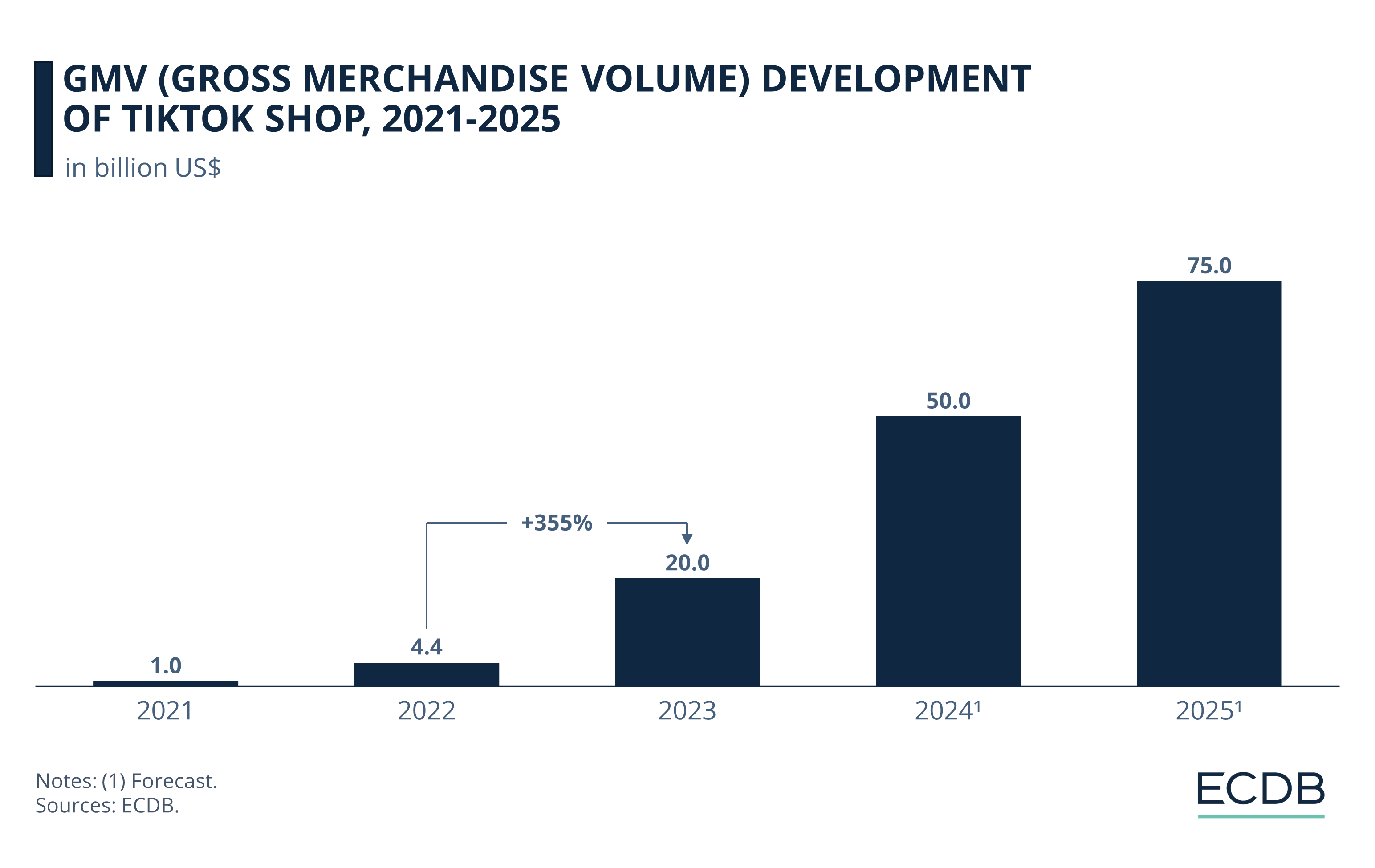

TikTok Shop Places Third: ByteDance's TikTok is the equivalent of Chinese platform Douyin. While social commerce is already a widespread online shopping phenomenon in China, the rest of the world is still catching up. TikTok Shop is one of the platforms that is bringing social commerce to markets where it hasn't been significant before.

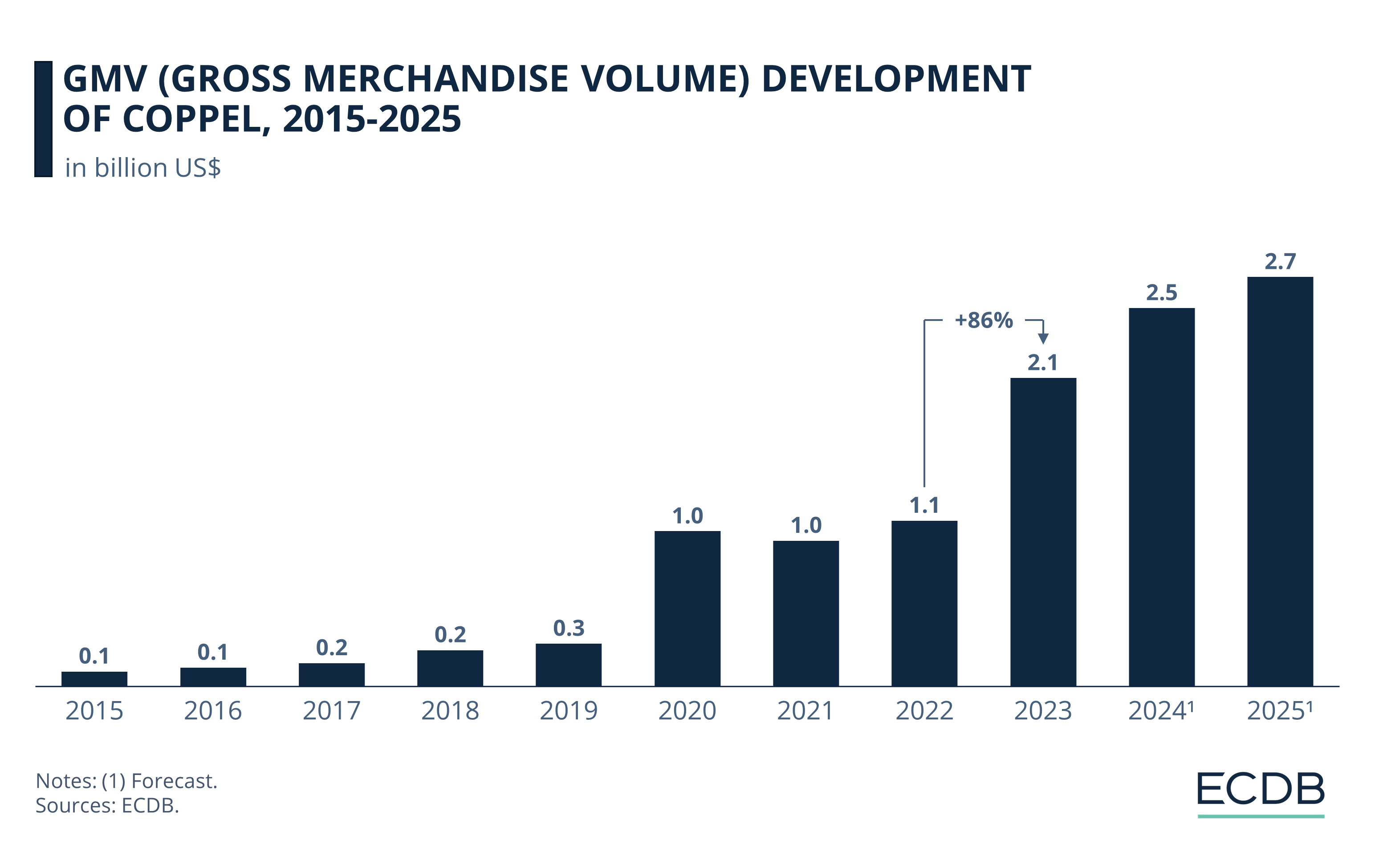

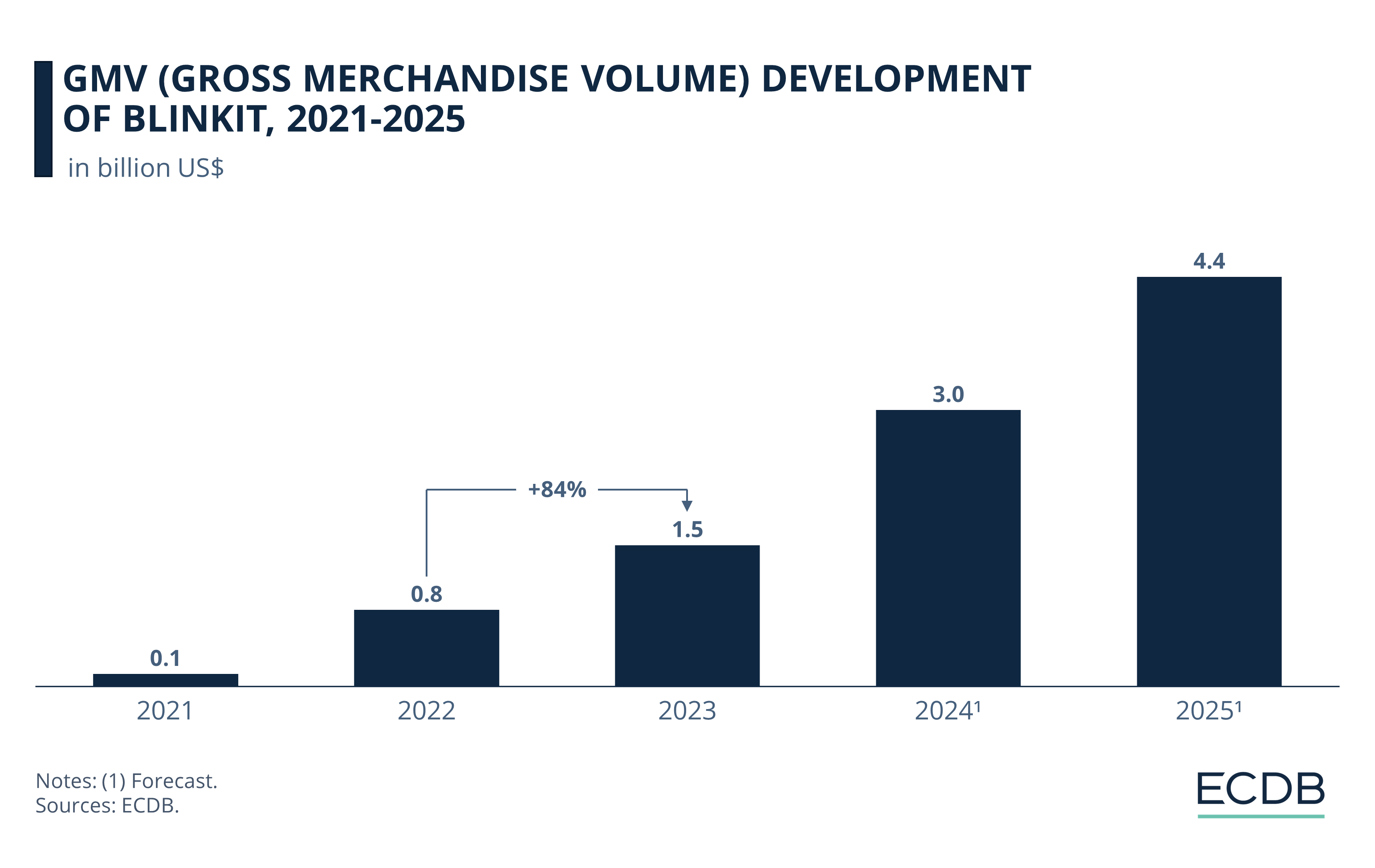

Coppel Is Fourth, Blinkit Ranks Fifth: Two marketplaces from emerging eCommerce markets, Mexico and India, rank fourth and fifth. Coppel is the online platform of the Mexican department store, while Blinkit was founded by a quick commerce startup. Both correspond to market conditions, as Mexico and India are in a process of digital development.

eCommerce marketplaces are digital platforms that connect sellers and consumers. New innovations in the field are disrupting online markets, as emerging marketplaces with competitive low-cost pricing strategies generate explosive growth rates that other marketplaces cannot match.

This insight is part of a series on the fastest-growing eCommerce players identified by ECDB. Following the fastest growing eCommerce markets, we looked at thriving online stores and product categories for online shopping.

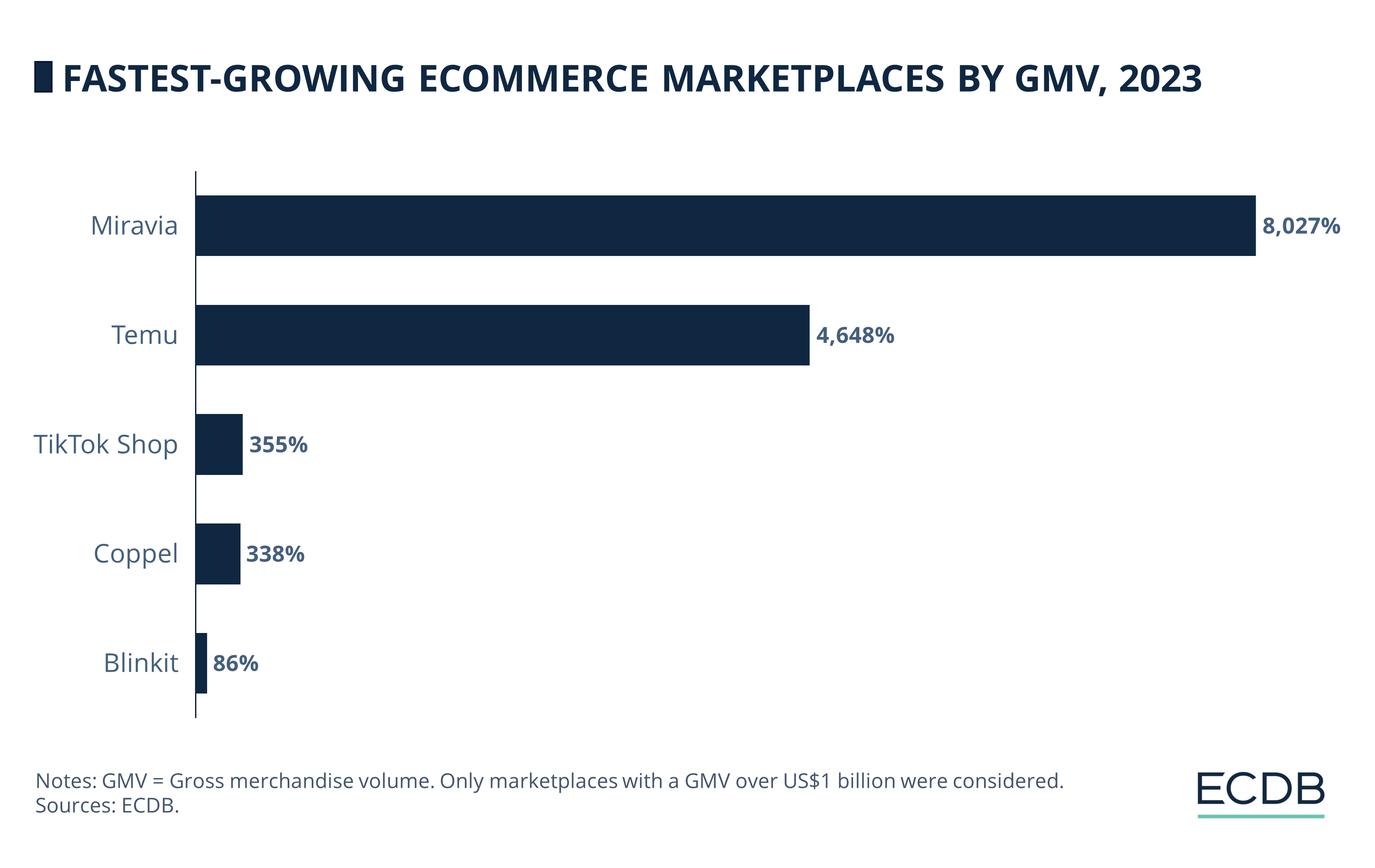

Below, we use data from the ECDB Marketplace Ranking to determine the top 5 marketplaces by GMV growth in 2023. Note that only marketplaces with more than US$1 billion in GMV were considered for the top 5.

What Is a Marketplace? Which Growth Rates Are Discussed?

An online marketplace connects sellers with a broad audience. Marketplace providers operate the platform and are responsible for its digital infrastructure. A marketplace can have a specific product focus or be a generalist, which means it offers a larger variety of products.

GMV measures the sales generated on a marketplace in a given time period. GMV does not equal revenue: the marketplace provider takes a commission for each sale made on the platform.

The types of marketplaces we distinguish at ECDB are hybrid and third-party-only (or 3P) marketplaces: The former offers sales from both the platform provider and third-party sellers, such as Amazon or JD.com, while the latter only operates the platform for sellers to list their goods, like eBay or MercadoLibre.

So which marketplaces were growing the fastest in 2023?

Top 5 Marketplaces by GMV Growth in 2023

Here are the five marketplaces that made the list of the fastest growing eCommerce marketplaces by GMV in 2023.

Miravia is an Alibaba-powered marketplace that ranks first as the eCommerce marketplace with highest GMV growth in 2023, at over 8,000%.

Temu follows in second place with an annual growth of 4,648%.

Further behind is TikTok Shop: Its 355% growth rate places it third.

Coppel is a marketplace from the Mexican department store of the same name. It ranks fourth, with 338% growth in 2023.

Fifth is Indian quick commerce marketplace Blinkit, with a growth rate of 86%.

What are these marketplaces all about? Let’s find out.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

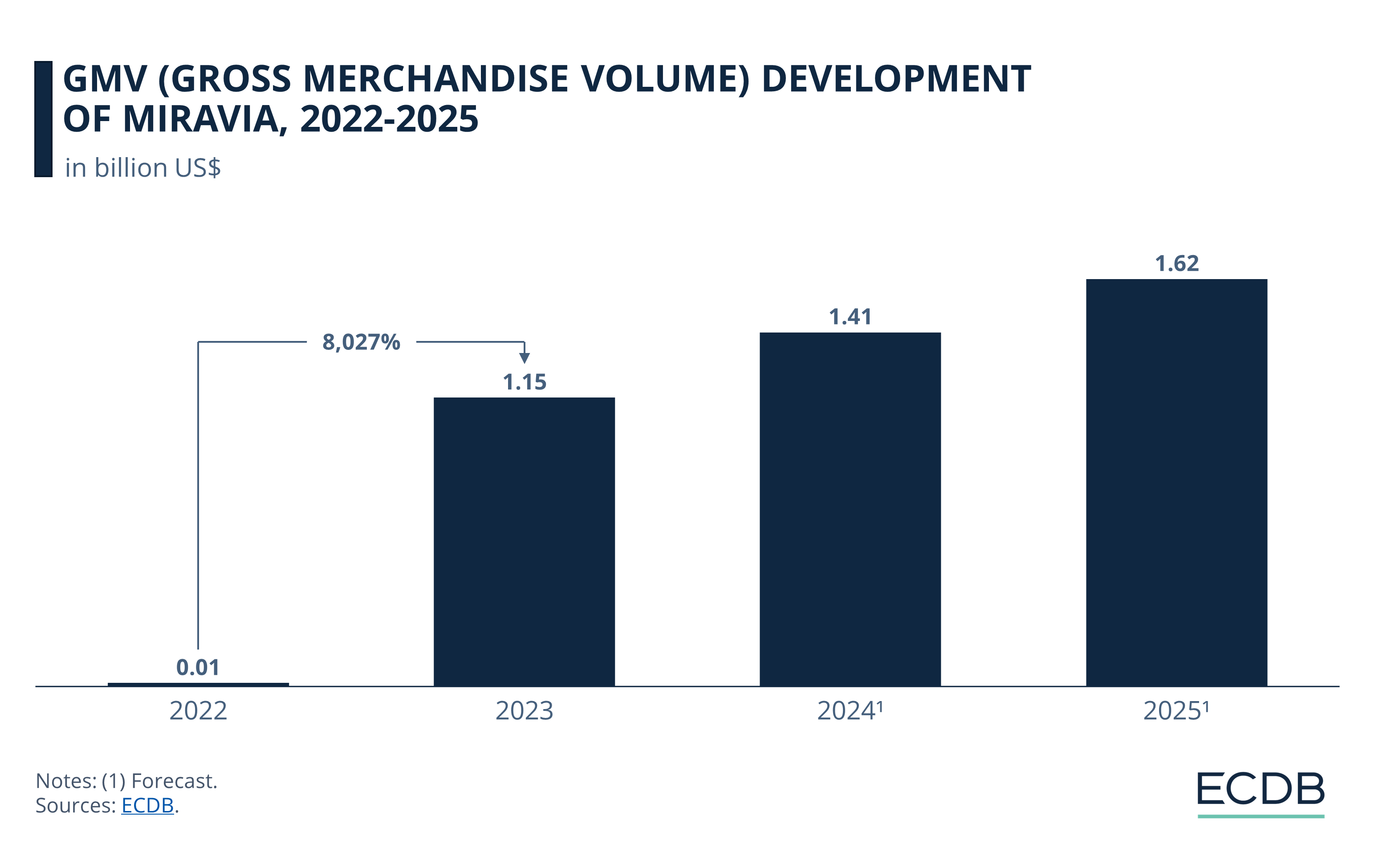

1. Miravia (8,027%)

Miravia is a subsidiary of Alibaba, the Chinese eCommerce giant. Miravia is designed for Alibaba to add European eCommerce success to its portfolio. Its country of operation is Spain, but Alibaba reportedly plans to expand the service to a wider variety of European markets if it is successful.

In Miravia’s launch year of 2022, GMV was correspondingly premature at US$14 million, as the marketplace launched later in the year.

In 2023, GMV picked up pace. Given its late launch in 2022, this is how the staggering GMV growth of over 8,000% came about.

Forecasts for 2024 and 2025 expect growth to continue, but more moderately: Reaching first US$1.4 billion in 2024 and then US$1.6 billion in 2025.

Miravia’s strategy is similar to Shein’s and Temu’s in that it uses aggressive promotions, gamification and social media marketing to reach its target audience. But the key difference between Miravia and these other platforms is that Miravia sells high- to mid-margin products instead of the low-cost product assortment of the others.

Because of its subsidiary affiliation with Alibaba, Miravia can offer deep discounts on products and reach a competitive edge this way. As AliExpress is the second largest marketplace in Spanish eCommerce, Miravia benefits from existing infrastructure, partnerships and expertise.

It is also particularly fitting that Spanish online shoppers tend to have lower AOV (average order value), which is almost 40% below the global average. They are therefore the ideal consumer base for marketplaces with a discount strategy, given the prevalence of fast fashion in the country.

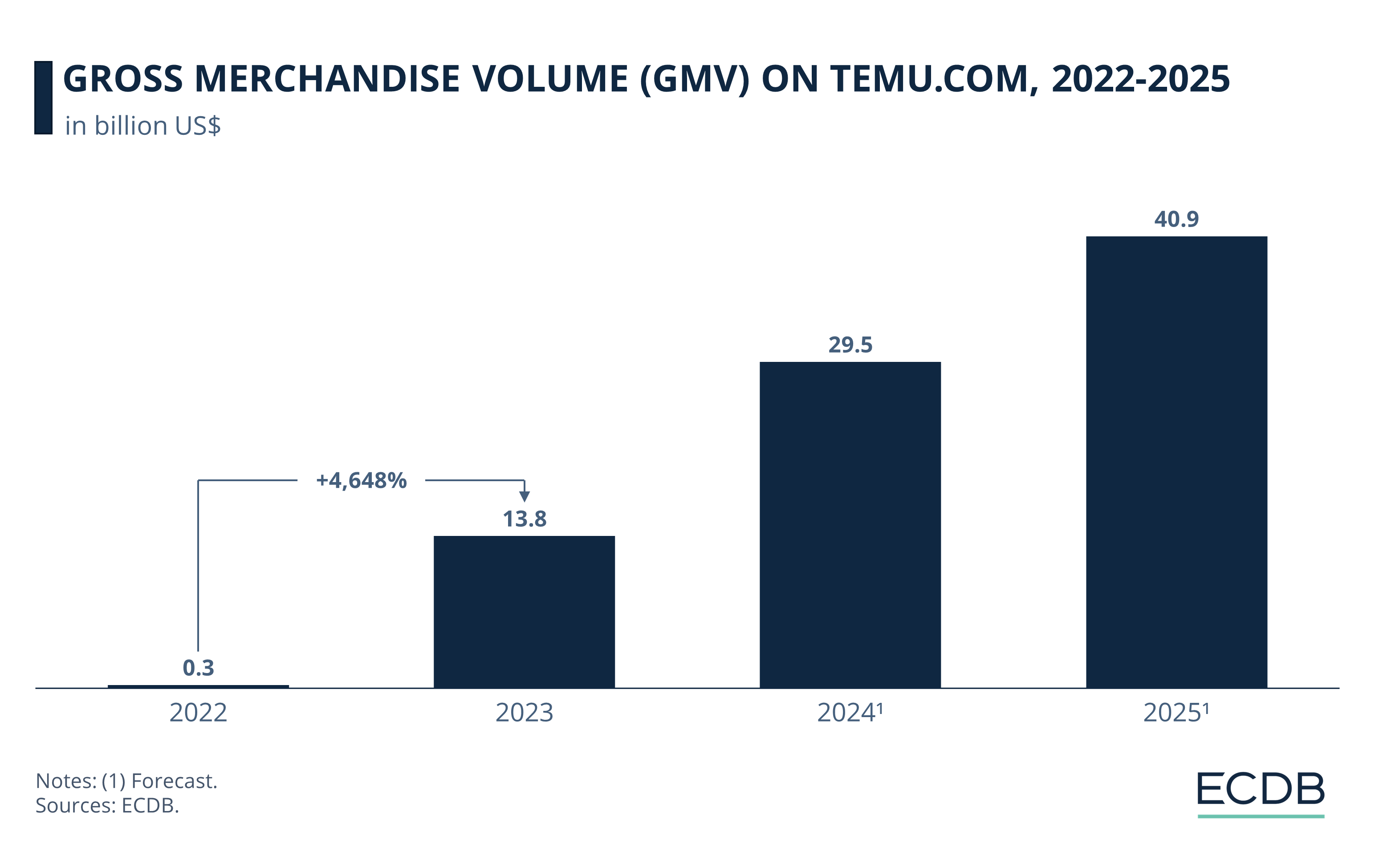

2. Temu (4,648%)

Temu is the international marketplace run by China’s PDD Holdings, which is also the parent company of Pinduoduo.

Temu launched at the end of 2022, but has already reached a GMV of around US$300 million. Temu's growth was sudden and rapid due to its ubiquitous marketing, reaching consumers through television, online advertising, social media, and media coverage due to its controversial nature.

In 2022, Temu’s GMV was US$290 million, generated in just a few months of operation. By 2023, the marketplace's GMV had already reached US$14 billion, which is why the annual growth rate was so tremendous, at 4,648%.

Projections for 2024 and 2025 anticipate high growth: Jumping to US$30 billion by 2024 and US$41 billion by 2025.

Temu stands out as a low-cost generalist, with fashion being the most prevalent category. It sells only 3P products, but keeps prices low by operating on a C2M (consumer-to-manufacturer) model. This approach cuts out intermediaries and sends products directly from manufacturers to consumers. Its disruptively low prices have motivated even established retailers to adopt a similar model.

While Temu is commonly mentioned in the same breath as AliExpress and Shein, Temu undercuts both these platforms in price and delivery time. As a result of its global success, Temu is currently preparing to launch in Latin America, having recently entered Brazil, the continent's largest market.

However, it is widely believed that Temu is currently losing money due to its low-cost, free-delivery approach, despite the company's denials. Analysts believe that Temu is losing around US$30 per order to gain market share.

3. TikTok Shop (355%)

TikTok Shop is the social commerce marketplace of the Chinese company ByteDance, which operates Douyin, the Chinese counterpart to TikTok. It already had social commerce integration since before the pandemic, as social commerce has been more recognized in China for years.

TikTok Shop builds on the success and widespread use of the social media platform of the same name. The social commerce integration was announced in 2020 and officially launched globally in 2022, with an initial launch in Indonesia a few months earlier in late 2021.

Despite only launching in a few markets in Southeast Asia, GMV was already US$1 billion in 2021 and US$4.4 billion in 2022.

In 2023, TikTok Shop was more widely available around the world, generating a GMV of US$20 billion.

Growth is expected to remain high: ECDB predicts GMV of US$50 billion in 2024 and US$75 billion in 2025.

The most profitable product categories on TikTok Shop are Care Products and Fashion. This is in line with the predominantly younger audience that tends to be largely interested in new fashion and makeup trends, clothing hauls and get-ready-with-me content.

The general design of TikTok Shop is similar to that of Douyin. However, the type of content will be tailored to the tastes of each specific market. TikTok Shop will continue to work on bringing Douyin's successes to international markets, such as livestream commerce.

4. Coppel (338%)

Coppel is the online marketplace of the well-established Mexican department store. Coppel.com has been in business for more than 10 years, but its online success really took off during the pandemic.

Until 2019, coppel.com was generating GMV up to US$300 million.

In 2020, GMV grew rapidly: It jumped to US$1 billion and hovered around that number for the subsequent two years.

In 2023, there was another surge: GMV reached US$2.1 billion, and is forecast to grow to US$2.5 billion and US$2.7 billion in the following two years.

The recent growth spurt is most likely driven by a continued shift to 3P business, which has increased from 5% in 2021 to 15% in 2024. Coppel has a generalist approach, with Electronics and Fashion being its strongest categories.

Coppel's growth is certainly linked to Mexico’s burgeoning eCommerce market. It is one of the fastest-growing online markets, with over US$10 billion in revenues, highlighted in our recently published ranking. Mexico’s current drive to increase internet penetration and banking among its population is responsible for its digital development. This, in turn, benefits the market’s eCommerce players who profit from its growth.

5. Blinkit (86%)

Blinkit is the fifth largest marketplace in India and the second largest grocery marketplace in the country after Walmart’s Flipkart. Blinkit was founded by an Indian quick commerce startup that was backed by large international investment firms recognizing the potential of the business model in the emerging Indian eCommerce economy.

In its launch year of 2021, Blinkit generated a GMV of US$100 million. This grew to US$800 million in the subsequent year.

By 2023, Blinkit had crossed the billion-dollar mark at US$1.5 billion. Its GMV growth is expected to remain substantial, reaching figures of US$3 billion and US$4.4 billion in 2024 and 2025, respectively.

Since its inception in 2021, Blinkit has seen a steady shift towards 3P business, which already accounted for 100% of its sales in 2023. The company's product range is predominantly grocery (57%), but it also supplies a wide range of other products, from pharmaceuticals to pet food.

Indian grocery is one of the biggest growth markets, with expected annual growth rates of around 28% in the coming years. Much like the Mexican online landscape, Indian eCommerce is characterized by digital development initiatives aimed at bringing large segments of the population into the pool of online shoppers. As a result, it is poised for continued growth and innovation.

Fastest-Growing Marketplaces:

Wrap-Up

Two eCommerce marketplaces of Chinese origin, backed by leading eCommerce platforms from China, tower over the others in terms of 2023 growth: Alibaba’s Miravia and PDD Holding’s Temu. Both are using their capital backing to offer deep discounts and consumer conveniences like free shipping. While it’s not clear how viable this approach will be in the long run, established retailers are already scrambling to keep up with the price race to the bottom.

The remaining marketplaces in the top 5 thrive on developing markets and their eCommerce growth: TikTok Shop is widely popular in Southeast Asia and just entering Western markets, Coppers is a Mexican marketplace, and Blinkit operates in India.

Low prices mean inclusion of populations with smaller incomes and those previously excluded from the online market. But that this comes at the expense of quality is an issue that consumers must consider when shopping with these trending players.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Back to main topics