eCommerce Trends 2024

Amazon Went From Marketplace Leader to Temu Twin

Remember when Amazon was the go-to marketplace for everything reliable? Fast shipping, top-quality products, and reviews you could trust? Well, the shipping is still fast, but Amazon is turning into a Temu clone, and that's not good news for small businesses making quality products – or for us consumers.

Article by Patrick Nowak | March 18, 2024Download

Coming soon

Share

Amazon Temu Similarities: Key Insights

Cost Efficiency and Profits: Low production costs due to cheap labor and minimal quality control lead to high profits in eCommerce. This approach is prevalent in fast fashion and various product categories, contributing to the success of Chinese online marketplaces.

Growth and Competition Challenges: Amazon's growth rate is slowing, particularly in comparison to the rapid expansion of Chinese online marketplaces.

New Amazon: Instead of resembling Chinese online marketplaces, Amazon should find ways to become more sustainable.

Low production costs, due to inexpensive labor and lack of quality certifications, result in significant profits. This "model" underpins eCommerce trends like fast fashion and applies to nearly all product categories. This is the very simplified truth about China and their booming eCommerce marketplaces.

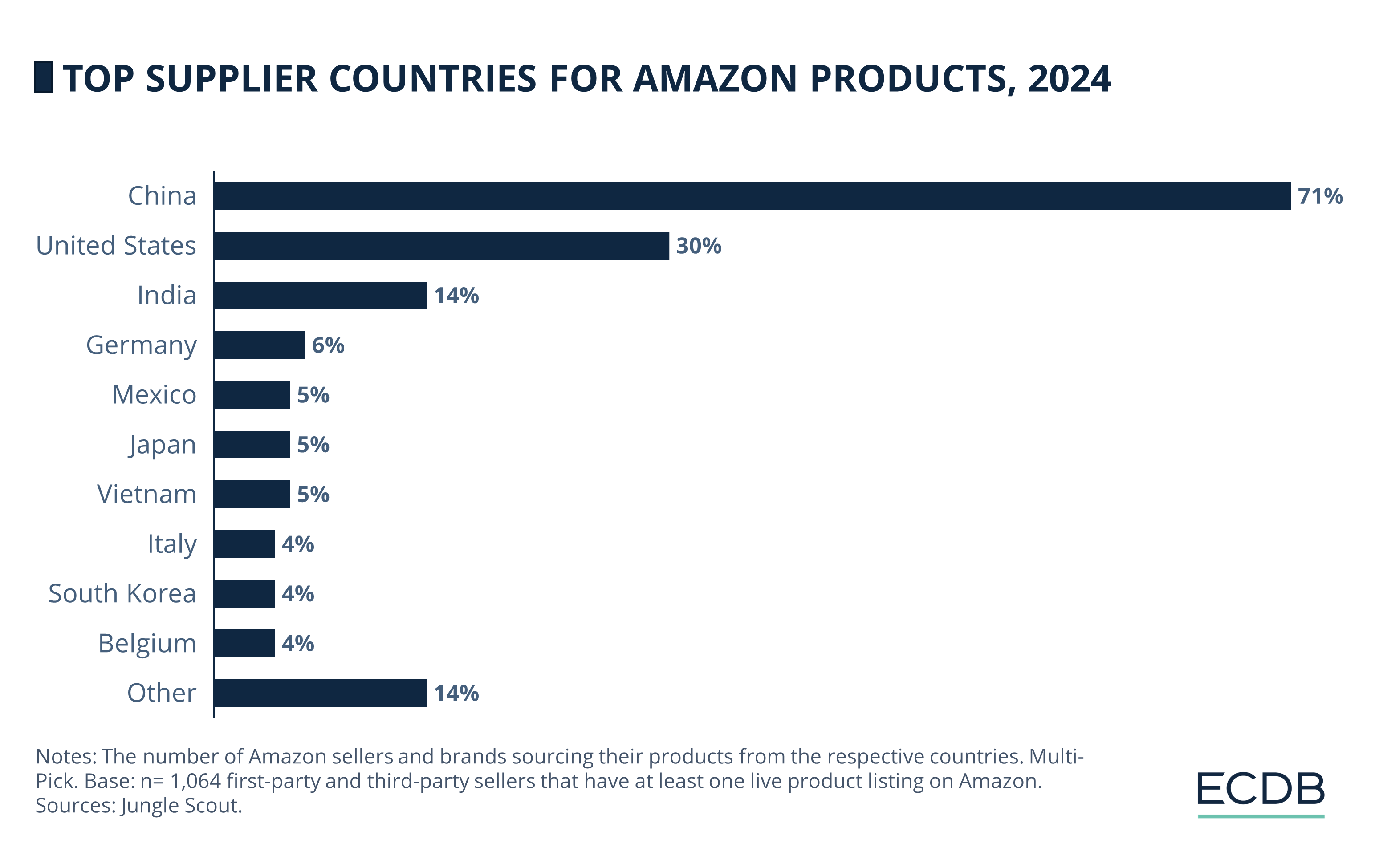

Manufacturers and distributors are making substantial profits by importing their cheap products to Europe and the United States, which also accounts for their impressive growth rates as they tap into Western markets. The leading supplier country for Amazon is China, already accounting for a staggering 71 percent ... which has significant consequences.

Which consequences? Search for a dog bowl, mountain bike shoes, or gym equipment. Look for it on Amazon and watch cheap products flooding your search results. On Amazon, anyone can sell their goods, including those who bulk-buy cheap Chinese goods from other marketplaces to resell. As a result, Amazon warehouses are filled with millions of these inexpensive items, marked up slightly from their original prices on sites like Pinduoduo or other marketplaces.

This has led to Amazon increasingly resembling these other marketplaces. Our educated opinion is: Amazon should avoid that. Their growth is already slowing down.

Amazon Growing Slower Than Pinduoduo

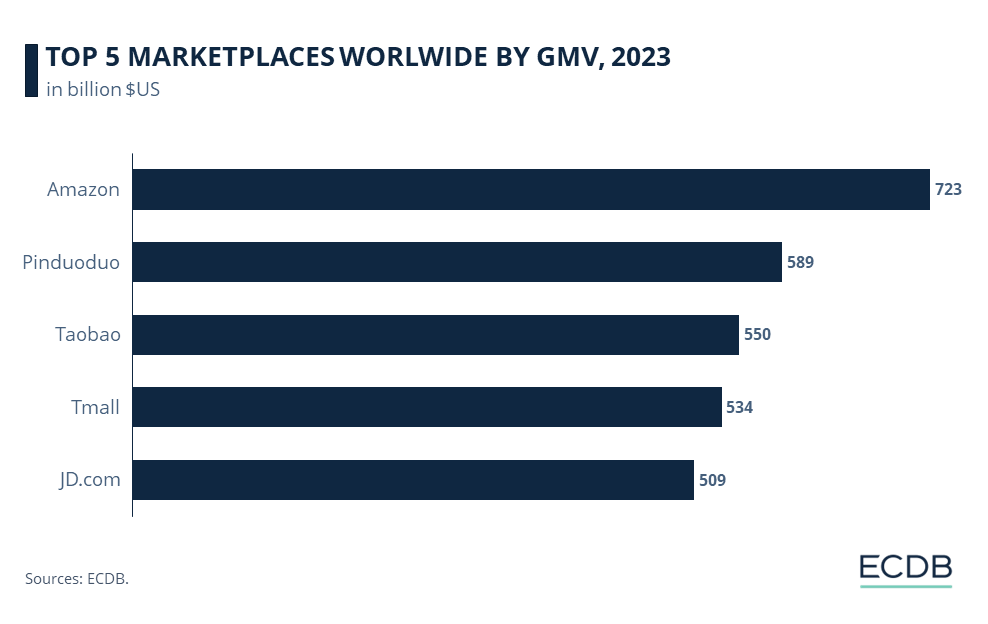

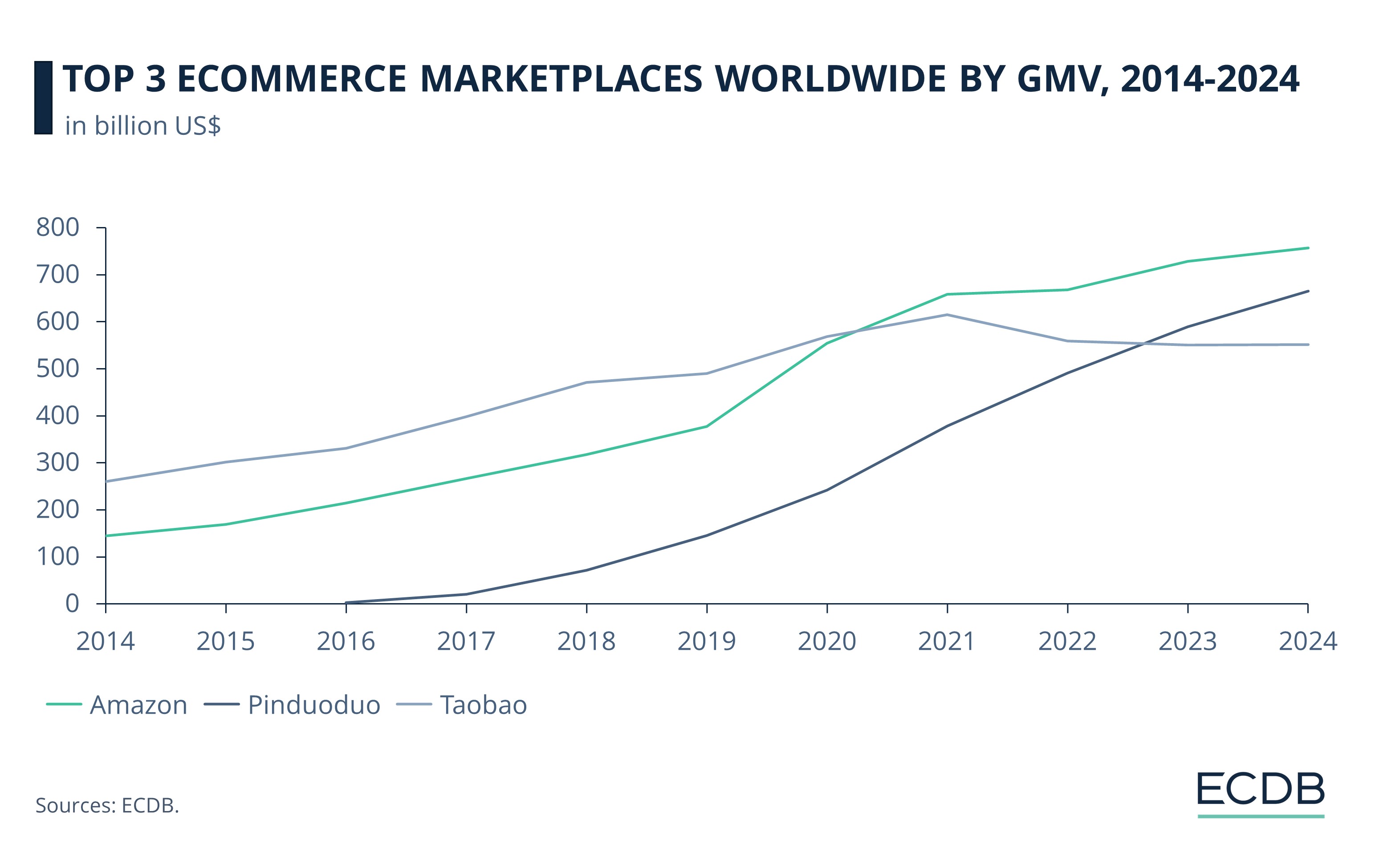

Despite still being the world's largest marketplace, Amazon's growth is slowing down, especially when compared to Chinese marketplaces. Our projections for 2024 suggest a mere 3.9% growth in GMV. This still represents significant revenue, but Amazon's analysts should be aware of the competition from the East.

Pinduoduo is a major competitor and the marketplace is expanding rapidly. Its current Gross Merchandise Value (GMV) is now on par with Amazon's GMV in 2020. With Pinduoduo's expected 12.8% growth rate in 2024, it's likely to outpace Amazon in a few years.

Why is this? Well, the population of Asia is approximately 4.8 billion people and the populations of Europe (approximately 741.8 million) and the United States (approximately 341.8 million) are way lower. Other reasons are:

Social Commerce and Group Buying: Asian platforms like Pinduoduo integrate social features, encouraging group buying and word-of-mouth referrals, which enhance engagement and drive sales.

Mobile-First Strategy: These platforms prioritize mobile users, offering optimized app experiences for the widespread smartphone usage in Asia, ensuring accessibility and convenience.

Focus on Tier 2 and Tier 3 Cities: Unlike Amazon's focus on urban areas, Asian marketplaces target lower-tier cities with rising populations and disposable incomes, tapping into underserved markets.

Low Pricing: Asian platforms often offer lower prices, appealing to cost-conscious consumers, and leveraging economies of scale to maintain competitiveness.

China has a classification system that categorizes Chinese cities based on their economic development, population size, infrastructure, and consumer behavior, among other criteria. This system, although not officially defined by the Chinese government, is widely used by businesses and analysts to understand market potential and regional dynamics within China.

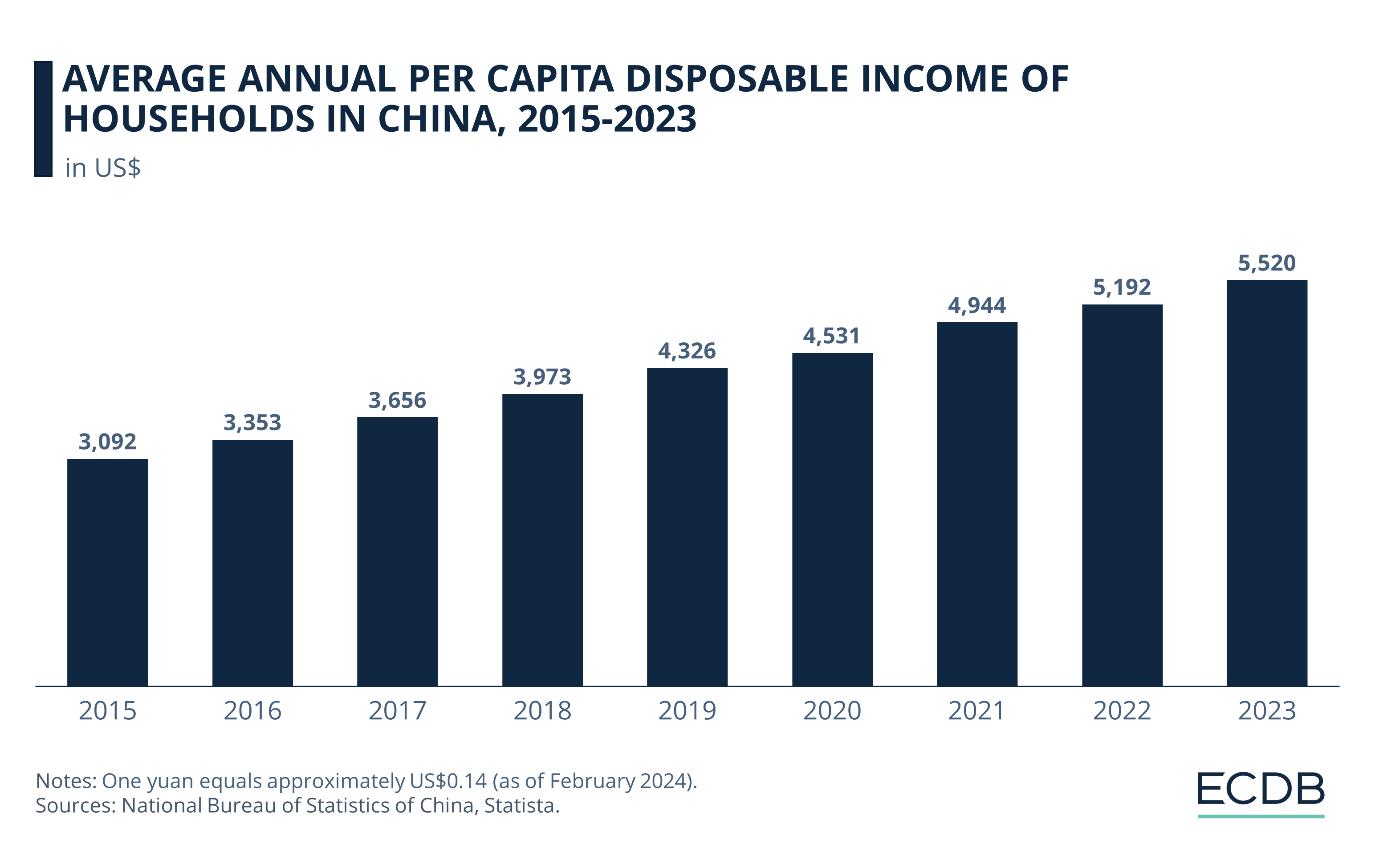

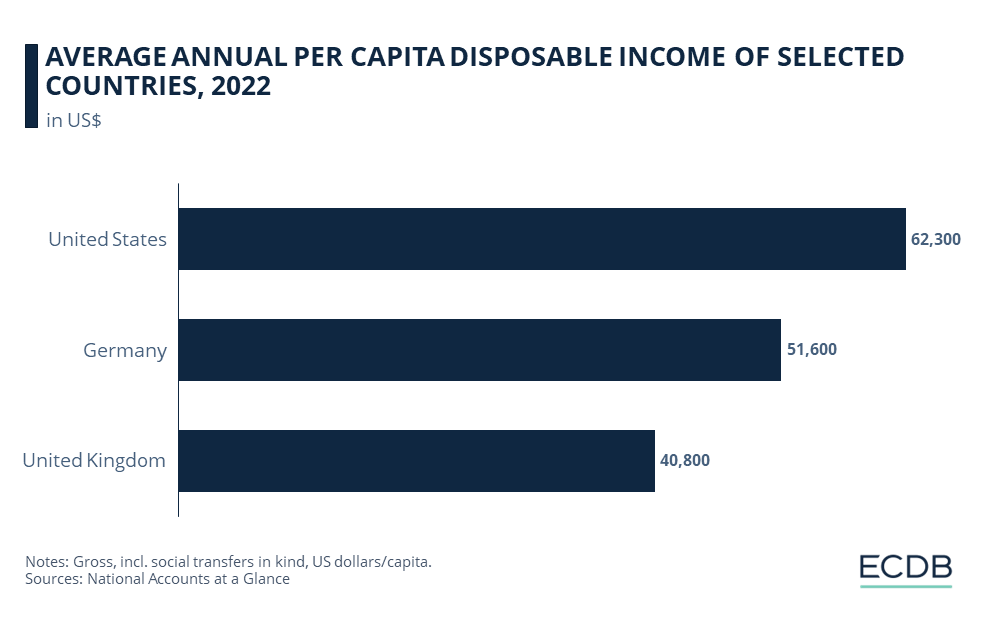

The downside is that the average disposable income in Asia is generally much lower compared to Western economies. Therefore, high-priced products are deemed to fail. However, this isn't the case in Europe or the United States.

Amazon Should Find Another Way

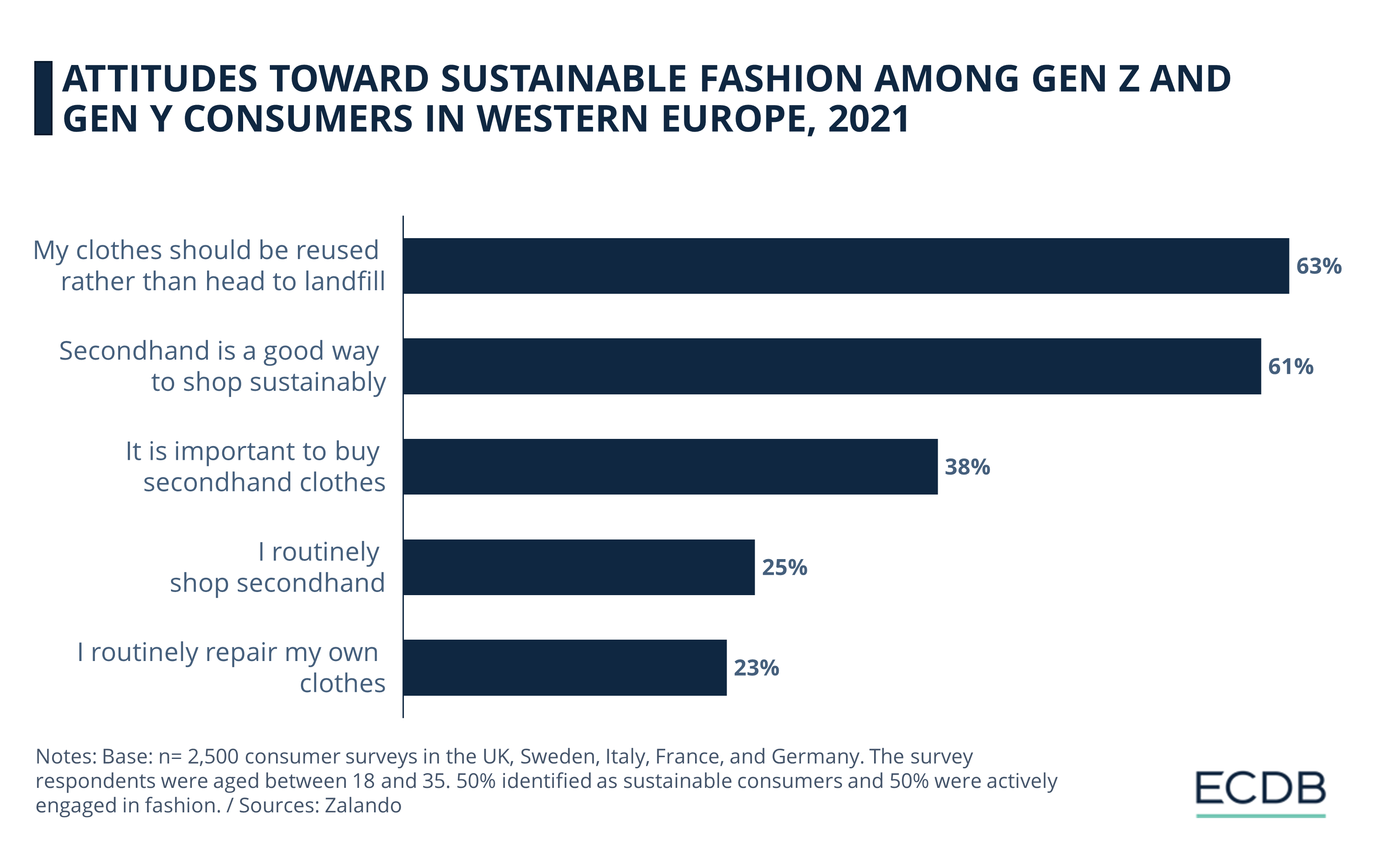

"Fast shopping" appears to be highly profitable, yet Amazon might benefit from pursuing a different approach. Why? Because Western economies, which possess greater financial resources, tend to prioritize not only quality but also sustainability in their purchases.

Consumers are increasingly expressing a desire for sustainability in their online shopping, favoring durable and eco-friendly products over disposable items that travel long distances. There's a growing preference for goods that offer long-lasting quality and have a minimal environmental impact, reflecting a shift away from products that contribute to waste for the sake of convenience.

Consumers are willing to invest more for sustainable options, presenting an opportunity for Amazon to reestablish its leadership in the e-commerce space by moving away from lower-end product offerings. Another reason supporting this claim is that the Amazon Search Bar has become problematic.

Shopping Isn't Enjoyable Anymore

Take, for example, mountainbike shoes. Just type it in the search bar and watch cheap product flooding your search results.

Every description claims to be the best. The descriptions seem like someone just mixed a bunch of keywords together to improve SEO.

It's not just a rare occurrence. Amazon's virtual shelves are getting more and more filled with products that have these confusing titles, making shopping feel like you're trying to crack a code rather than enjoying an easy online experience.

And it's only getting worse.

The "reviews": Once the holy grail for discerning shoppers, they're now a minefield of questionable authenticity. Spotting a genuine review among the sea of suspiciously enthusiastic 5-stars is like finding a needle in a haystack.

Customer trust is taking a nosedive: We used to flock to Amazon for the assurance of quality and reliability. Now, we're greeted by a flood of cheap, knockoff products that leave us questioning our every click.

Small sellers getting pushed out: For small, quality-focused sellers, it's becoming increasingly tough to stand out in a market saturated with low-cost, low-quality goods. And for consumers, the risk of getting duped isn't just frustrating... it's costly.

Is This Why Amazon’s Growth Has Slowed Down?

Not exactly, but pretending nothing's wrong doesn't help. Amazon's growth has slowed because people are shopping more in stores and on other websites again. Also, sales from other companies selling on Amazon aren't increasing as fast as before. Problems during the pandemic, like keeping warehouses running and limiting stock from sellers, hurt Amazon too. More cheap products and Asian marketplaces popping up in Europe and it's affecting Amazon. They need to find ways to manage resellers, become more eco-friendly, and ultimately offer more than just low prices.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics