eCommerce: Temu's Global Expansion

Temu Launched in Vietnam and Brunei, Now Available in 5 Southeast Asian Markets

Temu recently launched in Vietnam and Brunei. It is therefore now active in five countries across Southeast Asia. Find out more about Temu's markets here.

Article by Nadine Koutsou-Wehling | October 10, 2024

Temu's New Markets: Key Insights

Launch in Vietnam and Brunei: With these two new markets, Temu is now available in five countries in Southeast Asia.

Many Small Markets: Temu's ubiquity is underlined by the fact that the eCommerce platform speaks to consumers all over the world. But with the rapid growth, challenges emerge.

Temu is expanding into Southeast Asian markets. The eCommerce marketplace is now also available in Vietnam and Brunei. The Philippines and Malaysia were added a little over a year ago, and Thailand in June this year.

We at ECDB regularly cover Temu, which has become notorious for its low prices, aggressive marketing and fast growth. With the five Southeast Asian markets in its portfolio, Temu is now available in 82 countries and regions. A subsidiary of PDD Holdings, Temu is the sister company of Chinese eCommerce giant Pinduoduo. Temu leverages similar platform strategies to Pinduoduo, which include gamification and flashy rewards, as well as social referrals and a wide variety of products.

Temu Goes Global: Its Core Markets

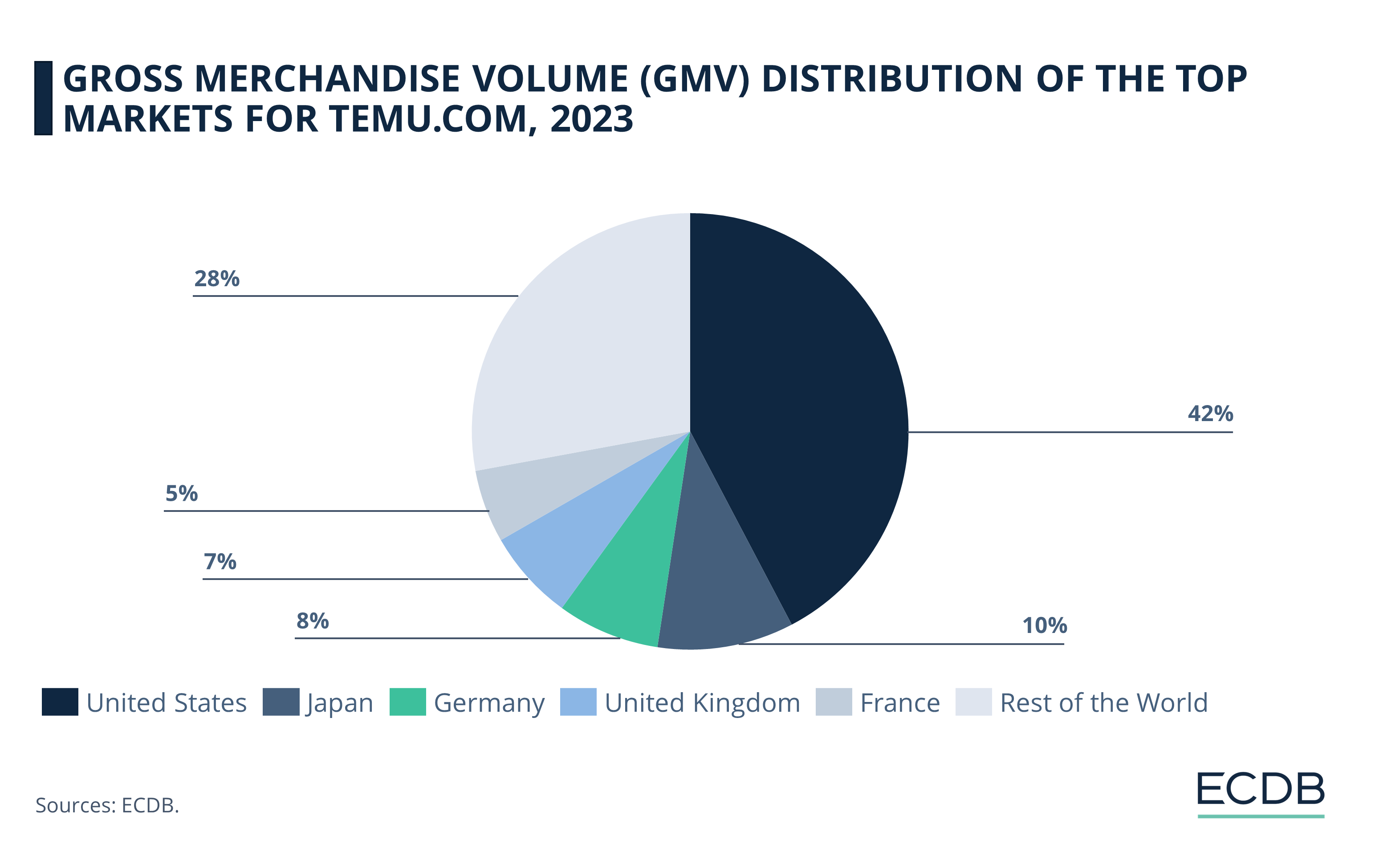

Temu's main market is the United States, with the U.S. contributing 43.3% of Temu's total GMV (gross merchandise volume).

Japan is Temu’s second most profitable market (10.3%), followed by the UK (6.8%), France (5.6%), and Germany (5.4%). The rest of the markets contribute a share of 28.6%. This means that many smaller markets account for Temu’s marketplace activity, which speaks to the broad appeal and universal nature of its strategy.

But rapid growth also brings challenges: Temu Vietnam is still quite underdeveloped, offers site navigation solely in English, and currently only accepts credit cards. Here is why a lack of payment variety is a widespread challenge for merchants at the moment.

Business Intelligence: Our rankings, updated regularly with fresh data, offer valuable insights to boost your performance. Which stores and companies are the leaders in eCommerce? What categories are generating the most sales? Explore our detailed rankings for companies, stores, and marketplaces.

Another issue is logistics partnerships and regional infrastructure barriers. Temu Vietnam works with two logistics companies, Ninja Van and Best Express. Best Express used to be a major logistics player in China, but sold its domestic express business to J&TExpress while focusing on overseas markets. In Vietnam, Best Express is considered a top logistics provider.

In Mexico, however, the surge in deliveries caused by increasing orders at Temu and its close rival Shein has contributed to overstrained logistics capacity and unsatisfied customers. J&T Express, which is the dominant partner in the market for the two booming platforms, is facing thousands of complaints as orders continue to grow.

Sources: VIR

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Temu Revenue: Does Temu Really Lose US$30 per Order?

Temu Revenue: Does Temu Really Lose US$30 per Order?

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Deep Dive

Temu Business Model 2024: Gaming, Gambling & Low Prices

Temu Business Model 2024: Gaming, Gambling & Low Prices

Deep Dive

Wayfair and Etsy Struggle in the U.S. Market Because of Temu

Wayfair and Etsy Struggle in the U.S. Market Because of Temu

Back to main topics