eCommerce: Company Analysis

How Does Amazon Make Money?

Over the last 30 years, Amazon has become the largest eCommerce player in the world. But how does the giant actually make money?

Article by Nikolai Surminski | June 06, 2024Download

Coming soon

Share

There is no company as synonymous with global eCommerce as Amazon.com, Inc. Over the last 30 years, Amazon has become the largest eCommerce player in the world.

It operates the largest marketplace with more than US$729 billion in GMV as well as 8 of the 50 largest online stores in the world. As of today, Amazon remains the largest eCommerce company by revenue (US$575 billion in 2023). Amazon alone is worth more than all other eCommerce companies combined.

But in recent years, the role of retail for Amazon has changed dramatically. As other business ventures have grown, there are now major question marks on what Amazon’s eCommerce business might look like in the future.

How Does Amazon Make Money?

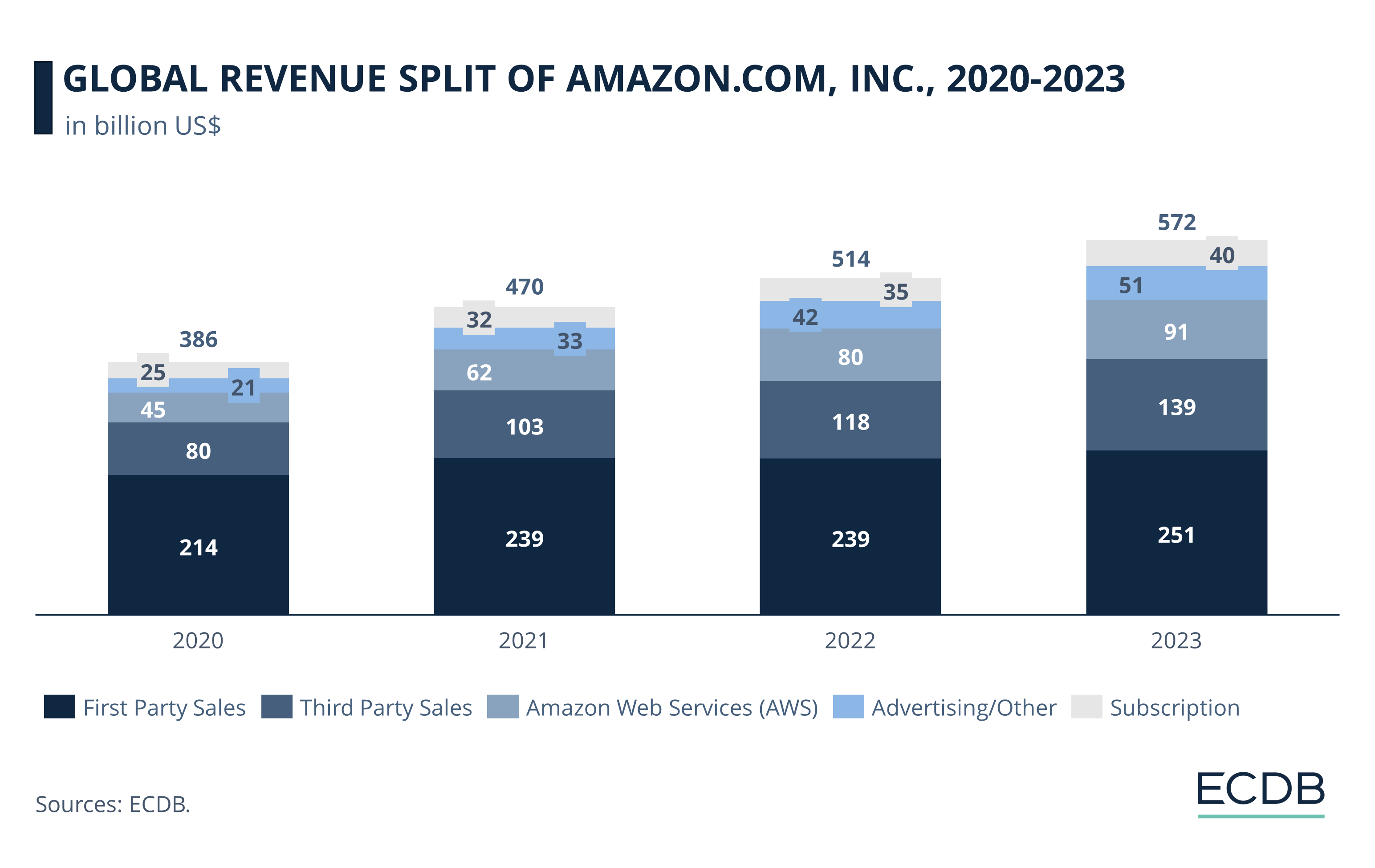

Amazon reports six major business streams that are contributing to its overall revenue. Online Stores and Physical Stores make up the company’s first-party business, selling products directly from warehouses to consumers. Combined, these two segments generated US$251 billion in 2023 or around 44% of all revenues. Despite growing by more than 5.6% annually since 2020, this number has fallen dramatically over the last years. In 2020, first-party sales accounted for more than 55% of Amazon’s earnings.

But what are the other segments that are growing more important for Amazon?

1. Third-party seller services

Amazon’s marketplace business allows entities not affiliated with Amazon to use its platform. Third-party sales accounted for US$139 billion or 24% of revenues in 2023, growing by 74% since 2020.

2. Advertising services

Selling sponsored ads and advertising space on its platforms to other vendors. This segment generated US$47 billion or 8% of revenues after 143% of growth over the last years.

3. Subscription services

Fees for Amazon Prime as well as music, digital video, and other non-AWS services. Subscriptions make up US$40 billion or 7% of all sales, up 60% since 2020.

4. Amazon Web Services (AWS)

Amounts earned from global sales of compute, storage, database, and other services for corporate clients. With around US$91 billion, AWS accounts for 16% of all revenues having grown more than 100% over the last four years.

All of these revenue streams are growing in importance for Amazon while its eCommerce business seems to have peaked. There are two main reasons why this is the case.

The first is the fact that the eCommerce market in many of Amazon’s core markets is no longer running as hot as they did during Covid. Total eCommerce revenues in the U.S. have only grown by 6.8% in 2023 with international markets growing even slower, a far cry from the double-digit growth rates seen between 2019 and 2021.

This slowdown is particularly felt by first-party stores, in this case Amazon’s Online Stores segment, while third-party marketplaces across the world are still expanding. The other reason is that Amazon has other business segments that are just significantly more profitable.

How Profitable is eCommerce for Amazon?

The best way to determine the level of profitability is the profit margin. The profit margin expresses profits as a percentage of total revenue providing insights into a company’s profitability by indicating how much of its revenue is converted into profit.

By observing the profit margin of Amazon’s business segments, one can compare profitability between different operations. And as profitability is generally considered the most important metric for investors, this comparison provides an insight into Amazon’s strategy.

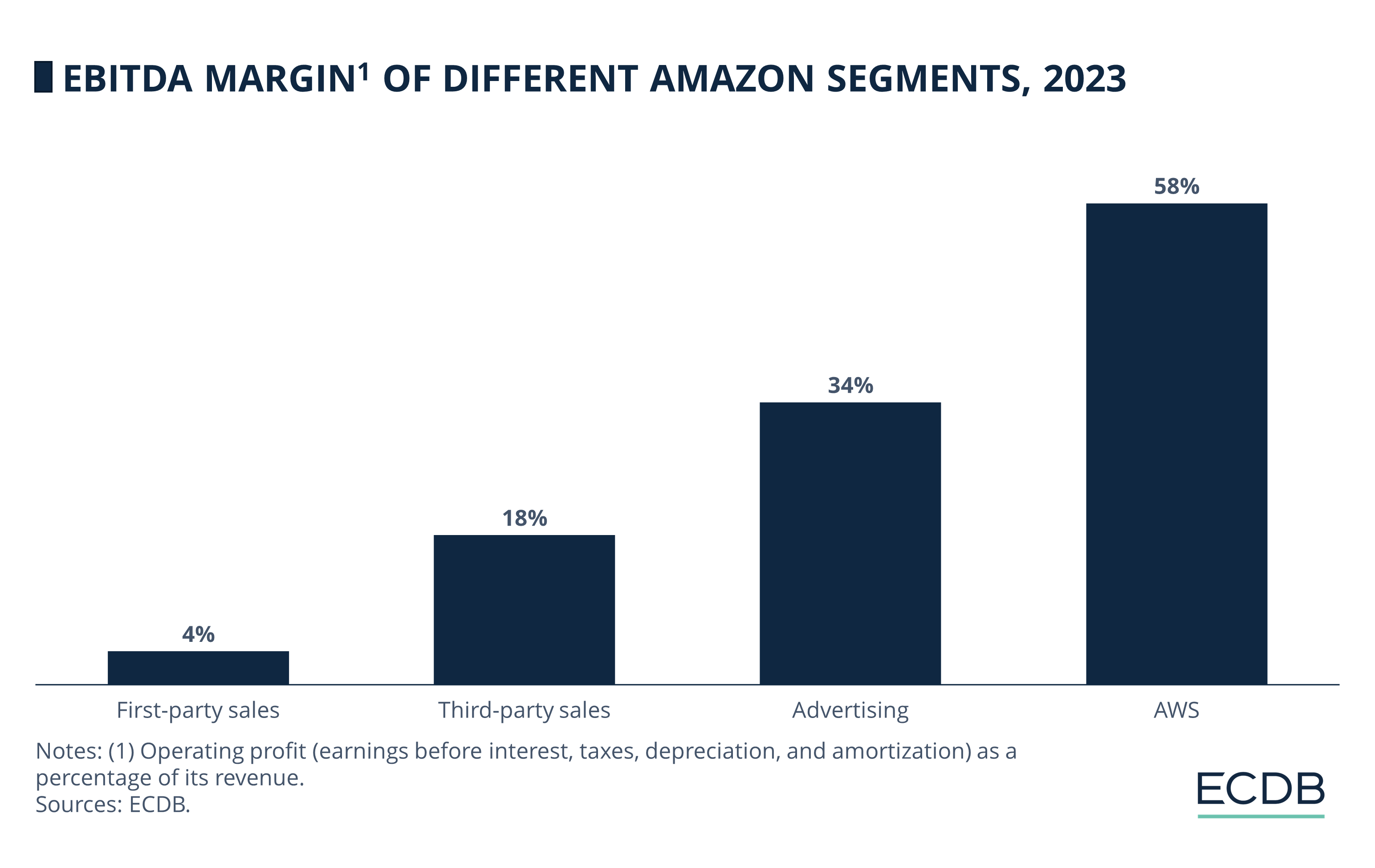

Even though Amazon’s first-party eCommerce business makes up almost half of its revenues, only 4% of the more than US$250 billion converts into earnings. This is considerably lower than both other major revenue streams of Amazon itself and accepted benchmarks in the industry. Profit margins for tech companies generally hover around 30%.

Amazon’s other segments all surpass its first-party retail in terms of margins. Especially AWS has turned into Amazon’s biggest profit center generating almost two-thirds of Amazon’s operating income in 2023.

This explains why the focus has shifted away from traditional eCommerce business, as every dollar of revenue generated in its other segments is more lucrative for the company.

Why Are Amazon’s eCommerce margins so low?

Amazon’s low eCommerce margins are nothing unusual as retail is a low-margin business. Offline retailers post average operating margins of just 2.4%.

And margins are even lower for online retailers with an average of just 0.6% meaning that every dollar of revenue brings in just 0.6 cents in profits. There are various reasons why the retail industry’s margins are so low:

Competitive environment: The eCommerce landscape is home to thousands of retailers across the globe, including other giants such as Alibaba or Pinduoduo. It has also never been easier to start an online store, meaning even more competition due to low barriers of entry. This competition drives down prices as companies need to attract customers with lower prices.

High operating costs: eCommerce companies still have significant costs such as fulfillment, logistics and digital infrastructure. Companies are often required to offer free shipping to stay competitive combined with high investments into customer acquisition and retention.

Price sensitivity: eCommerce consumers often expect lower prices online compared to brick-and-mortar stores because customers expect online stores to have lower costs. As there are always competitors that consumers can switch to, retailers are pressured to keep prices low.

All of these factors still hold for a giant company such as Amazon. And the lack of profitability in retail becomes even more apparent in absolute numbers.

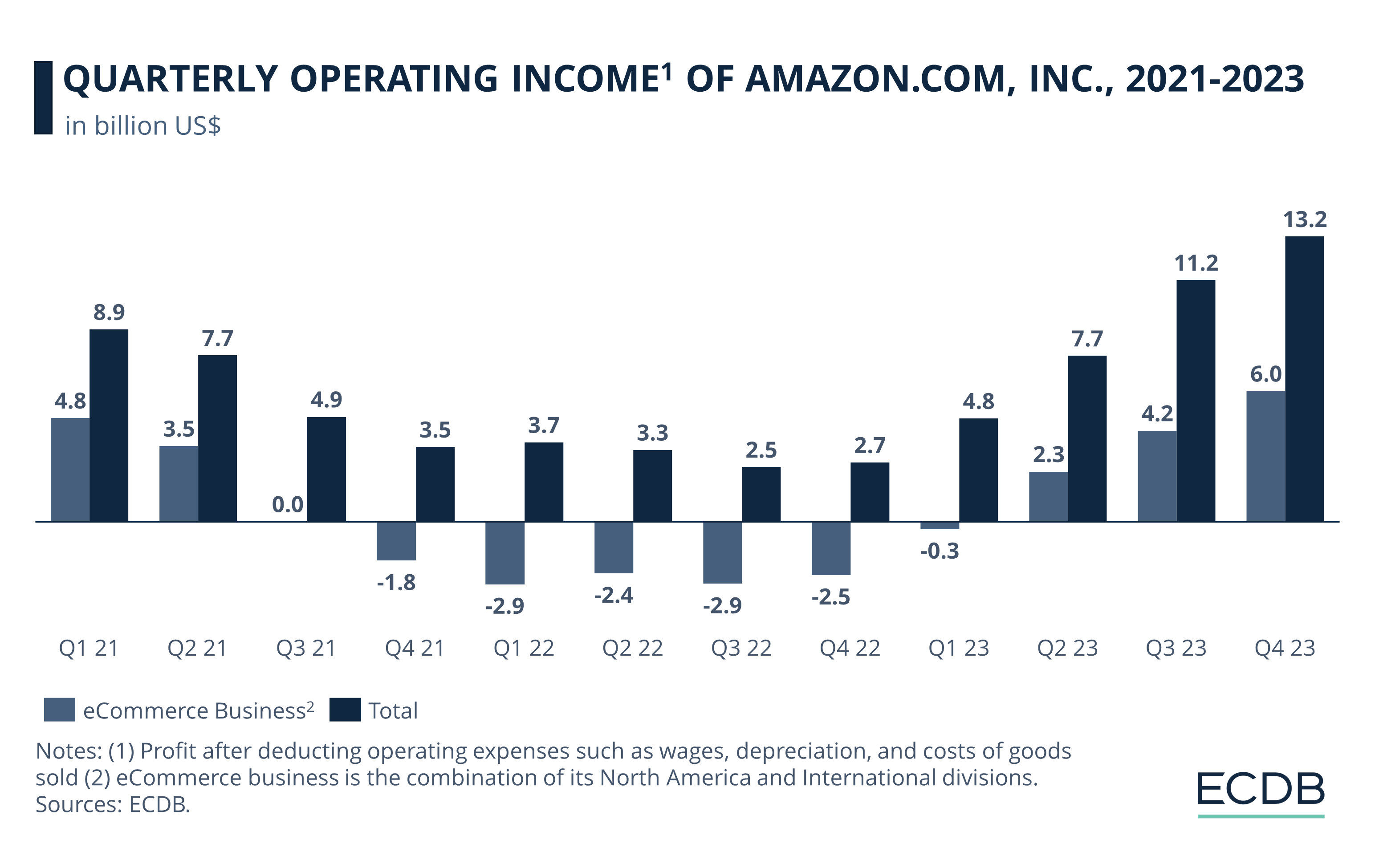

Without AWS and its other non-retail segments, Amazon would have barely been a profitable company in recent years. As the post-covid environment shifted in late 2021 and 2022, Amazon’s retail divisions were not profitable for an entire year.

Instead, its online businesses have been historic loss-leaders. Only the high-margin cloud business generated significant income. And even in 2023, when operating income from the eCommerce business recovered, AWS generated between 55% and 108% of income.

Low Margins: A Problem for Amazon?

Low margins are not a new phenomenon for Amazon. Ever since going public in 1997, the company has generally preferred to grow its market share rather than profits. Therefore, earnings generally did not grow in-sync with revenues when these skyrocketed in the late 2010s.

Instead, profits were invested into growth of both retail and AWS as well as health services, consumer electronics and video game development. This was also in line with macroeconomic trends. Interest rates were historically low, and investors encouraged tech companies to grow customer base and revenue over all other metrics.

Ongoing inflation and subsequent interest rate increases have changed this environment. These interest rates have made it harder for companies to finance business ventures that are not making money. And because higher interest rates have turned other investments into more attractive investments, investors have refocused on profitability for investment decisions.

Combined with other macroeconomic shifts (the end of Covid-19, geopolitical conflicts, supply chain challenges), this means higher scrutiny for low-margin divisions.

In addition, Amazon is now one of the largest retail companies in the world. It is no longer sustainable for Amazon to grow its retail by double-digits every year.

Every one of Amazon’s recent moves can be understood through this lens. The slowdown of eCommerce growth. The transformation to align its platform with that of Temu in the face of competition. The increase in fees for third-party sellers. Upping the price for its Amazon Prime subscription.

All of these are signs that Amazon itself is shifting its focus away from traditional retail and into business segments with higher profit margins.

What Does This Mean For Amazon’s Stock?

The difference in profitability is also of greater importance to Amazon’s stock valuation. In financial theory, a company’s stock price is the sum of all future profits. A more profitable company is therefore a more valuable company, which is the main metric of importance for shareholders.

The fact that large parts of Amazon’s business are not as profitable has therefore not gone unnoticed. As AWS is the most profitable business segment, some investors have in the past called for a spin-off.

A spin-off means splitting off a section of a company into a separate business. This is mostly done to increase the value for shareholders if the two companies have a higher combined valuation than the larger original company. Reasons could that one growing part of the company is held back by other less attractive parts.

And a deeper analysis of Amazon’s businesses suggests that a spin-off would increase value for shareholders.

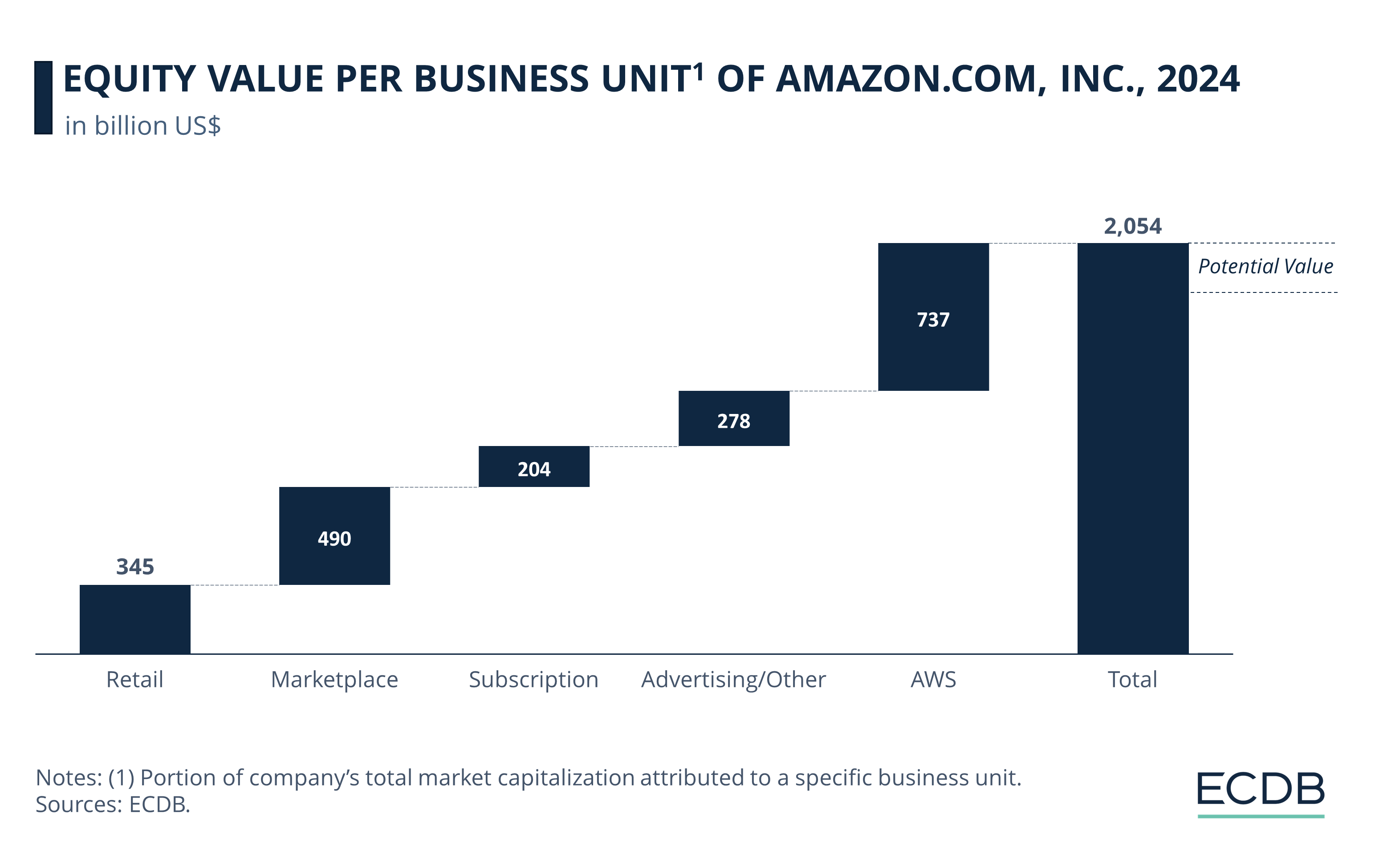

As of June 2024, Amazon has a market capitalization of around US$1.89 trillion. This should be the combined value of all its business segments indicating a price-to-sales ratio (the ratio between total revenues and market capitalization) of 3.2. This is above the average (1.43) of online retail companies which implies that Amazon, as market leader in eCommerce, is a financially “better” company.

We can use a Sum of Parts valuation to assess the current price level of Amazon. This technique assumes that all of the company’s business segments are run as distinct businesses and assigns a price-to-sale ratio to each of them.

The ratio for each segment is based on industry averages. Historically, these ratios are following profit margins meaning that high-margin industries such as Software – Infrastructure (Cloud Computing) tend to have higher price-to-sales ratios and therefore higher valuations than Retail.

Through deriving these partial valuations, one can see that AWS contributes the lion’s share of this theoretical valuation. The first-party online retail business only makes up 16% of valuation despite generating over 40% of revenues reflecting its low margins.

Instead, it’s the business segments that are further removed from Amazon’s “core business” that are responsible for its high valuation again questioning the future importance of its retail roots. For Amazon, this has a positive and a negative side:

1. The Sum of Parts valuation presents some financial growth potential. Amazon’s market capitalization is currently 12% under the proposed valuation of US$ 2.05 trillion (2,054 billion). This indicates that Amazon’s stock could potentially continue its recent rally just on the back of the underlying business.

2. There is financial argument that the highly profitable cloud business is held back by the lower margin retail business as it makes up the biggest share of both income and market capitalization. If Amazon’s sole focus is current shareholder value, spinning off AWS would unlock a substantial portion of value. Since AWS is also the least interconnected segment, the potential loss in economies of scope would be less severe than for other business streams.

Amazon: eCommerce Is Just The Cost of Doing Business

From a pure growth perspective, Amazon is no longer an online retail company. Instead, it is a tech company with a large warehouse that is experiencing continued growth through its cloud computing and advertising services. And this has changed the perspective of eCommerce for Amazon.

While in the past, it expanded services to sell more products directly, this approach severely limits future profit opportunities. Instead, Amazon has adopted platform models using the large base of existing shoppers as a starting point for complementary services.

Once a consumer is integrated into the eCommerce ecosystem (e.g., while routinely shopping in Amazon’s stores), it is easier to convert them to use the company‘s payment system or offer additional subscriptions.

Simultaneously, the large customer base makes a marketplace or a cloud service more appealing for corporate clients as it increases both trust and leverage. In a way, the massive eCommerce business is just the cost of doing business and achieving economies of scale.

This is the main reason that Amazon will not spin off its cloud business in the near future. The combination of retail and cloud computing has a value that goes beyond the purely financial. But the time of double-digit eCommerce growth financing all other business ventures for Amazon is over.

Instead, it is now cloud computing, advertising and marketplace business that is supporting a peaking retail segment. And profit margins, both for Amazon and in the wider online retail industry, indicate that this is not going to change anytime soon.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics