American eCommerce: Quick Commerce

Quick Commerce in the U.S: Market Trends, Top Providers & Consumer Behavior

Walmart, Amazon, and Costco dominate online groceries, but quick commerce is rising fast. Discover what key factors drive shoppers' choices in this competitive field.

Article by Cihan Uzunoglu | July 17, 2024Download

Coming soon

Share

Quick Commerce in USA: Key Insights

Leading Providers: Walmart, Amazon, and Costco lead in U.S. quick commerce, with Walmart being the top choice for over half of the consumers for fast grocery deliveries.

Consumer Priorities: Consumers prioritize convenience, valuing time-saving and round-the-clock availability above all in their shopping experiences.

Market Complexities: Challenges for quick commerce include high delivery fees and questions about product quality, suggesting areas for improvement to enhance customer satisfaction.

Lower prices, lack of time, convenience: We all have our reasons to order something online. While most people consider "online shopping" as buying a shirt on Amazon, a considerable number of people also buy their groceries without leaving the house.

This aspect of eCommerce, known as quick commerce, is already established and thriving in the United States. Before we dive into the top players in the market, let's get our definition straight.

What Is Quick Commerce or qCommerce?

Quick commerce (or qCommerce) is a type of online shopping focused on delivering everyday items like groceries, household products, and meals to your doorstep, often within an hour or less.

Unlike traditional eCommerce, which might take days, qCommerce aims to fulfill instant needs by leveraging local warehouses and speedy delivery networks. It caters to urgent moments when you need something quickly but don't have time to go to the store.

Top Quick Commerce Companies in the U.S.

Quick commerce proliferated during the pandemic, when the need for instant grocery delivery was most acute. In the years that followed, a variety of players emerged to offer super-fast delivery of everyday items.

Data below provided by Statista Consumer Insights shows a ranking of the top 10 qcommerce players that U.S. online shoppers have ordered products from in the past year.

Walmart ranks first, with 53% of U.S. users saying they have purchased groceries, beverages, or ready-made meal kits online in the past year.

Amazon ranks second with 42%, followed by Costco with 26%.

At 21% both, Aldi and Instacart follow the top 3.

While Blue Apron is at 15%, Burpy, HelloFresh, Deliv and EveryPlate round out the list with 11% each.

Let's take a closer look at the top 3 players.

1. Walmart

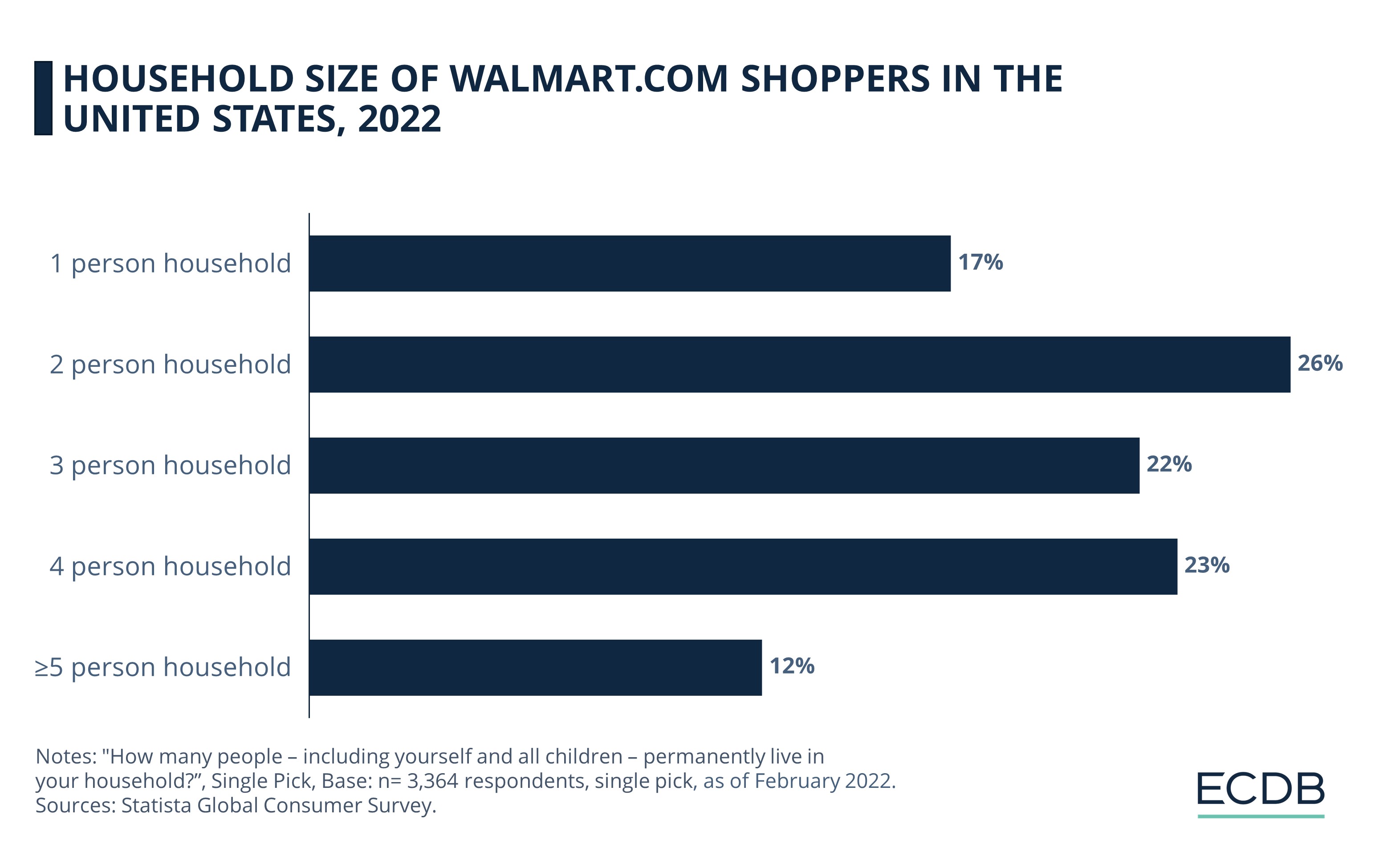

Walmart leads the U.S. quick commerce market, with 53% of users buying groceries, beverages, or ready-made meal kits online from them in the past year.

The retail giant leverages its extensive logistics network and physical locations, reaching 90% of the U.S. population within ten minutes, according to Forbes. Walmart's strategy integrates its brick-and-mortar presence with online offerings, utilizing vast resources to dominate the qcommerce sector.

As an established retailer, Walmart's success in quick commerce adds to its robust portfolio without depending on it, ensuring a strong market position. Walmart's extensive product assortment and financial resources enable it to offer rapid delivery services effectively, making it a leader in the quick commerce landscape.

2. Amazon

Amazon ranks second in quick commerce, with 42% of users purchasing groceries online from them in the past year.

To meet the demand for instant delivery, Amazon implemented "same-day sites," micro-fulfillment centers located near populated areas. These centers, with a smaller product assortment, enable faster distribution without relying on traditional postal services, allowing Amazon to meet consumer expectations for speed and convenience effectively.

This adaptation showcases Amazon's commitment to maintaining its competitive edge in the quick commerce market. Amazon's extensive logistics network and innovative strategies continue to drive its success in the fast-paced quick commerce industry.

3. Costco

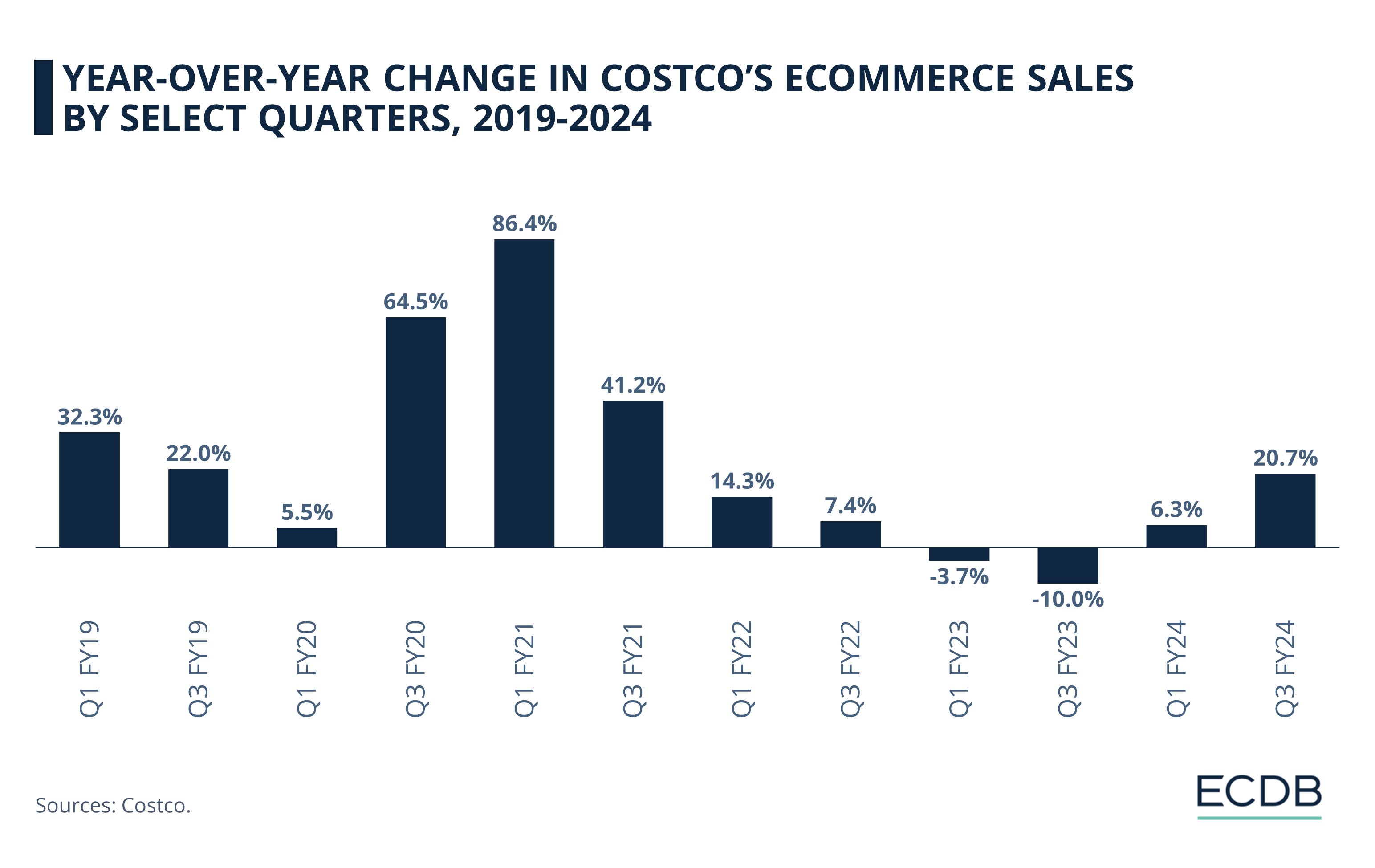

Costco, ranking third with 26% of users purchasing groceries online from them in the past year, combines its brick-and-mortar stores with enhanced online offerings.

Responding to the rise of quick commerce, Costco offers same-day delivery, adapting to changing consumer preferences post-Covid. Like Walmart, Costco uses its extensive physical store network and online presence to provide rapid delivery services. This approach ensures Costco remains competitive in the quick commerce market, leveraging its established retail presence to meet consumer demands for convenience and speed.

Costco's strategy of integrating physical stores with online services allows it to maintain a strong position in the market.

The success of these large businesses shows that they have a competitive advantage, ensuring faster delivery and boasting a larger network than smaller startups just getting into the game can profitably offer. And customers seem to be taking notice.

But what exactly do U.S. consumers value about quick commerce? The following subsection explores the benefits of this model.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

U.S. Consumers Value Convenience

Above All Else

In a 2022 McKinsey survey of U.S. consumers’ reasons for ordering groceries online:

29% cited saving time as the primary reason. Covid was the second most cited reason at 26%, highlighting the lasting impact of the pandemic on consumption patterns.

In third place, 23% valued the round-the-clock availability characteristic of quick commerce.

The fact that online grocers deliver orders to consumers is a benefit that 19% of users acknowledge, and similarly, 18% explicitly cite convenience as an added benefit. Close behind are 17% of users who say it is easier to compare products online.

Notably, 13% preferred online shopping in general, believed online prices were more economical, or found it easier to locate items.

Another 12% feel that online stores have consistent inventory, better promotions, and superior product quality than physical stores.

Overall, convenience and product availability are top motivators for consumers to purchase groceries, beverages and meal kits online. However, reasons why some may resist the trend toward quick commerce challenge these findings.

Nearly One-Third of U.S. Users Traditional Retail Settings

Recent developments involving quick commerce players have shown that not all is well with this hyper-convenient form of eCommerce. As some qcomm companies merge and others exit the market, customers are noticing problems from their own perspective.

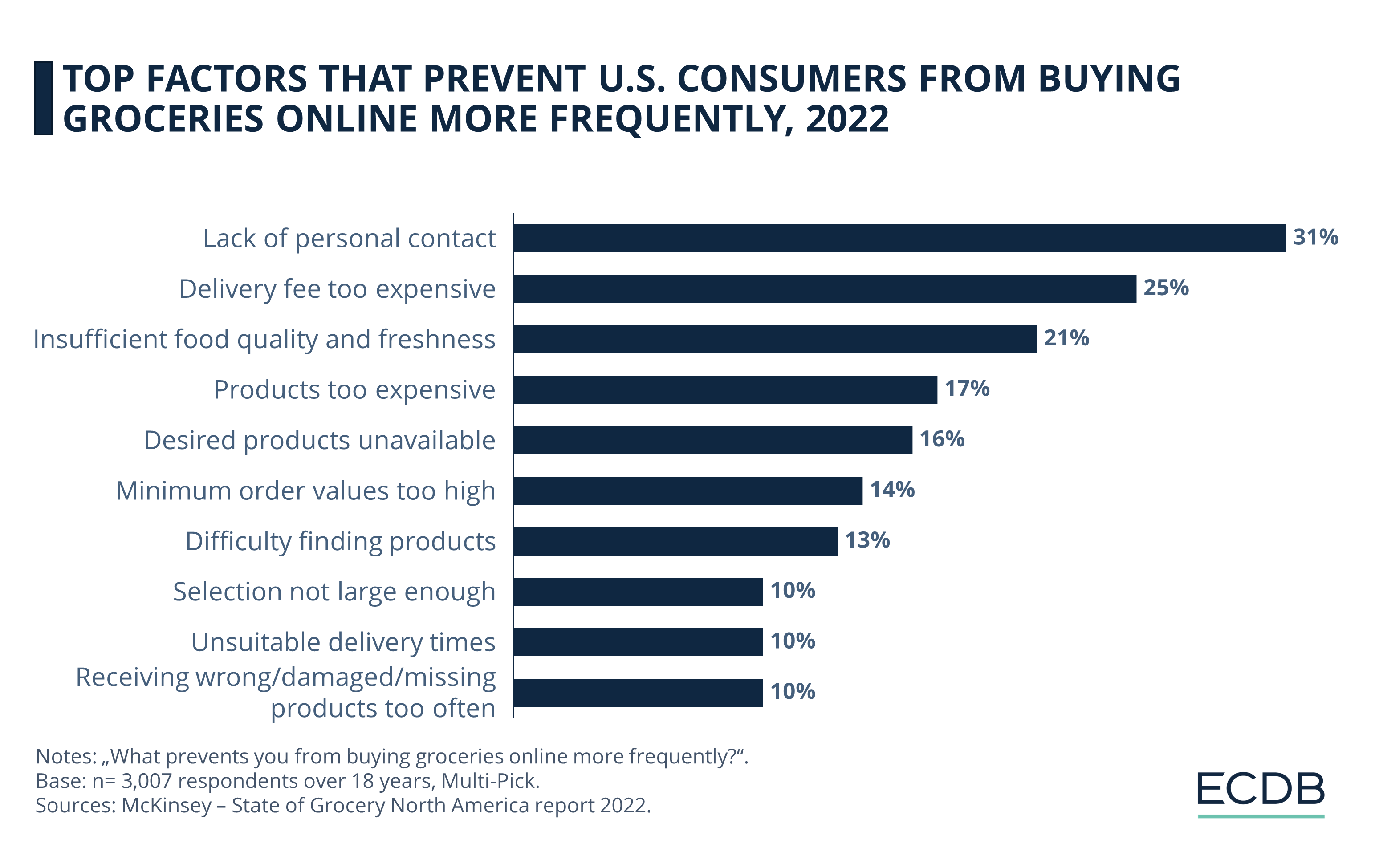

The McKinsey survey cited above asked U.S. consumers about the problems they perceive when ordering groceries online. The chart below illustrates these issues.

Nearly one-third of users say they miss the personal interaction inherent in in-store shopping, an experience exacerbated after the pandemic when social interactions were limited.

QCommerce Performance

High delivery fees discouraged 25% from ordering online, while 21% questioned the quality of products - a sentiment that contradicts the above argument praising the quality of online products.

Other contradictions to consumers' stated benefits include 17% who said the products were too expensive, 13% who said they had difficulty finding products, and finally 10% who thought the product range was too small and delivery times were unsuitable.

These ambiguous views underscore the diversity of experiences with quick commerce and how the quality of service can vary significantly from one provider to the next. Inconsistencies such as high minimum order values (14%), damaged goods (10%) or missing items (10%) can discourage repeat online purchases and, in the long run, damage the quick commerce landscape.

McKinsey: Consumers Demand Lower Delivery Costs

Having established the downsides of quick commerce, what is it that providers can do to make their service more appealing to consumers? McKinsey’s study renders the following results.

First and foremost, lowering delivery costs is the most preferred measure, cited by 47% of respondents. More promotions persuade 42% of users, followed by lower minimum order values (32%), covering two pricing aspects.

Faster delivery is important to 28% of users, ahead of precise delivery windows (20%) and delivery at off-peak times (15%). Finally, 14% would like to be able to receive orders via drop-off, without having to be present when the delivery arrives.

It is clear that some changes need to be made for U.S. consumers to more fully and sustainably embrace quick commerce. Based on the available data and recent market developments, what will the qcommerce landscape look like in the future?

Quick Commerce: The Future of Instant Shopping and Delivery

Does this mean that startups like Getir, Gorillas, Gopuff and others will go under? Not necessarily. However, it is expected that most of the startups will sell their business or cease operations altogether, while a few select ones will remain and grow along the way.

If the qcommerce trend has accomplished anything, it has reminded larger players of consumer preferences for convenience, low cost, and instant delivery. With the advent of robotics, automation, and drone services, it is only to be expected that the quick commerce segment has not reached its end. The market will simply adapt to the most viable strategies and eliminate those that cannot compete, just as nature does.

Sources: Charged Retail - Data Impact – Forbes: 1 2 - McKinsey

FAQ: Quick Commerce

Why Is Quick Commerce on the Rise?

QCommerce, or Quick Commerce, emerged as a modern approach to grocery shopping. The allure of convenience, especially in urban settings, greatly influences consumer buying behaviors. Additionally, increased social isolation has led many to prefer home deliveries. Recognizing these shifts in consumer habits, eCommerce companies have been motivated to adopt rapid delivery business models.

What Are Dark Stores?

Dark stores are specialized warehouse systems designed for efficient order fulfillment, particularly for eCommerce. They focus on tasks such as accurate goods placement, stock replenishment, packaging items based on orders, and rapid dispatching for delivery. Ideally, orders in dark stores are prepared in under 5 minutes, ensuring swift deliveries to customers. The implementation of a streamlined process system is vital to maximize efficiency, eliminating unnecessary movement or item searches by operators. This concept emphasizes precision and speed in every phase of order processing.

How Are Dark Stores Changing Delivery Systems?

Dark stores are revolutionizing eCommerce delivery. Exclusively catering to online orders, they optimize order processing, enabling faster and more efficient deliveries. Their strategic urban locations reduce delivery distances, ensuring quicker dispatch to customers. By focusing solely on fulfillment without in-store foot traffic, they enhance storage, picking operations, and overall inventory management, leading to quicker, more accurate deliveries. In essence, dark stores streamline the eCommerce supply chain, meeting the demand for rapid order turnaround.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

What Exactly Are In-Game or In-App Purchases?

What Exactly Are In-Game or In-App Purchases?

Deep Dive

AI in eCommerce: Better Deals, Greater Precision, and Easier Targeting

AI in eCommerce: Better Deals, Greater Precision, and Easier Targeting

Back to main topics