eCommerce: Customer Journeys

The Customer Journey in Online Shopping: It Begins with Search Engines

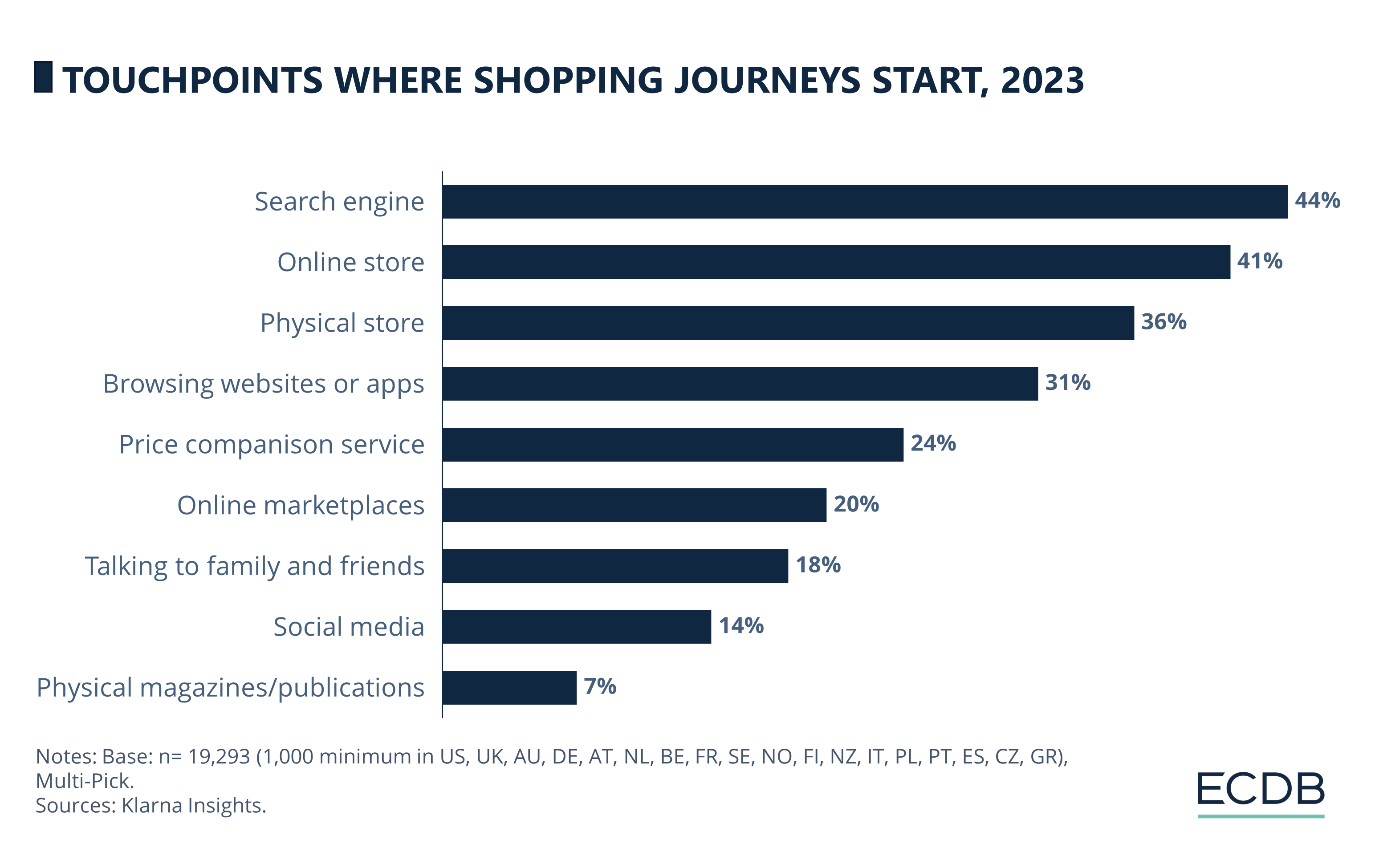

Nearly half of online shoppers initiate their purchasing journey with an internet search, while just over one-third prefer to start at physical stores, according to recent market analysis.

October 28, 2024Download

Coming soon

Share

Consumer Shopping Journey: Key Insights

Blending Shopping Experiences: A whopping 83% of shoppers research online before heading to physical stores, while 72% utilize their smartphones for in-store research.

Digital Shopping Journeys: Most shopping begins online, with 44% starting with internet searches and 41% at online stores, making digital channels as important as physical stores.

eCommerce online share in major economies such as the U.S. and China is already over 20%, steadily progressing towards 30% and over in the coming years. Concurrently, global eCommerce penetration rates and the frequency of online shopping are on the rise. But how do consumers find their desired products?

Increasing Importance of Online Channels in Shopping Journeys

The combination of offline and online services is typical for an average customer journey of a 2023 shopper. According to Klarna’s Shopping Pulse report, 83% of shoppers who go to a physical store have at least sometimes done some research on the internet before.

Even when they are physically in the store, the majority of shoppers browse the internet to search for comparable offers or to check product reviews – 72% of shoppers state that they use their smartphone in a store for this kind of research at least sometimes. Klarna’s Shopping Pulse insights also reveal where a usual shopping journey starts in 2023:

According to the Klarna analysis, not only the actual checkout, but also earlier steps in the customer journey become more and more digital: Most shopping journeys – no matter if the purchase is concluded online or offline in the end – start at an online touchpoint. With 44%, most customer journeys start with an internet search via Google or another search engine. Online stores are in rank 2, with 41% of retail customer journeys starting there.

The only relevant offline channel in this comparison is physical stores, with just above one third of customers starting their shopping journey there. This makes physical stores roughly as popular as a first touchpoint than browsing through apps and websites other than search engines or online stores. Around one in four shopping journeys starts on a price comparison website. The other options in the list include conversation with peers and physical magazines/publications.

Among the countries analyzed by Klarna, Belgium, France, and Spain stand out, as a larger portion of consumers in these countries begin their shopping journeys in physical stores compared to online stores, as well as search engines.

Source: Klarna Insights, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

FTC’s New Ban in Effect & How to Spot Fake Reviews in Online Shopping

FTC’s New Ban in Effect & How to Spot Fake Reviews in Online Shopping

Back to main topics