eCommerce: Health Products

Walmart Introduces Prescription Deliveries, Outpacing Drugstores CVS and Walgreens

Walmart is launching a prescription delivery service in six U.S. states, with plans to expand to 49 states by the end of January 2025. Here's what it's all about.

Article by Nadine Koutsou-Wehling | October 22, 2024Download

Coming soon

Share

Walmart Prescription Delivery: Key Insights

Walmart's Prescription Delivery Service: Walmart.com is introducing a prescription delivery service, with the same terms as its standard home delivery service. Delivery costs an additional US$9.95 for online orders or is free for Walmart+ members. A pharmacist phone consultation is offered for new prescriptions.

Outperforming CVS and Walgreens: Traditional drugstores have struggled in the U.S. in recent years. This is reflected in store closures and discontinued services. Walmart has a clear advantage as customers choose it for its convenience and accessibility.

Walmart is now offering prescription delivery to customers. The project is being launched in six U.S. states: Arkansas, Missouri, New York, Nevada, South Carolina and Wisconsin. By the end of January, the retailer plans to launch the prescription delivery service in 49 U.S. states.

Walmart’s move puts additional pressure on competing retailers, especially drugstores that are currently struggling to turn a profit and maintain relevance, like CVS and Walgreens. Walmart customers can now order any product and have it delivered to their doorstep for an additional US$9.95, or for free if they are Walmart+ members. Prescription delivery is part of the same offer, along with a pharmacist phone consultation for new prescriptions.

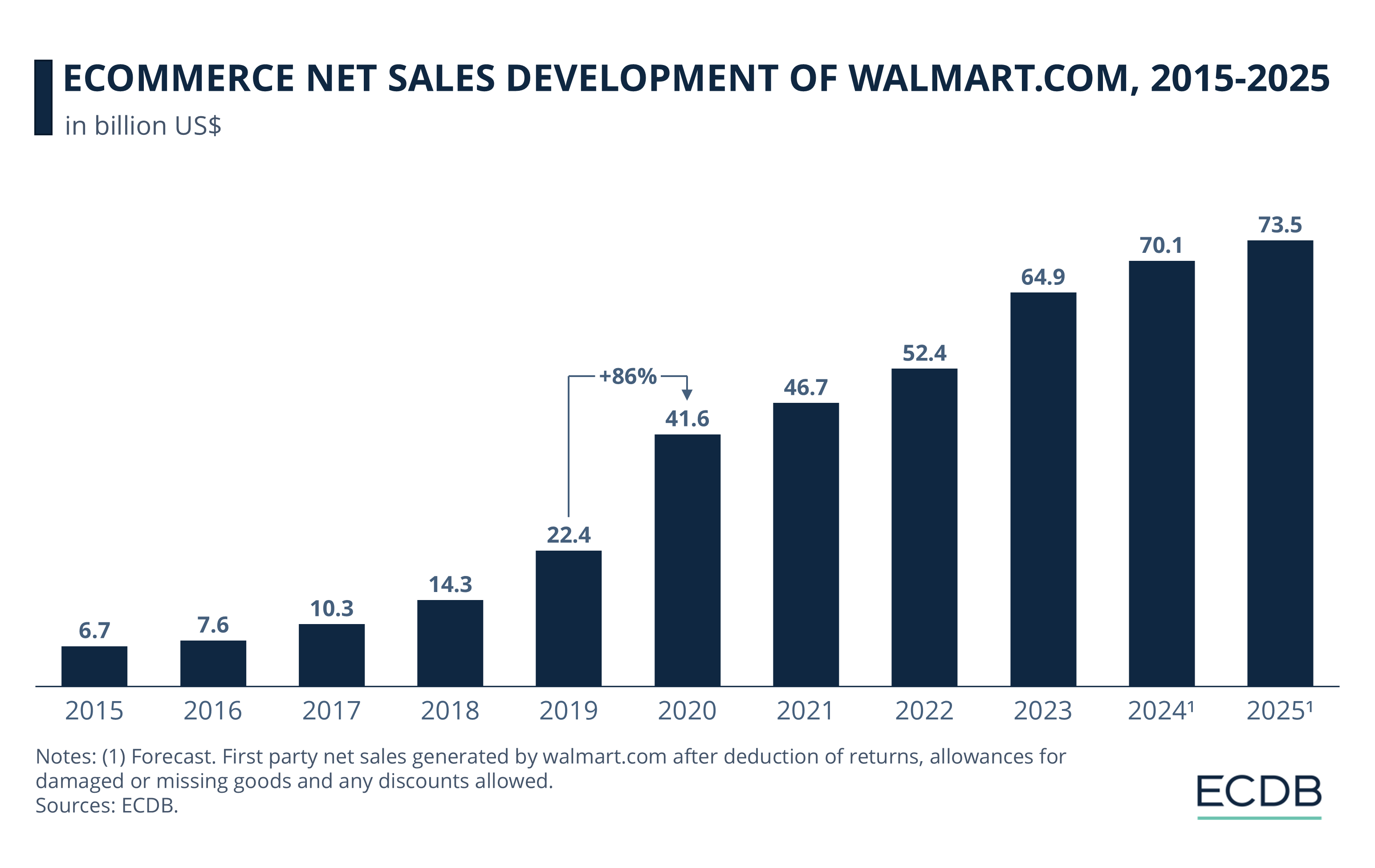

Walmart.com on the Rise

The United States is Walmart's most important market. While Walmart's global eCommerce sales have fluctuated, walmart.com has consistently performed well.

eCommerce revenues on walmart.com leapt in 2020. In 2023, another jump occurred.

The 2023 increase can be attributed to improved delivery capabilities, advertising, and Walmart + subscriptions, all of which increased order volume.

With the new service, Walmart is taking market share from traditional drugstores CVS and Walgreens, which have struggled in recent months. The solution for U.S. consumers who live in so-called “pharmacy deserts”, or areas where there is no immediate access to a pharmacy, is to order online.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

But the question is where to order online? Consumers are going to choose a provider based on experience, proximity, availability, price, and speed. The offering of each provider has a significant impact, and in the case of Walmart it is clear: On Monday (Oct 21) Walmart shares increased 54% for the year, CVS was down 26%, while Walgreens’ declined by 60%.

Sources: CNBC

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

eCommerce in the United States: Best Product Categories

eCommerce in the United States: Best Product Categories

Deep Dive

Mexican Online Pharmacy Market: The Top 5 Stores

Mexican Online Pharmacy Market: The Top 5 Stores

Deep Dive

Sephora Business Model: The Online Beauty Leader and Its Succes

Sephora Business Model: The Online Beauty Leader and Its Succes

Back to main topics