eCommerce: Walmart Financial Report

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Walmart eCommerce revenues achieved new heights in the second quarter of 2024. While overall revenue is up 5% year-over-year, eCommerce business is outpacing overall business at a growth rate of 21% compared to the previous year. Find out more on Walmart's trajectory here.

Article by Lukas Görlitz | September 23, 2024Download

Coming soon

Share

Walmart eCommerce Growth: Key Insights

Walmart's Second-Quarter Earnings in 2024: With quarterly total sales of US$169.3 billion in Q2 2024, Walmart grew its numbers by 4.8%.

eCommerce Is Taking the Lead: With a 21% increase in eCommerce sales, Walmart outpaces growth of its physical retail segment.

Generative AI and International Growth: Walmart is enhancing its fulfillment center capabilities through automation and is increasing its eCommerce segments across international markets.

The largest grocery retailer in the U.S., Walmart, ended 2023 on a high note, increasing its quarterly revenue by 5.7% to US$173.4 billion. Walmart thereby beat Wall Street's expectations of US$170.7 billion for the 4th quarter. 2024 continues successful: Its second-quarter results showed very positive results, which were driven by a higher value proposition across all demographics and a growing strength in eCommerce.

An important factor in Walmart's success is the company's eCommerce sales. While overall revenue is up 5% from the previous year, Walmart's eCommerce growth is outpacing its overall business, as it grew by 21% compared to 2023. This is mostly due to Walmart's enhanced focus on multichannel services and the online marketplace. In consequence, this is the 8th quarter in which Walmart's online sales grew by more than 15%.

Walmart Boosts eCommerce Sales

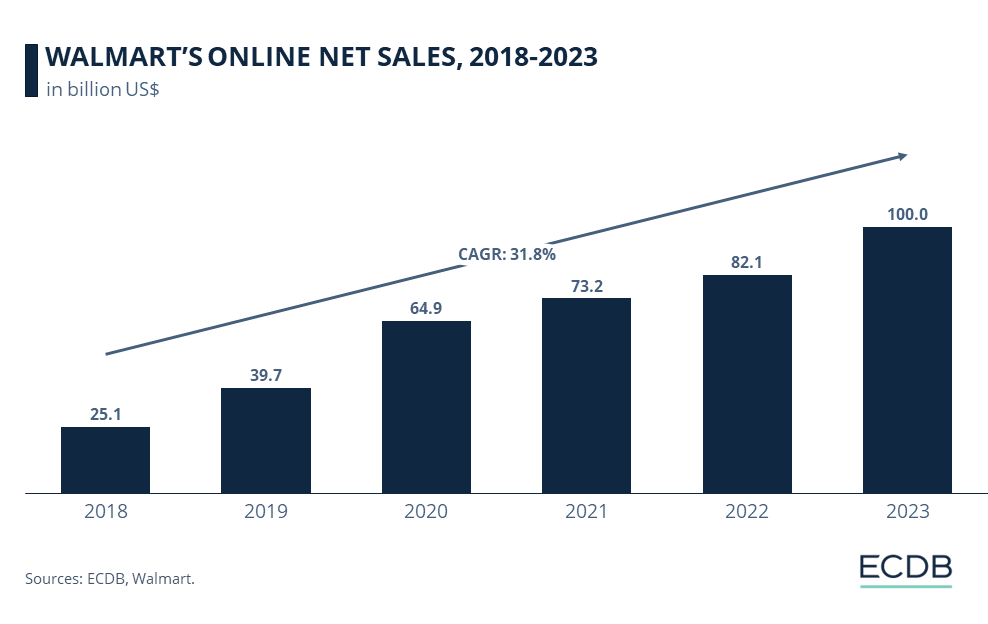

In recent years, Walmart has been able to improve its online net sales by 31.8% per year. The biggest gain Walmart experienced was in 2020, when eCommerce sales improved from US$39.7 billion to US$64.9 billion during the first year of the pandemic. In the following years, it grew by about US$9 billion every year until it took another big leap in 2023 from US$82.1 billion to US$100 billion, as Walmart announced.

How did Walmart attract so many new customers to its online store and app?

By leveraging its value reputation as one of the leading retailers in the U.S., Walmart attracted people from all income levels. The retailer’s ad sales grew 33% globally and 22% in the U.S. market. Another factor is Walmarts third party marketplace: by packing and shipping online orders from other sellers, the company could account for significant transactions from this area.

Walmart also introduced its new subscription program called Walmart+. For US$12.95 per month, the subscription offers benefits such as gas discounts or free delivery from stores to boost their eCommerce sales.

Over a one-year period, Walmart's customer transactions increased by 4.3%, while the average ticket and the amount a customer spent decreased slightly. This could be an effect of Walmart lowering prices on many products such as dry groceries, paper goods, and cleaning supplies in response to a possible deflationary environment in the end of 2023.

Still, Walmart's eCommerce business is not yet profitable, but it is getting closer. Fulfillment costs fell 20% last year as the retailer drops more packages on each delivery route and continues to promote the service.

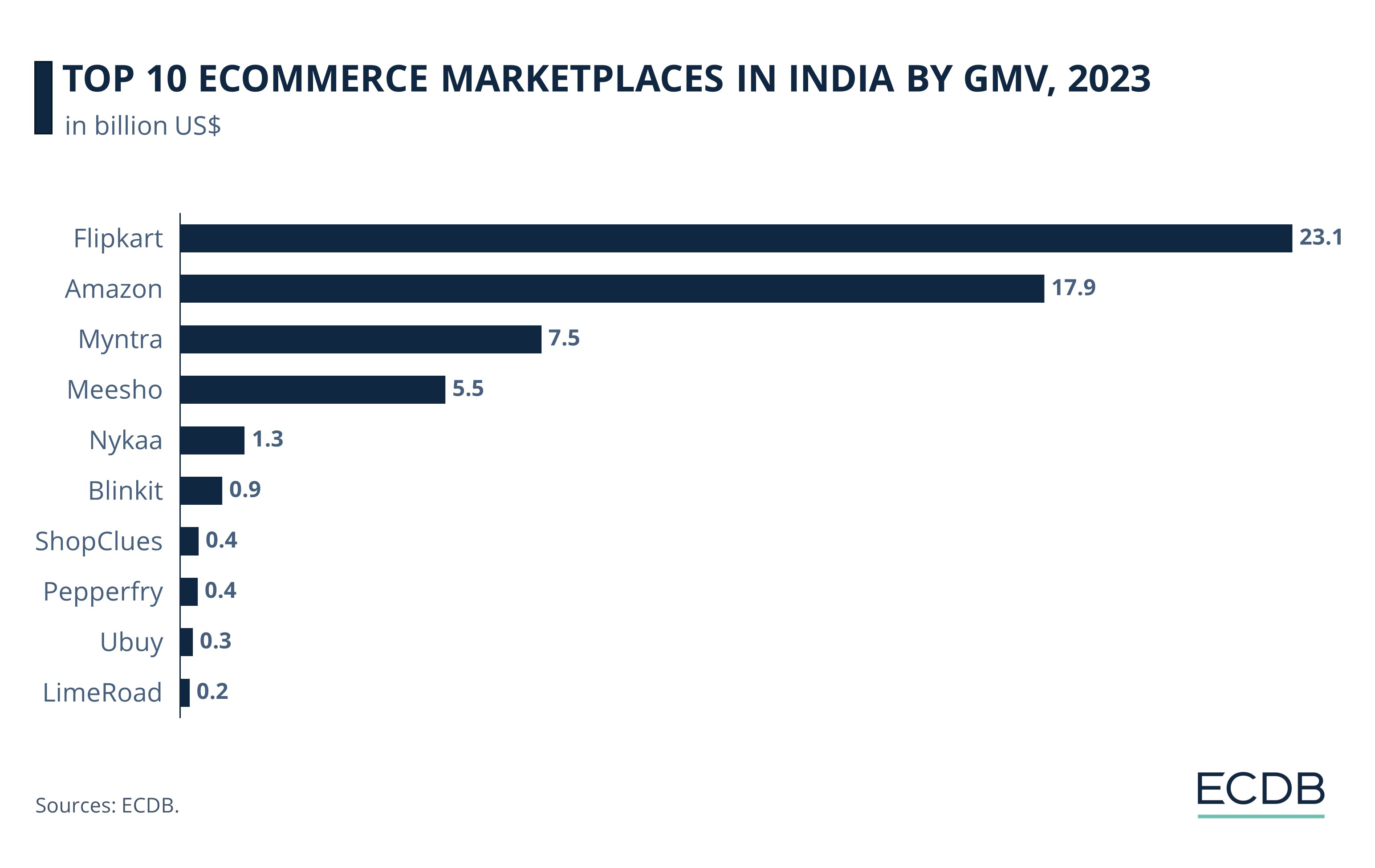

At the rate at which Walmart is progressing currently, profitability should be reached soon: eCommerce penetration has grown over all segments in 2024. This includes 22% eCommerce growth in the U.S. and 18% internationally. But the highest increase in eCommerce sales occurred in one of the leading growth markets, India. Walmart's subsidiary Flipkart grew by 50%. The quick commerce sector is currently thriving in India, where Flipkart is one of the leading marketplaces to serve customers.

Throughout both its international U.S. segments, Walmart is working on widespread modernization of its fulfillment centers, 45% of which are currently powered by generative AI. Walmart also growing its retail media ads business, similar to other eCommerce giants such as Amazon, with advertising revenue growing by 26% year-over-year.

U.S. eCommerce Hits Sales Record

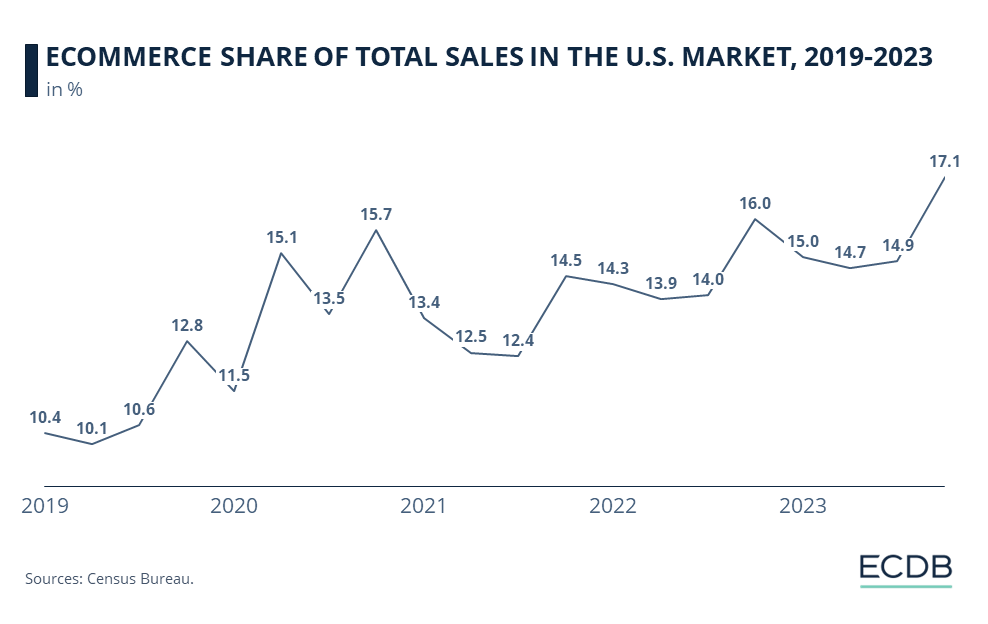

Walmart's U.S. eCommerce sales are growing simultaneously.

It shows that the trend in the U.S. continues to grow every year after the pandemic times, where the spike of eCommerce sales was the biggest.

Walmart eCommerce Sales: Closing Remarks

With a strong finish in Q4 2023 and an increasing focus on its online sales, Walmart is expected to end the non-profitability of its eCommerce division soon.

Business Intelligence: Our rankings, updated regularly with fresh data, offer valuable insights to boost your performance. Which stores and companies are the leaders in eCommerce? What categories are generating the most sales? Explore our detailed rankings for companies, stores, and marketplaces.

Walmart's investment in growth markets such as India shows that it is acting with foresight, as are most of the largest international retailers who have seen the profit potential in the market. Not all of them are as successful as Walmart though: Walmart has even outpaced Amazon, which operates the second largest online marketplace in India. But both retailers have run into trouble with the Indian government's antitrust laws. At the same time, Walmart sold its stake in Chinese eCommerce giant JD.com as it refocuses its resources on more profitable segments.

Sources: Walmart 1 2, CNBC 1 2, Census Bureau.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Top Online Supermarkets Worldwide: Market Share, Growth & Sales

Top Online Supermarkets Worldwide: Market Share, Growth & Sales

Deep Dive

Top Categories for Online Shopping in Spain: Food and Beverages Lead

Top Categories for Online Shopping in Spain: Food and Beverages Lead

Deep Dive

Top Online Wine and Liquors Online Stores in France

Top Online Wine and Liquors Online Stores in France

Deep Dive

eCommerce in Australia: Market Expected to Hit US$75.2 Billion by 2028

eCommerce in Australia: Market Expected to Hit US$75.2 Billion by 2028

Deep Dive

Live Commerce Market China: GMV to Exceed US$1 Trillion by 2026

Live Commerce Market China: GMV to Exceed US$1 Trillion by 2026

Back to main topics