eCommerce: Product Categories

Top Categories for Online Shopping in Spain: Food and Beverages Lead

What are the top eCommerce product categories purchased by Spanish consumers in 2023? We provide the answers by revealing the fastest-growing Spanish eCommerce segments – let's dive into the data.

August 21, 2024Download

Coming soon

Share

The Top Categories for Online Shopping in Spain:

Key Insights

Consistent Growth Across Categories: Despite variations in growth rates, all categories are projected to continue expanding significantly through 2028, with compound annual growth rates (CAGR) ranging from 12.2% to 22.6%.

Post-Pandemic eCommerce Boom: The eCommerce growth across all these categories highlights the lasting impact of the pandemic on consumer behavior, with online shopping becoming a permanent and increasingly dominant industry in Spain.

Food Leads Growth: Food eCommerce saw the highest year-on-year growth in Spain at 16.9% in 2023, driven by the increasing convenience of online grocery shopping.

Online shopping is becoming increasingly convenient. In 2023, the global eCommerce sector for Grocery (11.1%) grew the most. And in Spain, the trend seems to be similar, with the Grocery category on the rise.

Which categories have seen the most significant gains in 2023? Why are they so popular? Our data reveals the performance of different product categories in the Spanish eCommerce industry in 2023.

Top Categories for Online Shopping in Spain: Food Grew Highest in 2023

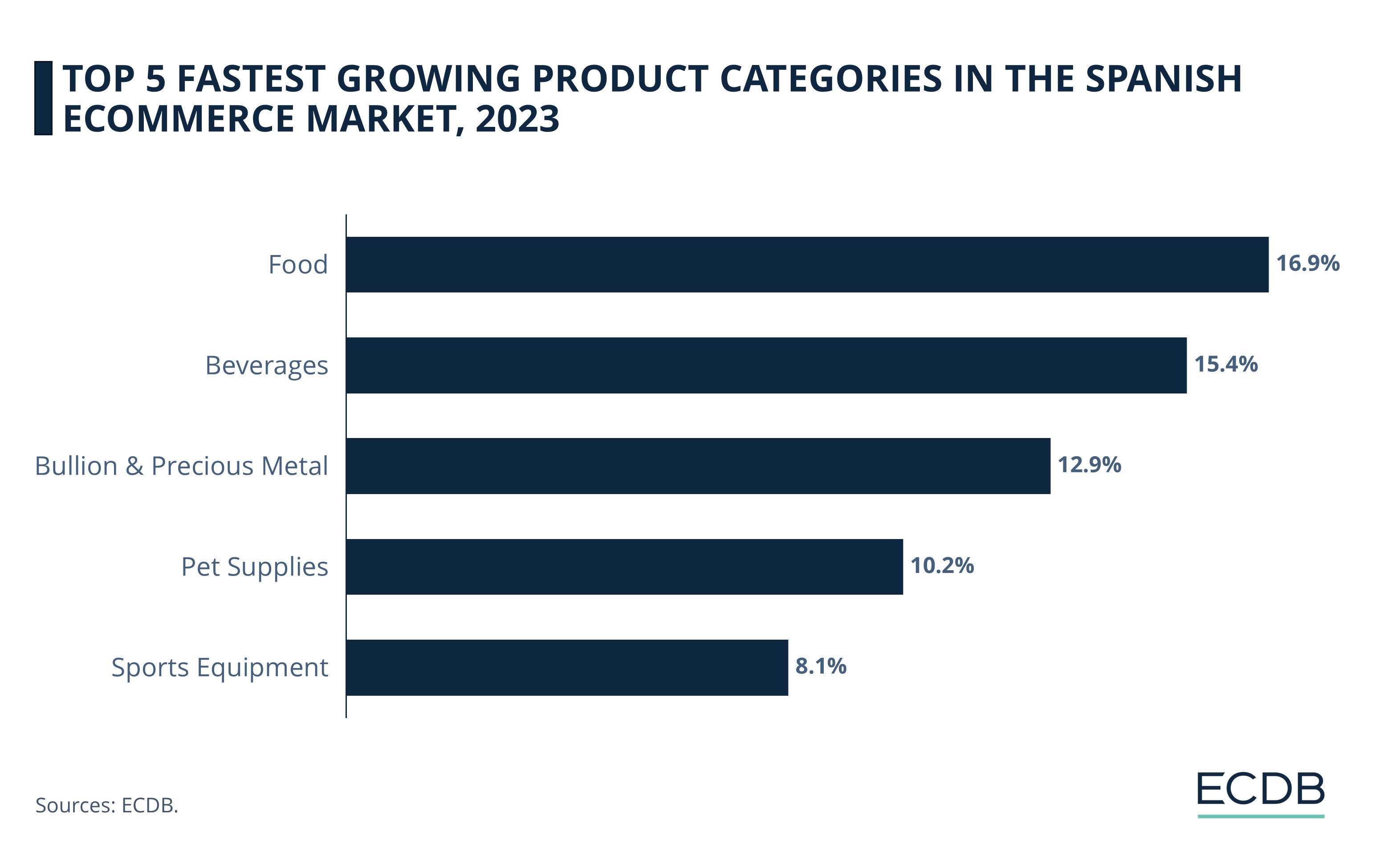

As per ECDB’s latest data, in 2023, the categories that saw the highest year-on-year growth in the Spanish eCommerce market are:

Food, as part of the Grocery category, had the highest YoY growth in Spain with 16.9%.

Also included in the Grocery eCommerce market is Beverages, which follows in second place with an increase of 15.4%.

Next is Bullion & Precious Metals, under Hobby & Leisure, in third place with an annual uplift of 12.9%.

Pet Supplies, also part of Hobby & Leisure, ranks fourth with a yearly gain of 10.2%.

Sports Equipment, another component of Hobby & Leisure, ranks fifth with a 7.9% improvement in revenue.

1. Food (16.9%)

Doing your weekly grocery shopping online with only a few clicks is becoming the new normality. Instead of standing in line at the checkout after work, more and more people want to use their time for more meaningful things – and Spain is no exception.

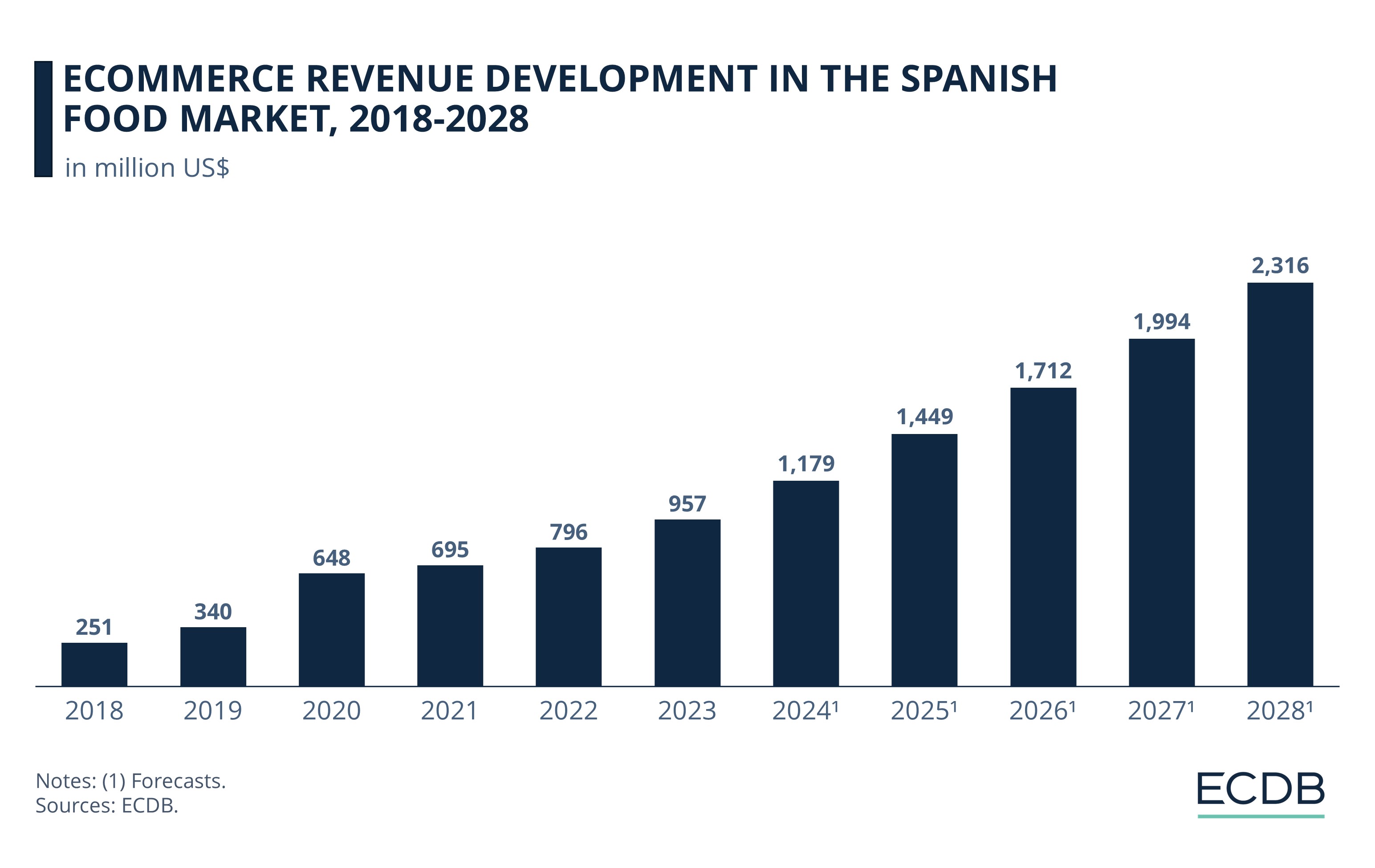

The Spanish eCommerce sector for Food achieved in 2023 a total revenue of US$957 million, ranking it in 12th position among the largest product categories.

ECDB expects a compound annual growth rate for the next four years (CAGR 2024-2028) of 18.4%, resulting in a projected market volume of US$2.3 billion by 2028.

Food refers primarily to products such as fresh food, frozen food, food cupboard, bakery, and meal kits.

But how exactly has this eCommerce industry developed recently? Take a look at the details of the Spanish grocery market.

The food market clearly gained from the eCommerce boom during the pandemic, increasing by more than 90% in 2020 compared to 2019, to reach a net sale of US$648 million.

After this episode, the growth trend in Spain slowed down in 2021, with net sales of US$695 million.

However, the market's year-on-year growth then accelerated, rising by 20.4% in 2023 to reach US$957 million in revenue.

This year, the market is expected to break the US$1 billion mark with an expected growth rate of 23.2%.

Behind this development, there are different players driving the industry's progress. At the top are online stores such as mercadona.es, carrefour.es, and elcorteingles.es, which generated net sales of US$435 million, US$222 million, and US$171 million in this ecommerce market in 2023.

2. Beverages (15.4%)

Alongside food, Beverages are an important part of the Grocery category. While food is the main focus of grocery shopping, beverages follow a very similar development trajectory:

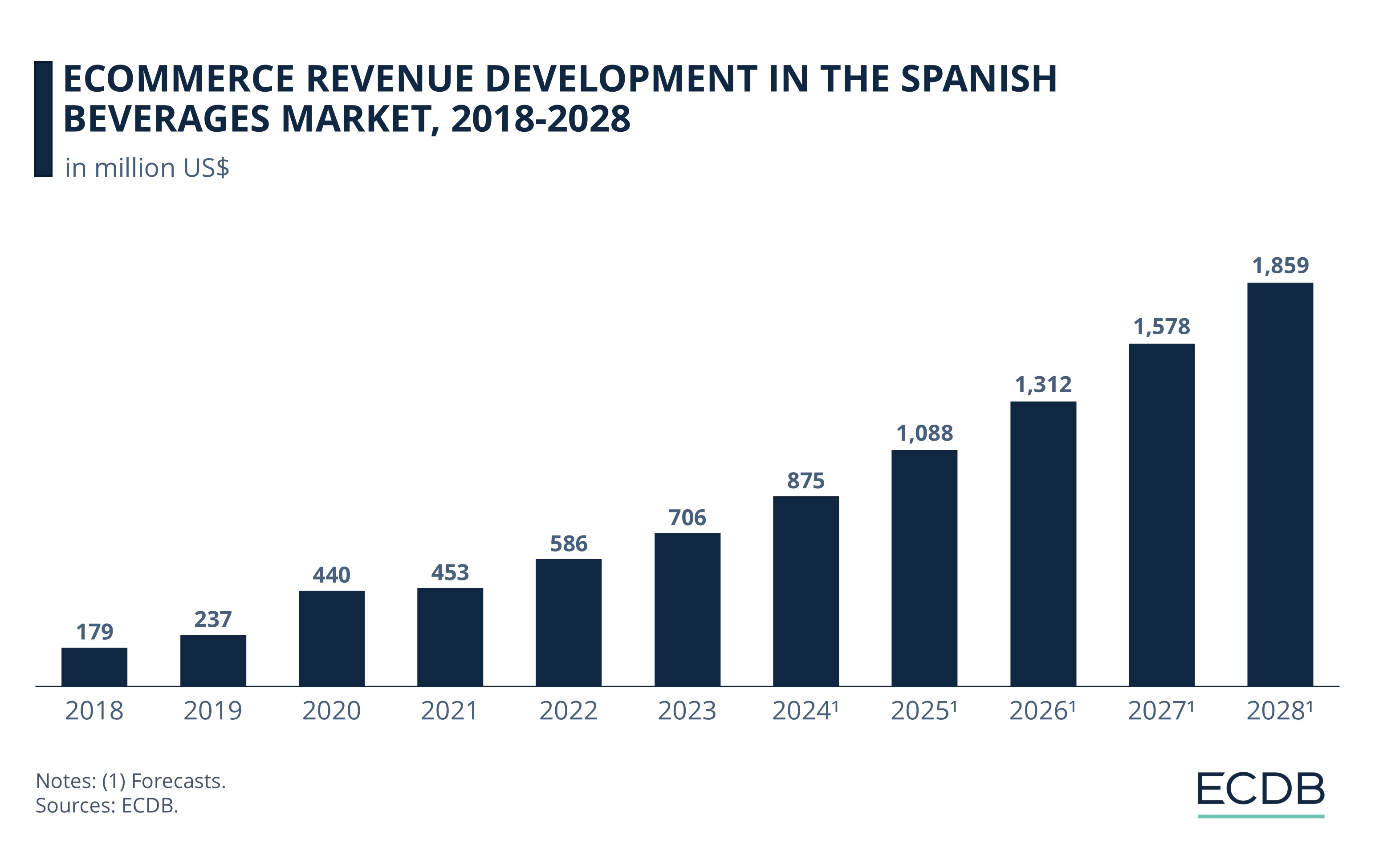

Beverages ranks 17th in the Spanish eCommerce with total sales of US$706 million in 2023.

The CAGR for the next four years (2024-2028) is expected to be 20.7%, reaching a market volume of US$1.8 billion in 2028.

The product category includes alcoholic beverages, such as wine and spirits, along with non-alcoholic beverages, such as water and juices.

The Spanish eCommerce sector is not the largest among all, but with its annual growth rate, it can be proud of itself – let's have a look at its detailed development:

With the onset of the COVID-19 pandemic, the numbers began to rise, reaching an annual growth rate of 86%, resulting in total eCommerce revenues of US$440 million.

After the dip in 2021 with revenues of US$453 million, a new but slower upward trend began. In 2022, the Beverages category generated net sales of US$586, an increase of 30% over the previous year.

For this year, ECDB forecasts a turnover of US$875 million for the Spanish Beverages product category, while by 2025, the eCommerce sector could surpass the US$1 billion mark.

As in the food eCommerce category, similar online stores are driving the positive development. Leading the way is once again mercadona.es, which generated US$105.4 million in Beverages. In second and third place are elcorteingles.es with sales of US$71.6 million and carrefour.es with US$49.5 million, both in 2023.

The trend toward digital grocery shopping is not unique to Spain. It is also apparent in the United Kingdom, for example.

3. Bullion & Precious Metal (12.9%)

Ever thought about investing in bullion? Precious metals offer an opportunity for a safe and reliable method of capital preservation. As part of the Hobby & Leisure super category, the Bullion & Precious Metal eCommerce industry accounts:

As defined by ECDB, Bars and coins made out of gold, silver, platinum or palladium, as well as Storage solutions.

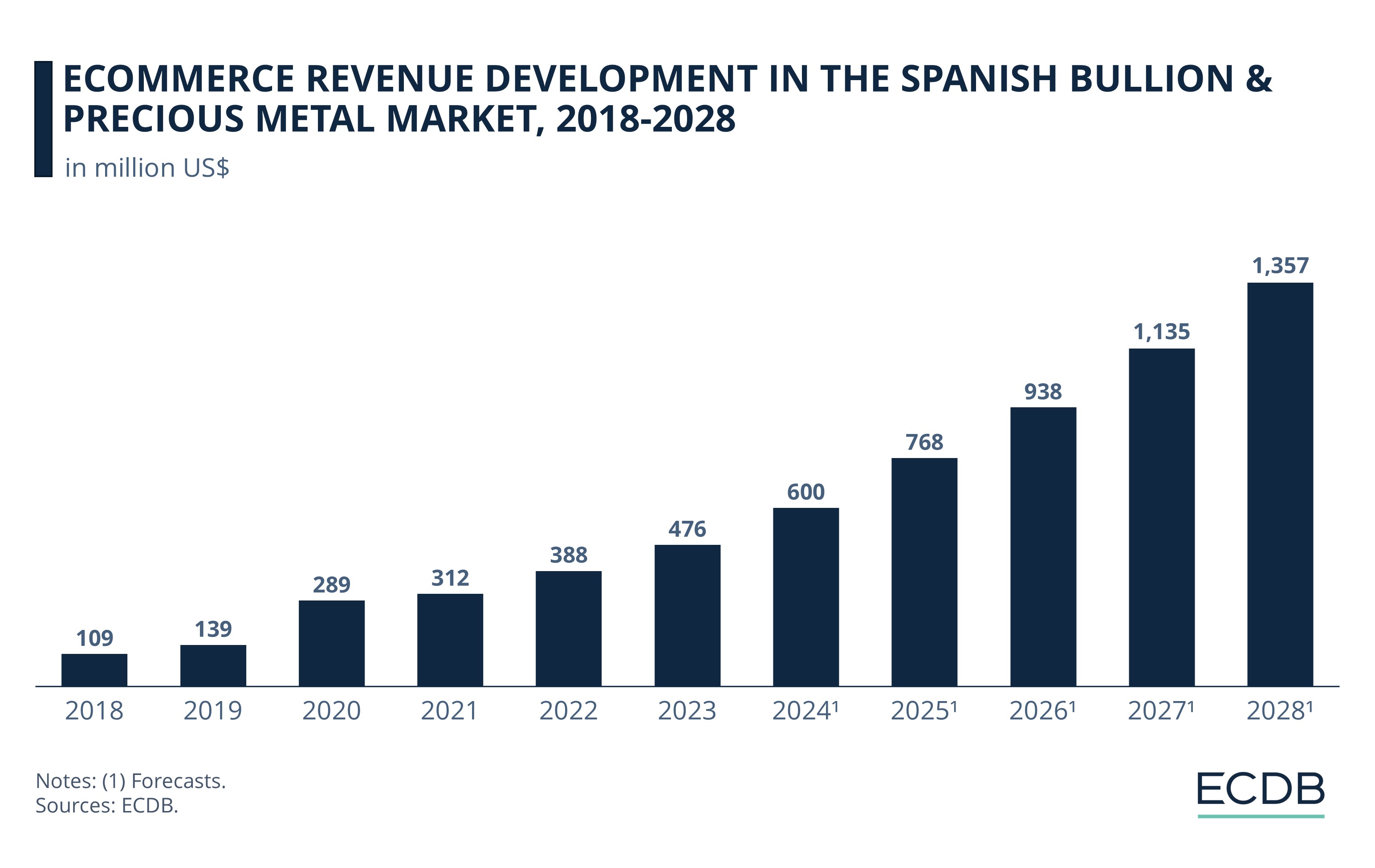

The market in Spain positions in 19th place of the largest categories in Spanish eCommerce.

The CAGR for 2024 to 2028 is by 22.6%, resulting in a projected market volume of US$1.3 billion by 2028.

Once an online activity during the pandemic, it has become established in eCommerce – including in Spain. But how exactly has the market for gold and silver evolved and what can we expect from it?

In 2020, the eCommerce revenue surged by 107% to reach US$289 million.

The subsequent year, the year-on-year increase slowed to 7.8% in 2021, but climbed to 24.6% in 2022, resulting in net sales of US$388 million.

Last year, Bullion & Precious Metals continued to grow at a rate of 22.5%, generating net sales of US$476 million.

For 2024, the ECDB projects a revenue share of US$600 million. In addition, the eCommerce market is forecast to exceed the US$1 billion mark by 2027 with sales of US$1.1 billion.

Specialized online stores, which offered consumers a good deal to participate in the precious metals trade, played a significant role in contributing to this positive development. At the top of the list, we find metalmarket.eu with a revenue share of US$36.6 million in 2023, followed by inversoro.es at US$25.8 million and stonexbullion.com at US$19.4 million.

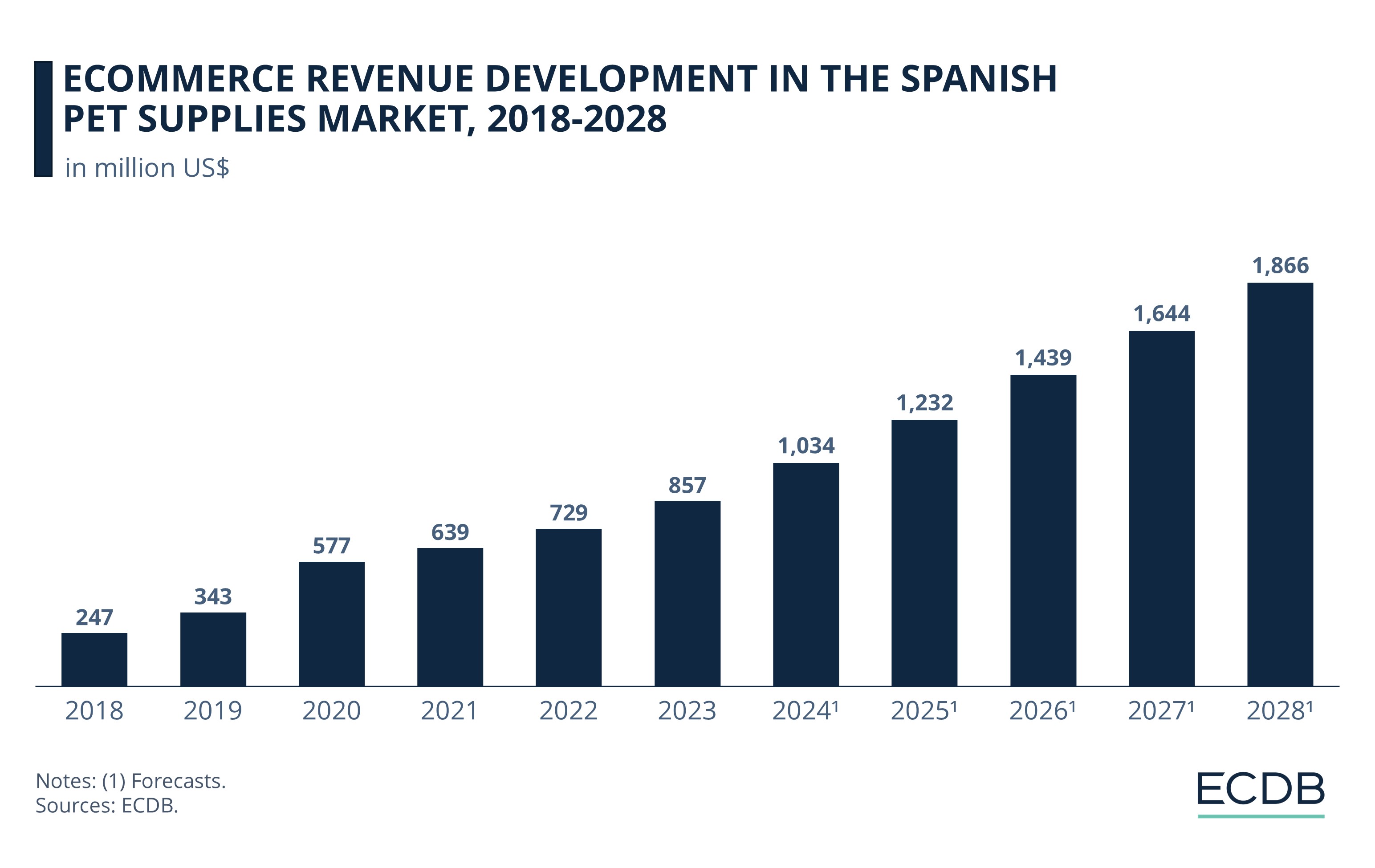

4. Pet Supplies (10.2%)

Shopping online is not limited to human-related goods. There is also an eCommerce product category for animals: Pet Supplies. Here, the owners of humans' best friends can find everything they need for their companions with just a few mouse-clicks. The Pet Supplies market belongs to Hobby & Leisure:

It includes products like pet food and treats, pet toys, crates, carriers, aquariums, tanks and enclosures, collars and leashes, pet grooming supplies, pet clothing and accessories, and finally pet pharmaceuticals and nutrition.

By 2028, market volume is projected to reach US$1.9 billion at a CAGR of 16% between 2024 and 2028.

Overall, Pet Supplies takes 13th place among the largest product categories in Spanish eCommerce.

How did the market get here? Let's take a step back in time and take a closer look at recent developments, as well as what might happen in the future:

Pet Supplies experienced the strongest increase in the first corona year, with an annual growth rate of 68.3% jumping from US$343 million in 2019 to US$577 million in 2020.

Growth slowed down a bit afterward, with 10.8% in 2021. Nevertheless, in 2023 the revenue reached US$857 million, an augmentation of 17.6%.

As per ECDB’s data, the Spanish Pet Supplies industry might this year cross the US$1 billion mark, an increase of 10.6%.

A variety of online stores are driving this success. The largest digital retailer among them is the online Pet Supplies specialist zooplus.es, with a revenue share of US$111 million in 2023. Not far behind are tiendanimal.es and kiwoko.com, which generated net sales of US$97 million and US$88 million, respectively, in the same year, both also Pet Supplies specialists in Spanish eCommerce.

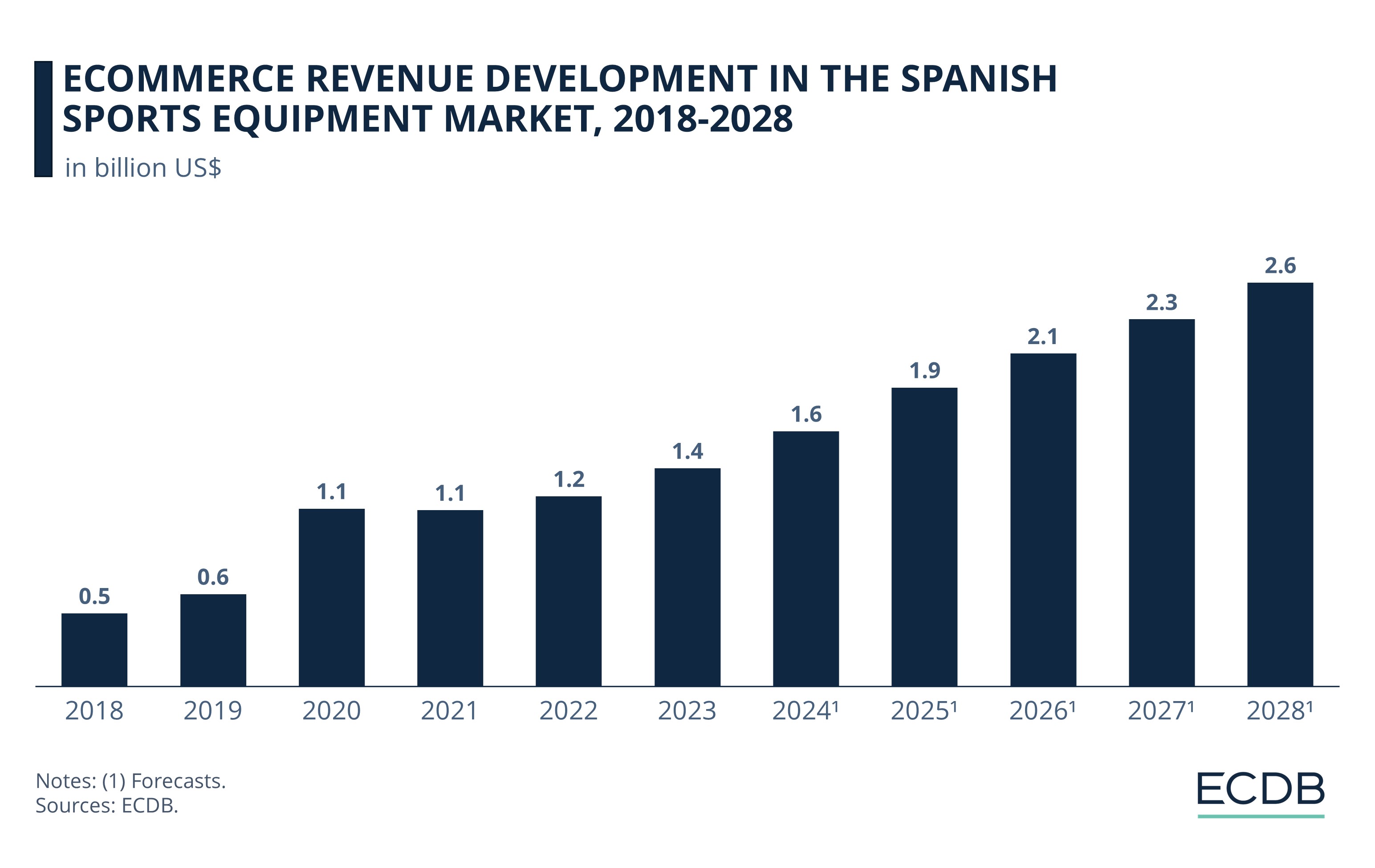

5. Sports Equipment (8.1%)

Especially during the lockdown periods under Corona, many athletes were forced to practice their sports elsewhere, as gyms were closed, group sports weren't allowed, and people had to stay at home whenever possible. Some athletes turned to home workouts, and where do you go when everything is closed? Exactly, on the Internet.

This special time in history is now over, and that for good, but the popularity to buy Sports Equipment online remains.

The CAGR for 2024 to 2028 is by 12.2%, resulting in a projected market volume of US$2.6 billion by 2028.

The eCommerce industry for Sports Equipment in Spain generated in 2023 a total revenue of US$1.4 billion, ranking it in 9th position among the largest product categories.

Under Spores Equipment ECDB’s definition understands Bicycles, Hunting & Weapons, Fishing Equipment, Fitness Equipment, Other Individual Sports.

Thus, this eCommerce market represents the largest category in terms of revenue among all the 5 presented classifications – where does it come from? Check out the past and projected eCommerce revenue development:

Like all eCommerce segments in this ranking, Sports Equipment experienced a surge in growth (93%) in 2020, with a revenue share of US$1.1 billion, breaking the US$1 billion mark.

After the high, annual growth stayed low at -0.9% in 2021 and 8% in 2022, with revenues of US$1.1 billion (2021) and US$1.2 billion (2022).

For 2024, ECDB expects the Spanish eCommerce Sports Equipment market to expand by 17%, resulting in net sales of US$1.6 billion.

By 2026, the online market could surpass the US$2 billion mark, with a year-on-year growth rate of 11.4%.

The biggest drivers in this online product category are the online stores of two major players: Decathlon & Amazon. At the top is decathlon.es, with a total revenue of US$33.5 million, followed by amazon.es with US$24.7 million. In third place appears deporvillage.com with a net sale of US$21.9 million also for 2023.

Top Categories for Online Shopping in Spain: Closing Remarks

Spanish eCommerce follows UK eCommerce and especially the global trend to buy more and more food online. And what should be part of a good meal? A good drink, with or without alcohol, Spain's online foodies are driving the trend.

In Spanish eCommerce, three preferences can be observed: the demand for convenience, a wide range of products and low costs. Preferences that can be satisfied by online retailers such as amazon.es or shein.com. Pet Supplies and Sports Equipment are easily bought on low-cost platforms. Alibaba has also recognized this and has been trying to win the Spanish market for itself with Miravia since 2022.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics