eCommerce: Shopee Business Model

Top Marketplaces in Southeast Asia 2024: Shopee Dominates the Region

What makes Shopee the top marketplace in Southeast Asia? Discover the top competitors, Shopee's GMV, and forecasts in our detailed business model analysis.

Article by Cihan Uzunoglu | August 07, 2024Download

Coming soon

Share

Shopee Business Model: Key Insights

Shopee's GMV Growth:

Shopee's GMV increased from US$1.2 billion in 2016 to US$35.4 billion in 2020, US$70 billion in 2023, and is projected to reach US$88.4 billion by 2024.

Indonesia's Market Share:

Indonesia is Shopee's most significant market, contributing 26.5% of its GMV, with nearly US$21 billion in 2023.

Regional Leadership:

Shopee is the top online marketplace in Indonesia, Thailand, Vietnam, the Philippines, and Malaysia, but ranks third in Singapore behind Tmall and Taobao.

Ramadan Shopping:

Shopee is the most popular online app for Ramadan shopping in Indonesia, with 89% of users choosing it, compared to Tokopedia (51%), TikTok Shop (41%), and Lazada (34%).

App Downloads:

With over 160 million downloads, Shopee was the 4th most downloaded shopping app in 2023, behind only Temu, Shein, and Amazon.

Asia, the largest continent, hosts a diverse eCommerce landscape with different regional leaders. In Southeast Asia, Shopee dominates major economies like Indonesia, Thailand, Malaysia, Vietnam, and the Philippines.

Launched in 2015 as a subsidiary of Singapore's Sea Ltd., Shopee has evolved into one of the largest online marketplaces, ranking 9th worldwide by GMV.

What are the past, present, and future of this online marketplace? How did Shopee achieve its current status, and can it maintain its leadership?

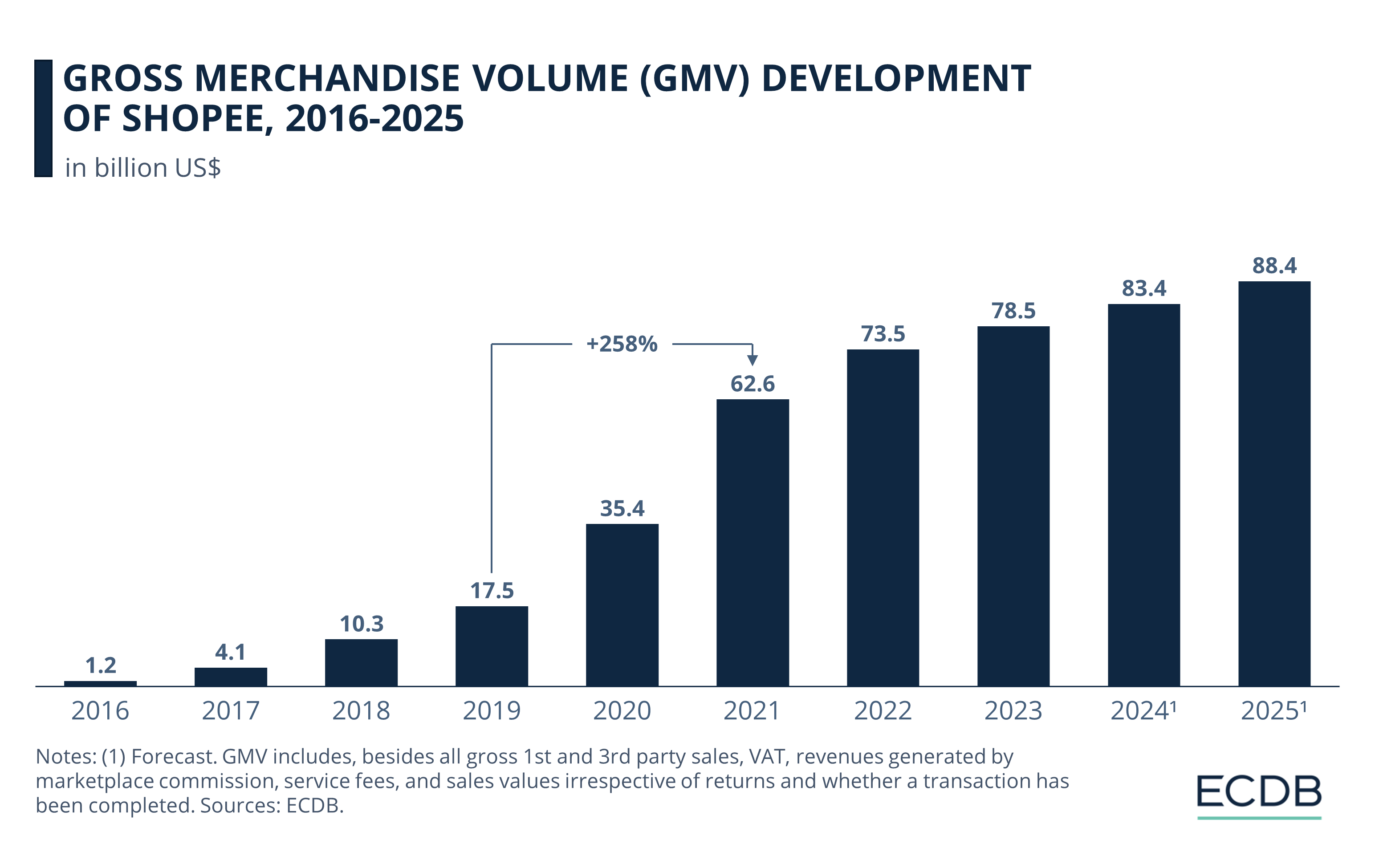

Shopee GMV Grew by Over 250%

in 2019-2021

Comprising almost a third (32%) of Shopee’s total GMV, Fashion is the top product category for Shopee. Following closely, Electronics account for over a quarter (27%) of the GMV. Meanwhile, Hobby & Leisure and Care Products each capture 14% and 11% of the GMV, respectively. Additionally, Furniture & Homeware and DIY categories contribute 11% and 5% to the GMV. Speaking of GMV, Shopee's GMV has seen remarkable changes in the span of almost 10 years:

From a humble beginning of US$1.2 billion in 2016, it grew to US$17.5 billion by 2019 – just before the pandemic.

Outpacing the growth rate of most marketplaces in our top 10, Shopee's GMV reached US$35.4 billion by the end of 2020, an increase of 102%.

Despite a lower growth rate in 2021 (76.8%), the online marketplace's GMV continued the success story with US$62.6 billion.

While Shopee's GMV reached the US$70 billion mark in 2022, it continued to grow last year, albeit at a slower growth rate.

As for the next years, the online marketplace is expected to maintain a similar growth rate to last year, and reach USS$88.4 billion in GMV by 2025.

For context, Pinduoduo – which currently sits at no. 2 – had a GMV of US$3 billion in 2016, a year after it launched. In the same year, global leader Amazon had a GMV of US$214.7 billion.

Indonesia’s Top Marketplace: Shopee

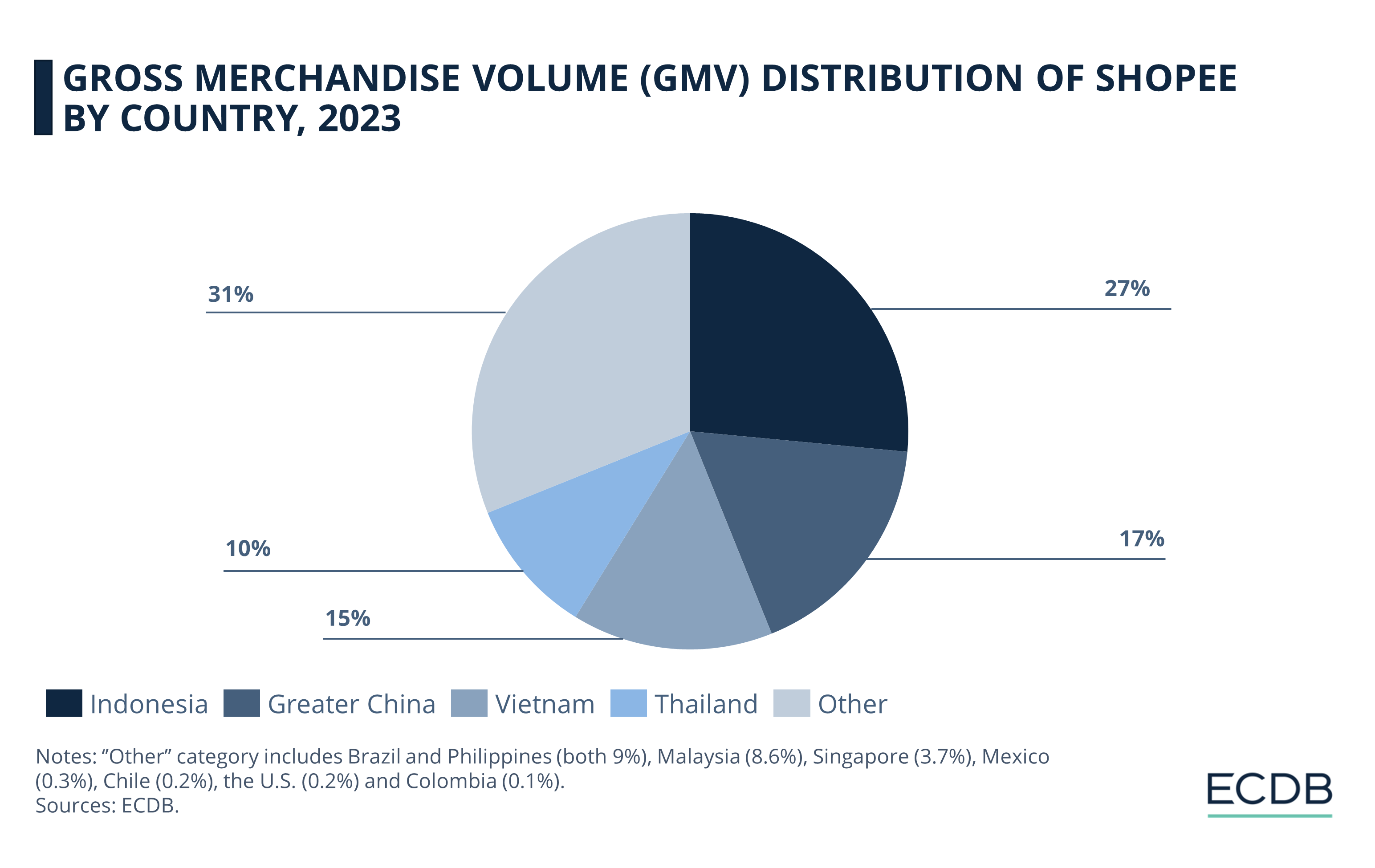

In 2015, Shopee debuted in seven markets, including Singapore, Indonesia, Malaysia, Thailand, Taiwan, Vietnam, and the Philippines, marking its entry into online commerce. The online marketplace launched the China Marketplace portal in 2018, followed by an expansion into Brazil the following year. Fast forward to 2023, we see a GMV distribution primarily focused on Asian markets.

Accounting for more than a quarter (26.5%) of Shopee's GMV, Indonesia is arguably the most important market for the marketplace.

China follows in second place with a 17.4% share. Vietnam is also a key market for Shopee, accounting for almost 15% of its GMV.

Other markets from which the online marketplace derives a significant share of its GMV are Thailand (10.1%), Brazil and the Philippines (both at 9%), Malaysia (8.6%) and Singapore (3.7%).

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

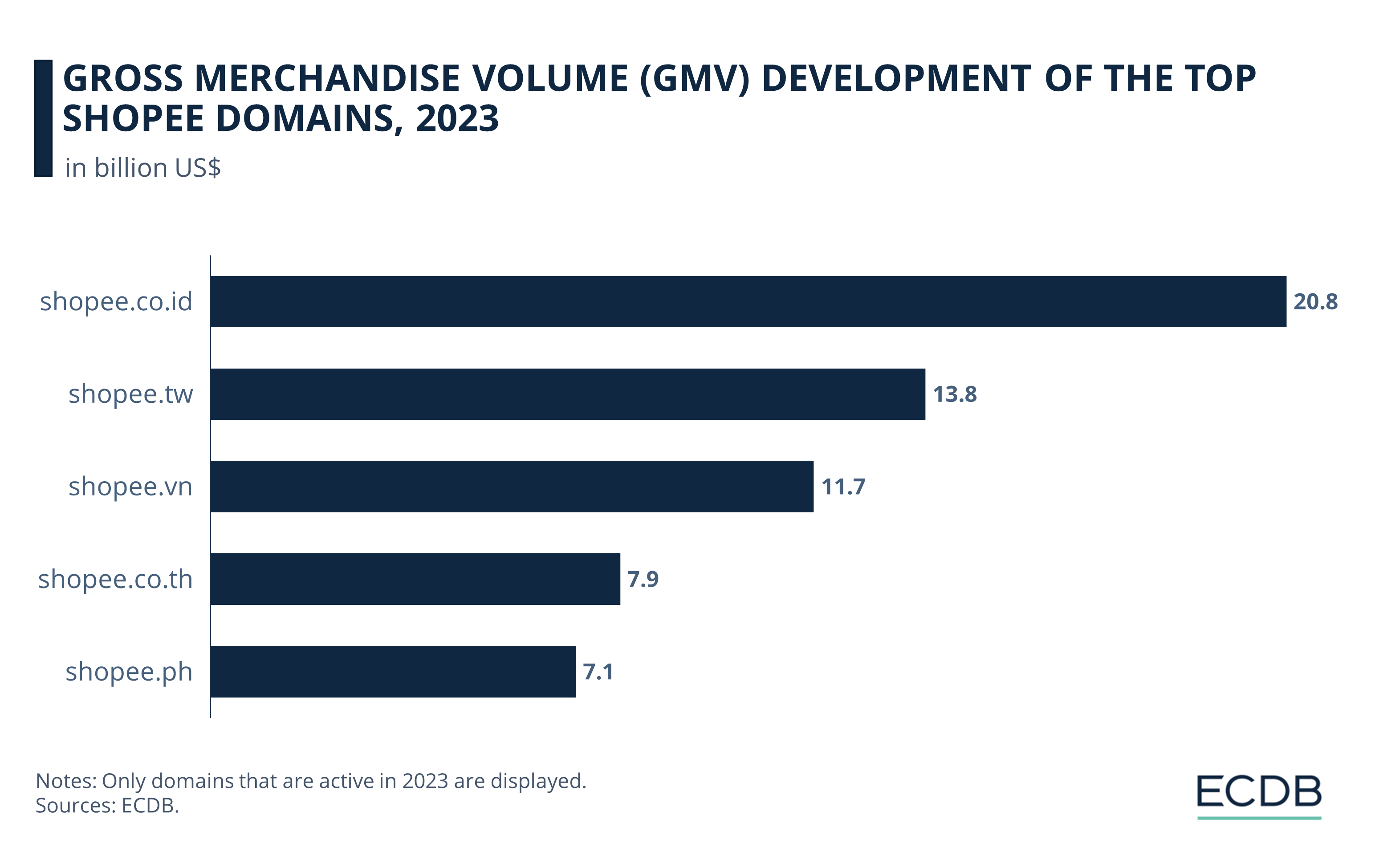

More or less in line with the market distribution, the top domains in terms of GMV share also give us an understanding of Shopee's dynamics.

With a GMV of nearly US$21 billion last year, shopee.co.id is the top domain for the online marketplace.

Shopee.tw and shopee.vn follow with nearly US$14 billion and US$12 billion respectively.

Shopee.co.th and shopee.ph, on the other hand, are just below the top 3 with around US$8 billion and US$7 billion respectively.

Trouble in the Polish Market

Although Asia is Shopee's forte, the online marketplace is also among the top players in Latin America. According to data from Web Retailer and SimilarWeb, Shopee has the fourth largest monthly traffic (as of April 2023) behind local online marketplace MercadoLibre and foreign players AliExpress and Amazon.

Despite its successes in Asia and Latin America, Shopee faced challenges in penetrating the European market, particularly in Poland. While AliExpress had established itself in Poland before the pandemic and navigated through the global health crisis, Shopee encountered difficulties.

In 2021, Shopee made its entry into the Polish market but faced setbacks, ultimately leading to its withdrawal. Representatives cited structural economic barriers and low profitability as key factors in the decision. Additionally, an advertising campaign that failed to resonate with Polish consumers hindered Shopee's ability to effectively engage with the local market.

Who Are Shopee's Competitors?

Looking at the top markets of Southeast Asia, we see varying competitors who are challenging Shopee's dominance:

Starting with Indonesia (8th largest eCommerce market globally), Shopee is the top online marketplace in the country, followed by Tokopedia and Bukalapak.

Another important market in the region, Thailand (ranked 18th globally), also has Shopee at the top, this time followed by Lazada and TikTok Shop. The same top 3 ranking can be observed in the case of Vietnam (ranked 21st globally) and the Philippines (25th globally).

As for Malaysia, the 26th largest eCommerce market, Shopee is still the top online marketplace, with TikTok Shop and Taobao taking second and third place.

The only major Southeast Asian eCommerce market where Shopee isn't at the top is Singapore. Ranked 33rd in the world, the market is dominated by Tmall and Taobao, with Shopee in third place.

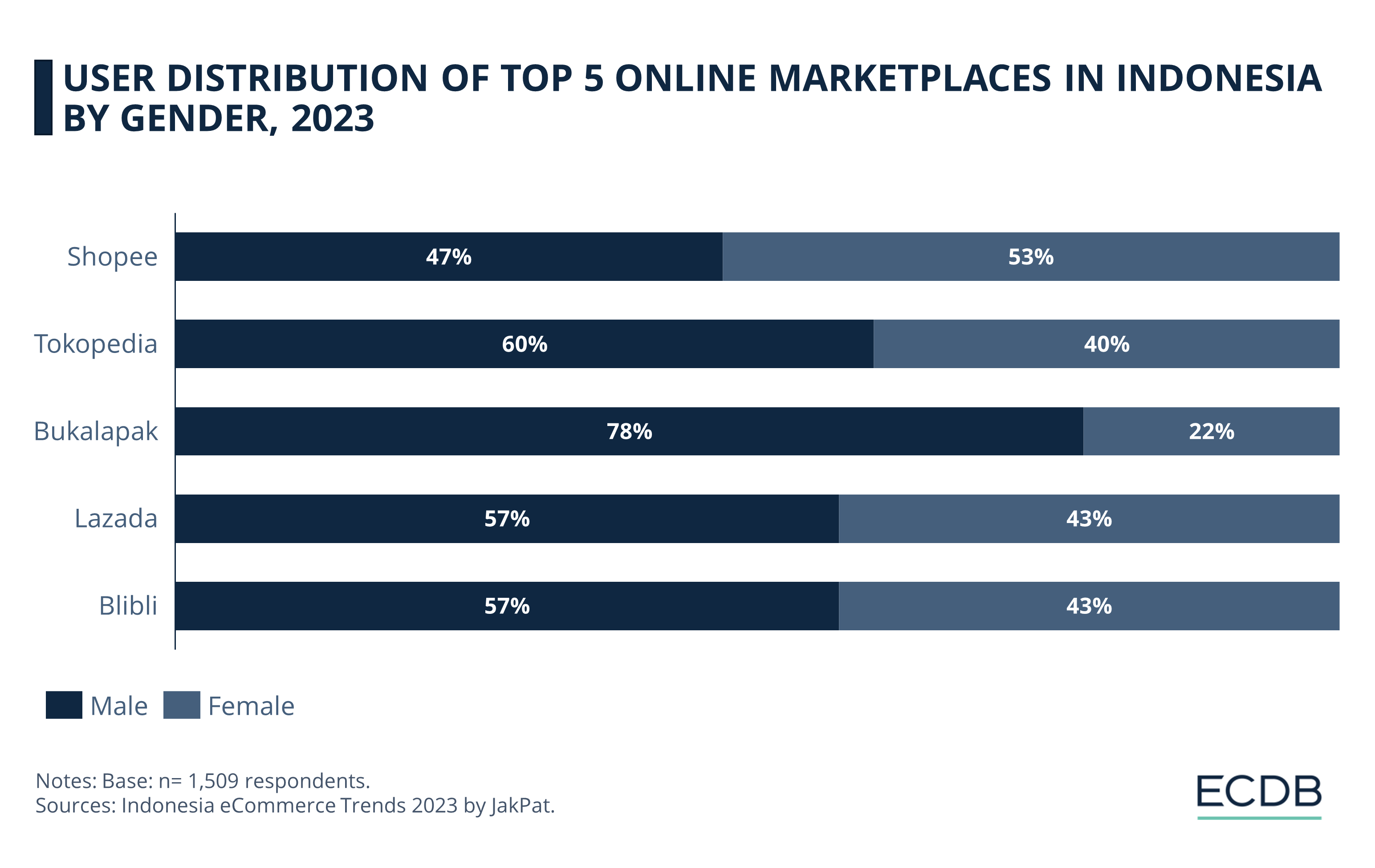

Shopee in Indonesia: Women Are More Likely to Use the Marketplace

As we've highlighted before, Shopee is the leading online marketplace in Indonesia. JakPat's data provides valuable insights into Shopee’s Indonesian consumer base. According to JakPat's report:

Shopee is one of the few major eCommerce platforms in the country whose users are more likely to be female than male.

The study shows that Shopee's female user share is 53%, and Alfagift is the only platform included in the study that surpassed Shopee at 58%.

Looking at the other major online marketplaces in the Indonesian market, female users account for 43% of both Lazada and Blibli, while Tokopedia's share is slightly lower at 40%. As for Bukalapak, just over a fifth (22%) are female users.

Shopee is the Go-To App for Ramadan Shopping

in Indonesia

Diving into the Indonesian eCommerce market, the topic of Ramadan eventually comes up. Aside from its importance in eCommerce, Indonesia is also known to be home to the largest Muslim population in the world, with approximately 230 million Muslim residents.

As we covered before, Ramadan is a significant time for eCommerce. Data shows that online shopping engagement elevates in this period, and consumers are more open to product discovery. Shopee's consumer perception during Ramadan is very positive as it's considered to be the eCommerce platform that offers the best promos during Ramadan, in addition to offering the affiliate program with the highest commission and being perceived as the safest eCommerce platform for Ramadan shopping.

As a result, Shopee is the most used online app for Ramadan shopping in Indonesia. At 89%, the share of users who said they use the platform for Ramadan shopping is much higher than the likes of Tokopedia (51%), TikTok Shop (41%) and Lazada (34%).

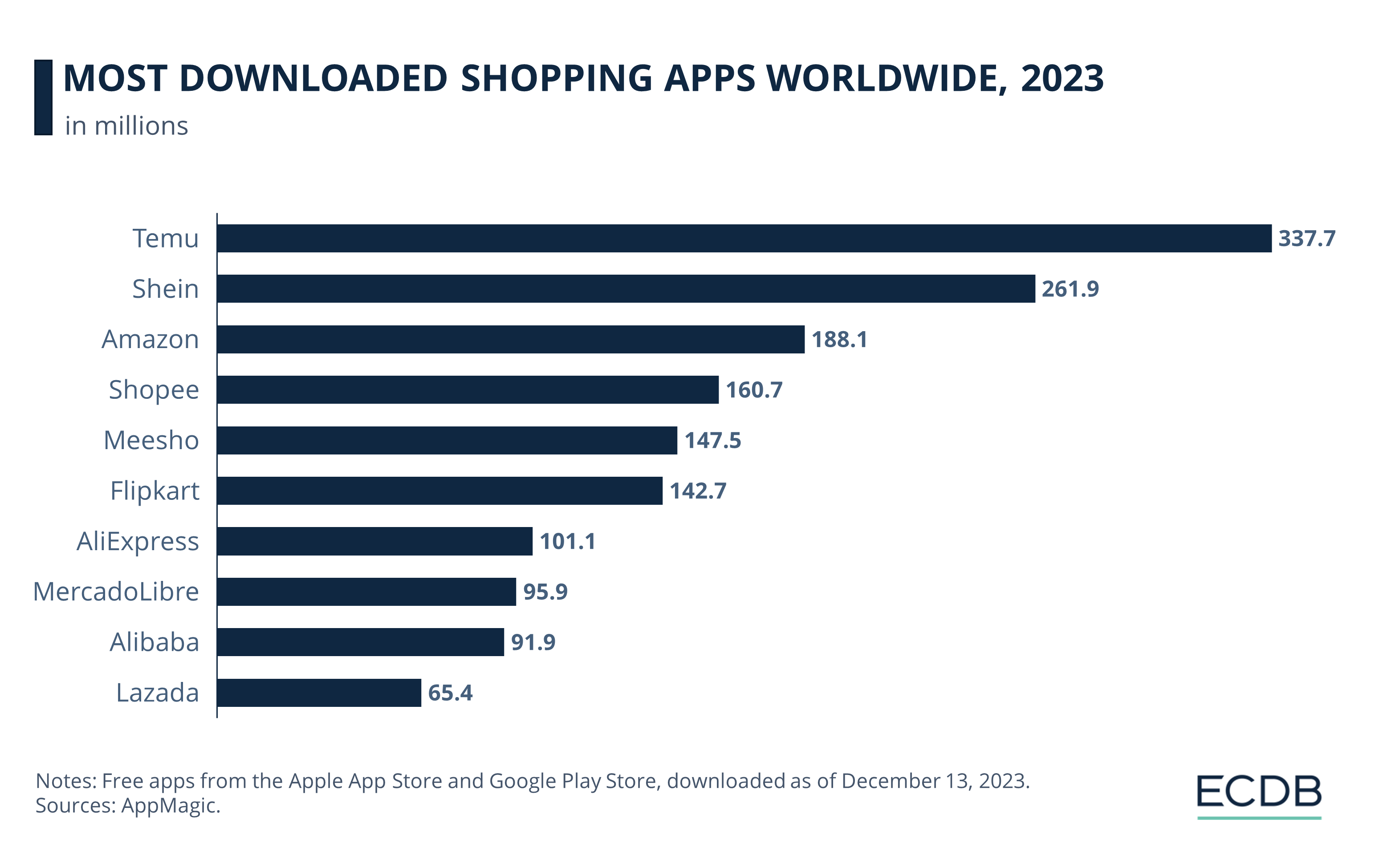

Shopee Was the 4th Most Downloaded Shopping App in 2023

Shopee’s dominance is evident on different levels. As the largest online marketplace in Indonesia by GMV (Gross Merchandise Volume), Shopee is also the largest non-Chinese online marketplace in Asia. But it doesn’t stop there.

With over 160 million downloads, Shopee was the 4th most downloaded shopping app last year. Only behind Temu, Shein and Amazon, the online marketplace surpassed the likes of AliExpress, MercadoLibre and Alibaba.

Shopee Business Model: Closing Thoughts

The potential U.S. ban of TikTok could reshape the social commerce landscape in Asia, particularly in Southeast Asia, where the platform might focus its efforts more intensely. Despite the region's smaller market size and lower spending power compared to the U.S., Southeast Asia holds significant importance for TikTok, boasting over 325 million monthly active users.

Indonesia, with its 125 million TikTok users and ranking as the company’s second-largest market, could become a focal point. TikTok may allocate additional resources to ensure compliance and strengthen its presence in such markets, potentially intensifying competition for local players like Shopee, Lazada, and Tokopedia.

As these eCommerce platforms incorporate features like short videos and live streaming to attract users, they may face new challenges if TikTok redirects its focus and resources to the region. This heightened competition could create a tougher environment for local players.

Sources: AppMagic, Web Retailer, SimilarWeb, Trans.info, JakPat, World Population Review, Snapcart, Tech in Asia, Statista, ECDB

Shopee: FAQ

Can I use Shopee in the USA?

Shopee offers international shipping for selected items, enabling U.S. customers to purchase goods from overseas sellers. However, the availability of this service is quite restricted, making it necessary to rely on external shipping providers.

In what countries is Shopee available?

Shopee attracts 342.8 million visits each month and operates in nine countries. Apart from Indonesia, Taiwan, Vietnam, Thailand, the Philippines, Malaysia, and Singapore, it also serves users in Mexico and Brazil.

Is it safe to buy from Shopee?

Shopee is dedicated to providing a safe and secure shopping experience for all users. They frequently release information through different communication channels to help users recognize and report any suspicious activities.

Is Shopee available in India?

In March 2022, Shopee shut down its India operations, just five months after launch, citing global market uncertainties. The sudden exit came despite the company's efforts to recruit sellers and establish a foothold in the market.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Back to main topics