ReCommerce: Secondhand in eCommerce

ReCommerce Market 2023: Online Secondhand Shops & Consumer Behavior in the United States

Year-on-year, the number of secondhand shoppers in the United States continues to grow. What's behind the trend? Read up on the current market development in the reCommerce sector and the reasons for the popularity of secondhand shopping.

Article by Antonia Tönnies | April 04, 2024Download

Coming soon

Share

ReCommerce Market 2023: Key Insights

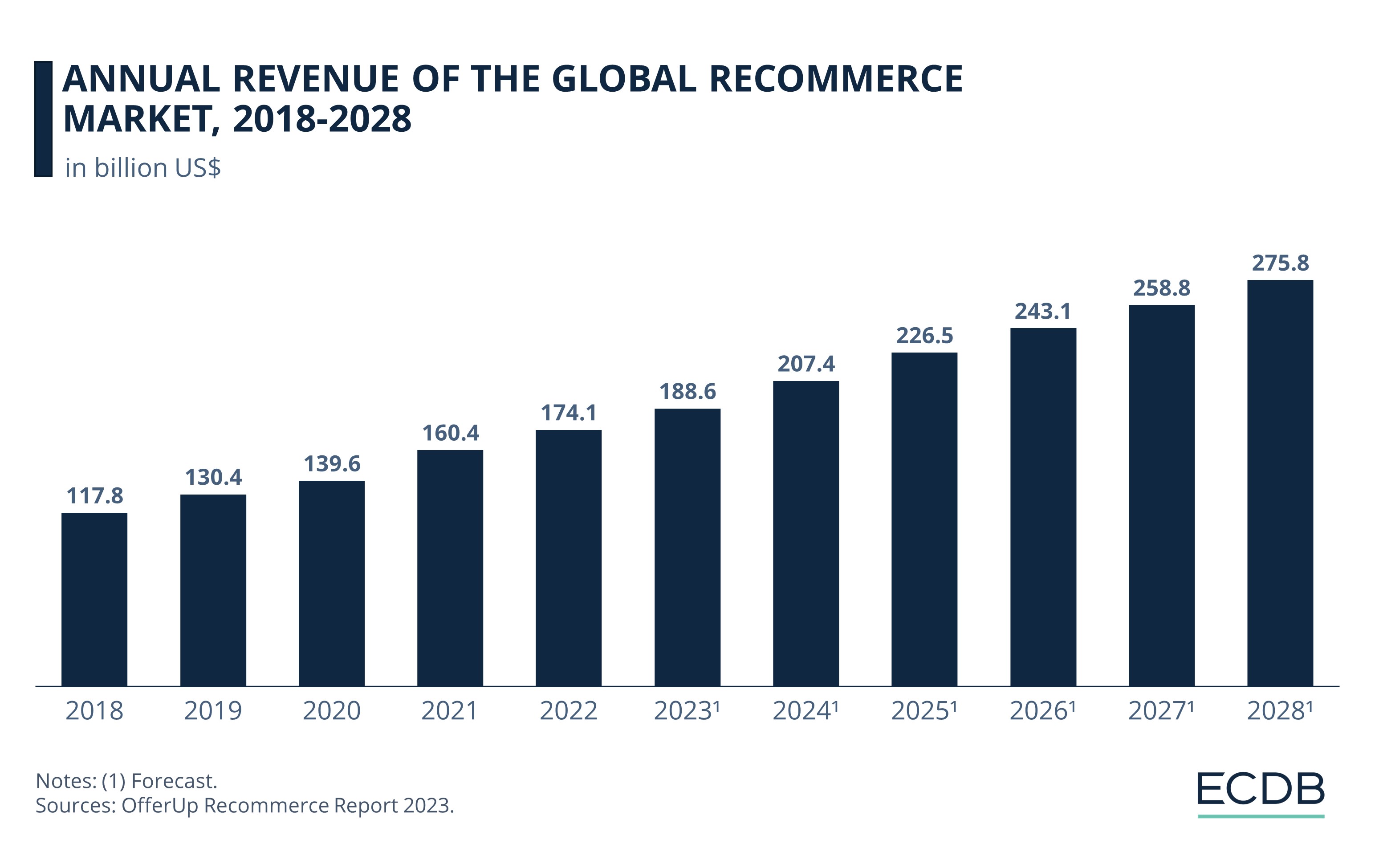

ReCommerce Growth Projection: The global reCommerce market is projected to reach US$275.8 billion by 2028, reflecting a 10% year-on-year growth and outpacing the overall retail market.

New Entrants and Steady Expansion: The steady growth of reCommerce can be attributed not only to the preference for resale but also to a continuous influx of new customers and sellers, with 27% entering the market between 2022 and 2023.

Thrift Benefits: Besides extra income (84%), thrifting helps declutter (73%) and fund new purchases (43%), appealing beyond financial gains.

Popular Platforms among U.S. Consumers: Platforms like Facebook Marketplace and eBay dominate, offering easy access to pre-loved items, from everyday goods to unique finds.

Secondhand shopping, or reCommerce, once an alternative purchase behavior, has become part of the mainstream shopping culture, driven by consumers, as well as retailers. Some reasons for this development may be a social shift towards sustainability and a more wallet-friendly shopping option.

The OfferUps report reveals that 76% of reCommerce shoppers in the United States believe that secondhand shopping has become less stigmatized in recent years, and 41% consider buying secondhand goods to be a status symbol. The trend towards recycling and reuse enjoys popularity among young people belonging to Gen Z and Gen Y.

Global ReCommerce Market Forecast to Reach US$275 Billion in 2028

In fact, according to the OfferUp reCommerce Report 2023, 78% of U.S. consumers buy secondhand to get a good deal, while 58% do so to avoid higher prices caused by inflation. The trend towards more sustainable and conscientious shopping behavior reflects in the development of the annual revenue of the global reCommerce market, which can be seen in the chart below:

The OffeUp report estimates reCommerce sales at US$207.4 billion for 2024, corresponding to 10% YoY growth. By 2028, the value is expected to continue to increase steadily to US$275.8 billion.

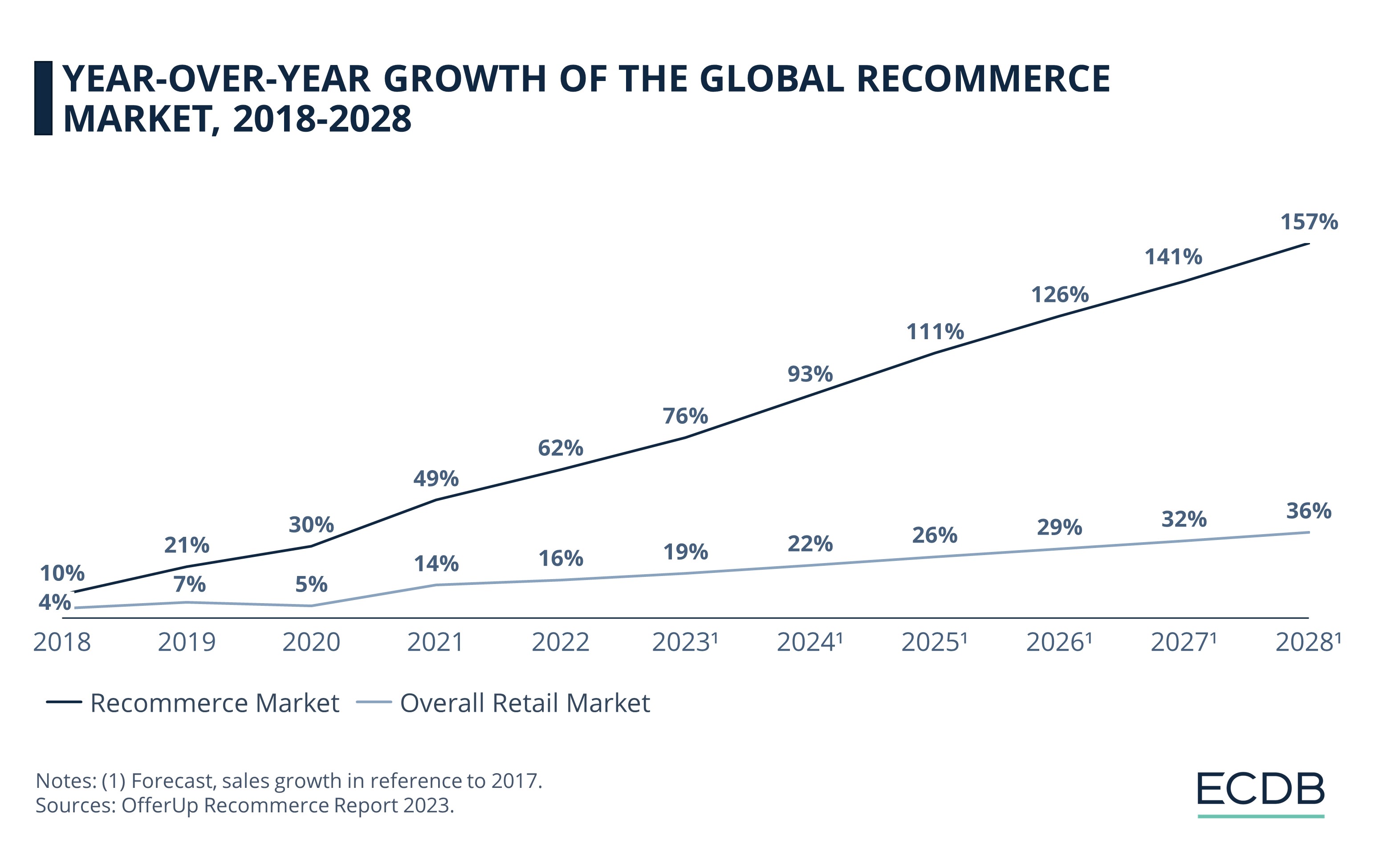

ReCommerce Market Grows Over Four Times Faster than Overall Retail Market

Between 2017 and 2023, the reCommerce market grew by 76% overall, while the overall retail market, which refers to offline and online retail, grew by 19% in the same period - this corresponds to a quarter of the reCommerce market growth.

The success of this industry is expected to maintain this trend in the future and is set to increase by 157% in 2028 in comparison to 2017. This would mean that reCommerce would account to 8% of the overall retail market by 2028.

An explanation for this linear growth of the reCommerce market may be, besides the preferences for resale, a continuous steady number of new customers and sellers entering the industry. Research from OfferUp reveals that 27% of buyers and sellers in the United States bought or sold a used product for the first time in 2022-2023.

Thereby, 69% of the sellers use their earnings to pay bills or everyday living expenses, whereas 39% stated it has helped them make ends meet. In general, 84% trade secondhand items in order to obtain an additional income alongside the work.

In addition to the opportunity to expand their personal income, thrifting provides even more benefits. For instance, 73% see it as an opportunity to declutter and create space at home, followed by 43% selling secondhand to invest in new purchases.

Where Do U.S. Consumers

Shop Secondhand?

Secondhand shopping isn't just about saving money, it's a way to be more eco-friendly. Online platforms have made finding pre-loved items a breeze, adding convenience to a sustainable practice. The range of platforms to shop and sell has grown with the trend.

According to Statista Consumer Insights, the most popular platform among U.S. consumers is the Facebook Marketplace with 34%, followed by an old stager in the eCommerce world, eBay Marketplace with 31%.

Slightly further behind comes Etsy at 22%, which offers second-hand products solely in the vintage and craft supplies category. In fourth place comes the social commerce platform Poshmark with 20%, and behind that Craigslist, reaching 19%.

Consumers search these platforms for simple or everyday items that are still in good condition (69%), cheaper brand-name items (68%) and unique or vintage items (57%), as OfferUp reports. While marketplaces, such as eBay or Facebook, allow sellers to sell almost anything used – from fashion to cars – there are platforms that focus on specific categories.

ReCommerce Market 2023:

Closing Thoughts

The role of sustainability in eCommerce is becoming increasingly important. In addition to the consumer trend toward greener shopping, employees are also demanding that companies act more sustainably. As a result, awareness is growing in various areas of eCommerce – whether it is consumer behavior or business development.

It is expected that the general environmental awareness in the eCommerce industry will continue to grow and therefore companies will have to adapt sooner or later if they want to remain successful.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Back to main topics