eCommerce: Secondhand Trend

ReCommerce: A Growing Trend Among Younger Users in the U.S.

Buying and selling used goods online, or recommerce, is becoming increasingly common in the U.S. Learn about consumer preferences by age group, their primary motivation for buying pre-owned products, and emerging recommerce trends.

Article by Nadine Koutsou-Wehling | November 22, 2023Download

Coming soon

Share

ReCommerce Trend: Key Insights

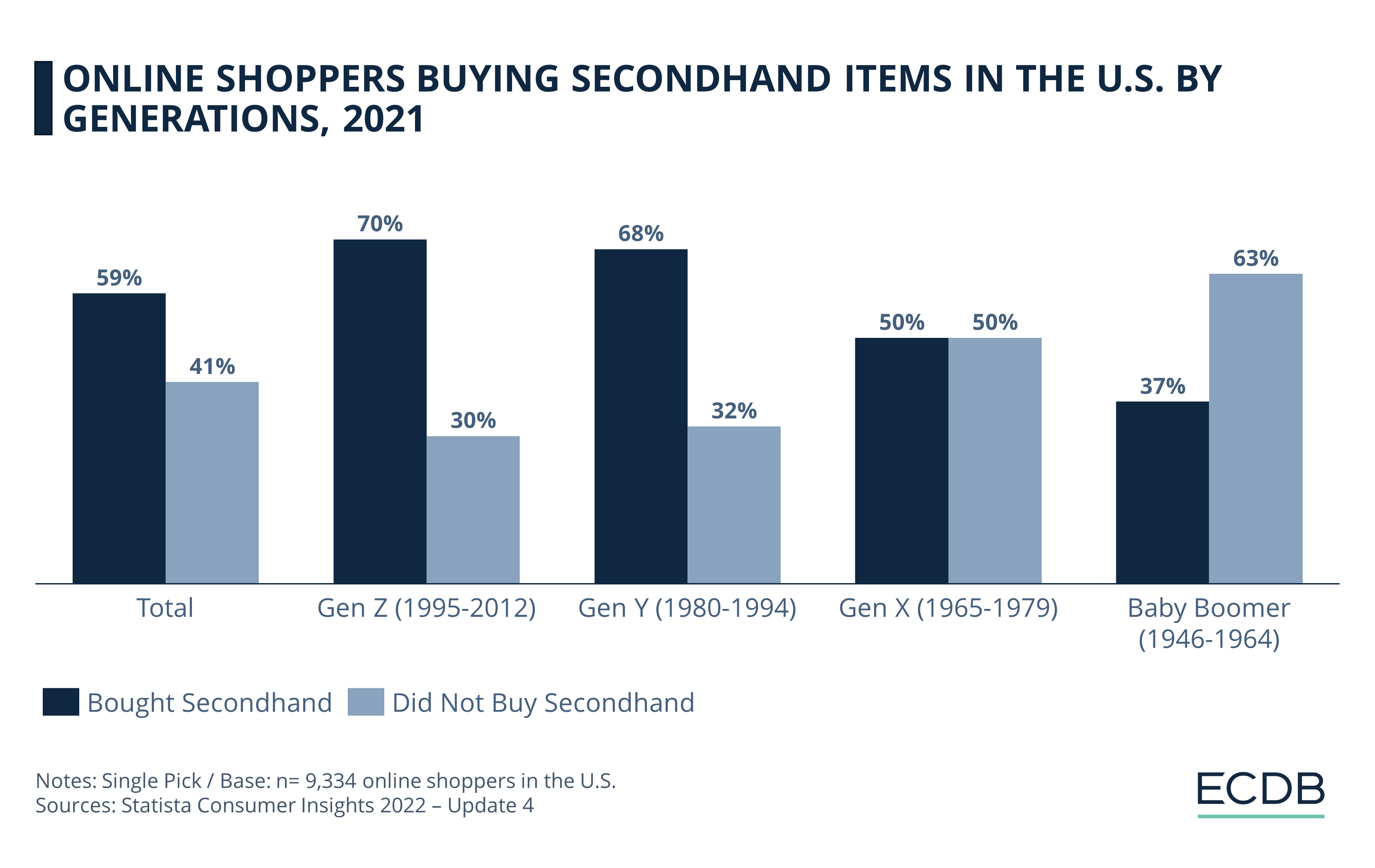

According to Statista's Consumer Insights, Gen Z and Gen Y consumers have a higher propensity to buy secondhand goods. This is evidenced by the fact that 70% and 68% of Gen Z and Gen Y users, respectively, say they have purchased a pre-owned item in the past 12 months.

Older consumers, represented by Gen X and baby boomer respondents to the Consumer Insights survey, were less likely to have purchased secondhand products. This emphasizes the impact of younger users on the emerging recommerce trend, particularly as younger users are known to drive online trends.

A survey conducted by eBay on the reasons for buying secondhand products shows that consumers are primarily driven by financial reasons, greater accessibility of used products, and ethical/sustainability concerns.

New offerings such as a credit system in exchange for the sale of used products and clothing rental services are attracting a growing number of customers in the U.S. These trends reflect widespread consumer demand for circularity in online retailing.

Recommerce, or eCommerce for used goods, is a growing trend around the world. During the pandemic, recommerce experienced a surge as shoppers were looking for ways to get a bargain on their purchases and sell some of their own possessions they no longer had a use for.

Beyond the obvious financial benefits, however, recommerce has other advantages for both sellers and buyers. eBay, one of the most prominent platforms for C2C (consumer-to-consumer) online sales, asked its users about their primary motivations for buying pre-owned goods.

But before we get into what drives consumers to engage in recommerce, Statista's Consumer Insights serve as a baseline to examine consumers' propensity to buy secondhand goods. When broken down by generation, there are some notable differences. Are younger shoppers really more open to buying secondhand?

A Majority of Gen Z and Millennial Users Have Bought Secondhand in the Past Year

Statista's Consumer Insights survey interviewed online shoppers in the U.S. about whether they have bought pre-owned products in the past 12 months. The chart below illustrates the results.

The chart indicates a negative correlation between age and the propensity to shop secondhand. This is seen by 70% and 68% of millennial and Gen Z respondents, respectively, who say they have bought a pre-owned product in the past year. On the other hand, exactly half of Gen X consumers and 37% of baby boomers say they have purchased secondhand. These responses reflect a clear trend of younger consumers embracing the secondhand trend as opposed to older cohorts.

Although Statista's Consumer Insights specifically allowed for both online and offline purchases in their question, this data reflects the general propensity of consumers to buy secondhand goods. Since the chart shows that younger users are generally more open to buy pre-owned goods, their higher propensity to shop online will also have a direct impact on recommerce.

Speaking of recommerce: The largest online C2C platform in the West, eBay, has asked its users for reasons to buy secondhand products. Let's see what the most common responses are.

Lower Cost and Ethical Concerns Motivate Users to Shop Secondhand

A survey conducted by eBay in 2020 named the primary reasons for buying used products: 73% of respondents named lower costs of usually expensive goods such as luxury clothing or high-end technology as a motivator to buy pre-owned goods.

Ethical concerns seem to be a major driver to buy used items for Gen Z and Gen Y. There are several benefits associated with buying used items, the most common being efforts to create a circular economy, i.e., reducing waste and keeping well-functioning products in use longer rather than throwing them away.

Other reasons to purchase secondhand items are a greater availability of exclusive products that may have been sold out new, 37% of respondents agreed with that reason. 23% saw it as a fun hobby, and the cost factor comes in again for 17% of survey participants who named the profit from reselling secondhand goods.

New ReCommerce Trends

Online fashion retailers have grasped the potential of turning the concept of circularity into strategic business moves. As a final look, this section highlights some of the latest examples.

Collecting Credit for Online Thrifting

U.S.-based online thrift platform ThredUp encourages customers to trade in their used fashion items and receive credit usable for discounts on future purchases in return. Recently, ThredUp partnered with Rebag, a retailer with a similar business model. Rebag enables customers to buy and sell high-end accessories, shoes, and select clothing. The collaboration between the two retailers gives customers access to a wider range of products and discounts for the credit they earn by selling their pre-owned and still usable products.

ThredUp has had similar collaborations with other retailers in the past, such as Adidas and Crocs, both in 2021. While these collaborations are all temporary projects, they point to a broader trend that is taking hold among consumers. Although the monetary aspect does play a role, as seen in the previous section, there are other motivations for participating in the resale trend, a key one being efforts to create a circular economy.

Initiatives like the above are offering consumers a more advantageous trade-off, allowing them to receive further discounts on other platforms when selling their used products. This helps to reinforce the extended product cycle that many consumers are asking for.

On a related note, there is another trend to watch out for: clothing rental services.

Subscription Services for Rental Fashion

Especially popular among Gen Z and millennial users are fashion rental platforms. The most prominent examples in the U.S. are Nuuly (a subsidiary of Urban Outfitters) and Rent the Runway. Both charge a monthly subscription fee, based on which customers can select a certain number of items to wear for the month. The difference between the two is that Rent the Runway focuses more on luxury and high-end products, while Nuuly offers a wider variety of casual wear.

Nuuly was reported to have become profitable in its quarterly report for the third quarter of 2023. This is a notable success, as rental platforms face high fixed costs due to complex logistics and maintenance. But users seem to appreciate the service, as it gives them the opportunity to wear a diverse set of fashion items and interchange styles regularly.

These two examples show that there is a substantial demand for secondhand clothing and the innovative business models that go along with it.

A Shift Toward Sustainable Consumption

Younger consumers are driving the secondhand buying trend, providing a foundation for the growth of recommerce in the U.S. In particular, Gen Z and millennials are more likely to buy secondhand than Generation X and baby boomers.

The benefits of reuse go beyond saving money: By reducing waste and extending the life of products, consumers are looking to make a positive impact on the environment. Reuse means reducing the carbon emissions associated with manufacturing new products and shipping them overseas to consumers. With the rise of ethical consumerism and the desire to buy sustainably, consumers are choosing to buy pre-owned products and contribute to the circular economy.

Sources: CNBC – eBay – Ecommerce Times – Retailbrew

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

What Exactly Are In-Game or In-App Purchases?

What Exactly Are In-Game or In-App Purchases?

Deep Dive

AI in eCommerce: Better Deals, Greater Precision, and Easier Targeting

AI in eCommerce: Better Deals, Greater Precision, and Easier Targeting

Back to main topics