eCommerce: Trends

Sustainable Fashion in Nordic eCommerce: Consumer Attitudes & Top Stores

Sustainability and fashion: irreconcilable or feasible with a well thought-out strategy? One of the world's regions known for its progressive ideals, the Nordic countries, serves as an example of how companies can pursue an eco-friendly strategy and still be relevant on a large scale.

Article by Yokany Oliveira | March 28, 2024Download

Coming soon

Share

Sustainable Fashion eCommerce in the Nordics: Key Insights

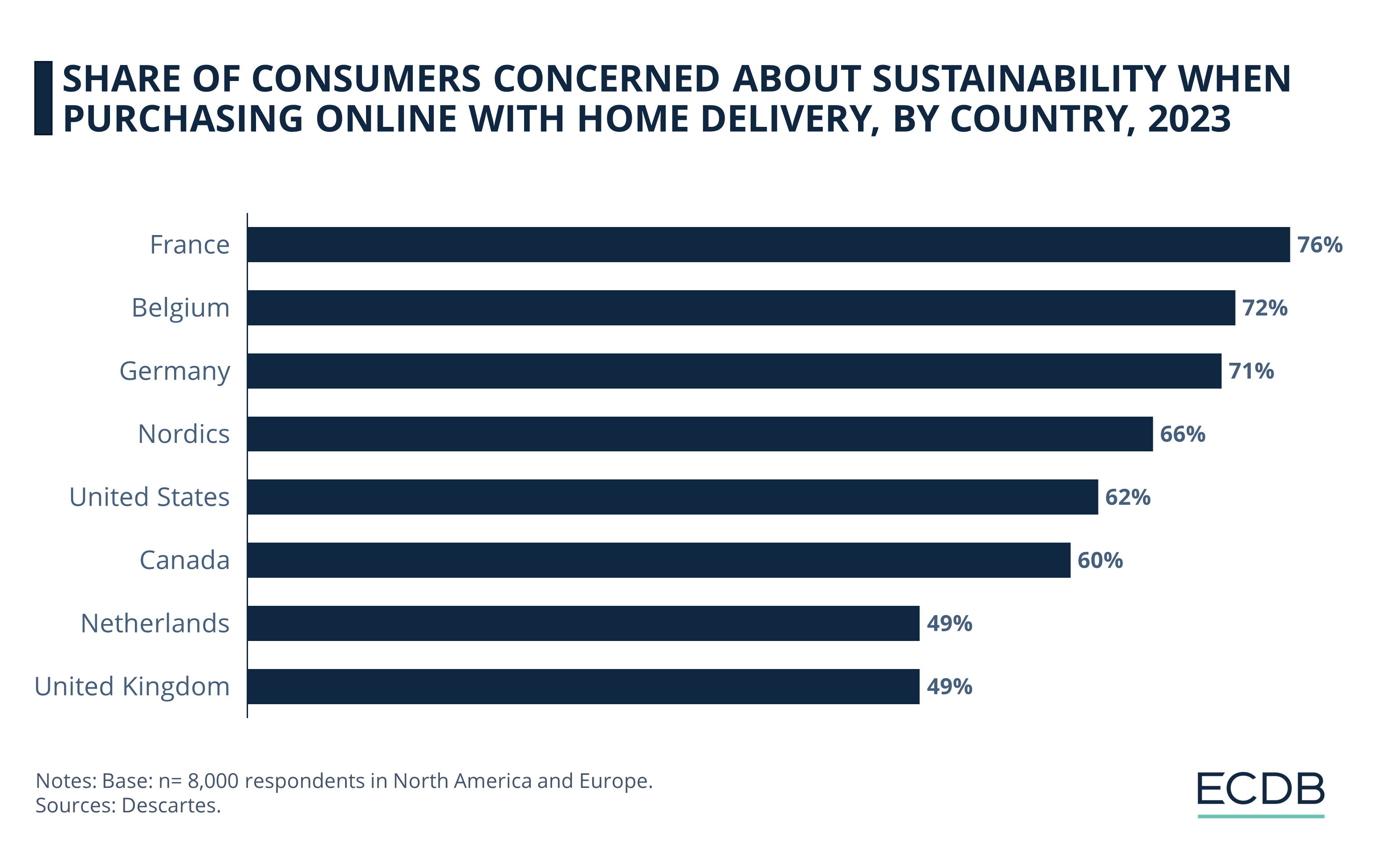

Consumer Interest in Green eCommerce: A 2022 study of respondents in Scandinavia found that 66% of consumers in the region are concerned about the environmental impact of their online home delivery orders.

Leading Fashion Online Stores Pursue Environmental Goals: The most successful companies in the online fashion markets of Denmark, Sweden, Finland and Norway are expressive about their intentions to reduce the negative impact of their business activities.

Challenges in a Complex Environment: Zalando's 2023 Sustainability Report shows how difficult it is to successfully integrate a eco-friendly strategy while surviving in the highly competitive global fashion industry.

The Nordic countries Sweden, Denmark, Finland and Norway are known for high income levels, digital maturity and progressive values, particularly when it comes to ecological matters. However, a sustainable lifestyle sometimes clashes with the very nature of eCommerce, which generates tons of CO2 emissions and waste.

How do successful fashion retailers in the Nordics, such as H&M, Boozt, and Zalando solve this problem? But first,

Sustainability in Nordic eCommerce: A Consumer Perspective

As we reported in 2023, consumers around the world are concerned about the environmental impact of eCommerce. A 2023 Descartes study reveals that French consumers are the most concerned about the sustainability of home delivery, with more than three quarters (76%), while 66% of Nordic consumers expressed the same concern.

The average figure between consumers in Nordic countries thus comes behind Belgium and Germany, but ahead of the U.S. and Canada by about 5 percentage points.

To avoid long delivery distances, multichannel preferences are becoming increasingly important. Of consumers in the Nordics, 48% of Swedish consumers prefer to order online and pick up their items in a physical store, while 39% of consumers prefer to have their products delivered to their home.

In Finland, multichannel preferences are similar: 53% of Finnish consumers prefer to order online and pick up their items at a physical store, and 39% of consumers prefer to have their products delivered to their home.

In a pool of 8,000 consumers from Canada, the United States and 9 European countries, including Sweden, Denmark and Finland, a 2022 survey by the Descartes Systems Group found that 54% of online shoppers are willing to wait longer for environmentally friendly delivery if the item is from a sustainable seller.

These growing consumer trends show that companies can achieve higher sales and build a better brand reputation by addressing these concerns.

How are Scandinavia's most successful fashion retailers responding to consumer preferences for sustainability?

H&M: Methods to Reduce Fashion Waste

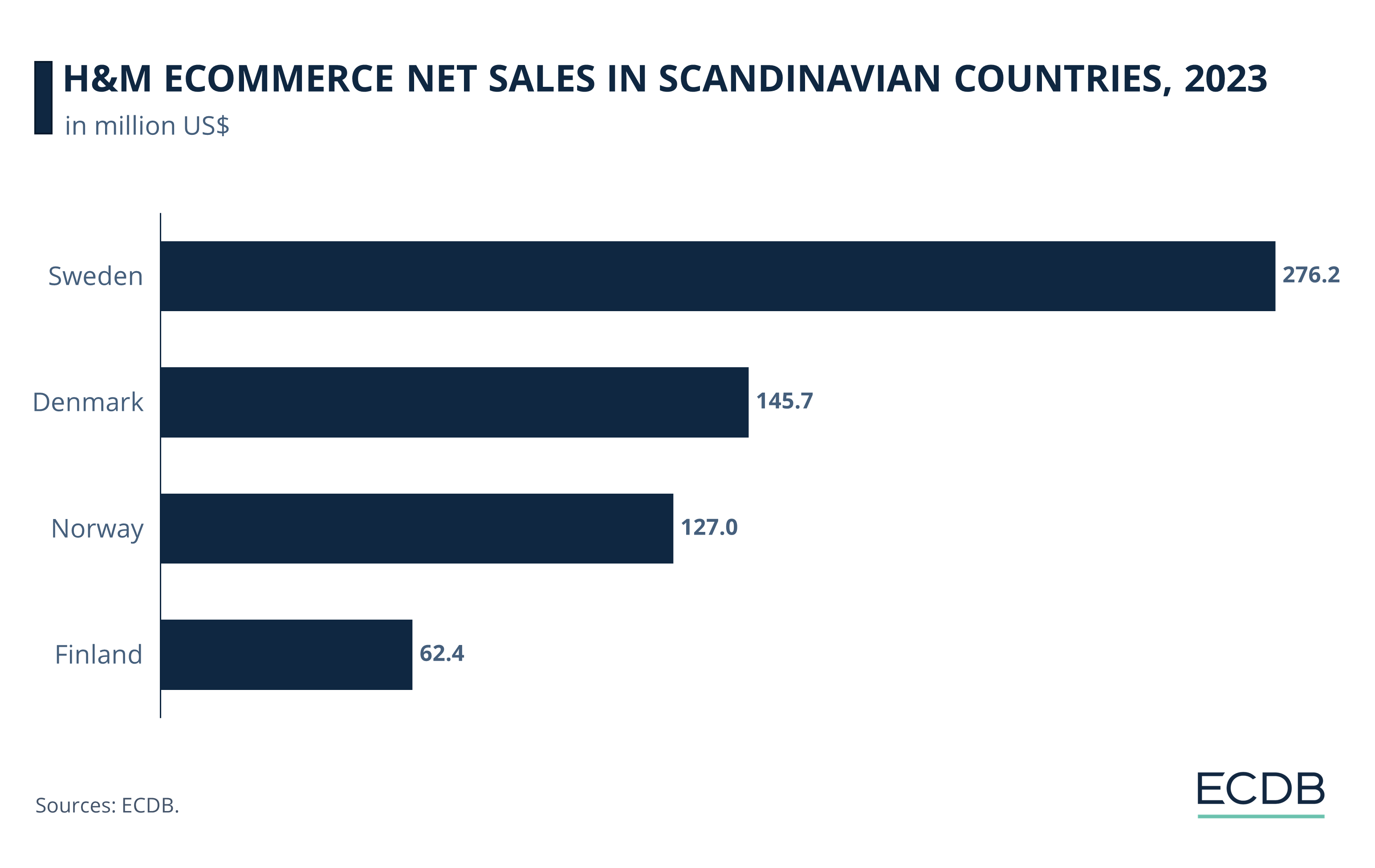

H&M, a Swedish brand, generates a large proportion of its net sales in its country of origin. In a cross-country comparison across Scandinavia, Sweden emerges as the clear leader for eCommerce net sales with US$276.2 million generated in 2023.

Denmark and Norway follow further behind with net sales of US$145.7 million and US$127 million, respectively. In Finland, the affordable and stylish fashion brand ranks second among all online fashion stores, but compared to the other Nordic countries in our analysis, sales lag at US$62.4 million.

Sustainable Supply Chain & Circular Economy

The H&M Group has made efforts to improve its logistics and transport sustainability. In the second and third quarters of 2022, 9% of delivery distances were covered by environmentally friendly transportation, including electric, zero-emission and 100% biofuel vehicles.

The company's 2030 goals build on a commitment made in 2017, aiming to achieve climate positivity across its entire supply chain. H&M's sustainability initiatives are divided into six pillars: Climate, Water, Commercial Goods, Packaging, Chemicals, and the Garment Collection Initiative. These target areas align with the Ellen MacArthur Foundation's concept of a circular economy — a model also adopted by the other online fashion platforms we examine in this insight, Zalando and Boozt. This approach focuses on eliminating waste, ensuring the value retention of products and materials, and actively restoring the environment.

Convenient Return Solutions & Incentives

For the environmentally conscious Nordic consumer, H&M has integrated recycling boxes in all its clothing stores through its garment-collection box initiative, which was launched globally in 2013. It was first introduced in Switzerland in 2012. Consumers can drop off all textiles from different brands, regardless of their condition, and receive rewards like gift cards in return.

H&M’s products are typically categorized under the fast fashion category, with affordable products and a rapidly changing assortment of new clothing styles several times a year. Therefore, the company’s attempt at reducing some of its environmental footprint can be seen as a strategy to improve its reputation and impact in alignment with evolving society demands.

The next fashion store in our analysis is the Nordic brand Boozt, which caters specifically to the tastes and needs of local consumers.

Boozt: Offering Quality and Sustainability

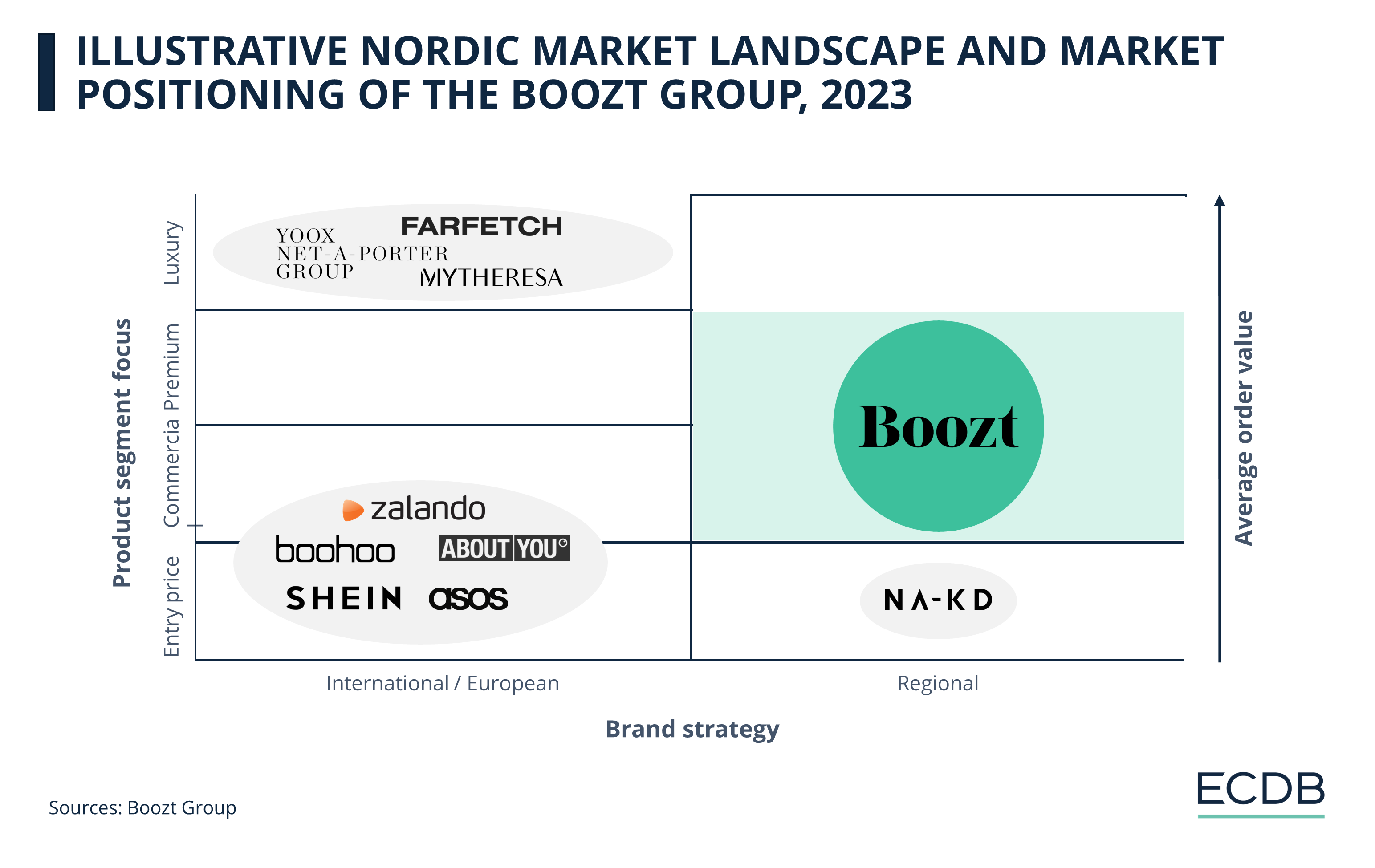

Boozt is a regional company in the Nordic market, and its assortment includes both commercial and premium products. See its market position in the illustrative chart below.

In addition to offering a quality alternative to the fast fashion segments of the market, Boozt is also known for its sustainable strategy.

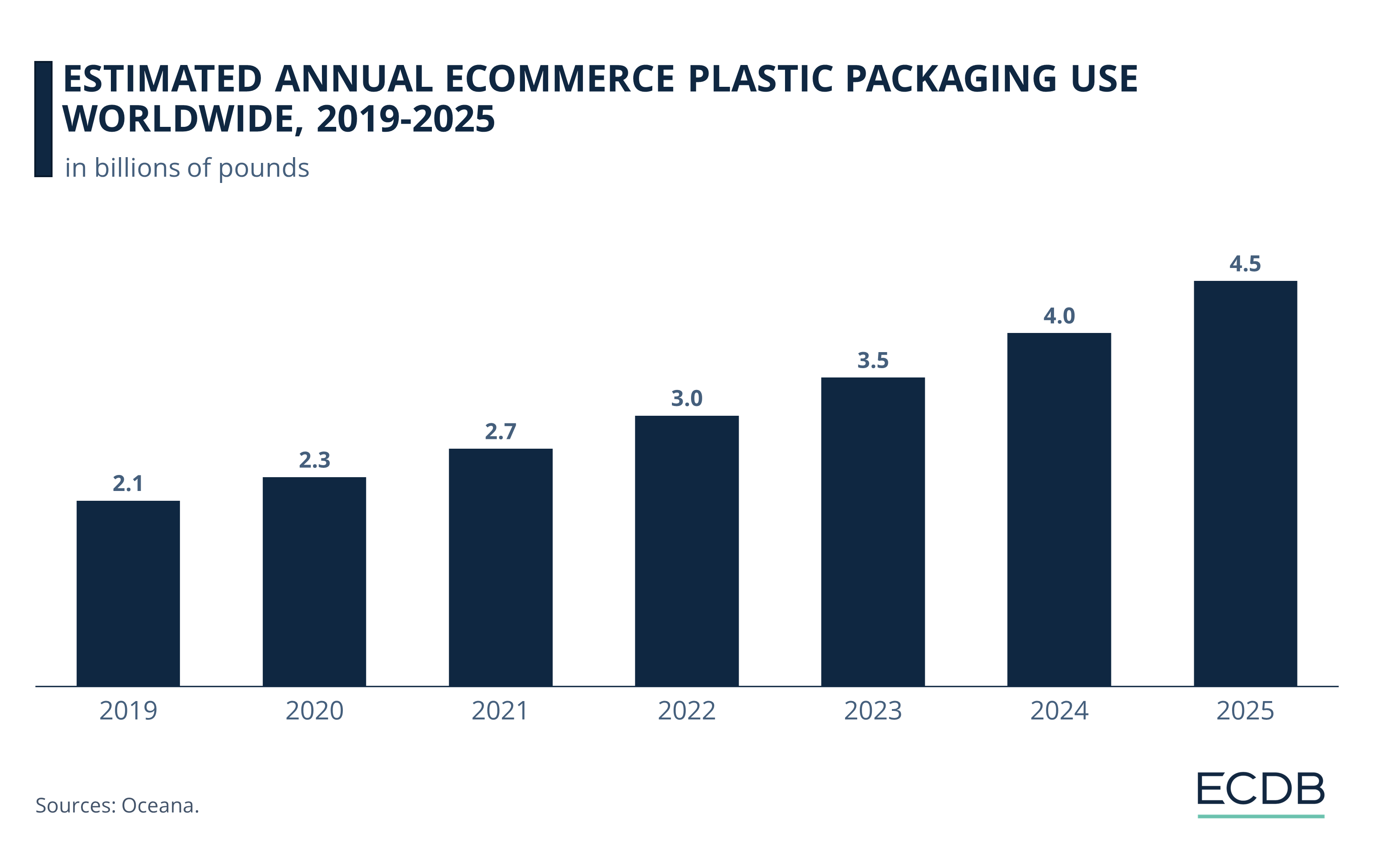

Packaging accounts for a lot of waste worldwide, and retail giants are aware that eCommerce is part of the problem. We know that in 2016, the European Union generated 87 million tons of packaging waste, most of it plastic. As seen in the chart below, estimates predict a constant increase in plastic packaging and related wastage generated by eCommerce deliveries through 2025.

Reducing Waste by Going Digital

According to its 2022 Annual Report, Boozt works with a company that collects the waste generated by Boozt's operations and ensures that it is properly handled in accordance with local regulations. The waste generated by the online store is primarily related to packaging materials from customer returns.

In 2022, the company introduced corrugated paper in its shipping orders, replacing some of the plastic filling. This change alone resulted in a 35% reduction in plastic packaging compared to the previous year. The strategy is part of the company's circular approach for sustainable development.

In addition, Boozt offers its customers an all-digital form for their return labels. This not only simplifies the process at their Pick & Pack stations, but also results in significant paper savings. The move is expected to eliminate the need for approximately 6.9 million sheets of paper by 2023.

Another major player in the online fashion space in Europe is Zalando. The Berlin-based eCommerce retailer generates a remarkable share of its sales in Scandinavia, not only because of its trend-led product range, but also because of its progressive sustainability strategy.

Zalando: Corporate Social Responsibility

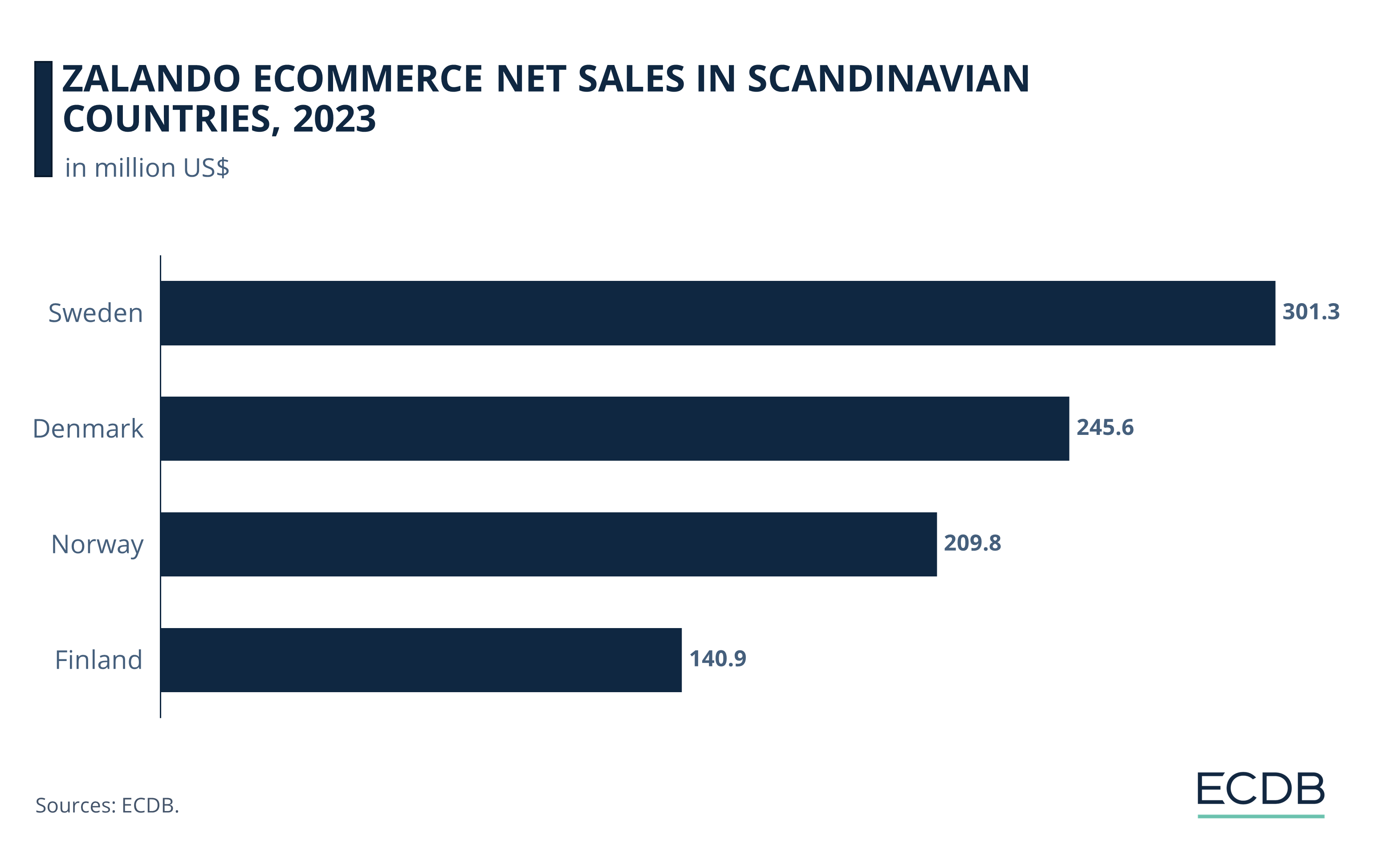

Across the observed Scandinavian countries on our list, Sweden emerges as the largest Scandinavian market for Zalando, at 2023 net sales of US$301.3 million. Zalando is the leading fashion online store in Sweden, Denmark, Norway, and Finland.

Zalando's outstanding position in Scandinavia is due in no small part to its commitment to environmental values:

Reducing the waste associated with packaging materials is one of Zalando’s stated focus areas of improvement. According to the company’s 2023 Sustainability Report, Zalando works towards using increasingly more sustainable packaging materials such as paper, recycled plastic, recycled paper, and recycled cardboard.

In addition, Zalando works closely with its brands, as well as packaging and last-mile delivery partners to help them reduce their carbon emissions.

Zalando's Secondhand Initiative

To support the secondhand movement, the company offers a growing range of pre-owned clothing. Ethical working conditions in manufacturing countries is another stated concern in the Sustainability Report, which is difficult to enforce on the one hand, but nonetheless a valuable contribution to improving the livelihoods of garment producers, especially when done collectively.

In terms of organic products, Zalando expanded its sustainability assortment to more than 180,000 items in 2022, compared to around 140,000 a year earlier. However, the sustainability assortment was reduced in 2023 to around 108,000 items. In 2022, around 54% of Zalando's customers bought at least one product with a sustainability symbol, compared to 60% in the previous year. This percentage also decreased in 2023 to 43%.

The 2023 reduction shows that despite the company's efforts, challenges remain: meeting sustainability goals while the online fashion industry demands improvements to compete with emerging online stores that undercut prices with a low-cost strategy and growing, disposable product assortments.

Sustainable Fashion eCommerce: Wrap-Up

H&M, Boozt, and Zalando are leading stores in the Nordics with ambitious sustainability initiatives. By pursuing circular economy principles, increasing the use of renewable energy, and implementing recycling initiatives, they are taking concrete steps to achieve their eco goals.

Nonetheless, Zalando's 2023 report uncovered the many challenges companies face in their efforts to leave a more sustainable footprint with their business activities. With the gap between stated values and actual purchasing behaviors showing that style and price is indeed the supreme concern for a majority of the consumers shopping for fashion, this lays bare the complex terrain a sustainably minded business has to maneuver.

Sources: CNN - Daily Scandinavian - Ellen Mc Arthur Foundation - Zalando

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics