eCommerce: Fashion Stores

Zalando: Adjusted Business Approach for Renewed Growth – The Stock Market Likes It

Germany-based online fashion retailer Zalando recently announced adjustments to its business approach in an effort to reverse declining revenues over the past few years. Learn about the strategies and our projections for Zalando's eCommerce performance.

Article by Nadine Koutsou-Wehling | March 15, 2024Download

Coming soon

Share

Zalando New Business Approach: Key Insights

Stagnant Sales in 2022 and 2023: Both by selling first-party products and by providing the marketplace for third-party retailers, Zalando lost eCommerce revenues since its sales peak in 2021. In US$, online revenues increased slightly, but overall activity slowed.

B2B Network Services: Zalando tested an operating system for third-party sellers to leverage its extensive supply chain capabilities in 2022. The system, called ZEOS, is designed to ensure the fashion conglomerate's long-term relevance.

Improving the Customer Experience: Several approaches are being used to attract more consumers to the brand: A higher quality product assortment, a move into sports and family lifestyle products, and personalization through AI and data analytics are among them.

Zalando is a textbook example of a company that thrived with a modern business model and a functioning strategy of expansion into various European markets. But company revenues have been declining in recent years due to a reduction of consumer purchasing power, rising inflation, and growing competition from low-cost fashion online stores.

To address degrowth, Zalando announced some fundamental changes to its operations. And the stock market likes it: Shortly after the announcement, stock price went up by over 20 percent.

Adjustments to Its Business Approach

With the latest announcement, Zalando sets a target of 5% to 10% annual growth until 2028, which includes both marketplace and retail segments. Adjustments to the model relate to the B2C (business-to-consumer) and B2B (business-to-business) sectors, with the help of which Zalando aims to capture a 15% market share of the European fashion industry over the long haul.

First, there is the B2B segment, which is represented by Zalando's operating system ZEOS (Zalando E-Commerce Operating System).

B2B Logistics Services: ZEOS Fulfillment

In October 2023, Zalando officially introduced ZEOS, a project that the company has been testing with selected retailers for the past year. Ultimately, ZEOS is a multichannel fulfillment service that allows business customers to participate in Zalando's extensive logistics and supply chain network in Europe through a simple interface.

According to Zalando, ZEOS services include logistics, software and digital services to manage marketplace activity with data analytics, and services such as product display and financing. Businesses can choose the services that best fit their needs, and Zalando benefits by expanding its network of partners across Europe. Today, ZEOS has access to 12 fulfillment centers, around 20 returns centers, and over 40 regional transport service providers, and numbers are growing.

So far, the venture has been a success, generating €900 million since its inception.

Reducing Costs Across All Segments

In addition to expanding its reach, Zalando is reducing costs to increase overall efficiency. This means a smaller marketing budget, focusing on innovative ways to promote the company, thereby replacing traditional marketing spend. Moreover, the company has cut costs through layoffs.

On the B2C side of the business, Zalando has planned some major changes to reach more customers and sell higher value products.

B2C: Focus on Entertainment and Lifestyle

Beyond its network growth, Zalando is altering its product assortment to encompass sports and family products. The brand is also targeting consumers in the entertainment segment, as exemplified by its collaboration with German broadcaster RTL+, where outfits are introduced to audiences through TV series and are available for immediate purchase.

Offer a Higher Quality Assortment

In order to generate higher margins and meet the challenges posed by the cheap but disposable fast fashion conundrum, Zalando declared its intention to broaden its range of luxury and high-quality products. Through Zalando's marketplace, consumers already have access to brands like adidas, lululemon, Hoka, On, Lancôme and Missoni. Apart from that, there are also the sustainability and secondhand initiatives.

Personalization Through Technology

Personalization has long been a part of Zalando's customer strategy, which is now being complemented and enhanced by AI assistants and data analytics. The function in which this will most immediately help customers is finding the right outfit and receiving product recommendations based on individual preferences. Moreover, the technology is being used to assist users finding the right product size, which in turn reduces return rates and increases customer satisfaction.

Stagnant eCommerce Development in 2022 and 2023

Since its launch in 2008, Zalando has entered a multitude of business fields, serving an increasing number of markets across Europe. The platform operates both as a store, selling its own brands, and as a marketplace provider, selling third-party products.

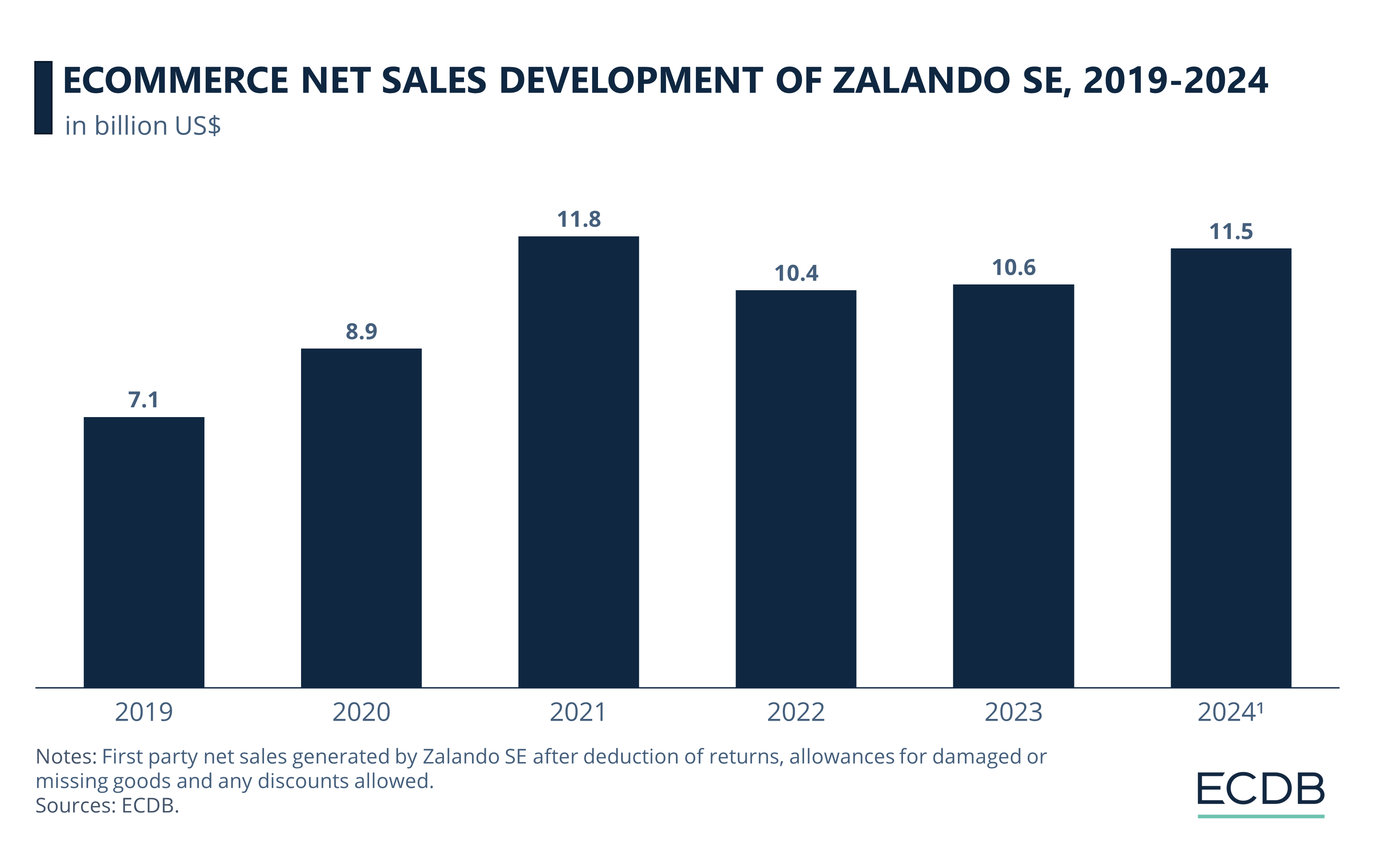

Looking at eCommerce activity, Zalando generates net sales by selling its own-branded products. See the development of Zalando's first-party net sales below.

The pandemic accelerated revenues, which increased from US$7.1 billion in 2019 to US$11.8 billion in 2021. While net sales followed the industry-wide decline in 2022, which reflected economic circumstances and the return to physical retailing after Covid, a slight increase was seen in 2023, although it did not match revenues at the height of the pandemic. It should also be noted that the increase only occurred after currency conversion into US$, as revenues declined when measured in €. Recovery is, however, expected by 2024, when net sales are projected to reach US$11.5 billion.

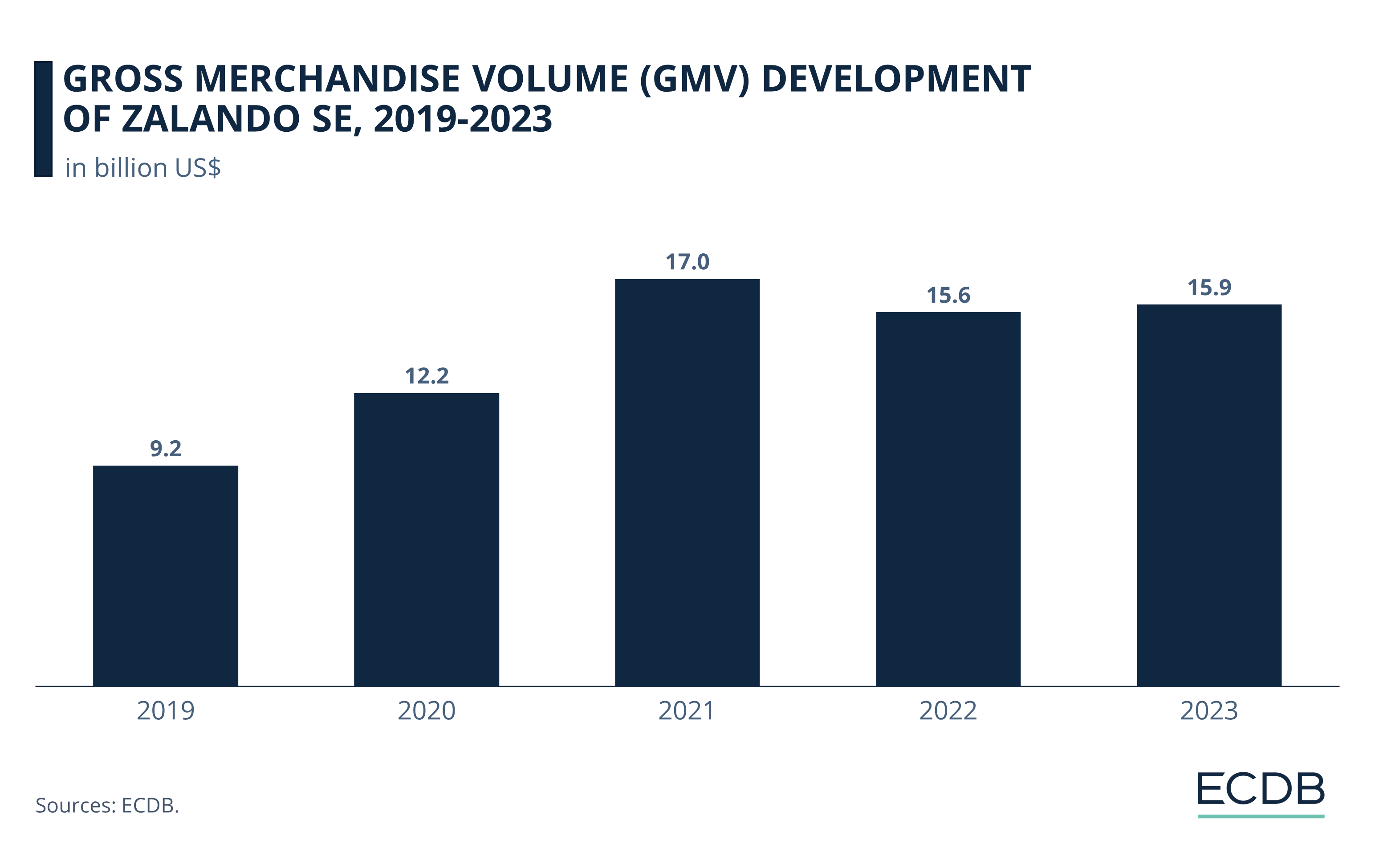

In addition to this comes GMV, the gross merchandise volume used to assess marketplace actvity. By providing the platform, Zalando earns a portion of the GMV as revenue. For these third-party items, we see degrowth through 2023 in € terms, but slight growth in US$ terms.

And yet, our forecast for 2024 anticipates GMV to recover as well.

The projections for the coming years are positive, and Zalando supports this notion by posting adjustments to its business approach.

Zalando's New Approach: Closing Remarks

As Germany's largest online fashion retailer with a growing presence in Europe, Zalando has a significant advantage over smaller players, but is still under pressure to maintain growth. By competing with About You's SCAYLE eCommerce software with a larger and more service-oriented system, ZEOS is securing profits and providing Zalando with the necessary data insights.

On the consumer side, it will be difficult to reach more users with luxury products, but AI technology is highly likely to improve the customer journey by suggesting more relevant products and reducing returns. Zalando is Germany's most popular online fashion platform for a reason, and will likely remain a viable competitor against low-cost rivals.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Secondhand Fashion Online Market in the UK: Categories, Preferences by Generation, Top Stores

Secondhand Fashion Online Market in the UK: Categories, Preferences by Generation, Top Stores

Deep Dive

European eCommerce Market Size 2024: Top Players & Market Size

European eCommerce Market Size 2024: Top Players & Market Size

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Back to main topics