eCommerce: Fashion Ranking

About You vs Zalando: Who Is Germany's Top Online Store in Fashion by Revenue?

Germany is a leading market for fashion eCommerce, home to numerous domestic players including Zalando, About You & Otto. While all of these players are well known in German eCommerce, who ranks at the top of the most successful online fashion stores?

Article by Nadine Koutsou-Wehling | June 06, 2024Download

Coming soon

Share

Online Fashion in Germany 2024: Key Insights

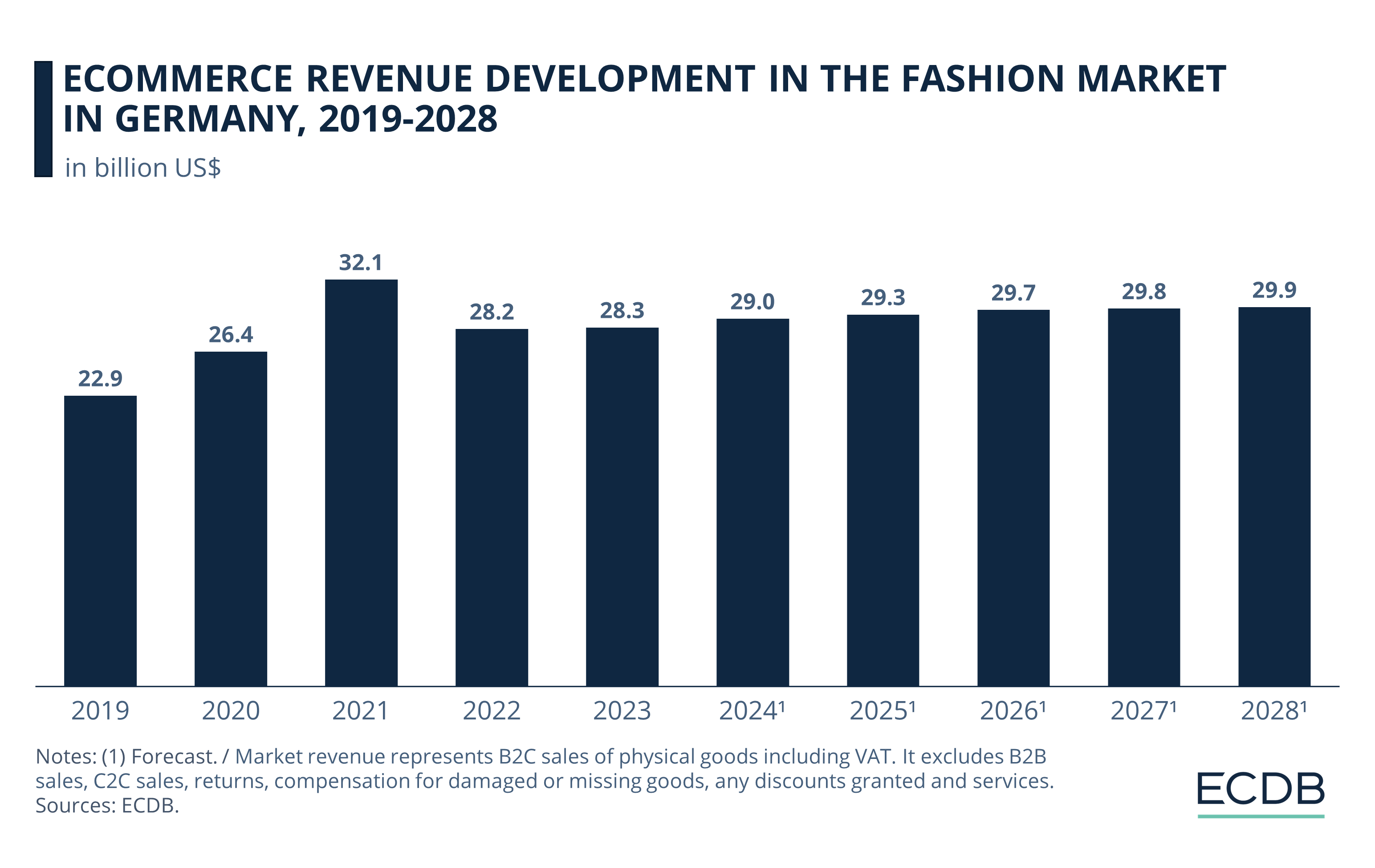

Online Fashion in Germany Is Growing: Online revenues peaked temporarily in 2021 with US$32 billion, and revenues declined the following year to US$28 billion. But forecasts predict slow and steady growth through 2028.

Zalando Ranks First: With online net sales of US$2.5 billion in 2023, zalando.de outperformed all other players in the German eCommerce fashion segment. About You did not surpass the US$1 billion mark with its 2023 online net sales. The Otto Group is involved with three stores in the top 5, including otto.de, aboutyou.de and bonprix.de.

Common Strategies for Success: Big data and machine learning help fostering a competitive approach in the online fashion sector. Economies of scale help meeting the high standards of German consumers, who expect trustworthiness and punctuality, while social media marketing and influencer collaborations improve brand image.

The Fashion Paradox - A Universal Phenomenon: Sustainability is one of the key aspects an increasing share of online shoppers say is important, but consumers tend to place almost as much value on low prices and accessibility, which contradicts a green mindset.

Fashion is an all-time favorite product category for online shoppers worldwide, and Germany is no exception. According to our ECDB Markets section, 24% of online retail revenues in Germany are generated by fashion sales, which makes it the largest product category in the German market.

eCommerce revenues in the German fashion market reached a temporary peak during the pandemic in 2021, but there was a decline in sales the following year.

Forecasts predict that fashion sales in Germany will grow steadily again in the subsequent years, driven by increased consumer demand and technological advances.

Innovations like virtual reality (VR) and augmented reality (AR) give consumers the option to experiment with new styles at home, while machine learning is improving the accuracy and personalization of recommendations.

Zalando or About You? The Winner Is Clearly Zalando

The top 5 online retailers in the German fashion market are predominantly domestic players:

With the exception of amazon.de, all of the online stores in this ranking are based in Germany.

In addition, three out of these five platforms have ties to the Otto Group: otto.de, its subsidiary bonprix.de and former subsidiary aboutyou.de, in which the Otto Group is a major shareholder today.

Of all the online stores in the German fashion market, however, zalando.de is the number one player. With 2023 net sales of US$2.5 billion, zalando.de even outperformed Amazon.

But revenues generated by the remaining stores in the top 5 ranking demonstrate the profitability of Germany’s online fashion market: All players generated online net sales approaching US$1 billion in 2023.

This is no small feat in an industry that is characterized by high fixed costs, rapidly changing product assortments due to the seasonality of fashion styles, high return rates and intense competition among domestic and international retailers. So, what sets these top 5 online stores apart?

Performance of Leading Store: Zalando.de

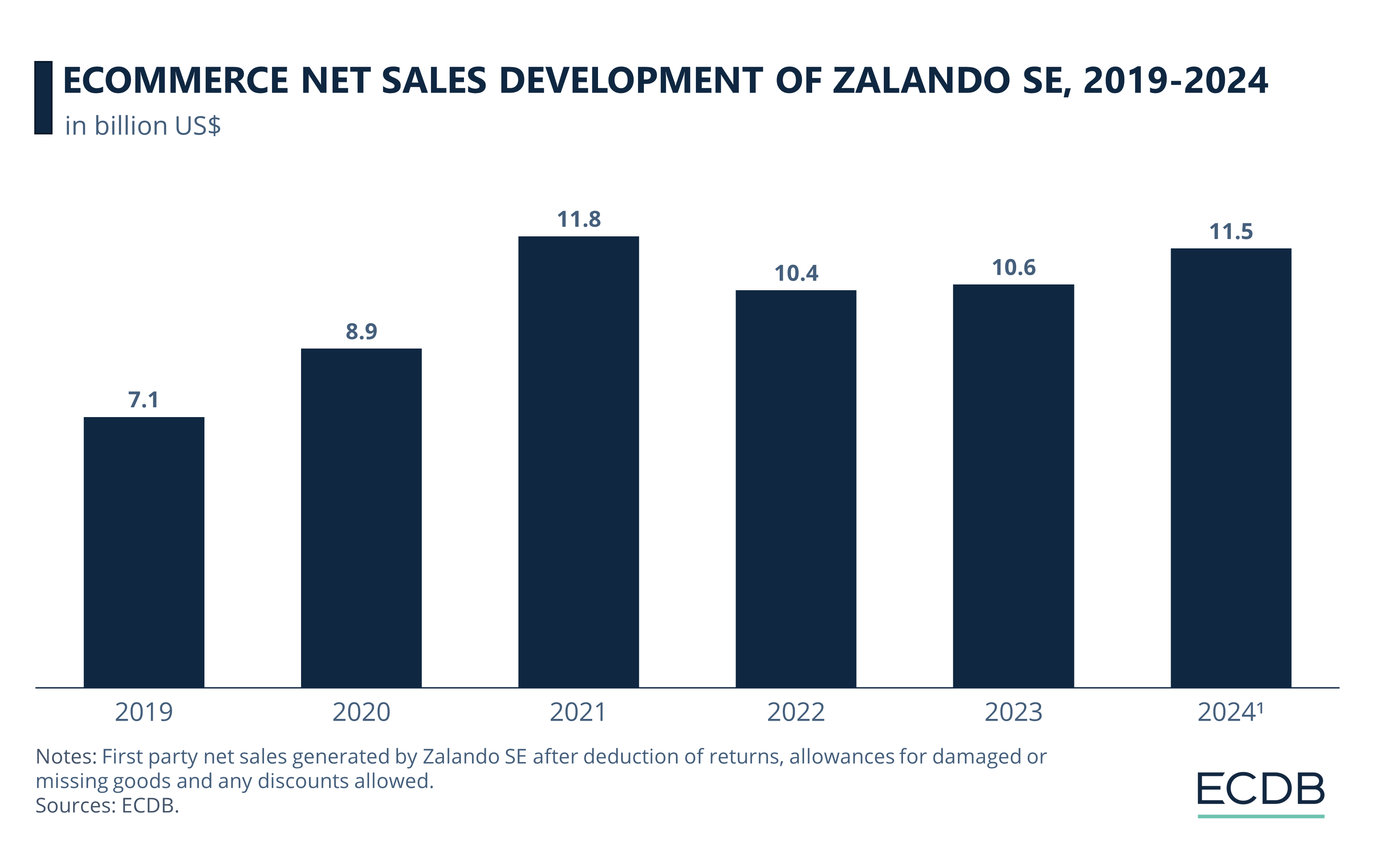

Zalando is one example of an online fashion retailer using big data analytics to predict consumer behavior and preferences, as well as to manage inventory. While Zalando’s online net sales have been declining in 2023 compared to the previous year, projections for the next few years expect revenues to grow again.

This trend follows the revenue development of the overall fashion market, showing how even the largest players are dependent on factors such as general consumer sentiment, increasing competition from international players, and improved multichannel strategies of traditional brick-and-mortar retail.

The most notable surge of Zalando's overall net sales occurred in 2021, when they peaked at US$11.8 billion. Compared to pre-pandemic levels, however, the following years are expected to remain at a higher level.

What Role Does Big Data and Machine Learning Play?

While artificial intelligence (AI) and its adoption has become a mainstream topic with the launch of chatbots like ChatGPT and Google Gemini, successful online shopping platforms have been integrating AI features into their operations for years now.

This is also the case for the online retailers mentioned above. The very nature of an online platform allows for the analysis of consumer data, which subsequently increases the accuracy of predicting consumer preferences and behavior. For fashion retailers, big data analysis enables algorithms to learn users' individual styles, thereby providing tailored recommendations for outfits or pieces that align with their interests. As machine learning improves with increasing input, recommendations are expected to become more accurate over time.

The use of big data and machine learning can also help manage inventory more efficiently, as seen in the highly controversial case of Shein, which has faced allegations of worker exploitation and design copying, stirring widespread debate within the fashion industry. While Shein ranks 9th in the German market for online fashion with net sales of US$397 million in 2023, its method of keeping costs and inventory down by analyzing consumer preferences in real time is increasingly being implemented by leading fashion retailers.

About You and Scayle: Venturing Into Tech Services

About You, the Hamburg-based fashion retailer, was founded by the Otto Group in 2014 to offer consumers a personalized shopping experience catered to their personal tastes. This is enabled by its own digital infrastructure, the About You Cloud. After verifying the functionality of the software, it was ready for large-scale distribution, corresponding with the system's name: Scayle.

Having introduced this headless commerce feature as early as 2018, About You's move into tech services is proving to be particularly forward-thinking. Considering that we named programmatic commerce as one of the leading online shopping trends in 2024, selling businesses reliable software for their own use is a mutually beneficial strategy. Today, according to Scayle themselves, the system is being applied beyond the Otto Group, serving brands such as Marc O'Polo, Depot, Tom Tailor, and more.

To compete and increase revenues, Zalando recently launched its own fulfillment service, called ZEOS. Read more on that in the dedicated insight.

Consumer Attitudes: “Amazonization” of the German Fashion Market

Another important aspect of the success among Germany’s leading fashion retailers is economies of scale, with larger retailers able to meet more consumer needs.

In what has been called the “Amazonization” of the market, consumers are becoming increasingly accustomed to conveniences such as fast delivery, large product ranges, low prices and social proof of product quality and validity.

Consumer analysis of the typical shopper in Germany claims that German consumers tend to be more cautious and rely on more proof that they can trust a business they buy from. Statista’s Consumer Insights corroborate this statement, as the most agreed upon opinion regarding fashion online shops relates to a brand’s familiarity and trustworthiness:

Given that three out of the top 5 online retailers in the German fashion market are owned by the prominent Otto Group, with Amazon in third place, the preference for companies with a wider reach is clear. Large conglomerates have the financial prowess to help their subsidiaries thrive financially and operate with a profit. The Otto Group is a prominent example of this phenomenon in the German industry.

Additionally, a large scale improves a company’s ability to operate in a more sustainable manner – another important consideration for 20% of consumers in Germany.

Sustainability vs. Low Prices

The fashion paradox is a universal phenomenon that refers to the discrepancy between consumer preferences for sustainable products and the demand for low-cost items with a quick turnaround.

While the sustainability of fashion online shops is important to 20% of consumers in Germany, almost as many users, 19%, say they value a lower price over high quality. See how these preferences evolve across generations.

The data shows that 22% of Gen Z and millennial respondents say they value sustainability when shopping for fashion online, while fewer Gen X (18%) and baby boomer (14%) respondents agree. But the same share of Gen Z users (22%) and nearly as many millennials (21%) prefer low prices to high quality, while Gen Xers and baby boomers are less likely, at 17% and 13%, respectively.

Secondhand Success or Pre-Owned Failure?

Sustainability initiatives are quite common among the top 5 online stores in the German fashion market. Zalando and About You have integrated a pre-owned section on their platform, as well as the option to filter for organic and recycled materials, as have Amazon, Otto and Bonprix. To participate in the reCommerce trend, Amazon recently launched a collaboration with the pre-owned luxury retailer Hardly Ever Worn It.

However, the success of these initiatives is not self-evident. While Zalando discontinued its experimental secondhand C2C platform Zircle in 2022, it also stopped buying secondhand clothing from consumers in France and Belgium in the same year due to low demand for these products.

The last strategy for success among fashion online stores may be a reason for this.

Up-to-Date Styles via Social Networking

Another feature of Amazon’s large network that serves as a prime example (pun unintended) for online shopping platforms is its extensive recommendation system and implementation of emerging social commerce initiatives.

Among the online retailers discussed in this insight, About You stands out as a platform that leverages social networking to promote its brand and styles to users.

According to brand analyses, About You primarily targets a younger consumer base, especially through its frequent collaborations with influencers. The prerequisite is a high social media reach and story views. With these modern advertising methods, About You improves its brand reputation and awareness through aesthetic images and social media presence. Other means of promoting the brand include its own festival, About You Awards and About You Fashion Week.

Germany’s Fashion eCommerce: Wrap-Up

The three distinct strategies that the top online stores in Germany’s fashion market have in common emphasize the importance of scaling effects to improve infrastructure, platform algorithms and offering coveted styles. While it is clear that online shoppers in Germany tend to rely on familiar brands and providers they have had positive experiences with, certain preferences like the demand for sustainable products seem a rather complex task to solve.

The fashion paradox describes how consumers want ecologically clean products on the one hand, but are less willing to make concessions in terms of cost, novelty or frequency of purchase on the other. New initiatives of leading retailers in German online shopping reflect this dilemma, as it remains to be seen how successful these endeavors ultimately are.

Sources: AboutYou – DLDNews – FashionUnited – IMD – Marginbusiness – P4Markets – Retaildetail – Retviews – Vogue

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics