eCommerce: Top 5 Online Shopping Fashion Sites in Germany

Top 5 Online Marketplaces in German Fashion: Amazon, Zalando & About You

What online marketplaces take the lead in German fashion eCommerce? This insight focuses on the best fashion marketplaces bv GMV, Zalando competitors, About You, and Amazon.

Article by Nadine Koutsou-Wehling | June 28, 2024Download

Coming soon

Share

Fashion Marketplaces in Germany: Key Insights

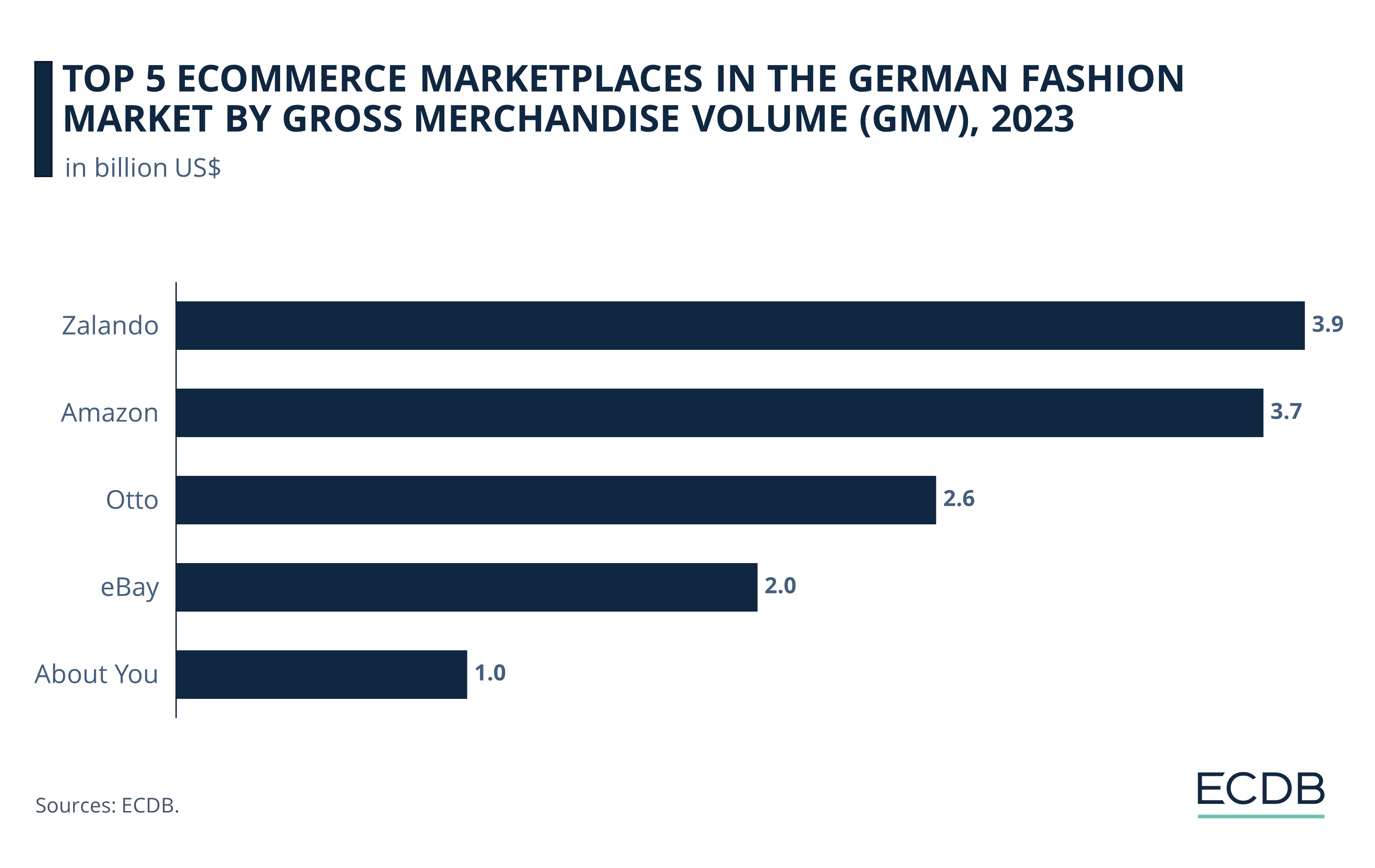

Zalando and Amazon Take the Lead: Zalando and Amazon are the most popular marketplaces in German fashion eCommerce. They generated respective GMVs of US$3.9 billion and US$3.7 billion in 2023.

Current Trends: Comparing the two pure-play fashion retailers in the top 5, Zalando vs About You, shows stagnant growth of their online marketplaces. But Zalando's German GMV is at a significantly higher level than About You's.

Emerging Competitors Are Looming: Three marketplaces outside of the top 5 that could take over the upper positions in the near future are Vinted, the Lithuanian secondhand marketplace, the controversial low-cost marketplace Temu, and AliExpress, Alibaba's international platform.

Germany’s fashion eCommerce is shaped by the industry’s largest companies, but emerging players are vying to take the top spots. In general, economies of scale are the key driver of convenience and success in eCommerce. But does this principle also apply to the top online marketplaces in German fashion?

Learn about the leading marketplaces in German fashion eCommerce and which competitors are lurking to take over the ranking.

What Is a Martketplace? How Does It Apply to Fashion eCommerce?

An online marketplace is a type of eCommerce platform that allows multiple sellers to sell their products or services to consumers. The marketplace operator provides a platform where sellers can list and sell their products, and buyers can browse and purchase them.

The operator typically charges a commission for each transaction and/or a fee for using the platform.

For fashion, it is either established fashion brands looking for an additional sales channel, wholesale retailers selling third-party products they buy from manufacturers, or private persons re-selling used pieces or items they bought at a lower price to re-distribute.

Top Fashion Marketplaces: Zalando Ahead of Amazon

Our ECDB Marketplace Ranking for fashion in Germany shows that almost all of the companies that operate the top stores also run the top marketplaces:

1. Zalando

Zalando’s marketplace ranks first, with a GMV of US$3.9 billion in 2023. The number one position corresponds to Zalando's leadership as an online store in the German fashion market.

Zalando recently ventured into logistics and software services with ZEOS, a move that is expected to increase Zalando's revenues in Europe and for the participating companies in the coming years.

2. Amazon

Amazon ranks second, just behind Zalando, with US$3.7 billion worth of fashion products sold through its marketplace in 2023. Compared to its first-party products, the GMV for fashion on its marketplace is higher.

Amazon is known for the high convenience it offers to customers, with next-day delivery for Prime members in Germany and its discounting event Prime Day. Amazon takes the leading position for most product categories in German eCommerce, even those that are usually dominated by specialized retailers.

3. Otto

The third top marketplace for German fashion is Otto, with marketplace transactions of US$2.6 billion in 2023. Otto is similar to Amazon in its broad product category focus. It is involved as a shareholder in top-performing online stores, such as About You and Bonprix for fashion.

4. eBay

A pure-play marketplace with declining relevance but still significant GMV is eBay: US$2 billion worth of fashion products were sold on the auction site in 2023. eBay operates the marketplace for consumer-to-consumer (C2C) business, meaning that private sellers interact directly with buyers on eBay.

This can increase the chances for shoppers to find a bargain on the products they are interested in, but it is also a place for scammers and fraudsters, a fact that certainly accounts for eBay's declining popularity in recent years.

5. About You

About You is the fifth largest marketplace in German fashion eCommerce by GMV, with US$1 billion. Theis figure is around US$200 million higher than its net sales as an online store. About You is particularly popular with younger audiences due to its partnerships with social media influencers and frequent celebrity collections.

Note that three of the top five marketplaces are domestic players. Two of those, Zalando and About You, are pure-play fashion retailers.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

Emerging Marketplaces: Vinted, Temu & AliExpress

While the top 5 marketplaces in the German fashion ranking are still well ahead of the rest, with GMVs over US$1 billion, other marketplaces are catching up.

An emerging marketplace does not necessarily have to be new, but rather gained notable traction in marketplace activity over recent years. A prime example of this is Vinted, which was launched in 2008, but has grown at rates of over 100% over recent years and became widely popular.

1. Vinted

Vinted generated a GMV of US$803.7 million with fashion products in Germany. The Lithuanian reCommerce marketplace has grown steadily over the past few years with a business model that meets the growing demand for secondhand alternatives. At an annual growth rate of 36.1% in Germany, Vinted’s GMV could surpass About You’s in the foreseeable future.

2. Temu

Temu, the platform operating under the motto “shop like a billionaire”, is drawing increasing attention for its addictive gamification features and low-cost pricing model.

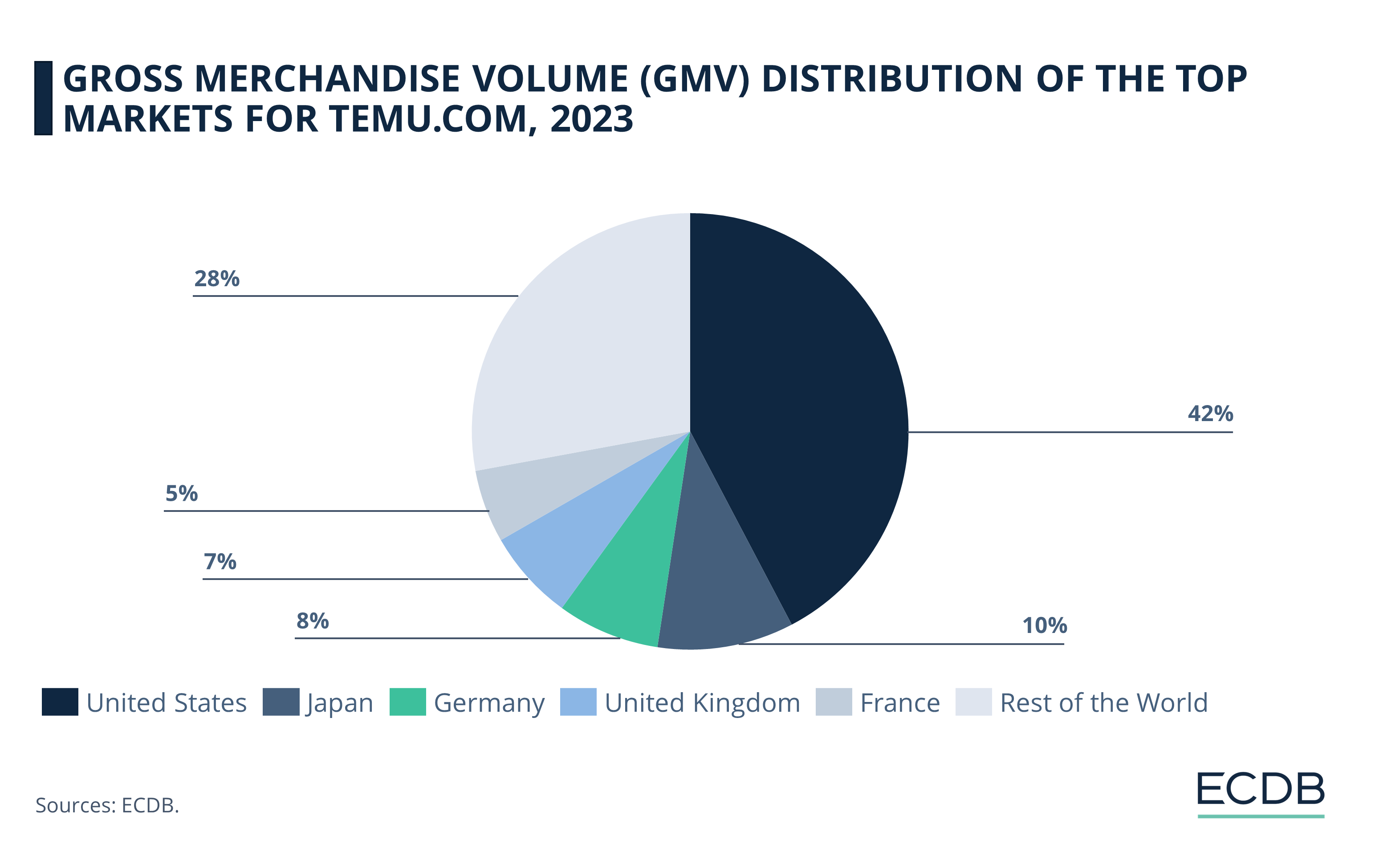

In a recent insight, we discussed the likelihood of Temu taking over the established domestic marketplaces in German eCommerce. Germany is Temu’s fifth largest market by GMV:

With an annual growth rate of 4,647.5% in 2023, the likelihood of Temu overtaking the other marketplaces and becoming one of the top 5 in Germany in the coming years is quite high. In 2023, however, it was still far behind the top players, with a GMV of US$429 million for fashion and ranked 7th.

Temu's current ranking may improve sooner than you think: A recently published study by economic researchers in Germany (IFH Köln) confirms Temu's rapid growth, represented by consumer awareness and participation rates. In 2023, 11% of consumers in Germany said they shopped at Temu, while in 2024, the figure was already 32%.

What makes Temu stand out to consumers is its entertainment through gamification and its extensive social media marketing, which 35% of respondents encounter several times a week. However, Temu's prevalence has its downsides: About half of consumers exposed to the marketing are annoyed by it.

3. AliExpress

In contrast, AliExpress is not yet a credible contender for one of the top 5, with a 10th place ranking and a 2023 GMV of US$211 in fashion. The Alibaba-powered marketplace has been experiencing degrowth since 2020, and Germany is not one of the main markets for its products, accounting for only 3.2% of its total GMV.

Zalando vs About You: GMV Since 2021

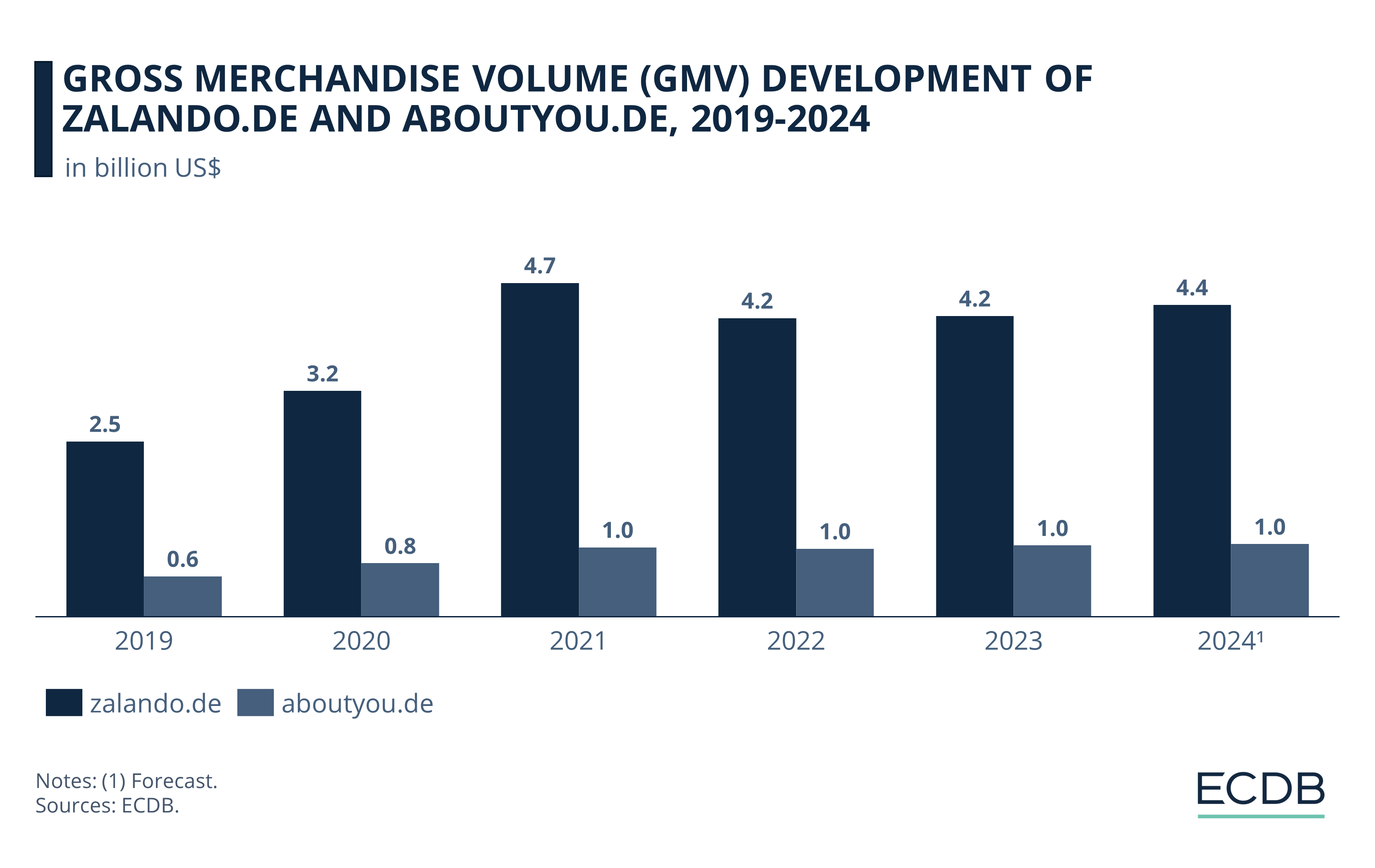

Zalando is Germany’s most successful online marketplace and store. Its third-party marketplace sales, as measured by GMV and not to be confused with revenue, have remained more or less constant since 2022:

Zalando's pre-pandemic GMV was around US$3 billion.

Zalando’s GMV temporarily spiked during the pandemic, reaching US$4.7 billion in 2021.

In the following years, marketplace activity remained at US$4.2 billion, and it is expected to increase slightly to US$4.4 billion by 2024.

Zalando operates across Europe, but its home country of Germany accounts for the largest share of GMV. In comparison, About You is similarly distributed throughout Europe, with Germany being the primary market for both third-party and first-party offerings.

About You’s GMV development follows a similar trend to that of Zalando, but it remains at a notably lower level:

Before the pandemic, About You’s GMV was below US$1 billion, at US$600 million in 2019.

In 2021, About You’s marketplace GMV approached US$1 billion for the first time, with US$972.4 million worth of products sold through the marketplace.

From 2022, GMV is increasing slowly, resulting in a GMV of a little more than US$1 billion.

Generalist Marketplaces With a Fashion Offering Dominate

Amazon, Otto and eBay show that German consumers are not against one-stop shopping for fashion online. This is reflected in Amazon’s outstanding GMV of US$3.7 billion for fashion in Germany, just US$200 million short of Zalando’s first spot.

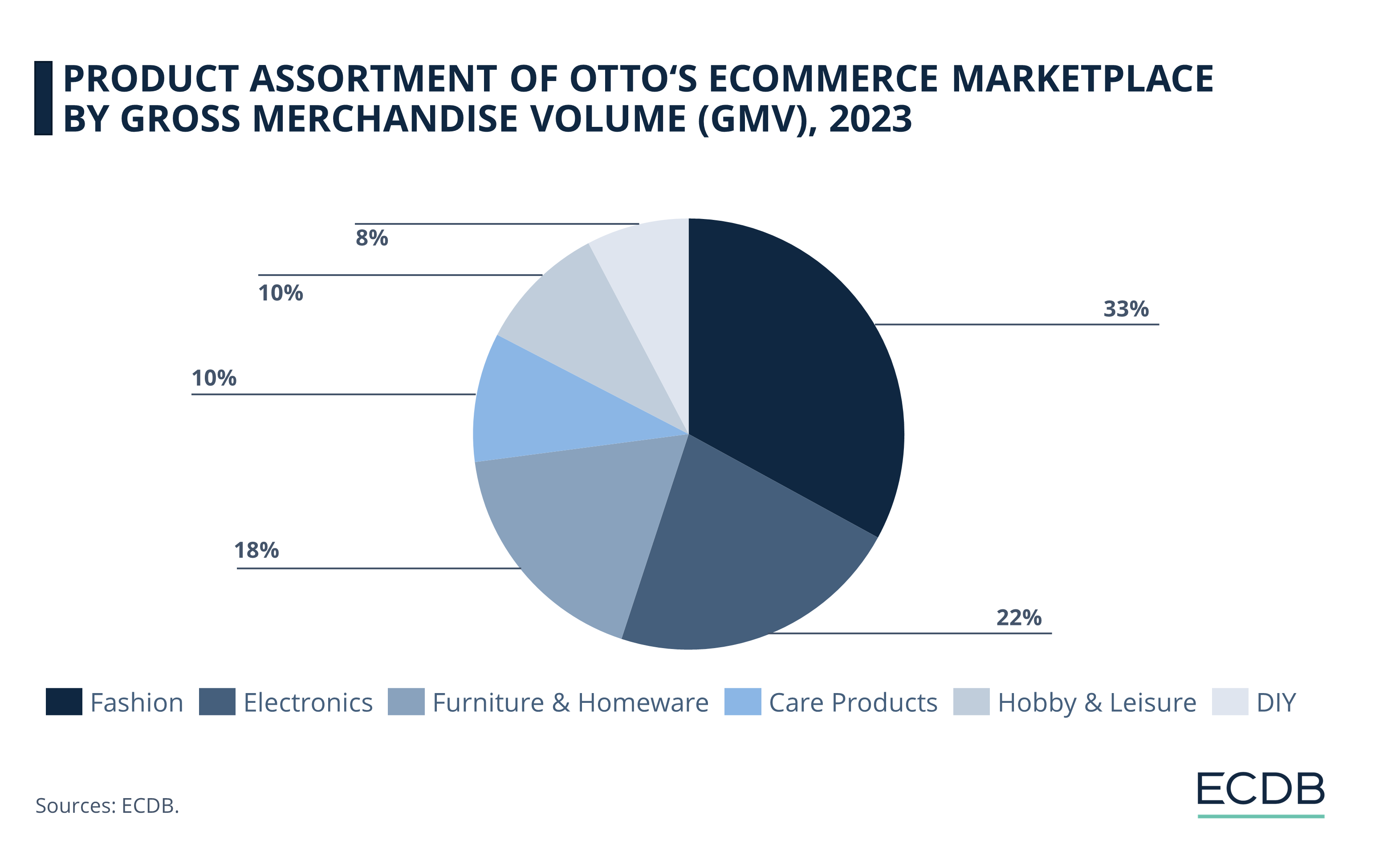

Otto, About You’s majority shareholder and one of Germany’s leading domestic retailers, has been on an upward trajectory since the typical downturn in marketplace activity after 2021. As seen on Otto’s ECDB Store Page, 33% of its GMV is accounted for by fashion products, making it the top-selling product category.

But Otto’s marketplace is also a popular place to buy electronics (22%) and furniture & homeware (18%). The remaining share of GMV is accounted for by care products and hobby & leisure, each with 10%, and DIY with 8%.

Another generalist marketplace in the top 5 for fashion products in 2023 is eBay. However, despite its global prominence, eBay has struggled to maintain positive growth rates since 2021 and has experienced annual declines for years.

Positive growth rates are essential to maintain a leading position, as competing marketplaces close the gap. Here are three to watch.

Top 5 Marketplaces in German Fashion: Closing Remarks

The top 5 online marketplaces for fashion in Germany are roughly the same as the top online stores in the market. But emerging competitors Vinted and Temu are threatening to overtake the incumbents.

The public outcry against the rise of low-cost marketplaces reflects the uncertainty of a leading position, especially in the face of degrowth in recent years. While the top players are currently still far ahead of the rest, the race to the bottom is leading to profit erosion, labor exploitation, design copying, and declining product quality standards.

The study by IFH Köln mentioned in this insight defuses common inhibitions about the rise of low-cost platforms from Asia: 54% of consumers in Germany do not believe established retailers will be undermined by the likes of Temu and AliExpress, as their offerings lack the trustworthiness, data security and seamless shopping experience that incumbents provide. However, the percentage of consumers who share this view has fallen by 10 percentage points since 2023, putting a question mark over this reassurance.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics