ReCommerce Trend

Secondhand Online Market in Europe 2024: Marketplaces, Stores & Product Categories

ReCommerce, or the secondhand online market, is thriving in Europe. Beyond the most renowned auction site eBay, many smaller platforms contribute to the secondhand trend and efforts to build a circular economy. Here is more on Europe's growing reCommerce market.

Article by Nadine Koutsou-Wehling | June 28, 2024Download

Coming soon

Share

Online Secondhand in Europe: Key Insights

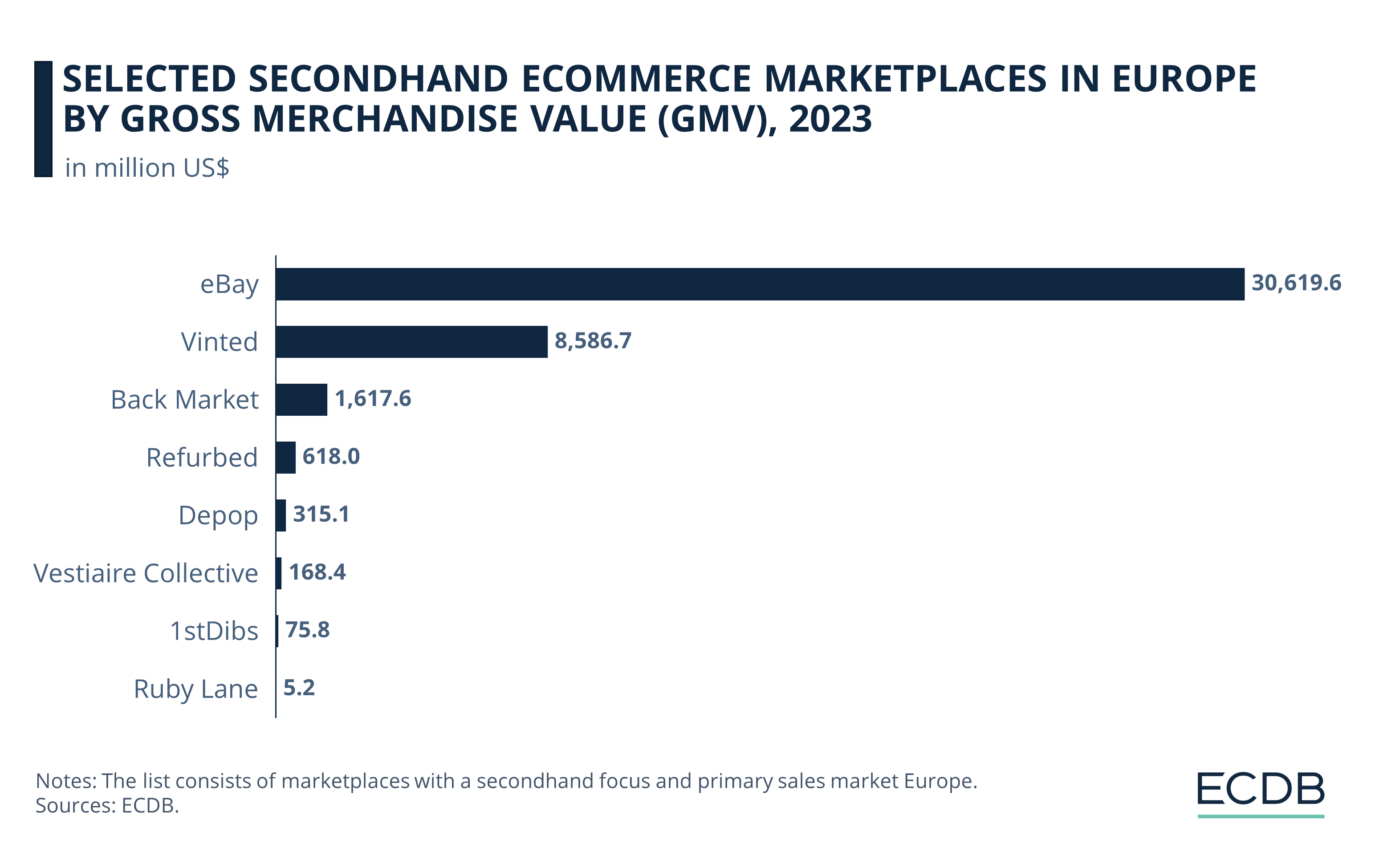

eBay Most Popular, Vinted Follows: With a GMV of more than US$30 billion in 2023, eBay is Europe's go-to platform for secondhand sales. Competitor Vinted has improved its position over recent years.

Category Specialization: ReCommerce marketplaces usually operate with a focus on particular categories. Notable platforms include Vestiaire Collective and Depop for fashion, Ruby Lane and 1stDibs for antiques, and Back Market and Refurbed for electronics.

Secondhand Online Stores: Another business model involves the resale of used products that platforms have purchased after quality control. European examples include Momox and ReBuy. Also find out about our experiences with these platforms.

In recent years, and further driven by the pandemic, eCommerce marketplaces that sell secondhand goods have seen a surge in worldwide activity. Several factors contribute to this development: The widespread movement towards eco-friendly consumption meets online shoppers looking for a bargain on pre-owned products.

The concept of reCommerce is not new: ECDB already covered comprehensive analyses on secondhand fashion in the UK and reCommerce in the U.S. But what about the European continent?

With homegrown platforms like Vinted proliferating on a large scale, what exactly does the secondhand eCommerce market in Europe look like?

Generalist Marketplaces: A Wide Assortment

Probably the best known, as well as one of the oldest online auction sites, is eBay. Despite receding marketplace activity (measured in GMV), the U.S.-based company was still the undisputed leader of secondhand eCommerce platforms in 2023.

Its US$30.6 billion in GMV on the European market supports this notion:

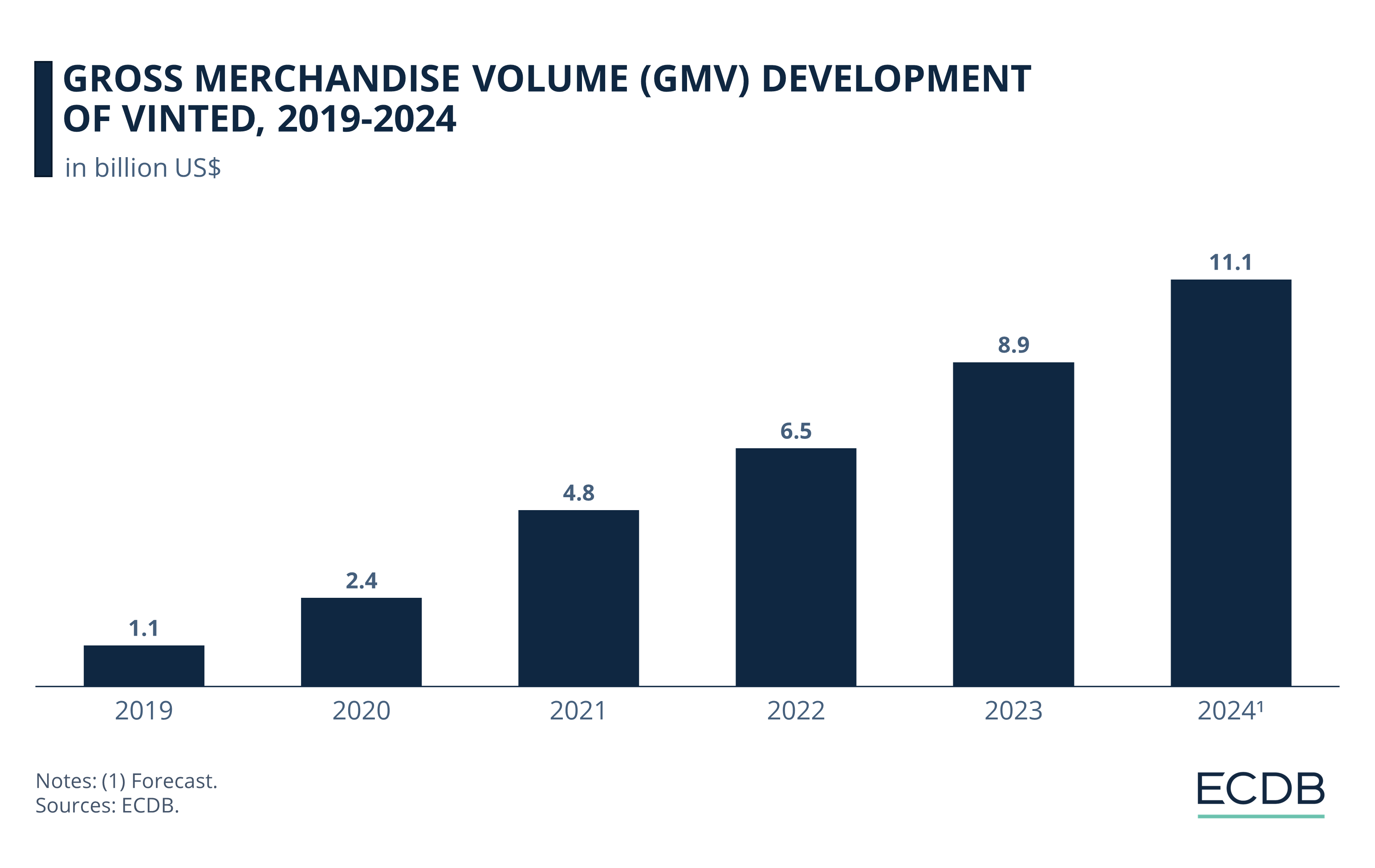

But a European competitor is threatening to challenge eBay’s dominance in the foreseeable future: Vinted. The Lithuanian company managed to maintain positive growth over the past years, exceeding US$1 billion in GMV by 2019 to approach US$9 billion just four years later, in 2023.

See the specifics in the dedicated chart:

Note that Vinted’s 2023 GMV is different here from the previous chart, which focused on Vinted’s GMV in Europe. This one here depicts Vinted’s global GMV, where a small share is also generated in the U.S. By 2024, ECDB analysts expect Vinted to increase its GMV by a little more than one quarter (25.6%) annually, reaching US$11.1 billion.

What explains Vinted’s steep ascension over the past few years? Clearly, the pandemic was a common occasion for many to declutter their wardrobes and shelves, leading to a surge in sellers and increasing demand. But after the pandemic, Vinted’s marketplace activity continued to grow.

One of the reasons for Vinted’s success can be found in the site’s social networking aspects. Users can come into contact with each other, share styling tips and discuss prices of offered products.

The platform makes money by charging buyers a fee for each item purchased, and in turn it provides buyer protection and returns for products that are different from their description on the platform.

Fashion Marketplaces: Offering Environmentally Conscious Styles

For fashion enthusiasts, platforms like Vestiaire Collective and Depop are reshaping the way we think about used clothing.

While overall, fashion is an obvious category for secondhand, and one of the major categories sold on the previously introduced platforms, Vinted and eBay, Vestiaire Collective and Depop exclusively sell pre-owned fashion. Vestiare Collective generated a GMV of US$168 million in Europe in 2023, while Depop generated US$315 million.

Vestiaire Collective offers a curated selection of high-end pre-owned fashion items, while ensuring authenticity and quality. Depop, popular among the younger crowd, serves as a hybrid of a social media platform and a sales outlet, where users can follow popular sellers and trends.

Antique and Collectible Marketplaces: Ruby Lane and 1stDibs

Antiques, like vintage accessories or furniture, are not as mainstream as fashion, but there are marketplaces that connect buyers and sellers.

Two typical eCommerce marketplaces for antique products are Ruby Lane and 1stDibs. Responding to the more niche character of the product assortment itself, GMV for Ruby Lane and 1stDibs is a little lower than what the other platforms generate. In Europe, products worth US$5.2 million were sold on Ruby Lane in 2023, while it was around US$76 million on 1stDibs.

Especially noteworthy are the safeguards implemented by platforms to ensure that antique sellers and stores are certified and that the catalog encompasses authentically vintage pieces.

Security measures for buyer protection and to ensure products are functioning are also important for the next product category.

Electronics & Media Marketplaces: Selling Refurbished Items

Two factors contribute to the popularity of reCommerce for electronics: The demand for affordable technology and the growing disapproval of electronic waste for products that are still good to use. However, the underlying business structure varies.

For instance, Back Market, a leading electronics marketplace with a 2023 GMV of over US$1.6 billion in Europe, operates as follows: Back Market manages a network of repair shops across its target markets, where sellers send their used products. After refurbishment, products are offered to customers and eventually resold. Basically, Back Market provides the intermediary platform for repair shops to offer the electronics to consumers.

Other marketplaces, like Refurbed with a European GMV of US$618 million in 2023, use the same business model of connecting refurbishment companies with consumers. In this way, the marketplace provider (in this case Refurbed) saves warehousing costs and can ensure a more seamless forwarding of products, which reach customers directly from repair stores.

But there is also the case in which online retailers buy the products before forwarding them to consumers. Let’s have a look.

Online Stores Selling Used Electronics & Media

Instead of a marketplace model whereby platforms act as intermediaries, there is also the option to buy used products and re-sell them.

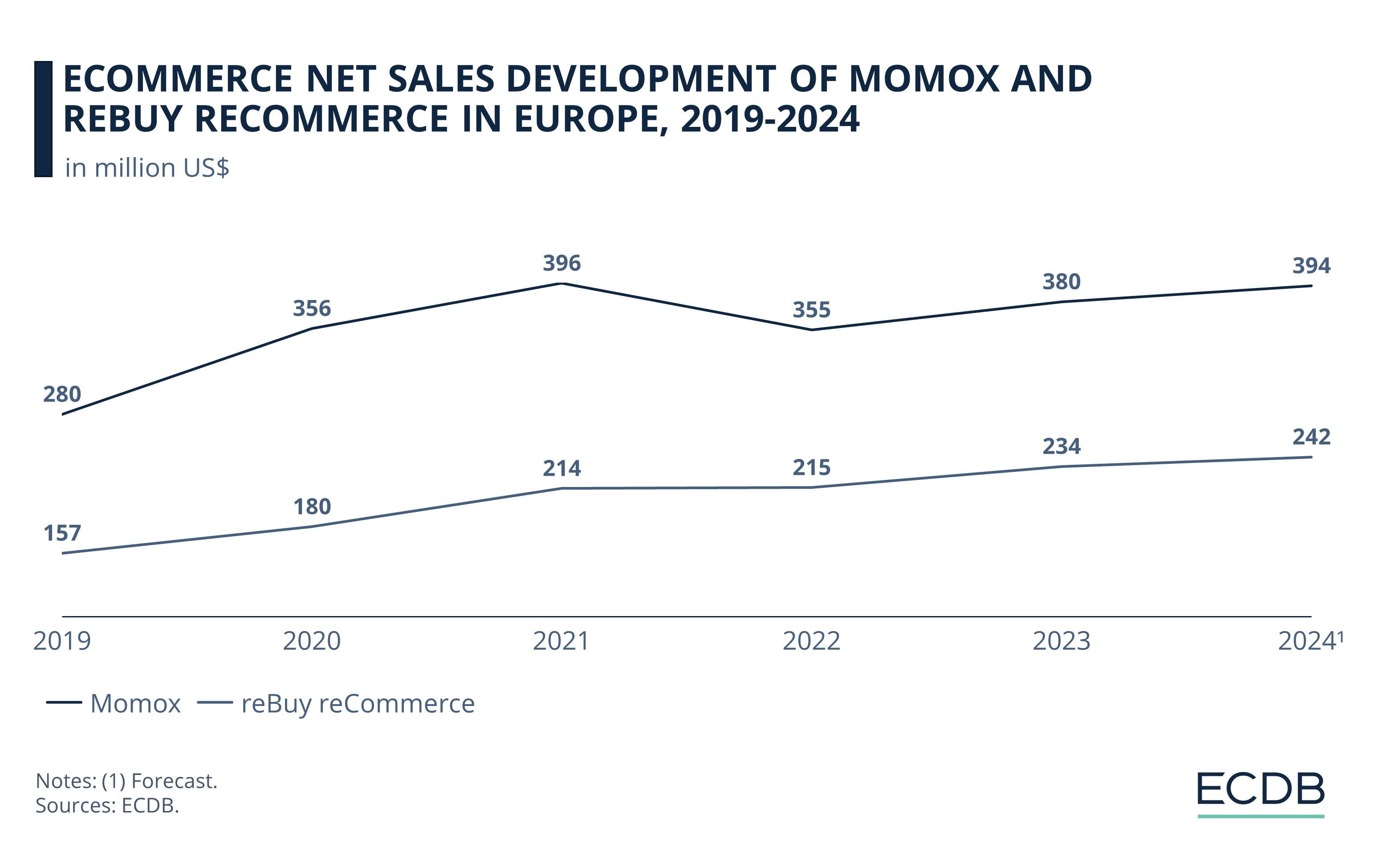

Popular European providers selling electronics and media this way are Momox and reBuy reCommerce.

Both platforms managed to overcome the post-pandemic slump in net sales rather quickly.

Nevertheless, there is a distinction between these platforms, not in the least marked by varying net sales. Momox sells a wider range of products and reBuy reCommerce focuses on media like books, video games, CDs and DVDs. Visible on Momox’ respective ECDB Store Page, more than one third of its assortment consists of media products (78.4%), while the rest is fashion products with 21.6%.

Resellers conduct quality control upon receiving products. Unlike platforms that connect buyers and sellers, retailers such as Momox act directly as the seller.

Be careful though: For individual sellers who send their used goods to resale sites such as Momox, be sure to provide the seller with proof of shipment. A personal sales test at ECDB revealed that the most expensive product in the package was conveniently "not found" upon arrival.

Customer reviews tell a similar story: In some instances, the use of quality control appears to be an excuse to receive items free of charge.

Are resale sites taking advantage of the current secondhand trend to make easy money on the backs of unsuspecting customers and private sellers? What is clear is that the spatial distribution of internal tasks makes it difficult to resolve consumer issues.

For individual sellers considering to sell their products on resale platforms, it is best to check customer reviews of the companies in question.

ReCommerce in Europe: Closing Thoughts

Whatever the business model looks like, secondhand initiatives are on the rise. With increasing success of incumbents, new platforms with similar or adapted strategies will follow, further contributing to this burgeoning market.

Stay Competitive: Our constantly updated rankings provide you with the latest insights to improve your business strategy. Discover which stores and companies are at the top of the eCommerce world and which categories are driving the highest sales. Dive into our rankings for companies, stores, and marketplaces. Stay a step ahead in the market with ECDB.

Sources: Business Adobe – EU-Startups – Reboundstuff – Redbull – Vogue

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Top Categories for Online Shopping in Spain: Food and Beverages Lead

Top Categories for Online Shopping in Spain: Food and Beverages Lead

Deep Dive

Top Amazon Competitors in the UK: GMV, Market Share & Growth

Top Amazon Competitors in the UK: GMV, Market Share & Growth

Deep Dive

eCommerce in Australia: Market Expected to Hit US$75.2 Billion by 2028

eCommerce in Australia: Market Expected to Hit US$75.2 Billion by 2028

Deep Dive

Which Product Categories Are Growing The Fastest in Global eCommerce?

Which Product Categories Are Growing The Fastest in Global eCommerce?

Deep Dive

Most Profitable Amazon Categories 2024: Which Products Are Most Lucrative?

Most Profitable Amazon Categories 2024: Which Products Are Most Lucrative?

Back to main topics