eCommerce: Holiday Shopping

Holiday Shopping Season Trends 2024: Mobile Takes Over Desktop

More and more people are using their mobile phones to shop online. How does this play out during the holiday season? ECDB provides data driven insights.

Article by Cihan Uzunoglu | September 03, 2024Download

Coming soon

Share

Holiday Shopping Season Trends 2024: Key Insights

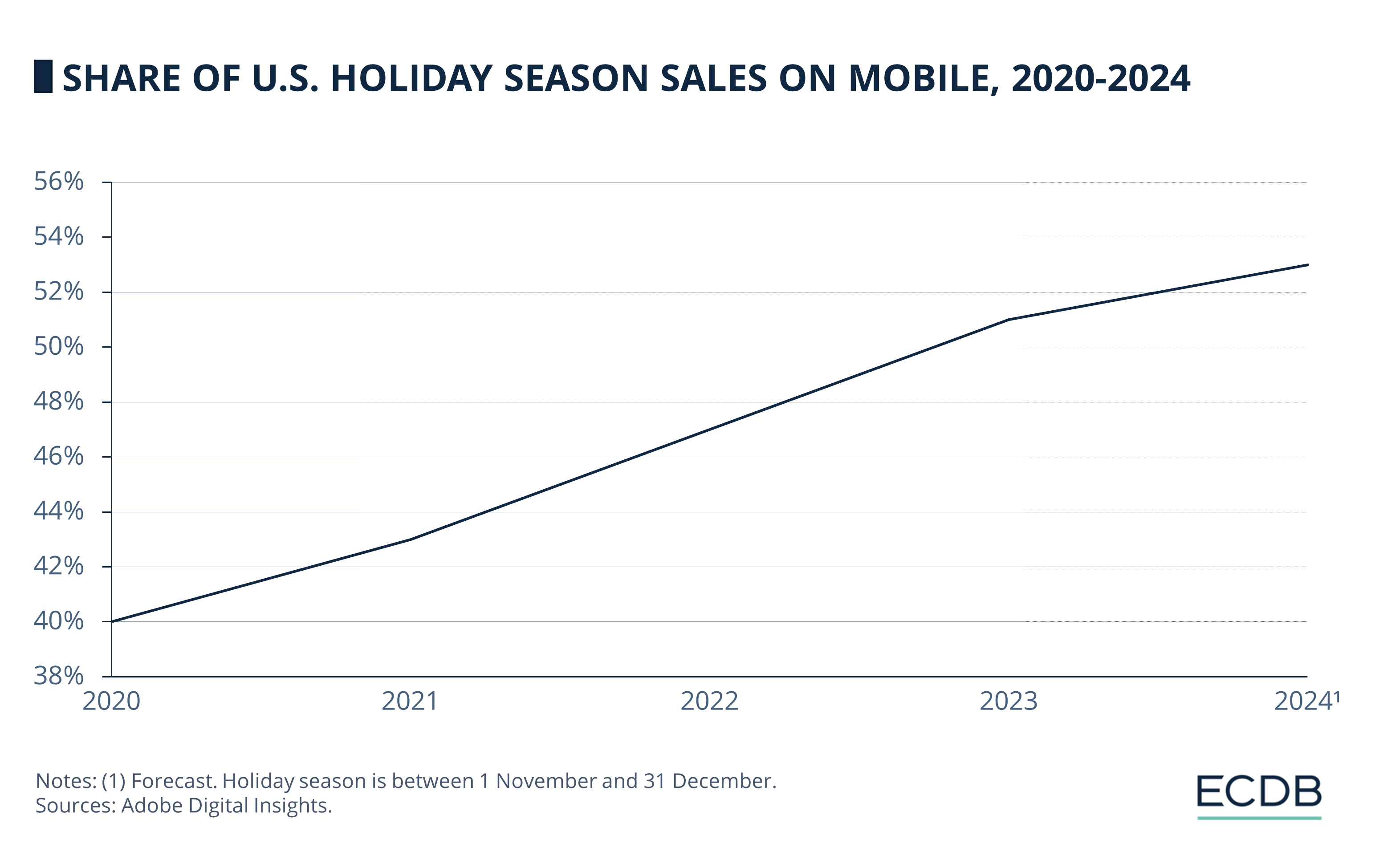

Mobile Dominance and Promotional Events: The majority (53%) of online sales are expected to occur on mobile devices during the 2024 holiday season, with significant boosts from events like Prime Day and Cyber Monday.

Top Categories for Mobile Sales: Groceries, personal care, and apparel are leading the mobile shopping surge, with 68-77% of their sales via mobile devices.

Desktop for Big Purchases: Despite mobile's rise, consumers still favor desktops for high-value items like electronics and home improvement.

Mobile Basket Size: Although mobile shopping is growing rapidly, the average basket size on mobile remains 32% smaller than on desktop.

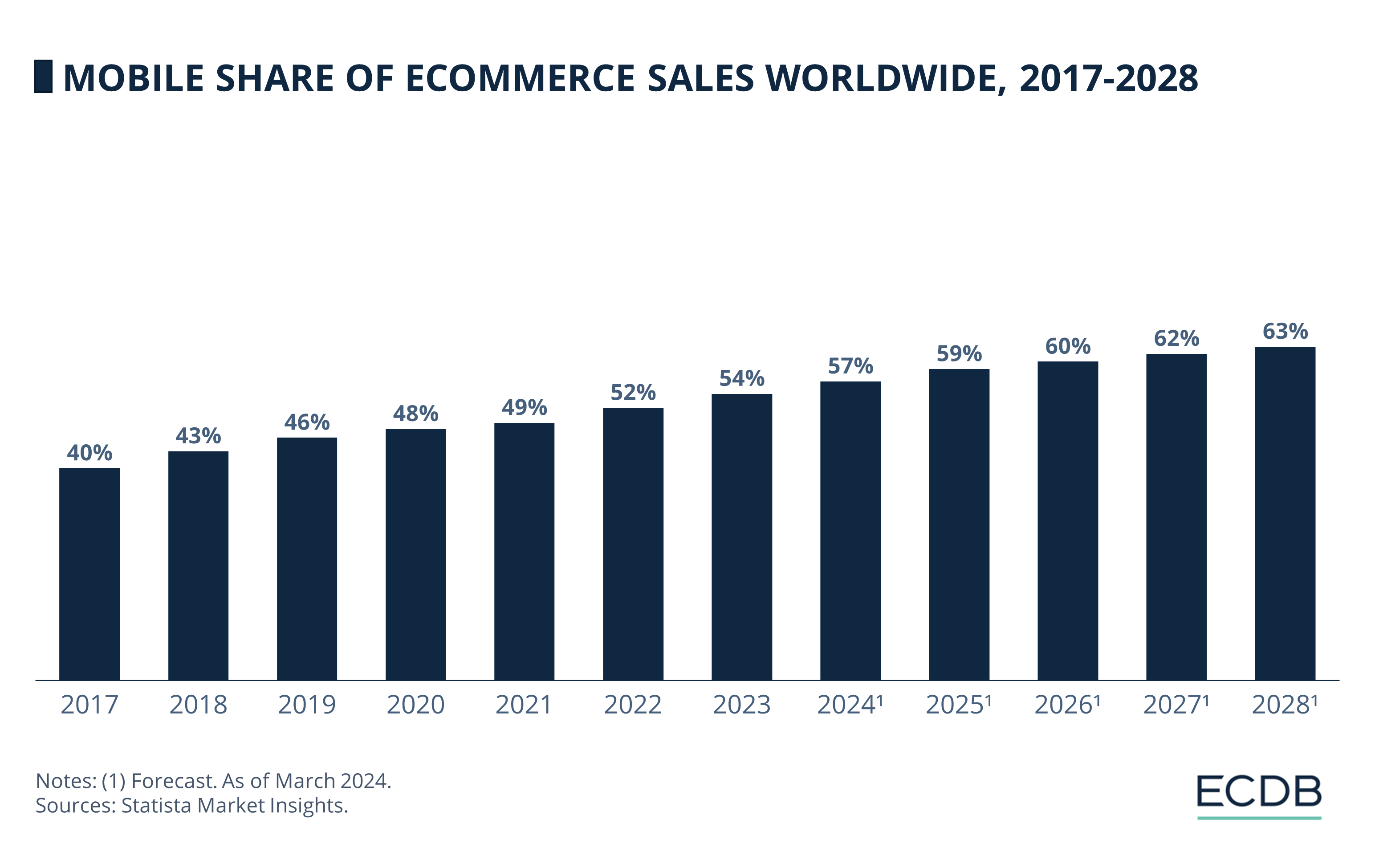

Mobile shopping is no longer just a growing trend – it’s a market standard, particularly as we head into the 2024 holiday season.

Recent data from Adobe Analytics and other sources show that mobile devices are rapidly becoming the primary mode of online purchasing. What are the consequences and how can businesses take control and ride the wave?

Holiday Shopping Season: Mobile Shopping Becomes More Popular

The transition from desktop to mobile shopping has been happening, but 2024 is expected to mark a decisive tipping point:

Adobe Analytics predicts that during this year’s holiday season, 53% of online sales will be conducted via mobile devices.

To put this in perspective, mobile devices accounted for around 40% of online holiday sales in 2020.

This number grew steadily over the following years, with mobile overtaking desktop for the first time during the 2023 holiday season, when it captured 51% of online sales.

The current trajectory suggests that this trend is not just seasonal but will continue to intensify, with mobile expected to grow well into 2025 and beyond.

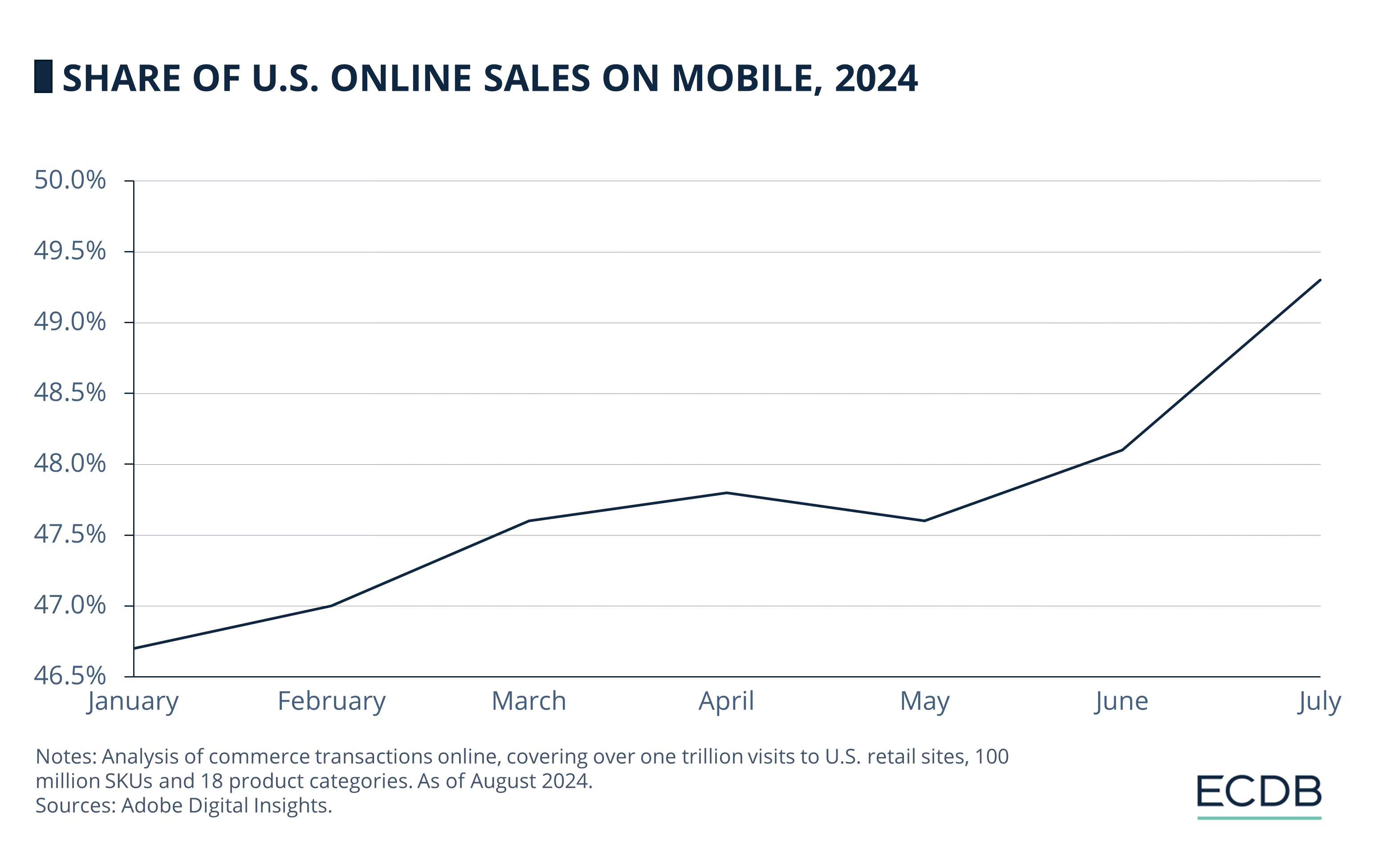

Looking at this year alone, the first half of 2024 provides further evidence of this shift:

Between January and July, mobile sales comprised nearly 48% of all online sales.

This amounts to US$280.4 billion – an impressive 10.2% year-over-year increase.

Shopping Days Fuel Mobile Growth

One of the key drivers behind the popularity of mobile shopping is the increasing importance of promotional events. Sales events such as Amazon’s Prime Day, Fourth of July, and Memorial Day have consistently shown higher mobile engagement compared to desktop.

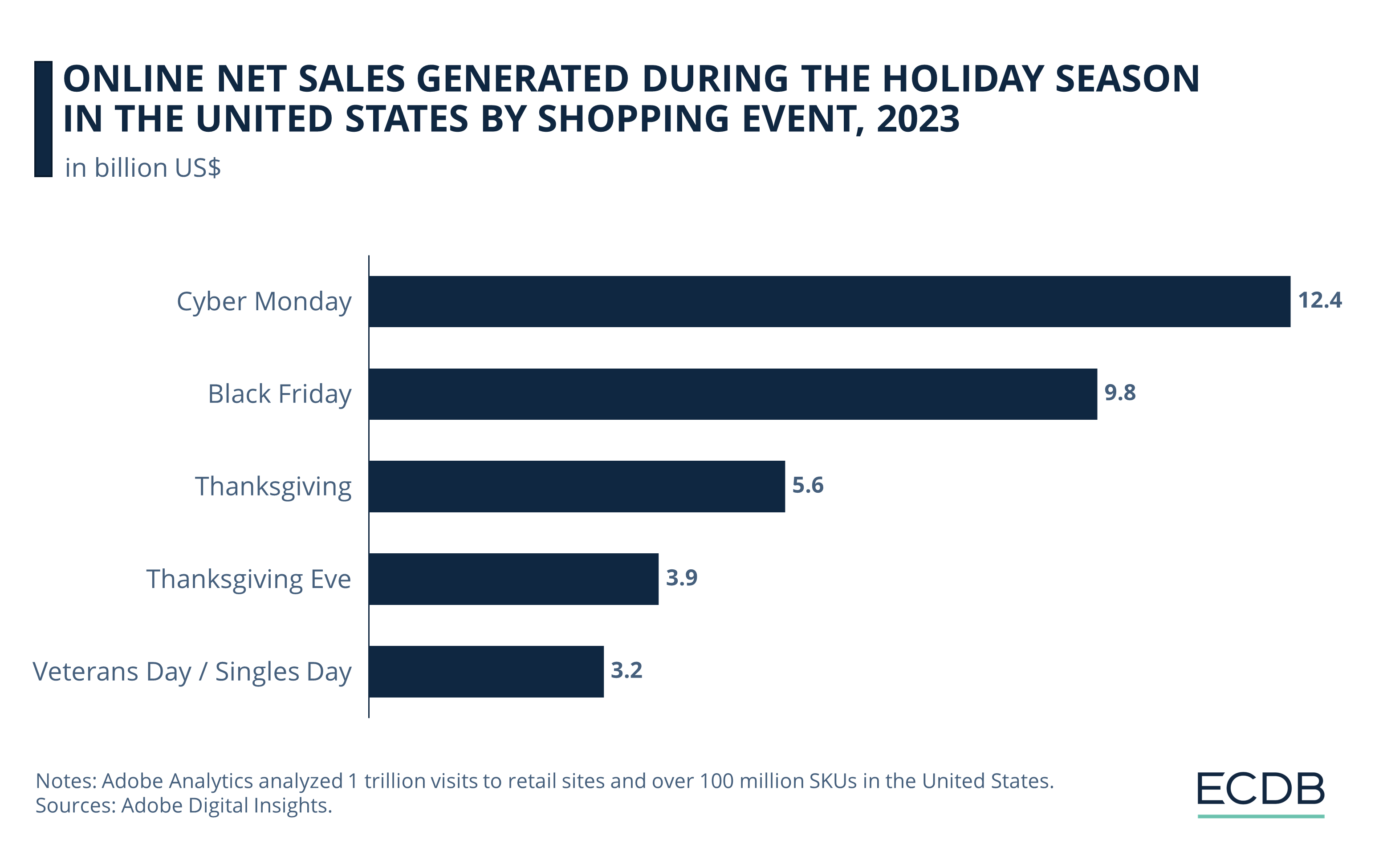

In last year’s holiday season, Cyber Monday was the top shopping event that brought the largest net sales (US$12.4 billion) in the United States. Black Friday followed with almost US$10 billion, but Thanksgiving (close to US$10 billion with Thanksgiving Eve included) and Veterans/Singles Day (US$3.2 billion) also scored significant amounts.

During these events in 2024, mobile devices accounted for an average of 51% of online sales. This pattern suggests that consumers are more likely to shop on their phones when time-sensitive deals are on offer, taking advantage of the immediacy and convenience that mobile shopping provides.

Why Is Mobile More Preferred?

The growth in mobile shopping during these events can be attributed to several factors:

First, mobile wallets and improved checkout processes have made mobile shopping quicker and more seamless.

This reduces the friction that once deterred users from completing purchases on their phones.

Additionally, the integration of shopping features within social media platforms has played a crucial role, with brands leveraging social commerce to drive sales directly through mobile apps.

Top Products in Mobile Shopping

Certain product categories have shown particularly strong adoption of mobile shopping. Groceries, personal care, and apparel are leading the charge in this regard.

In July 2024, 68.2% of online grocery sales were made through mobile devices. This trend is even more pronounced in the personal care category, which includes cosmetics. In the same month, a staggering 77% of online sales in this category were made via mobile devices. Apparel also saw a strong mobile presence, with 60.8% of sales happening on mobile.

Why Some Products Sell Better on Mobile?

The reasons for this dominance in certain categories are multifaceted:

Personal care items, for instance, are typically lower in price and are often purchased on a recurring basis, making them ideal for quick mobile transactions.

Moreover, the rise of influencers on social media platforms has further boosted mobile sales in categories like cosmetics and apparel.

Although Adobe reports that influencer-driven traffic accounts for only about 3% of overall sales in personal care, this figure represents a significant increase and underscores the growing influence of social media on mobile shopping behaviors.

Old Habits Die Hard: Desktop Still Popular

for Big Purchases

While mobile shopping is gaining popularity, desktop still holds sway in certain categories, particularly those involving higher-priced items.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

For example, mobile accounts for only a third (33.3%) of online sales in the home improvement category and a fifth (21.3%) in electronics. These categories have seen relatively little growth in mobile adoption since 2019, suggesting that consumers remain more comfortable making larger purchases on devices that offer a more robust browsing experience.

Several factors contribute to this hesitation to shop for big-ticket items on mobile:

First, the user experience on desktop is often superior, with larger screens providing a better view of product details and easier navigation through complex websites.

Additionally, many consumers still perceive desktops as more secure and reliable for making significant purchases.

This presents a challenge for mobile commerce, as retailers must find ways to build consumer confidence in mobile platforms for higher-value transactions.

Closing the Mobile Basket Gap

While mobile shopping is becoming more popular, there are still areas where desktop outperforms, particularly in terms of basket size – the total value of items purchased in a single transaction.

Adobe reports that basket sizes on mobile are typically 32% smaller than on desktop, indicating that consumers tend to make smaller, more frequent purchases on their phones. This presents both a challenge and an opportunity for retailers. To close the gap in basket size, retailers need to focus on refining the mobile shopping experience:

This could involve improving site navigation and offering better product recommendations.

Enhancing the overall user interface is a good idea to make it easier for consumers to find and purchase multiple items in a single session.

Additionally, offering incentives such as discounts for larger mobile purchases could encourage consumers to spend more when shopping on their phones.

Retailers with significant resources, such as Walmart and Target, have already begun investing heavily in mobile commerce technologies. These investments are paying off, with large retailers (defined as those with US$1 billion or more in annual revenue) seeing mobile capture 52.8% of their online sales on average.

This contrasts with smaller retailers, where mobile accounts for just 43% of sales. For these smaller businesses, focusing on mobile optimization could be a key strategy for growth, particularly as mobile tends to drive more impulse purchases.

Holiday Shopping Season Trends 2024:

Final Thoughts

As mobile continues to dominate the eCommerce space, it’s clear that a mobile-first strategy is no longer optional for retailers – it’s essential. The upcoming holiday season, with mobile predicted to account for 53% of online sales, will likely be a litmus test for how well retailers can adapt to this new reality.

For larger retailers, the focus will be on maintaining their lead by continuing to innovate in the mobile space. This could include expanding mobile app features, improving the integration of Artificial Intelligence and personalization tools, and leveraging data analytics to better understand consumer behavior on mobile platforms.

Smaller retailers, on the other hand, have a significant opportunity to close the gap with their larger counterparts by embracing mobile-first strategies. By optimizing their mobile sites, improving the mobile checkout process, and leveraging social media to drive traffic, these businesses can capitalize on the growing trend of mobile shopping and drive revenue growth.

Sources: Retail Dive, Fibre2Fashion, WWD, Fast Company, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics