eCommerce: DIY & Home Improvement

Top Online DIY & Home Improvement Stores in the United States

Discover the top online DIY and home improvement stores in the U.S., uncovering market leaders, key trends, and sustainable practices driving personalized projects.

Article by Cihan Uzunoglu | June 26, 2024Download

Coming soon

Share

Top Online DIY & Home Improvement Stores in

the United States: Key Insights

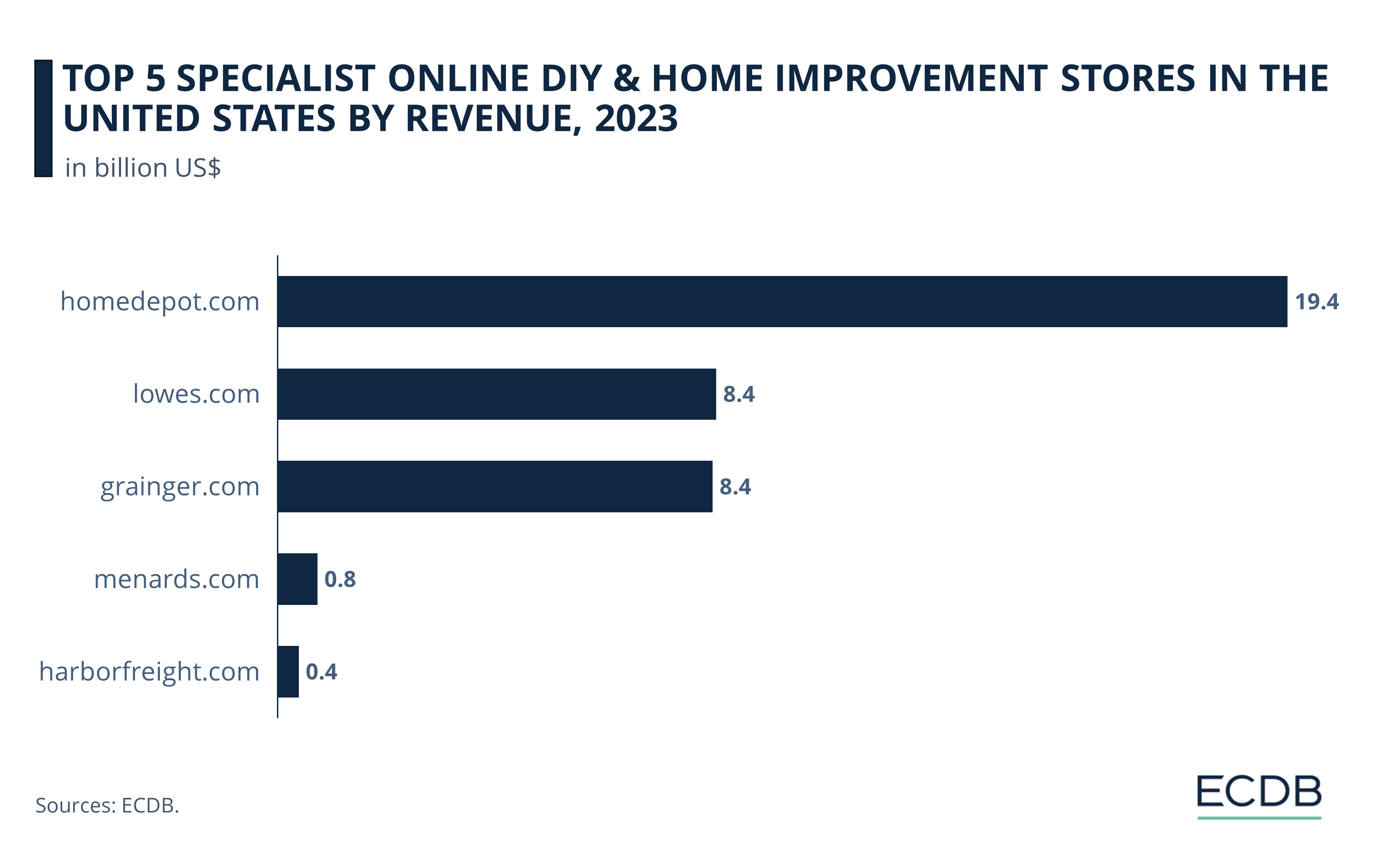

Market Leaders: Home Depot dominates the U.S. online DIY and home improvement market with nearly US$20 billion in revenue, far ahead of competitors, while Lowe's and Grainger are relatively close rivals, each earning over US$8 billion.

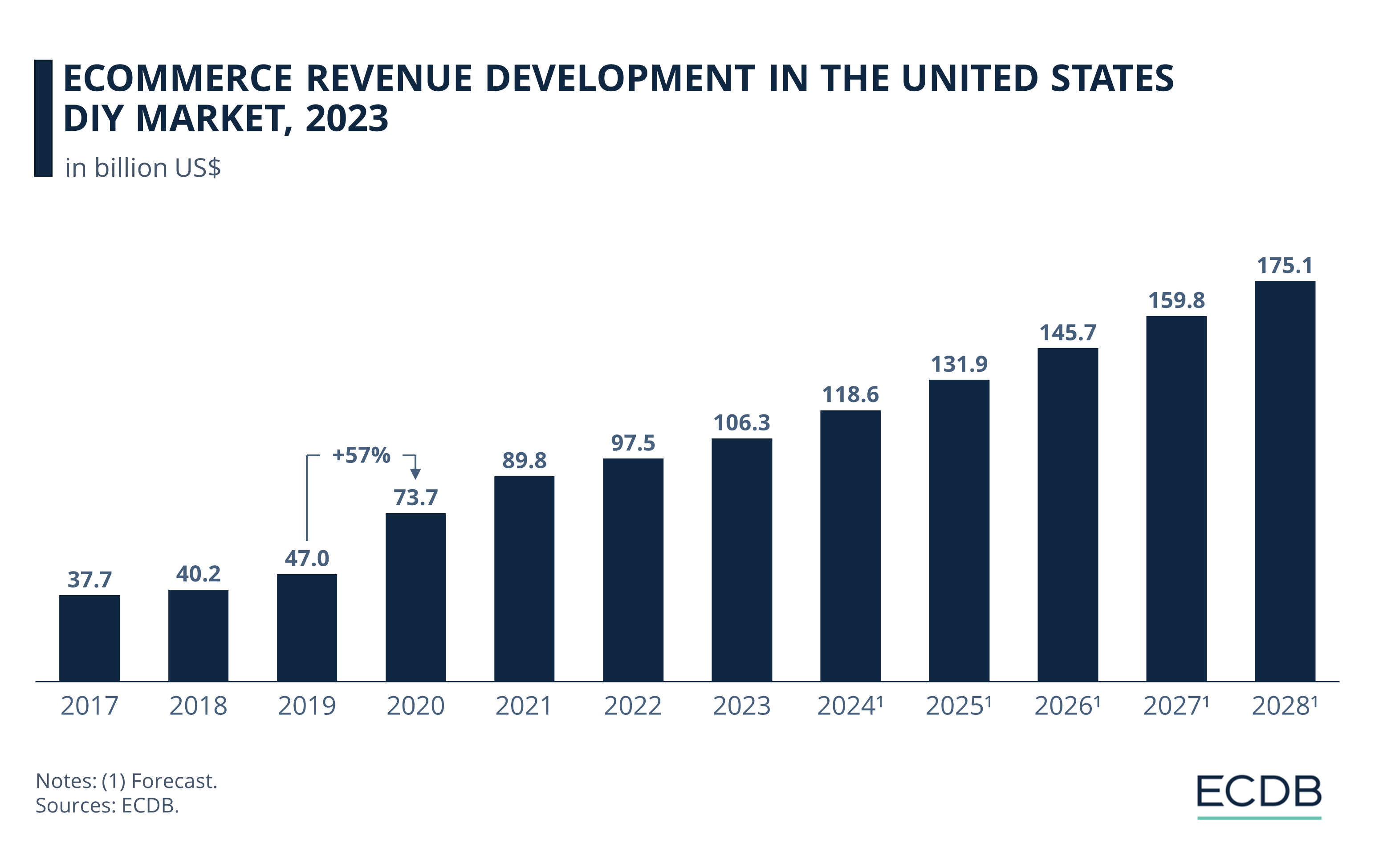

Revenue Growth: The U.S. DIY market saw eCommerce revenue grow from US$37 billion in 2017 to US$106 billion last year, with a significant spike in 2020, and is expected to continue rising to US$175 billion by 2028.

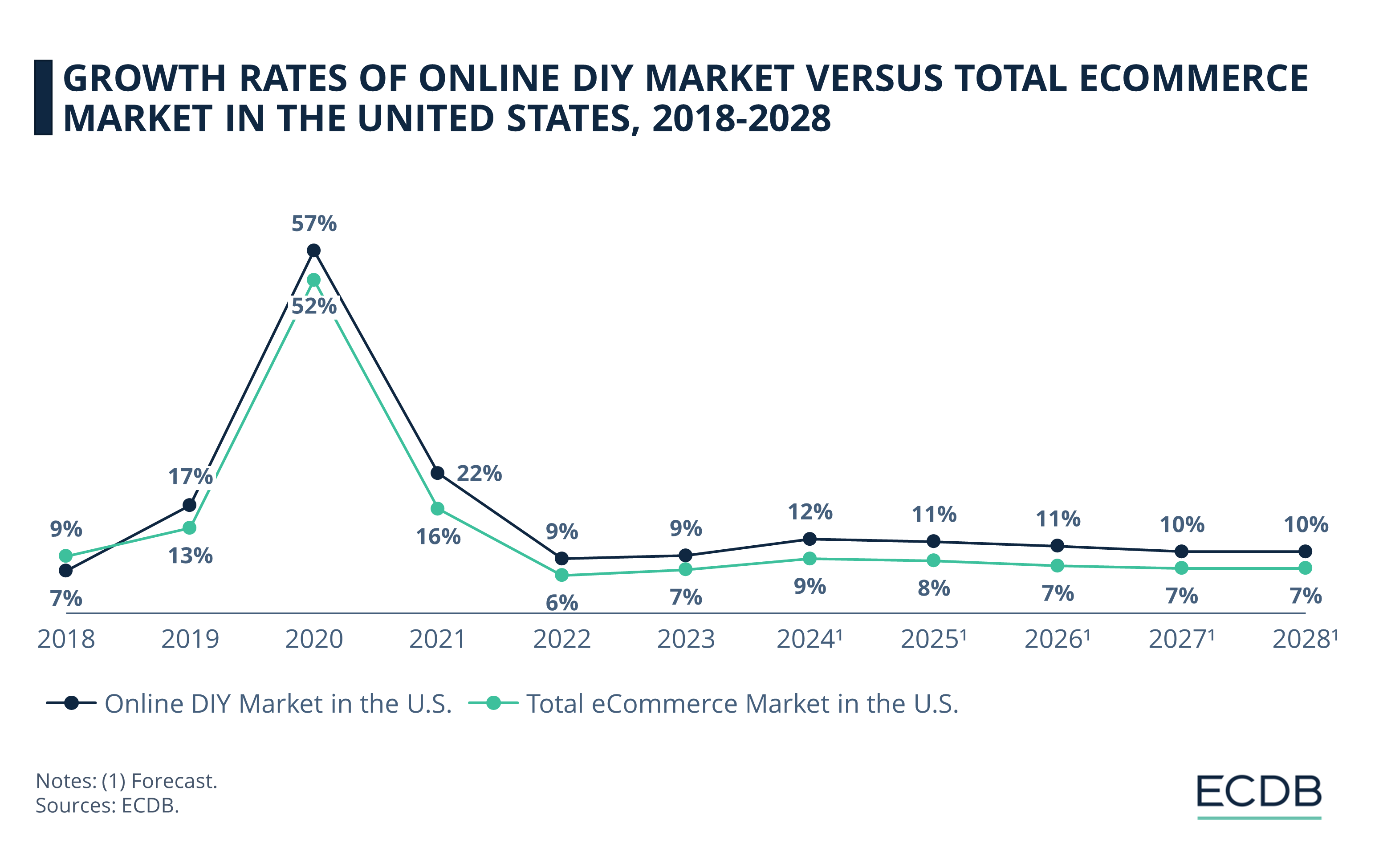

Outpacing eCommerce: The online DIY market in the U.S. has consistently outpaced total eCommerce growth over the past decade, with significant spikes, such as a 57% growth in 2020 compared to the eCommerce market's 52%.

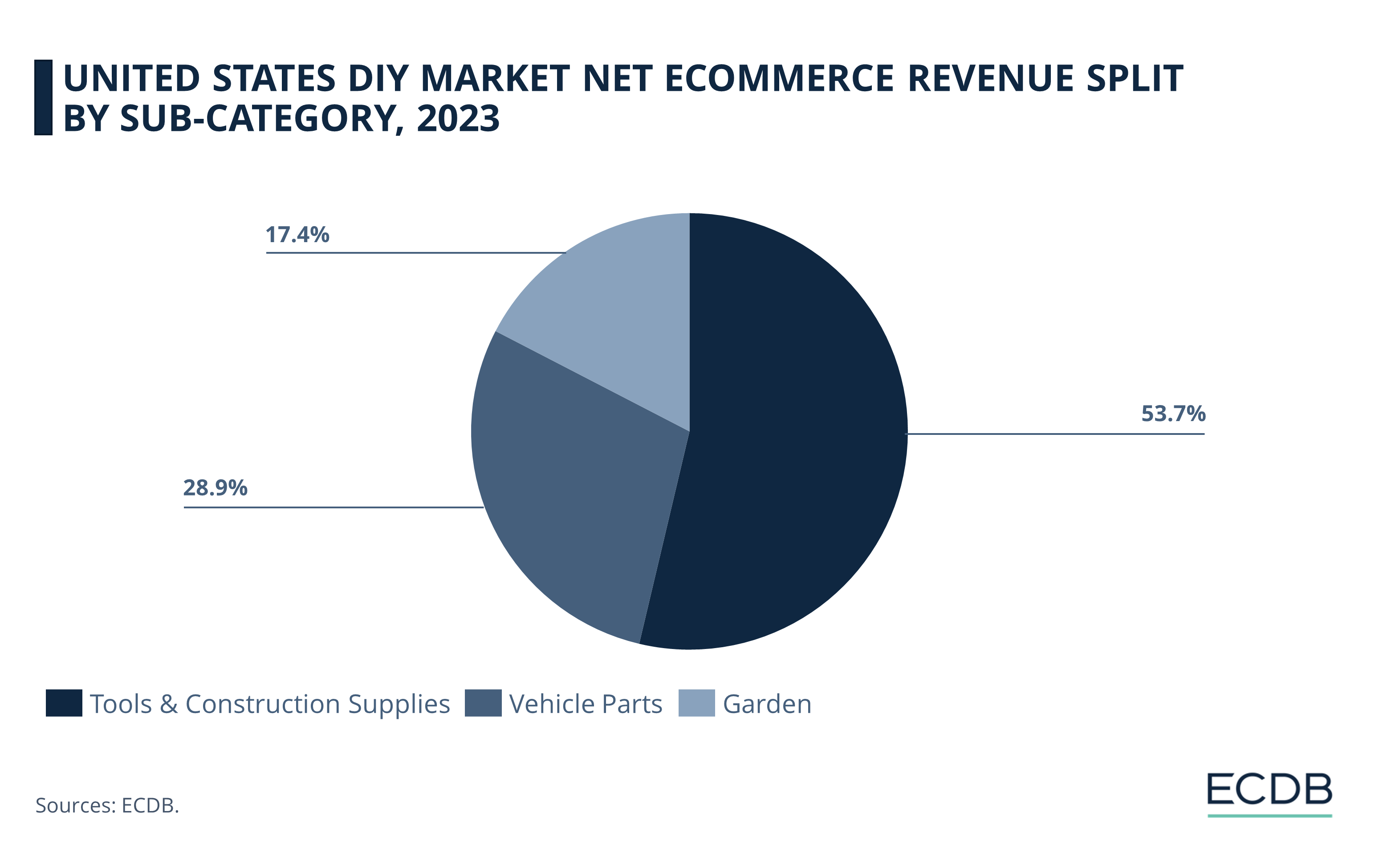

Category Breakdown: In 2023, tools and construction supplies dominated the U.S. DIY market, accounting for 53.7% of eCommerce revenue, followed by vehicle parts at 28.9% and garden supplies at 17.4%.

Transforming your home without professional help is now easier and more cost-effective than ever. The online DIY & home improvement market has been gaining popularity, allowing homeowners to personalize their spaces with ease. From custom shelves to garden revamps, the market offers endless possibilities.

Who dominates this growing market, and what sets these leaders apart? How do trends influence the future of DIY? Let's explore the top online DIY and home improvement stores in the U.S. to see what makes them unique and how they shape the market.

What is DIY?

Talking about the DIY (Do-it-yourself) market, we're referring to a comprehensive category that includes a wide selection of products aimed at improving and personalizing your living or working space.

This category encompasses essential items for garden maintenance (such as plants, fertilizers, shovels, and lawn mowers), vehicle parts (including car tires, car parts, and motorcycle parts), and tools and construction supplies (like hammers, screwdrivers, nails, faucets, lumber, paints, and laminate).

It's important to note that online stores focused solely on stationery, crafts & art supplies, gardening services, or vehicle repair services do not fall within this market definition.

Top Online DIY & Home Improvement Stores in the U.S: Home Depot Leads

When looking for DIY and home improvement products online, a few major players dominate the market. These stores not only offer a vast array of products but also stand out due to their impressive revenue figures.

Below are the top 5 specialist online stores in the U.S. DIY & home improvement market:

1. Homedepot.com

Home Depot, a giant in the online DIY and home improvement market, reported a substantial revenue of nearly US$20 billion in 2023. This impressive figure outpaces all competition by far, underscoring the leading online store’s position.

Recently, Home Depot has launched several initiatives to maintain its market leadership and adapt to changing consumer needs. In August 2023, the company introduced the New Homeowners Hub, designed to support millennials and first-time homeowners. This online platform provides a range of DIY guides, product recommendations, and design inspiration to help new homeowners tackle their home improvement projects with confidence.

Additionally, Home Depot announced the creation of Home Depot Ventures, a US$150 million venture capital fund, in May 2022. This fund is aimed at fostering innovation in retail and home improvement by investing in early-stage companies that promise to enhance customer experiences and develop new capabilities for Home Depot.

2. Lowes.com

Despite a slight decline in growth, Lowe's ended last year with strong eCommerce sales of US$8.42 billion. In addition, the company reported a decline in total sales to US$21.4 billion in the first quarter of 2024, down from US$22.3 billion in the prior year, indicating a 4.1% decline in comparable sales.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

The company has been preparing for a potential slowdown in 2023 due to factors such as a cooling housing market and rising mortgage rates. Despite these challenges, Lowe's remains focused on enhancing its omnichannel shopping experience and improving customer conversion rates through strategic initiatives such as launching Apple Pay and revamping its delivery model for bulky items.

3. Grainger.com

Grainger, a significant player in the online DIY and home improvement market, recorded substantial online sales in 2023, totaling US$8.35 billion.

Buoyed by the rising demand for ready-to-assemble furniture and custom-designed items that suit bespoke interiors, these trends align well with Grainger's offerings aimed at both amateur DIY enthusiasts and professional contractors seeking quality tools and materials.

Additionally, the broader home improvement sector is experiencing a shift toward eCommerce, with an increasing number of consumers opting to purchase their DIY supplies online. This movement favors well-established online retailers like Grainger, which are equipped to meet this growing demand through their comprehensive online catalog and resources.

4. Menards.com

With its distinctive Midwest charm and focus on cost savings through mail-in rebates, Menards reported US$775 million in online sales in 2023.

The online store sets itself apart from other online home improvement stores by emphasizing its unique mail-in rebate system, which offers substantial savings across a wide range of products. This approach not only distinguishes Menards in terms of pricing strategy but also encourages customer loyalty and repeat purchases.

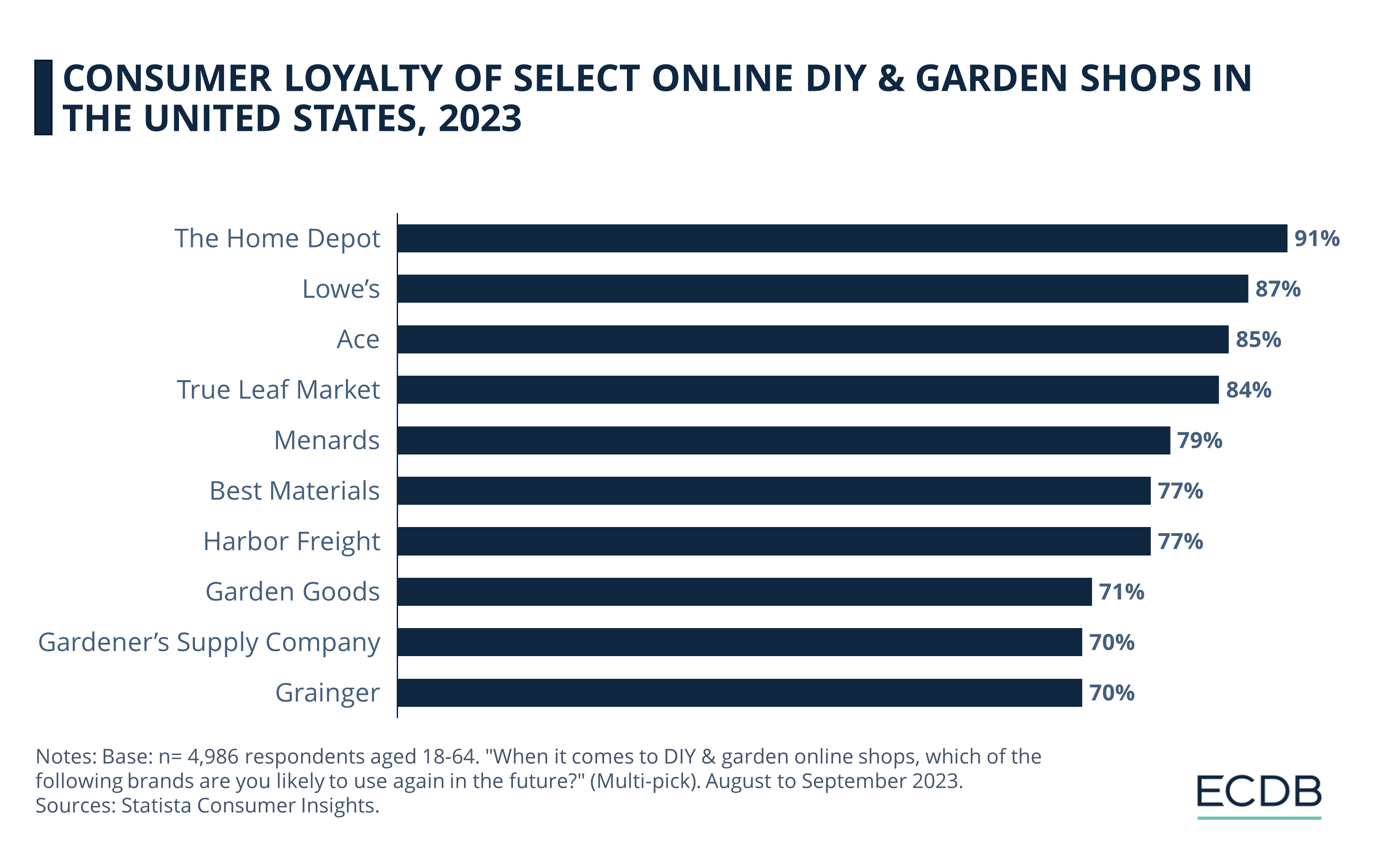

According to Statista data, Home Depot is the top online DIY & garden shop when it comes to consumer loyalty in the U.S. Lowe's follows in second place, while Menards, Harbor Freight, and Grainger are further down the list.

Additionally, unlike its competitors, Menards does not offer installation services, instead directing customers to local service providers. This policy positions Menards as a retailer rather than a competitor to the contractors and professionals who shop for supplies at its stores.

5. Harborfreight.com

Harbor Freight Tools, recognized for its extensive range of tools, reported online sales of US$413 million in 2023. Recently, Harbor Freight Tools introduced a Commercial Credit Card in partnership with TreviPay. This card offers B2B credit with features like net terms invoicing and purchase tracking, catering specifically to business and institutional customers.

This initiative reflects Harbor Freight's commitment to enhancing B2B customer engagement and simplifying business transactions, indicating a strategic expansion beyond their traditional consumer base to more tailored commercial services.

Online DIY & Home Improvement Market

in the United States: Nearly 60% Growth in 2020

The U.S. DIY market has shown remarkable growth in eCommerce revenue over the years.

From US$37.7 billion in 2017, the market expanded steadily, reaching US$106.28 billion by 2023. The pandemic year, 2020, marked a significant jump to US$73.67 billion from US$46.97 billion in 2019, highlighting a surge in DIY activities during lockdowns.

Future forecasts remain optimistic, with projections indicating a rise to US$118.61 billion in 2024, reaching up to US$175.1 billion by 2028.

Market Expansion Surpasses Overall

U.S. eCommerce Growth

The online DIY market in the U.S. has shown higher growth trends when compared to the total eCommerce market over the past decade.

In 2018, the online DIY market grew by 7%, slightly underperforming against the eCommerce market's 9% growth rate. However, from 2019 onwards, the DIY market consistently outpaced the total eCommerce growth. A significant spike occurred in 2020, with the DIY market soaring to a 57% growth rate, outstripping the eCommerce market's 52% due to a surge in home improvement projects during the pandemic.

This trend continued robustly; by 2023, both markets showed growth at 9% for DIY and 7% for total eCommerce. Projections from 2024 to 2028 indicate that the online DIY market will continue to outperform the total eCommerce market, with an estimated steady growth rate around 10% to 12% for DIY compared to a consistent 7% to 9% in the total eCommerce sector.

Majority of the Market Comprised of

Tools and Construction Supplies

In 2023, the U.S. DIY market showcased a notable division in net eCommerce revenue across its various sub-categories. Accounting for 53.7% of the total eCommerce revenue, tools and construction supplies dominated the market.

Vehicle parts also held a substantial portion of the market with 28.9% of the revenue, underscoring the increasing trend of consumers taking on vehicle maintenance and enhancements themselves. Garden supplies, including tools and outdoor decor, contributed to 17.4% of the market revenue.

Online DIY & Home Improvement Market in the United States: Final Thoughts

The DIY and home improvement market is expanding due to rising homeownership, a strong DIY culture, and increased renovation activities. Consumers favor cost-effective DIY solutions, supported by online resources. Customization trends and social media influence are also key drivers here.

Digital platforms revolutionize shopping, with eCommerce becoming essential. Innovations like B2B commercial accounts, as seen with Harbor Freight, cater to diverse consumers. Despite challenges like fluctuating home sales and economic uncertainties, the long-term outlook remains positive, driven by consistent home improvement demand and evolving DIY culture.

A shift towards sustainable practices and eco-friendly products is expected, with consumers increasingly seeking green solutions for their projects. Companies that integrate these aspects will likely see higher engagement and growth. Overall, the market's adaptability and innovation promise a vibrant future for DIY home improvement.

Sources: Home Depot: 1, 2, Digital Commerce 360 : 1, 2, AlphaStreet, Mordor Intelligence, Hiri, SkyQuest, Business Insider, Yahoo Finance, PR Newswire, Forbes: 1, 2, Enterprise Apps Today, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

Top Online Do-it-Yourself (DIY) Home Improvement Retailing Market in the UK

Top Online Do-it-Yourself (DIY) Home Improvement Retailing Market in the UK

Deep Dive

Reverse Logistics: Market Development, Top Returned Product Categories, eCommerce Returns

Reverse Logistics: Market Development, Top Returned Product Categories, eCommerce Returns

Deep Dive

Top Online Garden Stores in Germany

Top Online Garden Stores in Germany

Deep Dive

What Are the Fastest Growing Product Categories in UK’s Online Market?

What Are the Fastest Growing Product Categories in UK’s Online Market?

Back to main topics