eCommerce: Tech Market

Top 10 Online Electronics Stores in the United States: Amazon Leads The Way

Where are Americans buying electronics online? We look at online sales and top store growth to analyze market dynamics.

Article by Cihan Uzunoglu | July 19, 2024Download

Coming soon

Share

Top Online Electronics Stores in the United States:

Key Insights

Top Online Retailers:

Amazon.com leads the U.S. online electronics market in 2023, with Apple.com, Walmart.com, and other major players following.

Key Developments:

Amazon partners with Shopify to enhance "Buy with Prime." Apple introduces the iPhone 15 at the "Wonderlust" event. Walmart expands into drone delivery. Best Buy faces sales challenges. Home Depot sees a decline in sales.

Delivery and Innovation:

Target boosts delivery services in Georgia with TLMD. Costco observes a shift to budget-friendly products. Wayfair reduces workforce due to economic pressures. Sam's Club enhances online shopping with AI. Lowe's launches Style Studio for improved home design.

Market Growth:

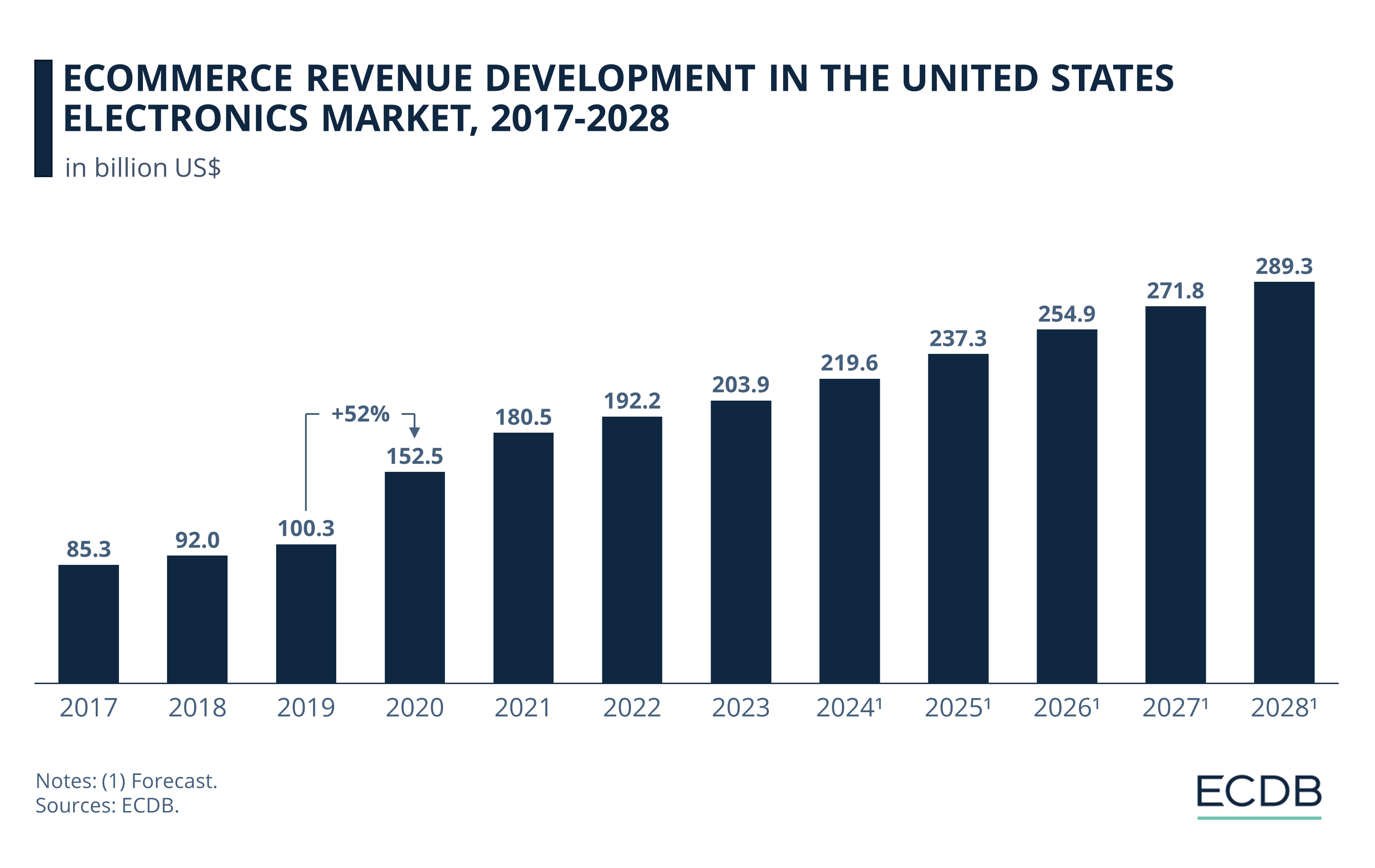

The U.S. online electronics market has seen varied growth over the past 5 years, with significant spikes during the pandemic and more moderate increases recently. It is projected to reach US$289 billion by 2028.

Much like in most places around the world, buying the latest electronic devices online has become the norm in the United States. Leading electronics websites in the U.S. not only reflect trends but often set the standard for what becomes popular in Europe.

The U.S. online electronics market is dominated by a few major players. So, where do American consumers prefer to shop for their electronic gadgets? And which sites are leading the way? Our data provides insights into these questions.

What is Online Electronics Market?

As per our definition, the online electronics category includes consumer electronics (e.g., computers, smartphones, TVs, headphones, game consoles) and electrical appliances (e.g., refrigerators, washing machines, vacuum cleaners, coffee machines, hair dryers, electric toothbrushes) sold through digital channels.

We exclude online stores focused on mobile contracts, tariffs, setup and installation services, or software.

Top Online Electronics Stores in the U.S: Amazon Leads by Far

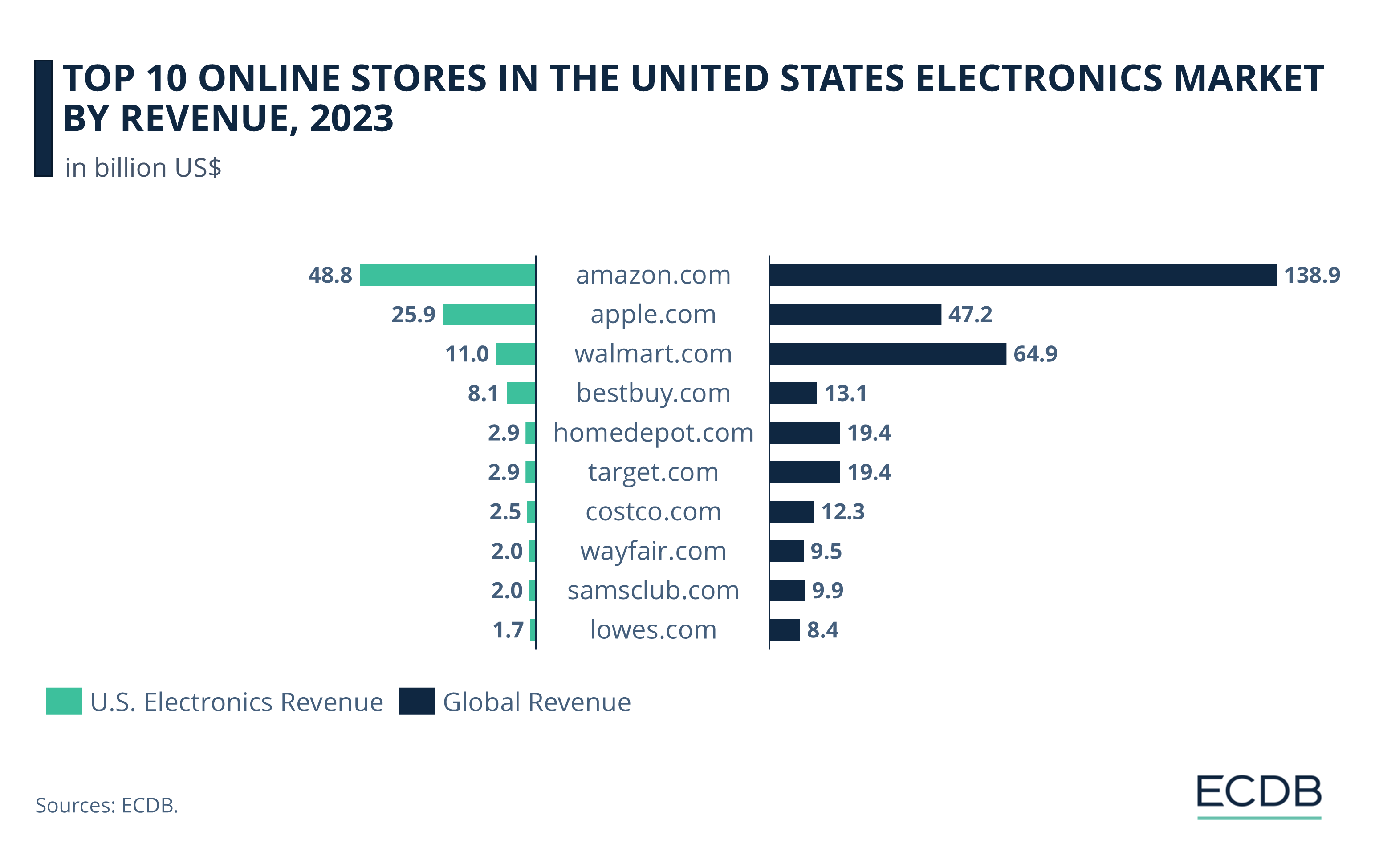

Among the leading online stores in the United States electronics sector, based on their 2023 eCommerce net sales:

Amazon.com holds the top position with sales of US$48.84 billion in the U.S. market. Apple.com follows with sales of US$25.85 billion.

Walmart.com generated US$11.03 billion in sales, while Bestbuy.com reported US$8.11 billion, solidifying its position as a major player in the electronics market. Homedepot.com and Target.com both recorded sales of US$2.9 billion.

Other significant contributors include Costco.com with US$2.45 billion, Wayfair.com with US$1.99 billion, Samsclub.com at US$1.97 billion, and Lowes.com rounding out the top 10 with US$1.68 billion.

Walmart Overtakes Apple in Total Revenues

Focusing on global revenues of the top online electronics stores in the U.S., we see some shifts in rankings compared to their filtered net sales:

While Amazon.com remains on the top with global revenues of almost US$139 billion, Walmart.com (US$65 billion) overtakes Apple.com (US$47 billion) in total revenues.

Homedepot.com and Target.com share the fourth spot with almost US$20 billion each.

Bestbuy.com is sixth with US$13 billion, while Costco.com and Samsclub.com scored around US$10 billion.

Wayfair.com is 9th with US$9.5 billion, and

Lowes.com rounds out the top 10 with US$8.4 billion.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

With the broader metrics in perspective, it's time to zoom into the intricate specifics of each major player. Here's a closer look at the American tech giants that dominate the scene.

1. Amazon.com

The retail behemoth, with a U.S. revenue of almost US$49 billion in online electronics, firmly dominates the domestic market among the top electronics stores online. This dominance is further stressed when we look at the global scale, where its revenues soar to an impressive US$139 billion.

Last year, Amazon and Shopify unveiled a notable integration. This move will empower Shopify merchants to incorporate the "Buy with Prime" feature on their platforms. As a result, consumers can conveniently utilize their Amazon wallet at Shopify's checkout, seamlessly enjoying Amazon's prompt delivery and streamlined return process.

Such a strategic pivot underscores a significant shift in Shopify's strategy, not only amplifying its merchant-centric offerings but also bolstering Amazon's footprint in the eCommerce sector.

2. Apple.com

The tech giant apple.com claims a U.S. online revenue of US$26 billion in electronics. However, it's on the global stage that its financial strength truly stands out, skyrocketing to US$47 billion.

In September 2023, Apple hosted its "Wonderlust" event, unveiling the iPhone 15 with a new USB-C port, a shift towards industry standards. This release, along with high-end models like the iPhone 15 Pro and Pro Max, is expected to influence consumer spending and the accessories market. Additionally, the event saw the introduction of the Apple Watch Series 9 and a USB-C charging case for AirPods Pro.

3. Walmart.com

Our data shows that Walmart.com scored a U.S. online revenue of US$11 billion in the electronics sector last year, while its global revenue, at US$65 billion, surpasses Apple.com's. This showcases the online store's formidable online presence both domestically and worldwide.

Taking innovation a step further, Walmart is broadening its drone delivery horizons, now collaborating with Wing, a drone service supported by Alphabet. This venture will enable two Dallas-based stores to cater to an additional 60,000 homes, championing both innovation and sustainability. Through this, Walmart highlights its commitment to eco-friendly, on-demand delivery, revolutionizing last-mile solutions.

4. Bestbuy.com

The online store's domestic revenue in electronics is pegged at US$8 billion, and when this figure climbs to US$13 billion worldwide, it hints at a more pronounced U.S. electronics market resonance.

In 2023, Best Buy confronted challenges arising from changing consumer behaviors. A 10% sales drop in Q1 prompted staff reductions. While Q2 showed signs of recovery, narrowing the sales decline to 6%, the brand still navigates a shaky resurgence, particularly with Amazon casting a long shadow in the online electronics domain.

5. Homedepot.com

Homedepot.com, a key player in home improvement, also stands out in the electronics sector with a U.S. online sales revenue of near US$3 billion and a global revenue close to US$20 billion.

Home Depot reported a 3% dip in sales for the third quarter of fiscal 2023, totaling US$37.7 billion. This downturn, more pronounced in the U.S. with a 3.5% drop in comparable sales, indicates shifting market dynamics. Despite this, Home Depot continues to be a major force in the retail market.

Online sales account for about half (48.6%) of the U.S. electronics retail market and are anticipated to reach 58.1% by 2028.

6. Target.com

Despite its U.S. online electronics revenue being US$3 billion, Target.com has impressively managed to rack up US$20 billion globally, like Homedepot.com.

In 2023, bolstering its delivery game, Target launched its Target Last Mile Delivery (TLMD) extension in Georgia, United States. This initiative, which augments the reach of its sortation centers, promises next-day deliveries to an additional 500,000 guests. Collaborating seamlessly with Shipt.

7. Costco.com

Costco.com's U.S. revenues stand at US$2.5 billion, but it's on the global front where the online store truly shines, raking in US$12 billion.

As economic concerns reshape consumer habits, CFO Richard Galanti has pinpointed a preference for more affordable food options and non-perishables. This shift in spending, coupled with a 3.5% sales decline in the U.S. during Q1 2023, suggests consumers are postponing significant purchases, especially in electronics and appliances.

8. Wayfair.com

Wayfair.com, known for its extensive home goods collection, also excels in the online electronics market with a U.S. revenue of US$2 billion and a global figure of US$9.5 billion.

Last year, the company announced a significant workforce reduction, cutting about 1,750 jobs, which was 10% of its staff at the time. This decision reflected the challenges Wayfair has been facing in the evolving economic environment, where inflation and changing consumer habits have impacted its business. The move was part of Wayfair's broader strategy to streamline and refocus on its core operations.

9. Samsclub.com

Similar to Costco.com, Samsclub.com also boasts around US$2 billion in U.S. online electronics sales and US$10 billion globally. Its strong performance in the U.S. highlights its influence in the online electronics market, while its international sales reflect its global reach.

Sam's Club is streamlining online shopping by deploying AI to speed up in-store processes, like its Scan & Go system, enhancing both in-store and online experiences. This tech move, aimed at reducing wait times, indirectly boosts online shopping efficiency by integrating smoother, faster service models, demonstrating Sam's Club's focus on customer satisfaction and innovation.

10. Lowes.com

Lowes.com, primarily a home improvement and appliance retailer, also demonstrates notable performance in the online electronics sector. In the U.S., Lowe's.com achieved an online electronics sales revenue of US$1.7 billion, and on a global scale, this figure reaches US$8.5 billion.

Launched in February, Lowe's introduces Lowe's Style Studio for Apple Vision Pro, a game-changer in home design. This app allows users to create their dream kitchen in immersive 3D, leveraging spatial computing. It simplifies choosing styles, materials, and appliances with millions of combinations, all available at Lowes.com. This step reflects Lowe's drive to blend technology with customer experience, making home improvement simpler and more interactive.

Online Electronics Market in the United States

In the last 5 years, the online electronics market in the U.S. has seen a mixed growth trend. Let's see how it compares to the overall market:

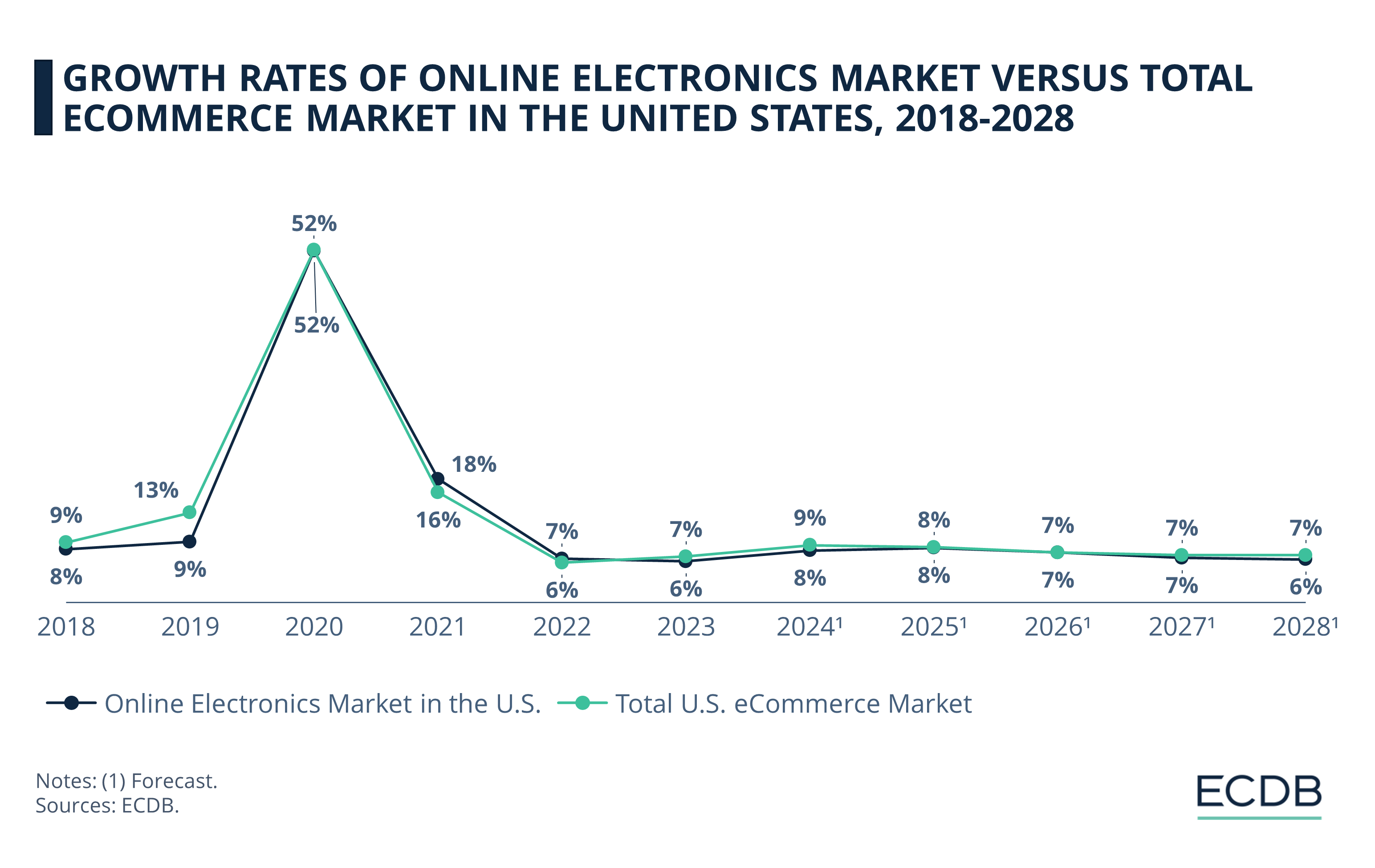

2019: The online electronics market in the U.S. grew by 9%, which was below the global eCommerce market growth of 15.1%.

2020: Amid the pandemic, the U.S. online electronics market surged by 52.1%, significantly outpacing the global eCommerce market growth of 31%.

2021: Following the pandemic's peak, the U.S. online electronics market expanded by 18.3%, closely aligning with the global eCommerce market growth of 18.5%.

2022: As growth stabilized post-pandemic, the U.S. online electronics market saw a modest increase of 6.5%, lagging behind the global eCommerce market growth of 8.5%.

2023: Continuing the trend of moderate growth, the U.S. online electronics market grew by 6.1% last year, which was again lower than the global eCommerce market growth of 9.2%.

The U.S. electronics eCommerce market is forecasted to hit US$219 billion this year, making up one fifth (20.6%) of the total U.S. eCommerce market.

As for the future, driven by a compound annual growth rate (CAGR) of 7.1% from 2024 to 2028, the market is anticipated to reach US$289 billion by 2028.

United States: Online Electronics Sales vs.

Total eCommerce Market

Looking at the growth of the market compared to the overall U.S. eCommerce market, we see a close relationship.

While the overall market grew faster than the electronics market through 2020, the pandemic changed that: Both the online electronics market and the overall eCommerce market in the U.S. grew by 52% in 2020.

Although the growth of both markets slowed down in the following years, they remained close to each other.

For the coming years, our forecasts show that both the online electronics market and the overall eCommerce market in the country will grow at stable rates of around 6-9%.

Consumer Electronics Make Up 72% of the Market

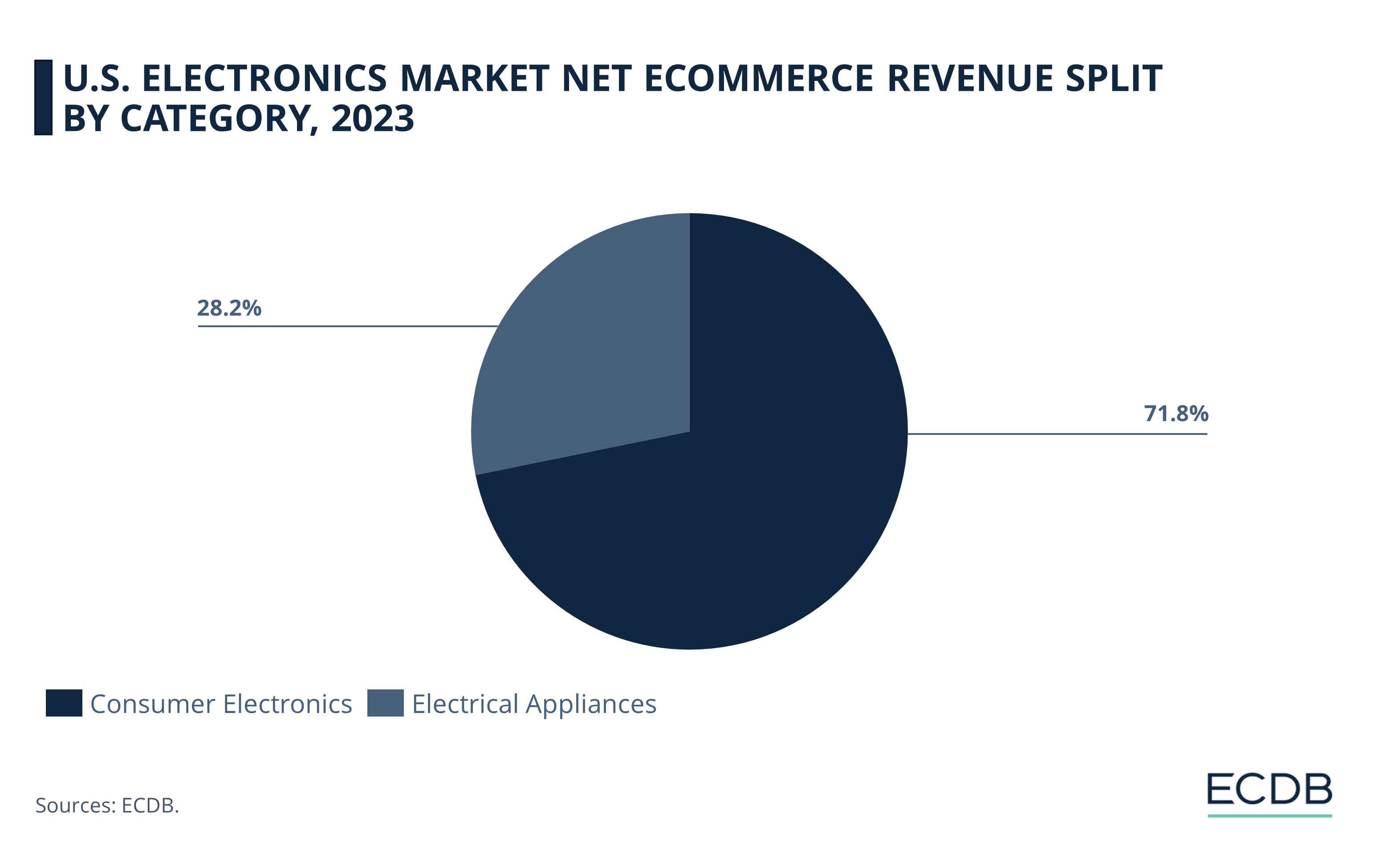

If we break down the U.S. online electronics market into categories by net eCommerce sales, we see that the consumer electronics category leads the way.

Accounting for 71.8% of the market, consumer electronics is followed by electrical appliances, which amounts to a near third (28.2%) of the market.

Sources: TechCrunch, Walmart, Target, PYMNTS, Yahoo, ComputerWeekly, Home Depot, ABC7, Digital Commerce 360, ECDB

FAQ: Online Electronics Stores in the U.S.

What is the best online electronics store?

Amazon.com is considered the best online electronics store, holding the top position with nearly $49 billion in U.S. sales.

What is the most popular electronic store in the US?

Amazon.com is the most popular electronic store in the U.S., leading the market with significant sales.

Which is the best site for buying electronics?

Amazon.com is the best site for buying electronics due to its extensive range and top sales figures.

Where can I buy electronics other than Best Buy?

You can buy electronics from leading sites like Amazon.com, Apple.com, Walmart.com, and Homedepot.com.

What is the #1 online store?

Amazon.com is the #1 online store, dominating both the U.S. and global markets with the highest revenues.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Top Online Payment Methods in the United Kingdom: Cards & eWallets

Top Online Payment Methods in the United Kingdom: Cards & eWallets

Deep Dive

Inside Apple Revenue: Latest Sales Figures and Key Insights

Inside Apple Revenue: Latest Sales Figures and Key Insights

Deep Dive

eCommerce in the United States: Top 5 Companies by Revenue

eCommerce in the United States: Top 5 Companies by Revenue

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Back to main topics