eCommerce: UK Payments

Top Online Payment Methods in the United Kingdom: Cards & eWallets

UK online payment methods show that VISA and Mastercard dominate. While PayPal enhances tools, Apple Pay integrates more deeply, and eWallets slowly gain ground.

Article by Antonia Tönnies | October 17, 2024

UK Online Payment Methods: Key Insights

VISA & MasterCard Domination with Regulatory Challenges:

VISA and MasterCard are accepted by 97% of UK eCommerce retailers. Despite their wide adoption, both face regulatory pressure due to rising transaction fees, especially post-Brexit.

Digital Wallets Gaining Ground: PayPal and Apple Pay

PayPal, used by 82% of retailers, enhances its offerings for small businesses with the "Complete Payments" solution. Apple Pay, with 20% penetration, introduced a new feature in 2023 to integrate more deeply into the UK market through Open Banking.

American Express Resilience Post-Pandemic:

With 62% penetration, American Express has adapted to shifting consumer needs during the pandemic by focusing on non-travel benefits and campaigns like "shop small," showing resilience in a changing market.

The rise of online payment methods has closely paralleled the growth of eCommerce. Among the fastest-growing options today are eWallets like PayPal, Amazon Pay, Apple Pay, and Google Pay.

Payment preferences vary by country, and in the UK, PayPal - of the earliest digital payment platforms, active since 2003 - still isn’t among the most popular. Instead, cards continue to dominate the payment space.

Top Online Payment Methods in the UK: Cards Dominate

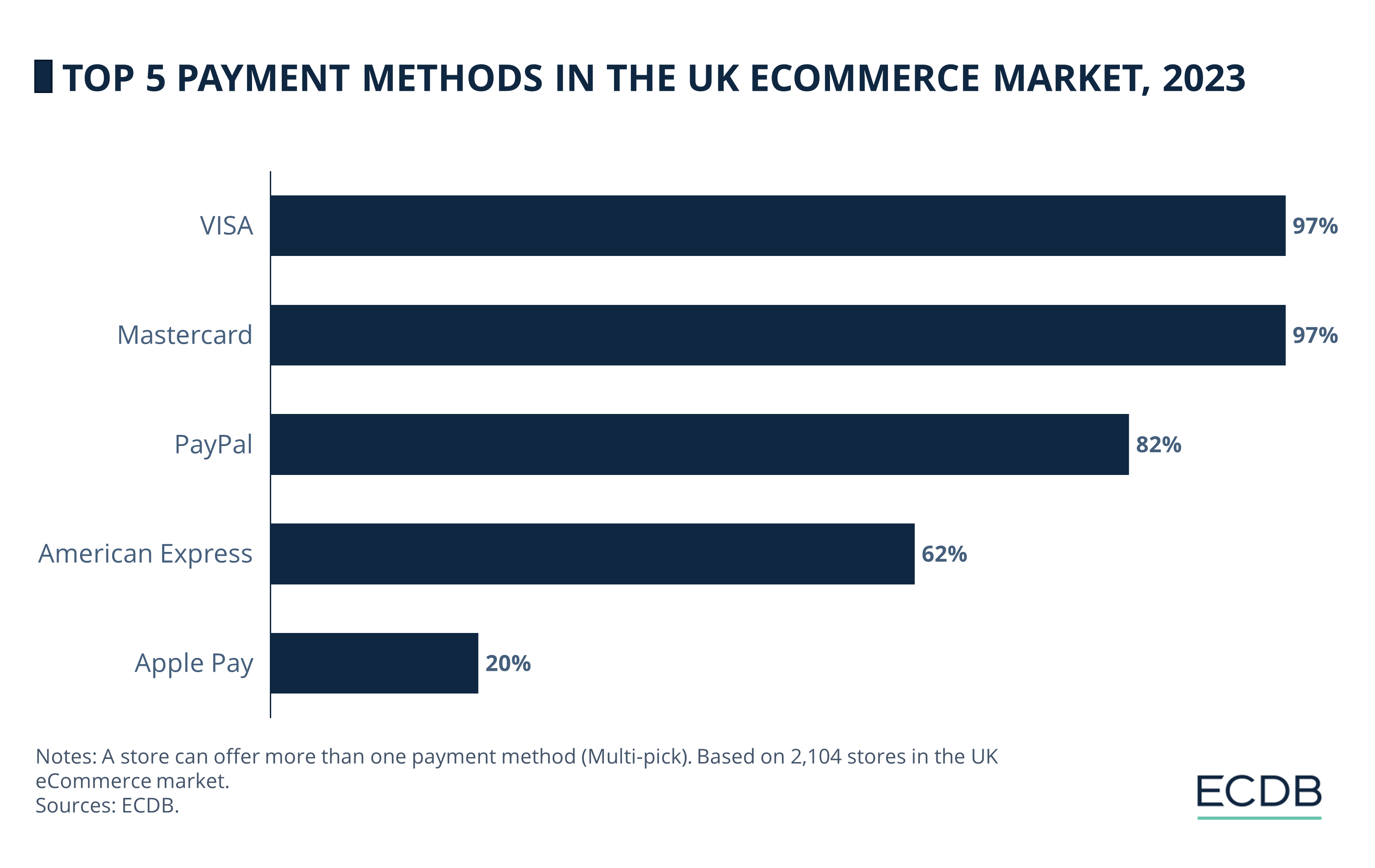

Based on the online stores on our database, we provide a detailed map of the eCommerce payment landscape in the UK:

VISA and Mastercard share the top spot at 97% penetration each.

The popular eWallet option PayPal is at number 2, with 82% of online stores in the UK offering it.

While American Express is at number 3 with 62%, Apple Pay rounds out the top 5 with 20% penetration.

1. VISA

As per our 2023 data, cards are the most commonly used payment type by online retailers in the UK. Among the most offered payment methods is VISA with a 97% usage rate. Despite VISA's widespread acceptance, recent regulatory scrutiny has raised concerns.

Late last year, the Payment Systems Regulator (PSR) in the UK proposed capping fees that VISA charges retailers for transactions between the EU and the UK. These fees, which spiked after Brexit, cost UK firms an extra £150 to £200 million (US$195 to US$260 million with the current exchange rate) in 2022. VISA disputes the need for a cap, arguing that the fees support reliable and secure digital payments.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

While large companies might absorb these extra costs, smaller ones could pass them onto consumers. It's also worth noting that these developments caused calls for a UK-developed alternative to U.S. payment giants.

2. Mastercard

Mastercard shares the first spot with VISA, also with a 97% rate. Like VISA, Mastercard faces proposed fee caps from the PSR due to increased costs for cross-border transactions since Brexit.

These fees, which were previously regulated by the European Union, have significantly risen, impacting UK businesses. Mastercard contends that these fees offer value in a competitive market and are crucial for maintaining the security and efficiency of digital payments.

3. PayPal

Not far behind the cards is the well-known digital payment platform PayPal, with 82% usage rate in the UK.

In March this year, PayPal launched "Complete Payments" for online small businesses in the UK, Canada, and over 20 European markets. This new solution allows businesses to accept various payment methods, including buy now pay later options, Apple Pay, Google Pay, and credit and debit cards.

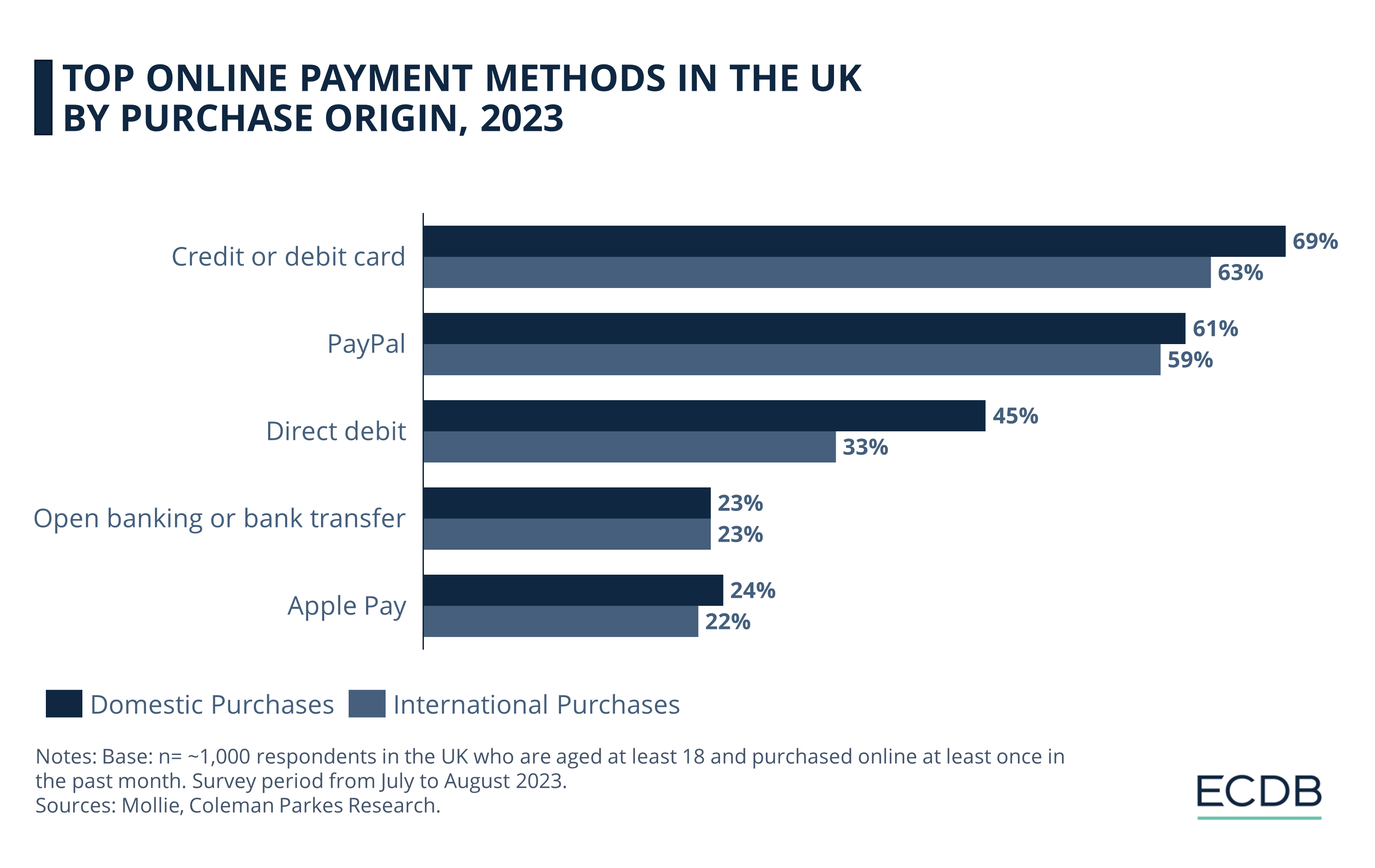

Looking at the top online payment methods in the UK, we see that credit/debit cards are the top payment method for both domestic and international purchases. While the shares between domestic and international purchases are minimal (2-7%) for each payment method, the gap is rather large (12%) for direct debit.

With integrations in major eCommerce platforms and advanced features like secure payment storage and package tracking, PayPal aims to boost checkout conversions and provide robust fraud protection, making it a favorite among UK consumers.

4. American Express

American Express follows the top 3 with 62%. Despite the challenges brought on by the pandemic, American Express adapted in the UK by investing in non-travel benefits like online workshops and the “shop small” campaign.

This shift helped counter the decline in travel-related perks and proved that Amex could still thrive even with reduced travel. By 2023, American Express saw a significant rebound in consumer spending in the UK, demonstrating resilience and adaptability in a changing market.

5. Apple Pay

Significantly further down the list is the payment method of the tech giant, Apple Pay, with 20%. Apple Pay launched in the UK in 2015, providing a secure and easy way to pay using popular credit and debit cards.

In November 2023, Apple Pay introduced a new feature allowing users to view their debit card balance, transaction history, and account details directly in their Wallet.

This move, part of the Open Banking initiative, further integrates Apple Pay into the UK market, enhancing user control over their finances and fostering deeper relationships between banks and their customers.

Top Online Payment Methods in the UK: Closing Thoughts

In 2021, cash in advance held the fifth position with 12%, but by 2023, Apple Pay had taken over this spot, surpassing the former. This makes Apple not only a growing competitor for individual payment companies, but also, together with PayPal, mobile wallets that could potentially surpass card payments. While PayPal has seen an almost 4% increase compared to 2021, the values of VISA, Mastercard, and American Express, albeit only minimally, have decreased.

Claiming that cards are being replaced by eWallets and digital wallets might be an overstatement, but the change is clearly there. The future will reveal which payment method remains the most popular in the UK.

FAQ: Top Online Payment Methods in the UK

Which online payment gateway is best in UK?

VISA and Mastercard are the most widely accepted and used payment gateways in the UK.

What is the most popular digital wallet in the UK?

PayPal is the most popular digital wallet in the UK, with 82% of online stores offering it.

What is the largest payment provider in the UK?

VISA and Mastercard dominate the UK market, each with a 97% penetration rate.

What are the payment systems in the UK?

The UK uses various payment systems, including card networks like VISA and Mastercard, digital wallets like PayPal and Apple Pay, and bank transfers.

What is the popular payment method in the UK?

Credit and debit cards are the most popular payment methods in the UK.

Sources: BBC, PayPal, The Guardian, Apple, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Deep Dive

Tinaba Partners with Alipay+ to Launch European Super App

Tinaba Partners with Alipay+ to Launch European Super App

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

Payment Options Matter: Retailers Face A Persistent Challenge With Shopping Cart Abandonment

Payment Options Matter: Retailers Face A Persistent Challenge With Shopping Cart Abandonment

Back to main topics