eCommerce: Market Insights

Trends in German eCommerce: Germans Like What They Know

The German eCommerce market is one of the world's top performers. So, what are the most important eCommerce trends in Germany? How significant is the German influence on the European market? Here’s what to watch for in 2024 and 2025."

Article by Nadine Koutsou-Wehling | October 14, 2024

eCommerce Trends in Germany 2024/25: Key Insights

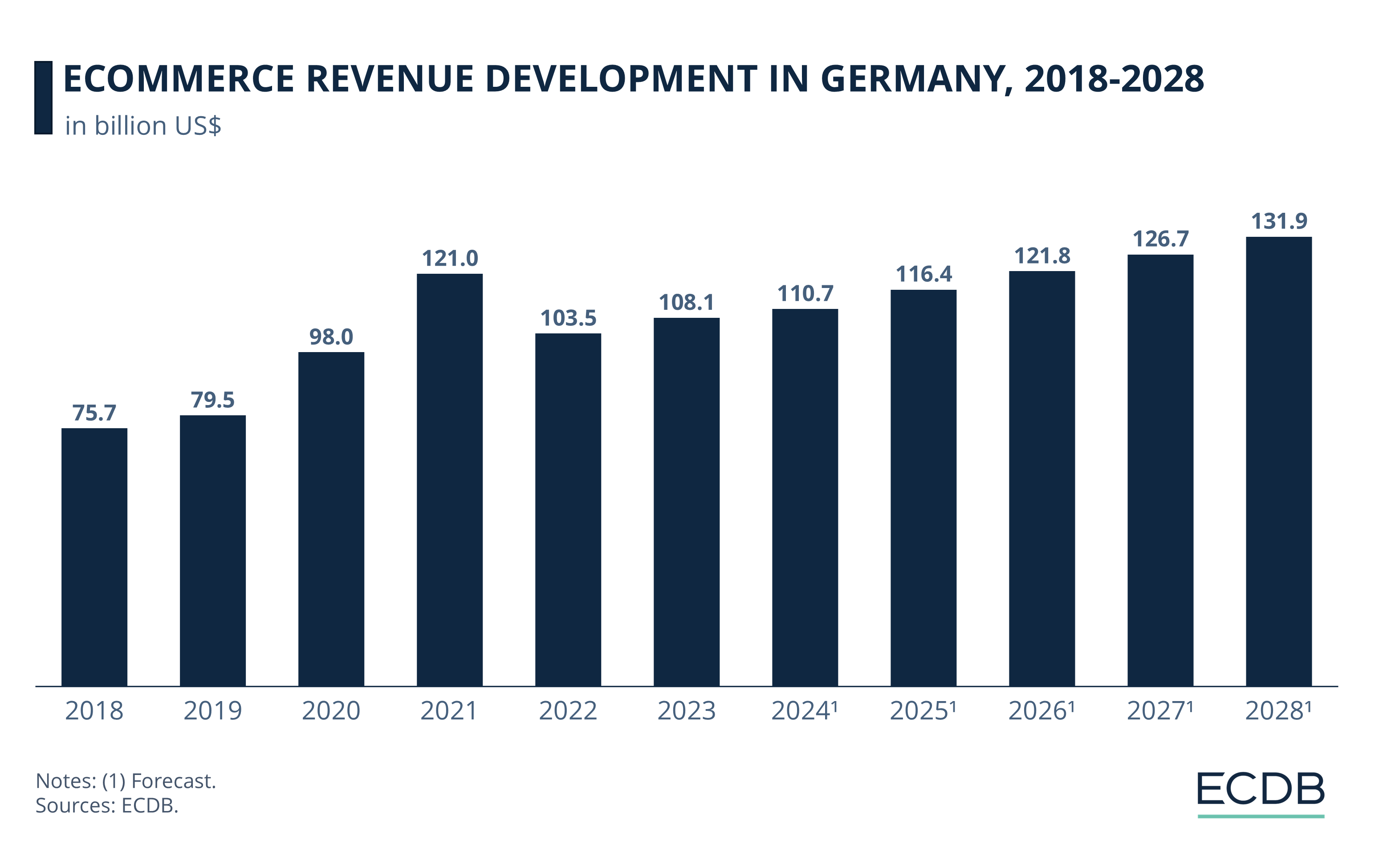

Market Revenues: German eCommerce revenues are robust, with a forecast of US$116 billion for 2025.

Top Players Are Largest Retailers: Amazon dominates in the market. Other top retailers are mostly domestic.

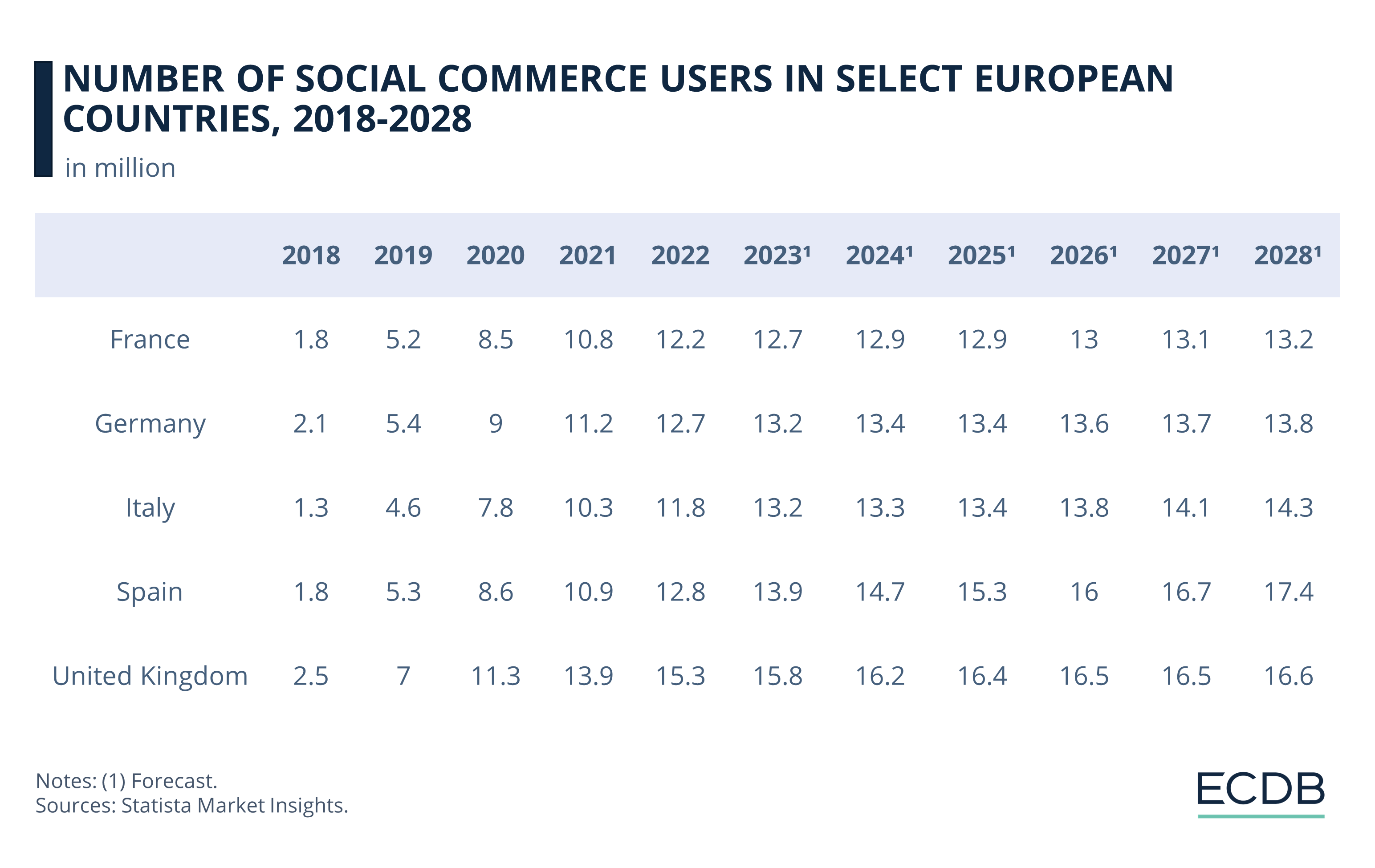

Social Commerce, Smartphones, Payment: Germany does not have the largest social commerce market in Europe, which is related to the relatively low adoption of smartphones for online shopping. However, the number of users is expected to grow.

Trends for 2025: eCommerce events are an integral part of the industry, where trends and developments are identified. For 2025, individualization, omnichannel presence, environmental projects and import regulation are issues to watch.

Germany is the third strongest country in the world by GDP, but when it comes to online shopping, it’s in sixth place globally – making US$108 billion in 2023. So Germany is a major force economically and in eCommerce. The top marketplace is Otto, which is the second largest in Germany (only bested by Amazon). Other dominant German companies like Zalando, Ceconomy, Kaufland, and About You have a big impact on the European online shopping market.

With over 83 million people, Germany is the second most populous country in Europe. Approximately 90% of the population has internet access, creating a large base of online shoppers. Online shopping is very popular in Germany, with 58 million people – 84 percent of the population over the age of 16 – making regular purchases online. This presents many new opportunities for eCommerce. Germany is also a hub for eCommerce innovation, hosting influential events like K5, DMEXCO, E-Commerce Expo Berlin, and EHI Connect. So, what’s happening in the German eCommerce market right now? What trends can we expect for the future?

German eCommerce Trends 2025: The Market is Growing

German eCommerce revenues are forecast to reach US$116 billion by 2025, which approaches the pandemic peak of 2021, when revenues were US$121 billion. With steady increases, this peak is expected to be surpassed in 2026. Why is Germany's eCommerce and economy growing so steadily, making it an ideal place for eCommerce? It's because of their economic power, political stability and relative wealth. High internet penetration and highly efficient logistics make Germans prefer ordering online rather than going to a store. Germany also has a strategic position in Europe, serving as a gateway for cross-border eCommerce.

Post-Pandemic Normalization: The largest annual increase occurred in 2021, when market revenues increased by 23.5% over the previous year. The following year, 2022, saw the typical dip as market revenues returned to normal amidst physical store reopening and inflation.

Steady Recovery: After 2022, market revenues are expected to grow at a steady rate, reaching US$111 billion in 2024 and surpassing US$130 billion by 2028. This represents an outperformance of the pandemic peak with steady growth.

German eCommerce Trend 1: Germans Prefer Shopping on Online Marketplaces

Germans prefer shopping on online marketplaces because they offer convenience. They get a wide range of products, safe and fast delivery, and easy-to-navigate websites or apps – and that's exactly what they want. These platforms like Amazon are trusted for their secure payment methods, fast delivery, and easy return policies. Germans know that marketplaces like Amazon and eBay have become go-to choices for efficient, stress-free shopping.

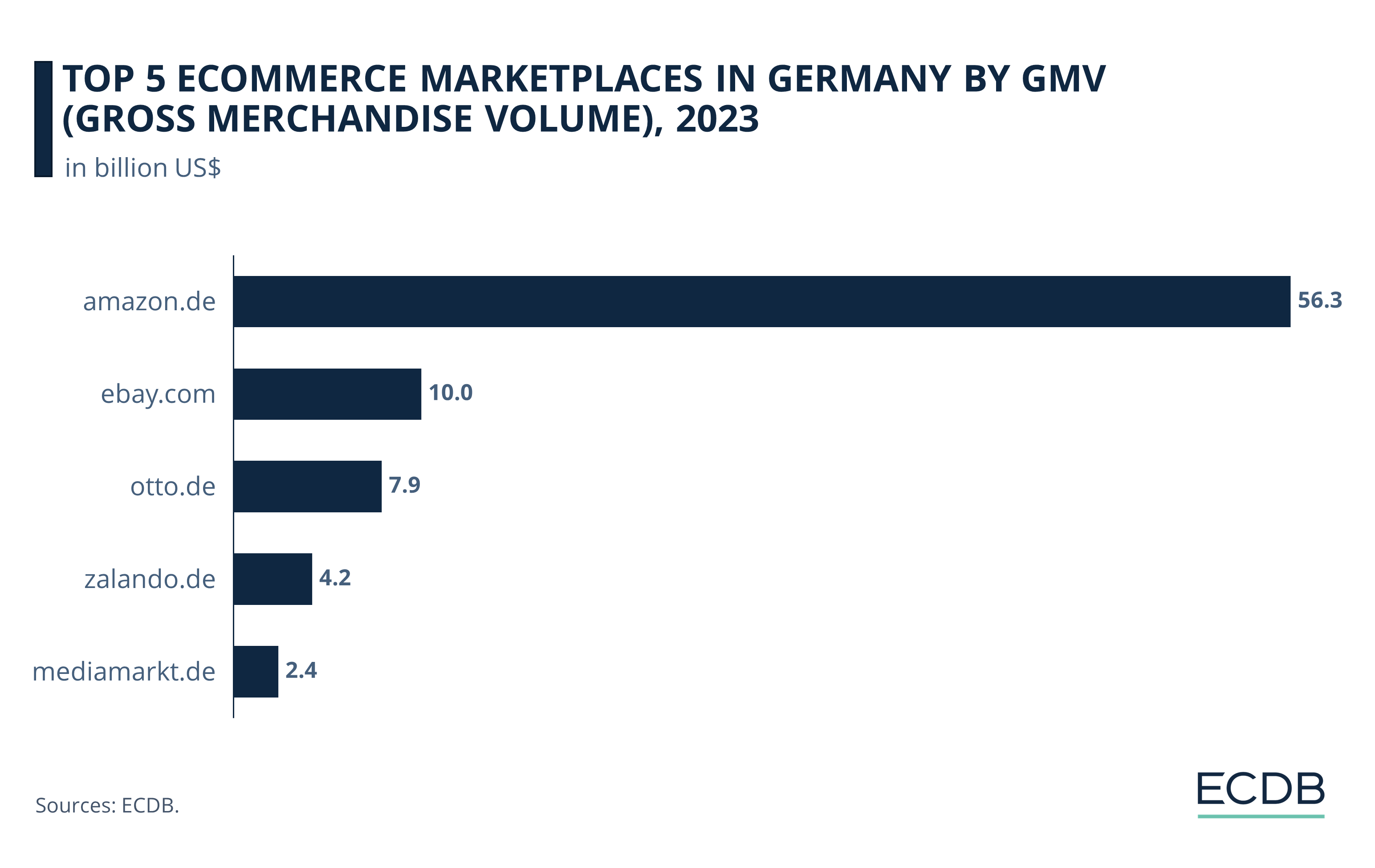

Online stores are also important in German eCommerce. Whatever the type of platform, Amazon takes the lead. In 2023, Amazon’s marketplace generated US$56 billion in GMV (gross merchandise volume). GMV measures third-party sales activity and should not to be confused with a company’s revenue.

Apart from eBay, all other marketplaces in the German top 5 list are domestic players, including Otto, Zalando and Media Markt. The ranking does not change significantly when looking at online stores instead of marketplaces, suggesting that consumers in Germany place a high value on familiarity and trustworthiness. In addition, economies of scale allow for more efficient handling of operations and lower prices.

According to the report ECDB recently published in cooperation with the EHI Retail Institute, Amazon is the most relevant online seller for Hobby & Leisure and Electronics in Germany. Germany is typical in the sense that Amazon has set market benchmarks for product variety, price, and customer convenience like speed of delivery.

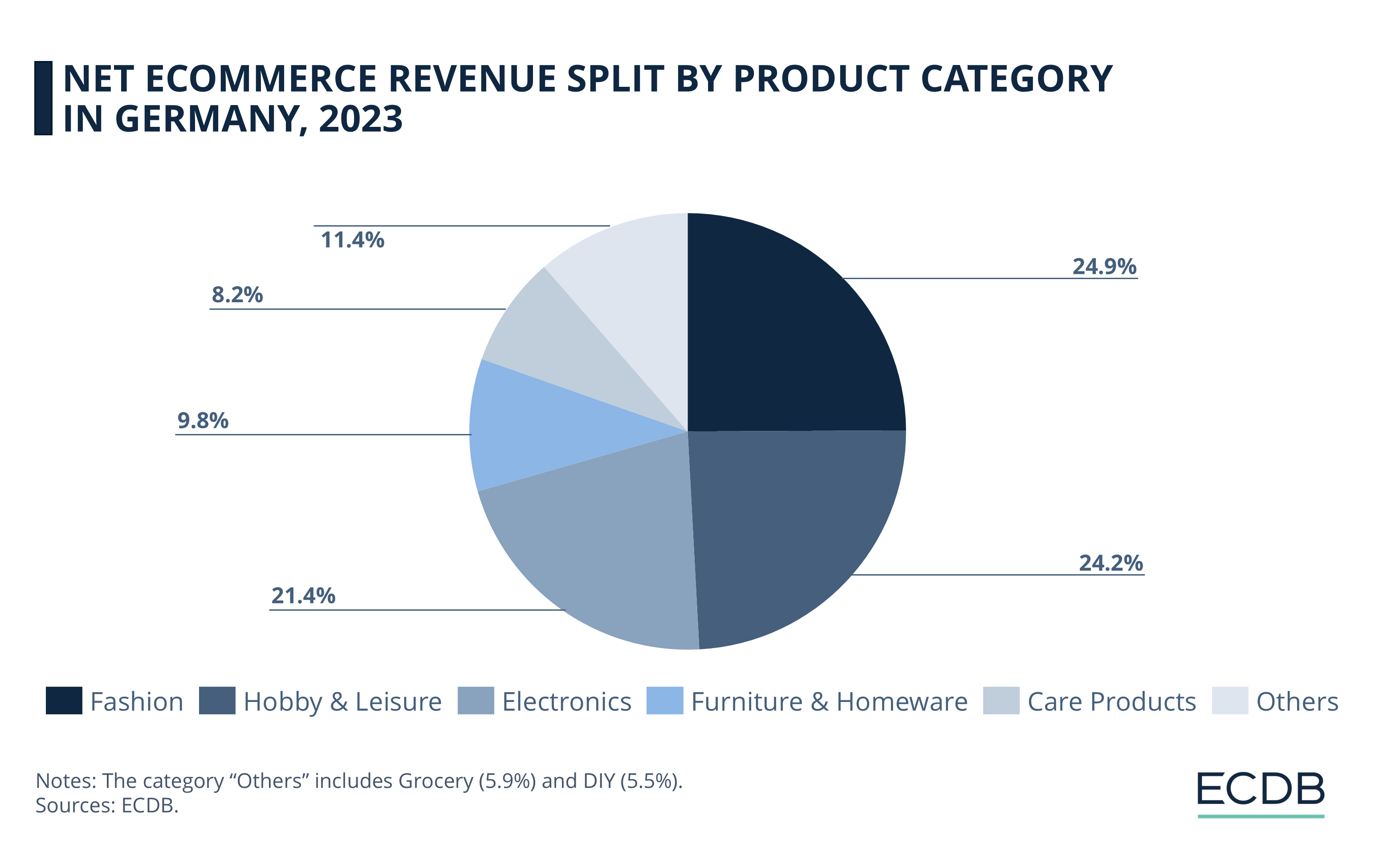

Trend 2: Online Shoppers Love Fashion, Fun & Electronics

The most important product category in German eCommerce is Fashion, which accounts for 24.9% of the market’s revenues. Zalando is the top-performing online store in fashion, but Germany has strong domestic competition, such as About You and Best Secret. People also shop for fashion on major marketplaces like Otto and Amazon. The fashion sector thrives because many trustworthy brands offer various payment options. Additionally, customers can order clothes, try them on at home, and easily return items, making it very convenient compared to trying things on in a fitting room.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

However, fashion isn’t the only golden product category. Hobby & Leisure generates 24.2% of revenues in German eCommerce, while Electronics follows closely with a share of 21.4%. These three categories are fairly close in terms of revenue. This trend is likely to continue, as furniture, homeware, and personal care products, including groceries, are not as popular for online ordering.

Shopify’s recent investigation into trending product categories shows that an increasing number of consumers, including those in Germany, look out for their health and purchase related products online. Skin care and other beauty products are also on the rise. This might be a trend you shouldn't sleep on.

Hobby & Leisure generates 24.2% of revenues in German eCommerce.

The third most lucrative category is Electronics, with a share of 21.4%.

The remainder of categories includes Furniture & Homeware (9.8%), Care Products (8.2%), Grocery (5.9%) and DIY (5.5%).

Trend 3: AI in eCommerce

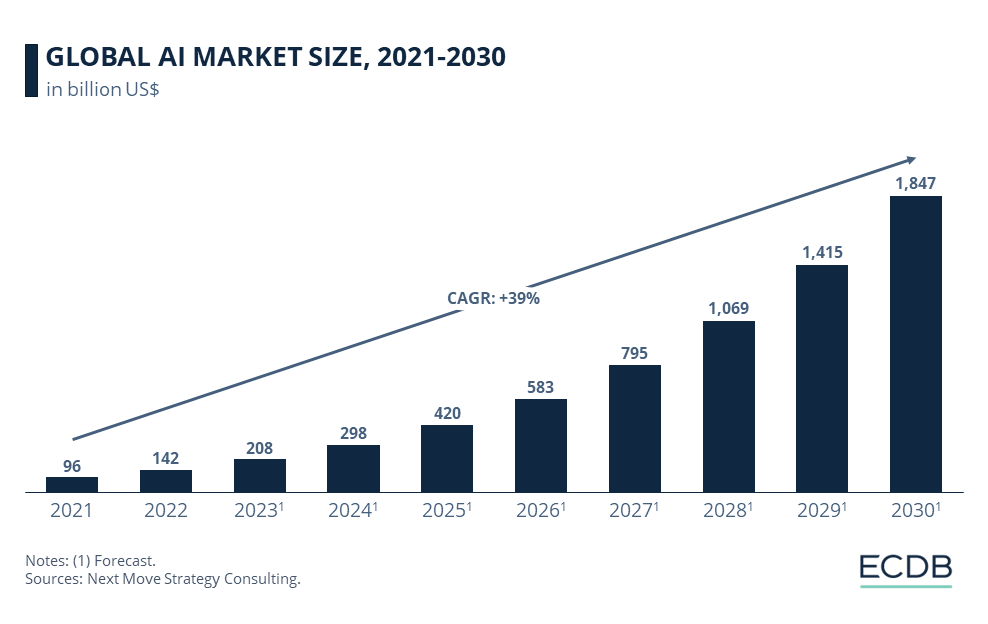

AI could boost German eCommerce in exciting ways! First, it makes shopping more personal. By looking at what you like, AI can suggest products just for you. Amazon is already using that tech. This means happier customers and more sales.

AI chatbots are another cool feature. They can help you 24/7, answering questions and guiding you through purchases. This keeps shoppers engaged and merchants are happy about reduced cart abandonment rates.

AI tech also predicts what items will be popular, so stores can keep the right products in stock. This saves money and improves service.

Also: AI enables merchants to create personalized, dynamic promotions, ensuring that offers and discounts align with individual consumer preferences. With AI tools that help merchants create targeted promotions using dynamic pricing, offering discounts that truly match consumers' needs, eCommerce could explode very soon. AI also simplifies the shopping experience for consumers by automatically finding the best deals online.

At DMEXCO 2023 in Cologne, AI took center stage. Samir Fadlallah of Axel Springer announced that the company will become "AI first," aiming to integrate generative AI across its brands. While excited, he acknowledged the risks and likened the AI landscape to "the wild west," predicting upcoming regulations.

Microsoft and Google also showcased AI's growing role in everyday life. Microsoft highlighted AI's impact on search engines, with Bing Chat now handling informational queries and integrating AI into tools like Windows and Office. Google announced plans to embed its AI chatbot, Bard, into platforms like Gmail and YouTube to enhance user experiences.

Trend 4: Social Commerce Adoption Is Moderate

Social media is just as important in Germany as anywhere else, and so the influence of UGC (user-generated content) for product promotion has grown in recent years. While social commerce platforms are currently gaining widespread recognition, there is still some hesitation. Germany may not be the largest social commerce market in Europe, but it does have a significant user base. In comparison to Spain or the United Kingdom, however, Germany has fewer social commerce users.

A notable shift in the user base occurred during the pandemic, but since then user numbers have been slowly increasing.

The user numbers for 2024 and 2025 are around 13.4 million, and are expected to reach 13.8 million by 2028. While these are estimates that may or may not reflect the actual number of social commerce shoppers, prevailing trends in Germany include a high value placed on trust and familiarity. This may prevent online shoppers from trying social networks for shopping.

Trend 5: Two-Thirds of Online Shoppers in Germany Use Smartphones for Purchases

The moderate adoption of social commerce in Germany ties into the fact that smartphones are not preferably used for online shopping in the market. Other than in eCommerce markets with a high smartphone preference, like China and India, where 92% and 88% of consumers use their phone to shop online, only 64% of consumers in Germany use their smartphones for eCommerce:

The frequency with which smartphones are used for online shopping is directly related to the use of social commerce: The very success of social commerce depends on the spontaneity of finding products while scrolling through social platforms and clicking through to purchase without many additional steps.

This is not to say that influencer marketing or UGC does not have an impact on the purchasing decisions of German consumers. On the contrary, brands have been using influencers and social media marketing to promote their products for years. Because consumers tend to respect these personalities and trust the advice they offer, influencer marketing can be effective in Germany if it is done in a way that conveys the quality and trustworthiness of the product.

As social commerce becomes more commonplace and provides adequate safeguards against fraudulent offers and scams, it has a chance to thrive in German eCommerce. Convenient and secure payment methods are key to the successful adoption of online shopping. What methods do German consumers prefer?

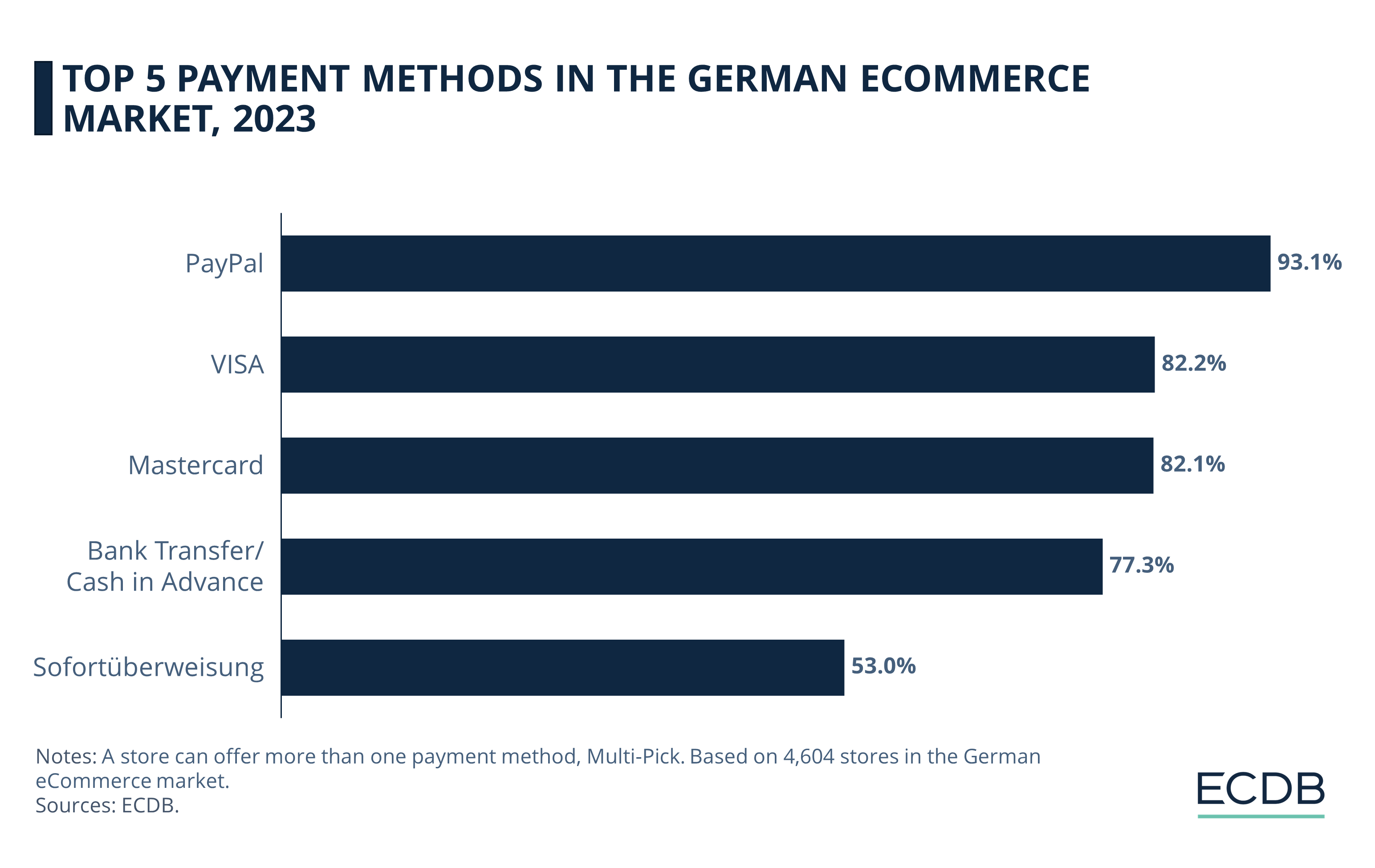

Trend 6: PayPal Is Germany’s Favorite Payment Method

Data from the ECDB Markets section provides a clearer picture of the most common payment methods offered by online stores in each country. In Germany, PayPal leads the way, ahead of even credit cards. PayPal is popular in Germany due to trust and security, offering buyer protection and fraud prevention that reassure users. Many online retailers accept PayPal, making it a convenient payment option for shoppers. The platform allows for quick transactions without the need to enter card details each time, and it provides flexible payment methods, including direct debit and credit card options. Additionally, PayPal's reputation for responsive customer support enhances user confidence.

PayPal Is Most Common: Among all payment options, PayPal is widely adopted in German eCommerce. 93.1% of online stores offer the eWallet because it is easy and trusted.

Cards Come Second: VISA and Mastercard have almost identical adoption rates, with VISA surpassing Mastercard by 0.1 percentage point.

Bank Transfers and Cash Still Predominate: For 77.4% of online stores, bank transfers and cash in advance allow users to find more traditional ways to pay their purchases.

Sofortüberweisung Ranks Fifth: Just over half of online stores in Germany offer Sofortüberweisung, a service that allows users to log directly into their bank account and make an immediate transfer to the recipient.

Trend 7: Germany Hosts Huge eCommerce Events

eCommerce has become a network of professions and industries that all contribute. Germany hosts several significant eCommerce events, including E-Commerce Expo, Internet World Expo, DMEXCO, K5, and EHI Connect. These events are major because they provide platforms for networking, knowledge sharing, and showcasing the latest trends and technologies in the eCommerce sector.

The E-Commerce Expo focuses on the entire online retail ecosystem, featuring exhibitors and speakers from various sectors, making it a hub for innovation and collaboration.DMEXCO is one of the largest digital marketing expos in Europe, bringing together thousands of visitors and exhibitors to discuss the future of digital business. K5 is known for its focus on networking and insights into market trends and strategies from industry leaders. Meanwhile, EHI Connect gathers professionals from the retail and eCommerce sectors to discuss innovations and best practices.

More German eCommerce Trends 2025

At these conferences, a significant part of the game is the discussion of current developments and future trends.

More individualization: This includes recommendations based on machine learning, wider adoption of AI chatbots and platforms that more immediately incorporate consumer demand into the product mix.

Deeper integration of entertainment and shopping: It’s not just video platforms like YouTube that are integrating eCommerce into their offerings. Streaming services like Paramount, Netflix and Disney are also working on features to enable shopping of products seen on screen.

Social commerce: Social commerce has been talked about endlessly, so why include it in the 2025 trends? Because new offerings are popping up all the time. With platforms like Flip paying users to engage with content and post product reviews, TikTok Shop rolling out globally, and younger consumers coming of age as we speak, we haven’t heard the last of social commerce.

Innovation for Environmental Consciousness: Secondhand eCommerce, or reCommerce, and related platforms such as refurbishment services, aim to contribute to the circular economy while generating commercial success. In general, consumers in Germany tend to appreciate these environmentally conscious forms of consumption. But reCommerce is still in its infancy. It needs to become more secure and mutually beneficial for it to work.

Regulatory Steps for Fair Competition: Similar to what is happening in the U.S., the German Ministry of Economics is investigating how to handle import value thresholds to deal with low-cost competitors that undermine domestic offerings.

There is a lot going on in eCommerce at the moment. As holiday season approaches, German consumers are sure to be in a shopping frenzy like many others.

eCommerce Trends in Germany: Closing Thoughts

German eCommerce is home to some of Europe’s most relevant shopping platforms. While consumers in the country appear slower to respond to new trends like social commerce, it is also owed to a higher reluctance to shop online with a smartphone. The coming year is expected to continue developing the AI playground, increasing personalization and recommendation accuracy in the process. Also environmental alternatives to usual ways of shopping are interesting to consumers in the market. While low-price competition from Asia is generating attention and buzz, regulators are moving to support domestic offers.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics