Buy Now, Pay Later (BNPL)

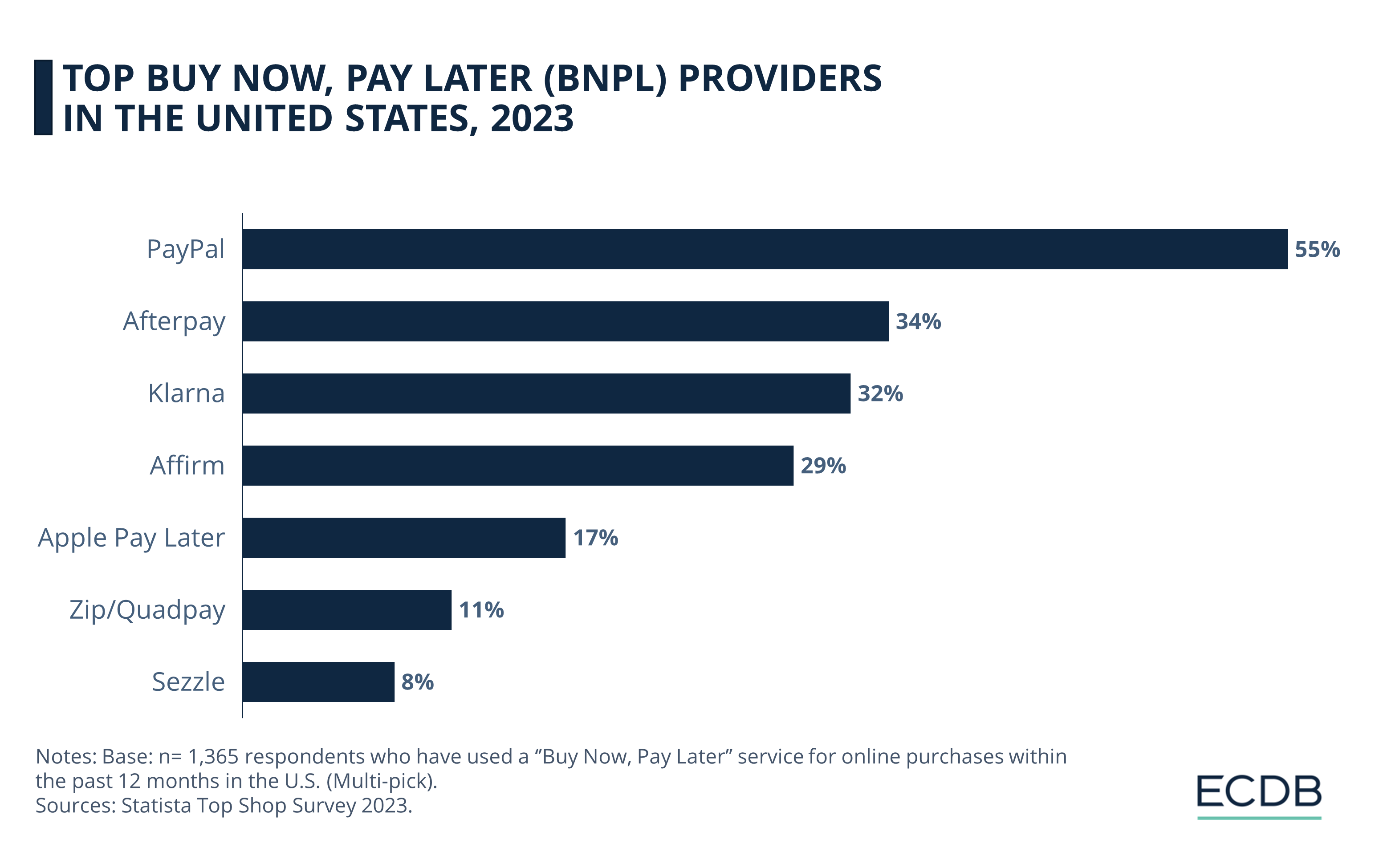

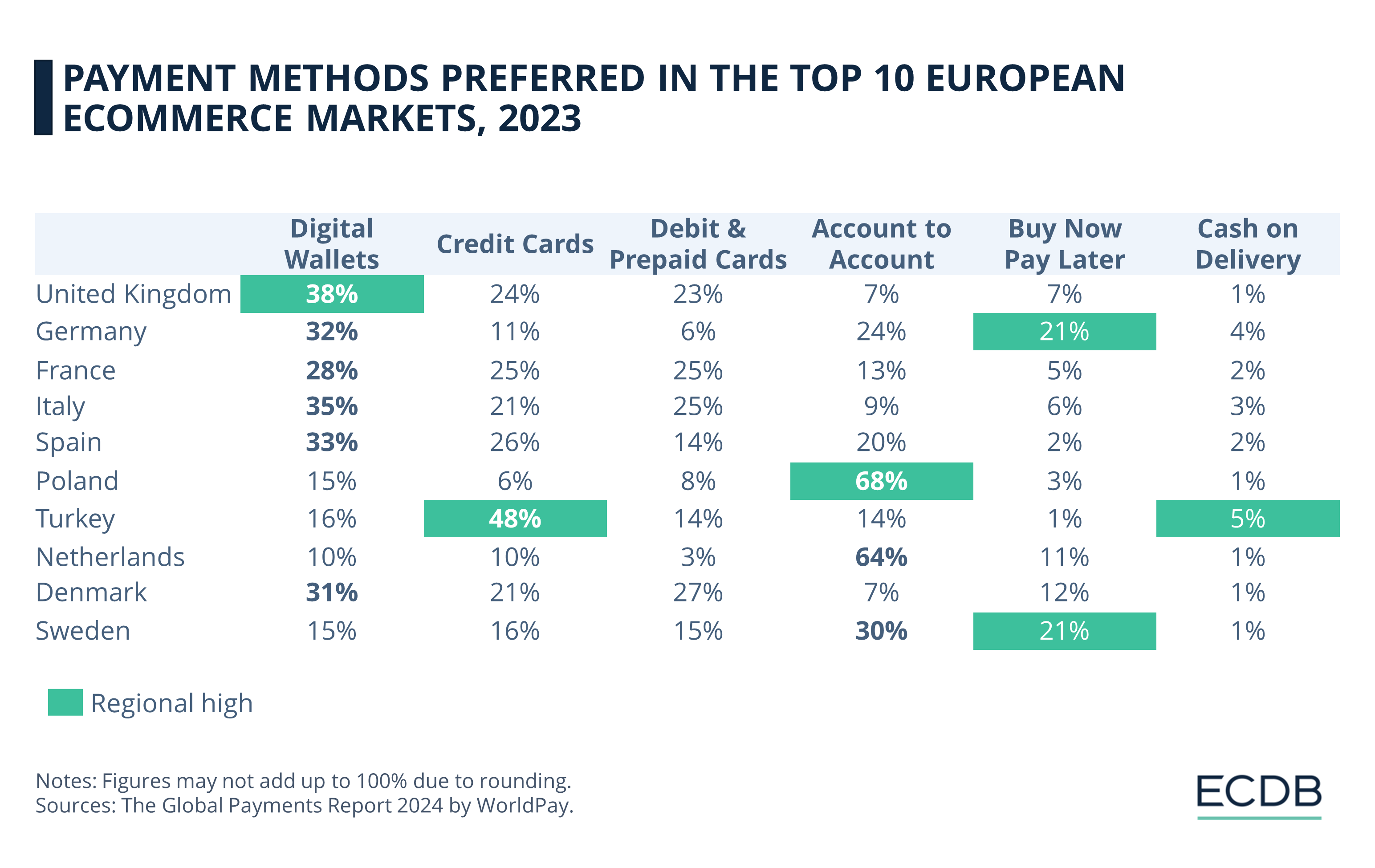

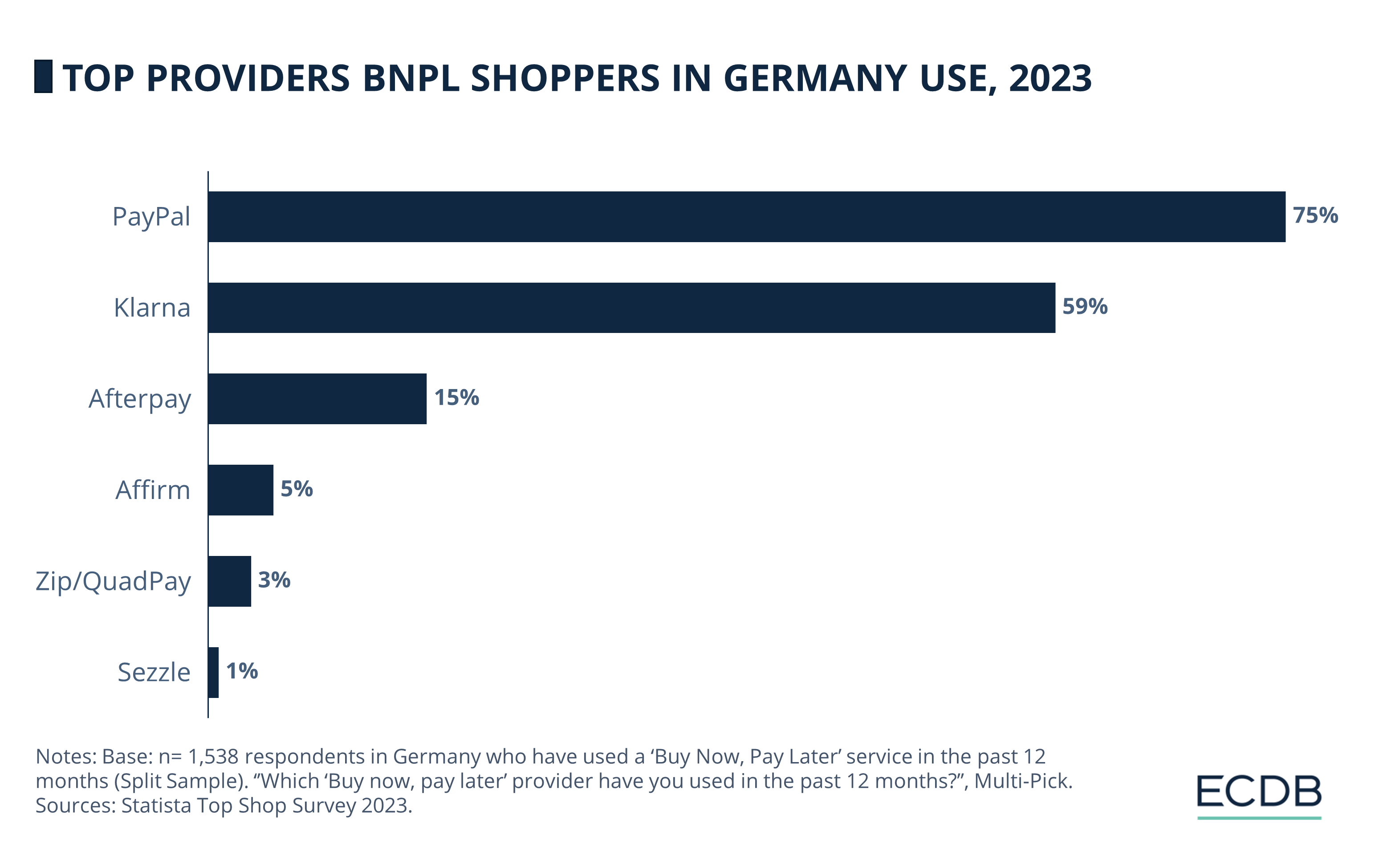

Buy Now, Pay Later (BNPL) is a deferred digital payment option that requires an upfront payment of a percentage of the total purchase price and then allows the user to pay off the remainder of the bill in installments over a period of time. Some of the most popular BNPL payment providers include PayPal, Klarna, Afterpay, QuadPay, and Affirm. BNPL payment options are most commonly used in Europe, especially in Northern Europe, where they have gained popularity in 2019.

Latest Insights

Back to

Deep Dives

Deep Dive

Klarna’s Impact Is Strongest in Sweden and Norway

Klarna’s Impact Is Strongest in Sweden and Norway

Deep Dive

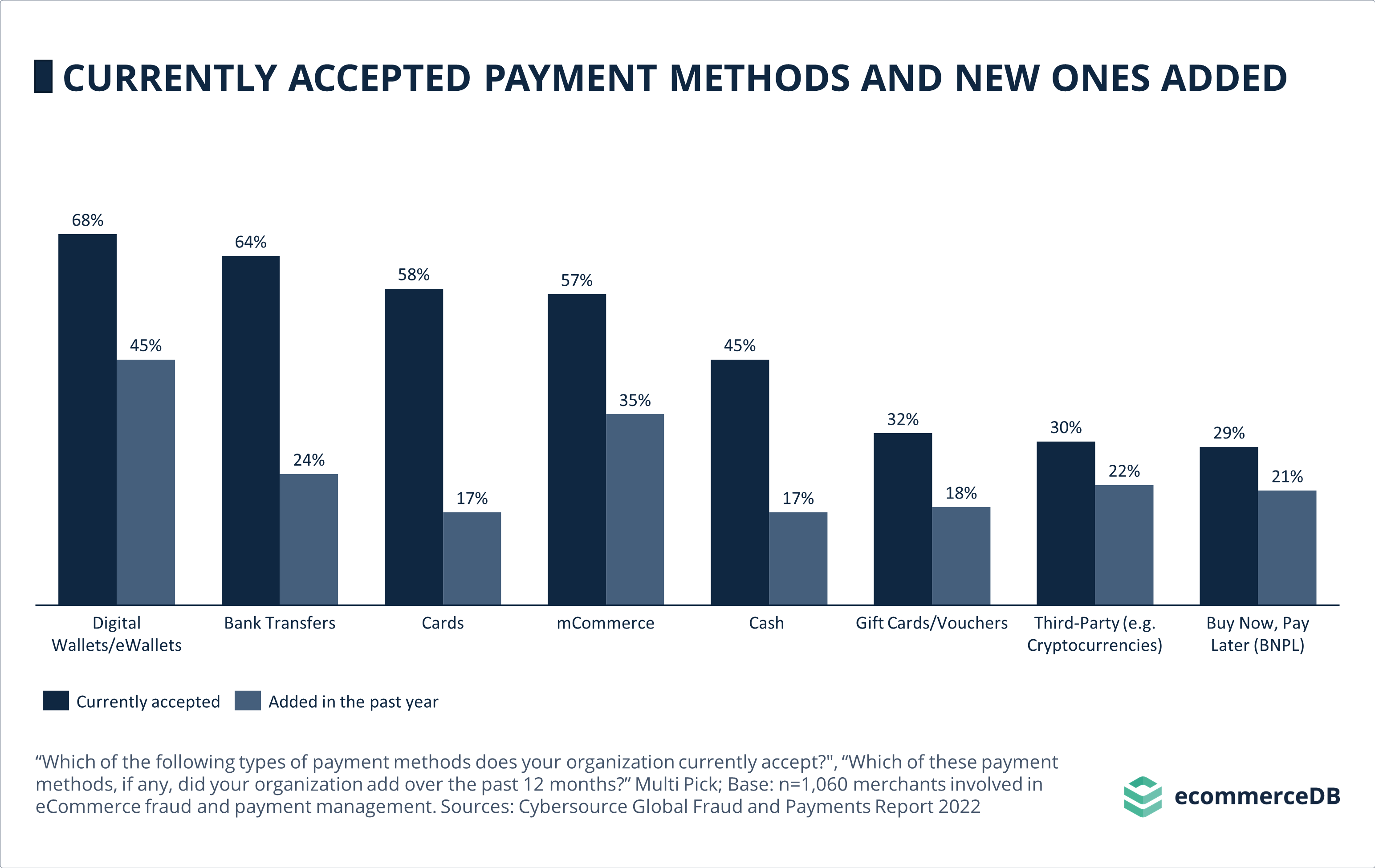

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Deep Dive

Payment Options Matter: Retailers Face A Persistent Challenge With Shopping Cart Abandonment

Payment Options Matter: Retailers Face A Persistent Challenge With Shopping Cart Abandonment

Deep Dive

Poland’s eCommerce Trends 2023: Market Share, Payment Methods & Amazon

Poland’s eCommerce Trends 2023: Market Share, Payment Methods & Amazon

Deep Dive

Buy Now, Pay Later (BNPL) Explained: What Is It & How Does It Work?

Buy Now, Pay Later (BNPL) Explained: What Is It & How Does It Work?

Deep Dive

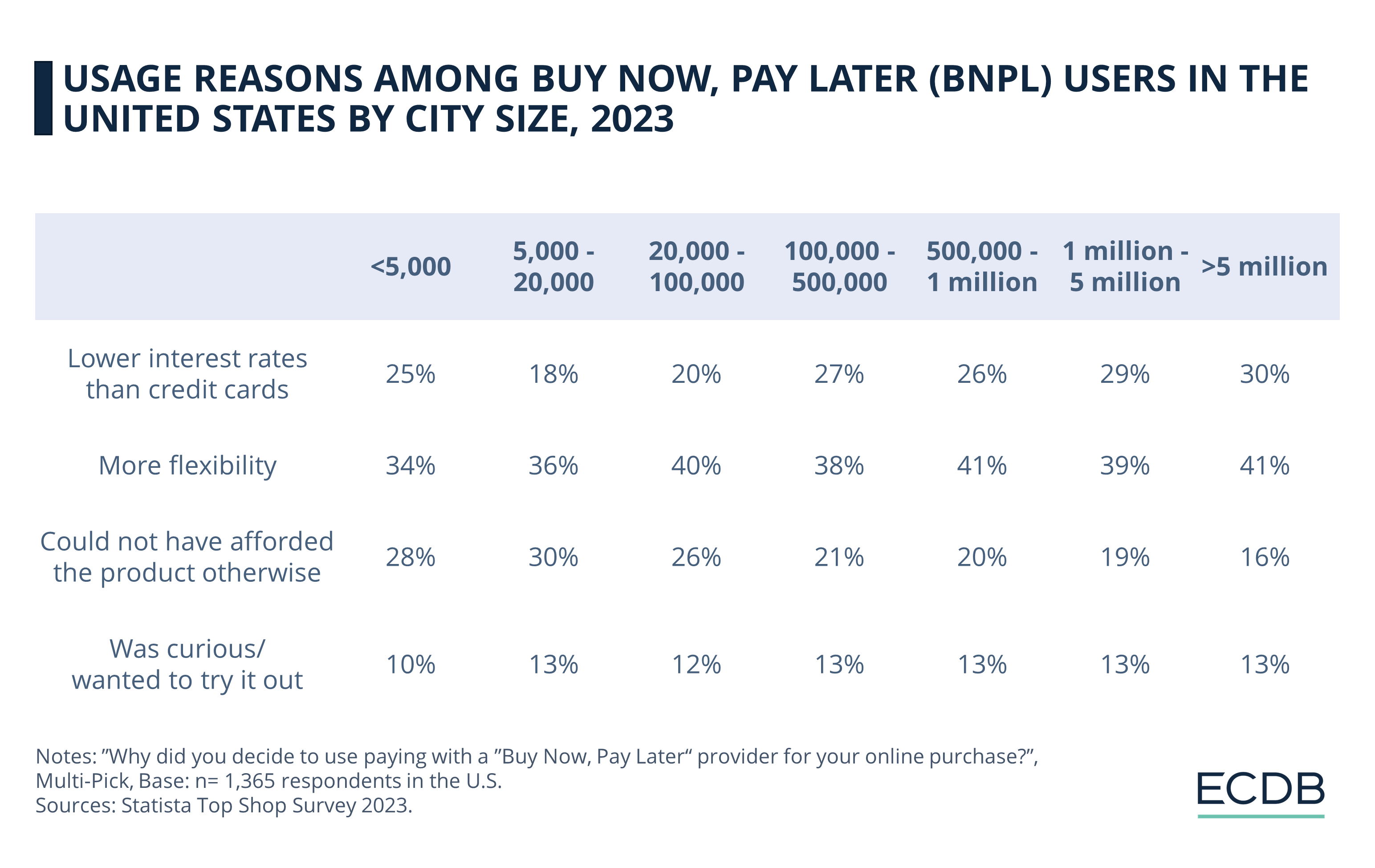

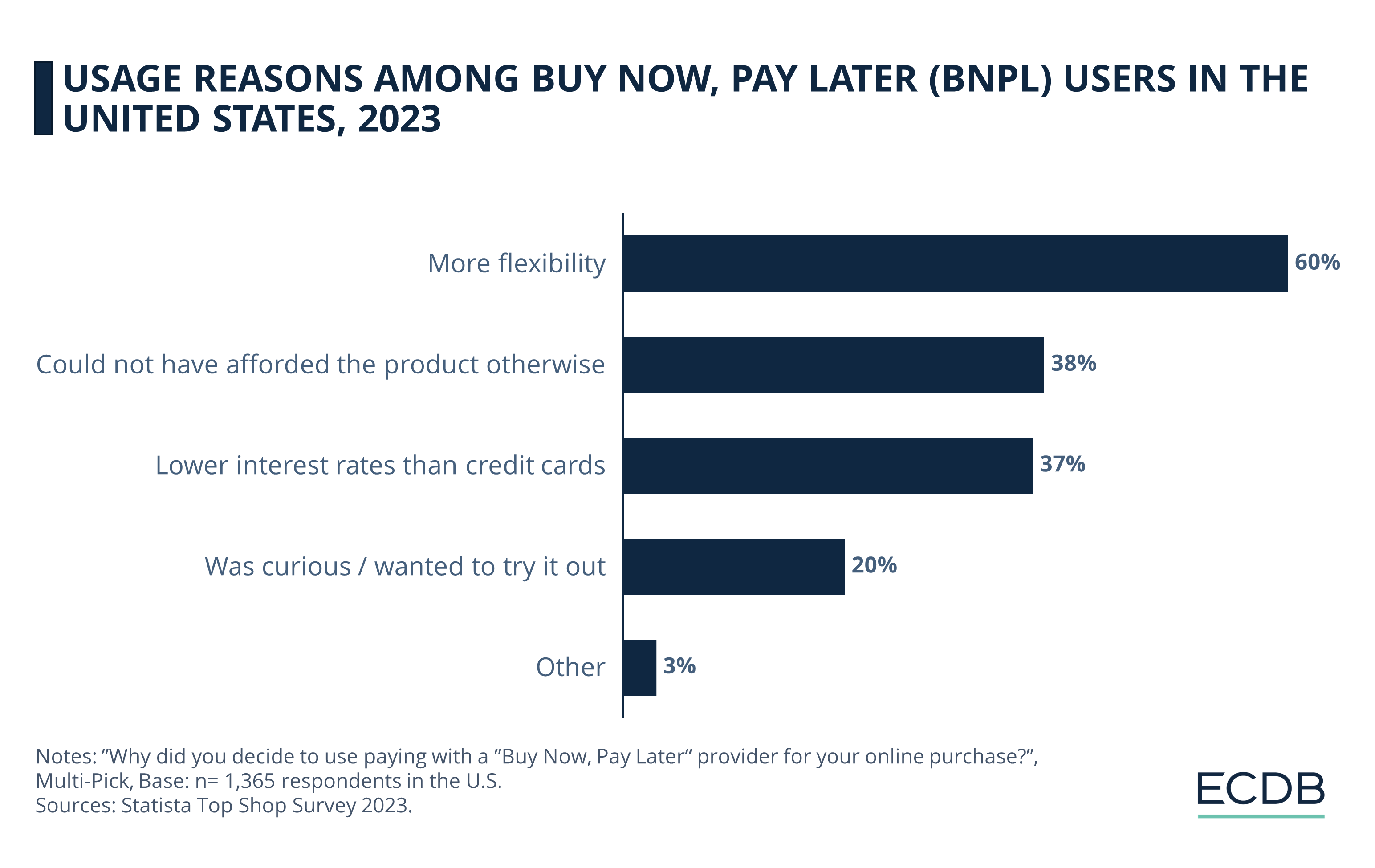

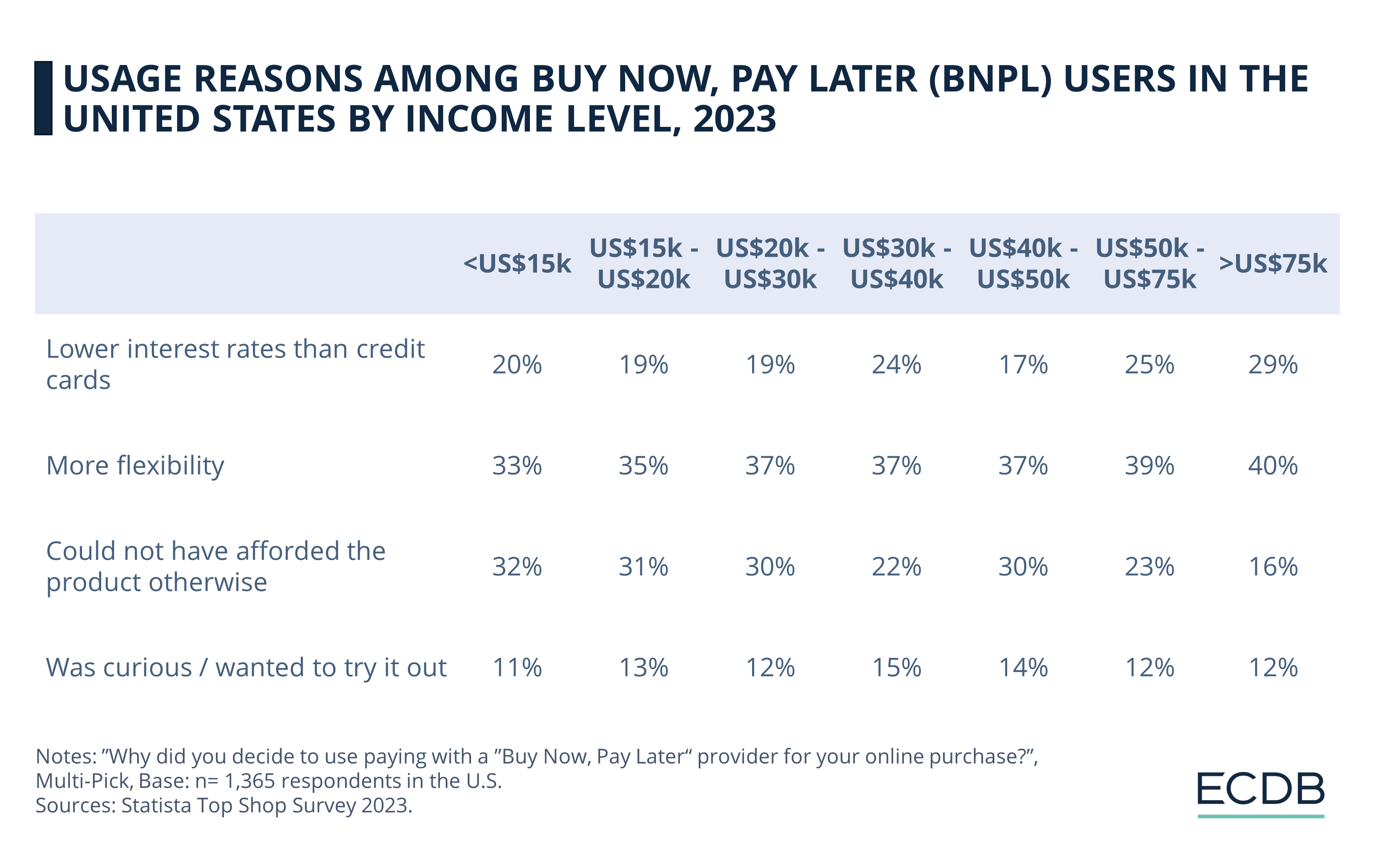

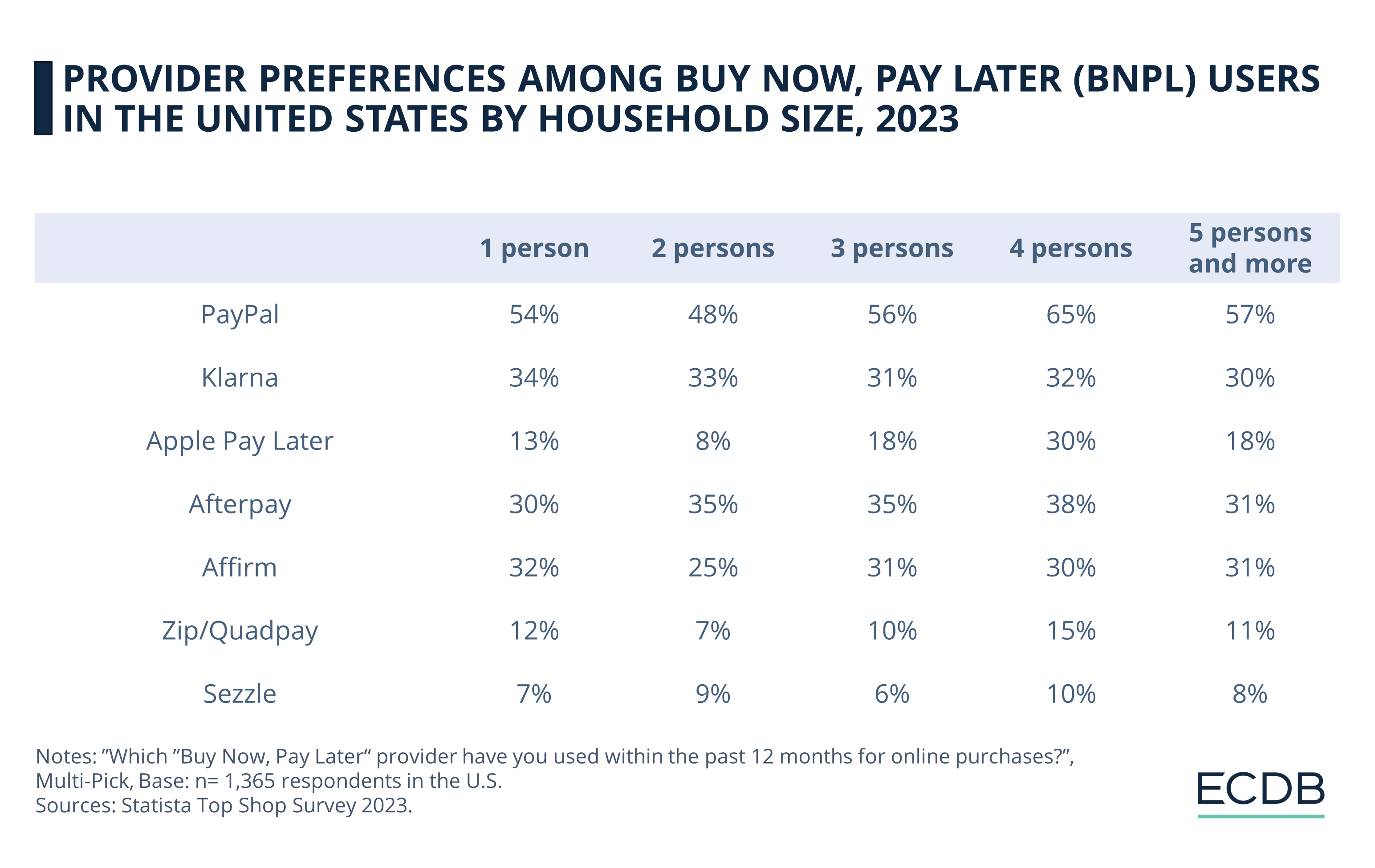

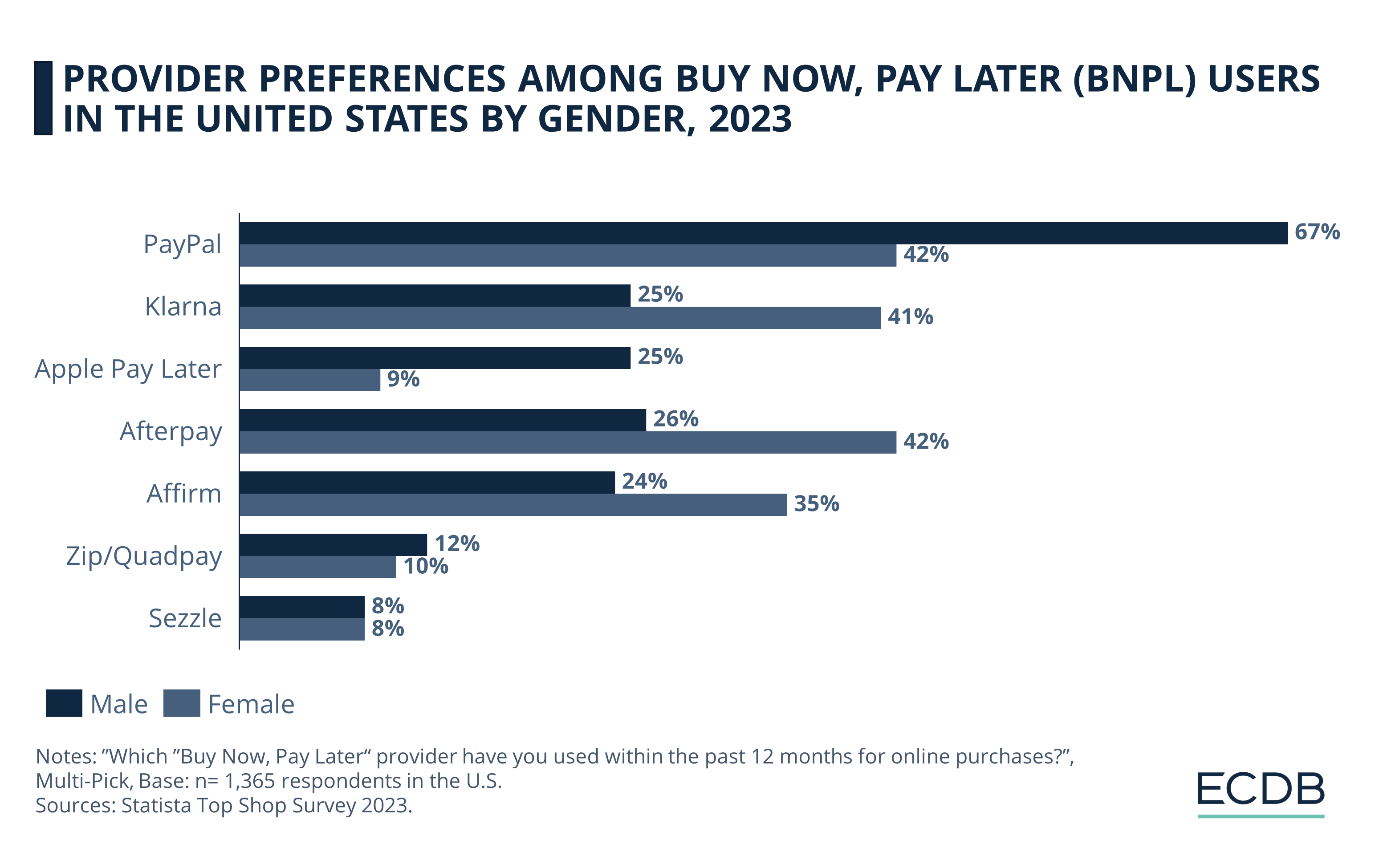

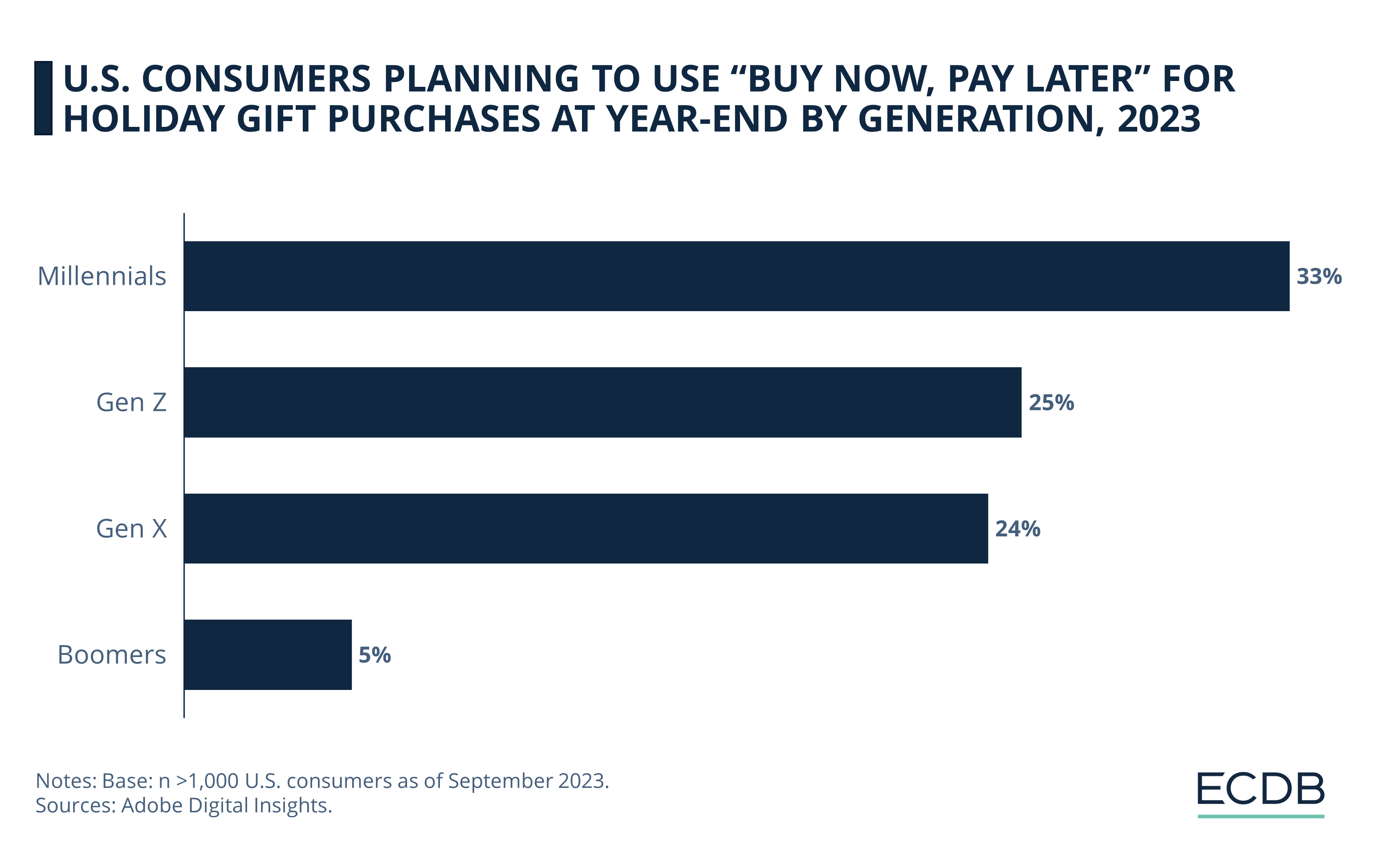

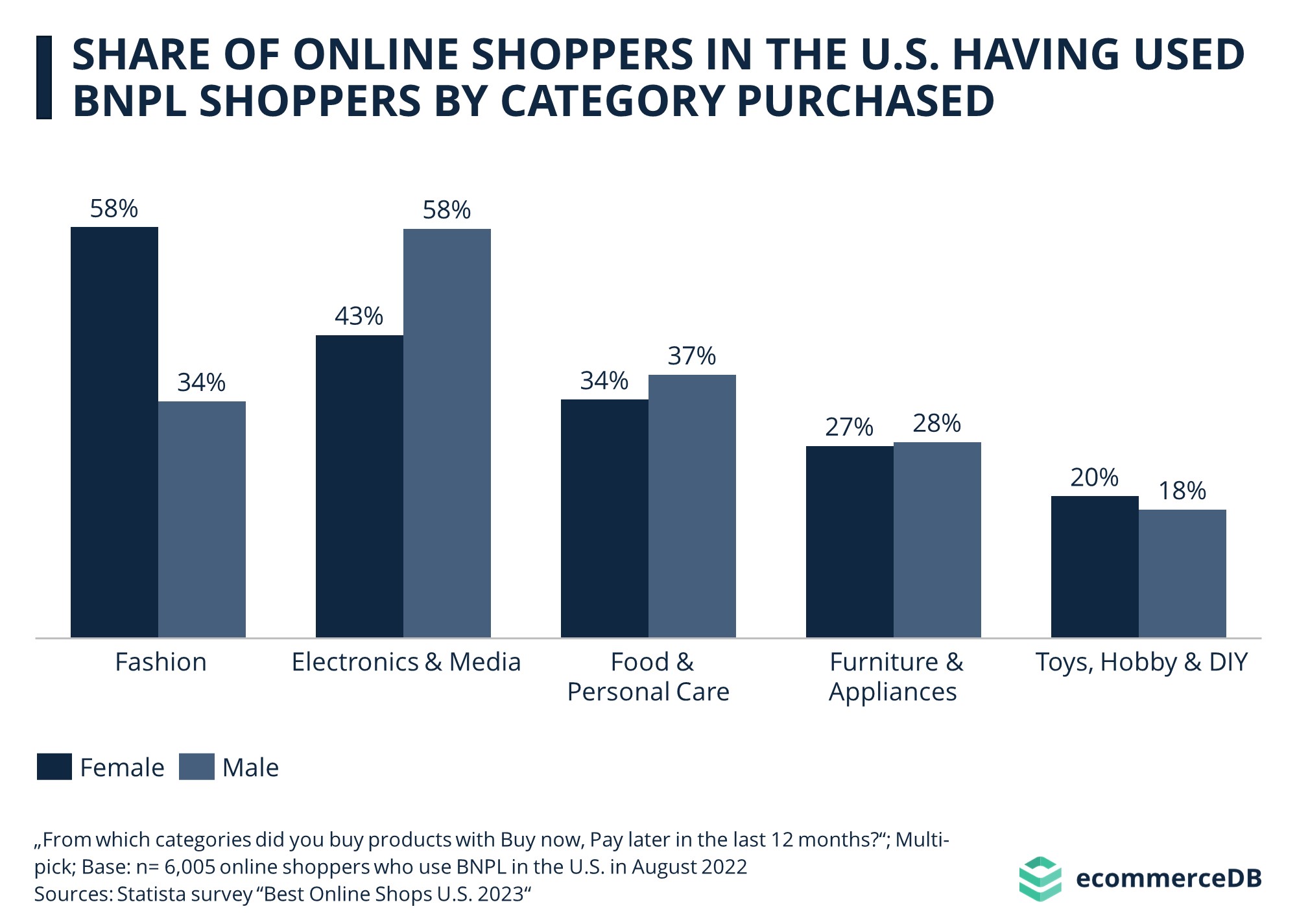

Buy Now, Pay Later (BNPL) in the U.S: Top Providers, Market Analysis & Consumer Behavior

Buy Now, Pay Later (BNPL) in the U.S: Top Providers, Market Analysis & Consumer Behavior

Deep Dive

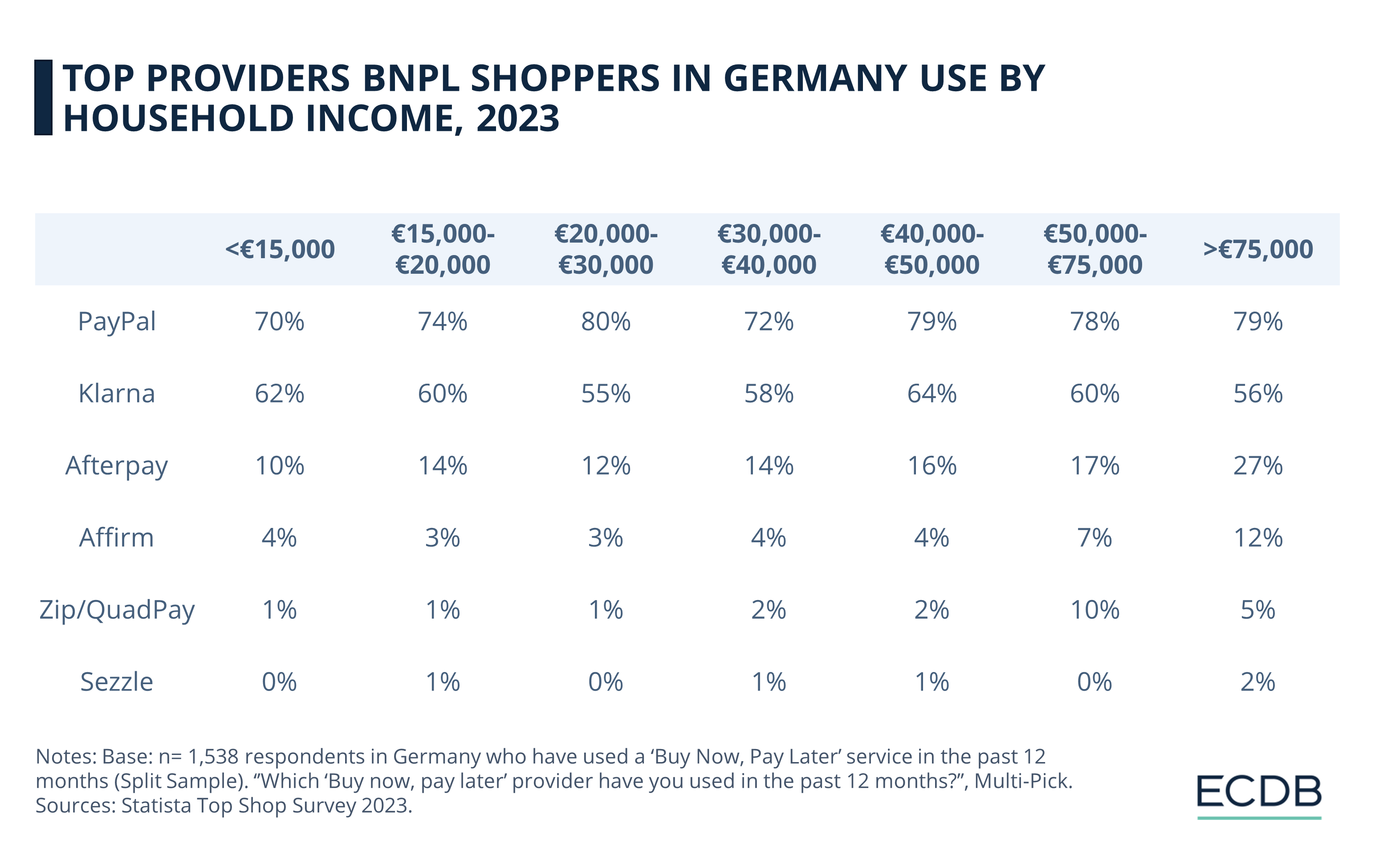

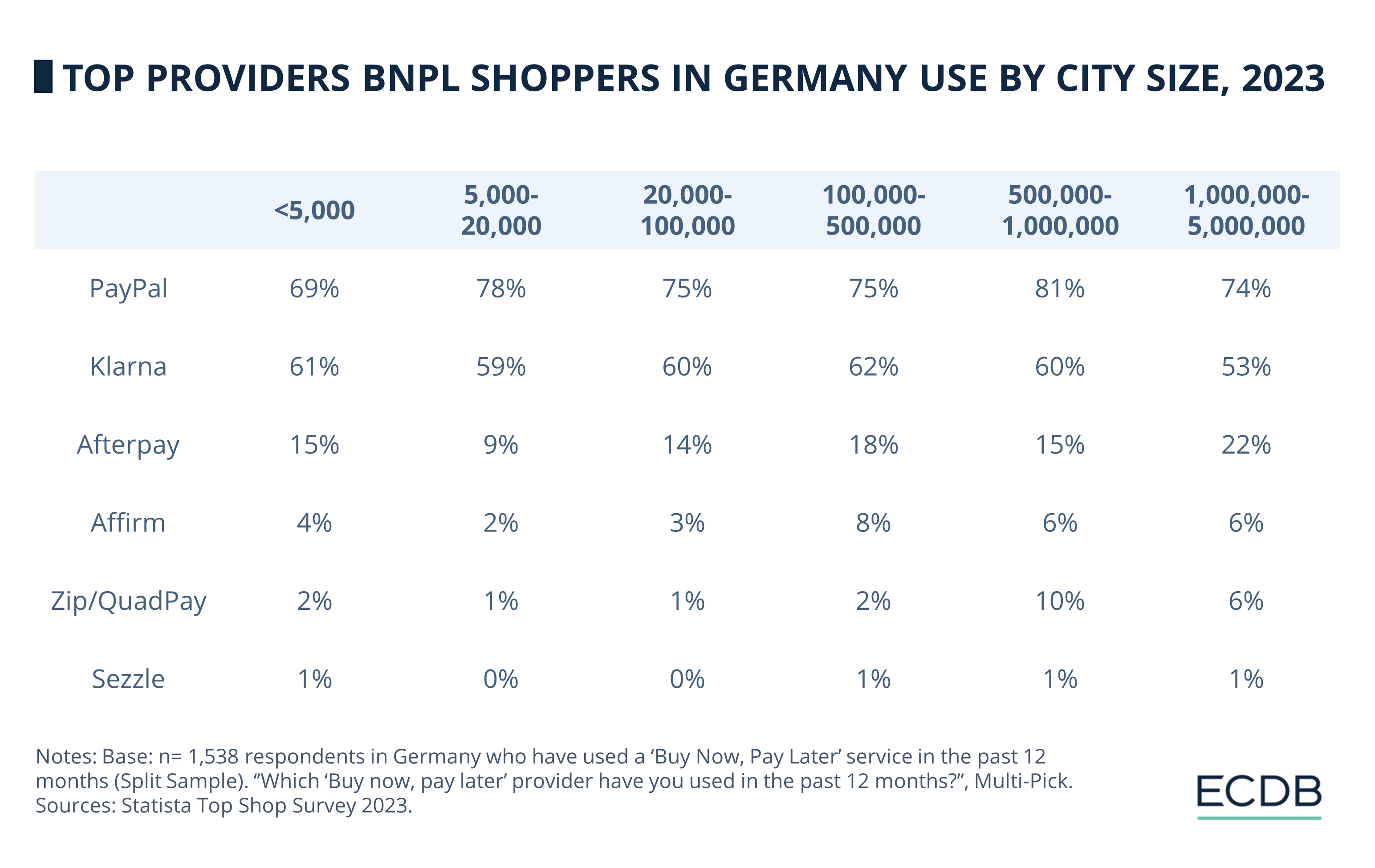

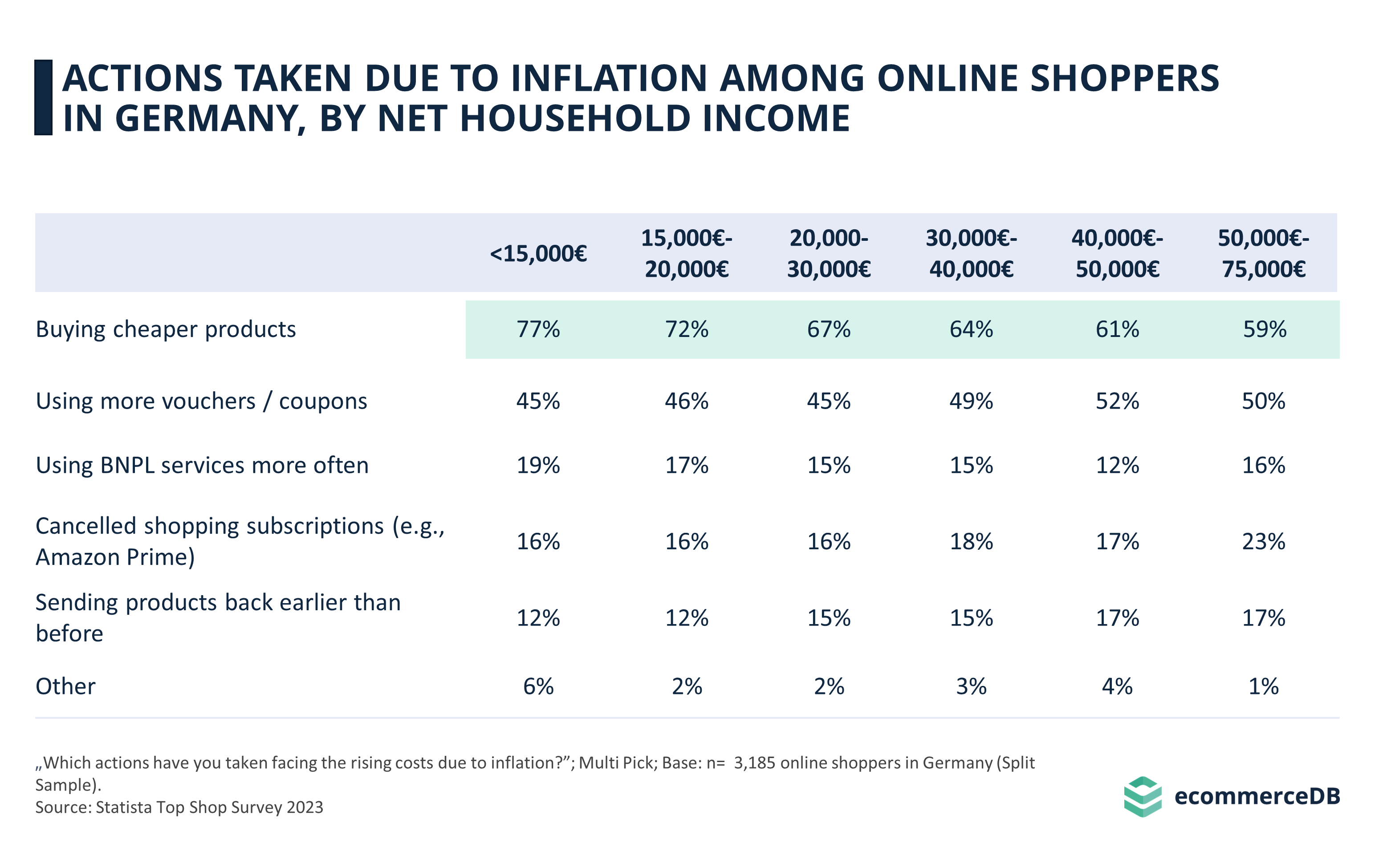

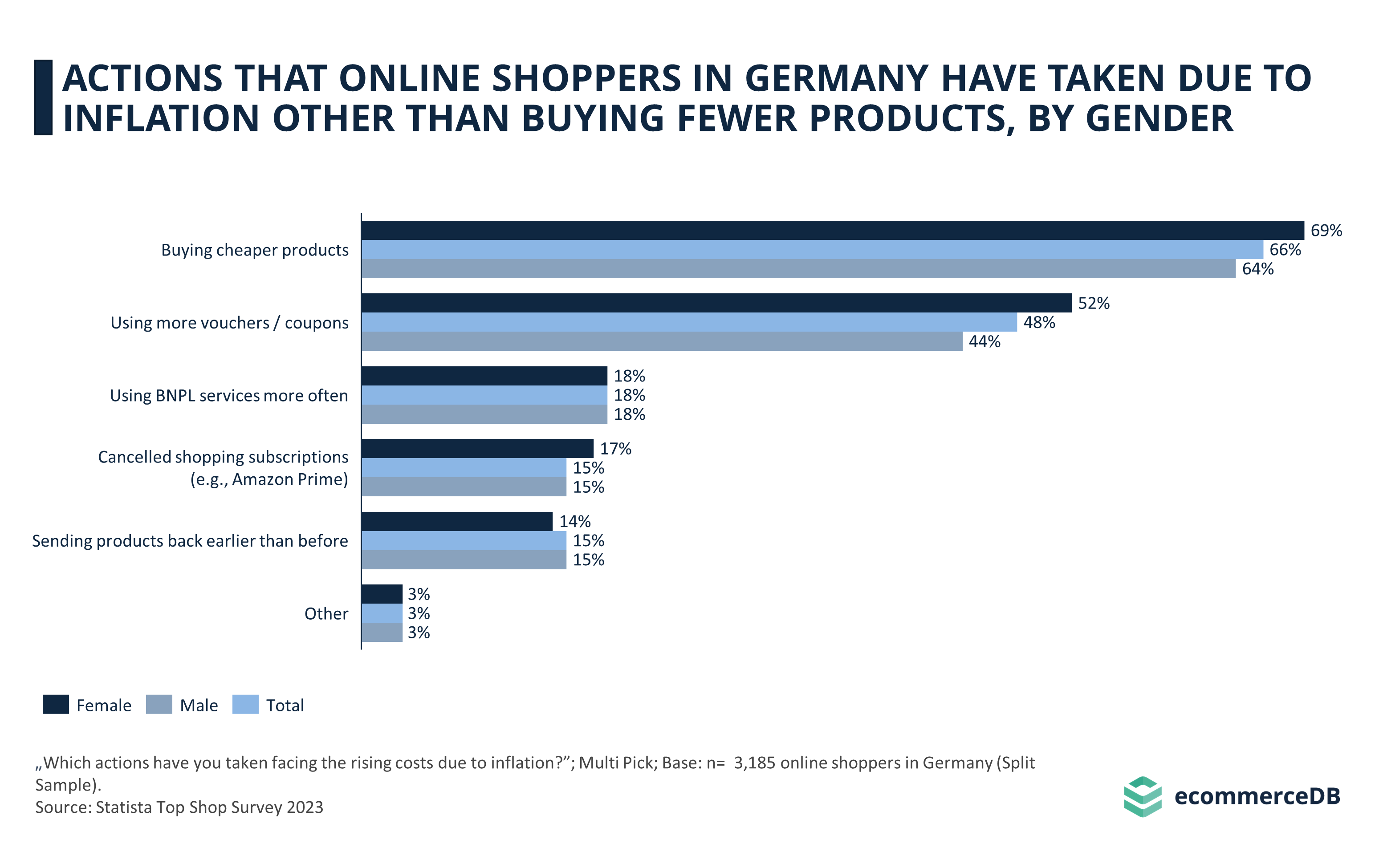

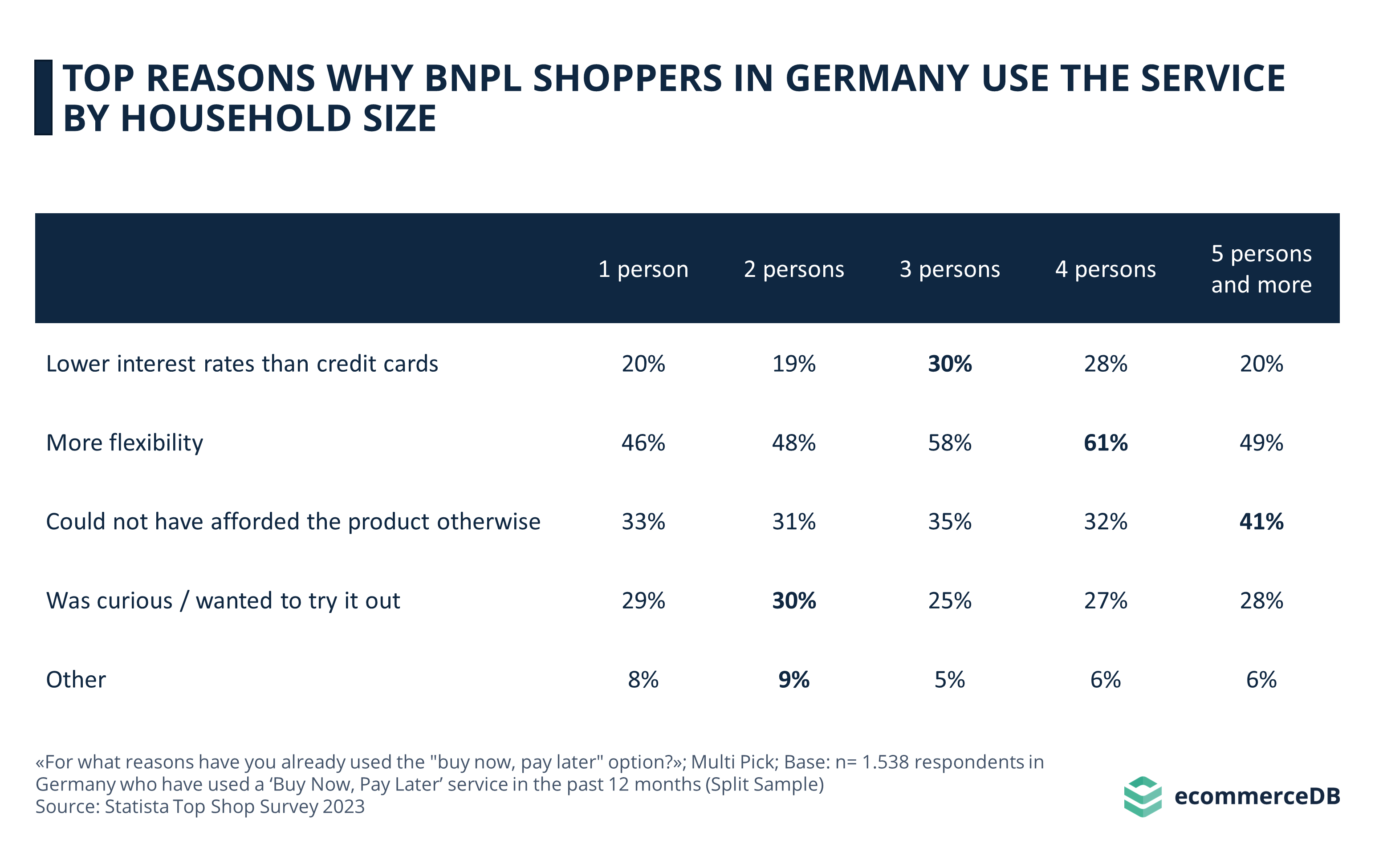

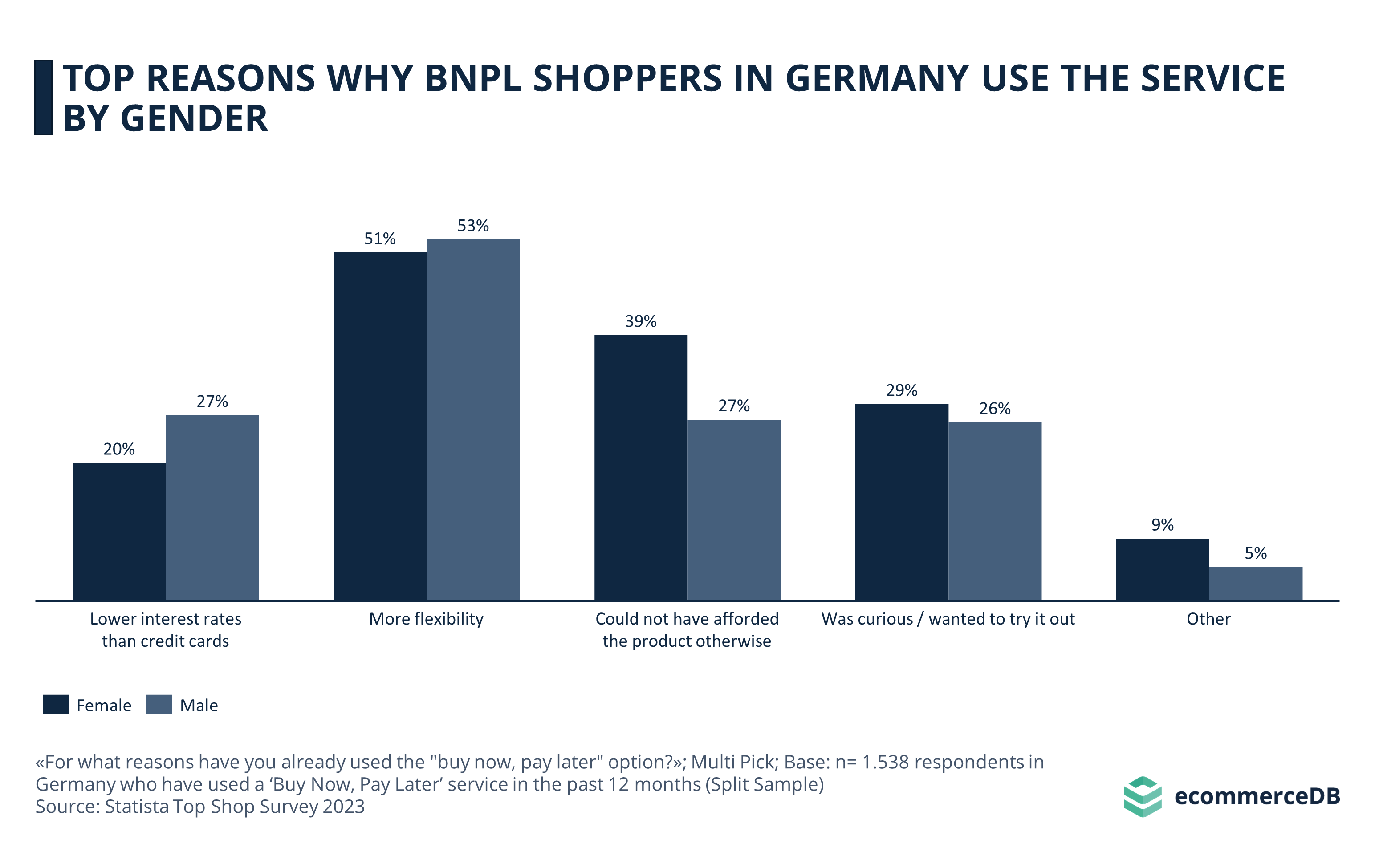

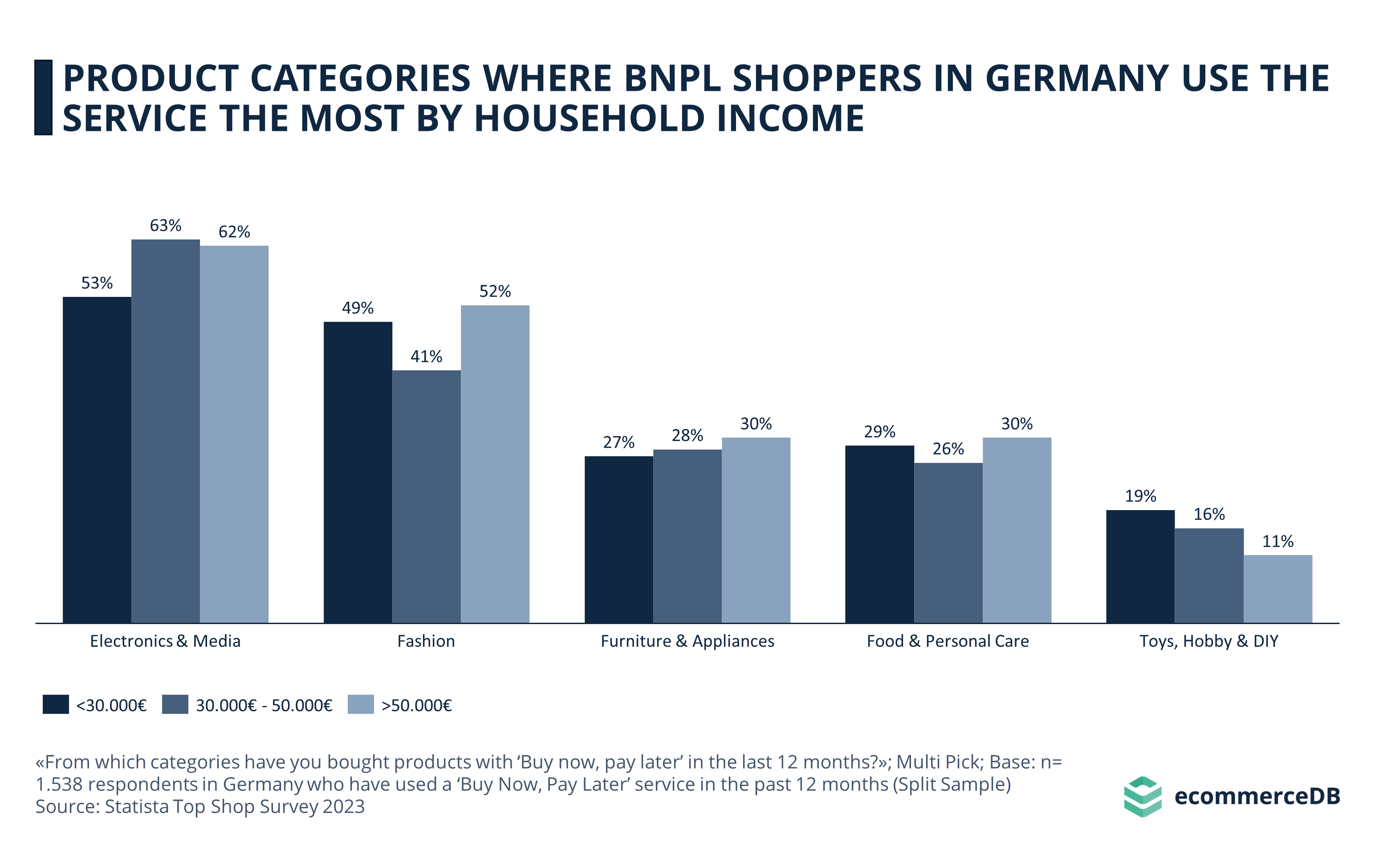

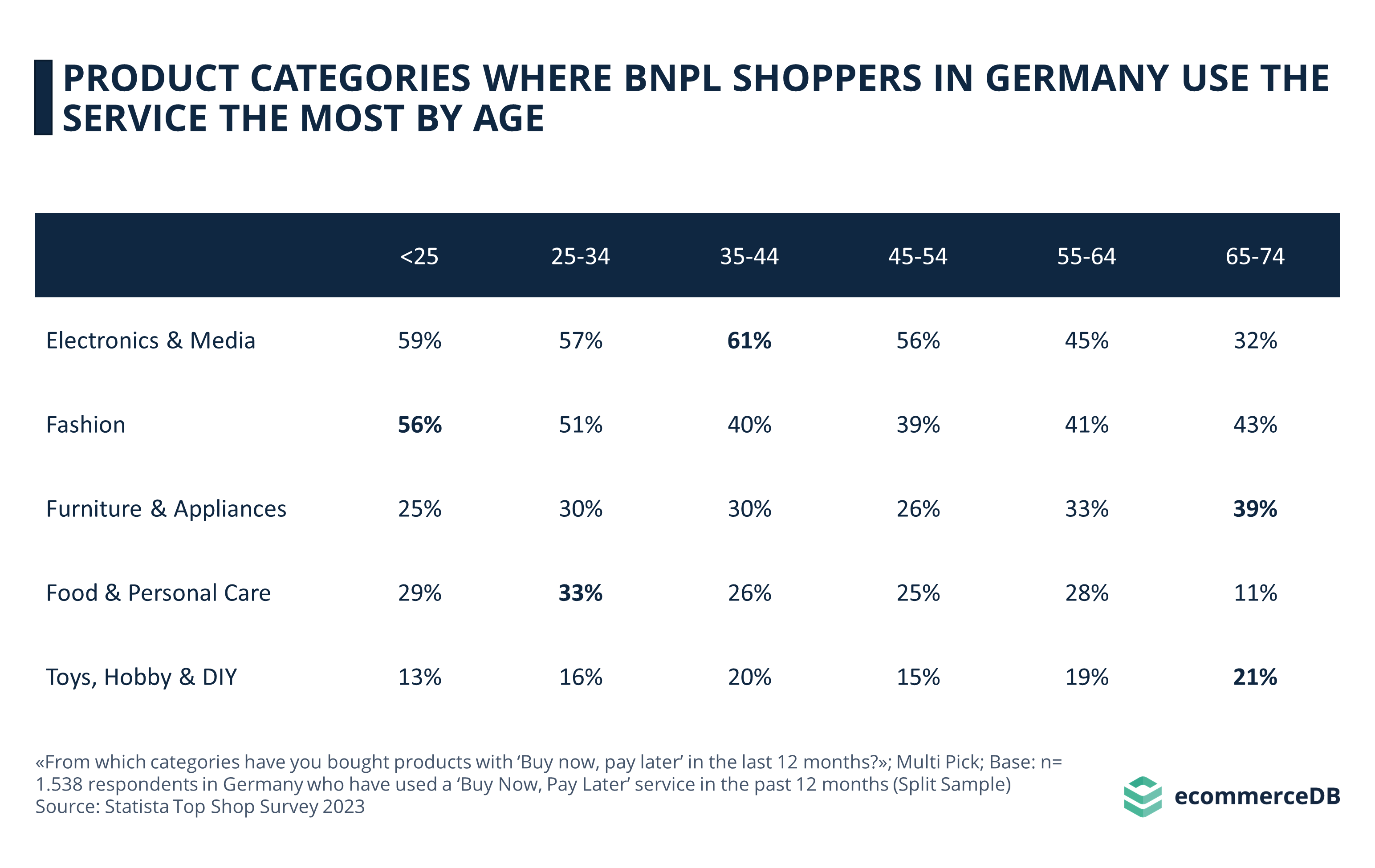

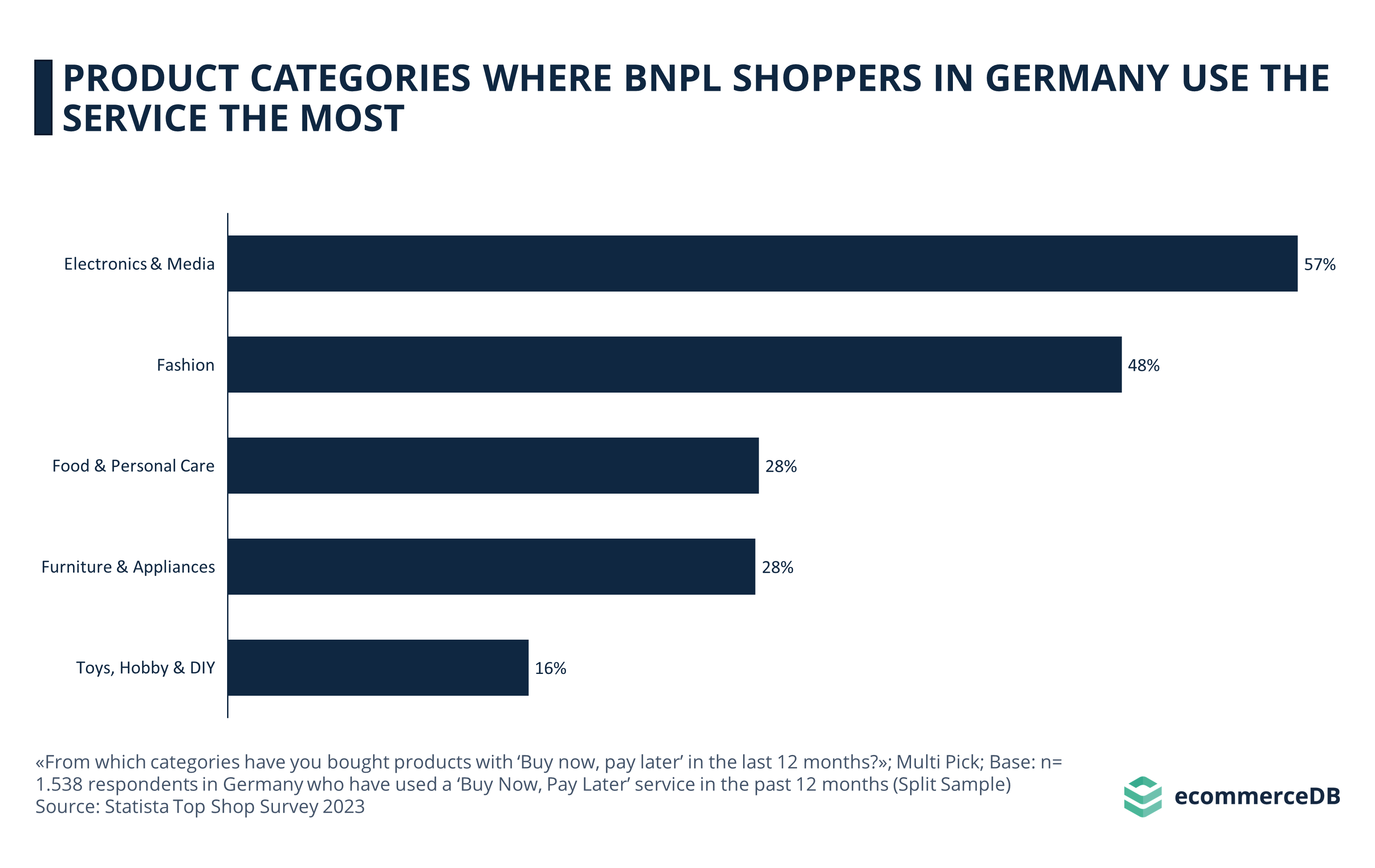

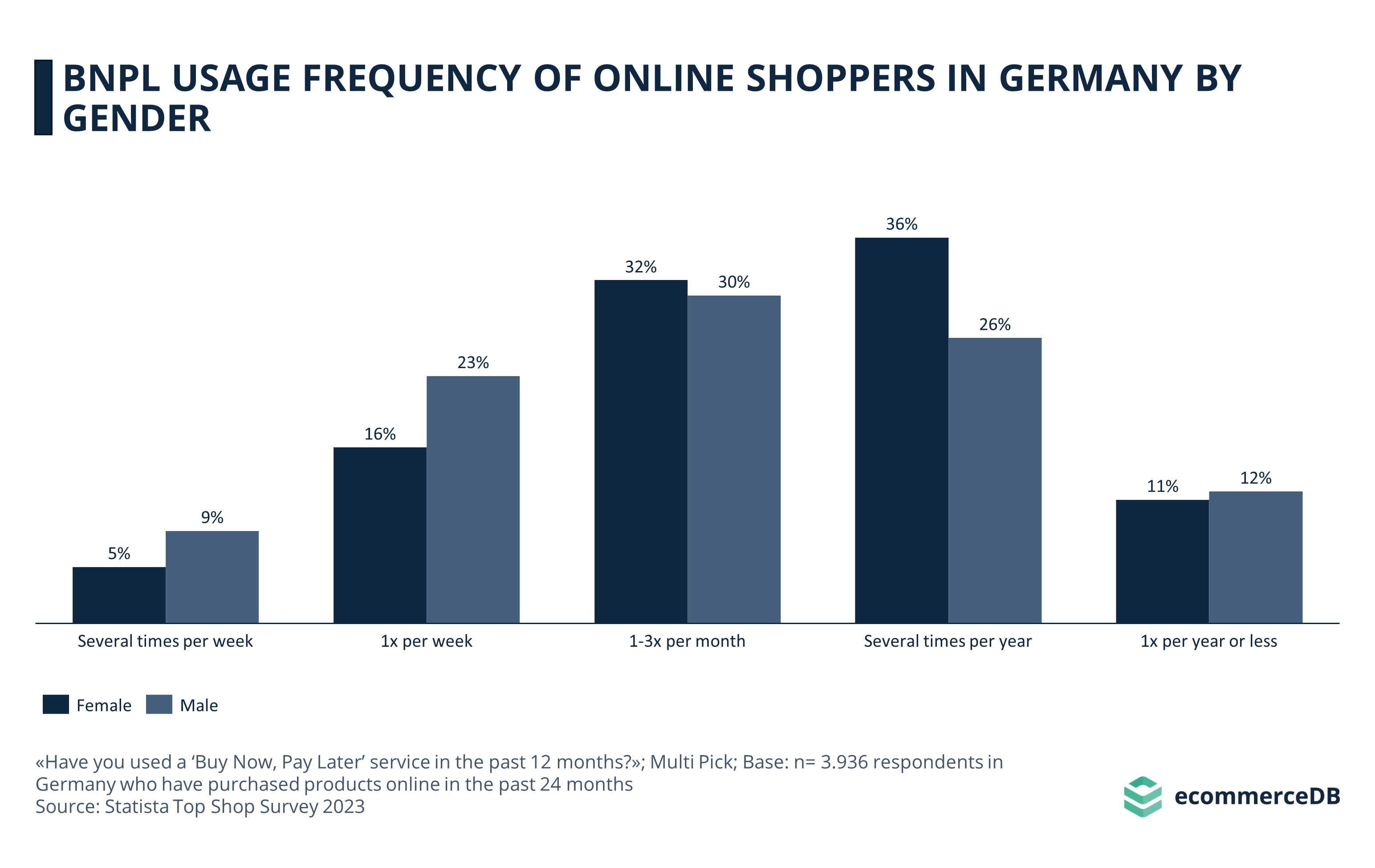

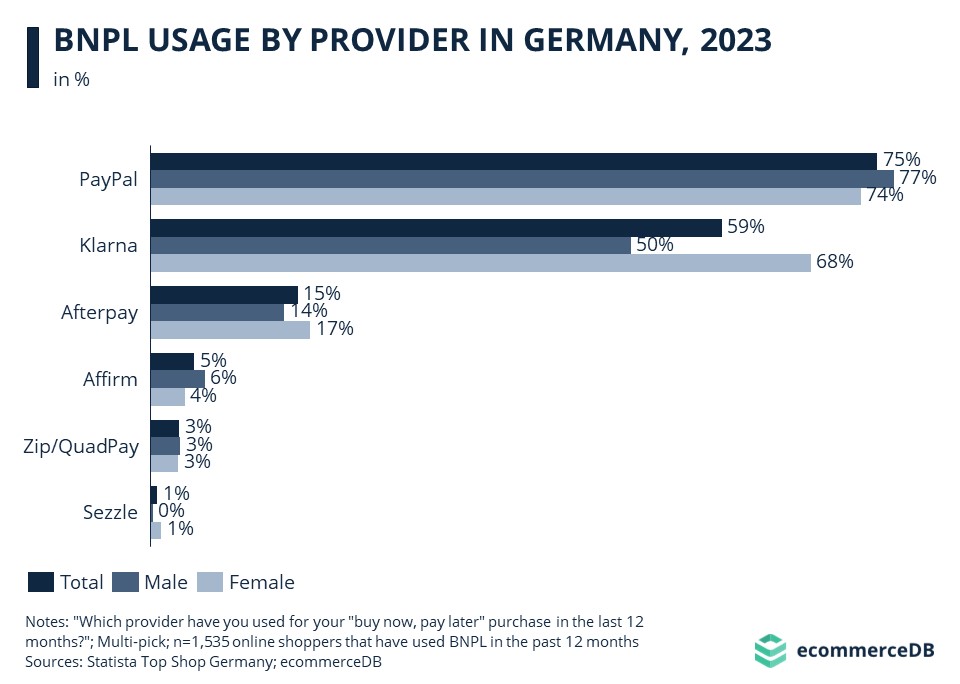

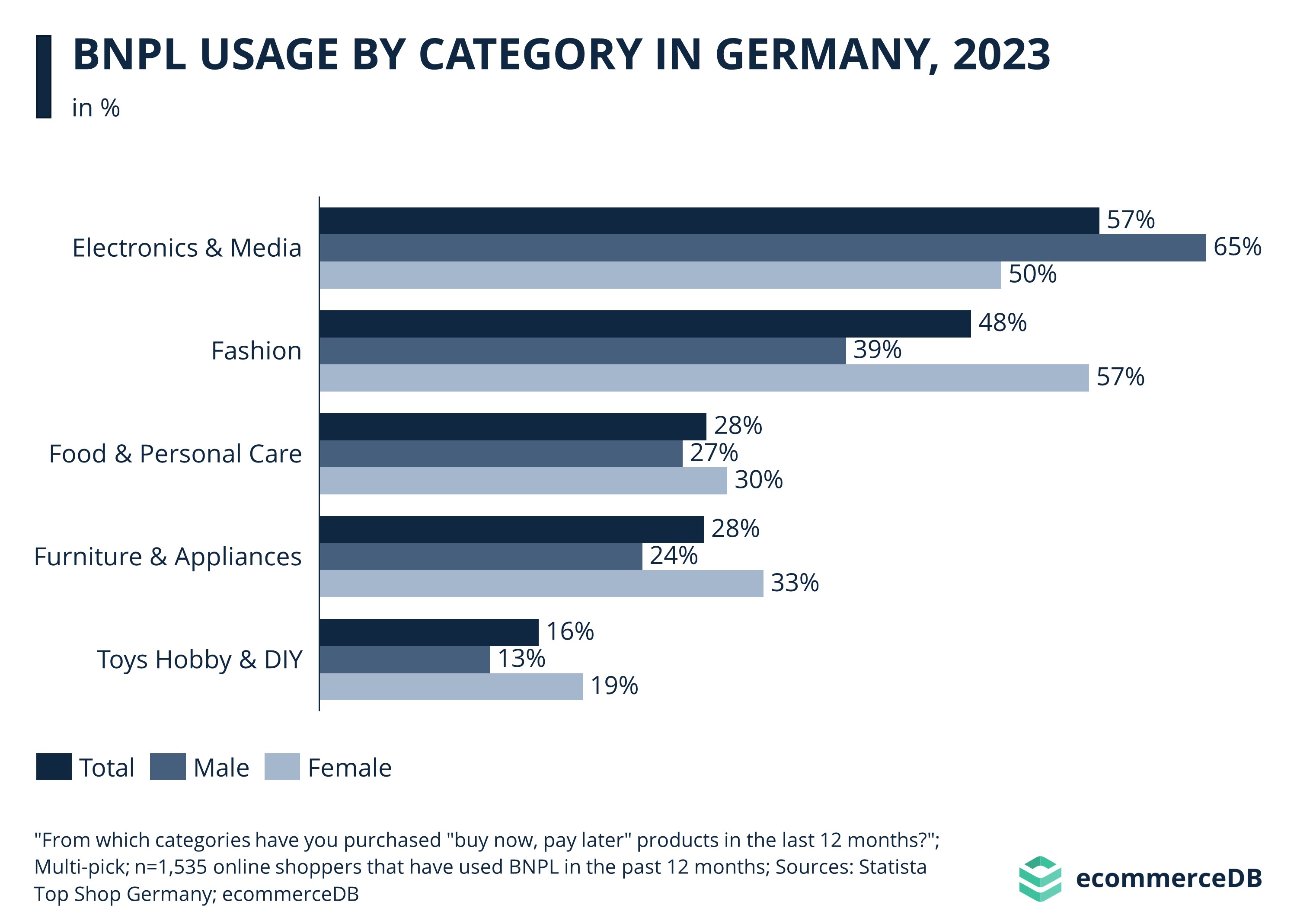

Buy Now, Pay Later in Germany: Top Providers, Consumer Behavior, PayPal & Klarna

Buy Now, Pay Later in Germany: Top Providers, Consumer Behavior, PayPal & Klarna