eCommerce: Rankings

Top 5 Online Stores in Global Fashion: Chinese and U.S. Companies Dominate

Fashion is a popular product category for eCommerce, but can you guess which companies are leading the global charge? Between two of the world's largest online economies, China and the United States, the race to the top of the fashion market is on.

Article by Nadine Koutsou-Wehling | May 28, 2024

Top Global Fashion Online Stores: Key Insights

Online Store Definition: An online store generates first-party net sales by selling own-branded products. However, companies can act both as a marketplace provider and as a seller.

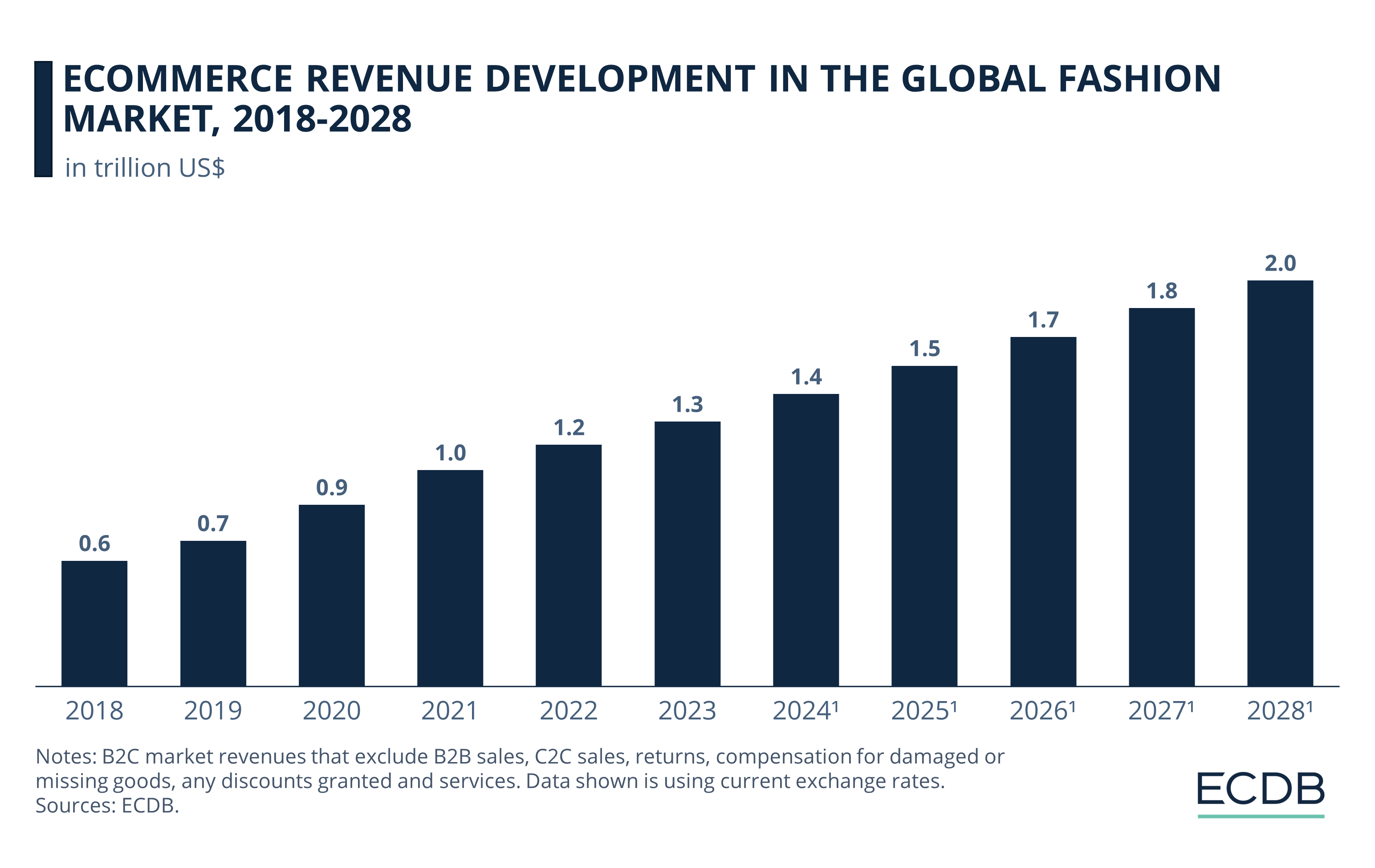

Consistent Growth in Global Online Fashion: A lucrative product category for eCommerce, fashion surpassed global market revenues of US$1 trillion for the first time in 2021. The subsequent years saw steady growth, which is expected to continue into 2028.

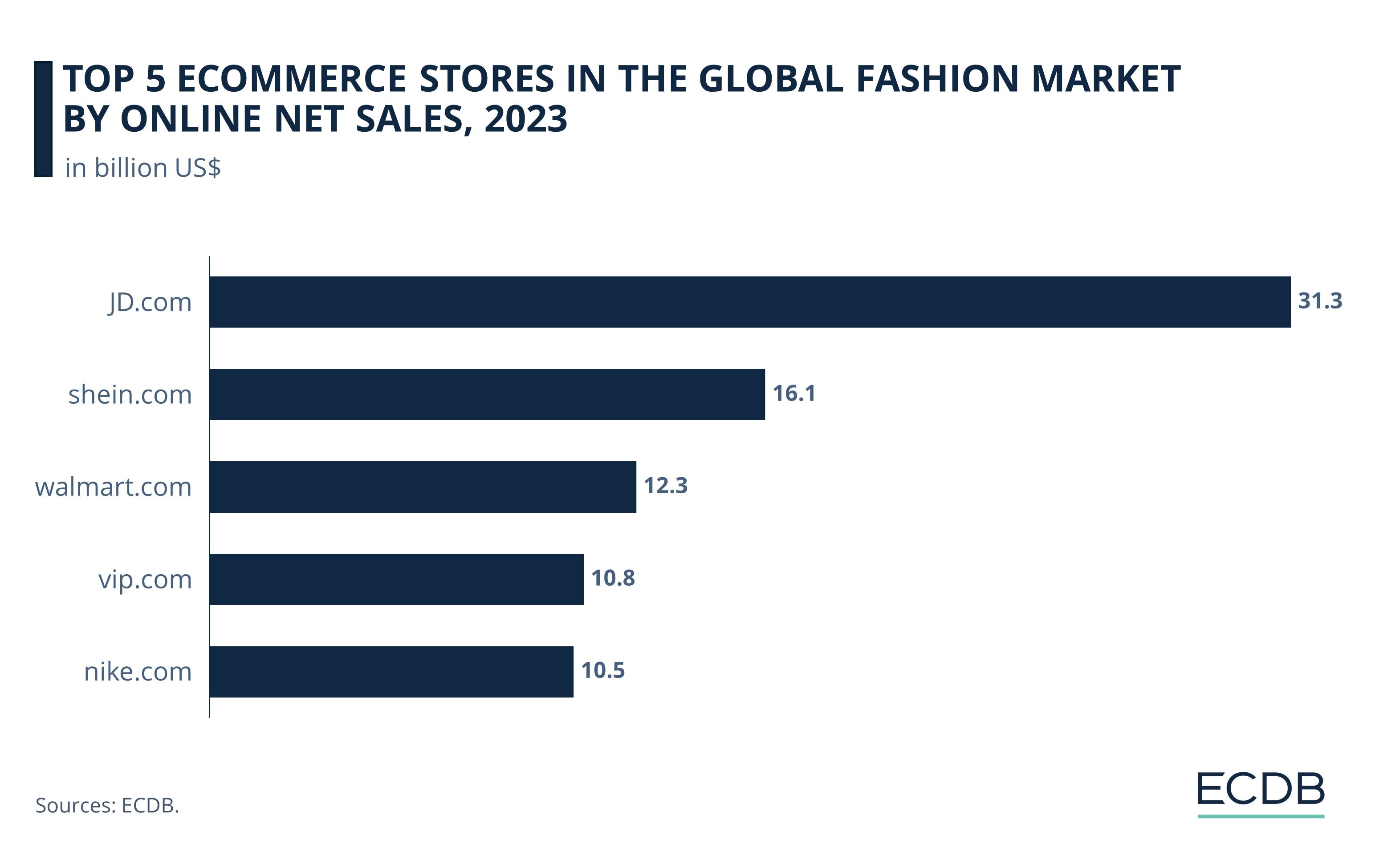

Top 5 Online Stores for Fashion: JD.com ranks first with online net sales of US$31.3 billion in 2023. Following this are Shein (US$16.1 billion), Walmart (US$12.3 billion), VIP (US$10.8 billion), and Nike (US$10.5 billion).

Fashion is an integral product category for eCommerce, and digital shopping has influenced global fashion as much as vice versa. By 2024, eCommerce revenues for the global fashion market are expected to reach US$1.4 trillion.

ECDB’s fashion product category consists of the sub-markets Apparel, Footwear, and Bags & Accessories. Find out which online stores generated the most eCommerce net sales for fashion in 2023.

What Is an Online Store? How Does It Apply to Fashion eCommerce?

In contrast to an online marketplace, which acts as an intermediary by providing a platform for companies to list their product offerings to consumers, an online store generates revenue by selling its own branded products. While a marketplace provider earns money through commissions on products sold through its platform (measured in GMV), an online stores’ key income metric is net sales, which is gross sales minus returns, allowances, and discounts.

However, one doesn’t exclude the other, meaning that companies can host a marketplace and be a seller through their own online store at the same time. In fashion eCommerce, online marketplaces like ASOS earn through commissions on sales, while branded stores like Zara focus on net sales. Because fashion is such a popular category for eCommerce, many generalist marketplaces and stores also rank highly in fashion.

Steady Growth in Fashion eCommerce: Reaching US$2 Trillion by 2028

The popularity of fashion in global eCommerce is illustrated by the resilience of fashion revenues in recent years, despite common fluctuations in company revenues due to pandemic surges and subsequent declines:

Before the pandemic and until 2020, global fashion eCommerce market revenues were less than US$1 trillion per year.

Since 2021, market revenues exceeded US$1 trillion for the first time, and continued to grow steadily in subsequent years. In this way market revenues reached US$1.2 trillion in 2022 and US$1.3 trillion in 2023.

Forecasts for 2024 and beyond predict continued growth. At a CAGR (2024-2028) of 9%, US$1.4 trillion in fashion eCommerce revenues in 2024 are expected to become US$2 trillion by 2028.

Which online stores are leading this thriving market?

The World’s Top Online Stores for Fashion by Revenue

Looking at the ECDB eCommerce Store Ranking for global fashion, Chinese and U.S. online stores take the lead:

By far the highest revenue in the top 5 ranking belongs to JD.com, the first online store on our list. Here are more details:

1. JD.com

JD is one of the top China’s leading eCommerce platforms, both as a marketplace provider and as a seller of own-branded products. In China, JD is the largest online store by net sales and this leadership is reflected in its dominant position in the global fashion market.

But fashion is only the second largest category of JD’s total assortment. First is Electronics with 45%, while Fashion accounts for 27% of online net sales.

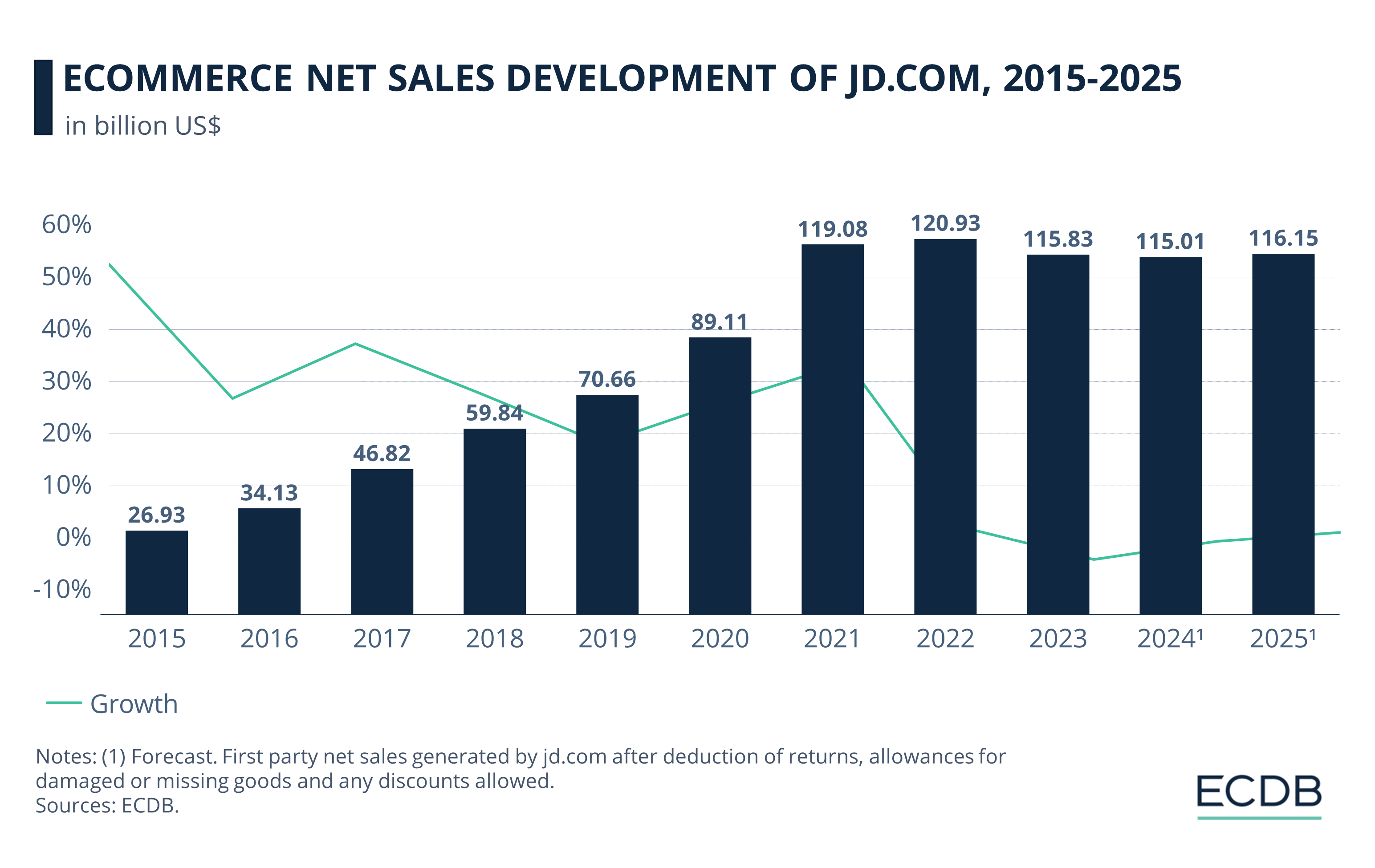

Despite its leadership position, note how JD’s eCommerce net sales have struggled to maintain positive growth after the post-pandemic normalization period. Note that the following chart includes net sales across all of JD’s product categories, of which fashion accounts for just over a quarter.

The annual growth rates for JD’s online net sales were 26% and 34% in 2020 and 2021, respectively. This resulted in annual revenues of US$119.1 billion in 2021.

While there was a slight increase in 2022 to US$120.9 billion, revenues declined to US$115.8 billion in 2023 and are expected to decrease further by 2024.

A slow recovery is forecast for 2025.

JD’s prominent position in global fashion leaves room for stagnant growth, but for how long before the lower ranks close the gap?

2. Shein.com

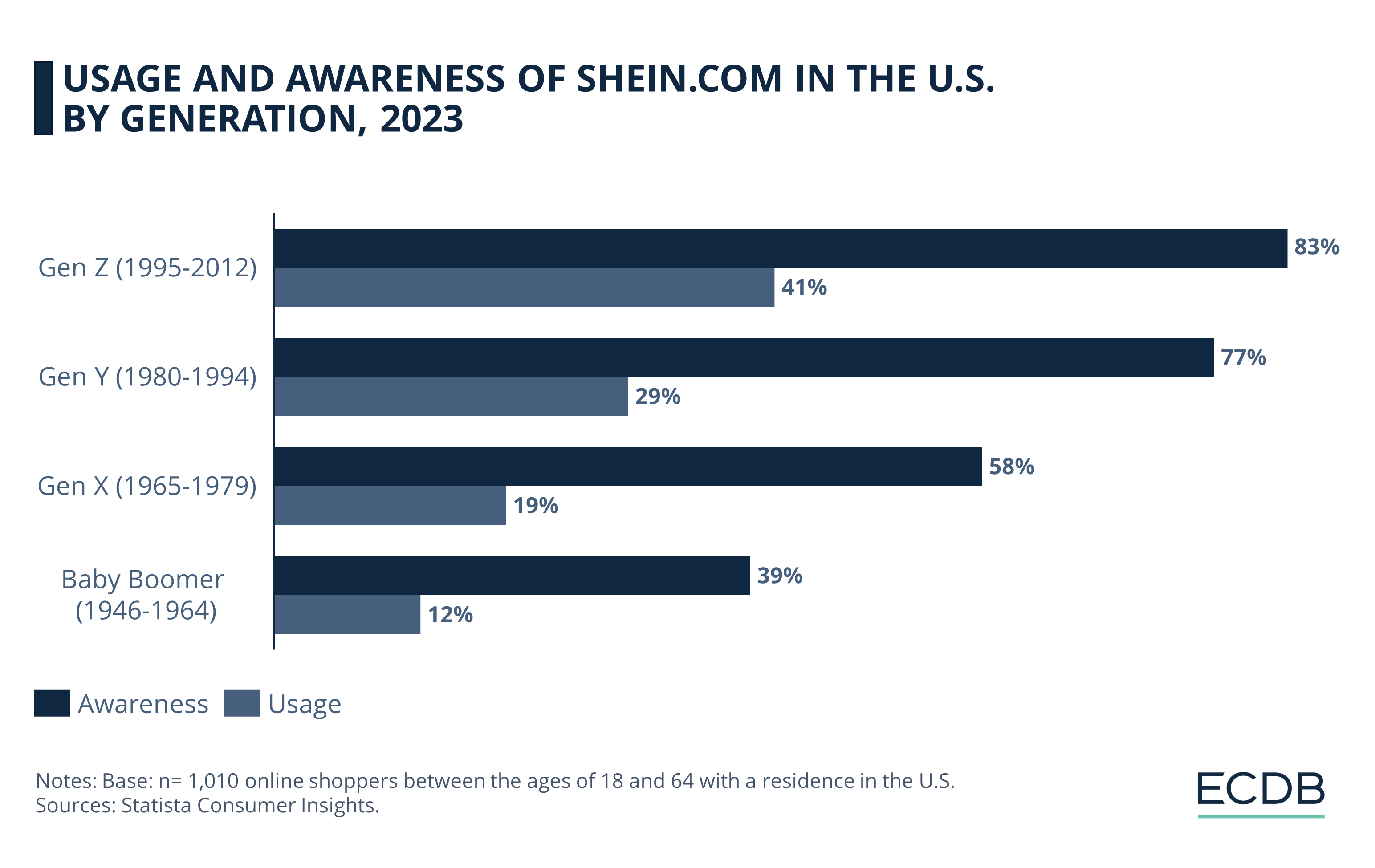

Shein.com is the rapidly growing fast fashion online store that everyone is talking about. The pandemic has served as a major accelerator for Shein’s net sales. Its highly effective social media strategy, combined with low prices and trend-led product assortments, make it particularly popular with the younger crowd.

See a generational breakdown of Shein’s audience in the United States, which is Shein’s primary market:

With global fashion online net sales of US$16.1 billion in 2023, Shein is well behind first place JD. But considering its annual growth rate of 39.6% in 2023, compared to JD’s negative rate of –4.2%, it may not take long for Shein to catch up sooner than later.

3. Walmart.com

Walmart.com generated US$12.3 billion in eCommerce net sales from its online store in 2023. While Walmart ranks first in the U.S. fashion eCommerce market, its extensive sales in the country propel it to third globally. Like JD, walmart.com generates all of its net sales in a single market. Because China and the United States are such vast countries with large consumer bases, an international strategy is not necessary to top the global ranking. But Walmart operates country-specific domains in Canada and Mexico.

Walmart also has a successful online marketplace. Because it is a generalist retailer with a broad product assortment like Amazon, fashion is only part of Walmart’s overall product mix. More specifically, 19% of eCommerce net sales on walmart.com are in fashion, its largest category. But Hobby & Leisure is close behind, at 18%.

4. VIP.com

The second online store on this list that operates exclusively in China is vip.com. 70% of VIP’s product mix consists of fashion products, with the remainder split evenly between electronics and personal care products.

VIP.com also operates as both a marketplace operator and a first-party seller. While it consistently ranks among China’s top 10 online marketplaces and is the country’s third-largest online store by eCommerce net sales, it has experienced volatility in terms of GMV and net sales. Unlike Alibaba and PDD, which have diversified portfolios, VIP is focused on one market. This makes it more vulnerable to government regulations and consumer sentiment than the others.

5. Nike.com

Nike.com’s primary market is the U.S., where 42.8% of its eCommerce net sales were generated in 2023. But nike.com operates globally, in a variety of markets. The brand has experienced steady growth in online net sales throughout the pandemic and in the years since.

A large majority of Nike’s product assortment consists of Fashion (78%), of which 38% is Footwear and 40% is Apparel.

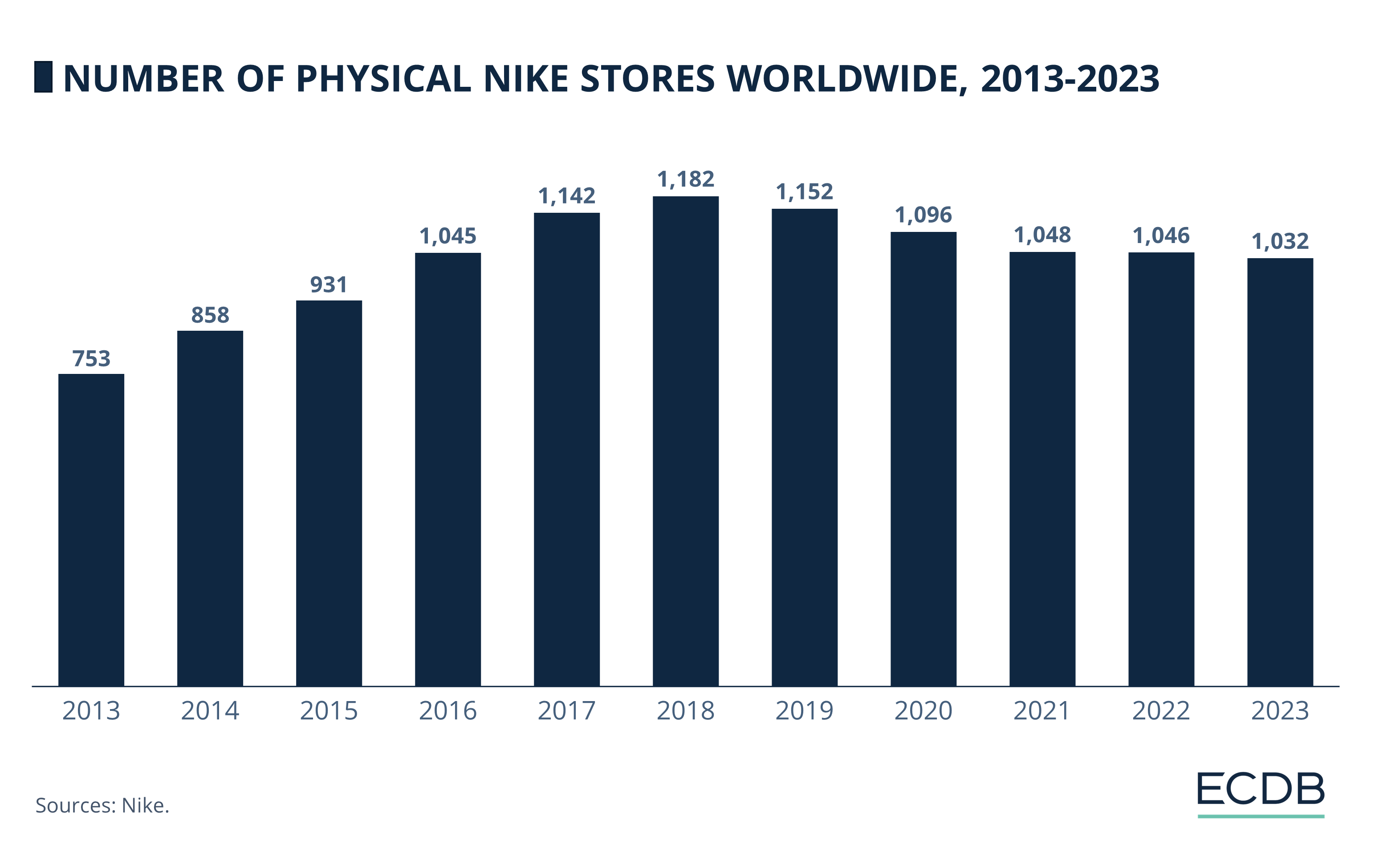

Similar to other established fashion retailers, Nike has reduced the number of physical stores in recent years and strengthened its hybrid approach of online and offline sales. Unlike H&M and Zara, however, the reduction began before the pandemic:

Until 2018, the number of physical stores grew steadily, exceeding 1,000 for the first time in 2016 and peaking at 1,182 in 2018.

From 2019 onwards, physical store count declined by an average of 30 stores per year until 2023.

In 2023, physical store numbers were lower than they were in 2016, at 1,032.

Nike’s move to reduce physical store count is typical of major fashion brands. The cutback is indicative of online expansion, as technological advances enable consumers to try on shoes virtually. Reducing the number of physical stores also cuts costs and allows brands to focus on improving the customer experience in the remaining locations through services like click & collect, automated returns, and more.

Recently, however, Nike reportedly warned investors and the public of decreasing revenues to come. This is due to increasing competition from athletic wear brands such as On and Decker’s Hoka that sell running shoes with foam soles similar to those for which Nike is known. The novelty and buzz of the new brands is what gives them traction. While Nike has built a brand identity around U.S. sports personalities taking a stance for social justice causes, it repels some consumers who do not want to participate, for various reasons.

Global Online Fashion Stores: Wrap-Up

Fashion in eCommerce is highly competitive, with many companies and different business approaches participating. Reaching many consumers through a diversified offering, of which fashion is only a part, dominates among the world’s top 5 online stores for fashion products. But ultra-fast fashion store Shein threatens to take over with its strategy of offering vast arrays of styles for incredibly cheap prices.

Is the strategy viable or only a short-term trend? ECDB analysts expect Shein to continue thriving in subsequent years. To learn more, check out the other articles on fashion eCommerce on this website.

Sources: NY Post

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Zalando’s Takeover of About You: Expanding Into Eastern Europe

Zalando’s Takeover of About You: Expanding Into Eastern Europe

Deep Dive

High Growth Rate, Low Online Share: Grocery eCommerce on Track for Future Expansion

High Growth Rate, Low Online Share: Grocery eCommerce on Track for Future Expansion

Deep Dive

Understanding the CVR and AOV Correlation Across Product Types

Understanding the CVR and AOV Correlation Across Product Types

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics