eCommerce: KPIs Explained

CAGR: Compound Annual Growth Rate – Definition, Usage & Calculation

Although it might appear mundane and reminiscent of elementary school management concepts, the Compound Annual Growth Rate (CAGR) can be a reliable indicator of a company's profitability. Nevertheless, its significance and calculation method are not immediately obvious.

Article by Patrick Nowak | May 29, 2024

CAGR (Compound Annual Growth Rate) Explained – Key Insights:

CAGR is a metric that measures investment growth potential

It is calculated by finding the average yearly growth rate over a specific period

CAGR is used to assess investment performance, compare returns, and forecast future values in finance

While it may seem mundane and reminiscent of elementary school management principles, the Compound Annual Growth Rate (CAGR) can serve as a solid indicator of the profitability of company. However, its meaning and calculation method are not self-explanatory.

Understanding the growth potential of an investment or business venture is crucial. While there are numerous metrics available to assess growth, the Compound Annual Growth Rate, or CAGR is simple to calculate and easy to understand. Here is why.

Compound Annual Growth Rate (CAGR): What Does It Mean?

It is a way to measure how much an investment grows on average each year over a period longer than one year. Therefore it serves as a pretty reliable method to calculate and determine returns for various assets, investment portfolios, and anything else that can increase or decrease in value over time. CAGR is a term often used by investment advisors and funds to showcase their market knowledge and investment performance.

CAGR Formula and How To Calculate It

Compound Annual Growth Rate (CAGR) might sound intimidating for someone, who is new to management. In this article, we'll break it down into simple terms even for the most unfamiliar with financial concepts. To calculate it, we need two essential pieces of information: the starting value of the investment and the ending value after a certain period. Let's take a relatable example:

Imagine you invested US$1,000 in a company's stock three years ago. Today, that investment has grown to US$1,500.

Now, we want to find out the average yearly growth rate. First, we calculate the total growth by subtracting the starting value from the ending value:

US$1,500 - US$1,000 = US$500.

Next, we divide the total growth by the number of years to get the average annual growth:

US$500 ÷ 3 = US$166.67.

Finally, to find the CAGR, we need to convert this average annual growth into a percentage. In this case, it's approximately 16.67%.

So, if someone asks you about the CAGR of your investment, you can confidently say it's around 16.67%. This means, on average, your investment has been growing by about 16.67% each year over the past three years.

Remember, CAGR is a handy tool to understand how investments perform over time, and now you're equipped with the basic knowledge to calculate it even if you're new to financial concepts.

The Most Common CAGR Applications

Compound Annual Growth Rate (CAGR) finds various applications that help individuals and businesses make informed decisions. Here are some examples, each with its distinct purpose:

Calculating and Communicating Investment Fund Returns: CAGR is utilized to determine the average annual returns of investment funds, enabling investors to assess their performance over time.

Example: An investor can compare the CAGR of different mutual funds to make an informed choice about where to invest their money.Demonstrating and Comparing Investment Advisor Performance: Investment advisors often highlight their expertise by showcasing the CAGR of their clients' portfolios.

Example: An investment advisor can present the CAGR of their clients' investments to demonstrate their ability to generate consistent returns.Comparing Historical Returns: CAGR assists in comparing the historical returns of various investment options, such as stocks, bonds, or savings accounts.

Example: By comparing the CAGR of stocks and bonds over a specific period, an investor can evaluate which asset class has delivered better long-term returns.Forecasting Future Values: CAGR can be employed to forecast future values based on the historical growth rate of a data series.

Example: By applying the CAGR of a company's revenue over the past five years, analysts can estimate its expected revenue for the next few years.Analyzing Business Measures: CAGR helps in analyzing and communicating the behavior of different business metrics, such as sales, market share, costs, customer satisfaction, and performance, over a series of years.

Example: A company can use CAGR to assess the annual growth rate of its market share, providing insights into its competitive position.

By utilizing CAGR in these diverse applications, investors, advisors, and businesses gain valuable insights and make more informed decisions in the dynamic world of finance.

ECDB: CAGR With Simplified Calculations

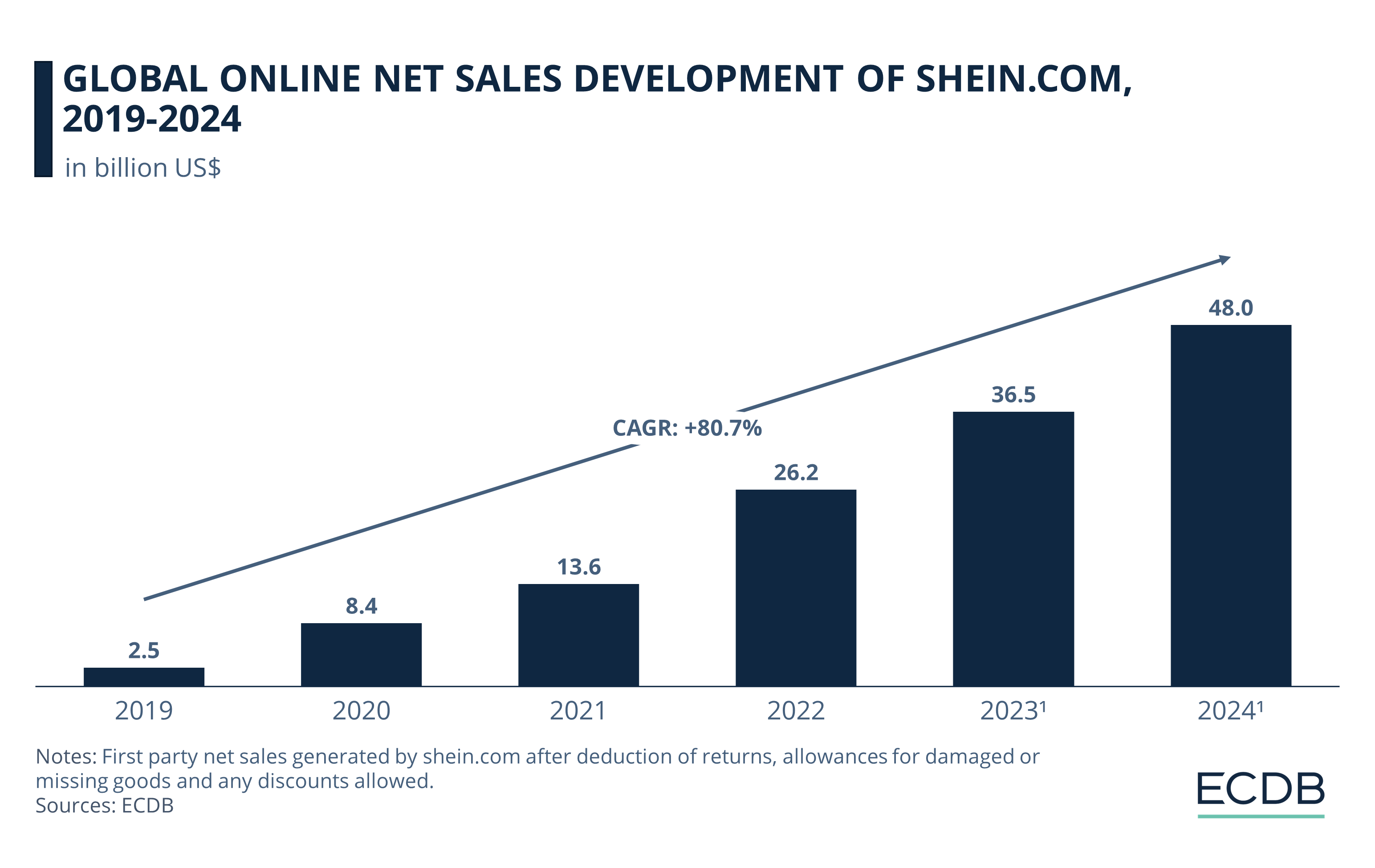

Discover every company's CAGR for informed investments with ECDB's comprehensive data. Unlock more insights and information to make confident financial decisions. For example, here is the Compound Annual Growth Rate (CAGR) of Shein from 2019 to 2024. For more information, visit our database.

What Is a Good CAGR?

So now we know what CAGR is and how to calculate it. But what is a good Compound Growth Rate? While a positive CAGR is often favored, it's essential to understand that some investment strategies, such as hedge funds or specialized sector funds, may experience occasional negative CAGRs due to short-term market fluctuations or specific investment approaches. Negative CAGR doesn't necessarily indicate a poor investment choice. It may be a result of temporary setbacks or strategic repositioning. However, it is crucial to scrutinize the reasons behind the negative CAGR and consider the long-term prospects of the fund before making investment decisions.

CAGR: Summary

Compound Annual Growth Rate (CAGR) is a metric used to measure investment growth potential. This article explains the concept of CAGR, how to calculate it step by step, and its applications in finance. A positive CAGR is generally preferred, but negative CAGRs may occur in certain investment strategies.

FAQ: Compound Annual Growth Rate (CAGR)

How do you calculate compound annual growth rate CAGR?

Apply the following formula: CAGR = (Ending Value / Starting Value)^(1 / Number of Years) – 1. To express the CAGR as a percentage, multiply the result by 100.

What is CAGR in simple terms?

The compound annual growth rate (CAGR) is the average yearly rate at which revenue grows between two specific years, assuming the growth happens at a steadily increasing rate.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Back to main topics