eCommerce: Leaders in Sportswear and Athleisure Fashion

Adidas vs Nike: Which Brand Leads in eCommerce?

Two iconic sportswear brands in a direct comparison: Who wins in terms of revenues, benchmarks and consumer preference?

Article by Nadine Koutsou-Wehling | October 09, 2024

Adidas vs Nike: Key Insights

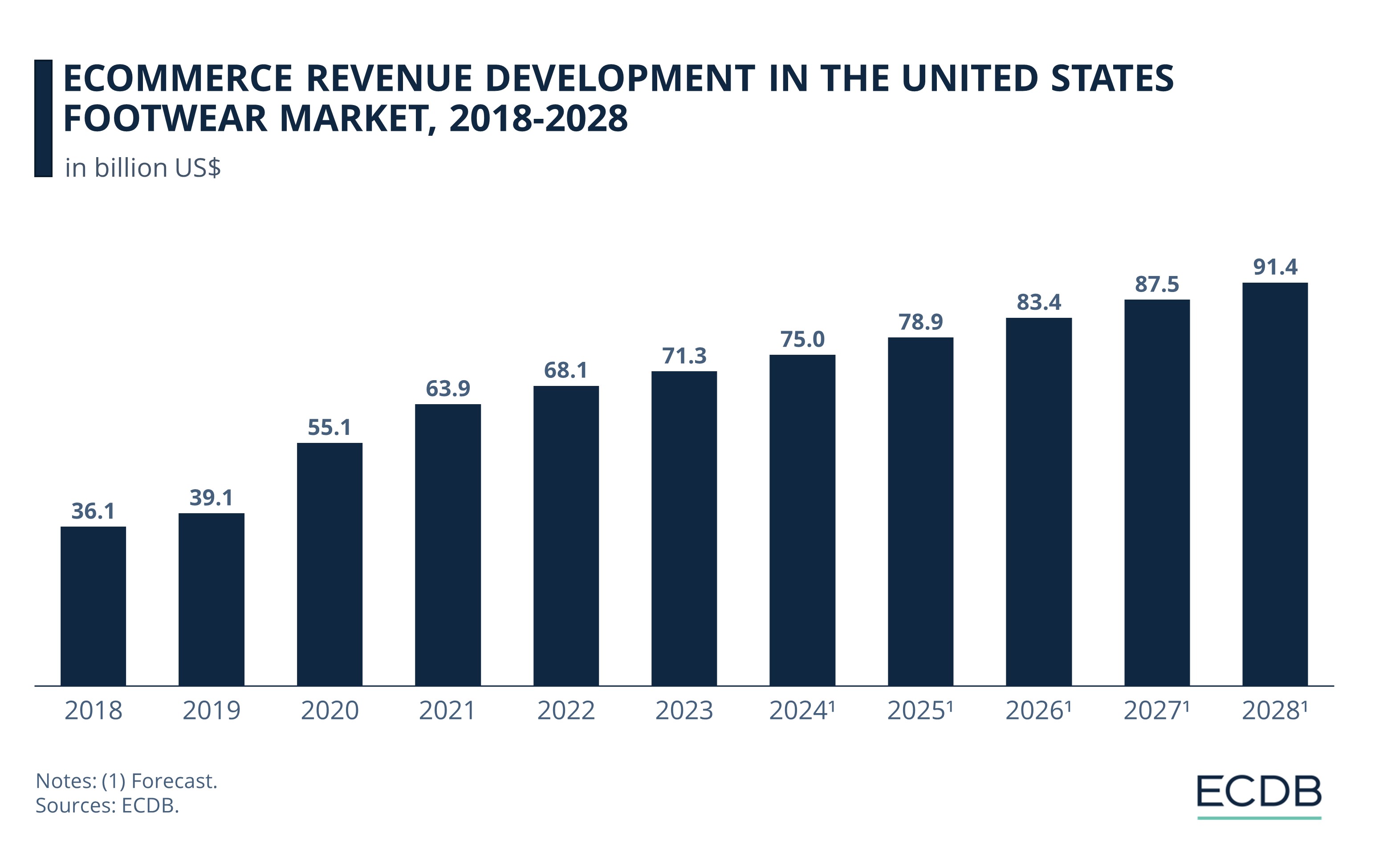

Footwear eCommerce in the U.S.: The online market for footwear in the United States is growing steadily, which poses room for expansion for retailers in the segment.

Nike Generates Higher Online Revenues: Nike.com has been consistently outperforming Adidas in eCommerce revenues. The gap has widened over the past five years, as Adidas saw fluctuating revenues and Nike grew more steadily.

The Reasons For Success Are Harder to Grasp: While Nike is better known for product innovation and trendy designs, Adidas is seen as the more classic option. Ultimately, the preference comes down to deeply personal attitudes and team affiliations.

Nike vs Adidas: What is a matter of personal preference and individual style for consumers is clearer in terms of financials and market metrics. Both companies sell sportswear and athleisure products, with an emphasis on footwear. Nike’s corporate logo is the swoosh, while Adidas is recognizable by its three stripes.

Both Adidas and Nike are brick-and-mortar stores with an additional online offering, but one clearly takes the lead over the other with its online platform. Here is more on Nike, Adidas, and footwear eCommerce.

U.S. Footwear eCommerce to Surpass US$90 Billion by 2028

Footwear eCommerce in the United States is a lucrative market segment and its revenue development has been quite robust. Forecasts for the coming years also show continued growth.

A jump in online revenues occurred in 2020, with a growth rate of 41%. In 2021, revenues increased by 16%.

The steady growth in the following years shows that the pandemic helped to establish footwear as a popular product category for eCommerce. This trend has been supported by advances in technology and a growing acceptance of online shopping among broader segments of consumers.

The outlook for footwear eCommerce in the United States is positive, with market revenues expected to surpass US$90 billion by 2028.

The growth trajectory of footwear eCommerce sales suggests room for expansion in the U.S. market. Between Nike and Adidas, it is clear who is leading the way.

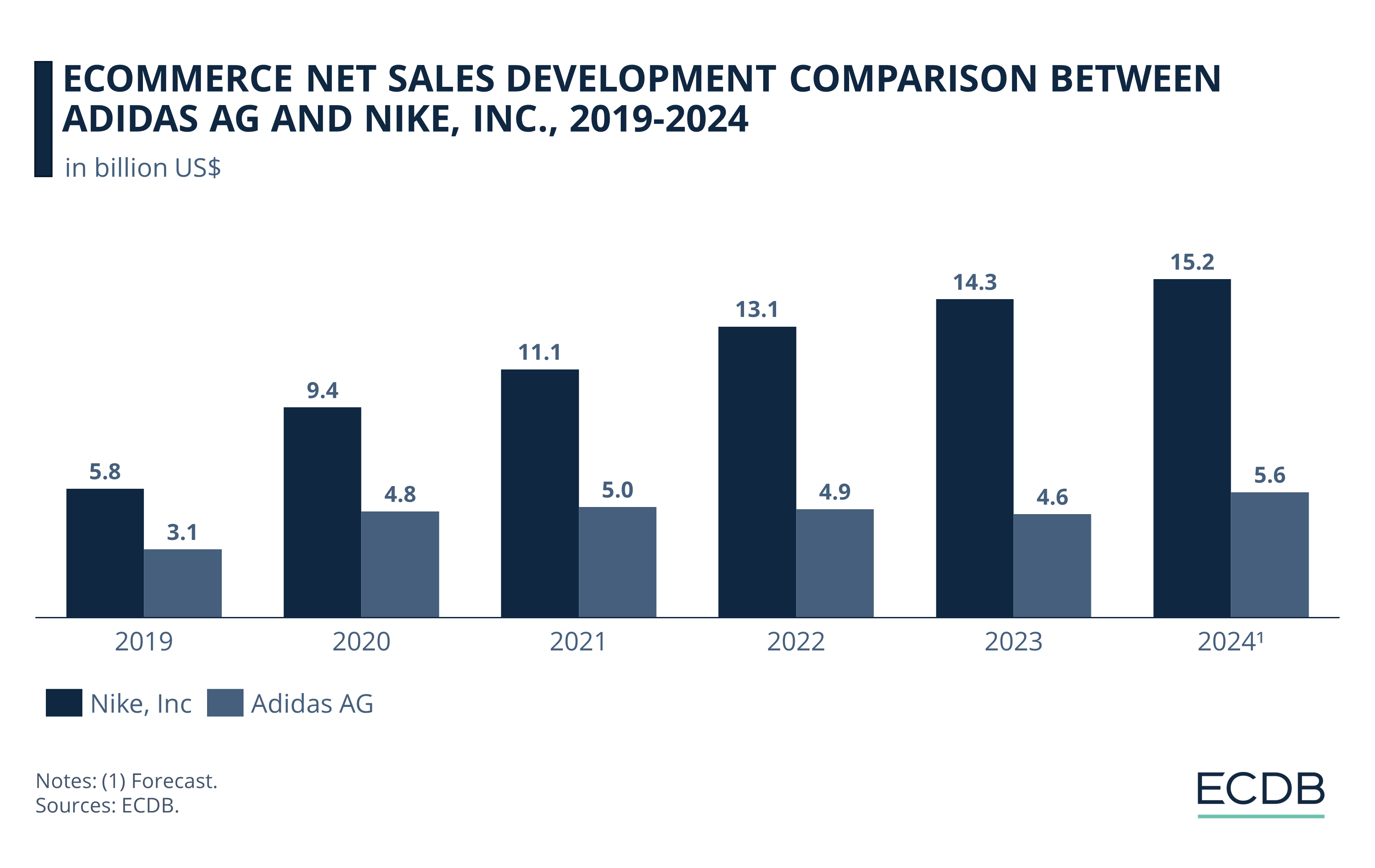

Nike, Inc Generates Higher Online Revenues Than Adidas AG

As we have discussed in previous insights, the similarities in business models between Adidas and Nike are evident. Not for nothing are these two brands seen as each other's biggest competitors.

But comparing their global operations, Nike generates significantly more online revenue than Adidas. Moreover, while Adidas' online sales have fluctuated, Nike has been on a steady growth path.

The gap between Nike and Adidas in eCommerce revenues was smaller in 2019, when Nike generated US$5.8 billion and Adidas generated US$3.1 billion. It widened as sales grew, especially for Nike, in the following years.

By 2022, Nike’s eCommerce net sales were at US$13.1 billion, while Adidas remained at US$4.9 billion. Slight declines in 2023 are expected to return to growth in 2024, when eCommerce revenues for Adidas are projected at US$5.6 billion. Nike’s forecast for 2024 is significantly higher, at US$15.2 billion.

The distance of sales on their online platform is also evident in the growth rates. Nike has outpaced the global footwear market, while Adidas has lagged.

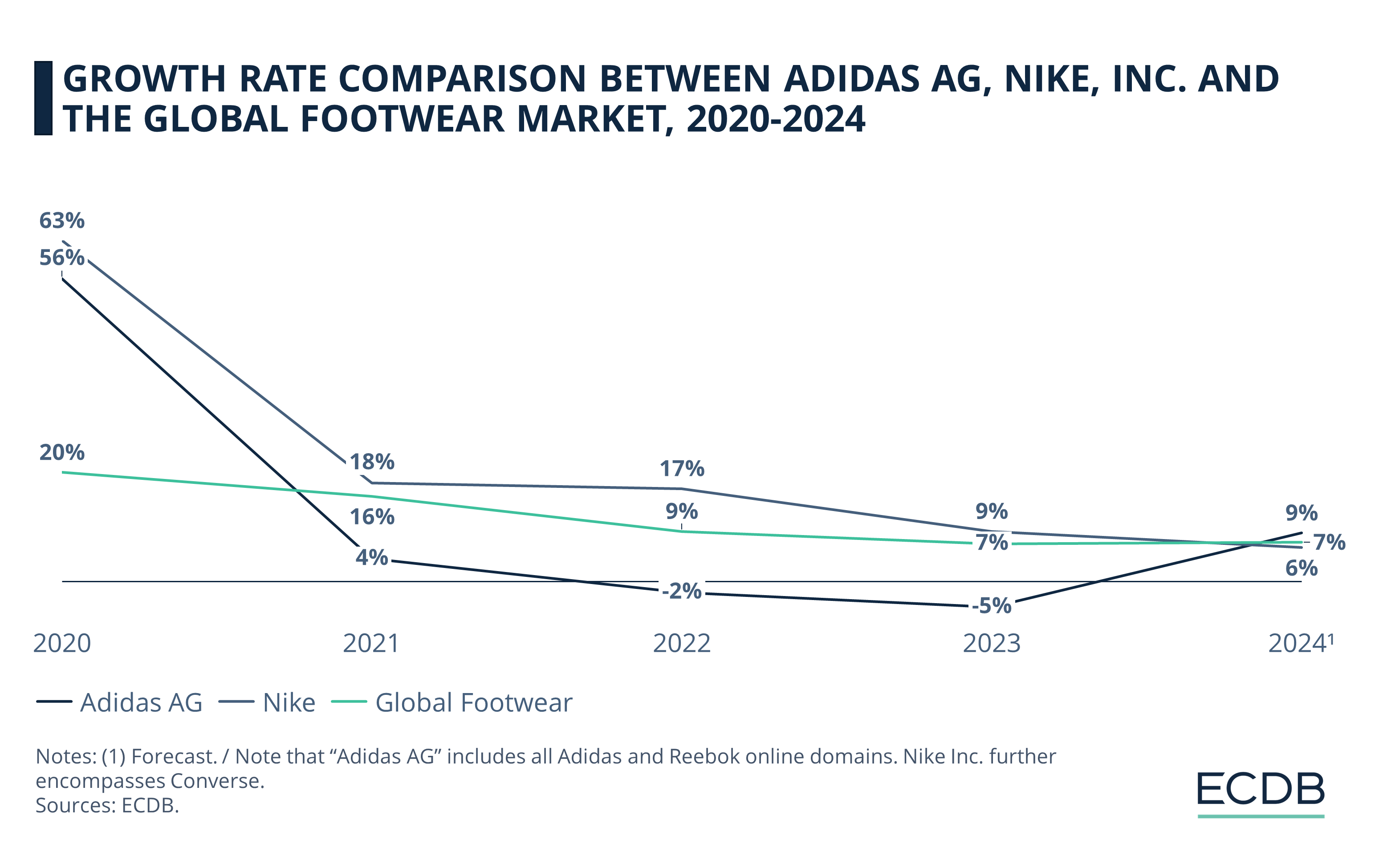

Adidas Online Sales Have Struggled Since 2022, to Recover by 2024

Adidas’ eCommerce revenue fluctuations are somewhat different from Nike and the global footwear market, which saw positive rates even in the post-pandemic years when online revenues were prone to fall.

Adidas’ growth rates fell below zero in 2022 and 2023. They are expected to recover in 2024. With a decline of –5%, 2023 was the worst year for Adidas in the last five years.

Adidas has come up against unexpected obstacles in the past few years: The discontinuation of the Yeezy line, competition from smaller players with similar offerings, and a subsequent lack of product differentiation are cited as challenging aspects of Adidas sluggish online sales.

Let's take a closer look at each site's consumer spending habits.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

On a Global Average, Nike Users Tend to Spend More

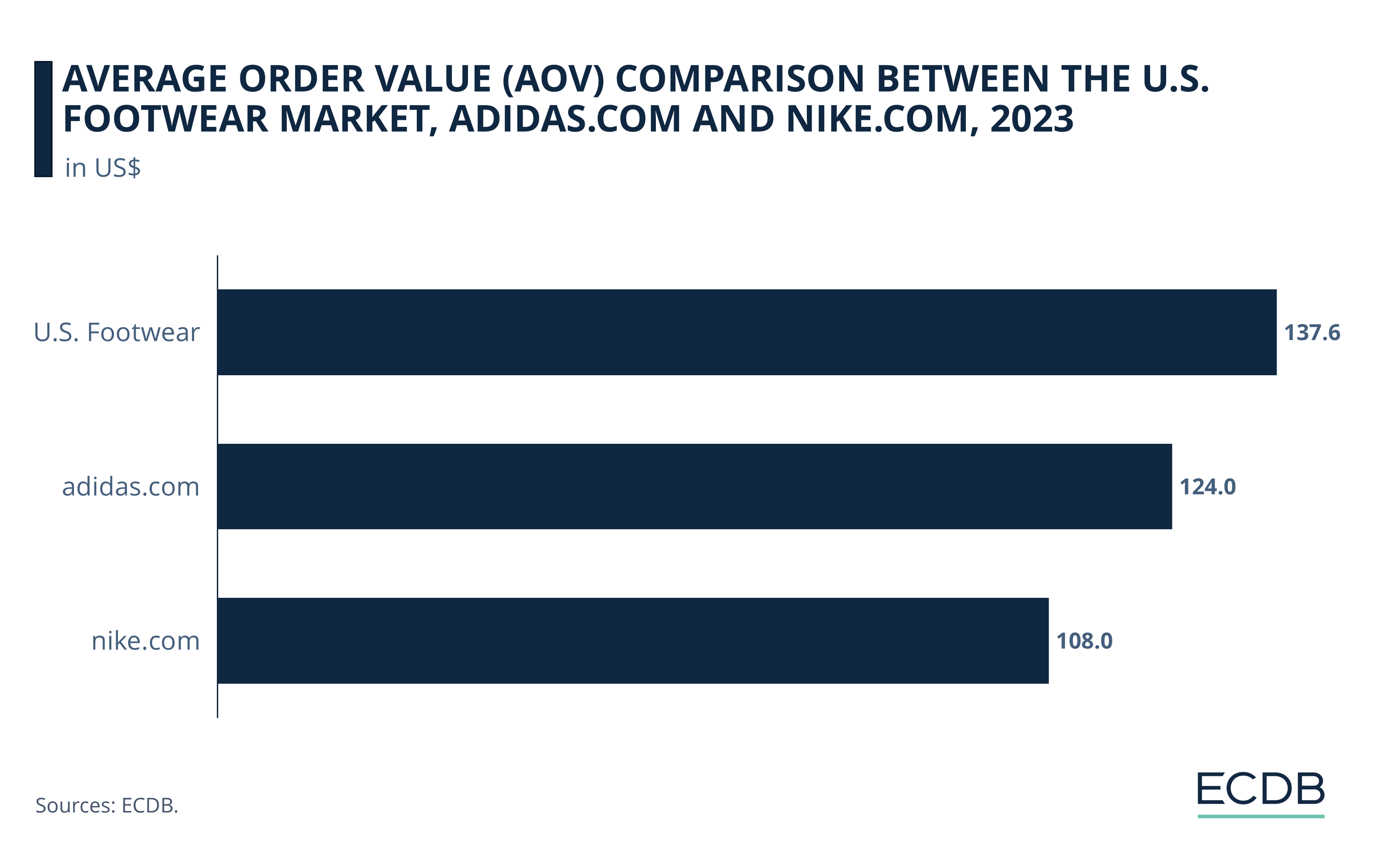

The AOV, or average order value, of eCommerce transactions indicates how much consumers in each segment typically spend on their online orders.

U.S. Footwear has an AOV of US$137.6, which is the highest value compared to adidas.com (US$124) and nike.com (US$108).

However, it should be noted that nike.com serves all of the brand's markets, while adidas.com specializes in offering products in the United States. This may explain nike.com's lower AOV, as other countries may have a lower AOV level overall. Looking at adidas.fr (US$94), adidas.ca (US$112) and adidas.com.br (US$68), this assumption gains further ground.

Calculating a weighted global average for Adidas’ AOV across all of its online domains yields a figure of US$97.2. This is around US$10 less than Nike’s global average.

Adidas vs Nike: What Makes Consumers Choose One Over the Other?

Given such similar conditions, what makes one brand more successful than the other? Here is some food for thought:

Nike Focuses on Product Innovation to Improve Performance: Adidas is perceived more as a classic brand with timeless designs. Nike has made international headlines by offering products that are said to enhance athletic performance, sparking a debate about whether shoes can be considered doping.

The Styles of the Two Brands Are Simply Different: In fashion, it always comes down to what’s trending and what fits personal preferences. Some of Nike’s designs and marketing campaigns may just visually speak to audiences, while Adidas captures a little smaller segment.

Sports Team Affiliation: In the case of these two sportswear companies, sports fans may just be exposed to one more than the other. Positive affiliation with a team or multiple teams that wear a particular brand is one of the most important factors in making sponsorship the effective marketing strategy that it is.

Individual Preferences and Upbringing: Whether it is one’s social environment, the way one perceives a U.S. brand vs a German brand, or fitting preferences, the reasons for choosing one brand over the other tend to be deeply personal and, to some extent, subconscious.

Nike vs Adidas: Closing Thoughts

Nike’s online platform is more successful than that of Adidas, despite the obvious similarities between both brands. While Adidas has faced unexpected obstacles in the past few years along with challenging market dynamics, Nike is on a consistent upward trend. Ultimately, however, the preference for either brand depends on deeply personal consumer preferences, which are not as measurable as the eCommerce revenue and benchmarks.

Sources: Adidas – Nike – Retail Dive

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

Back to main topics