eCommerce: Fast Fashion in the UK

Fashion Market in the UK: Top Stores and Cheap Fashion

Fashion is a profitable category in UK eCommerce, which is the third-largest eCommerce market in the world. Here is which online stores take the market lead.

Article by Nadine Koutsou-Wehling | August 13, 2024Download

Coming soon

Share

Online Fashion Market in the UK: Key Insights

Top Online Stores in UK Fashion: Most retailers in the top 10 of UK fashion eCommerce are generalist online retailers, meaning fashion is only part of their assortment. Asos.com ranks 6th, while boohoo.com did not reach the top 10 list, placing 25th.

ASOS Has Higher Net Sales Than Boohoo: Both online stores have followed a similar path over the past few years, with an online sales spike during the pandemic and a decline in the years after. Recovery was slow. But asos.com is far ahead of boohoo.com in terms of online net sales, at US$4 billion versus US$550 million, respectively.

Reasons for the Decline: Both ASOS and Boohoo are struggling due to miscalculated acquisitions, competition in global fashion, and greenwashing allegations.

The United Kingdom is the third largest eCommerce market in the world, with market revenues of US$153 billion in 2024. Fashion accounts for 18.3% of UK eCommerce revenues, making it the second most profitable product segment in the market.

Two domestic online fashion stores in the UK are of particular interest: ASOS and Boohoo. Along with grocery chain Asda, ASOS and Boohoo were recently investigated by the CMA (Competition and Markets Authority) for practices commonly referred to as greenwashing.

Here is what the UK fashion market is all about and what role fast fashion is playing.

UK Fashion Market: Post-Pandemic Recovery Was Quick

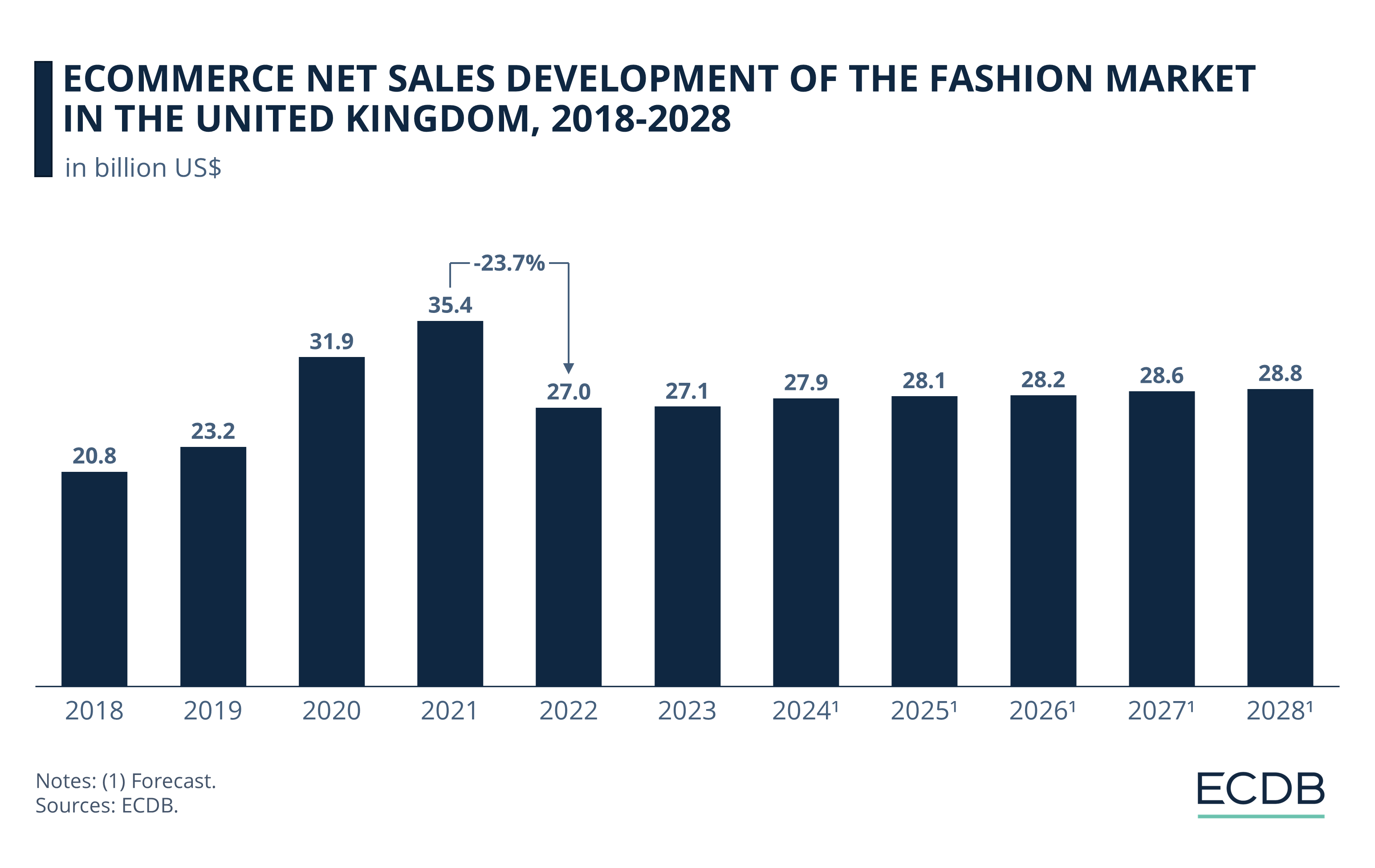

But first, check out the development of fashion eCommerce revenues in the UK from 2018 to projected 2028.

Revenues reached a peak of US$35.4 billion in 2021 and declined by 23.7% in 2022 when stores reopened.

After the drop, revenues slowly grew from US$27 billion in 2022, expected to reach US$28.8 billion step by step until 2028.

Which stores rank highest in the market?

Top 10 Stores in UK Fashion eCommerce

What is striking at first glance is the dominance of generalist retailers. Generalists offer a wider range of products than just fashion. Their success in fashion eCommerce suggests that UK consumers prefer one-stop shopping for their fashion products.

1. Sainsbury's

Sainsbury’s takes the lead with online fashion net sales of US$2 billion by 2023. This puts it ahead of Amazon in fashion sales.

2. Amazon

Amazon made US$1.5 billion in online fashion net sales by 2023. It is the go-to platform for consumers in UK eCommerce, where amazon.co.uk sold US$16.1 billion worth of products in 2023.

3. John Lewis

John Lewis, the UK department store, rounds out the top three retailers in UK online fashion.

Interesting for our analysis is asos.com in 6th place, with online revenues of US$1.15 billion.

Boohoo did not make the top 10 ranking in 2023 and placed 25th with online net sales of US$228.9 million on its boohoo.com domain in the UK. However, it should be noted that the conglomerate has been very active in acquiring fashion brands over the years, so the revenues generated by boohoo.com are only part of the picture.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

As mentioned in the introduction, the CMA is investigating the sustainability claims of Boohoo, ASOS, and Asda. The following sections provide more details on the first two, as two pure-play online fashion stores. Asda falls out of the analysis, being a supermarket chain with an additional fashion offering.

Boohoo.com: Struggling to Maintain

Pandemic Revenues

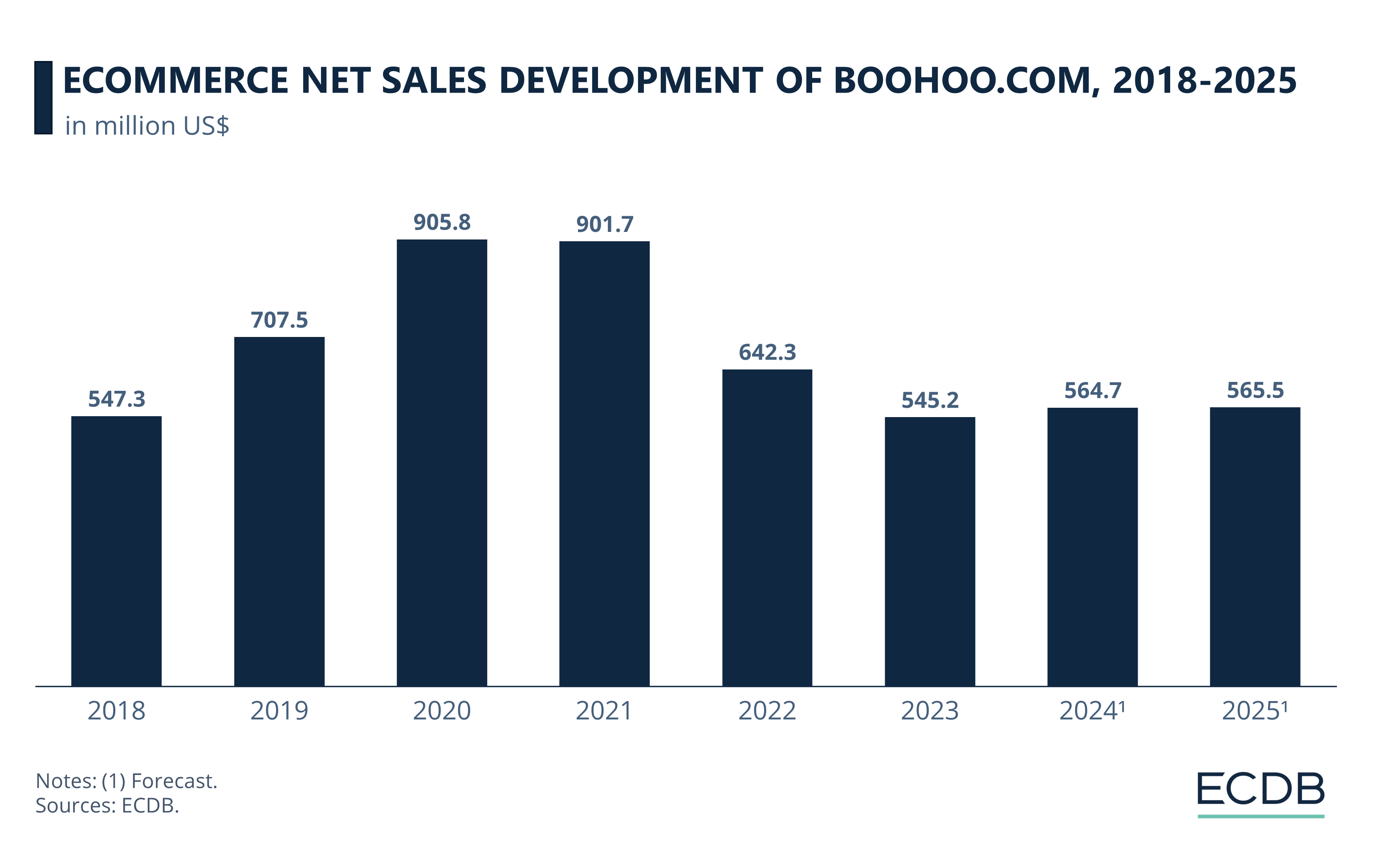

Boohoo is a fast-fashion online retailer with a strategy focused on proximity to production, low labor costs, and fast-paced style changes. The company saw a spike in eCommerce net sales during the pandemic, but was hit by the common revenue decline in 2022 and has struggled to recover since:

At the peak of the pandemic, in 2020 and 2021, boohoo.com generated online net sales of US$905.8 million and US$901.7 million, respectively, across all markets.

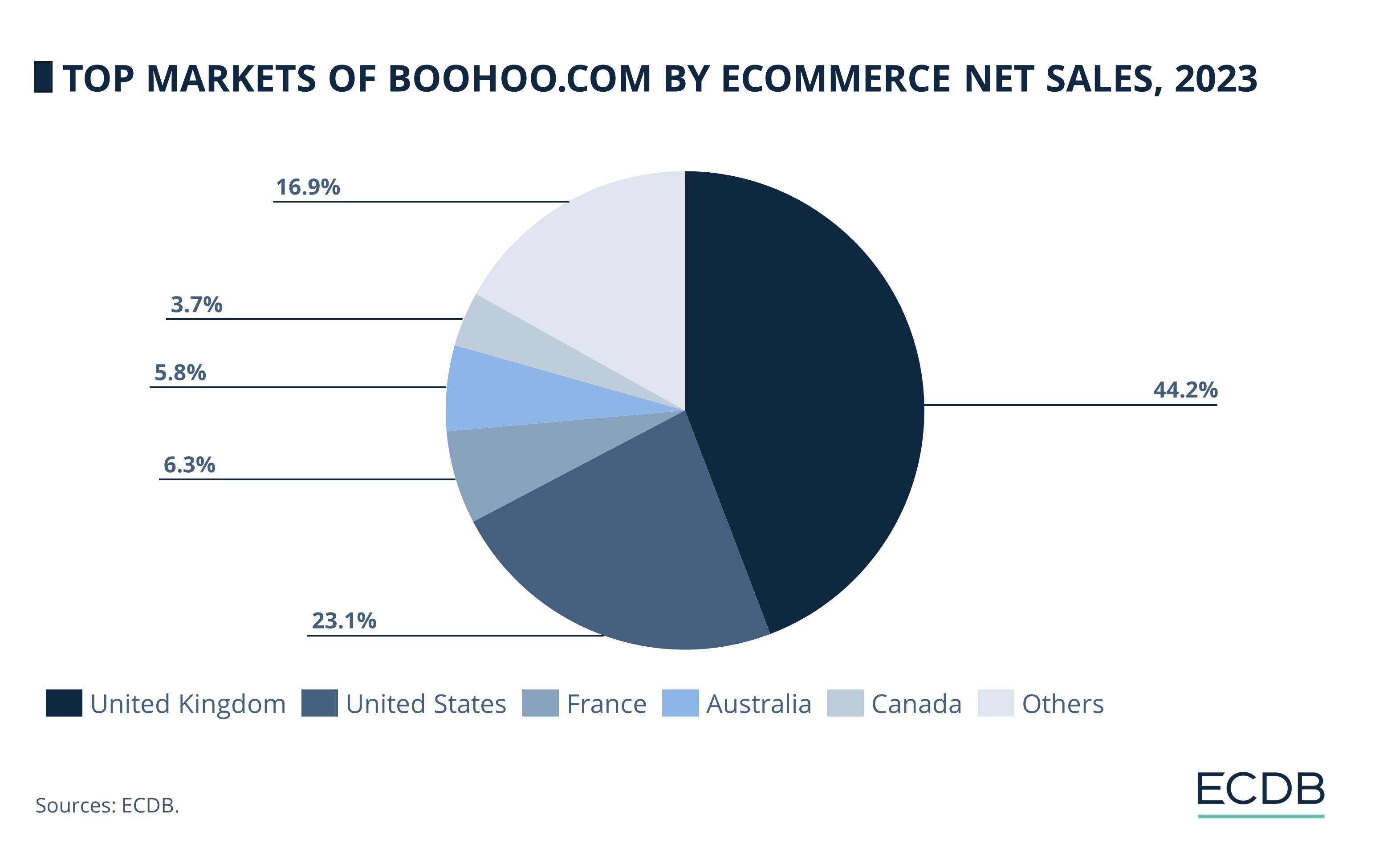

The UK is clearly boohoo.com’s primary market, with 44.2% of net sales having been generated in its home market in 2023. This is followed by the United States with 23.1%. The rest of the top 5 consists of France (6.3%), Australia (5.8%) and Canada (3.7%).

The “Other” category consists of many markets with smaller shares. Visit the ECDB Store Page of boohoo.com for more information.

What Is the Appeal of Boohoo.com?

In addition to its low-price strategy, the eCommerce fast fashion retailer has used extensive social media marketing and influencer campaigns to build awareness among its target audience, which is largely made up of consumers under the age of 40.

Its approach has been dubbed “fashion for all”: including plus sizes up to UK size 26 (22 in the U.S. and 54 in Europe). This is reflected in the prevalence of plus-size models on the site.

As a pure-play online store, Boohoo does not need to manage an extensive physical network, saving on overheads. It’s clear that Boohoo’s strategy is similar to Shein’s, the online fashion platform everyone is talking about. But Shein is growing where Boohoo is shrinking.

Reasons for Boohoo Group’s Decline

Boohoo Group’s latest earnings report shows that the conglomerate is heavily in debt with stagnating sales. There are several reasons for this:

Extensive acquisitions of bankrupt stores: Boohoo is known for acquiring stakes in fast fashion brands (prettylittlething.com, nastygal.com) and struggling department or high street stores (Debenhams, Burton, Wallis, and others). While this strategy aims to diversify Boohoo’s portfolio to offset losses in other areas, the extra weight is becoming increasingly burdensome. This can be seen in the case of debenhams.com, where online net sales fell by 72% in 2021.

Highly competitive market and saturation of providers: Boohoo’s similarity to Shein (ranked 13th in the UK) means that consumers have little incentive to purchase from both retailers at the same time. In addition, the proliferation of cheap, affordable, trend-led clothing retailers means that the market is quickly becoming saturated, making it harder for Boohoo to stand out.

Sustainability claims meet greenwashing allegations: The CMA’s recent investigation into the sustainability claims of Boohoo and its competitors reflect a lack of confidence in their environmental strategy: Producing cheap, easily broken clothes goes against the very nature of sustainability, which is based on quality and longevity.

Speaking of the greenwashing allegations: ASOS was singled out by investigators alongside Boohoo and Asda. So, what is ASOS all about?

ASOS: Online Revenues Are Evening Out at US$4 Billion

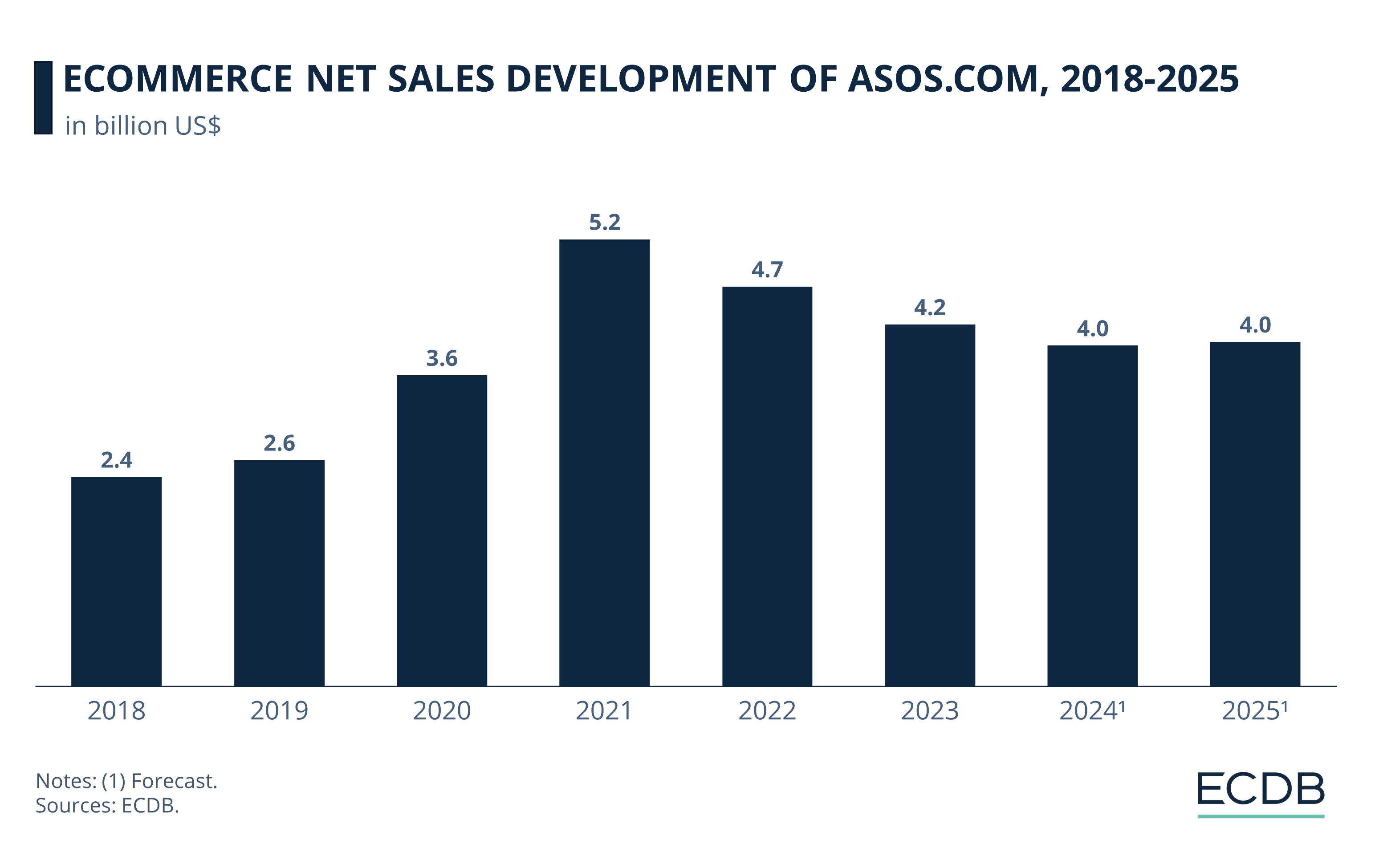

Like Boohoo, ASOS is a homegrown, pure-play online fashion retailer based in the UK. Unlike boohoo.com, however, asos.com generates significantly higher online revenues.

Asos.com’s online net sales were approximately US$2.5 billion in the years immediately before the pandemic. In 2020 and 2021, its net sales experienced the usual spike, reaching first US$3.6 billion and then peaking at US$5.2 billion.

However, similar to boohoo.com, asos.com's net sales declined in 2022 and 2023, and are expected to decline further in 2024 and 2025.

What Is the Appeal of Asos.com?

ASOS has built a loyal following through its brand image and wide range of products to suit a variety of tastes and budgets.

Its marketing strategy is highly effective, as ASOS understands its target audience and uses the right methods to generate interest. The brand positions itself for example at major events that are popular with the younger crowd and its effective social media campaigns: This includes the hashtag #asseenonme (derived from the ASOS acronym: as seen on screen).

Users who post their ASOS street outfits can become brand champions, if ASOS notices and contacts them. For ASOS, this is ideal: free coverage, customer engagement and low-cost advertising.

Despite these positive aspects, there are also problems. Interestingly, ASOS’ issues are very similar to Boohoo’s:

Reasons for ASOS' Decline

While ASOS’ online net sales are still well above of what they were before the pandemic, the slump since 2022 is not easily reversed. This is due to

Miscalculated acquisitions: Similar to Boohoo, ASOS pursued an extensive acquisition strategy. This included “rescuing” the Arcadia Group’s bankrupt retail stores, amongst them Topshop and Miss Selfridge. Unlike Boohoo, which kept the domains as subsidiaries, ASOS integrated the brands into its own platform. Whatever the strategy, the result was the same: these acquisitions proved to be an extra burden.

ASOS “lost its identity” amidst the competition: To be affordable and trend-led, or quality and sustainable? ASOS is trying to be both, which is problematic in an environment where consumers can have everything just a click away. According to a Guardian opinion piece, “ASOS was a cool, pioneering presence on the London fashion scene. Its models had an edge to them and its fashion had a fun, slightly indie vibe that its competitors didn’t.” Today, the look and feel of ASOS resembles one of many fast-fashion platforms, with nothing particularly distinctive about it.

Greenwashing allegations: As with Boohoo, ASOS was called out by the CMA for using vague credentials such as “responsible” or “eco” that convey a positive impression without any real meaning. In line with growing consumer demand for sustainability, ASOS jumped on the bandwagon, but now has to comply with the CMA's rules.

UK Cheap Fashion: Wrap-Up

The CMA's investigation into ASOS and Boohoo shows how easy it is for unsustainable brands to appear more environmentally conscious than they are. Consumers readily accept these claims because it justifies buying from cheaper brands if they have a green marketing.

But with low-cost platforms such as Temu and Shein disrupting the low-cost market, Boohoo and ASOS will either have to adapt or accept losing the price war with declining sales.

Sources: Accountancy Cloud – Fashion Monitor – Gov.uk: 1 2 – Guardian – Marketingweek – Retailbrew

FAQ: Online Fashion Market in the UK

How big is the fashion e-commerce market in the UK?

The fashion e-commerce market in the UK is expected to generate US$28.8 billion by 2028. It represents 18.3% of the overall UK eCommerce market, which is projected to reach US$153 billion in 2024. Fashion is therefore the second most profitable segment in the market.

What is the UK's largest online fashion retailer?

The UK's largest online fashion retailer is Sainsbury's, with online fashion net sales of US$2 billion in 2023.

Who are the key players in the UK online clothing retail market?

Key players in the UK clothing retail market include Sainsbury's, leading with US$2 billion in net sales, followed by Amazon with US$1.5 billion, and John Lewis rounding out the top three.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics