eCommerce: Social Commerce

Social Commerce in Europe: Market Development & Consumer Behavior

Social commerce is changing the way we shop, and Europe adds its own flavor to this trend. Learn how its distinct culture, legal framework, and what shoppers want influence this growing field.

Article by Cihan Uzunoglu | February 20, 2024Download

Coming soon

Share

Social Commerce in Europe: Key Insights

Global Comparison:

Europe is behind other regions in social commerce, with only 26% of platform users engaging in it, the lowest rate globally.

Legal and Cultural Barriers:

Europe's slow social commerce growth is due to its strong retail traditions, strict data protection laws, and a cultural mismatch with social shopping habits.

Social Media Preferences:

Most Europeans use social media for chatting and news, not shopping, with buying or selling activities being particularly low at 13%.

Shopping Features Interest:

European shoppers show less interest in direct purchases from influencers, live streaming, and augmented reality compared to global averages.

Platform Dominance:

Facebook and Instagram are the leading platforms for social commerce in Europe, showing the significant influence of established social networks on shopping.

Ever clicked a "Buy Now" button while scrolling through your social media feed? What pulls you into shopping on a social network as opposed to visiting a traditional online store?

The fusion of social media and commerce is changing our shopping habits, turning casual scrolling into possible buying moments. This dynamic retail landscape, however, is not a one-size-fits-all phenomenon; it's shaped by a complex interplay of cultural norms, legal frameworks, and consumer expectations. Following our previous analyses of global social commerce and the United States market, we're now focusing on Europe's unique market. Prepare for a revealing journey into a rapidly developing sector, offering insights on what makes Europe both similar to and distinct from other markets.

Europe Trails Other Regions in Social Commerce

First, let’s see how Europe compares to other regions of the world in terms of social commerce growth.

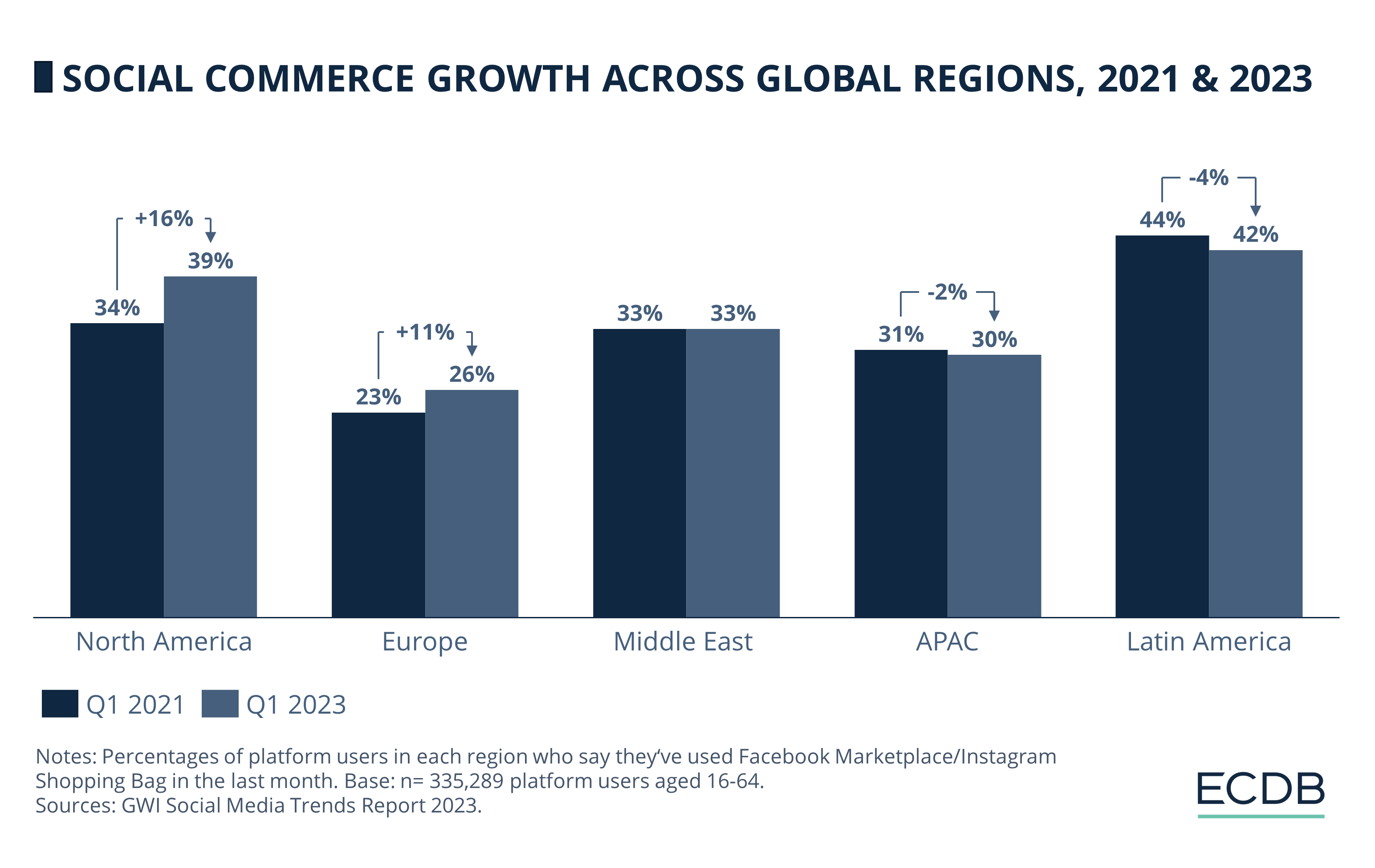

Social commerce is advancing globally, but its uptake differs markedly among regions. According to a study by GWI, Latin America is in the lead, with 42% of platform users saying they have used Facebook Marketplace or Instagram Shopping Bag in the past month. The Asia Pacific region is next, where 30% of users have engaged in social commerce.

Europe, however, trails in this burgeoning retail arena. A mere 26% of platform users in Europe report having used such services in the past month, the lowest among the regions studied by GWI. Yet, this figure has grown 11% since 2021, suggesting a slow but steady change in consumer behavior.

This uptick suggests that Europe, although initially slower to embrace social commerce, is demonstrating increasing interest in this retail channel. This still begs the question: Why is Europe lagging behind in social commerce?

Social Commerce in Europe: Stalled by Culture and Regulations?

In Europe, the social commerce landscape is shaped by a combination of legal, cultural, and behavioral factors that make it distinct from other markets. One significant reason is the presence of legacy retail systems in developed markets like Europe and the United States, which makes them less agile in adapting to new shopping paradigms.

Stringent data protection laws in European countries could also potentially slow down the expansion of social commerce platforms. Illustrating this point, in December 2022, the European Commission raised preliminary concerns against Meta for potential violations of EU antitrust laws.

The Commission accused Meta of abusing its dominant market position by tying Facebook Marketplace to its main social network and imposing unfair trading conditions on competitors. Meta contested these charges in a closed hearing in July 2023, stating that the European Commission's claims are "without foundation." If found guilty, Meta could face a fine of up to 10% of its global turnover and would be required to change its business practices.

Another distinguishing factor is the cultural landscape. European cultural habits do not align as closely with the socializing and shopping blend commonly seen in, for instance, Asian markets. Consumer behavior also plays a critical role in Europe's lagging adoption of social commerce. Europeans are keen users of social media for brand discovery and research, but traditional purchasing incentives like next-day delivery and easy returns often overshadow the appeal of social media "buy" buttons.

Consequently, the one-size-fits-all approach adopted by global social media platforms may not be as effective in Europe, considered a "mature market." In such a setting, convincing users to transition from merely social activities to making purchases on these platforms has proven to be a difficult task. To provide better context, we will now zoom out a bit and take a look at what exactly Europeans use social media for.

Europeans Favor Social Media for Chat Over Shopping

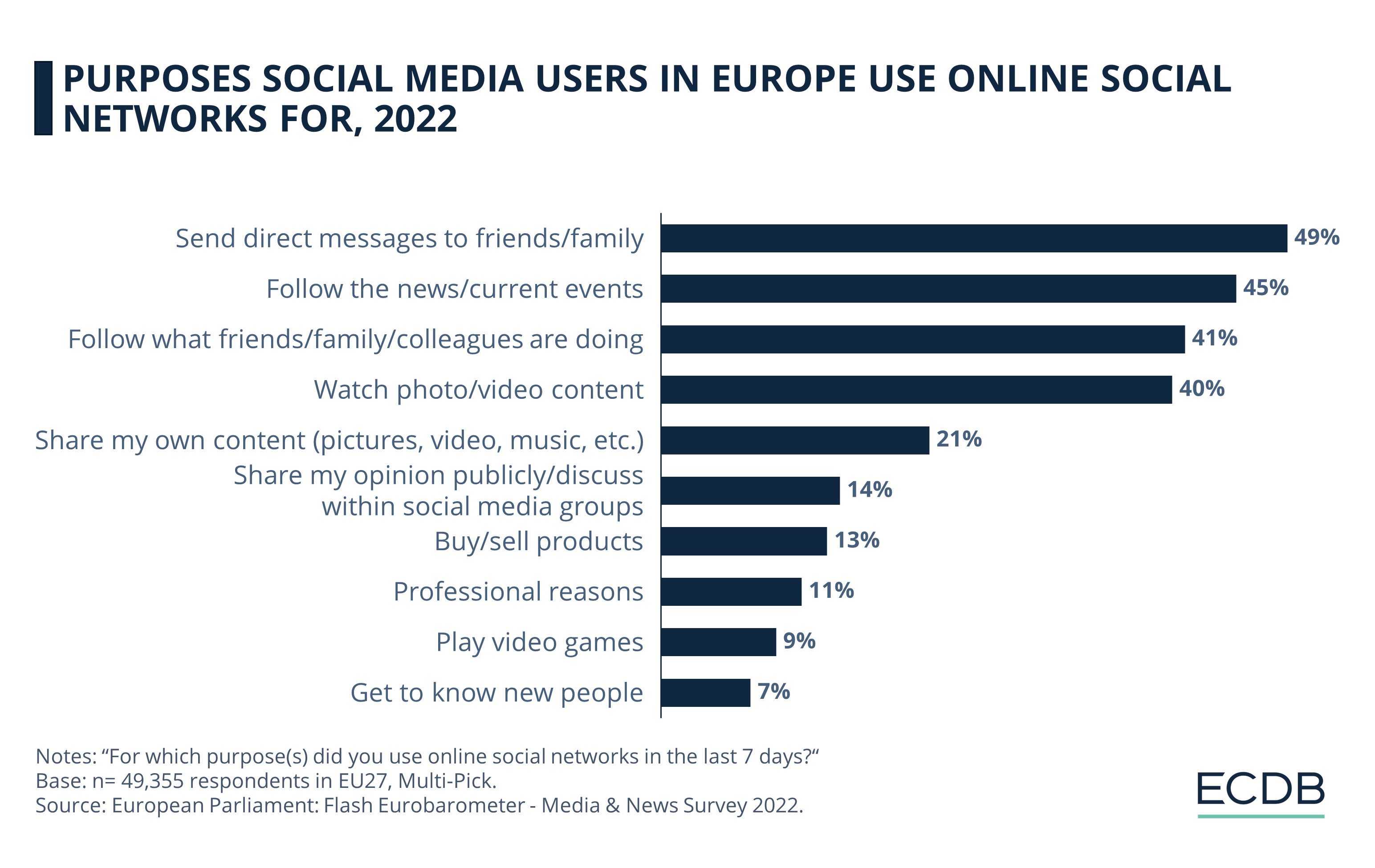

Eurobarometer survey data from 2022 outlines the primary reasons Europeans engage with social media platforms, and the results are telling. A significant 49% use these platforms to send direct messages to friends and family, followed by 45% who rely on them for news and current events. Keeping up with what friends, family, or colleagues are up to comes in at 41%, and watching photo and video content isn't far behind at 40%.

In stark contrast, using social media platforms to buy or sell products is notably less prevalent, registering at a mere 13% - suggesting that, for the time being, social media in Europe remains primarily a channel for communication and information dissemination rather than a marketplace. The modest interest in social media commerce raises questions about how quickly users will adopt buying and selling features that platforms are increasingly incorporating.

More Insights on Europe

The 2022 Deloitte report on social commerce also unpacks a lot in terms of shopper preferences in Europe with global comparisons. Keep in mind that the European figures are an average based on data from the UK, France, and Germany. Here are a few takeaways from the report:

28% of European shoppers want the ability to purchase directly and easily from influencers, compared to 41% globally.

Live streaming is an appealing feature for an immersive shopping experience for 27% of Europeans, whereas 40% of global shoppers feel the same.

In contrast to 60% globally, half of European consumers are interested in Augmented Reality-driven shopping experiences.

A brand's presence in the virtual world is valued by 53% of Europeans and 69% of global shoppers.

While 41% of global shoppers show interest, 50% of Europeans are keen on buying limited edition virtual products like NFTs.

Facebook and Instagram Lead the Way in Europe for Social Commerce

A report from Wunderman Thompson Commerce shows that among EU online shoppers, Facebook leads as the preferred platform for purchases with 24%, while Instagram follows at 16%. These two platforms seem to dominate the social commerce space in the EU, likely due to their established user bases and shopping features.

YouTube, TikTok, and WhatsApp trail behind, capturing 7%, 6%, and 5% respectively. These platforms are less traditional for shopping but still show potential for growth in eCommerce. Overall, social media plays a varied but significant role in influencing EU shoppers.

After digging into the social platforms popular among European shoppers and the various factors affecting their engagement, we shift focus to the market's economic dynamics.

Social Commerce Market Development in Europe

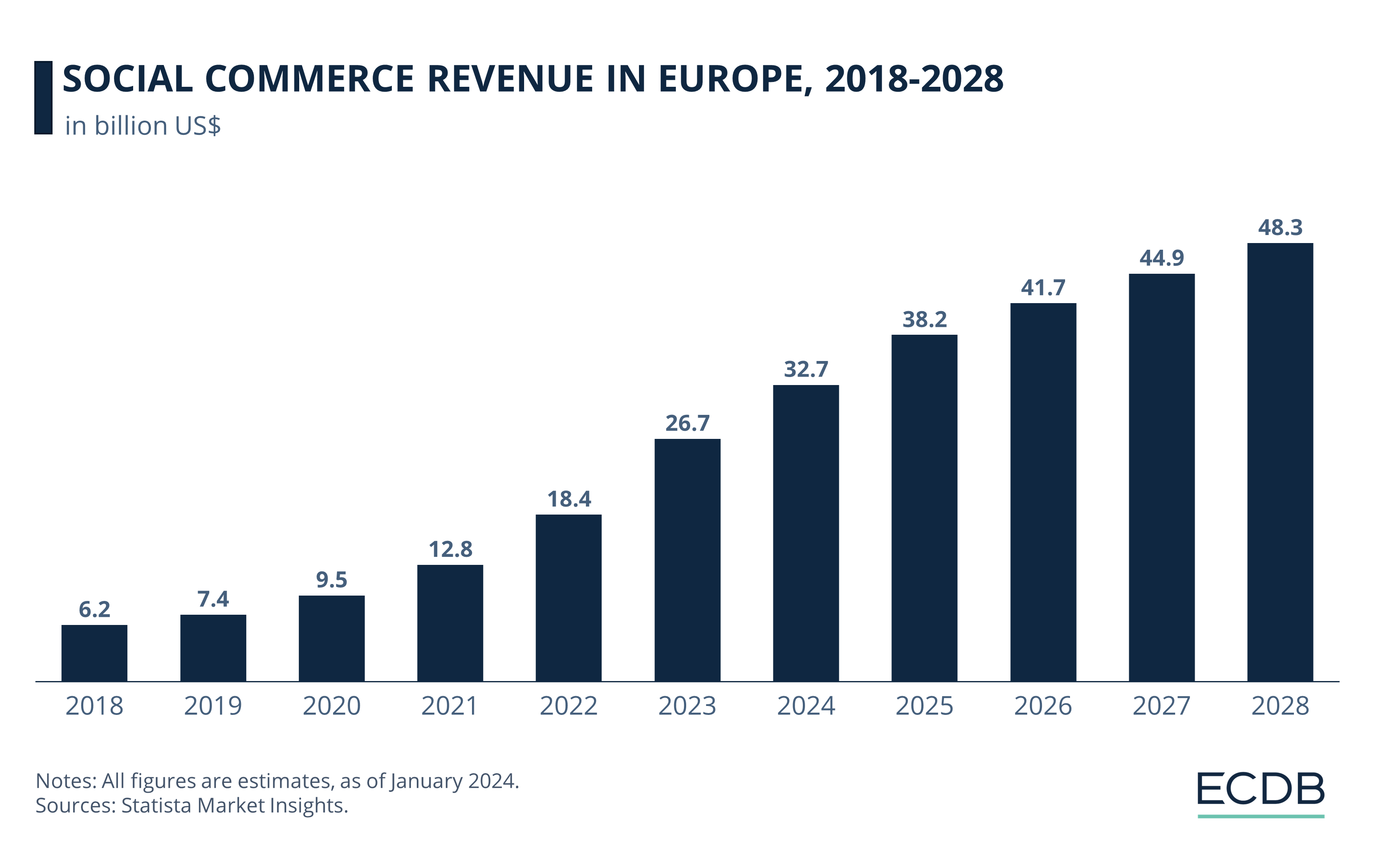

The European social commerce market has come a long way since its more modest revenue of US$6.22 billion in 2018, a year when the social commerce penetration rate among European online shoppers was a mere 2.5%. The sector's consistent upward trend, particularly in recent years, signals its growing role in the digital economy.

In the revenue context, Statista findings show that the market escalated from US$12.8 billion in 2021 to US$18.4 billion in 2022, signifying an approximate 43% growth. The projection for 2023 is another substantial leap to US$26.7 billion. Should this hold true, it would amount to an increase of around 45% year-over-year, emphasizing the rapid expansion of this commercial segment.

Looking to the future, the projected revenue for 2028 is US$48.3 billion, with a penetration rate among European online shoppers expected to rise to over a fifth (22%). While this implies sustained growth in revenue, the pace is likely to moderate in the years leading up to 2028. Similarly, the penetration rate shows incremental growth, further testifying to the mainstream acceptance of social commerce.

The European social commerce market is undeniably on the rise, but how does this translate to user numbers in individual countries?

Learn More About ECDB

Social Commerce Users: Spain Might Surpass the UK by 2027

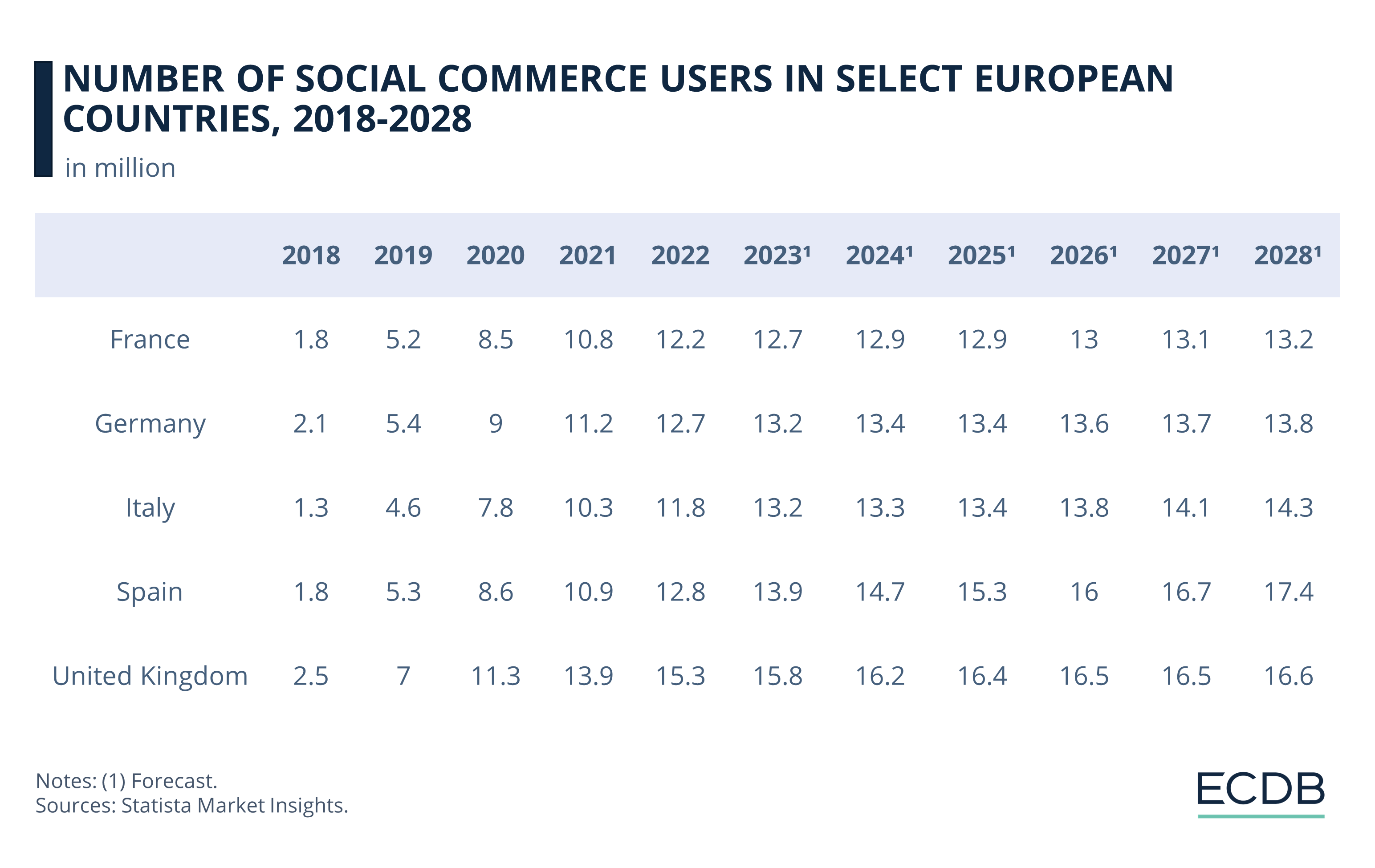

Over the course of the next few years, the number of social commerce users in key European countries—namely France, Germany, Italy, Spain, and the United Kingdom—is expected to show varying trends. According to data from Statista, the United Kingdom currently leads in terms of the number of social commerce users, followed by Spain, Germany, France, and Italy. Most nations are on a moderate upward trajectory, but some differences in the rates of growth are noteworthy.

In France and Germany, the number of social commerce users is expected to rise incrementally. Italy shows a similar pattern, albeit with a slight uptick anticipated towards the later part of the forecast period.

Spain distinguishes itself with a more robust growth rate in social commerce users compared to other nations. The country is projected to experience a steady rise over the years, gaining stronger momentum relative to its European neighbors. This pace is expected to culminate in a significant change in ranking: By 2027, Spain is forecast to surpass the United Kingdom in terms of the number of social commerce users.

However, despite this ranking shift in user numbers, the United Kingdom is still projected to dominate the European market in terms of social commerce revenue. In 2027, the UK is expected to maintain its top position, followed by Germany, France, Italy, and Spain – suggesting that while Spain's user base may expand impressively, the United Kingdom will continue to be the most lucrative market in Europe for social commerce revenue.

Sources: GWI, European Union, European Commission, Reuters, Deloitte, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Deep Dive

Live Commerce in Italy: Consumer Behavior & Preferences

Live Commerce in Italy: Consumer Behavior & Preferences

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Back to main topics