eCommerce: Live Shopping

Live Commerce in Italy: Consumer Behavior & Preferences

Live commerce is growing in Italy, led by younger, affluent shoppers. What are the platform preferences, popular devices, and reasons behind this eCommerce shift?

Article by Cihan Uzunoglu | October 18, 2024Download

Coming soon

Share

Live Commerce in Italy: Key Insights

Participation: Live commerce in Italy is still emerging, with more than half of online shoppers open to trying it. Younger and higher-income consumers are the most likely to have already made purchases.

Platforms: Amazon Live, YouTube, and Instagram Live dominate live shopping in Italy, with TikTok lagging behind as a less popular option for shoppers across different demographics.

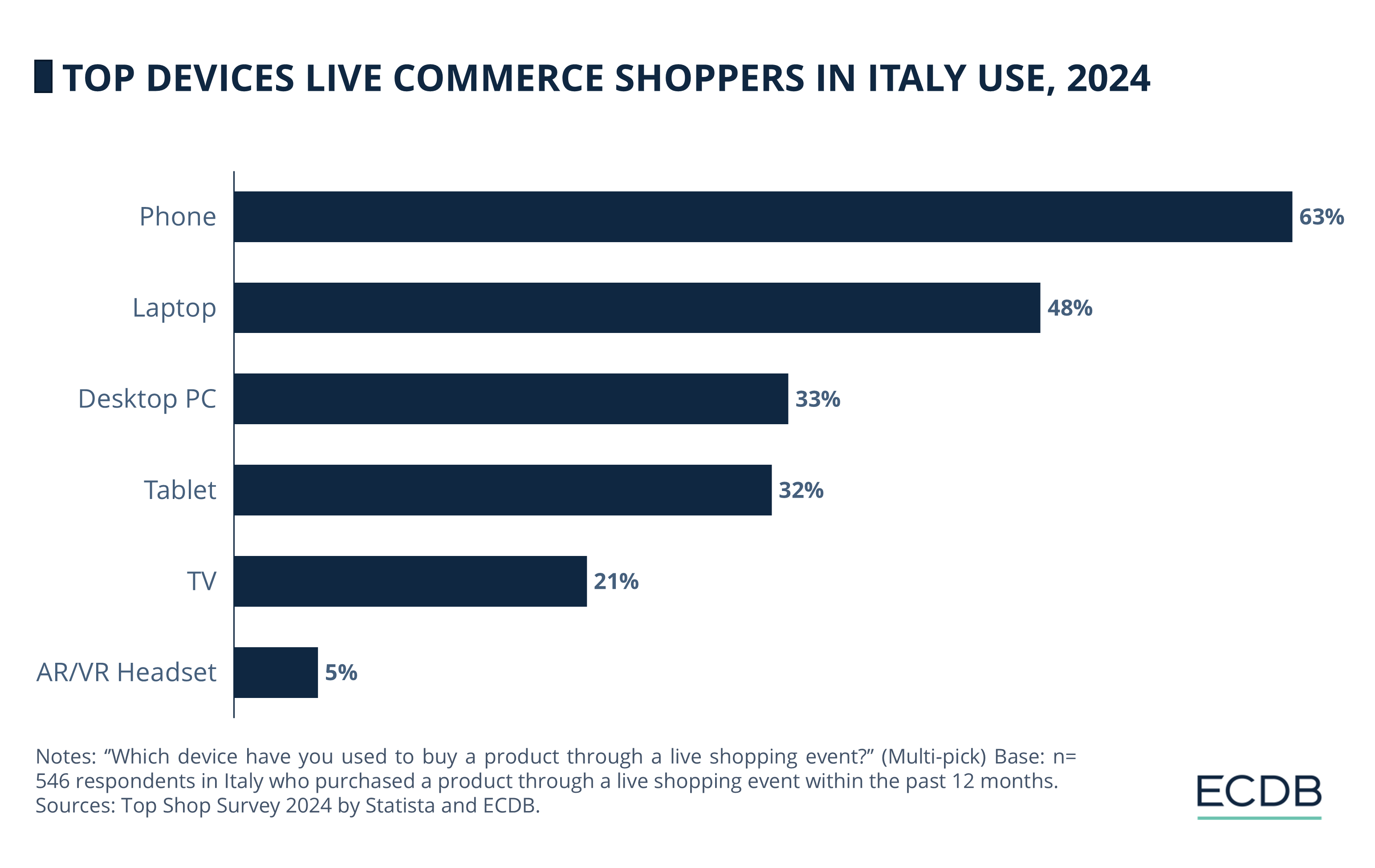

Devices: Phones are the primary device for live commerce in Italy, used by 63% of shoppers, with laptops and desktop PCs also seeing significant usage among live shopping participants.

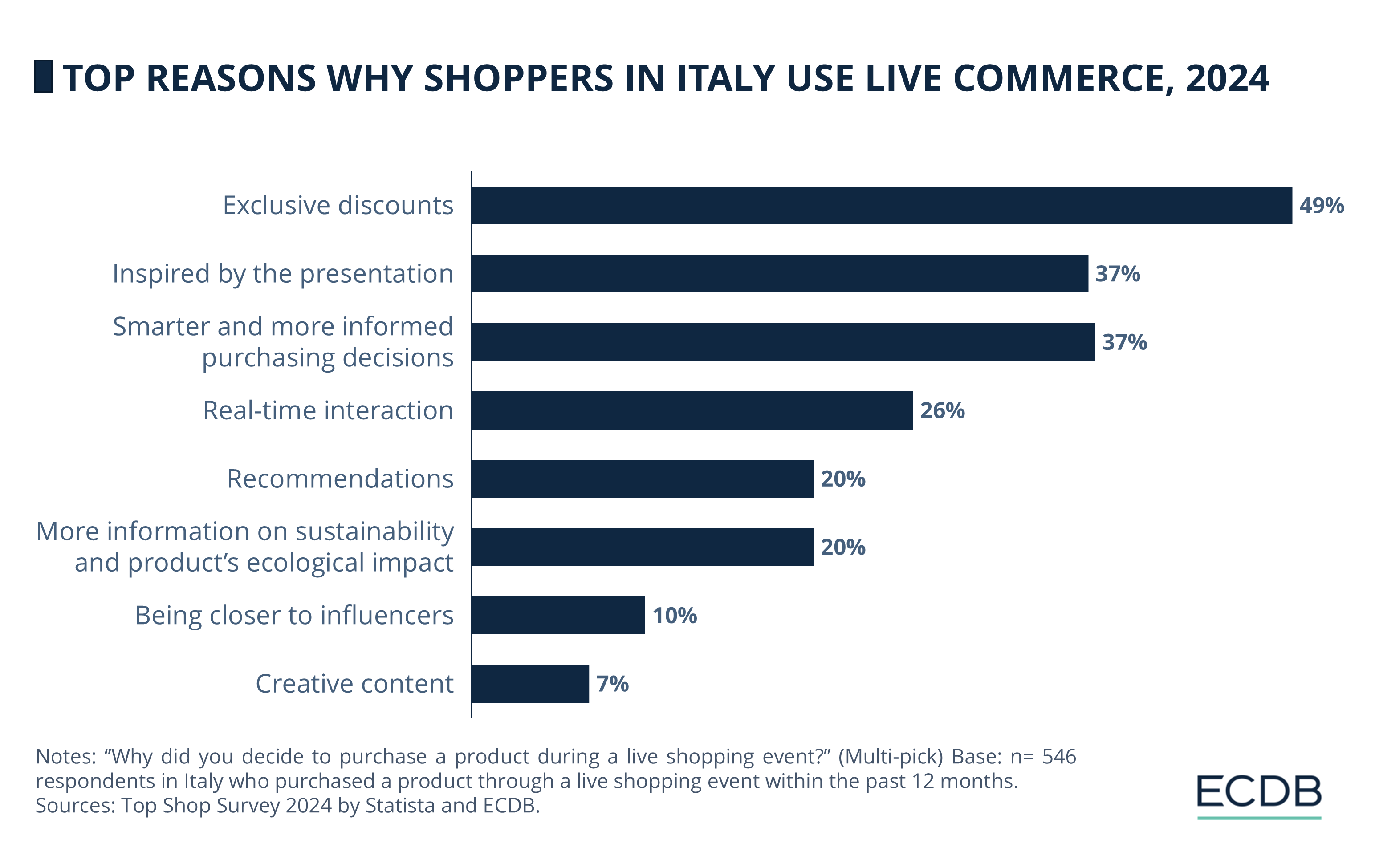

Reasons: Exclusive discounts are the main driver for Italian live commerce shoppers, followed by presentations that inspire purchases and the ability to make smarter purchasing decisions.

Italy, home to 60 million people, is quickly becoming a hotspot for live commerce. As the third-largest economy in Europe and the 13th largest eCommerce market globally, the country’s online shopping market is poised to generate nearly US$40 billion by the end of this year.

Live shopping is catching on, with younger and wealthier Italians leading the charge, blending entertainment with impulse buying. But what makes live commerce appealing to these shoppers?

From exclusive deals to real-time interaction, the latest data from Top Shop survey by ECDB and Statista reveals the platforms, products, and behaviors driving this shift.

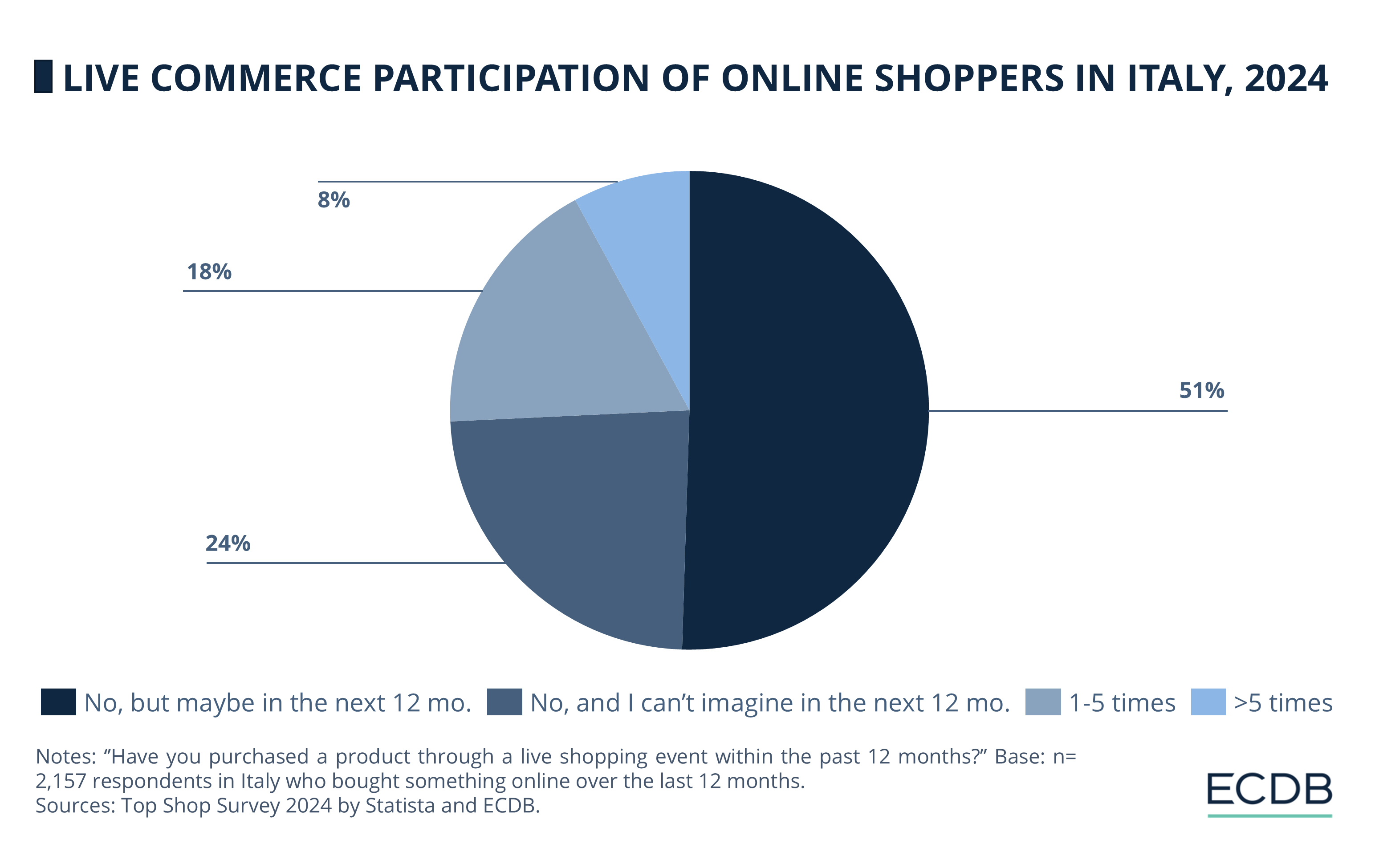

One Quarter of Online Shoppers in Italy Have Tried Live Commerce

According to the Top Shop survey, participation in live commerce is still in its infancy in Italy:

51% of online shoppers haven’t tried live shopping but are open to doing so in the next 12 months.

24% of shoppers remain uninterested, with no plans to engage in live commerce within the next year.

18% have purchased through live shopping between 1 to 5 times, while 8% have done so more than 5 times.

Breaking down the survey results using demographics, we see that male users and those aged 18-34 are more likely to have bought items through live shopping events. Participation also increases with income, while shoppers from smaller households and cities are less likely to have tried live commerce.

What Do Italians Buy in Live Shopping?

Despite live commerce being a relatively new trend in Italy, its potential is evident from the wide range of products that shoppers are willing to purchase through this channel.

As per data from YouGov Italy, clothing leads as the most popular category, with 56% of shoppers expressing interest, followed by consumer electronics (48%) and cosmetics (47%). Footwear also has a solid presence at 43%, while travel tickets are less common at 26%.

Other product categories preferred by Italian live commerce shoppers include accommodation, household appliances, home delivered food, packaged food, furniture, art products, and vehicles/car parts.

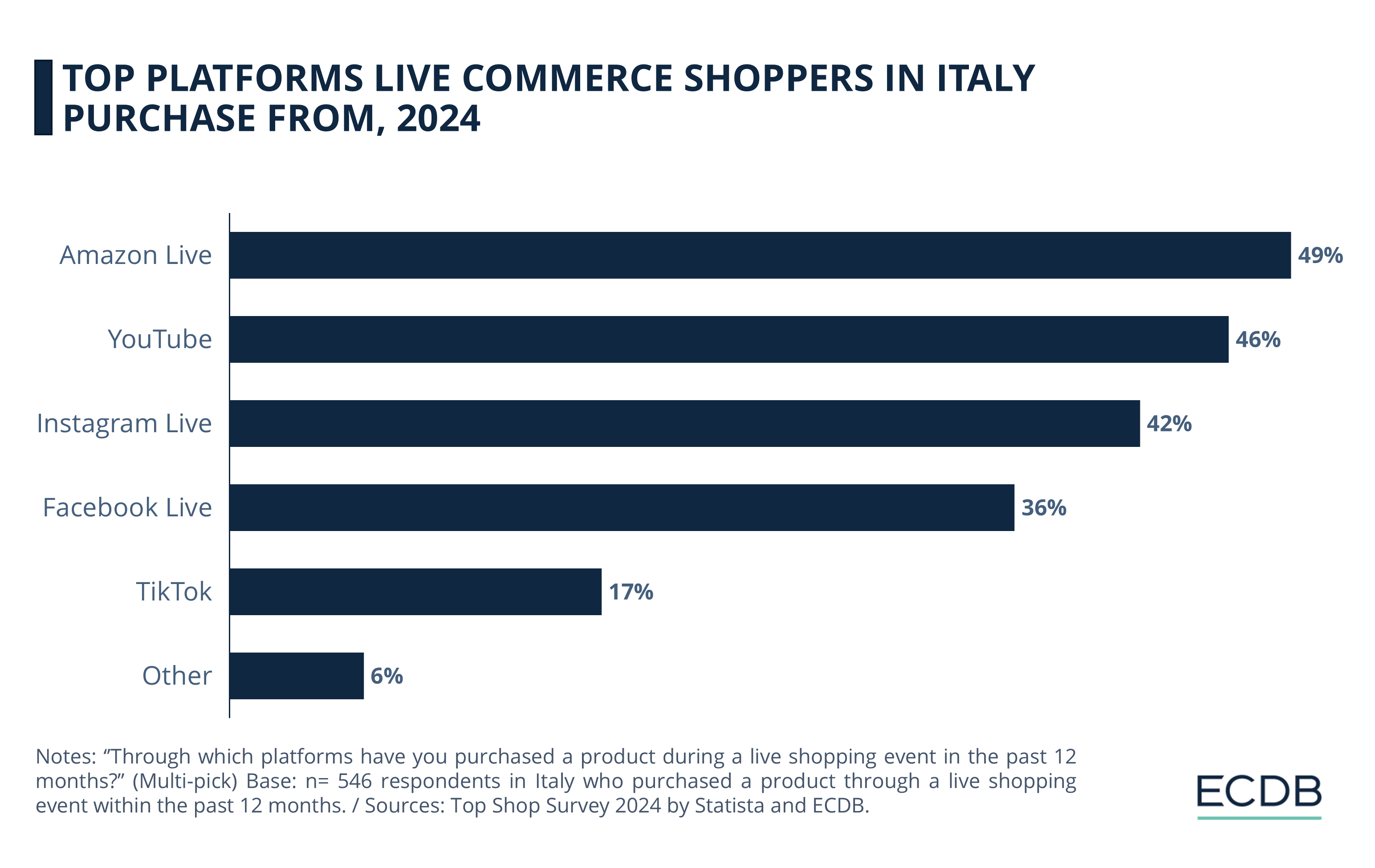

Amazon Live is the Top Live Commerce Platform in Italy

But what platforms do live commerce shoppers in Italy use for their live shopping? Launched 5 years ago, Amazon Live has conquered the Italian market:

Amazon Live leads with virtually half (49%) of shoppers, closely followed by YouTube (46%) and Instagram Live (42%).

Facebook Live captures a 36% share, while TikTok is used by only 17%.

In regard to age, Instagram Live and Amazon Live are most popular among 18-24-year-olds, while YouTube is dominant among shoppers aged 25-44.

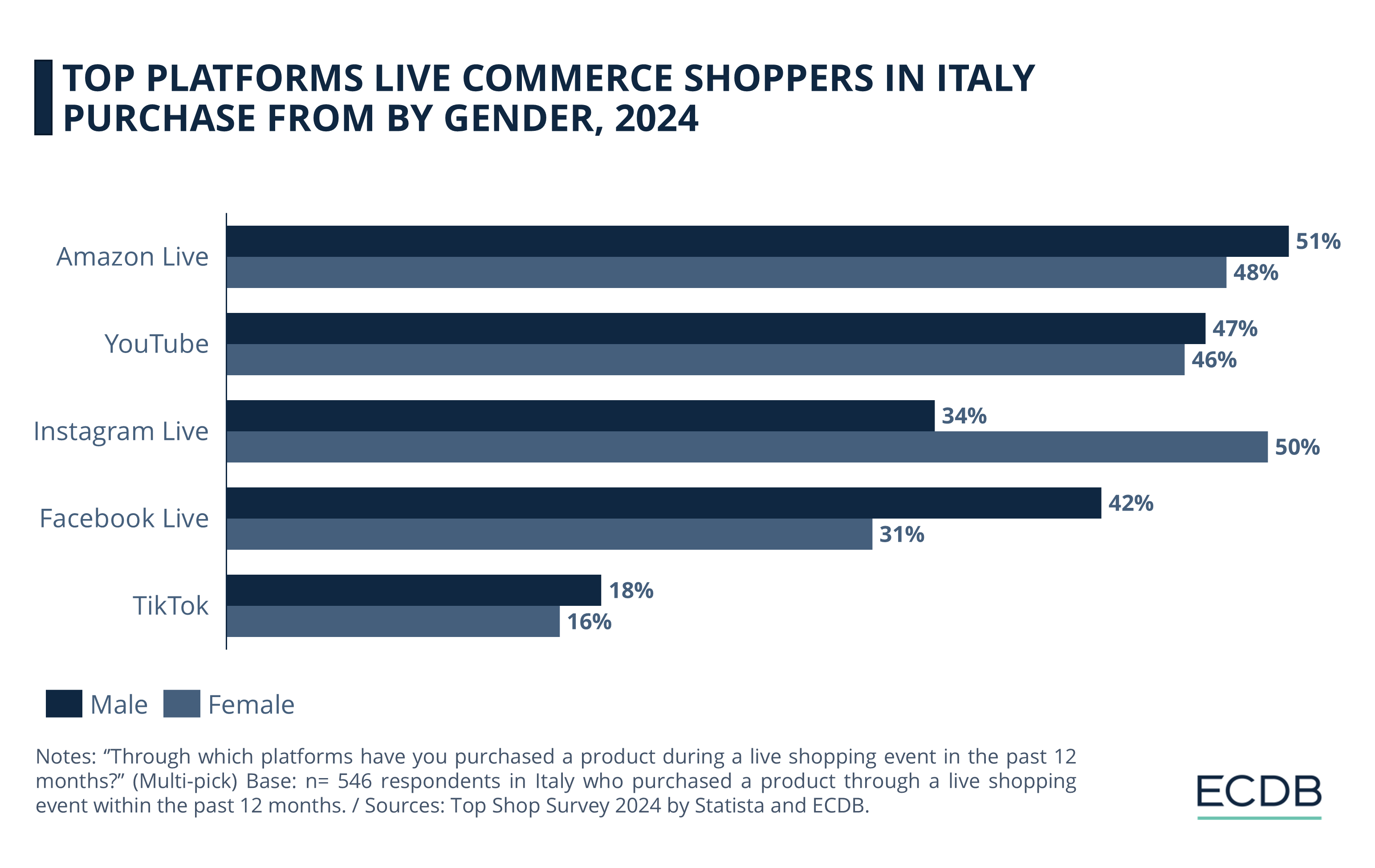

When it comes to gender preferences, we see clear differences in usage for Instagram Live vs. Facebook Live:

Male and female usage is close for Amazon Live (51% male, 48% female) and YouTube (47% male, 46% female).

Instagram Live is more popular with female users (50% vs. 34% male).

Men are more likely to use Facebook Live (42% vs. 31% female) and TikTok (18% vs. 16%).

In addition to that, high-income shoppers gravitate toward YouTube and Amazon Live, with shoppers in larger households showing the most engagement across almost all platforms.

A Pause on TikTok's Live Commerce Expansion in Europe

As the least popular major live commerce platform in Italy, TikTok doesn't appear to be expanding its presence in Italy anytime soon. With the platform shifting its focus to the U.S. market, where TikTok Shop has seen rapid growth, the expansion into European markets, including Italy, has been paused.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

This decision comes amidst regulatory scrutiny both in the U.S. and Europe, with Italy temporarily blocking access to TikTok for unverified users after concerning incidents. As TikTok navigates these challenges, Italian consumers may see even fewer live commerce opportunities on the platform in the near future.

Most Live Shoppers in Italy Use Their Phones to Purchase Products

In Italy, most live shopping happens on mobile devices, but other devices also play significant role. Top Shop survey results are as follows:

Almost two thirds (63%) of shoppers use their phones for live commerce, followed by laptops (48%) and desktop PCs (33%).

Tablets capture about a third (32%) of live commerce users, with TVs and AR/VR headsets trailing behind at 21% and 5%, respectively.

Demographically, phones dominate across all age groups, especially among lower-income shoppers.

Shoppers in larger households prefer using tablets and laptops, while those in the biggest cities show a stronger preference for laptops.

Mobile’s Influence is Expected to Increase in Italy

The mobile channel has been dominating the online shopping scene for some time now. This year's holiday season, for example, is expected to see mobile overtake desktop in the United States.

Mobile commerce may not be there yet in Italy, but the change in the mobile/desktop split in eCommerce is notable: While mobile channels accounted for 29.8% of the Italian eCommerce market in 2017, this figure reached 41.5% last year. This share is only expected to increase, reaching nearly 44% by 2028.

Half of Live Commerce Users in Italy Are in It for the Discounts

Why do people prefer live shopping? It's simple: live shopping is like watching infomercials on TV, but you can actually talk to the TV. Besides the discounts, interactivity is a big factor.

In the case of Italy, exclusive discounts stand out as the main reason why shoppers in Italy engage with live commerce:

Almost half (49%) of shoppers cite exclusive discounts as their top reason for participating in live shopping events.

37% are inspired by the presentation or seek smarter and more informed purchasing decisions. Real-time interaction attracts 26%, while recommendations and sustainability information draw 20% each.

Being closer to influencers (10%) and creative content (7%) are other reasons why live commerce shoppers in Italy use the service.

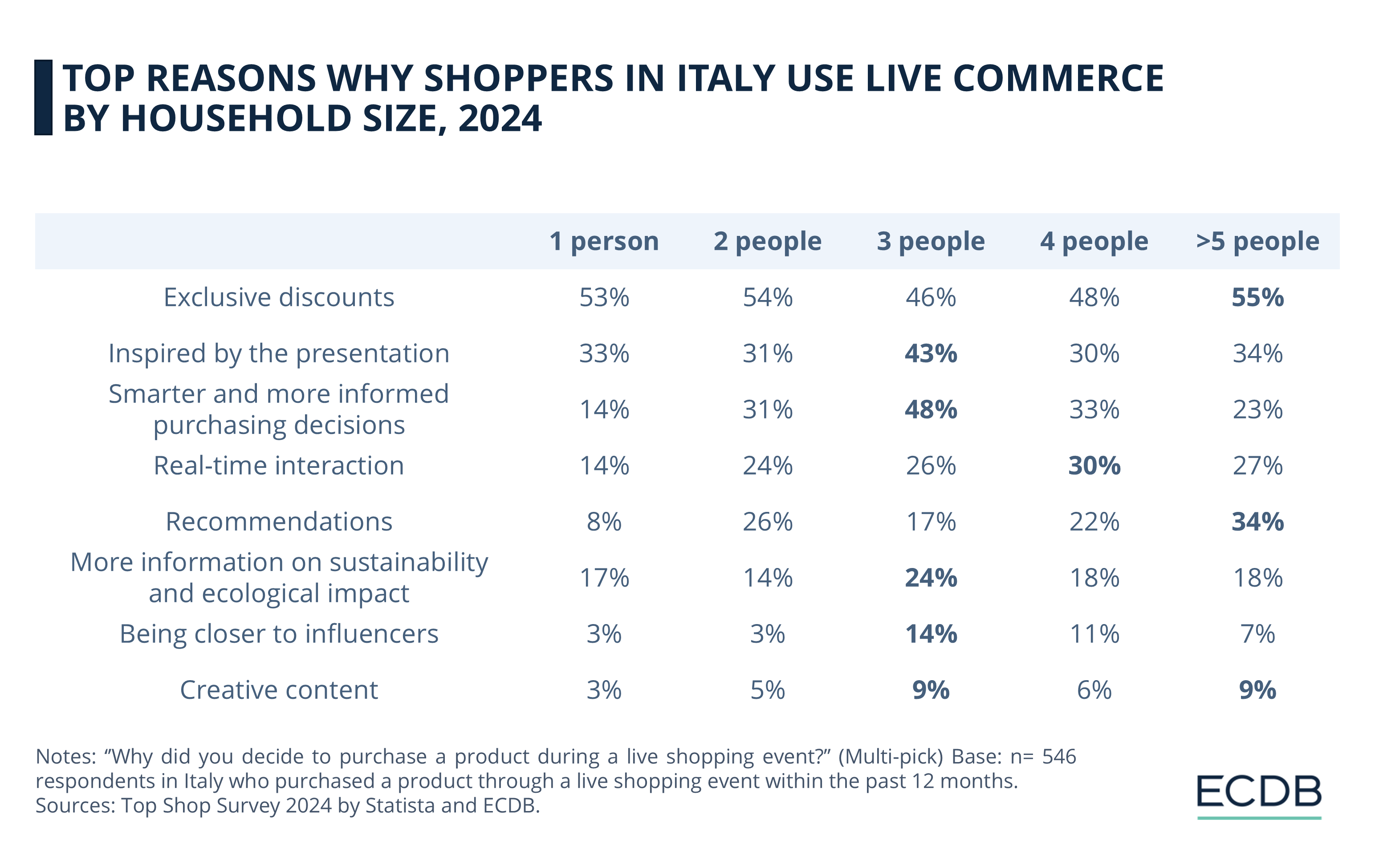

Exclusive discounts are particularly important for both the smallest and largest households:

Exclusive discounts are most important for the largest households (>5 people, 55%) and smallest households (1 person, 53%).

Smarter purchasing decisions are key for 3-person households (48%), while real-time interaction peaks in 4-person households (30%).

Recommendations are most valued in larger households (34% for >5 people).

Meanwhile, shoppers in larger cities are more driven by sustainability and closer connections to influencers. Those in smaller cities focus more on discounts and recommendations.

Barriers to Live Commerce Adoption in Italy

While live commerce holds great potential in Italy, certain barriers are preventing wider adoption.

According to YouGov Italy, half of those interested in live shopping sessions refrain from purchasing because they don't buy on social networks. As we covered before, many online shoppers still have their doubts about purchasing products on social networks.

Distrust towards influencer-sponsored products is another significant factor, with 45% of shoppers citing this as a concern. Additionally, one quarter feel they wouldn’t have the time to attend live shopping events, and 23% worry that these sessions won’t offer the products they’re looking for.

Live Commerce in Italy: Closing Thoughts

Live commerce in Italy is still in its early stages, but its rapid growth signals a shift in how consumers engage with eCommerce. As platforms adapt and more brands embrace live shopping, the trend is likely to become more widespread, particularly among younger shoppers and tech-savvy households.

Over the next few years, we can expect mobile devices to continue driving this shift, with exclusive deals and real-time interaction remaining key motivators. While barriers like distrust in influencers persist, they will likely diminish as platforms build credibility.

Sources: PYMNTS, Telegrafi, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

Counterfeit Goods Threaten Online Shopping Growth

Counterfeit Goods Threaten Online Shopping Growth

Back to main topics