eCommerce: Online Retail

Otto Faces Crisis as Over 1,000 Sellers Leave the Platform

Otto is in trouble. Germany's second-largest online marketplace has driven away more than 1,000 sellers in just a few months due to a steep increase in fees. As Otto tries to recover, it faces growing competition from Temu and Shein.

Article by Patrick Nowak | September 24, 2024

Otto Faces Crisis: Key Insights

Otto losing sellers: Otto lost over 1,000 sellers due to fee increases and dissatisfaction.

High fees: The platform dramatically increased fees, making it difficult for smaller sellers to stay.

Technical issues: Otto needs to fix technical issues and improve relationships with partners to rebound.

Otto.de is in trouble. In just a few months, the company has lost more than 1,000 sellers, with many citing high fees and dissatisfaction as the main reasons. The German marketplace, which ranks behind eBay and Amazon in the country, must now find ways to win back sellers while facing intense competition from chinese eCommerce giant like Temu or Shein.

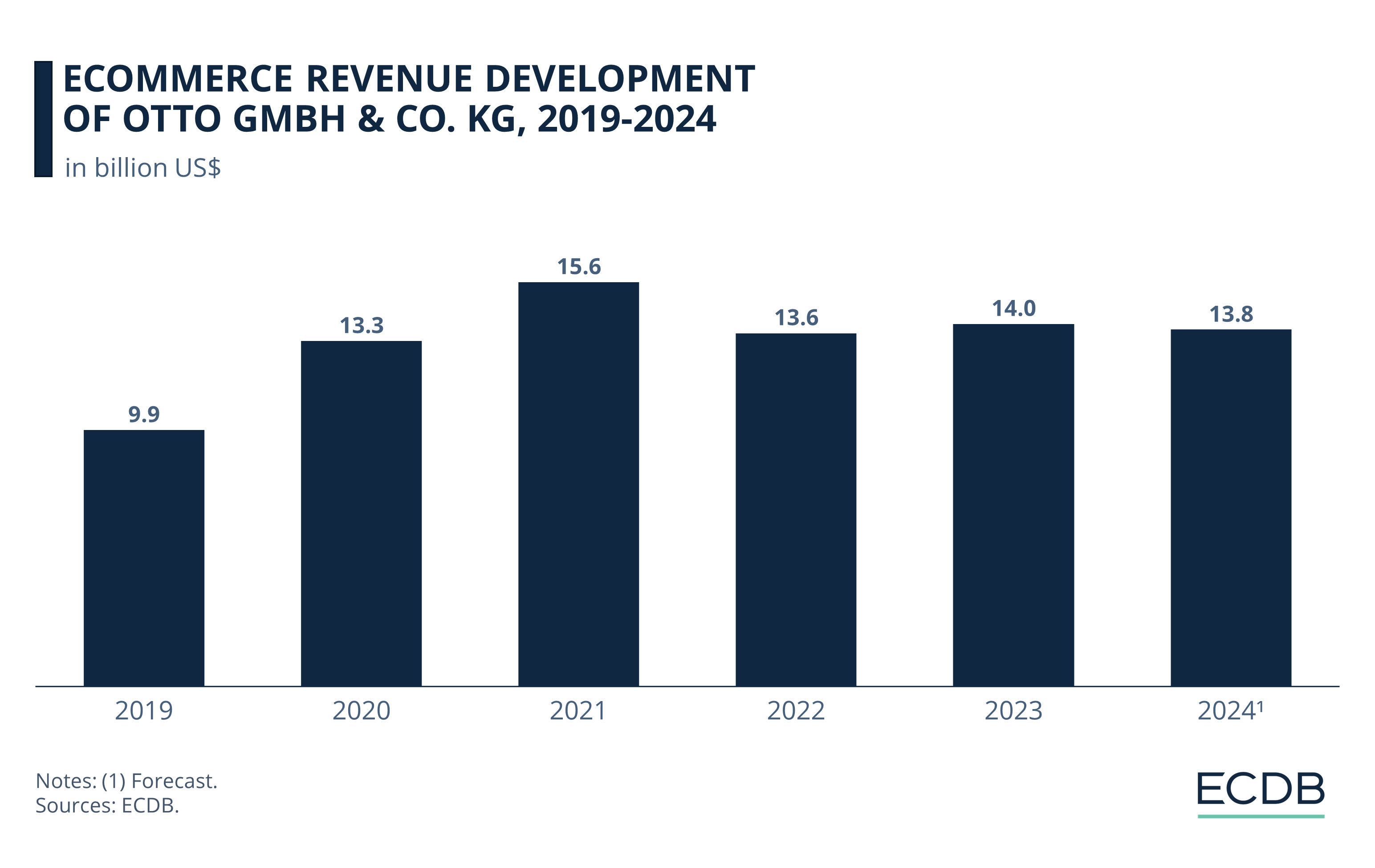

Otto GmbH & Co. KG’s overall eCommerce revenues followed a similar pattern to the ones its flagship otto.de experienced.

The conglomerate’s eCommerce revenues peaked at US$15.6 billion in 2021 and fell to US$13.6 billion in 2022.

While there was a slight recovery to US$14 billion in 2023, revenues are expected to decline again by 2024 with a forecast of US$13.8 billion.

Otto: Sellers Leave After Fee Increases

Earlier this year, Otto shocked its sellers by announcing sharp increases in fees. For many product categories, commissions jumped from 7% to 15%. Additionally, Otto raised the basic monthly fee from 39 euros to nearly 100 euros. Much higher than what competitors like Amazon charge.

The result? Over 1,000 sellers decided to leave. Many sellers couldn't justify staying when their costs rose so dramatically.

Otto Terminates Contracts Without Explanation

Otto’s problems don’t stop there. Allegedly, Otto itself canceled contracts with about 150 sellers. Many of these sellers were confused by the decision, as some had been making significant sales on the platform. Lawyer Lars Maritzen, who represents several affected sellers, noted that Otto gave no clear reason for these sudden terminations.

Otto, however, claims the terminations were due to breaches of contract, specifically regarding customer service issues and problems with shipping from China.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Competing in a Tough Market

Otto’s problems don’t stop there. The company’s overall sales dropped by nearly 5% last year, despite raising fees. At the same time, competition from global giants like Amazon, Temu, and Shein is growing stronger. These platforms offer lower fees and better technology, making it hard for Otto to keep up.

In May, Otto appointed Boris Ewenstein as the new head of its marketplace. His mission is clear: fix the platform’s issues, restore trust with sellers, and improve technical performance. Sellers have complained about frequent technical problems and high return rates, further hurting Otto’s reputation.

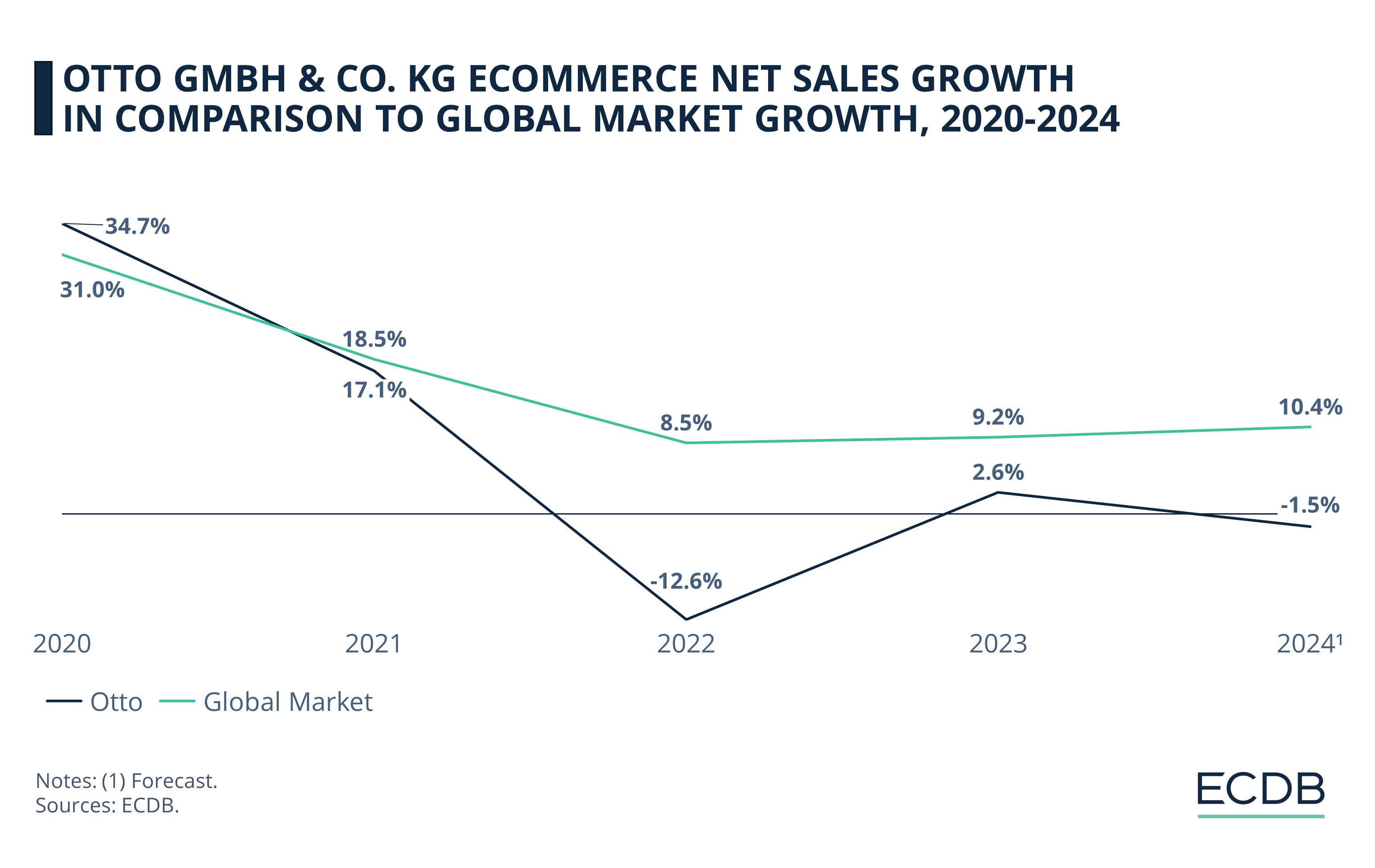

In 2020, Otto outperformed the global market in terms of annual growth, with a rate of 34.7% compared to 31% for the global market.

The situation reversed, however, in the following year: Global eCommerce grew by 18.5% year-on-year, while Otto’s rate was at 17.5%.

The year 2022 was particularly hard for Otto: Growth dropped to -12.6%, which stood against moderate market growth of 8.5% worldwide.

The subsequent years solidified Otto’s lag: With rates of 2.6% in 2023 and -1.5% in 2024, Otto cannot keep up with the market average of around 10% in both years.

Can Otto Recover?

Otto needs to make some big changes if it wants to recover. Lowering fees is just one part of the solution. The platform also needs to modernize its technology and improve the overall experience for sellers. If these issues aren’t addressed soon, more sellers may leave, putting Otto’s future at risk.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

Marketplaces in Germany: Platforms Under Pressure

Marketplaces in Germany: Platforms Under Pressure

Deep Dive

Fastest-Growing Online Stores in Germany: Children’s Entertainment, Health Products & Discounters

Fastest-Growing Online Stores in Germany: Children’s Entertainment, Health Products & Discounters

Deep Dive

Top 5 Online Marketplaces in German Fashion: Amazon, Zalando & About You

Top 5 Online Marketplaces in German Fashion: Amazon, Zalando & About You

Back to main topics