eCommerce in Poland

Online Fashion in Poland: Zalando dominates the Market with Its Online Stores

Online shopping has become an integral part of our daily lives. In Poland, among the biggest online fashion stores in this eCommerce market are big companies like Zalando and Shein, as well as Polish companies. But who leads the fashion market in Poland?

Article by Nadine Koutsou-Wehling | September 24, 2024Download

Coming soon

Share

Online Fashion in Poland: Key Insights

Market Leaders in Fashion: Online store zalando.pl leads the Polish fashion eCommerce market with revenues of US$437.8 million in 2023.

Rapid Growth of Shein: Shein.com saw a 40.2% growth in Poland in 2023.

Changing Shopper Demographics: The Polish online shopper demographic has shifted towards older age groups (35+), reflecting broader digital adoption.

Environmental Concerns Matter: Polish consumers value eco-friendly shopping options, and online retailers such as Zalando and Eobuwie have recognized and are partnering among other things with sustainable logistics companies.

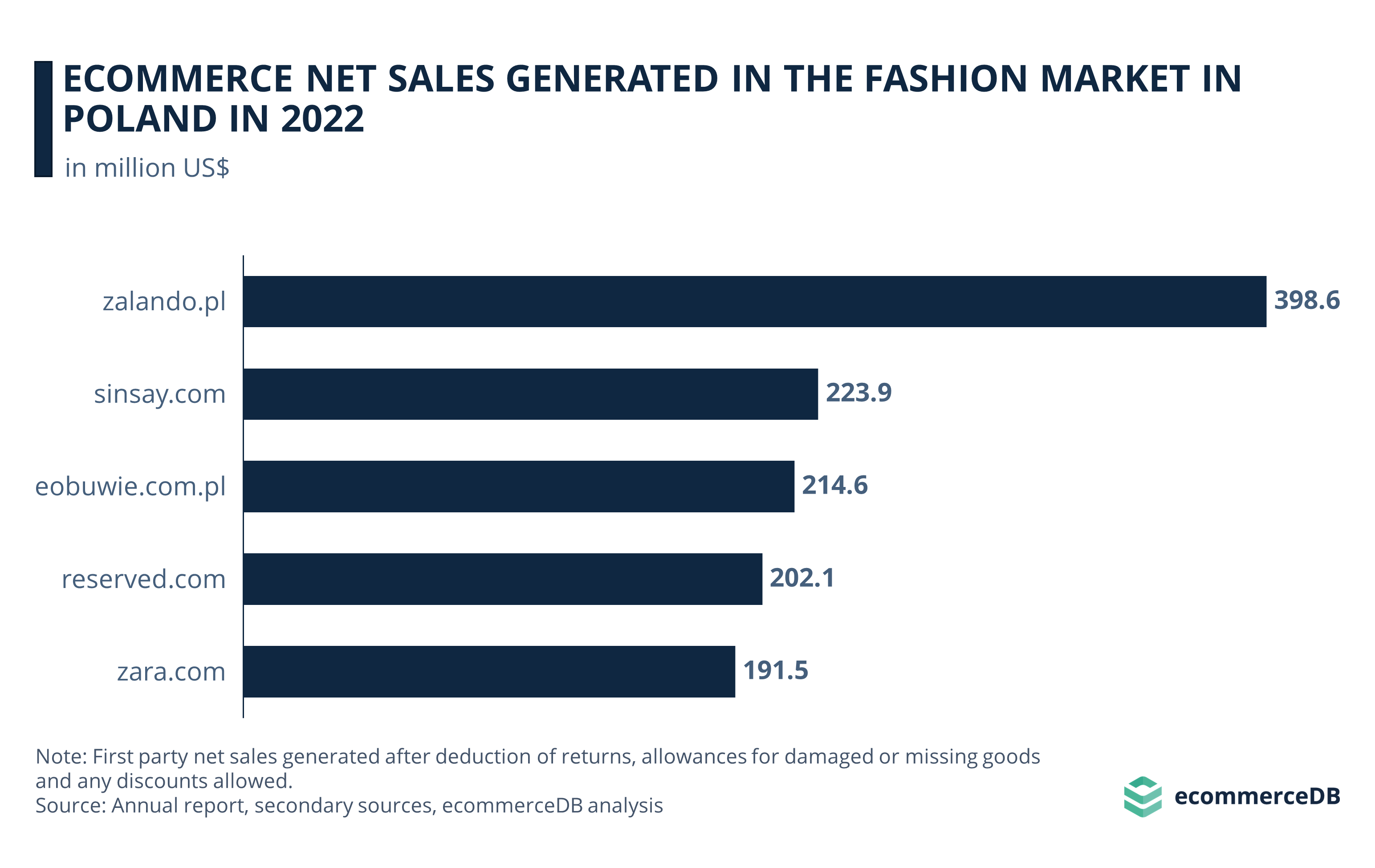

Fashion is a popular product category in eCommerce, and Poland is no exception. The Polish online fashion segment accounts for 8.7% of national eCommerce net sales. But which fashion stores generate the highest annual net sales in Poland?

Top Online Stores for Fashion in Poland

Poland is ranked 26th in terms of global eCommerce net sales, generating revenues of US$2.6 billion in 2023. The following ranking shows the top online stores driving the Polish fashion eCommerce market:

The top 5 include major fashion players such as Zalando, Nike and Shein.

Zalando appears twice in the ranking with zalando.pl and zalandolounge.pl.

Local eCommerce can also be found among the leading online fashion retailers, for instance eobuwie.com.pl.

1. Zalando.pl

The leading Fashion online store in terms of revenue is the Polish domain of Zalando SE, zalando.pl. The online store, which operates exclusively in Poland, generated total sales of US$437.8 million in the year under review. Compared to the previous year, the market grew by 4%. The online store was launched in 2012.

As fast fashion retailer Shein poses the biggest threat to the fashion player, the company is working on other things than low prices to lift itself from the market. Among other things, the company is trying to do this by offering more premium brands such as On Running, but also by investing in AI, for example with its shopping assistant.

2. Shein.com

In second place is the ultra-fast fashion online store shein.com, with eCommerce net sales of US$294.4 million in 2023. That's less than 1% of Shein's global sales of US$36 billion that year. Overall, shein.com increased by 40.2% compared to 2022.

Shein's business model focuses on low costs, rapid production cycles, advanced technology, and influencer marketing. But it is this model that has been criticized repeatedly for the poor working conditions and environmental damage that result.

3. Eobuwie.com.pl

Next in the ranking comes eobuwie.com.pl, which focuses entirely on the footwear market in Poland. The store is operated by the company CCC S.A. Last year, the online store achieved net sales of US$232.2 million, which represents an improvement of 5.3% compared to 2022.

The shoe retailer is working on an omnichannel formula to create a seamless experience between its eCommerce platforms and physical stores. Part of it is the shoeless store, a small digital browsing lounge combined with a stocked warehouse. Shoppers come into the shop to browse shoes on tablets, which are then brought out by a sales associate in a matter of minutes.

4. Nike.com

In fourth place is the online store of the sportswear brand Nike, nike.com. 1.9% of its global eCommerce net sales of US$12 billion in 2023 has been generated on the Polish market. This corresponds to a turnover of US$225.3 million in the same year.

Nike recently announced its first partnership with LEGO. It is still a mystery what products will result from this cooperation, but the first theories have already been posted. Among others, pictures of Nike Jordans and Air Forces as Lego products are circulating, which might let the hearts of sneaker and LEGO collectors beat faster.

5. Zalando-lounge.pl

Among the top 5 online fashion stores in the Polish eCommerce market is another store of Zalando SE: zalando-lounge.pl. In 2023, the online retailer achieved net sales of US$226.9 million. Zalando-lounge.pl concentrates 100% on the eCommerce market in Poland, while 92% of its net sales are generated by fashion products.

The online store was launched on the Polish market in 2017. It differs from the classic Zalando online store in terms of its business model. While zalando.pl offers a fixed product range with a seasonal focus, Lounge by Zalando offers limited-time deals and discounts on fashion, premium and homeware on a daily basis.

Flexible, Pan-European, and Cross-Border eCommerce Define the Polish Market

The first of the four business strategies builds on Poland’s geographic location. Poland's central European location and developing infrastructure make it an ideal hub for retailers to supply Poland and neighboring markets. Fashion players have also recognized this:

Zalando started its operations in Berlin in 2008. The company expanded to new European markets at an early stage and arrived in Poland in 2013.

Similarly, Zara has been operating in Poland since 1999 and is well-established player in the country.

The same is true for Reserved and Sinsay, both of which are owned by LLP S.A. LLP is driving an expansion program for its sister brands in both southern and northern Europe, ensuring the conglomerate's reach and visibility across the continent.

Since 2016, eobuwie.pl has successfully expanded to 15 European markets. eobuwie.pl's business strategy is based on cross-border trade, which is made possible by Poland's central location and infrastructure.

Who Are the Online Shoppers in Poland?

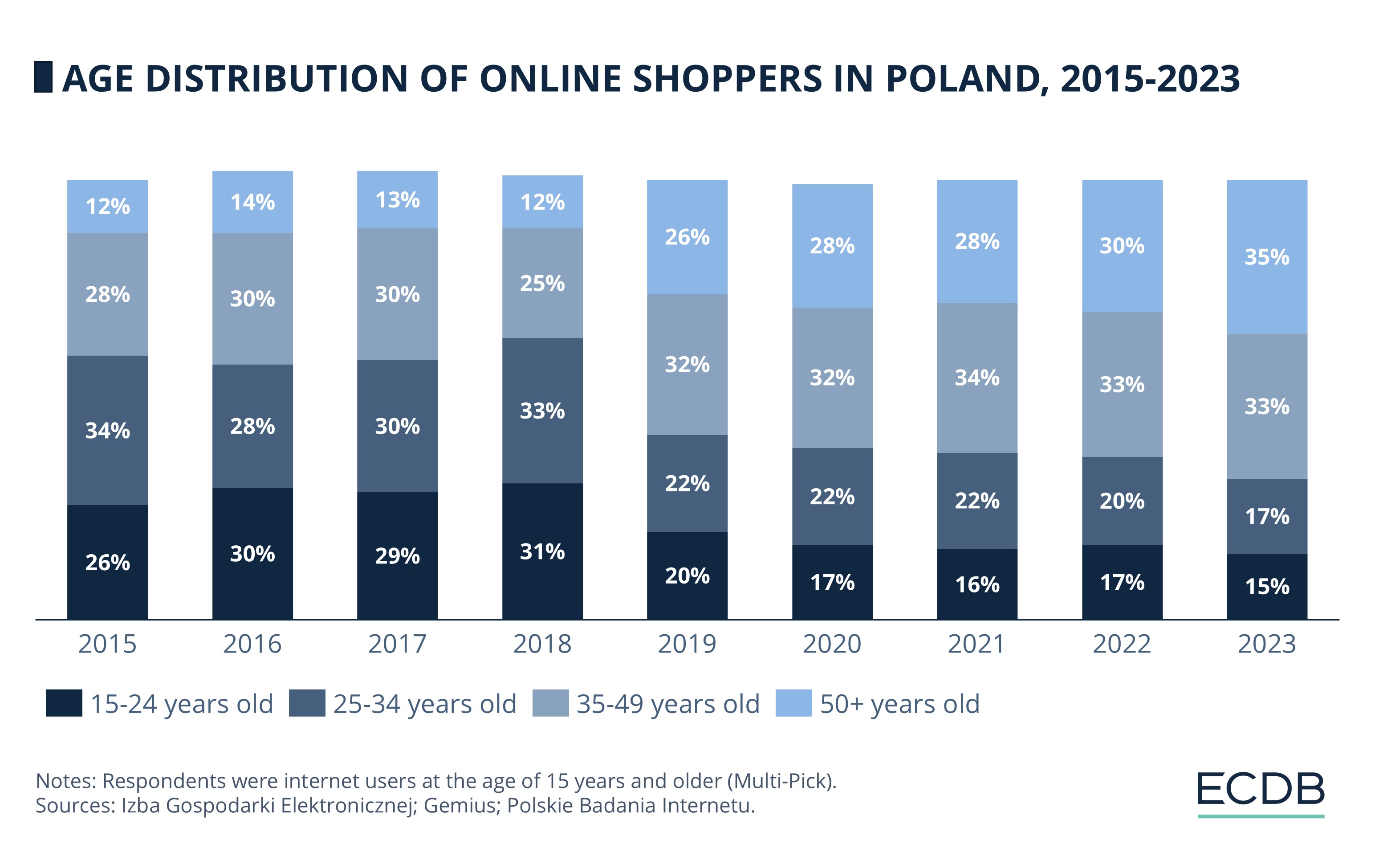

The pandemic has led to the proliferation of eCommerce, which in Poland has meant the wider inclusion of previously less represented older age groups in eCommerce – let’s take a closer at age distribution look:

Most age groups saw a large change in share between 2018 and 2019.

The share of online shoppers aged 15 to 24 accounted for 26% in 2015, rising to 31% by 2018. But in 2019, it dropped to 20%, and in 2023, it reached its lowest point in this chart with 15%.

The 25-34 age group showed a similar trend. Between 2015 and 2018, it had a share of 28% to 33%, which decreased after 2018 to 22% and last year to 17%.

Meanwhile, the 35-49 age group saw less drastic changes. While the share was between 25% and 30% from 2015 to 2018, it increased after 2018 and stabilized between 32% and 34%.

The 50+ age group has seen the largest increase in the past. Between 2015 and 2018, its share was at 12% to 14%. In 2019, the share more than doubled to 26% and continued to grow until reaching 35% in 2023.

According to Statista, in 2018, 52% of people in Poland shopped online, while, in 2023 it is 100%. It shows how this trend has evolved from being a matter for young consumers to one for all age groups, especially those over 34.

How Do Polish Consumers Shop Online?

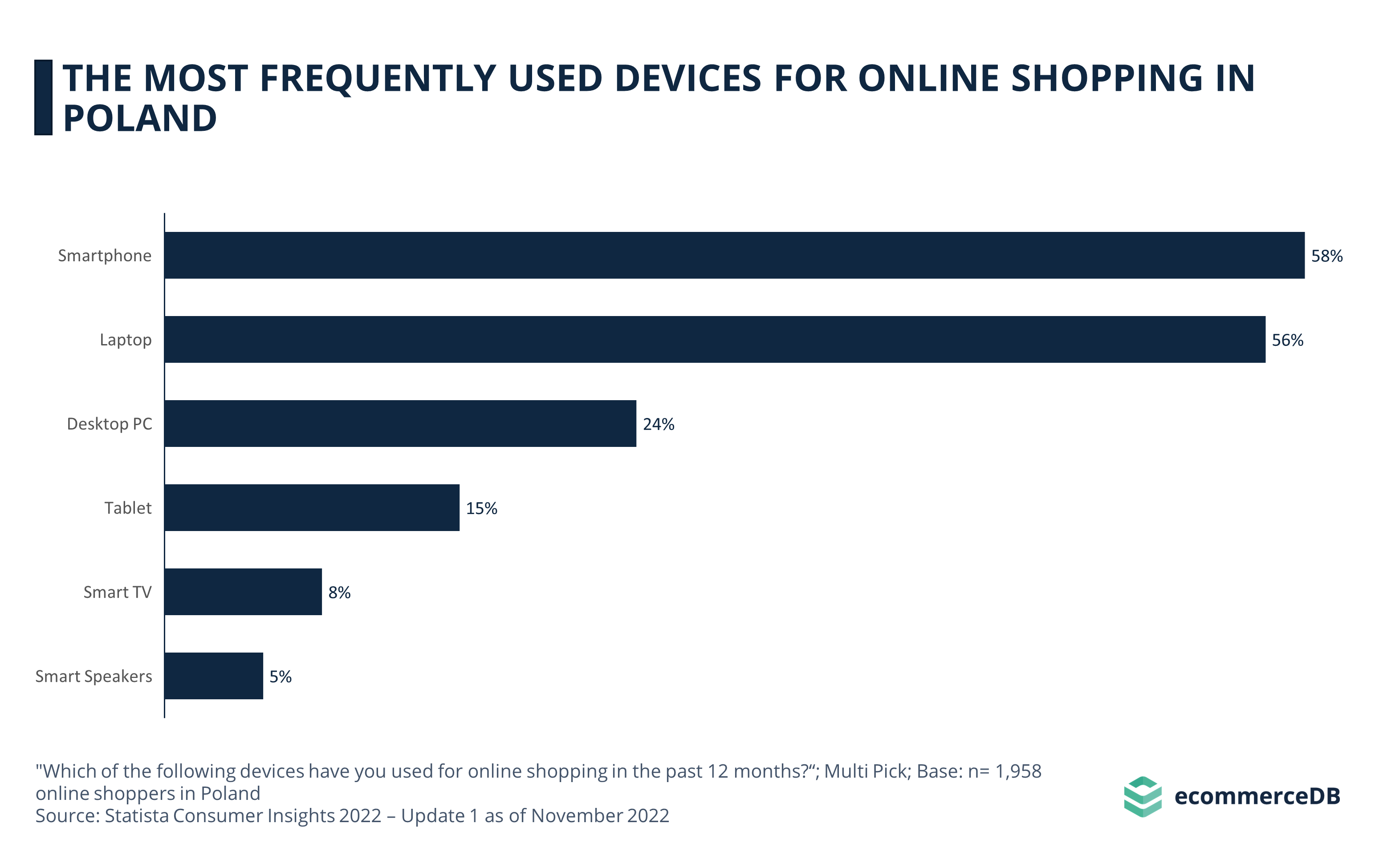

With the digitalization, the number of people who own a smartphone has increased in recent years. Nowadays it has become normal to own a smartphone. By 2024, the penetration rate of smartphone users in Poland is expected to reach 88.5%, thus it makes sense that smartphones are the most frequently used device for online shopping:

79% of the online shopping in Poland is done with a smartphone.

The second most used device is the laptop with 69%.

With 38%, the personal computer or PC is the third most used device.

Next comes the tablet which holds 16%.

Last is the e-book as a device for online shopping, with 16%.

Environmental Awareness as a Driver of eCommerce

Consumers are becoming increasingly aware of the environmental impact of their shopping habits. As a result, brands that implement an eCommerce strategy addressing these concerns are better positioned to secure a strong presence in the market.

Two stores in our top five list, Zalando and eobuwie.pl, have partnered with the European logistics company InPost to launch a network of parcel drop-off/collection machines in Poland. This customer-centric model allows users to select convenient locations and times for parcel pick-up, easing the pressure on delivery staff and reducing unnecessary travel, especially during peak shopping periods such as Christmas.

Meanwhile, ultra-fast fashion player shein.com is facing environmental restrictions in France and the EU. The EU restrictions were imposed as the Chinese online store is criticized not only for its environmental issues, but also for its dumping practices and forced labor of, among others, the Uighur Muslim ethnic minority.

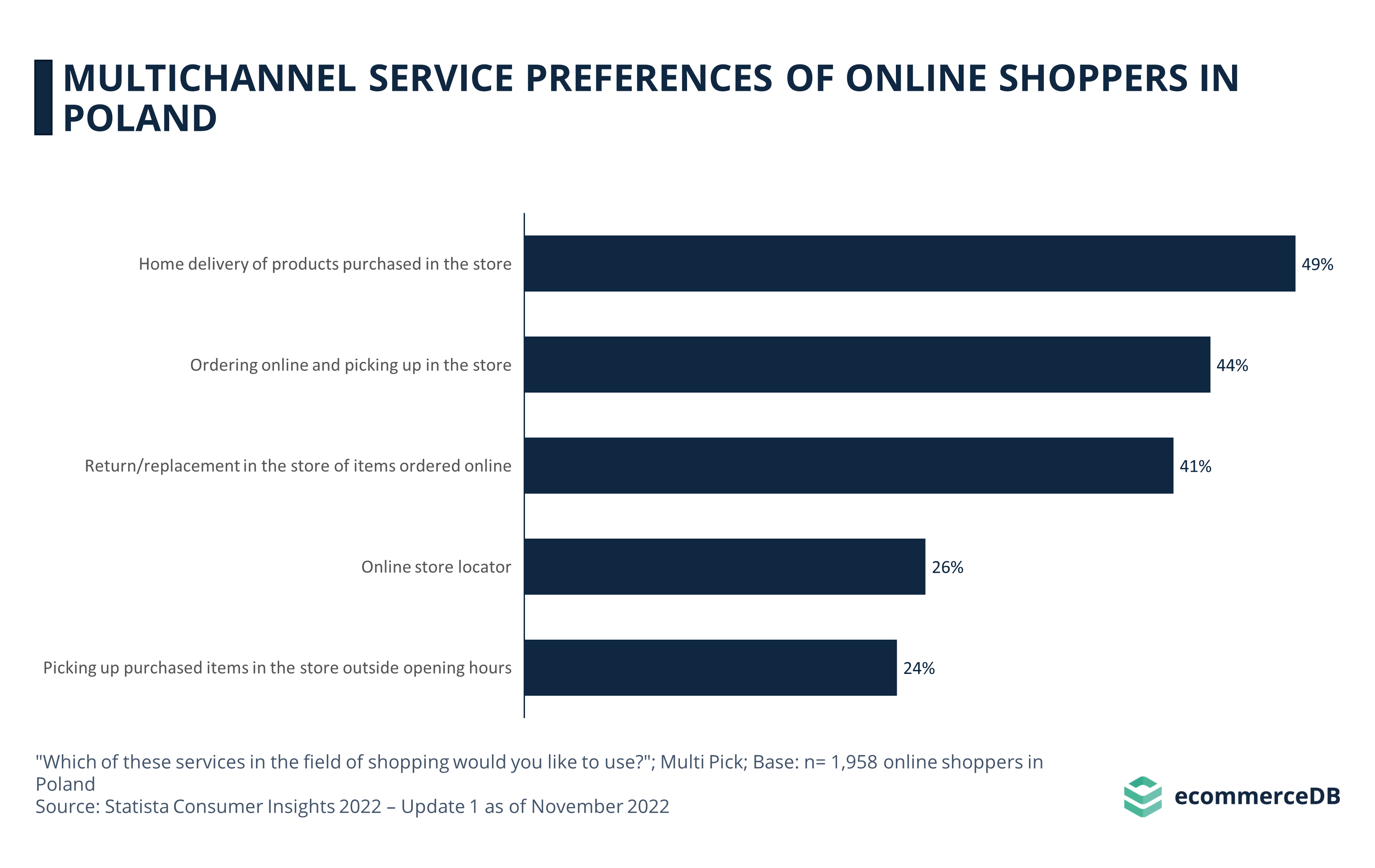

Multichannel Services and Store Innovation Boost Sales

In line with the flexibility of last-mile delivery is the ability for consumers to choose how they receive their orders. Multichannel services are becoming more prevalent as they meet consumer preferences and help alleviate some of the pressure on delivery providers during periods of high demand.

The most popular multichannel service is the availability to check online if certain products are available in-store with 44% of the Polish respondents having used this service.

It is followed by the option of ordering online and picking up the shopped items in the store with 41%.

With 36% comes the option of home delivery of products purchased in-store.

Fourthly stands the service of using an online store locator holding 25%, followed by the option of returning or replacing an item in the store holding 17%.

Eobuwie.com.pl, and nike.com with a hybrid brick-and-mortar/online model offer multichannel options to customers. However, eobuwie.pl went one step further and integrated online conveniences into its physical stores, aiming to combine the benefits of both channels into one comprehensive strategy.

Specifically, eobuwie.pl allows customers to create a 3D foot scan in their stores, which they can then save and use for future purchases on the online store platform, avoiding the uncertainty of sizing issues in an online setting. Users can also order a pair online to try on in their local store.

Online Fashion in Poland: Closing Thoughts

In the past, the Polish fashion market has experienced various changes, be it the increased use of online shopping by older users or the growing digitalization, which makes online shopping more and more convenient.

The online fashion market in Poland has benefited from a number of factors, including the dominance of pan-European fashion retailers, and the growing environmental awareness of Polish consumers.

The trend is moving toward combining the benefits of the online shopping experience with the offline one. Customers want to touch the products and get personal service along with 24/7 availability and fast delivery. Innovations such as Zalando's AI assistant or Eobuwie's shoeless store are already making this possible. The future will show us what other innovations will be on the horizon.

Sources: All4Comms - Drapers - InPost – LLP - Logistics People Community – Payu Poland - Propertywheel - RetailBrew – Zalando

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics