Social Commerce 2024

Global Social Commerce Market: Top Platforms, Markets & Trends

Social commerce is growing as the likes of TikTok and Facebook drive the market. Trends such as influencer marketing and community group buying are also influential.

Article by Nadine Koutsou-Wehling | September 19, 2024Download

Coming soon

Share

Global Social Commerce Market: Key Insights

Top Platforms: Facebook, Instagram, and TikTok are leading the charge in social commerce, with Facebook dominating user engagement, Instagram close behind, and TikTok quickly emerging as a strong contender.

China's Lead: China remains at the forefront of the global social commerce scene, with platforms like Taobao and Douyin playing pivotal roles, particularly among women over 50, and the popularity of community group buying in smaller cities and rural areas.

Challenges in the U.S. Market: While social commerce is growing in the U.S., led by Facebook and Instagram, challenges such as fraud and regulation persist. Platforms like Amazon Live and innovative startups are driving change, but a potential TikTok ban could significantly impact the market.

Europe’s Slower Adoption: Europe has been slower to embrace social commerce, with only 26% of users participating. Legacy retail systems and strict data laws have contributed to the lag, though Facebook and Instagram are pushing growth, especially among younger users in Germany.

Influencers Power Social Commerce: Influencers on Instagram and TikTok are key players in social commerce. Nano-influencers see the highest engagement, while Gen Z and Millennials are the most active in following and buying from these content creators.

Social commerce came into our lives and quickly transformed eCommerce, allowing users to buy everything from groceries to clothes directly through mediums like TikTok or Instagram. While China leads the way in social commerce, the United States and countries like Germany in Europe are catching up. In the near future, a potential TikTok ban in the U.S. or an Amazon acquisition of TikTok could change the landscape fast.

Top platforms such as Facebook, Instagram, and TikTok are battling for dominance, while trends like community group buying and influencer marketing are reshaping how we shop. How does social commerce differ across these regions, and what’s next for this dynamic market?

Facebook is the Most Used

Social Commerce Platform

To understand the market, we first have to look at which companies are leading it.

DHL surveyed 24,000 consumers across 24 countries to assess which social media platforms are most frequently used for online shopping. The survey results show that:

Facebook is leading the pack, being used by 37% of consumers worldwide. Instagram, which belongs to Meta Platforms together with Facebook, is the second most used social commerce site, with 28% of global consumers saying they have purchased from it.

Third rank is TikTok, with an 18% usage share. Considering that TikTok Shop is not yet available for usage in every country, the share leaves some room to catch up with the first two rankings over time. YouTube follows in fourth place with 16%, not far behind TikTok.

With lower adoption rates in the lower rankings are Pinterest (7%) and Snapchat (6%).

Pinterest is an image board to discover and post various kinds of aesthetics, products and information to share inspiration across a diversity of interests. While eCommerce sites and businesses tend to use Pinterest for promotional purposes, its Pinterest Shopping feature lags behind the leading platforms.

Similarly, Snapchat’s shopping feature is not highly frequented. This correlates to the rather young audience age of Snapchat users, who in turn are not the most spending-intensive customer base.

However, as these are global figures, it is important to remember that social commerce usage tends to vary significantly between regions of the world. Each market has its own dynamics and nuances.

What about the largest eCommerce market, how is social commerce faring there?

Social Commerce in China

As with eCommerce in general, China leads the world in social commerce, generating US$434 billion in 2023, 75% of global revenue. This figure is expected to reach US$824 billion by 2028. Women, especially those over 50, play a key role – over 60% of purchases on platforms like Taobao and Tmall are made by women, many of whom also drive family buying decisions.

Douyin, a major player, saw sales rise by 276% during International Women’s Day 2023, with beauty, skincare, food, and household appliances being top categories. Despite societal pressures to prioritize domestic roles, social commerce is empowering women economically, particularly through platforms like Douyin.

Community Group Buying in China

One of the biggest social commerce trends in China, community group buying combines online shopping with offline group ordering for discounts. This model, driven by China's middle class and rising internet use, boomed during the pandemic, reaching a market size of US$45.6 billion by 2023.

Groups form through platforms like WeChat to place bulk orders, mainly for groceries and household items, unlocking lower prices. Meituan Select and Duo Duo Grocery dominate, with US$18.6 billion and US$12.4 billion in GMV, respectively.

The model mainly targets smaller cities and rural areas, where 70% of users live. Community leaders, often local store owners, organize orders and earn commissions. However, the sector faces challenges, including price wars, intense competition, and government regulations.

Social Commerce in the United States

On the other side of the ocean, social commerce in the U.S. has lagged behind markets like China, but it is growing. Facebook and Instagram dominate this space, though they face challenges like fraud and a lack of strong regulation. In 2023, 77% of U.S. users were active on Facebook, followed by YouTube (66%) and Instagram (56%). TikTok, despite its popularity, has struggled with live shopping adoption in the U.S.

Platforms like Amazon Live and Walmart's partnerships with TikTok are helping boost live shopping trends. Startups like Ntwrk and TalkShopLive are also contributing to the rise of social commerce. While adoption is slower in the U.S., the market shows promise, particularly with new entrants pushing innovative shopping experiences.

Potential U.S. Ban of TikTok

President Biden’s new bill requires ByteDance to sell TikTok by 2025 or face a U.S. ban. With 150 million U.S. users, TikTok’s exit would greatly impact social commerce, as it merges entertainment with shopping. If banned, platforms like Instagram and YouTube would likely gain its audience and ad revenue.

TikTok’s sale is complicated by Chinese restrictions on exporting its algorithm. Meanwhile, TikTok partnered with Amazon to integrate shopping within the app, benefiting both. This partnership could challenge efforts to ban TikTok, and there’s speculation Amazon might eventually acquire TikTok to protect the collaboration.

Social Commerce in Europe

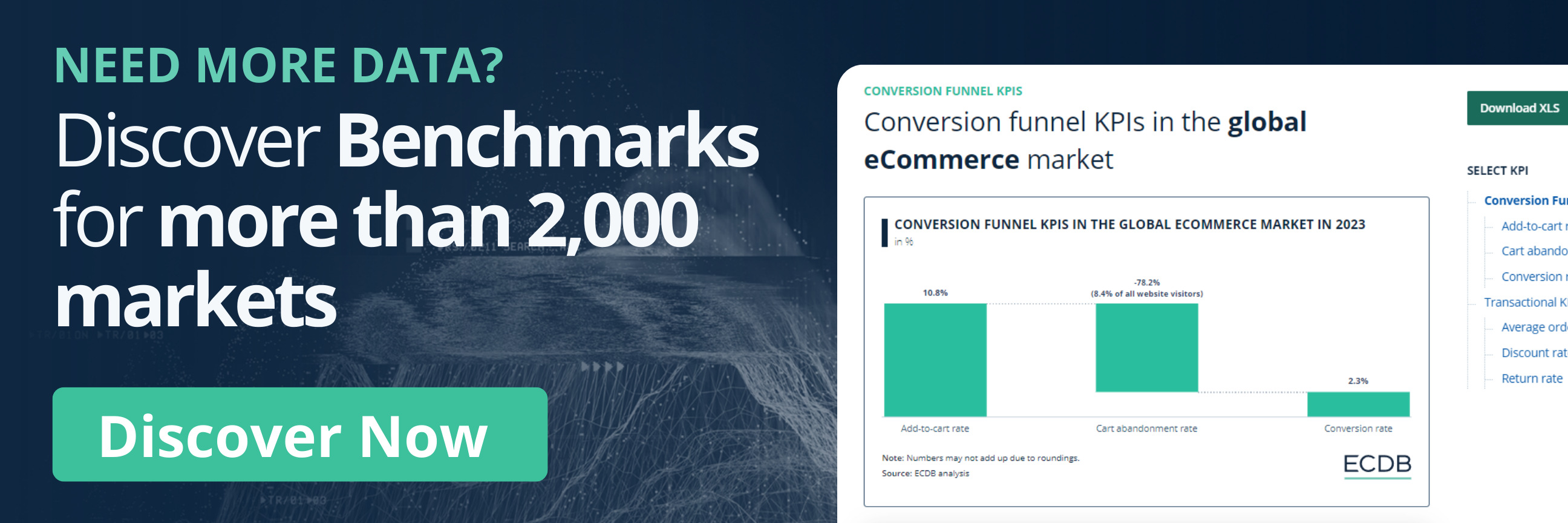

Looking beyond these two countries, Europe is another area to consider when talking about the growth of social commerce. Europe lags behind other regions in social commerce, with only 26% of users participating, compared to 42% in Latin America and 30% in Asia Pacific.

Factors like strong legacy retail systems, strict data laws, and cultural habits that favor communication over shopping slow social commerce adoption. Only 13% of Europeans use social platforms for shopping. High prevalence of social commerce scams is a major factor here.

The market’s progress is evident in numbers:

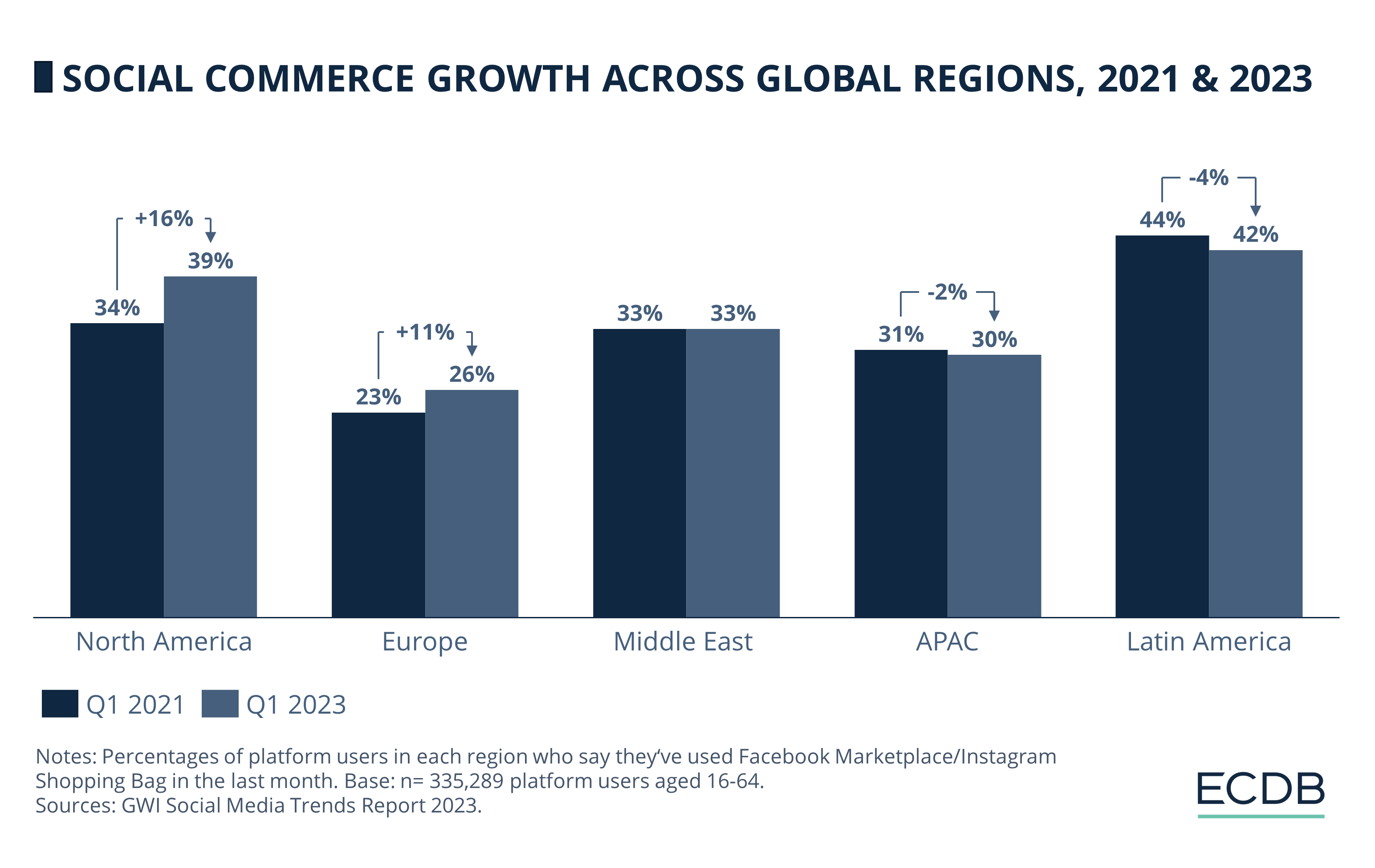

Valued at US$6.2 billion, the European social commerce market had humble beginnings.

With the pandemic, market revenues jumped to nearly US$10 billion, followed by US$12.8 billion and US$18.4 billion in the following years.

The market reached US$26.7 billion in 2023 and is expected to grow to nearly US$50 billion by 2028.

Facebook (24%) and Instagram (16%) lead the continent in social commerce, while YouTube and TikTok trail. Spain is set to surpass the UK in user numbers by 2027, but the UK will likely remain the most lucrative market.

Social Commerce in Germany

In Germany, the second largest eCommerce market of the continent, Millennials lead social commerce usage, with 42% actively shopping via social media, followed by Gen Z at 29%. In contrast, only 23% of Gen X and 6% of Boomers engage with social commerce. While younger generations are more active, Gen X shows the highest openness to trying social commerce in the future, with 36% expressing interest, compared to 29% of Millennials and 19% of Gen Z.

Older generations, especially Boomers, remain resistant, with one-third of Gen X and Boomers stating they neither use nor plan to use social commerce. Millennials, despite their high usage, also report higher rates of dissatisfaction, with 42% indicating they won't use the service again.

Influencer Marketing in Social Commerce

Influencers on Instagram and TikTok are vital to social commerce, promoting products directly to engaged audiences. Instagram is more popular in Latin America, while TikTok leads in Asia Pacific.

Business Intelligence: Our rankings, updated regularly with fresh data, offer valuable insights to boost your performance. Which stores and companies are the leaders in eCommerce? What categories are generating the most sales? Explore our detailed rankings for companies, stores, and marketplaces.

Influencers are categorized by follower count, from nano-influencers (1K–10K) to mega-influencers (1M+). Nano-influencers drive the highest engagement on both platforms – 2% on Instagram and 11.9% on TikTok – while larger influencers offer broader reach but lower engagement.

Choosing the right tier depends on a brand’s budget and goals. Smaller influencers provide authenticity and cost-effectiveness, while larger ones offer wider visibility. TikTok Shop, launched in 2023, further integrates social commerce, allowing users to shop directly through influencer content.

Gen Z Has the Highest Influencer

Following in Social Commerce

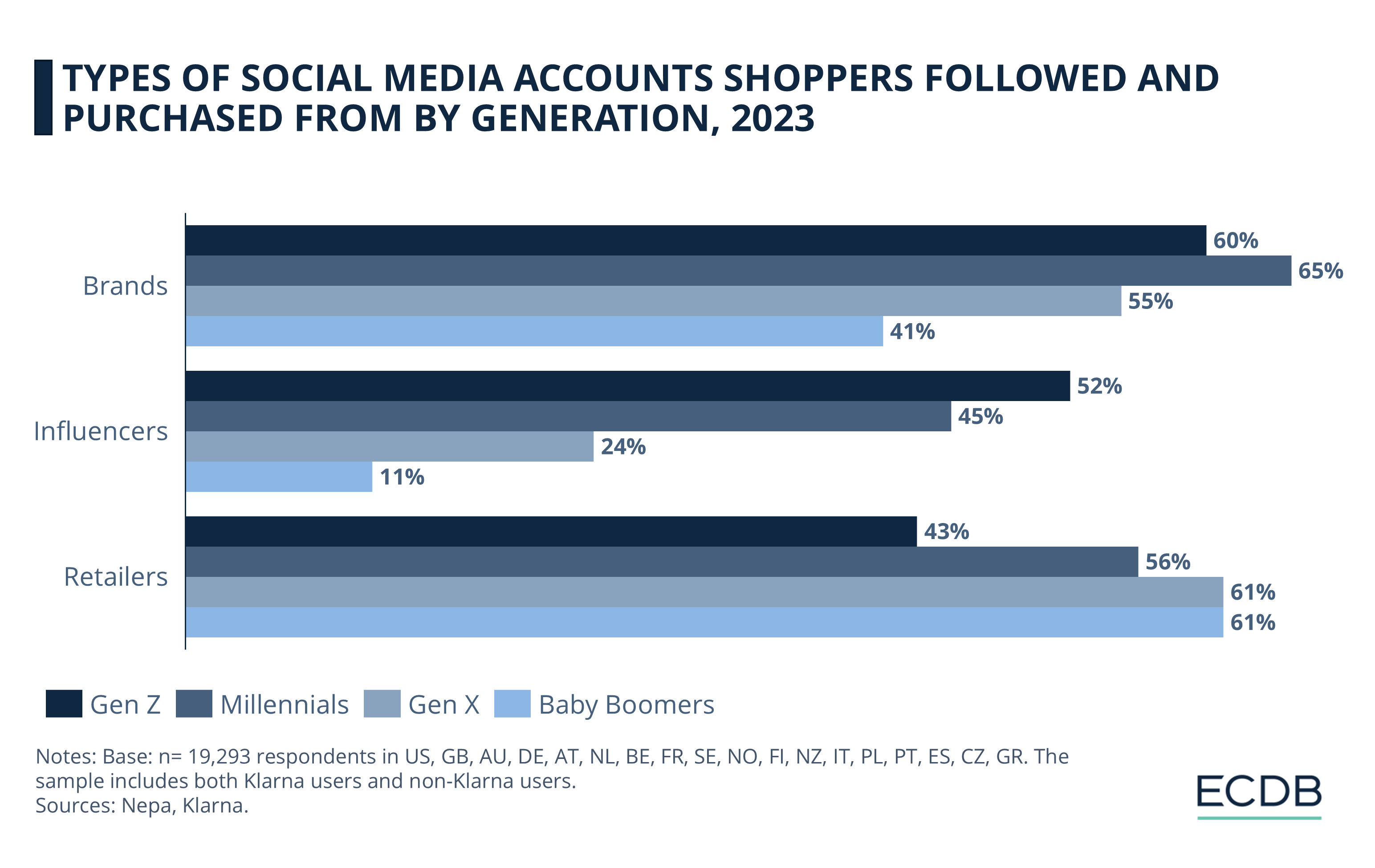

When it comes to types of social media accounts shoppers followed and purchased from, different generations have varying preferences:

At 65%, Millennials are the generation that most prefers brands to buy products from on social media.

While Gen Z comes in second, the majority (52%) prefers to follow and purchase products from influencers on social media.

As for retailers, Gen Xers and Baby Boomers are avid users of such social media accounts to purchase products.

Global Social Commerce Market:

Closing Thoughts

The pandemic acted as a catalyst for social commerce, pushing platforms like Facebook, Instagram, and TikTok to integrate shopping features more deeply into their ecosystems. While China has led the way, with group buying and live commerce becoming major trends, markets like the U.S. and Europe have been slower to adopt these innovations.

The growing influence of influencers and evolving platforms like TikTok Shop suggest that this market is only set to expand further. Over the next 5-10 years, we may see a shift in dominance, with younger platforms and more immersive shopping experiences driving the next phase of growth.

Sources: DHL, Statista, ECDB (and all secondary sources)

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics