eCommerce in India: Flipkart

Flipkart Business Analysis: India’s Leading eCommerce Marketplace

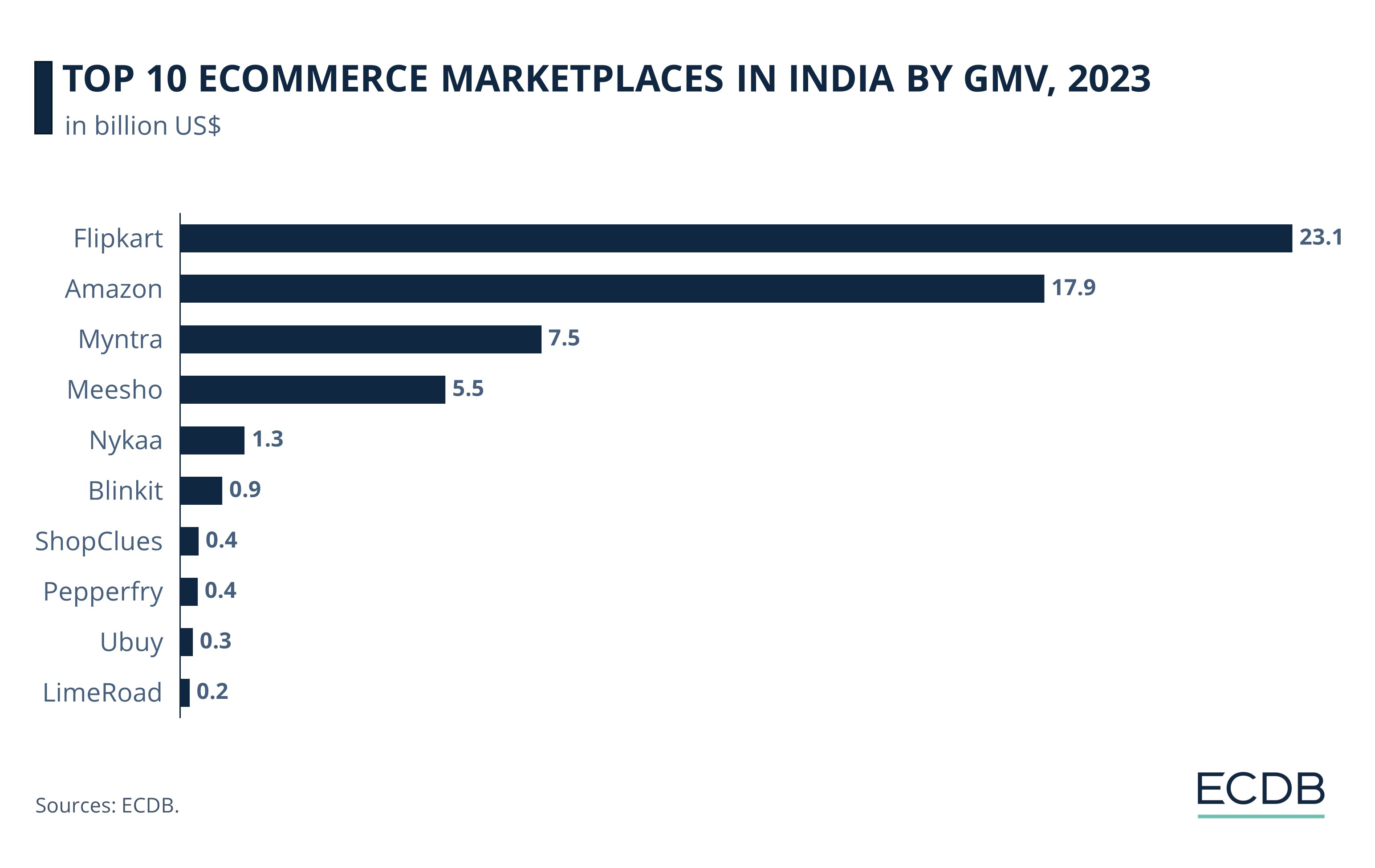

With special shopping events such as the Big Billion Days 2023, marketplace Flipkart achieved a GMV of US$23.1 billion in 2023, making it the leading eCommerce platform in India, even surpassing U.S. giant Amazon. What is behind its success?

June 12, 2024

Flipkart Business Analysis: Key Insights

Flipkart Leads Indian eCommerce: Flipkart reigns supreme as India's number one marketplace, outperforming Amazon by generating $23.1 billion in GMV in 2023, a significant feat in one of the world's top 10 eCommerce markets.

Diverse Market Landscape: While top players like Flipkart and Myntra boast of multi-billion dollar in GMVs, other contenders in the top 10 like Blinkit and ShopClues operate in the million-dollar range.

Flipkart's Recipe for Success: Flipkart's success has been powered by investments in affordability, loyalty programs like Flipkart Plus and SuperCoins, compelling features like video commerce and FireDrops 2.0, and innovative AI-powered on-app experiences.

The eCommerce industry in Asia and is characterized by big players especially from China, such as Pinduoduo, Taobao and Tmall. Nevertheless, it is not uncommon for domestic marketplaces to outperform the big tech companies in their home countries – see Coupang, for example – and Flipkart is no exception.

The eCommerce platform is 100% dedicated to the Indian market and is also the number one marketplace in India – leaving its biggest rival, Amazon, far behind.

What Is Flipkart?

Flipkart was founded by Sachin Bansal and Binny Bansal in 2007. Over the years, it has grown to become the largest online marketplace in India and despite only focusing on the Indian eCommerce market, it is ranked 15th in the world.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

In 2018, Walmart, Inc. bought a 77% stake in Flipkart for an amount of US$16 billion, wrote The Times of India. Since 2023, Walmart's controlling stake has grown and currently stands at 80.5%.

Flipkart Business Model

To maintain its leading position in the Indian eCommerce rankings, Flipkart is following a specific business model by improving various aspects of the marketplace, from membership to special shopping days, and by taking into account the latest trends in the eCommerce industry:

Competitive Pricing and Special Shopping Days: Flipkart maintains its leadership in the Indian eCommerce market with affordable payment options such as the Flipkart Axis Bank Credit Card and Flipkart Pay Later. Meanwhile, low prices, in particular during special sales events such as The Big Billion Days (TBBD) 2023, are driving significant growth.

Customer Loyalty Program: Expansion of loyalty programs like “Flipkart Plus” and “SuperCoins”, along with initiatives such as on-app donation drives, fosters customer engagement and loyalty, contributing to the company's success.

Video Commerce and Rewards Platform: Flipkart's Video Commerce feature and FireDrops 2.0 attract millions of users, driving a significant increase in transactions and showcasing the company's ability to effectively engage and captivate its audience.

Special Features & AI Integration: On-app experiences like Flippi, Vibes, SPOYL, and Flipverse elevate the shopping journey and drive the engagement rate. Particularly, Flippi, powered by ChatGPT, witnessed nearly a fourfold rise in engagement.

What's the Largest Marketplace in India?

The Indian eCommerce market – making it the 7th largest in the world – has big players battling it out at the top. In 2023, Flipkart generated US$23.1 billion in GMV, US$5 billion more than its closest competitor from the United States, Amazon, and almost as much as the GDP of Bosnia and Herzegovina (US$24.1 billion).

At the beginning of the COVID-19 pandemic, the Indian eCommerce sector experienced a brief boom, with a leap of 74.1% in revenue growth over the previous year, reaching US$47.7 billion by 2020. After that, India's growth trajectory slowed but remained stable.

Flipkart positions itself at the head of the top 10 eCommerce marketplaces in India with a GMV of US$23.1 billion. According to Reuters, Walmart has been focusing on developing the Indian market leader's growth since 2018, with a stronger focus on cities and small towns.

Amazon follows with US$17.9 billion in GMV in 2023. The U.S. giant is taking on its rival by announcing an investment of Rs 1,660 crore (equivalent to US$198.6 million as of June 2024) in its India unit.

A remarkable gap separates the third marketplace Myntra, with a GMV of US$7.5 billion, from Amazon. Like Flipkart, Myntra is owned by the American multinational Walmart, Inc. In fourth place stands Meesho with US$5.5 billion, followed by Nykaa with US$1.3 billion.

While the top five marketplaces are in the seven-figure range and the top leaders even in the eight-figure range, the other marketplaces in the top 10 range in the millions:

Blinkit ranks sixth with a GMV of US$870 million,

ShopClues follows with US$379 million GMV,

Pepperfry is next with US$360 million GMV,

Ubuy and LimeRoad complete the ranking with GMVs of US$259 million and US$193 million respectively.

Flipkart is Projected to Double Its 2022 GMV by 2025

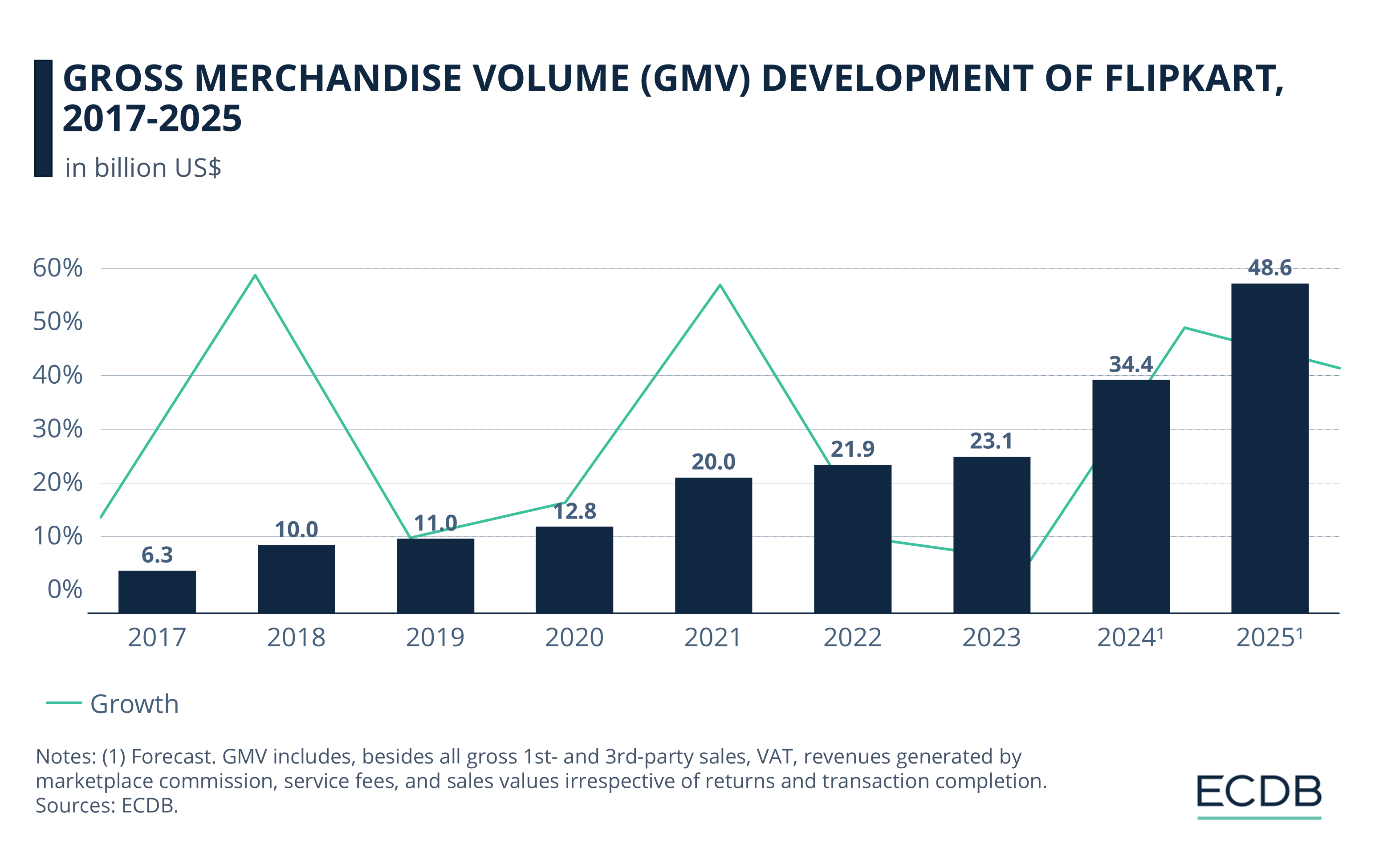

Overall, Flipkart has achieved a stable growth trend in terms of gross merchandise value over the last years: Our data shows that:

After a GMV growth of 59% in 2018, Flipkart didn't experience the same boost that some retail giants did due to the pandemic.

However, the online marketplace closed 2021 with an impressive GMV growth of 57%, reaching US$20 billion.

Returning to single-digit annual growth rates thereafter, we expect Flipkart to make a comeback and grow 49% this year, and 41% next year.

What Is the Reason for the Success of Flipkart?

There are several possible reasons for Flipkart's immense projected growth in 2024 and 2025. At first glance, it may seem to come out of nowhere, so let's take a closer look at the online marketplace's latest accomplishments:

Investments in Same-Day Delivery: The eCommerce player introduced the same-day delivery in 20 cities in February this year, according to The Economic Times.

Food & Beverages Soon Available too: Customers may soon be able to order food from restaurants and fast-food chains through the Flipkart app.

Taking Smaller Cities Into Account: With the launch of its new grocery fulfilment centre in Hubli, Karnataka, Flipkart is also reaching smaller cities that Amazon doesn't serve so easily, making it more attractive.

Keeping Its Business Model Up-to-Date: Flipkart ensures that it remains competitive by keeping up with the latest trends in the eCommerce industry, such as integrating AI into the marketplace.

Flipkart: Closing Thoughts

Despite the government's launch of the Open Network For Digital Commerce (ONDC) in early 2022 – a not-for-profit company set up by the Indian government to regulate Flipkart's and Amazon's leadership in the country – Flipkart seems to be gaining room to maneuver at the moment. At the same time, its investments in customer loyalty, special features, AI, and more seem to be blossoming. All of these factors contribute to Flipkart's predicted success.

Sources: Times of India, Business Standard, Inc42, Business Today India, CNBC TV18, ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Online Platforms Are the Number One Purchase Channels for Christmas Gifts

Online Platforms Are the Number One Purchase Channels for Christmas Gifts

Deep Dive

Thanksgiving Weekend GMV in the U.S. to Reach US$30 Billion in 2024

Thanksgiving Weekend GMV in the U.S. to Reach US$30 Billion in 2024

Deep Dive

Factors That Impact U.S. Holiday Shopping in 2024: Election, Deals, Weather, Number of Days

Factors That Impact U.S. Holiday Shopping in 2024: Election, Deals, Weather, Number of Days

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Peak Season of eCommerce & Air Cargo Capacity Crisis

Peak Season of eCommerce & Air Cargo Capacity Crisis

Back to main topics