ECOMMERCE: PRODUCT CATEGORIES

China’s eCommerce Market: Top Product Categories by Growth

As China’s eCommerce market goes from strength to strength, find out which product categories grew the fastest in 2023. Also learn about their development in recent years and projections for their growth.

Article by Nashra Fatima | July 22, 2024

Top Growth Categories in Chinese eCommerce: Key Insights

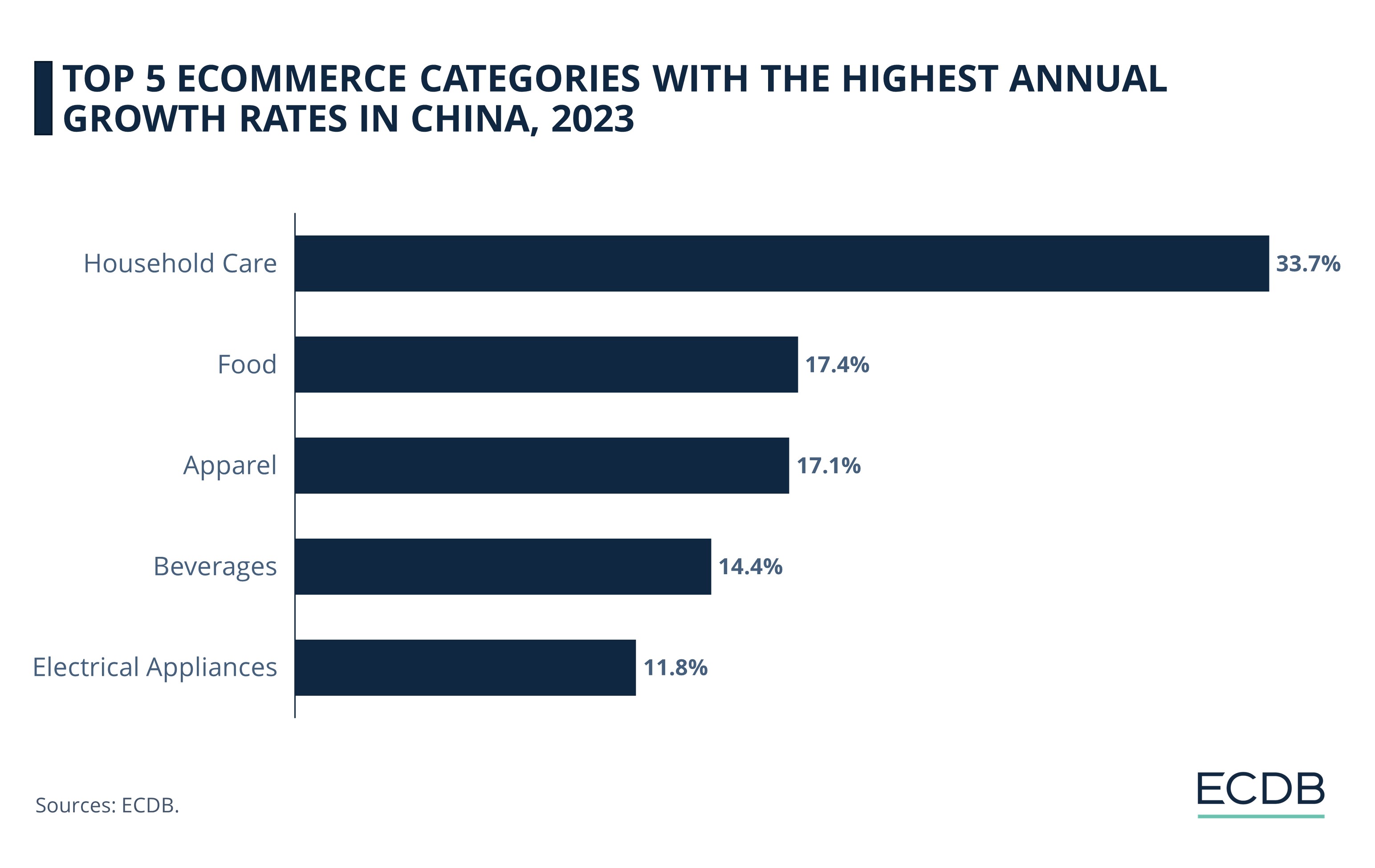

Household Care dominates: With an outstanding yearly increase of 33.7% between 2022 and 2023, household care takes the top spot in our list of China’s fastest growing online product categories in 2023.

Food and Apparel head-to-head: At 17.4%, Food takes the second spot. It beats the top category by revenue, Apparel, which stands third with 17.1%. Next up are Beverages and Electrical Appliances, with growth rates between 12-14%.

Market Outlook: All top 5 categories are projected to expand from 2024 to 2028. But some are likely to record higher growth (Household Care) than others (Electrical Appliances).

When it comes to the top growth product categories in China’s eCommerce market, categories that rank highest by revenue in 2023 largely take a backseat to their up-and-coming counterparts.

Three categories in our top five list did not have the highest revenues last year. However, they showed the most impressive yearly increases, hinting at their potential for profitability in the world’s largest eCommerce market.

We analyze the development of the top five product categories by growth in China’s online market.

Online Categories in China: Household Care Records Massive Growth in 2023

Per our ECDB data, the below categories experienced the highest yearly growth in the Chinese eCommerce market:

Household Care ranks first with an unparalleled yearly increase of 33.7%.

Food stands second. At 17.4%, its growth rate is nearly half the frontrunner’s record.

Apparel, top by revenue, stands third with a year-on-year increase of 17.1%.

Beverages is fourth with 14.4%.

Electrical Appliances is fifth with 11.8%. It ranks second by revenue.

ECDB’s latest data helps track the trajectories of all five categories.

1. Household Care (33.7%)

Household Care includes detergents, cleaning equipment, and other household care items. It is a sub-market within Care Products, for which it generated over 64% of the total revenues in 2023.

Development:

Online revenues for Household Care were US$20.2 billion in 2023—a spectacular rise from 2018 figures of US$3.7 billion. Moreover, 31% of the total retail for this category, which has seen notable changes in recent years, took place online.

Its growth plummeted to just 17% in 2022, from 61.5% in 2021. A high online demand for household care is likely behind the category’s recovery in 2023. Health-conscious Chinese consumers are continuing to spend on essentials even if they may scale back on discretionary purchases in a tougher economic climate.

Projections:

This year, revenues for Household Care are expected to hit US$36.8 billion. A robust projected CAGR (2024-2028) of 26.2% puts anticipated revenues at US$68 billion by 2028.

2. Food (17.4%)

Food constituted 66.4% of the total revenues of its main category of Grocery. It includes fresh food, frozen food, bakery, meal kits, and food cupboard.

Development: Food generated US$128.6 billion in 2023 – a value higher than Dominican Republic’s 2024 GDP. Revenues crossed US$100 billion in 2021, but the biggest growth jump (45.3%) occurred even earlier in 2018. Despite being a large market by revenue, the online share in total Food retail is notably small – at 7.7% in 2023, with predictions putting it at just 9% by 2028. The appetite for online food shopping among Chinese consumers is much lower than for categories like Apparel, where a large share of retail has already shifted online.

Projections: Revenues for Food are likely to reach US$149 billion in 2024. A healthy CAGR (2024-2028) of 10.9% estimates online revenues to hit US$225 billion by 2028.

3. Apparel (17.1%)

The largest submarket for Fashion, Apparel covers outerwear, tops, bottoms, undergarments, and activewear.

Development: With US$373 billion, Apparel was China’s leading online category by revenue in 2023. Its growth rates are strong – before, during, and after the pandemic: for example, it grew by 36% in 2018 and 27.6% in 2021. Although growth rates are expected to mellow down, the online share for Apparel retail is climbing. Online share was 40% in 2023 and will likely cross 56% by 2028. This indicates a lasting consumer shift towards online channels for clothes shopping in China, with the trend of ethically produced clothing likely to influence the market going forward.

Projections: Revenues for Apparel will likely cross US$436 billion this year. Its CAGR (2024-2028) of 13.9% is second highest in this list, putting its 2028 revenues at a whopping US$736 billion.

4. Beverages (14.4%)

Also under Grocery, Beverages constituted a smaller share (33%) of its total revenues. It includes alcoholic and non-alcoholic drinks.

Development: Beverages made US$65 billion in 2023. The highest yearly jump came in 2018 (41%), which halved in the following year. Online share of all beverages retail in China is 16% in 2023 – more than double than its more profitable counterpart Food. Despite taking the fourth spot, growth rates for Beverages have been on a downward incline since 2018. Even during the pandemic, when its revenues increased, there were no noticeable spikes in its revenue, unlike most other categories. Its market is expected to expand, but at a slower pace.

Projections: This year, Beverages’ revenues are projected at US$73.2 billion. Its CAGR (2024-2028) is 9.5%, with 2028 revenues predicted at US$105 billion.

5. Electrical Appliances (11.8%)

Part of Electronics, Electrical Appliances covers household, kitchen, and personal care appliances.

Development: With US$291 billion, it is the second best-performing online category in China. The biggest market expansion occurred in 2018 (32.5%), followed by a pandemic high of 20.2% in 2021. Since then, its yearly growth has stagnated. However, the online share in total retail for this category is ascending. It is likely to go up from 39% in 2023 to 46.5% in 2024. Online revenues are also expected to increase, but growth is likely to slip into the single digits from 2026 onwards.

Projections: This year, Electrical Appliances are projected to generate US$323 billion. With a CAGR (2024-2028) of 8.7%, the lowest in this list, its 2028 revenues are estimated at US$451 billion.

Top Growing Categories in Chinese eCommerce: Closing Remarks

Stellar performances of Household Care and Apparel build upon years of a dedicated push towards eCommerce in China. Trends like health awareness, environmental consciousness, and a rising inclination to purchase price-efficient domestic products determine purchasing decisions for these categories.

Factors like rising internet penetration in China, better technology integration in eCommerce, and social shopping also play an important role. Today, online shopping preferences for all five product categories are strong, which keeps eCommerce demand for them stable.

In the short run, the recently launched nationwide trade-in program for consumer goods in China – being considered an attempt to support the flagging economic environment – is likely to impact online spending on products like electrical appliances.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

Walmart Expands Pet Care Services

Walmart Expands Pet Care Services

Deep Dive

eCommerce in the United States: Best Product Categories

eCommerce in the United States: Best Product Categories

Deep Dive

Monthly eCommerce Market Revenue Growth: Online Retail Sales (September 2024)

Monthly eCommerce Market Revenue Growth: Online Retail Sales (September 2024)

Back to main topics