eCommerce: Luxury Goods

Cartier Business Strategy: Global Revenue, Ranking, Competitors

As one of the oldest luxury brands, Cartier is known as a "classic" with luxury goods such as the Love bracelet or the Trinity de Cartier ring. Discover the evolution of Cartier from its creation to its excellence in eCommerce, focusing on innovative approaches to the online luxury goods market.

Article by Cihan Uzunoglu | October 01, 2024Download

Coming soon

Share

Cartier Business Strategy: Key Insights

Classic Brand: Cartier is categorized as a "Classic" brand in the ECDB Global Luxury eCommerce Report, leading in luxury eCommerce with a ultra-high ranking in exclusivity and impressive online sales performance.

Top in Luxury Watches: In the luxury brand landscape, Cartier holds the 12th position in global online sales, notably excelling in the luxury watch segment while maintaining a diverse range of product offerings.

Steady Online Sales: From 2020 to 2022, Cartier demonstrated a significant growth in offline sales and maintained steady online sales, showcasing a strategic balance between digital and in-store luxury shopping experiences.

Shift Towards D2C: A gradual shift in sales strategy was observed in Cartier between 2020 and 2022, with an increased focus on direct-to-consumer (D2C) sales, slightly decreasing dependence on business-to-business (B2B) channels to enhance customer engagement and brand connection.

Founded in 1847 by Louis-François Cartier in Paris, the French luxury brand is specialized in the manufacture and sale of high-quality jewelry, leather goods and watches. Today, the brand owns more than 200 stores in 125 countries around the world. In addition, it was ranked 56th on Forbes' list of most valuable brands in 2020. The French luxury brand is part of the Swiss Richemont Group and is known for its historical connections with royalty, supplying them with luxury items.

Based on our recent Luxury eCommerce Market Report, this article explores Cartier's current strategies, particularly in online sales. It offers insights into how this esteemed brand is navigating the digital retail landscape and adapting its approach to meet the evolving demands of luxury eCommerce.

The Swiss Richemont Group: One of the Largest Luxury Goods Conglomerates

Before we dive into Cartier, it is important to see the big picture here to fully understand the context. As the parent company of Cartier, Richemont stands as a prominent Switzerland-based luxury goods holding company, established in 1988 by the South African entrepreneur Johann Rupert.

Richemont's portfolio, through its diverse subsidiaries, encompasses the production and sale of high-end jewelry, timepieces, leather goods, writing instruments, firearms, apparel, and other luxury accessories. As of 2017, it held the position of the world's third-largest luxury goods conglomerate, trailing only behind LVMH and Estée Lauder Companies.

Apart from Cartier, Richemont owns many other luxury goods brands included in our report. These are Alfred Dunhill, Azzedine Alaia, Baume & Mercier, Buccellati, Chloé, Delvaux, IWC, Jaeger-LeCoultre, Lange & Söhne, Montblanc, Officine Panerai, Peter Millar, Piaget, Purdey, Roger Dubuis, Serapian, Vacheron Constantin and Van Cleef & Arpels.

Make sure to check out our report for more insights on these brands.

Cartier Business Strategy: Embodying Classic Luxury Brand Elegance with Ultra-High Exclusivity

The ECDB Global Luxury eCommerce Report, now available for purchase, provides in-depth analysis of leading luxury brands such as Louis Vuitton, Prada, and Chow Tai Fook. It evaluates new sales of tax-exclusive personal luxury items, excluding returns and second-hand products. Additionally, the report assesses each brand's market value, including price mark-ups from third-party sales.

In this report, Cartier is categorized as a "Classic" brand, a testament to its enduring legacy and distinct identity. Also including well-known names like Gucci and Chanel, the Classic tier is the top performer by a large margin. Most high-end brands fall into this category, making up 52% of the luxury market. Additionally, their online sales are remarkable, accounting for 69% of the total in 2022.

When it comes to product availability, Cartier ranks in the ultra-high exclusivity category, alongside prestigious brands like Richard Mille and Louis Vuitton. This is based on comprehensive analyses of various luxury exclusivity indices, placing Cartier in the top 20% of luxury brands worldwide.

Cartier competes in the luxury market with notable brands like Louis Vuitton, known for its wide range of luxury goods and strong online presence; Gucci, recognized for its diverse luxury items and iconic designs; Tiffany & Co., a direct rival in high-end jewelry; Bulgari, with its unique jewelry and watch designs; and Rolex, a major player in luxury watches.

With Cartier's position in these critical aspects established, we will now focus our shift to the top ten luxury brands leading in online sales revenue, to see where the brand stands there.

Cartier Ranks 12th in Global Online Sales Among Top Players

When examining top luxury brands, it's crucial to note that their rankings vary depending on the criteria used. Our Luxury Brands report is centered around global online net sales. Although online net sales are our primary focus, other metrics like total net sales or B2B and D2C revenues could also be used for ranking.

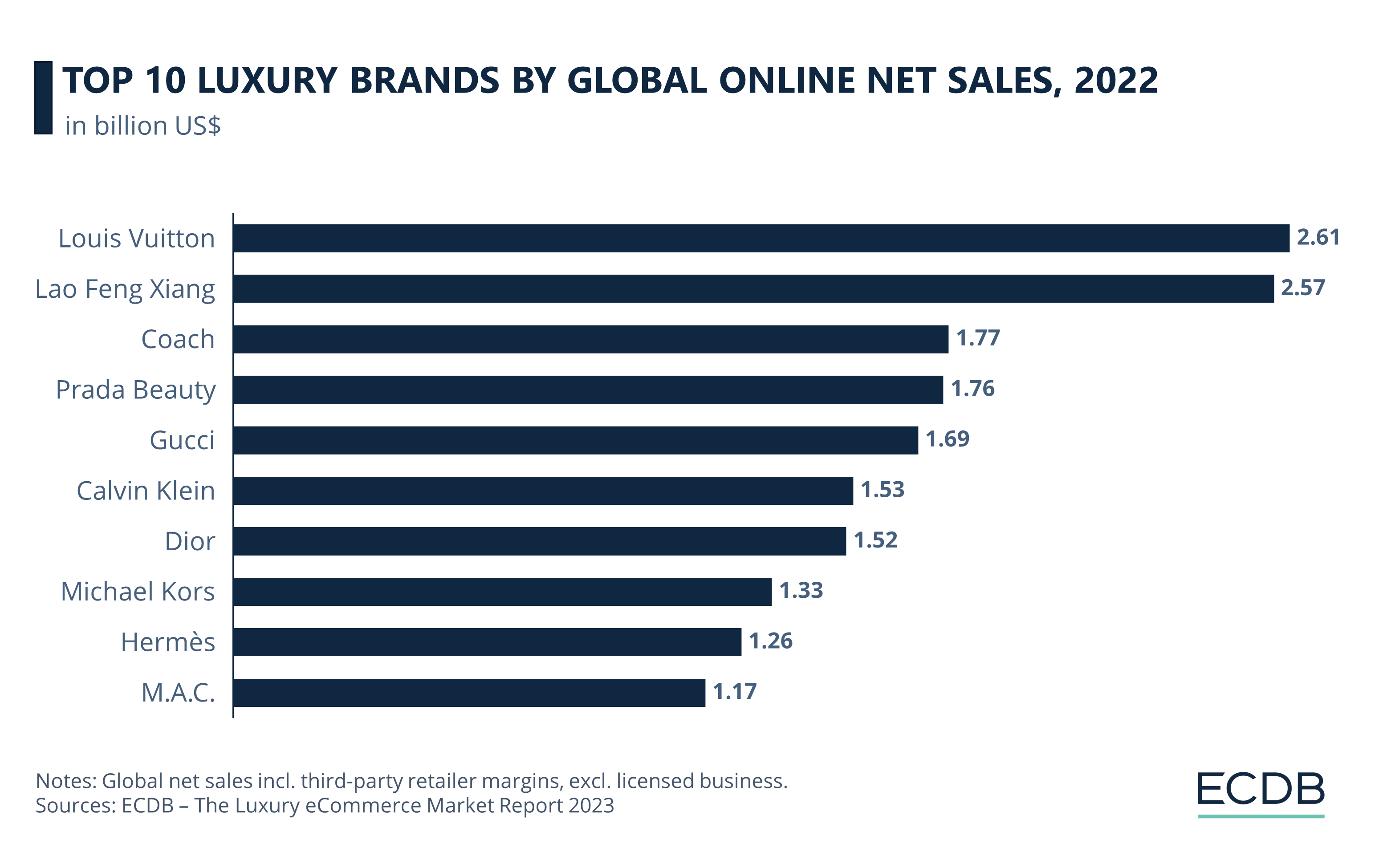

Louis Vuitton leads online sales with US$2.61 billion, followed by Lao Feng Xiang (US$2.57 billion), and Coach (US$1.77 billion). Brands like Prada Beauty, Gucci, Calvin Klein, Dior, and Michael Kors made US$1.76 to US$1.33 billion. Hermès is 9th with US$1.26 billion, and M.A.C. 10th with US$1.17 billion.

Although not making it to the top 10, Cartier is listed at the 12th spot with global online net sales of US$1.03 in 2022, right behind Pandora and ahead of Hugo Boss.

According to our study, Cartier is ranked 2nd among the leading brands by online luxury watch sales in 2022, despite having jewelry as its main product category. What is remarkable here is that all the other brands in the top 5 of this ranking have watches as their main product category and generate 100% of their sales from this category. In the case of Cartier, this figure is only 14%.

Given its recent performance, Cartier's significant role in the luxury market warrants further examination. We'll be exploring how its online net sales have changed since 2020 and comparing these figures to its total net sales. These aspects will be thoroughly analyzed in the next sections of our article, revealing Cartier's strategic decisions.

Cartier Business Strategy: Net Sales Climb Notably, Online/Offline Balance Remains

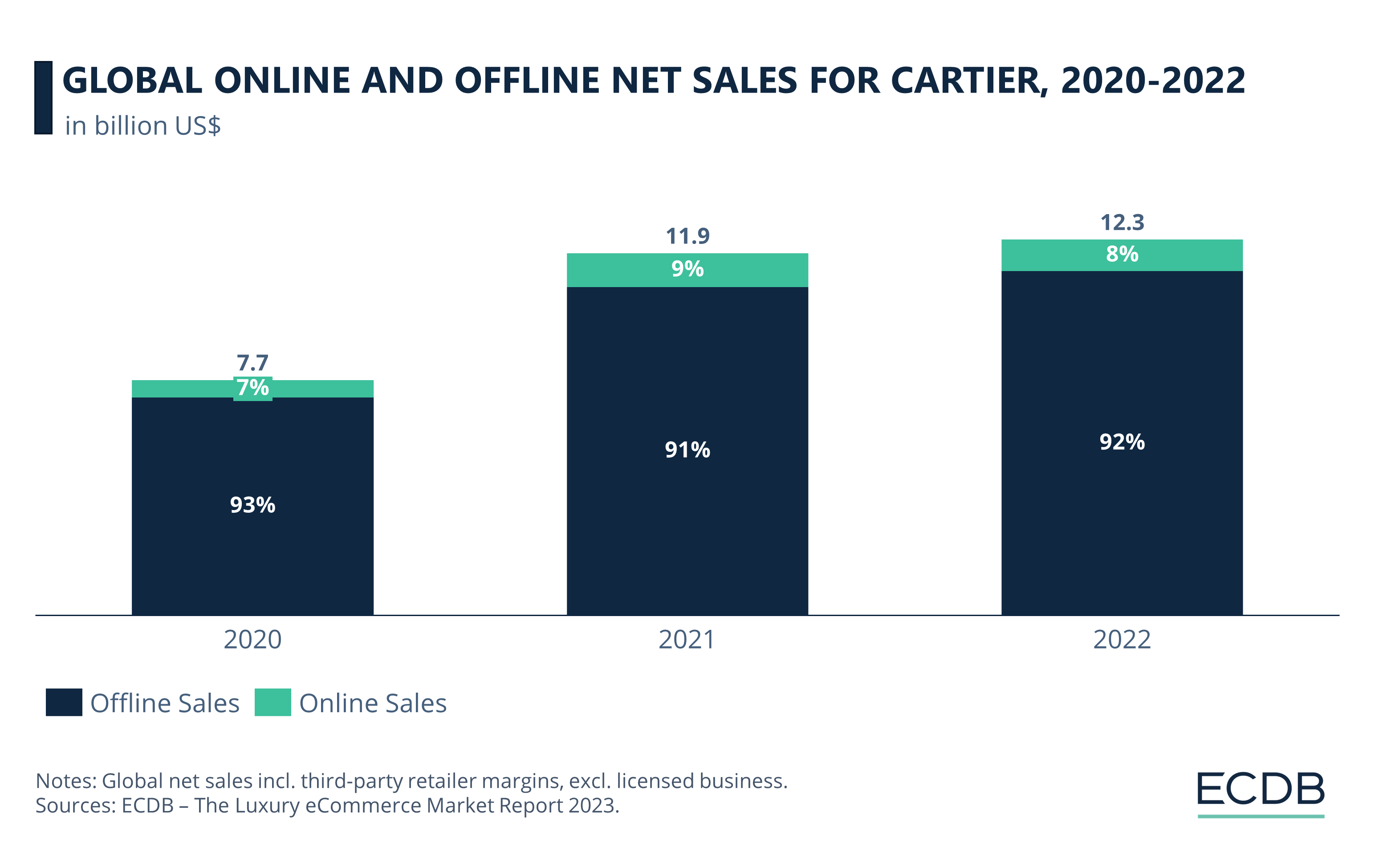

Revisiting Cartier's revenue from 2020 to 2022, the following data provides a comprehensive look at the brand's net sales, spotlighting the online and offline contributions during this period.

In 2020, Cartier's online sales were US$573 million, which then saw a significant increase in 2021, rising to US$1.11 billion. However, in 2022, there was a slight decrease to US$1.04 billion. Despite this minor drop, online sales remained above the 2020 figures, indicating a strong online presence that Cartier has maintained over the years.

Offline sales tell a story of consistent growth year over year. In 2020, offline sales were US$7.13 billion. The following year, 2021, saw a substantial rise to US$10.74 billion. This upward trajectory continued into 2022, with offline sales reaching US$11.26 billion, suggesting that Cartier's physical store sales are thriving and that customer preference for in-person luxury shopping experiences remains strong.

It's noteworthy that while the overall net sales for Cartier have changed significantly over the three years, the split between online and offline sales has remained relatively stable at the respective 7-9% to 91-93% marks. This balanced distribution between online and offline sales may point to Cartier's ability to cater effectively to diverse customer preferences in the luxury market.

Our Luxury Report offers additional insights, examining how top-tier luxury brands like Cartier are steering their online revenues. It underlines the balance between maintaining market exclusivity and expanding product offerings. The report notes a trend: brands with higher exclusivity typically report lower shares of online sales. Cartier's strategy is illustrative of this pattern, with a relatively minor slice of its revenues coming from online channels.

With this understanding, the next and final section will dissect Cartier's ratio of D2C and B2B sales. This examination is vital to grasp how Cartier harmonizes its diverse sales avenues to uphold its high-status market stance.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

Cartier Business Strategy: More Than Three Quarters of Net Sales Through B2B Sales

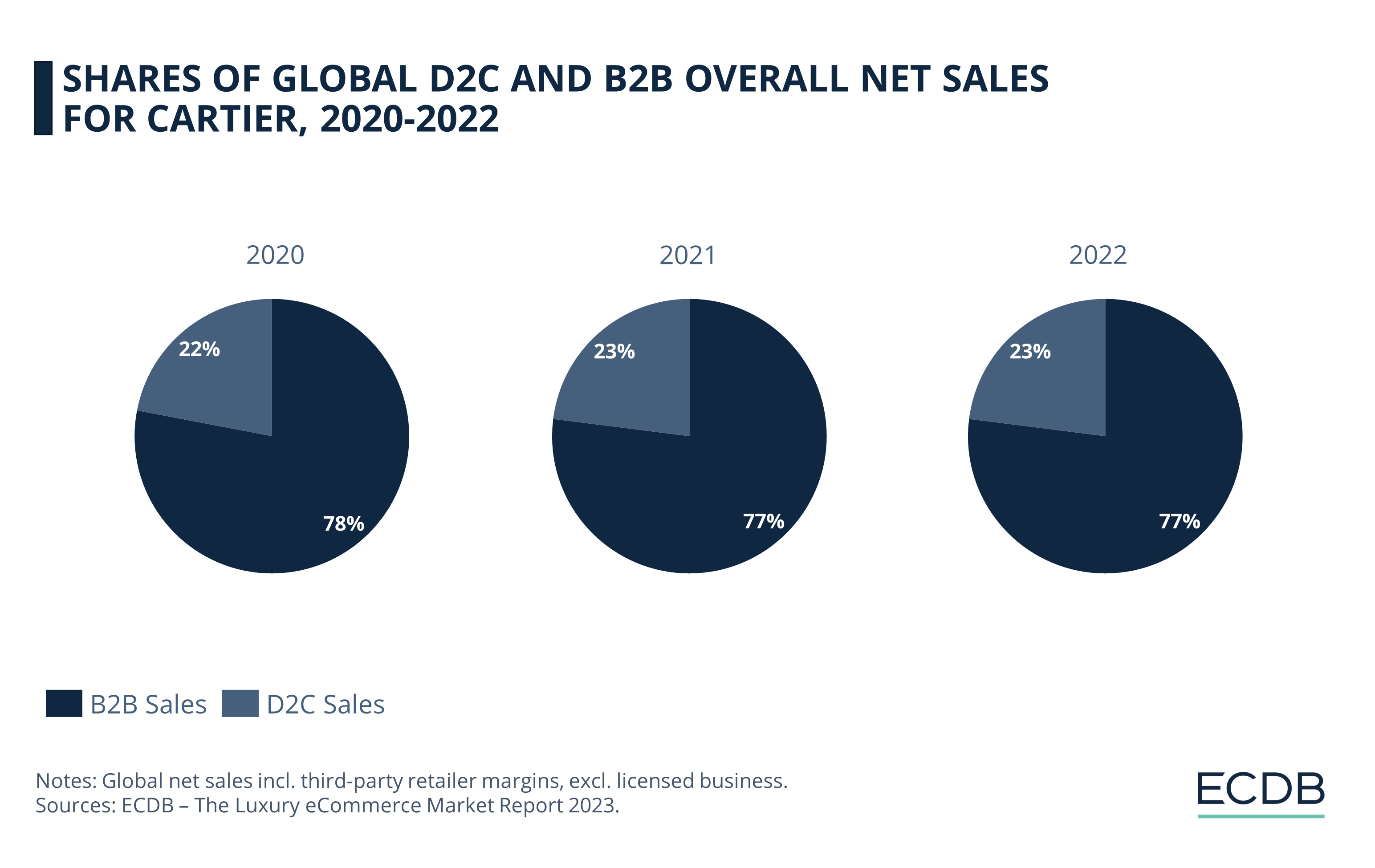

The strategic choice between D2C and B2B sales models is a pivotal aspect of a luxury brand's operational strategy and its distribution partnerships. Luxury brands have historically leaned towards B2B models, relying on intermediary retailers for product distribution in both online and brick-and-mortar outlets. However, there is a discernible trend towards embracing D2C models, which grant these brands greater control over customer interactions and branding initiatives.

Cartier's sales figures from 2020 to 2022 offer a window into their specific B2B and D2C sales dynamics. In 2020, a substantial 78% of Cartier's overall net sales were generated through B2B channels, with the remaining 22% stemming from D2C. Shifting to a 77/23 split, this distribution remained consistent through 2021 and 2022.

The Luxury eCommerce Market: Buy the Report Now!

The 2023 Luxury eCommerce Market Report by ECDB provides the comprehensive data set for 250 leading luxury companies in an additional Excel spreadsheet, which includes sales channels, product categories, brand exclusivity and positioning over the three-year-period from 2020 to 2022.

Order the report here for the full data set, including complete market analysis from our experts.

Cartier Business Strategy: FAQs

Is Cartier French or American?

Cartier is a French luxury brand.

What Company Owns Cartier?

Cartier is owned by Richemont, a prominent luxury goods conglomerate based in Switzerland.

Is Cartier Considered Luxury?

Yes, Cartier is considered a luxury brand, specializing in high-end jewelry, leather goods, and watches.

Can You Shop Cartier Online?

Yes, Cartier offers online shopping, contributing significantly to its global net sales.

Is Cartier Based in Paris?

Cartier was established in Paris and is based there.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Yoox Net-a-Porter Is Sold to Mytheresa by Richemont: What the Acquisition Means for the Online Luxury Brands

Yoox Net-a-Porter Is Sold to Mytheresa by Richemont: What the Acquisition Means for the Online Luxury Brands

Deep Dive

Forbes Asia 100 To Watch 2024: 9 Retailers to Follow

Forbes Asia 100 To Watch 2024: 9 Retailers to Follow

Deep Dive

Luxury Goods Market: Revenue, Net Sales, Online & Offline Sales

Luxury Goods Market: Revenue, Net Sales, Online & Offline Sales

Deep Dive

Louis Vuitton Analysis: Net Sales, Online to Offline, B2B vs. D2C

Louis Vuitton Analysis: Net Sales, Online to Offline, B2B vs. D2C

Deep Dive

Top 5 Online Jewelry & Watches Stores in the United States: Top Online Stores, Market Development

Top 5 Online Jewelry & Watches Stores in the United States: Top Online Stores, Market Development

Back to main topics