eCommerce: Jewelry & Watches 2024

Top 5 Online Jewelry & Watches Stores in the United States: Top Online Stores, Market Development

The Online Jewelry & Watches market in the U.S. is expanding. Learn about the revenue, segment’s development and top 5 stores.

Article by Cihan Uzunoglu | June 17, 2024Download

Coming soon

Share

Top 5 Online Jewelry & Watches Stores in the United States: Key Insights

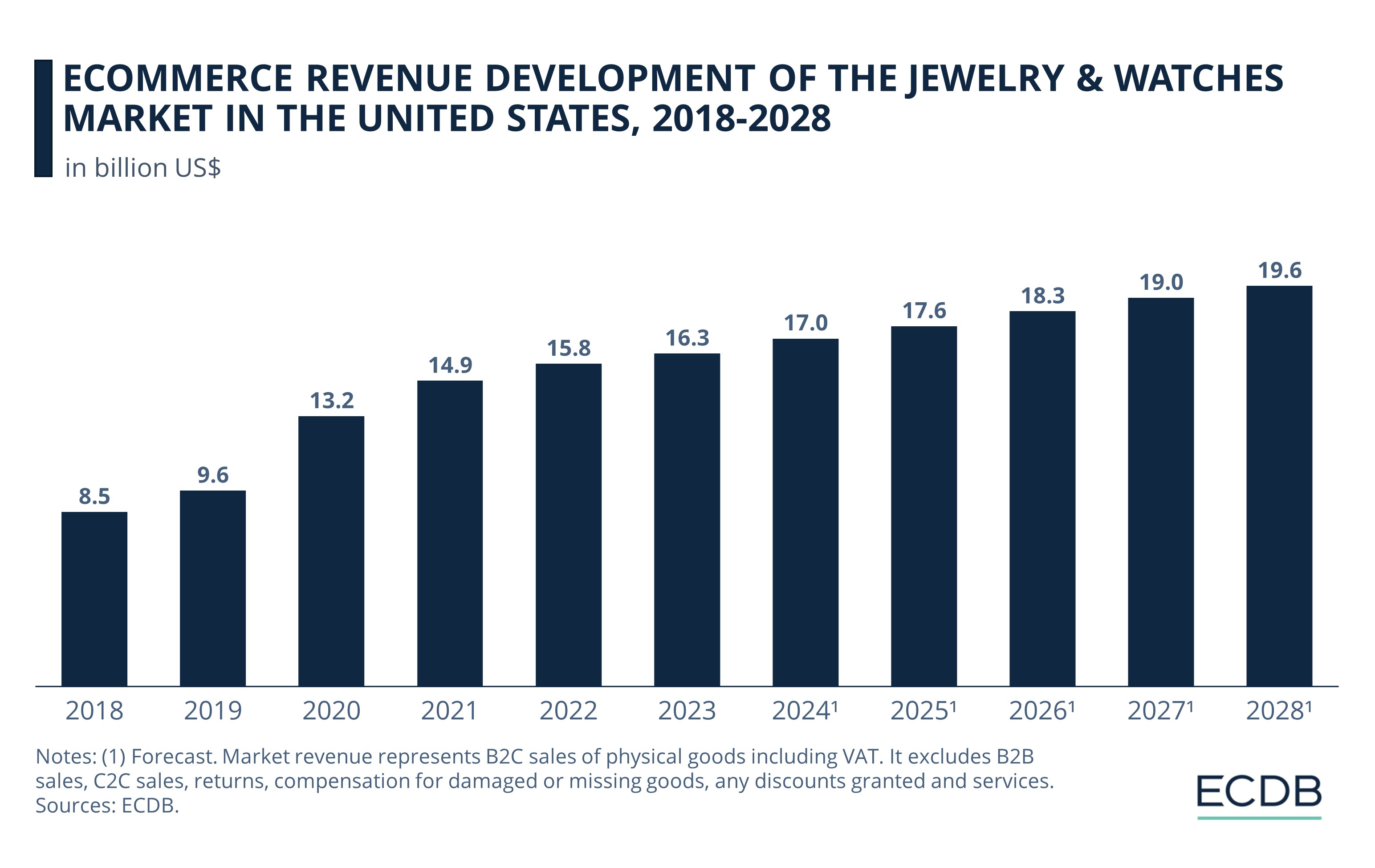

Market development: The online market for jewelry and watches in the U.S. has expanded consistently. Revenues in 2023 stood at US$16.3 billion – nearly double the value recorded in 2018 (US$8.5 billion).

Top Stores: In 2023, Brilliantearth.com took the top rank, displacing long-time frontrunner Bluenile.com. In the United States, the store generated net sales worth US$391 million in 2023.

Projections: In terms of overall net sales, the leading online jewelry retailers are set for diverging financial paths. Brilliantearth.com is poised for growth, while Bluenile.com and Zales.com both brace for further dips. Kay.com and Tiffany.com are also predicted to show positive growth.

Much like the Global Online Jewelry & Watches industry, the category’s eCommerce market is undergoing a consistent expansion in the United States.

Online revenues saw the greatest acceleration during the pandemic, with growth rates adjusting in the following years. However, in terms of individual stores, while some sustained their growth momentum, others registered declines.

How has the market for specialist Jewelry & Watches developed in the U.S.? What are the country’s top online stores, and how has their ranking changed over the years? Our ECDB data provides answers.

Online Jewelry & Watches Market Composition

Within the U.S. eCommerce market for Bags & Accessories, the Jewelry & Watches segment shines with a 34.5% share. This category is anticipated to grow at a compound annual growth rate (2024-2028) of 4.5%.

Within the Jewelry & Watches market, the Watches segment has the biggest share, holding 61% of the market revenue. While Jewelry has an also significant share of 34.8%, the remaining 3.8% market share is accounted for by the Other Jewelry & Watches category.

U.S. Online Jewelry & Watches Market Development, 2017-2028

The Jewelry & Watches market in the United States has seen steady growth since 2017, with the largest increase recorded during the pandemic.

In 2018, the market revenues were US$8.5 billion. With an increase in the following year, revenue reached US$9.6 billion by 2019. A more significant leap occurred in 2020: a notable year-over-year growth of 38% meant revenues crossed US$13 billion.

This upward trend did not stop. By 2021, revenues increased to US$14.9 billion. Two years later, in 2023, revenues stood at US$16.3 billion – more than double the 2017 value.

As we look to the future, the numbers keep looking up: forecasts for 2024 show an expected US$17 billion.

The sector doesn't show signs of slowing down, with projected revenues of US$18.3 billion for 2026, US$19 billion for 2027 and US$19.6 billion by 2028.

Top 5 Jewelry & Watches Stores in the United States: A Closer Look

Delving deeper into the U.S. eCommerce market for Jewelry & Watches, attention naturally gravitates toward its leaders.

While behemoths like Amazon command a sizable portion of online sales across many categories, the spotlight here is on specialist players exclusive to the Jewelry & Watches segment.

In 2023, the top five online Jewelry & Watches stores in the United States are: brilliantearth.com, bluenile.com, kay.com, zales.com, and tiffany.com.

Brilliantearth.com tops the charts with an impressive 2023 revenue of US$390.6 million. It was the first year when this store claimed the top spot. Brilliantearth displaced bluenile.com, which had held the first rank since 2019.

Displaced to the second rank, Bluenile.com made net sales of US$344.7 million. Kay.com was next, at US$332 million. Rounding out the top 5 are Zales.com and Tiffany.com, recording revenues of US$283.5 million and US$252.8 million, respectively.

Notably, three out of these five key players are under the umbrella of Signet Jewelers, Ltd. Below, we provide an analysis of the top 5 stores, with only their net sales and growth in the United States taken into account.

1. Brilliantearth.com

Being one of the two contenders in our roundup not associated with Signet Jewelers, this online store operates under Brilliant Earth Group, Inc. Founded in 2005, its online platform predominantly serves the U.S., while its footprint in other countries, such as Canada, remains comparatively light. It is worth noting that, in 2021, eCommerce net sales accounted for nearly all the company's revenue.

Brilliantearth.com ranked third in 2019, but its sales fluctuated in the coming years. In 2020, it fell to the sixth spot. From then onward, it started to climb up the ranks: to the fourth position in 2021, second in 2022, and the first position in 2023.

Brilliantearth.com’s growth trajectory has been volatile but promising. Its online sales saw a 25% increase in 2020. Even higher growth of 51% was registered in 2021, signaling the store’s arrival in the top echelons. While the revenue only grew by 1% in 2023, it was enough to catapult the store to the top spot.

Notably, this store secured positive growth even after the pandemic-induced eCommerce surge had subsided. This is not the case for most other stores on our list, which have seen varying degrees of negative growth since 2022.

2. Bluenile.com

No longer the top player in the U.S. Jewelry & Watches eCommerce landscape, Bluenile.com now occupies the second rank in the market. Since 2019, this online store had remained unyielding at the helm despite declining revenues. However, the losses added up and it finally lost its lead in 2023.

Bluenile.com's revenues grew by a modest 7% in 2020, only to decline at the same rate in the following year. A similar dip occurred in 2022, before its negative growth accelerated further. In 2023, revenue fell by a sizeable 20% compared to the past year.

The platform's net sales predominantly originate in the U.S., with limited presence in other regions. For instance, sales from Canada represent just a fraction of its eCommerce net sales. The store is owned by Signet Jewelers Ltd., a publicly traded enterprise established in 1949. Signet Jewelers also owns Zales.com and Kay.com.

3. Kay.com

Coming in third on the list, Kay.com has experienced shifts over the years. Predominantly serving the U.S. audience, nearly all of Kay.com's eCommerce revenue comes from the domestic market.

From the fifth rank in 2019, Kay.com seized the second rank in 2020. It maintained this momentum through 2021, before dipping to the fifth position in 2022. In 2023, it climbed its way to the third spot.

Kay.com’s revenues saw a dramatic increase of 81% in 2020, boosted by the turn to online shopping during the pandemic. Growth was still positive the next year when revenues hit an all-time high of US$376 million.

However, the return to in-store shopping dealt a blow to Kay.com’s growth trajectory. From 2022 and onwards, the store revenues decreased for two consecutive years – by 10% in 2022 and then 2% in 2023.

4. Zales.com

Zales.com, operated by Signet Jewelers Ltd., was founded in 1998 and has built a two-decade legacy. It focuses on the U.S. market, where most of its eCommerce revenue originates.

In 2023, Zales.com climbed from the fifth to the fourth rank. Despite the improvement in ranking, its net sales decreased by 12% compared to the previous year.

Between 2019 and 2021, Zales.com’s revenues saw sizeable increases. In 2020, the growth rate was 73%, which mellowed out to 25% in 2021. In both these years, the store was able to maintain its second rank.

In 2022, however, it dropped to the fifth rank, although negative growth of only 1% had occurred. This underlines the seismic post-pandemic adjustments in the online Jewelry & Watches segment, which introduced many shuffles in the ranking.

5. Tiffany

Owned by Tiffany & Co., Tiffany.com is a nationally focused store. In 2023, it reappeared in the top five list for the first time since 2019.

Although Tiffany.com experienced growth in the period under study, its ranking suffered: it dropped to the seventh rank in 2020, where it stayed in 2021. But its ranking improved in both 2022 and 2023.

While net sales increased for Tiffany.com during and after the pandemic period, its growth rate never reached the high levels experienced by most other stores on the list. For instance, it clocked in its highest yearly growth rate of 20% in 2021, compared to growth rates of 50%-80% seen by three other stores in the top five ranking between 2020 and 2021.

On the other hand, Tiffany.com also did not experience declining growth once the pandemic surge was over. This hints at its position as an established online store able to withstand market shifts. In 2023, among all other stores in the top five, it recorded the highest year-on-year growth of 9%.

Top 5 Online Jewelry & Watches Stores in the U.S.: Closing Remarks

Forecasts suggest varied outcomes for the top five stores we analyzed in this article. In 2024, these key players in the online Jewelry & Watches market are expected to face varying degrees of growth and decline in their performance – not just in the United States but overall.

Brilliantearth.com is expected to maintain its growth momentum, with its overall net sales likely to grow by 4% in 2024. On the other hand, Bluenile.com is projected to see a decrease in revenues in both 2024 and 2025.

Kay.com is anticipated to have a modest recovery in its growth in the next two years while Zales.com may see further dips in its growth in the same period. In contrast, Tiffany.com is projected to stay on its growth trajectory until 2025, with stronger growth rates expected compared to its competitors.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics