eCommerce: Uniqlo & GU

Uniqlo’s Sister Company GU Enters the U.S. Market

Fashion retailer Uniqlo's sister company, GU, is expanding into the U.S. market. Having made a name for itself in the Japanese market, GU will face tough competition.

Article by Cihan Uzunoglu | September 20, 2024

Uniqlo’s Sister Company GU: Key Insights

U.S. Market Expansion: GU has made a bold entrance into the U.S. with its first permanent store and eCommerce platform, marking a critical step in its global growth strategy and setting itself apart from Uniqlo by focusing on trend-driven fashion.

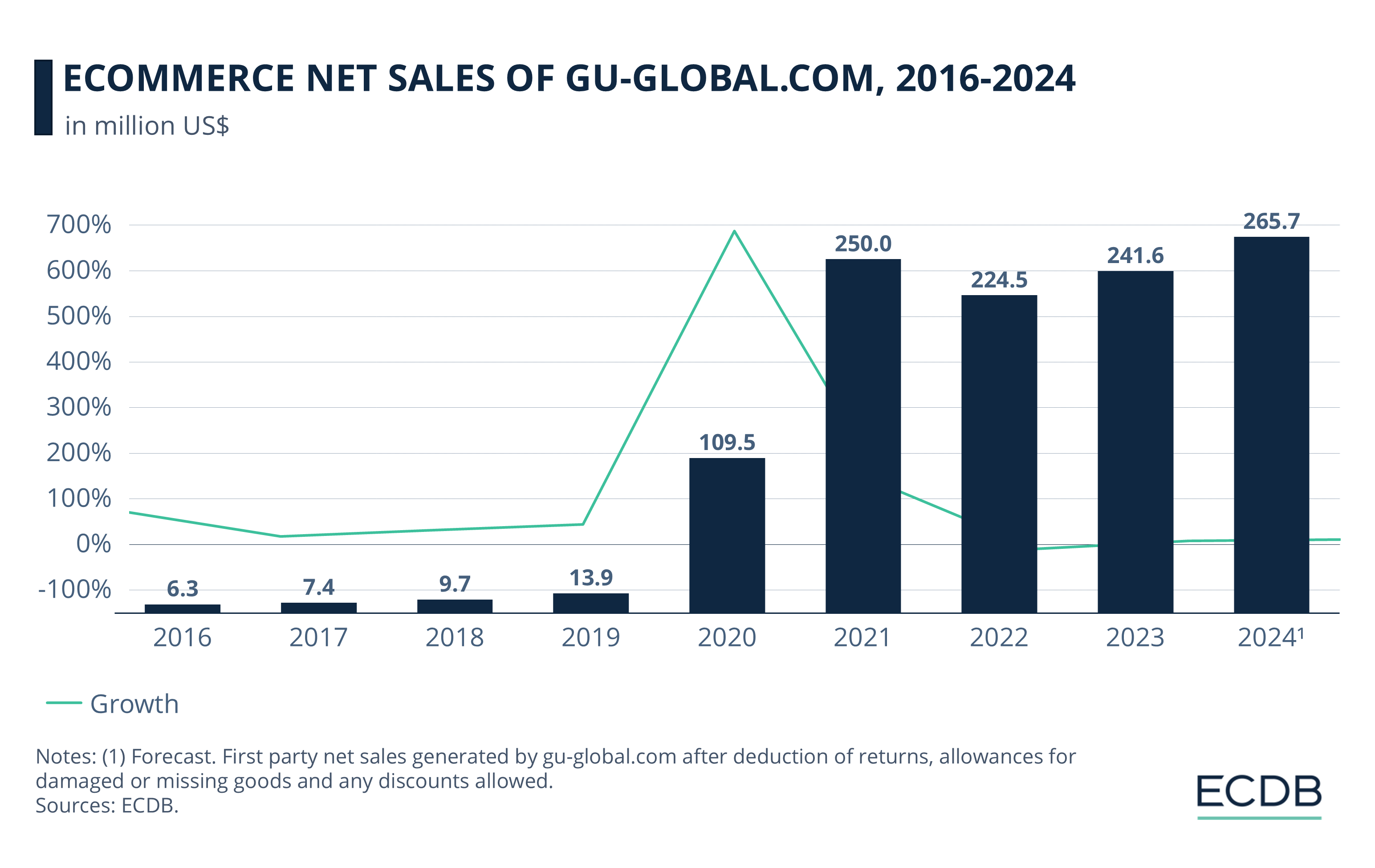

Pandemic Sales Surge: During the pandemic, Gu-global.com saw a dramatic near 700% increase in net sales in 2020. Although growth rates fluctuated in the following years, the site is projected to hit US$265 million in sales by 2024.

Tackling Competition: Facing tough competition from established fast fashion players like H&M and Zara, GU’s connection to Uniqlo and its introduction of exclusive U.S. products may help it stand out in the crowded market.

Uniqlo’s sister company, GU, has made a significant move into the United States market with the launch of its first permanent store outside Asia in New York City’s Soho neighborhood.

The brand also debuted its eCommerce website and app, allowing U.S. consumers nationwide to shop GU products for the first time. These initiatives mark a major step in GU’s global expansion strategy, positioning it as a more internationally recognized fashion brand.

Gu-global.com Grew by 686% in 2020

GU, which contributes a significant share to parent company Fast Retailing’s sales, offers a distinct value proposition compared to its sister brand, Uniqlo. While Uniqlo emphasizes timeless basics, GU targets a younger audience, focusing on social media-driven fashion trends.

Net sales for gu-global.com have fluctuated over the years:

While gu-global.com's numbers weren't necessarily impressive until 2020, the pandemic gave the company a boost, bringing net sales up to US$110 million in 2020 (686% growth).

Although the online store continued to grow at a more modest rate the following year (128%), it would decline by 10% in 2022.

With positive growth (7%) in 2023, the ECDB projects that the online store will end 2024 with net sales of US$265 million.

By adapting styles and sizing to suit U.S. preferences, GU hopes to resonate with American shoppers who seek affordable, versatile fashion.

Brand Will Face Tough Competition

Despite the promising entry, the U.S. market poses challenges for GU, with stiff competition from established fast fashion brands like H&M, Zara, and digital giants like Shein. However, GU’s association with Uniqlo and its strategic focus on U.S.-exclusive products could help it gain traction.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

GU’s expansion strategy in the U.S. remains cautious, with plans to focus on New York before expanding into other cities. The brand is taking a measured approach, testing its success in the U.S. market before moving to other regions in North America.

Sources: ModernRetail, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

Deep Dive

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Back to main topics