eCommerce: Adult Shops in the U.S.

Top Online Erotic Stores in the United States: There Are Adam & Eve Alternatives

How are top U.S. online erotic retailers driving the sexual wellness boom and shaping the industry's future? Read on for answers.

Article by Cihan Uzunoglu | July 18, 2024Download

Coming soon

Share

Top Online Erotic Stores in the United States: Key Insights

Top 5: The leading online erotic stores in the U.S. — Adam & Eve, Lovense, PinkCherry, Lovehoney, and Lelo — stand out with diverse product offerings, innovative technology, strategic partnerships, bold marketing, and a strong emphasis on inclusivity and consumer education.

Lower Ranks: The lower-ranked online erotic stores — Bellesa Boutique, Bad Dragon, Fleshlight, Spicy Lingerie, and EdenFantasys — shine with unique products, a focus on diverse and inclusive audiences, innovative designs, a commitment to quality and safety, and active customer engagement across various channels.

Market Development: While in-store purchases gain appeal due to tactile experiences, privacy options, and supply chain issues, the U.S. erotic and adult market is set for growth. Online sales remain promising as consumer behavior evolves and supply chain improvements loom.

In the digital age, shopping for intimate products has changed quite a bit. Once confined to specialty stores, the online sexual wellness industry has grown into a billion-dollar sector. The range now includes not only pleasure products but also a variety of items related to sexual health and reproductive wellness.

The appeal of online shopping extends beyond convenience. It offers a wide array of options and a level of privacy unmatched by physical stores. Moreover, online platforms provide extensive information, enabling consumers to make informed decisions.

Our analysis focuses on the top specialist online erotic retailers in the U.S., based on insights from their websites and data from ECDB.

What Are Online Erotic Stores?

In our definition, online erotic stores sell items like erotic lingerie, sex toys, lubricants, and fetish gear, focusing on sexual pleasure and wellness. ECDB considers online erotic stores as a part of the Hobby & Leisure market, specifically within the Erotic & Adult category.

It is important to note that this category excludes erotic books, contraceptives, and online dating services.

Top Online Erotic Stores in the United States: Adam & Eve at the Top

Which online stores are leading the way in selling erotic products in the U.S.? Based on 2023 eCommerce net sales:

Adameve.com leads with US$292.1 million in domestic revenue. The top player is followed by Lovense.com and Pinkcherry.com with US$100.3 million and US$90.5 million, respectively.

Lovehoney.com and Lelo.com conclude the top 5, with respective revenues of US$81.8 million and US$58.2 million in 2023.

Bboutique.co and Bad-dragon.com are up next, having made US$56 million and US$51.4 million, respectively.

With 2023 revenues of around US$50 million, Fleshlight.com and Spicylingerie.com are at number 8 and 9.

Finally, we see Edenfantasys.com rounding out the top 10 with US$38.6 million.

We will now dive deeper and see what makes these online stores special.

1. Adameve.com

Adameve.com reported domestic revenues of US$292.1 million in 2023, which made up a substantial 92.8% of its total global income of US$314.8 million. Growing revenues by 3.8% last year, Adam & Eve is by far the biggest erotic online store in the U.S.

With a legacy spanning over 50 years in the U.S. adult toy sector, Adam & Eve offers a diverse array of products that go beyond toys to include wellness essentials and intimate apparel. These offerings are tailored for both singles and couples.

The brand's emphasis on confidentiality, along with its varied product lineup, underscores its industry leadership and attuned understanding of consumer preferences in the U.S. market.

2. Lovense.com

Last year, lovense.com posted strong financial results, with U.S. domestic revenues amounting to US$100.3 million or 56% of the company's global earnings. Total worldwide sales for the brand touched an impressive US$179.3 million. Moreover, Lovense experienced a 20.9% YoY (year-over-year) growth rate, indicating its thriving business and enlarging footprint in the market.

What sets Lovense apart in the digital adult toy industry is its emphasis on high-tech capabilities. The company specializes in products that facilitate long-distance interactions, enhancing intimate experiences irrespective of physical location. Their proprietary "Lovense Remote App" amplifies this aspect by allowing remote toy control and featuring an extensive selection of customizable vibration settings.

Beyond mere product offerings, Lovense enriches the customer journey with additional features like interactive gaming and erotic audio narratives, fortifying their all-encompassing market strategy.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

3. Pinkcherry.com

In the fiercely competitive online retail landscape, pinkcherry.com distinguished itself by recording robust domestic sales of US$90.5 million. This impressive sum makes up a significant 94.2% of its global revenue for the year. When looked at in a broader scope, the company's worldwide sales reached a notable US$96.1 million. Further accentuating its strong performance, pinkcherry.com experienced a 15.1% increase in sales compared to the previous year.

This robust performance reflects a company in tune with its customer needs. The brand offers a wide array of products, from simple vibrators to elaborate wellness items, exemplifying their holistic approach to the market. Strategic alliances with renowned brands like LELO (at #5 on our list) and CalExotics further strengthen their market position. Their marketing efforts, aimed at a broad spectrum of audiences including women, men, couples, and novices, affirm their inclusive strategy and wide consumer appeal.

4. Lovehoney.com

In 2023, lovehoney.com, a key player in the sexual wellness arena, announced U.S. domestic sales amounting to US$81.8 million, a sum that equates to their global revenue, implying that the brand's focus remains solely on domestic operations. Though the online store scored an impressive growth of 71.6% in 2020, 2021's growth was much lower at 18.9%. 2022 saw lovehoney.com decrease in revenues by 1.4%, but the online store finished 2023 with a healthy 5.5% growth.

The setback in 2021 is largely credited to issues with dominant technology platforms like Google and Instagram. An alteration in Google's SafeSearch feature notably dimmed Lovehoney's online presence, resulting in a loss of an estimated one million customers. To directly confront Google's impact on their business, Lovehoney launched its "Ogle" billboard campaign in June 2022. The campaign featured a billboard with the recognizable primary colors of Google's search engine and carried the provocative message: "Turn off SafeSearch to lay eyes on our full range."

Despite this bold initiative and subsequent discussions with Google's advertising division, the brand found no relief in policy changes. Additional hurdles arose from third-party sales platforms like Amazon and various social media outlets, due to their conservative guidelines on product listings and advertisements. Nevertheless, Lovehoney posted a relatively low but still hopeful growth rate last year, and is expected to continue its growth, albeit at lower rates.

5. Lelo.com

Recording strong domestic earnings amounting to US$58.2 million last year, lelo.com's total worldwide sales for the year were an impressive US$124.4 million. The company also showcased a growth rate of 20%, illustrating a diversified and growing footprint in both domestic and international markets.

Lelo.com distinguishes itself not just as a maker of luxury sexual wellness products, but also as a leader in the broader self-care arena. Emphasizing inclusivity across various demographics like gender, orientation, race, and age, the platform holds a unique spot in the industry. With a comprehensive approach that combines an array of products and a focus on consumer education, the brand has set itself apart.

A two-decade-long legacy adds to the brand's strong market credibility. As it continues to evolve, lelo.com stands as a symbol of quality, inclusivity, and educational outreach in the realm of intimate care products.

6. Bboutique.co

Bboutique.co, also known as Bellesa Boutique, recorded substantial domestic revenues of US$56 million, comprising nearly 80% of its global sales in 2023. The enterprise's worldwide earnings reached a remarkable US$70.3 million, experiencing an impressive growth of 36.5% last year.

Bellesa Boutique is not just about sales figures; it offers a comprehensive product line designed for a diverse audience that includes individuals, couples, and the LGBTQ+ community. The company's dedication to discreet shipping and its distinction as the "Best Sex Toy Retailer 2022" underlines its commitment to customer satisfaction and privacy. Targeting primarily a female audience, the brand promotes the concept of "pleasure equality," signifying a deep resonance with and understanding of its core consumer base.

7. Bad-dragon.com

Since its inception in 2008, bad-dragon.com has uniquely positioned itself in the eCommerce landscape by bringing fantasies to life. Its offerings boast colorful and imaginative designs inspired by folklore and mythology. This creative angle permeates their wide array of products, from intimate wearables to dildos, offering a refreshing alternative in an otherwise crowded marketplace.

The year 2023, however, proved to be financially testing for the company. It reported domestic revenues of US$51.4 million, which constituted 69.2% of its total global income. Although the overall global revenue stood at a respectable US$74.3 million, the company faced a significant downturn, experiencing a 2.7% drop in growth in the same year. This contraction could hint at market saturation or unforeseen obstacles that emerged during the year.

Despite the financial hiccups, bad-dragon.com's consistent focus on quality, innovation, and safety for the body speaks volumes about the resilience embedded in the brand's philosophy. As they steer through these market hurdles, their unwavering dedication to craftsmanship and customer contentment reinforces their enduring charm and augurs well for a potential rebound.

8. Fleshlight.com

Fleshlight.com's domestic sales in 2023 reached a significant US$51 million, accounting for 69% of its global revenue. The total global sales for the year amounted to US$73.9 million. In addition to these substantial figures, the company saw a humble 2.2% growth last year.

Established in Austin, Texas, in 1997, Fleshlight has cemented its presence in the adult toy market, primarily targeting male customers. With a focus on realistic and intimate experiences, the brand features select items that are replicas of renowned adult film stars. Uniquely designed to resemble a flashlight, their products offer the utmost discretion for privacy-conscious users. Emphasizing user well-being and enjoyment, Fleshlight crafts its offerings from materials that are 100% safe for the body, hypoallergenic, and environmentally friendly.

Accentuating their commitment to authenticity, the brand uses its custom-made Superskin material designed to mimic the texture of real skin. To serve a clientele interested in holistic sexual well-being, the brand runs the "Fleshlife" blog, which delves into extensive sexual wellness topics.

9. Spicylingerie.com

As the last online store on our list, spicylingerie.com solidifies its standing in the digital market for intimate wear. The eCommerce site posted domestic sales of US$50.5 million in 2023, contributing to a substantial 95.8% of its global earnings, which totaled US$52.8 million. The company also saw a positive growth rate of 24.5%, highlighting its ongoing relevance and adaptability in the ever-changing consumer landscape.

Spicy Lingerie distinguishes itself through an extensive inventory of over 15,000 items that range from timeless romantic pieces to modern, edgy styles. Tailoring to inclusivity and diverse body types, Spicy Lingerie offers a wide array of sizes and a specialized selection of plus-size lingerie. Complementing its broad product range, the brand also provides a one-stop shopping experience with accessories like silky stockings and heels, all while upholding its promise of offering luxury without breaking the bank.

10. Edenfantasys.com

Known for its wide variety of intimacy products, edenfantasys.com posted domestic revenues of US$38.6 million last year. This accounted for 91.2% of its total global sales of US$42.3 million. However, the brand did experience a 10.7% degrowth in the same year, suggesting challenges in retaining its customer base or expanding its market presence.

The company caters to individuals and couples of all genders, offering products that range from vibrators to lubricants, and striking a balance between affordability and luxury. The platform also distinguishes itself by cultivating an active online community via its "Adult toys forum," where consumers can discuss experiences and ask questions about products. On the sustainability front, EdenFantasys is committed to eco-friendly practices, including minimizing its carbon footprint.

Further bolstering customer confidence, the company employs discreet shipping practices and secure payment options. While the company has faced some growth challenges in 2023, its well-rounded approach to the market suggests areas where strategic adjustments could drive future success.

Online Erotic & Adult Market in

the United States

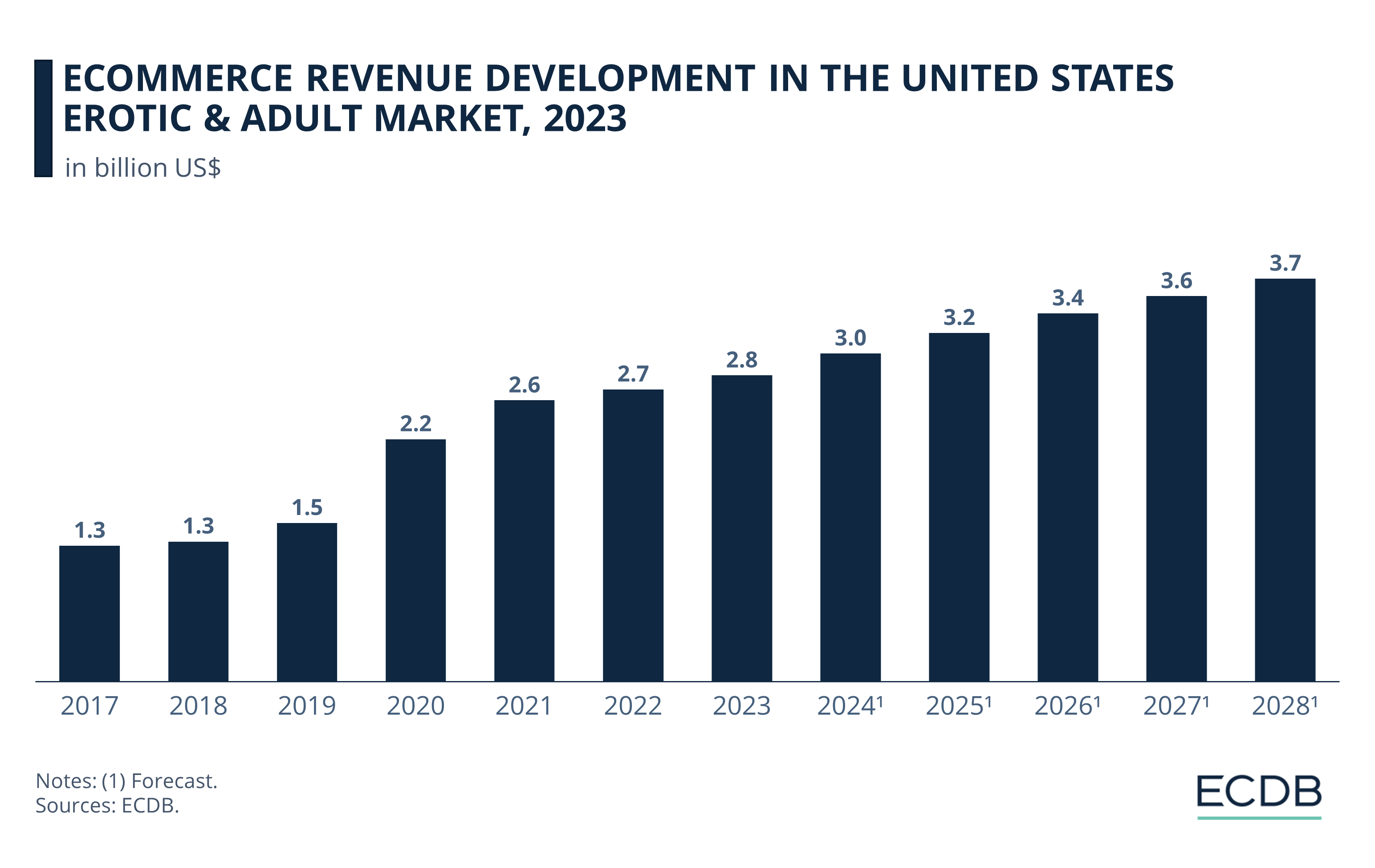

But how has the market developed over the years? We know that the pandemic was a booster to eCommerce in general, but has that growth been sustainable for the online erotic & adult market in the United States?

Looking at the market's eCommerce revenue development:

In 2013, the online erotic and adult market in the U.S. was valued at US$1.25 billion.

By 2019, the market had grown to US$2.23 billion, showing a significant increase just before the pandemic.

In 2020, the pandemic pushed revenue to US$2.59 billion, marking a 52% surge.

The market continued to expand, reaching US$2.69 billion in 2023 and is projected to hit US$3.02 billion in 2024.

By 2028, forecasts predict the market will grow to US$3.71 billion, indicating sustained growth and interest in online sales.

Consumers are increasingly drawn to physical stores for purchasing sexual wellness products, potentially enticed by tactile experiences and direct consultations that are at times lacking online. The option for cash payments in-store adds a layer of privacy difficult to match online. Further, supply chain issues, such as shipping delays and rising costs, make in-store purchases more appealing for some. This subtle change in consumer behavior demands continued observation, particularly as the market is set to grow significantly.

While the overall market's growth doesn't guarantee a similar surge in online sales, the market's sensitive nature and privacy concerns, along with potential resolution of supply chain disruptions, make the future of online sales cautiously promising.

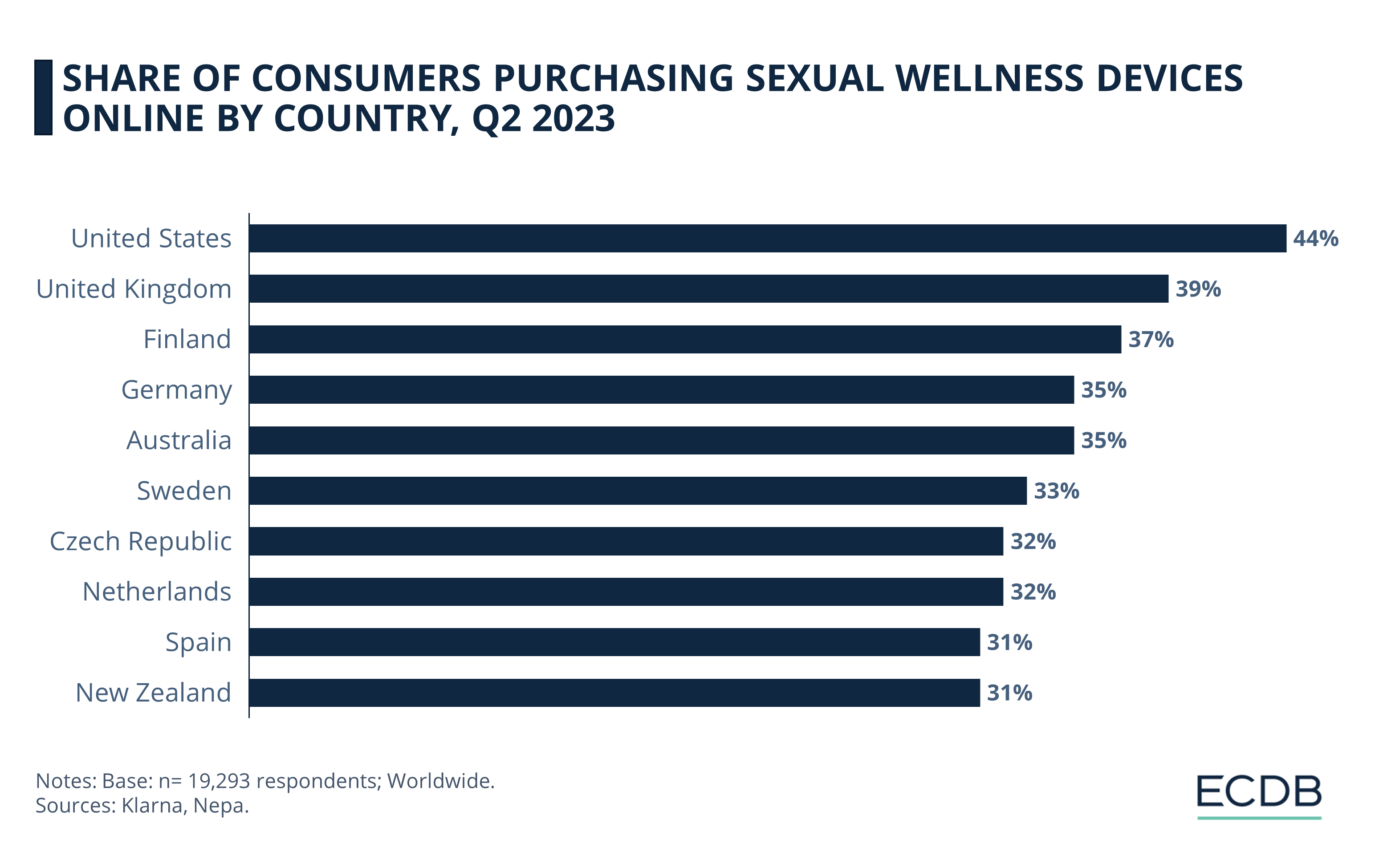

Buying Sexual Wellness Devices Online is the Most Popular in the U.S.

When it comes to buying sexual wellness products online, we see different trends in the world's top markets. Based on Klarna Insights data:

The U.S. tops the list for online purchases of sexual wellness devices, with 44% of consumers in the country buying sex toys.

The UK and Finland follow with similar shares (39% and 37%), while Germany and Australia have the same share (35%).

The rest of the list - Sweden, the Czech Republic, the Netherlands, Spain and New Zealand - includes countries where about a third of consumers buy sexual wellness products online.

Sources: Adam & Eve, Lovense, PinkCherry, Lovehoney, Bad Dragon, Fleshlight, LELO, EdenFantasys, Bellesa, Spicy Lingerie, Klarna Insights, PwC, The Drum, Grand View Research, Statista, ECDB

FAQ: Top Online Erotic Stores in the United States

What are sexual wellness products?

Sexual wellness products include a range of products, from vibrators and adult toys to sexual enhancers and family planning products, that help individuals and couples prioritize sexual wellness and general well-being.

Adam & Eve alternatives?

Lovense.com

Pinkcherry.com

Lovehoney.com

Lelo.com

Bboutique.co

Bad-dragon.com

Fleshlight.com

Spicylingerie.com

Edenfantasys.com

How big is the sexual wellness market?

According to ECDB, the online global erotic & adult market is worth US$30 billion (2023). While China has the largest market at US$21.7 billion, the U.S. follows with US$2.8 billion.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

German Cross-Border eCommerce: Marketplaces, Online Stores, Top Markets & Product Categories

German Cross-Border eCommerce: Marketplaces, Online Stores, Top Markets & Product Categories

Deep Dive

EHI: eCommerce Market Germany - Top 1,000 Online Stores Made €77.5 Billion in 2023

EHI: eCommerce Market Germany - Top 1,000 Online Stores Made €77.5 Billion in 2023

Deep Dive

Top eCommerce Countries in Africa

Top eCommerce Countries in Africa

Back to main topics